Oops

Wednesday, May 4, 2016 - Posted by Rich Miller

* I got really busy this afternoon and forgot to post a question. I also forgot to send out the afternoon e-mail to subscribers. Sorry about that.

So, instead of a question, I guess we’ll just have an overnight open thread. Have at it, but keep it state-centric and be kind.

62 Comments

|

CPS running on fumes

Wednesday, May 4, 2016 - Posted by Rich Miller

* From Aldertrack…

Officials at Chicago Public Schools laid out a “dire financial situation” for aldermen at briefings Monday and Tuesday: not only will the district need a school funding reform passed through Springfield, it also needs aldermen to file an additional property tax levy to address its cash crunch, slated to hit this summer. The district projects by June 30, it will have only $24 million cash on hand, enough to cover a day and a half of expenses, according to an 11 slide powerpoint deck provided to Aldertrack.

The district is already “borrowing on a credit card” to address its cash flow needs. It has an $870 million line of credit that expires in August. In order to cover costs for the next school year, CPS would need to renew that $870 million line of credit, but it can’t do so without a Fiscal Year 2017 budget and a new property tax levy. “Banks will only lend if they see a balanced budget with meaningful progress to structural balance and positive projected cash flows for FY 2017,” the powerpoint says.

CPS is scheduled to release that FY 2017 budget later this month, and school officials said it will need help from the Chicago Teachers Union (CTU), Springfield, and the city to close a yawning $1.1 billion structural deficit: “[it] will require shared commitment from all parties, starting with Springfield in the form of both pension parity and equitable funding; a contract with CTU that is fair to teachers, students and taxpayers; and the restoration of the pre-1995 property tax levy.” […]

During the briefings, CPS officials outlined a plan dependent on the General Assembly passing funding reform and Gov. Bruce Rauner signing it into law. CPS would then ask City Council to approve a $142 million property tax levy devoted to CPS capital improvements. City Council has a separate property tax levy it can raise for CPS capital spending–last October, aldermen approved a $45 million levy, though they demanded CPS regularly report on what projects that money would be spent on.

“They’re not asking us to do that yet, they’re counting on Sen. Andy Manar and [State Rep.] Christian Mitchell’s bills,” said Council Education Committee Chair Howard Brookins, Jr. “But nobody, including CTU, believes there will be a permanent fix to anything until June 2019, when Rauner will be out office.” [Emphasis added.]

Yeah, well, what if Rauner is reelected?

It’s past time to come up with a plan here. Hope ain’t working.

28 Comments

|

This has to change

Wednesday, May 4, 2016 - Posted by Rich Miller

* Rap sheet for a gang member suspect in a recent Northwest Side murder…

Court records show he was found guilty of robbery in 2009 and sentenced to boot camp at the Cook County Jail.

In early 2011, he went to prison on a four-year sentence for possession of a stolen vehicle. He was paroled in August 2012.

In 2013, the man violated his parole when he was arrested on a charge of being a felon in possession of a gun.

He was sent back to prison for three months to complete his stolen vehicle sentence as he awaited trial on the gun charge.

In January 2014, Judge Nicholas Ford sentenced him to a three-year sentence on the gun charge. He was paroled in that case in March 2015.

Then he violated his parole in that case by associating with gang members. Judge William Raines sentenced him to jail for two days.

In October 2015, he violated his parole again when he was arrested for reckless conduct and associating with gang members.

He was sent back to prison and was released on parole in January 2016.

Rosenau also was convicted of three felonies, including robbery in 2005; burglary in 2007; and aggravated battery on a police officer in 2012. He was sentenced to three years in prison for that crime, court records show.

Mr. Obvious: We have locked up too many people for stupid reasons, while too many bad guys are set loose and are walking around free.

I don’t know what the specific answer is, but we’re doing something very wrong here.

30 Comments

|

Today’s number: 86 percent

Wednesday, May 4, 2016 - Posted by Rich Miller

* Progress Illinois…

The epic political standoff between Republican Gov. Bruce Rauner and Democratic lawmakers has left the state without a full budget since last July. As a result, the state’s mental health service infrastructure “is being destroyed,” said Marvin Lindsey, CEO of the Community Behavioral Healthcare Association of Illinois. CBHA is a statewide association of mental health, substance abuse and youth service providers.

“What I keep being reminded of is, you put your resources where you think they’re important,” Lindsey said. “And right now, the state’s actions (suggest) that people with mental health conditions, or people with mental illness, are not really important. I mean, that’s the message that I keep hearing from the state. And we understand the politics. We understand what’s going on. However, there are some industries that are being funded, and people with mental health are not.”

During the state budget stalemate, funding for Medicaid services provided by community mental health centers has continued, Lindsey said. However, numerous other mental health services have gone unfunded since July 1.

Psychiatric care grants, for example, have been caught up in the budget standoff. The grants, Lindsey explained, supplement the state’s “low” Medicaid reimbursement rates for psychiatry and help community mental health agencies hire psychiatrists.

