|

Mayor Johnson’s reaction to North Lawndale mass shooting mentions weekend incidents in other states

Monday, Oct 30, 2023 - Posted by Rich Miller * Background is here and here if you need it. Mayor Brandon Johnson yesterday…

* The full list is here, but Moms Demand Action has a partial roundup…

Your thoughts?

|

|

Isabel’s afternoon roundup

Monday, Oct 30, 2023 - Posted by Isabel Miller * Crain’s | Stellantis battery plant gives Pritzker momentum to land more EV deals: Gov. J.B. Pritzker has landed deals for two EV battery plants in as many months. Stellantis plans build a battery plant as well as an EV assembly facility in Belvidere that are expected to employ more than 3,000 workers. Chinese battery maker Gotion Hi-Tech plans a battery plant in Manteno with 2,600 jobs. He isn’t done. Pritzker says the state is in talks with other companies, and he hopes to land more deals, though he declined to name the prospects. … “Every survey has Illinois in the bottom five for business climates,” says John Boyd Jr., a principal with The Boyd Company, a site-selection consultant in Boca Raton, Fla. “But success breeds success. These announcements will translate into suppliers and others having incentive to consider locating in Illinois.” * WAND | Illinois community colleges see second largest fall-to-fall enrollment increase in 30 years: Overall, the Illinois Community College System’s opening Fall 2023 enrollments had an increase in both headcount (+5.7 percent) and Full-time Equivalent (FTE) (+5.2 percent) from the previous year. The Fall 2022 to Fall 2023 increase of 5.7 percent is the second largest Fall-to-Fall enrollment growth in the last 30 years. Only the Fall 2008 to Fall 2009 increase of 7.4 percent during the Great Recession was higher. * Capitol News Illinois | Latest state school report card shows proficiency gains, persistent gaps on racial lines: A significant gap still existed between Black and white students in English language arts proficiency. But on a percentage basis, Black students saw the biggest gains in proficiency rates, rising from 12.1 percent to 16.1 percent – a 33-percent increase. * Daily Herald | ‘The good news is we’re recovering’: Illinois School Report Card shows second year of post-pandemic gains: This year’s results show a 16% change statewide year-over-year in English language arts from 29.9% to 34.6%, meaning an additional 39,000 students have mastered grade-level standards. Black students posted the largest gain with a 33% change in proficiency rates, according to report card data. * Block Club | Key City Committee OKs Purchase Of Far South Side Lot To Become Migrant Camp: Alderpeople on the Committee on Housing and Real Estate approved the city buying a 6.5-acre site for $1 from New Albertons LLC during a Monday morning meeting. The deal needs the full City Council’s approval, and it will go before council during its Wednesday meeting. * Tribune | Judge rules ex-Ald. Ed Burke’s comments on Jewish lawyers can be heard by jury: “Given the heightened sense of alarm” after the Hamas attacks, “any member of the jury sympathetic toward what the Jewish people have endured might find Mr. Burke’s comments to be particularly distasteful” and unfairly hold it against him, argued Burke attorney Kimberly Rhum at an Oct. 16 pretrial hearing. * AP | Illinois man pleads not guilty to hate crime and murder charges in attack on Muslim mother and son: His attorney George Lenard entered the not guilty plea after the judge read the 8-count indictment. Czuba did not speak, looking down at the podium with his hands folded behind his back as he stood before the judge in the court in Joliet. * Sun-Times | No testimony from Highland Park massacre suspect at dad’s trial next week: “I don’t see any reason why he should physically be here to do that,” said Strickland, who will be presiding over the bench trial. The father’s lawyer, George Gomez, said he had subpoenaed the son’s attorneys to call him as a witness. One of the son’s attorneys, Gregory Ticsay, said he still hasn’t received the subpoena. * Daily Journal | Homeless advocates learn from Rockford: A new light shone on how Kankakee County may be able to assist those who are homeless on a recent trip to Rockford. Several area officials traveled some 150 miles to the northern Illinois city to observe and learn how that community has served its homeless population. * NBC Chicago | Housekeepers walk out of downtown Chicago hotel, demanding fair pet policy: Workers are demanding that management revert to the previous policy regarding guests with pets, the labor union, UNITE HERE Local 1, said in a statement. The policy would alert housekeepers at the beginning on their shift if there is a pet staying in the room they are assigned to clean. * Crain’s | Cook County residential property taxes in northern suburbs shoot up by 15.7%: Homeowners are now taking on the lion’s share of the tax burden countywide this year, with 81% of Cook County property owners paying higher taxes this year. Overall taxes in Cook County rose 5.4%, or $909 million, with residents taking on $599 million, or two-thirds, of that increase. * Daily Herald | How Metra is working harder to stop suicides on tracks: Interventions to save lives and prevent death by suicide on railway tracks increased substantially in 2023, Metra reports. Through mid-October, police and train crews trained in crisis management reached 85 people in time to help prevent a tragedy. * Press Release | Rep. Rashid Invited to White House by President to Discuss Artificial Intelligence: “I am honored to have received an invitation to the White House to discuss the future and regulation of AI,” said Rashid. “In an era where artificial intelligence is reshaping our world, our duty as lawmakers is clear: we must prioritize the safety and well-being of our citizens by mitigating the risks that AI presents. The public is counting on us to enact safeguards that ensure their security, privacy, and fundamental rights in this rapidly evolving landscape.” * ABC | Biden speaks on AI development: Pres. Joe Biden and Vice President Kamala Harris discuss the administration’s commitment to the safe and secure development of AI. * Tribune | Snow showers, chilly temperatures expected for Halloween; experts say to ‘bundle up’ while trick-or-treating: Periods of snow showers will start mainly after 11 a.m. Tuesday, with new snow accumulation of less than half an inch possible, according to the National Weather Service in Romeoville. If it snows Tuesday, it would be the ninth Halloween with snow recorded in Chicago and the eighth in Rockford. * The Atlantic | The Secretive Industry Devouring the U.S. Economy: That may not have been such a big deal when private equity was a niche industry. Today, however, it’s anything but. In 2000, private-equity firms managed about 4 percent of total U.S. corporate equity. By 2021, that number was closer to 20 percent. In other words, private equity has been growing nearly five times faster than the U.S. economy as a whole.