The lack of funding for psychiatric care grants is a key reason why 86 percent of CBHA’s membership has either reduced or eliminated psychiatric services since the budget impasse began over 10 months ago, Lindsey said. Because of these cuts, clients may face waiting periods as long as two or three months to see a psychiatrist.

May, by the way, is national Mental Health Awareness Month.

15 Comments

|

* From the Illinois Department of Revenue’s analysis of HB 689, Rep. Lou Lang’s graduated income tax bill…

Dynamic analysis: For this part of the fiscal policy scoring we used the Regional Economic Models Inc. software (REMI). The static estimate of $1.76 billion in additional tax revenue is used as a starting point of the dynamic analysis.

In REMI modeling; balance budget feedback was suppressed. The reason is that the revenue estimate is insufficient to balance the state budget, much less allow for additional spending. Therefore, the logic of an increase of government spending offsetting the negative effects of a tax increase, does not apply.

The increase in the tax rate for persons in the higher income tax bracket, results in a decrease in the incentive to work for individuals in that tax bracket. Moreover, the increase in the tax rate results in such pronounced negative economic effects because this rate will also affect pass-through entities (small business income).

Some of the tax increase will be absorbed by a decrease in personal income or business profits. Some other fraction of the tax increase will be translated into price increase (compared to the rest of the nation). Consistent with empirical studies, REMI simulation shows a decline in population and labor force as a reflection of increased out-migration. Employment decreases compared to a baseline scenario (do-nothing scenario) due to the loss of competitive advantage with respect to other states with lower tax burden.

After accounting for the negative effect on the economy and other revenue sources, the net Revenue increase is $1.64 Billion (instead of the static estimate of $1.76B). Other revenue sources that decline are: Individual income tax $38.3 Million, Corporate Income Tax $7.0 Million, Sales Tax $50.5 Million, Gambling Taxes and Lottery $3.3 Million, Other Taxes (Estate, Public Utilities and Motor Fuel Taxes) $11.6 Million, Federal Revenue (reduced demand for federally matched programs due to increase in out-migration) $7.8 Million.

After 14 years of implementation of this tax policy (year 2030) the main economic effects of this tax policy are:

· Disposable Personal Income decreases $2.8 Billion per year compared with the baseline scenario (current conditions and economic trend).

· Real Gross Domestic Product of the state decreases $1.7 Billion compared with the baseline scenario (current conditions and economic trend).

· Total Employment decreases almost 18,000 jobs compared with the baseline scenario (current conditions and economic trend).

· Population and Labor Force decrease compared with the baseline scenario (current conditions and economic trend). This is a result of increased out-migration due to higher tax burden.

* From Emily Miller…

Hi Rich,

As part of an ongoing effort to kill efforts to achieve tax fairness in Illinois, the Department of Revenue issued a “summary of fiscal impact” on the fair tax proposal in Representative Lang’s HB689, a bill that would have provided a tax cut to 99.3% of all Illinois taxpayers, and provide an additional $1.9 billion in revenue.

Unfortunately for Illinois taxpayers, the governor’s anti-fairness narrative seems to have taken hold, and the result is that neither Representative Christian Mitchell’s fair tax constitutional amendment or Leader Lang’s tax cuts had the bi-partisan support they needed to pass.

The model the Department of Revenue used to disparage the fair tax plan is deeply flawed, highly speculative and subject to manipulation. You can find ITEP’s take on the analysis here: http://itep.org/itep_reports/2016/05/statement-itep-statement-on-illinois-department-of-revenue-analysis-of-house-bill-689.php#.Vyo35qgrI2y

Now that they’ve closed the door on a fair tax, where those who make less pay a lower rate and those who make more pay a higher rate, lawmakers and the Governor will have no choice but to raise the flat income tax, and will need to incorporate tax fairness measures like increasing the earned income tax credit and adding a targeted child tax credit to help low and middle income families who will be most impacted.

We look forward to working with everyone to create a responsible budget that invests in children, families and communities across Illinois.

Emily Miller

Policy and Advocacy Director, Voices for Illinois Children

* From that ITEP link…

“The Illinois Department of Revenue’s analysis of House Bill 689 is fatally flawed for one simple reason: it assumes that the $1.76 billion in new personal income tax revenue that would be raised under HB689 cannot help to fund any government services. The DOR analysis notes that because this $1.76 billion would be ‘insufficient to balance the state budget, much less allow for additional spending… the logic of an increase of government spending offsetting the negative effects of a tax increase, does not apply.’

“This argument is absurd. When lawmakers make the difficult decision to raise new tax revenues, those revenues are always used to shore up public investments. Whether it’s to reinforce education spending, build roads, or provide better health care, these investments have a lasting, positive effect on the quality of life of Illinois citizens and the infrastructure on which the state’s businesses rely.

“If any member of the state legislature took a $20 bill out of their wallet and set fire to it, they would obviously be worse off for having done so. On a much larger scale, this is essentially what the Department of Revenue’s analysis is asserting would be done with the $1.76 billion raised under HB 689.