|

|

Question of the day

Monday, Oct 30, 2023 - Posted by Rich Miller * Press release…

The bill is here. * Sun-Times editorial…

* The Question: Pay them an adequate salary, give them a “modest stipend” or don’t pay them anything except expense reminbursements? Take the poll and then explain your answer in comments, please.

|

|

Protected: SUBSCRIBERS ONLY - Fundraiser list

Monday, Oct 30, 2023 - Posted by Rich Miller

|

|

The answer you’ve all been waiting for

Monday, Oct 30, 2023 - Posted by Isabel Miller * Last Friday, Senate and House staff held their annual Capitol Trick-or-Treat. I was asked to judge best trick-or-treat area by the Senate President’s office.  I was told the Senate President’s office had stepped up its game this year. They didn’t take top prize… But they do win best candy. Take a look at those full-sized candy bars.  * And the big winner is….

The Senate Democrat Policy & Budget Department! (The alien stuck on the roomba cinched it.)

Sorry for the dark and blurry pictures. There was a princess behind me and I didn’t want to keep her waiting.

On to honorary mentions… Over in the Stratton C wing, the Senate Democratic Member/Legislative Assistant Office “killed it.”

Finally, House Republican Leadership office cracked me up…

* On to my unofficial costume contest… Congratulations to Donald and Eleanore Mitchell!  And some honorary mentions…

|

|

Protected: SUBSCRIBERS ONLY - A look back and ahead

Monday, Oct 30, 2023 - Posted by Rich Miller

|

|

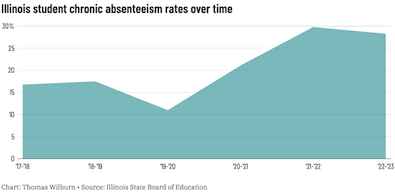

ISBE says chronic absenteeism ‘remains alarmingly high’

Monday, Oct 30, 2023 - Posted by Rich Miller * ChalkBeat Chicago on the Illinois State Board of Education’s latest school report card…

* Chart…  * From the ISBE…

Also, one thing that might help is if ISBE fixes its bungling of the after-school program.