“Dynamic revenue analysis is notoriously difficult—and notoriously manipulable. The hallmark of a sensible dynamic analysis is that it acknowledges the positive economic effects of public investments. By this standard, the DOR’s analysis fails utterly.”

* Indeed, there are issues with dynamic revenue analysis. Governing Magazine questioned the validity of this process…

Policy staff in least 21 states — and possibly many more — have experimented with dynamic scoring since the early 1990s. While many states regularly use dynamic models to assess the economic impact of infrastructure investments, almost all state-level efforts to dynamically score tax policies have been abandoned. The primary culprits: wildly unrealistic expectations of revenue changes and serious problems using a highly imprecise policy tool in a balanced-budget environment. […]

Kansas’ recent experiment with dynamic scoring is a case in point. In 2012, Kansas adopted major reductions in its income tax. In fiscal year 2015, the state economist’s static estimate forecast that revenues from the 2012 tax changes would decline from $6.466 billion to $5.642 billion (an $824 million loss or 13 percent). However, a dynamic analysis from a pro-tax-cut research institute predicted that the state would actually lose only $714 million. That analysis forecast that $110 million, or 13.5 percent, in additional revenues would be recovered through dynamic effects.

Kansas, of course, is now dealing with a horrible deficit.

* Related…

* RBC Statement: Failure to Consider Fair Tax Irresponsible, But Many Revenue Options Remain to Fix State Budget Crisis

22 Comments

|

Looking on the bright side

Wednesday, May 4, 2016 - Posted by Rich Miller

* I jumped in toward the end of a Twitter argument the other day…

* And that exchange apparently resulted in a column entitled “Left wing’s feathers ruffle too easily”…

The most sacred cow for the progressives of Chicago and Illinois appears to be the future of government pensions.

We can disagree on how we got here, but we all know the finances of City Hall, the Chicago Public Schools, state government and other local taxing bodies are in utter ruin. It’s a mess as severe as anywhere in the developed world right now except maybe Detroit, Puerto Rico and my ancestral homeland of Greece.

Progressive public-employee unions can spin the pension debate with terms such as “increased employer contributions” and “revenue enhancement.” Still, there’s no getting around the fact that government workers, including teachers, will not get all they’ve been promised unless taxes are raised much higher, for them and for the rest of us alike.

It’s easy for the leftists to howl that they are in the right. They often may well be.

Yet, really affecting policy is about much more than blasting your real or perceived foes in social media or feeling good about marching in a colorful and loud protest.

The heart of democracy is in persuading at least some who might not be on your side originally so that you get a majority to agree with your choice at the polls.

He acknowledged Anders’ point, which is a good thing and shows that Lindall did do some persuading.

25 Comments

|

* The Illinois State Board of Education has run Amendments 1 and 2 of Sen. Andy Manar’s education funding reform plan through its modeling program and has issued a report. Click here. Manar has introduced a third amendment which wasn’t looked at, however. He claims the new amendment would significantly alter the bottom lines.

*** UPDATE *** Senate President John Cullerton…

“On May 3rd, the State Board of Education released a simulation of SB 231 (Manar), which would substantially change the current method of funding Illinois’ schools. The State Board’s simulation uses FY 15 data and compares the current school funding formula to the new formula proposed under SB 231. This morning, Floor Amendment #3 was filed to SB 231. As a result, ISBE’s model is no longer current.”

[ *** End Of Update *** ]

* From GOP Sen. Jason Barickman…

“I appreciate Senator Manar’s continued work on school funding reform, but the numbers make it clear that his proposal has taken a major step backward in the process. The data shows what many of us have feared—that his legislation has become a vehicle for a major bailout of the bankrupt Chicago school system, while wildly shifting funding around suburban communities, and creating a detrimental impact on downstate schools,” said Sen. Barickman. “To create a real solution to our broken funding mechanism, we must work with all parties at the table, including the education community, parents, lawmakers from both parties, and the Governor’s administration. In the meantime, we must immediately do what we can to provide certainty for our schools so they can open on time in the fall. We can increase the help the state is providing, by fully funding the existing formula for the first time in seven years. There is no reason that our students should be held hostage while we negotiate real reforms to the system.”

Chicago would receive an additional $352 million, according to an easier to read Senate GOP document.

* But some superintendents and others spoke on behalf of Manar’s SB231 in the House today…

Advocates who support fixing Illinois’ broken education funding system today urged a House task force on public education funding to take action on the state’s inequitable and unfair system, which has penalized students from cash-strapped districts for decades, hurting those who need help the most.

School superintendents and education advocates from throughout Illinois traveled to Springfield to testify at the House Education Task Force meeting. Participants are all members of the Funding Illinois’ Future (FIF) coalition and included: David Lett, Superintendent from Pana School District 8; Kristin Humphries, Superintendent of East Moline School District 37; Mike Gauch, Superintendent of Harrisburg School District 3; Jim Greenwald, Superintendent of Granite City School District 9; Mary Havis, Superintendent of Berwyn South School District 100; and Ginger Ostro, Executive Director of Advance Illinois.