|

|

Bailey continues touting Trump ties while Bost struggles to keep up

Monday, Oct 30, 2023 - Posted by Rich Miller * Donald Trump, Jr. spoke at two Illinois locations on Friday. First up, Marni Pyke’s report from McHenry County…

Yeah, that’s the solution. Make the party smaller. But, hey, that’d work to his advantage in his congressional primary. Pic…  * Rick Pearson at the Tribune…

From Mar-a-Lago…  * Some local Effingham coverage…

* Pic from the Effingham event…  Caption? * Mike Bost is trying to keep up…

The Bailey campaign, however, says Bailey is also a Trump delegate.

|

|

Please, stop doing this

Monday, Oct 30, 2023 - Posted by Rich Miller * On Friday, the City of Chicago revealed that just 16 buses carrying asylum-seekers arrived in Chicago during the previous seven days. Just a few weeks ago, we were told to expect as many as 25 buses per day. * So, maybe news outlets like ABC 7 might wanna turn down the hype machine just a wee bit…

The extent of the “protest”…  * Back to the story…

NBC 5 also quoted “community activist Patrick Gibbons”…

“Sanctuary city” hokum debunked here. * Thanks to an alert commenter, it turns out that the Patrick Gibbons in the above story appears to be the same guy who, until fairly recently, was running for 31st Ward Republican committeeperson on Chicago’s Northwest Side - far, far away from the Jewels in Morgan Park/Roseland. I mean, this Patrick Gibbons?…  From our commenter…

* And even without the Gibbons stuff, a tiny handful of disgruntled people milling about a giant parking lot is hardly a compelling teevee visual. From NBC 5’s wide-shot…  Zoom in…  Hilarious. * More from Isabel…

* WTTW | Vote Set on Plan to Transform Former Jewel, Parking Lot on Far South Side Into Migrant Shelter: Mayor Brandon Johnson will ask a key City Council panel to purchase the now-vacant Jewel and surrounding parking lot near 115th and Halsted streets and transform it into a shelter for some of the 3,344 men, women and children being forced to sleep on the floors of police stations across the city and at O’Hare Airport. * Block Club | Ukrainian Village Neighbors Suing Mayor, City Officials To Block Migrant Shelter: In a lawsuit filed Wednesday in Cook County Circuit Court, James Cole and Danielle Roberts argue the city has illegally skirted zoning and building permit regulations to convert a privately owned building at 526 N. Western Ave. into a temporary shelter for asylum seekers. * Block Club | More Than 3,400 Migrants Have Been Flown Into Chicago Since June, City Data Shows: Most people were flown in from San Antonio, Texas, with a few hundred others coming from Houston, New York City and Denver. The majority of the flights have come to O’Hare, bringing in 2,705 people, according to city data. * WTTW | With Temperatures Set to Dip Below Freezing, Warming Buses Set to Shelter Migrants: Warming buses will be sent to 16 Chicago police stations to shelter some of the 3,344 men, women and children being forced to sleep on the floors of police stations across the city and at O’Hare Airport, as cold weather settled over the city in earnest and temperatures dipped below freezing, Mayor Brandon Johnson’s office said late Sunday. * The Hill | Tensions rise between new and established migrants: The tension is especially felt in Democratic strongholds such as New York and Chicago, where community leaders and elected officials have spent decades organizing their constituents with limited success. “Mixed-status families, people who have lived here for 10, 20, 25, 30 years, who have been working, paying taxes, sending money back to Mexico, abiding by the laws, laying low — probably being better citizens than most Americans — are frustrated,” said Illinois Rep. Jesús “Chuy” García (D).

|

|

*** UPDATED x1 - Ford to invest $430 million in local factories *** Stellantis coverage roundup

Monday, Oct 30, 2023 - Posted by Rich Miller * Crain’s…

* Tribune…

* UAW VP Rich Boyer says the plant will produce a new midsize truck and will run two shifts, according to Motor1.com…