All spoke at today’s House Education Funding Task Force in support of Better Funding for Better Schools (SB231), legislation that offers a fix to the state’s broken public education funding system. This system is a web of complicated formulas that result in less than half of all state education dollars going to school districts based on a local district’s ability to pay for local schools. More than half of state education dollars go to districts regardless of their wealth, shortchanging poor districts with students who have greater needs.

“We need action now,” said David Lett, Superintendent of Pana School District 8. “A statewide solution to our broken funding formula is what is needed. We cannot settle for anything less. Our students have waited for too long.”

Illinois has the most unfair school funding system of any state in the entire nation. Research shows that students living in poverty need additional resources in order to succeed. But, instead of giving them those resources, the state shortchanges students with the most need. This has created a system where wealthy districts in Illinois can spend as much as $30,000 per student, while the poorest barely spends $6,000. These inequities are holding generations of children back from realizing their full potential.

“There is unity and support across the state for Better Funding for Better Schools,” said Kristin Humphries, Superintendent of East Moline School District 37. “Let’s get this done for our districts, schools, and students. The time for action is now.”

19 Comments

|

Stuff that sounds good

Wednesday, May 4, 2016 - Posted by Rich Miller

* Vinicky…

A few other constitutional amendments are in position to go forward.

Like a push to create a “lock box” for transportation funding, so dollars can’t be diverted to other purposes; that already got out of the House and Tuesday advanced from a Senate committee.

* This proposal has received almost no publicity, but it’s been moving very fast. The measure is backed by the road builders and the unions…

Adds a new Section concerning highway funds. Provides that no moneys derived from taxes, fees, excises, or license taxes, relating to registration, titles, operation, or use of vehicles or public highways, roads, streets, bridges, mass transit, intercity passenger rail, ports, or airports, or motor fuels, including bond proceeds, shall be expended for other than costs of administering laws related to vehicles and transportation, costs for construction, reconstruction, maintenance, repair, and betterment of public highways, roads, streets, bridges, mass transit, intercity passenger rail, ports, airports, or other forms of transportation, and other statutory highway purposes, including the State or local share to match federal aid highway funds.

This sounds like a good idea, but it’ll lock up that money even in dire financial times.

14 Comments

|

Illinois Credit Unions: Giving Back to Our Communities

Wednesday, May 4, 2016 - Posted by Advertising Department

[The following is a paid advertisement.]

Credit unions exist to help people, not to make a profit. It is this motto of ‘People Helping People’ that sets credit unions apart. Credit unions are member owned, not-for- profit financial institutions that have a strong sense of community. Historically, credit unions have championed the cause of supporting underserved communities. In its 36 years of service, the Illinois Credit Union Foundation has awarded more than $3.5 million in scholarships, community service grants, assistance to peer assistance programs, emergency and natural disaster efforts, and community involvement projects. If you are not yet a credit union member, go to ASmarterChoice.org to discover of all the advantages that membership holds.

Comments Off

|

* COGFA…

Year To Date

Through April, base receipts are down $4.977 billion. The drop reflects comparatively lower income tax rates for the first part of the fiscal year, the one-time nature of some pharmaceutical court settlements recovered by the Attorney General‘s Office last fiscal year, no fund sweeps year to date, and the dismal performance of federal sources.

Gross personal income taxes are down $2.494 billion, $2.212 billion net of refunds, or $2.692 billion when the diversions to the education and human service funds are included. Gross corporate income taxes are behind last year’s receipting by $616 million, or $551 million net of refunds. Other sources are $139 million lower, reflecting the aforementioned court settlement proceeds received last fiscal year. Public utility taxes are off $59 million, while corporate franchise taxes declined $7 million.

A few sources managed to post modest gains. Insurance taxes are ahead of last year’s pace by $29 million, inheritance taxes are up $22 million, sales tax has managed a paltry $19 million increase, liquor taxes $3 million, and cigarette taxes $1 million.

Excluding last year’s $1.074 billion funds sweeps, overall transfers are down $8 million. Lottery transfers are ahead of last year by $23 million, but are offset by a $14 million decline in riverboat transfers, as well as $32 million less from all other transfers.

Federal sources are now down $521 million when compared to last fiscal year. Federal sources to the general funds have been off the expected pace for almost all of the fiscal year. A contributing factor to the poor year for general funds federal source performance has been a large amount of Medicaid bills being paid from the Healthcare Provider Relief Fund, rather than the GRF. [Federal reimbursement is deposited into the fund from which it was spent]. At this late stage of the fiscal year, even if spending and subsequent reimbursements shift back to general funds, federal sources are likely to fall well short of FY 2016 expectations.