* WIFR…

* ABC7…

* Gov. Pritzker…

* US Rep. Bill Foster…

* US Sen. Dick Durbin…

* US Sen. Tammy Duckworth…

* Meanwhile, General Motors has reached an agreement as well…

*** UPDATE *** Crain’s…

|

|

Clean Air, Big Savings Central To Fleet Electrification Policy

Monday, Oct 30, 2023 - Posted by Advertising Department [The following is a paid advertisement.] North Illinois has some of the worst air quality in the country, in large part due to heavy freight traffic. Converting just 3 in 10 heavy-duty trucks in Illinois from gas to electric would save $5.8 BILLION in health care costs and over 600 lives. Incentivizing fleet owners to go electric improves air quality, especially in heavy transit corridors. States like Nevada have incentivized the transition of school bus fleets from gas to electric, and Illinois can do the same to prevent children from breathing dirty air on their ride to school. Illinois children deserve clean air now and a healthy future. Fortunately, there are bills in front of the Illinois State House and Senate right now that can help transition whole fleets of large trucks to electric – saving lives and saving money. Our legislators must support. More here.

|

|

Bold crime-reduction promise falls way short, so now what?

Monday, Oct 30, 2023 - Posted by Rich Miller * My weekly syndicated newspaper column…

Discuss.

|

|

Protected: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Monday, Oct 30, 2023 - Posted by Rich Miller

|

|

Open thread

Monday, Oct 30, 2023 - Posted by Isabel Miller * I hope you all had a relaxing weekend. What’s going on in your part of Illinois?…

|

|

Isabel’s morning briefing

Monday, Oct 30, 2023 - Posted by Isabel Miller * ICYMI: UAW-Stellantis agreement may include a new vehicle, EV battery facility for idled Belvidere plant. Crain’s…

- The Belvidere plant was idled in February. - Stellantis will likely receive a more than Gotion’s $536 million tax incentive package from the state since it involves an assembly facility and a battery plant. * Related stories… ∙ Rockford Register Star: Illinois leaders sound off on UAW, Stellantis tentative agreement, impact on Belvidere ∙ WEHT: Gov. Pritzker issues statement on UAW contract deal ∙ Tribune: UAW-Stellantis tentative agreement to include a new vehicle, EV battery facility for idled Belvidere plant ∙ WIFR: Local leaders react to agreement that could reopen Belvidere’s Stellantis plant * Isabel’s top picks…

* Daily Herald | ‘Taking the side of peace’: Suburban Muslim and Jewish women try to find common ground here amid Middle East war: “Even the word for peace is so similar in our religions,” said Shazia Khan, co-leader of the Northwest suburban group that aims to build relationships between Muslim and Jewish women. “And that’s the point … that 99% of what we do and say is common, and it’s the 1% difference that has divided our societies and our political leaders have politicized and taken to extremes. But we’re trying to remind everybody of that 99%.” * Thoughts on the Governor’s Halloween costume?

* Here’s the rest of your morning roundup… * ABC Chicago | Morgan Park residents raise concerns over city’s plans for migrant shelter at vacant lot: But, the people living in Morgan Park say they want the city to provide critical resources for current residents, echoing the same message people have had in other neighborhoods that are being discussed as shelter options. “The people here in the community, they’re afraid they’re going to lose jobs. They’re afraid there won’t be shelter for the homeless. And so, this is a big thing for this community,” said Pastor Anthony Wilson. “I don’t oppose migrants or foreigners. I’m not against that, but the citizens of Chicago come first.” * NBC Chicago | Roseland residents frustrated over proposal to build migrant shelter: At a meeting in September, 21st Ward Ald. Ronnie Mosely, which represents the community, listened to residents concerns about the proposed tent city. In a statement, the alderman expressed his disappointment over the plan and said his “ward will not tolerate the prioritization of a crisis over our needs and voices!” * South Side Weekly | UN Specialist Warned City Council that Tent Camps Could Become Permanent: Emails obtained by the Weekly reveal that Committee Chair Andre Vasquez (40th Ward) discussed the camps with Joseph Ashmore, the IOM specialist, last month. In an email exchange following the discussion, Ashmore provided materials on mass shelters that explain topics such as preparedness, violence prevention, and community involvement. Ashmore emphasized that tent camps are “a last resort,” adding in his email to Vasquez, “They can be unsustainable, can last for much longer than expected, and are expensive to run and maintain.” Ashmore declined requests for an interview. * Sun-Times | Danny Solis’ rise and fall, from promising activist to disgraced Chicago politician to FBI mole: The former 25th Ward alderperson sold his political soul for small favors, then tried to reclaim it by wearing a wire on two of the biggest powerhouses in the history of Illinois politics. * Sun-Times | 15 shot at unsanctioned Halloween party in North Lawndale; suspect in custody: William Betancourt, commander of the Chicago Police Department’s Ogden District, told reporters the “senseless act of violence” occurred around 1 a.m. in the 1200 block of South Pulaski Road. Some of the roughly 100 partygoers told officers that the alleged shooter “was ejected from the party, and he came back a few minutes later with a gun and he began to shoot,” Betancourt said during a news conference Sunday afternoon. * Cook County Record | Union League Club hit with class action over worker fingerprint scans: The Union League Club of Chicago has become one of the latest employers in Chicago targeted by a class action lawsuit under the state’s biometrics privacy law, because the Club allegedly improperly required workers to scan their fingerprints when punching in and out of work shifts. The club’s biometric timekeeping system “includes the dissemination of biometrics to each other and third parties, such as data storage * Tribune | As Mayor Brandon Johnson invests in mental health, questions linger about funding for other public health crises: Johnson’s 2024 plan devotes relatively few additional city resources to keeping the systems that were created during the pandemic in place. Instead, the new mayor’s 2024 Department of Public Health proposal pledges to boost spending on mental health by more than $15 million. * Tribune | North suburban homeowners seeing biggest property tax increase in 30 years, treasurer’s analysis finds: After months of delay, nearly 1.8 million property tax bills for Cook County home and business owners are landing in mailboxes this week, and many homeowners in the north and northwest suburbs are in for jarring news. A new analysis from county Treasurer Maria Pappas’ research team found the median residential tax bill there increased by 15.7%, according to the report, “the largest percentage increase in the last 30 years.” * Tribune | Chicago-area environmental activists, experts seek to protect region’s trees after bur oak removal in Kane County: For years, Maher and a group of activists have tried to stop the removal of bur oak trees at a proposed industrial park development in Kane County near Geneva, contacting local elected officials, starting a petition and even climbing on machinery. They say almost all of the historic trees were cut down in the two weeks after Labor Day, calling it a “colossal failure” for the “Tree City USA” community. * Block Club | Columbia College Adjunct Faculty Plan To Strike Monday: The decision comes as a result of the school administration’s plans to cut hundreds of class sections, which union leaders said would decrease adjunct faculty’s workload — and therefore pay — or increase class sizes without a corresponding pay increase. Diana Vallera, union president and a part-time faculty member in the photography department, said about 340 class sections would be eliminated. * Fox 2 | George Harrison’s long-lasting impact on southern Illinois: Lead guitarist George Harrison ended up in southern Illinois for several days. Archives from BeatlesBible.com note that he flew into New York and caught a connecting flight to St. Louis before a roughly hour-and-a-half car ride to southern Illinois. At the time, Harrison’s sister, Louise, had recently moved to Benton, Illinois, with her husband, Gordon Caldwell. He was a passionate engineer and found opportunities within Illinois’ coal mining industry. * AP | Biden administration encouraging conversion of empty offices to affordable housing: The Biden administration is launching a multi-agency effort to encourage states and cities to convert more empty office buildings into housing units, with billions of federal dollars available to help spur such transitions * WaPo | Faced with abortion bans, doctors beg hospitals for help with key decisions: Huntsberger said she called six administrators before she finally got ahold of someone, her patient awaiting help a few rooms away. When she asked whether she could terminate a pregnancy under Idaho’s new abortion ban - which allows doctors to perform an abortion only if they deem it “necessary to prevent the death of the pregnant woman” - the OB/GYN said the decision was punted back to her. * The Atlantic | What Financial Engineering Does to Hospitals: Watkins and other Riverton residents concluded that, instead of dividing specialties between the two hospitals and beefing up the ones remaining at each location, hospital managers were simply stripping away essential services from their community. The drive to Lander isn’t hard in the summer, Watkins told us, but in the winter, the roads are often closed. Many more patients needed to be transported out of the county altogether.

|