* Meanwhile…

Now in its eleventh month, Illinois continued operation without an enacted budget has resulted in the State Employee Group Insurance Program (SEGIP) building up a large backlog of unpaid claims. As of the end of April, approximately $3.10 billion in claims were being held by the state from various insurers, organizations, and companies. Of this total, the largest portion is approximately $1.56 billion of Managed Care claims. The second largest line, Prescriptions, Open Access Plans, and Mental Health claims, totals $920 million. The third largest portion of the overall claims hold comes from CIGNA, which has $506 million in claims currently held by the state.

Concurrently, the estimated time for claims to be held is 522 days for Managed Care, 476-554 days for CIGNA, and 448-501 days for Prescriptions/OAPs/Mental Health. This information and other pertinent data is displayed on the chart below. As noted in previous SEGIP updates, without an enacted budget, claims will continue to build up and estimated claims hold times will increase.

* Related…

* Illinois legislators consider more higher education funding

* Plan To Equalize Illinois Universities’ Stopgap Funding Disparities

40 Comments

|

* Press release…

Pay Now Illinois, a coalition of 64 Illinois-based human and social service agencies and companies, today sued Illinois Governor Bruce Rauner and the directors of six statewide agencies seeking immediate payment in full of more than $100 million owed for work performed under contracts that date back to July 1, 2015, the beginning of the state’s current fiscal year.

In seeking a permanent injunction and declaratory judgment, the suit, filed in Cook County Circuit Court, charges that the Governor and other state officials have acted illegally by failing to make payments on contracts while continuing to enforce them. The suit also claims that the Governor’s veto of certain appropriation bills on June 25, 2015 was an unlawful impairment, or interference, with the agencies’ constitutional right to a legal remedy for the non-payment of these contracts. State agencies signed contracts with the social services providers, in some cases even after the Governor’s veto of the budget. The value of unpaid contracts for the members of the coalition exceeds $100 million.

The coalition members, who provide services including housing for the homeless, healthcare, services for senior citizens, sexual abuse counseling, and programs for at-risk youth, face “acute financial hardship.” Many have reduced staff and programs, and the viability of some of the organizations is threatened.

“This suit is about upholding a contract and paying your bills, basic good business practices,” said Andrea Durbin, of Pay Now Illinois. “We have delivered services under binding contracts, and now the state needs to pay us. We have delivered – and we continue to deliver – essential services to Illinois’ most vulnerable population of men, women and children as required under our contracts with the state. We are doing our part. We expect the state to do the same.”

In addition to Governor Rauner, other defendants in the suit include: John Baldwin, Acting Director of the Illinois Department of Corrections; Jean Bohnhoff, Director of the Illinois Department of Aging; James Dimas, Secretary of the Illinois Department of Human Services; Michael Hoffman, Acting Director of the Illinois Department of Central Management Services; Felicia Norwood, Director of the Depart- ment of Health and Family Services; and, Nirav Shah, Director of the Illinois Department of Public Health. In a detailed timeline of activities surrounding the Illinois budget approval process, the suit makes the case that funds were appropriated to pay the contracts, but the Governor’s action to veto appropriation bills blocked payment to service providers who had signed contracts.

“The Governor vetoed appropriation bills, and then his Administration entered into contracts for those same services,” said Durbin, who is also chief executive officer of Illinois Collaboration on Youth (ICOY), a statewide network of organizations providing services to at-risk youth and their families. “The state agencies have enforced these contracts, and have never suggested suspending or terminating them. They can’t simultaneously have us enter into a contract and perform services and then say there isn’t money to pay for them. The state has been having its cake and eating it too. That is just not good business.”

Click here to read the lawsuit. To see a list of coalition members, click here.

50 Comments

|

Games people play

Wednesday, May 4, 2016 - Posted by Rich Miller

* Mark Brown on the competing redistricting reform proposals…

The House and the Senate now have until the end of this week to approve the other chamber’s approach if either amendment is to go before Illinois voters in a referendum this fall.

Except that does not appear to be the plan. Instead, legislators in both chambers are preparing to ignore the other’s legislation.

This way they can all say they voted for legislative districting reform — without actually accomplishing anything.

Capitol Fax’s Rich Miller has aptly labeled this maneuver the “criss-cross,” a time-honored legislative method of deflecting blame and responsibility.

It’s a terribly cynical way of doing business, even accounting for honest differences of opinion on the best approach.

As I said months ago, if Democrats didn’t like the Independent Maps approach, then they needed to come up with their own plan to put before the voters this fall.

Agreed.

* But there are games being played everywhere. For instance…

A redistricting overhaul is part of the Turnaround Agenda that Rauner has said legislators must agree to before he’ll talk about new revenue to balance the budget.

But now that Democrats are moving forward, he’s rebuffing their redistricting proposals in favor of the citizen-driven bid. “What we want to do is have one initiative on the ballot,” he said Friday. “My personal opinion is the best one is the one that’s being advocated by Republicans and Democrats through a voter referendum process.”

21 Comments

|

Lucas threatens to walk

Wednesday, May 4, 2016 - Posted by Rich Miller

* Press release…

STATEMENT: We are now seriously pursuing locations outside of Chicago.

CHICAGO - The following statement is by Mellody Hobson on behalf of the Lucas Museum of Narrative Art following Friends of the Parks announcement rejecting a compromise location for the museum:

“My husband and I have worked in earnest for two years, side-by-side with every relevant city agency, community leader, and policy maker, to give what would be the largest philanthropic gift to an American city in the 21st century. From the beginning, this process has been co-opted and hijacked by a small special interest group. When the Friends of the Parks sued the city in order to preserve a parking lot, we were offered a different and feasible solution—the replacement of an underutilized and outdated convention space that would also add more than 12 acres of new parkland. Yet, even with this additional park space, an organization that claims to ‘preserve, protect, improve and promote the use of parks and open space’ now opposes this as well. While they claim to be a ‘strong steward of Chicago and a partner to its progress,’ their actions and decision rob our state of more than $2 billion in economic benefits, thousands of jobs and countless educational opportunities for children and adults alike.

As an African American who has spent my entire life in this city I love, it saddens me that young black and brown children will be denied the chance to benefit from what this museum will offer. As Chair of the Board of After School Matters, which serves 15,000 public high school students in Chicago and has more demand than can ever be met, I have seen firsthand what art can do to spur imagination and creativity, heal the soul and advance society—something so needed right now. This is a city of big shoulders and a metropolis that is second to none. In refusing to accept the extraordinary public benefits of the museum, the Friends of the Parks has proven itself to be no friend of Chicago. We are now seriously pursuing locations outside of Chicago. If the museum is forced to leave, it will be because of the Friends of the Parks and that is no victory for anyone.”

Maybe, but Lucas was also shown the door by San Francisco. He’s been trying to give this thing away since 2010, for crying out loud.

* Sun-Times…

“Mr. Lucas and the city only wanted a lakefront site, and we do not believe that is acceptable. We don’t think it’s appropriate to exchange building on lakefront land for other things — even if it’s park land. It’s inappropriate to build on public trust land,” said Juanita Irizarry, executive director of Friends of the Parks.

“Mr. Lucas may leave. That is ultimately his decision. But there are many other viable sites. Chicagoans should not be held hostage to one man’s desires. The public trust must be protected and we will continue to fight for our lakefront to remain open, free and clear.” […]

“The vision to put the Lucas Museum on the lakefront in the first place is what ultimately killed this deal. They should have fought for a legal site to begin with. It’s ultimately Mr. Lucas who wanted it his way or the highway,” Irizarry said. […]

“It would be too bad for Chicago to lose the Lucas museum, but that would demonstrate it’s not a commitment of George Lucas and [wife] Mellody Hobson to stay in Chicago. . . . It ultimately lies in the lap of Mr. Lucas as to whether he’s willing to cooperate with the broader needs of Chicago and put it on another site,” she said. “If he’s not, folks should ask Mr. Lucas, `Why not?’” […]

“There are many folks throughout the city who would love to see McCormick Place [East] gone. It’s something we expect will happen one way or the other in the not too distant future. It has become obsolete. There have been conversations about other uses for that site because it is obsolete. We expect it will eventually come down. We don’t think an excuse is necessary,” she said.

The whole idea of keeping the lakeshore clear and free of obstruction was to stop just these sorts of billionaire “gifts.” So, yeah, they make a good point.

* Neil Steinberg is not so polite…

Lucas wants a monument to himself, and Rahm wants to dilute his own general failure as mayor to solve substantive problems by hanging shiny prizes off his belt to dazzle the citizenry. […]

I’ve been saying this from the beginning. The “Star Wars” franchise was an enormous hit. But so was Cabbage Patch Kids, and they don’t deserve a lakefront museum either. Draping the “narrative arts” smokescreen over the museum fools no one. We could put it anywhere. […]

The Norman Rockwell Museum — Lucas owns dozens of Rockwells, and they are to be part of the collection — is in remote Stockbridge, Massachusetts, and plenty of Rockwell fans make the trek there to see it. I did. If the mayor actually cared about the whole city, as he pretends to, he’d be leaning on Lucas to put his new museum in Pullman, and not using the lakefront downtown to draw people to it instead of using the museum to draw people elsewhere. Maybe because it can’t, and they know it. Who’s going to fly to Chicago to see a museum that Chicagoans won’t get on a bus for 15 minutes to visit? […]

Evoking McCormick Place should be a clarifying moment. Longtime Chicagoans might remember that the reason McCormick Place is on the lakefront to begin with is because the Tribune bullied the city into putting it there in 1960. Six years after opening, it burned to the ground, thanks to the wrath of an angry God, only to be rebuilt again by Richard J. Daley.

Here’s a thought: Tear down McCormick Place and don’t build anything there. Let Lucas fob his museum off on Cleveland or Phoenix or one of those cities that will be genuinely delighted to have it. When that happens, how many of you would make plans to go to Cleveland or Phoenix or wherever the heck it ends up to see a mock-up of R2D2 and some framed comic strips? A show of hands. Anybody? I didn’t think so.

72 Comments

|

Whistling past the graveyard

Wednesday, May 4, 2016 - Posted by Rich Miller

* Bloomberg takes a look at Donald Trump’s potential impact on US Senate races…

“We’ve been preparing and running with the expectation that a Democrat will win Illinois maybe by 10 points,” [Sen. Mark Kirk’s campaign manager Kevin Artl] said.

That means that, to win against Democratic Representative Tammy Duckworth, who is challenging him, Kirk has to outperform the top of the ticket by five or six points.

The key to making up this deficit, according to Artl, is to focus on Kirk’s personal brand: “Fiscal conservative, social moderate, national security hawk,” he describes it. Artl mentions Kirk’s support for immigration reform, gay marriage and abortion rights, and the fact that he speaks Spanish.

The campaign is pressing hard on that specific qualification. It provided (partial) internal polling that said Kirk was beating Duckworth among Hispanics by more than six points in April. Artl said the candidates are essentially tied with independent women.

When he goes on the offensive, the strategy will be to paint Duckworth as the real Washington insider. Kirk might target Duckworth’s endorsement of Clinton, Artl said, but he’s more likely to hit her over a lawsuit against her from her time as head of the Department of Veterans Affairs, as well as the fact that former Governor Rod Blagojevich, who is imprisoned on corruption charges, appointed her to the position.

* Just 10 points? Well, Obama won Illinois in 2012 by 17 points and won in 2008 by 25 points. Then again, John Kerry beat President Bush by 11 points and Al Gore beat Bush by 12 points. Those Republican candidates were all solidly within the GOP mainstream, unlike the currently presumptive nominee, who has the highest unfavorables in modern presidential campaign history…

In response to [last night’s] developments in the Republican presidential primary race, Duckworth deputy campaign manager Matt McGrath released the following statement:

“Six weeks ago, Republican Mark Kirk pledged that he ‘certainly would’ support Donald Trump if he was his party’s nominee. Tonight, he got his wish. Congratulations.”

Clinton’s unfavorables are also extremely high, but assuredly not as high here as they are nationally.

* Also, the Paul Simon Institute poll found that fully a quarter of Illinois voters didn’t know enough about Kirk to rate him…

“(T)here is an unusually large number who say they do not know what kind of job he is doing” [said John S. Jackson, a visiting professor at the institute]

You gotta build a brand before you can campaign on it.

* To be clear, I don’t think this is going to be an easy race for Duckworth. Sen. Kirk is one of the better campaigners this state has produced in quite a while. But the trend is definitely not his friend.

28 Comments

|

* BND…

The company that operates several coal-fired power plants in central and southern Illinois announced Tuesday it would shut down units one and three at the Baldwin Power Station.

The shutdown will occur over the next year, according to a Dynegy statement. Company spokesman Micah Hirschfield said approximately 122 current jobs plus any vacant open positions will be lost. […]

The company has notified the Midcontinent Independent System Operator, which operates the power grid in central and southern Illinois, of the shutdowns that will take a total of 1,835 megawatts of generating capacity offline.

Hirshcfield said the next step in the process is for MISO to conduct a study to determine whether the grid can handle the loss of capacity. If it can, the shutdowns will go forward. If it cannot, MISO and Dynegy will negotiate a deal to keep the units online.

* Howard Learner, who runs the Environmental Law & Policy Center, responded with a warning…

“Dynegy’s management made a business decision to shut down old coal plants that are not economically competitive in the power market. Dynegy appears to now be asking Illinois legislators to force consumers to pay higher utility bills to subsidize Dynegy’s old, uncompetitive power plants. That’s just not fair. Illinois legislators should advance policies to support investment in the new clean energy technologies that keep electricity costs affordable while creating new jobs and spurring economic growth.

“Illinois has a surplus of old nuclear and coal plant supply while demand is declining due to smart energy efficiency that saves money for businesses at home. Natural gas and new wind power are outcompeting the old coal and nuclear plants, and they are saving consumers’ money. Illinois policymakers should not force consumers to pay higher utility rates to subsidize old plants they’ve already paid for.”

* And this is from the Sierra Club…

“Dynegy’s decision to phase out units at these coal-fired power plants is a signal of the profound shift that’s happening right now in America’s energy landscape. It is essential that we invest in the livelihoods of workers and communities historically dependent on coal, and work to maximize opportunities for the skilled workforce at the plants impacted by Dynegy’s announcement.

“Clean energy technology is growing every year in Illinois, but we must act now to get energy policy right to ensure that every Illinois community can thrive in the clean energy economy. The Sierra Club will continue to fight statewide for policies like the Illinois Clean Jobs Bill that will jump-start the state’s energy economy to allow for new, family-sustaining jobs for the workers impacted by a rapidly changing energy market.

“Workers and communities need the long-term stability that the clean energy economy can bring when we update our policies to make Illinois a national leader in technologies of the future. ”

29 Comments

|

* Tribune…

A report from Gov. Rauner’s Department of Revenue found that a switch from a flat income tax rate to a graduated system would drive 43,000 workers out of state and lead to a loss of more than 20,000 jobs within the first four years. […]

Still, the report backs up opposition from Rauner, who said earlier this week that such a change in the state’s tax code would be “the straw that breaks the camel’s back for Illinois’ economic competitiveness.”

According to the revenue department, the proposal would also decrease the state’s gross domestic product by nearly $2 billion.

“The increase in the tax rate for persons in the higher income tax bracket, results in a decrease in the incentive to work for individuals in that tax bracket. Moreover, the increase in the tax rate results in such pronounced negative economic effects because this rate will also affect pass-through entities (small business income),” said the report. “Some of the tax increase will be absorbed by a decrease in personal income or business profits. Some other fraction of the tax increase will be translated into price increase (compared to the rest of the nation).”

* Meanwhile…

Illinois House Democrats delayed a measure to tax millionaires at higher rates if voters approved the plan in November.

Democratic state Rep. Christian Mitchell, the bill’s sponsor, says he plans to bring up the proposal Wednesday. Lawmakers were expected to consider the bill Tuesday but Mitchell says he’s trying to get more support and give absent members a chance to vote.

Don’t bet on it.

…Adding… From the IMA…

Speaking on behalf of thousands of manufacturing companies across the state, the Illinois Manufacturers’ Association expressed strong opposition to the graduated income tax proposals pushed by Democrat Rep. Christian Mitchell and Democrat Leader Lou Lang that will make Illinois’ top tax rate the 2nd highest in the United States.

“This is a $2 billion tax hike on successful job creators including many small and medium-sized manufacturing companies that pay taxes under the individual rate. This is exactly the wrong message to send to job creators when we need to grow our economy and create jobs for hard working men and women in Illinois,” said Greg Baise, president & CEO of the Illinois Manufacturers’ Association. “Illinois already has the highest property tax rates in the United States and now Democrats want to make our income taxes among the highest in the nation as well.”

Illinois manufacturers lost 15,000 good, high-paying jobs last year that averaged more than $70,000 in wages and benefits.

Baise added, “The IMA does support comprehensive tax reform and passage of pro-growth policies such as workers’ compensation reform that will stimulate job growth and capital investment in the state.” The IMA notes that these policies will also generate revenue for Illinois in both the short and long term.

The current flat tax is one of few economic advantages that Illinois enjoys.

• The top tax rate under the Democrat plan is 9.75 percent

• Businesses filing under the individual income tax rate also pay a 1.5 percent corporate personal property tax replacement tax

• In total, the top rate on businesses and individuals will be 11.25 percent.

• Illinois’ top tax rate will be the 2nd highest in the country trailing only California at 13.3 percent.

This is a tax increase contrary to claims by the sponsors who pretend that this is a tax cut. Under Illinois law, the individual income tax rate will be reduced to 3.25 percent in the future so their lowest rate of 3.5 percent on the graduated scale means that every single Illinois taxpayer will see an INCREASE on their tax bills.

*** UPDATE *** As expected…

A proposal to move the state to a graduated income tax died in the Illinois House on Wednesday when the sponsor opted not to call the bill for a vote.

Rep. Christian Mitchell, D-Chicago, said he did not have enough votes to pass the proposed constitutional amendment that needed a three-fifths vote to pass the House.

Mitchell blamed Gov. Bruce Rauner for twisting arms on “three to five” Republican House members who Mitchell said were prepared to vote for the graduated income tax earlier in the week. He declined to name them.

98 Comments

|

Today’s quotable

Wednesday, May 4, 2016 - Posted by Rich Miller

* It’s little surprise that Cook County Sheriff Tom Dart is considering a mayoral bid. He wanted to run before, but stepped aside. But this is kind of a surprise. Sheriff Dart has never met or spoken with Gov. Bruce Rauner…

What about Rauner? Any conversations with him?

Very strange. The first month he was in office, he would give me dates [to meet] and then they got canceled. We gave him other dates. And then he never got back to us. So I’ve never spoken to him, period, ever in my life.

11 Comments

|

|

Comments Off

|

|

Comments Off

|

Moody’s states the obvious

Tuesday, May 3, 2016 - Posted by Rich Miller

* Tribune…

A national credit rating service is calling the emergency bridge funding measure for Illinois colleges and universities a “credit positive” move, but only for the short term.

The $600 million stopgap measure signed into law last week provides $356 million to public universities, $169 million to Monetary Award Program financial aid grants and $74 million to community colleges.

“The measure provides some breathing room, particularly for those with the thinnest liquidity and pressured student markets,” Moody’s said. But it also warned the higher education sector “will continue to confront longer-term funding pressures as the state remains unable to resolve its own severe budget issues and significant pension underfunding.”

Moody’s noted the money amounted to 29 percent or less of the state funding that Illinois’ largest public universities received in the 2015 budget year.

We need a real budget. Period.

11 Comments

|

[The following is a paid advertisement.]

Comments Off

|

[The following is a paid advertisement.]

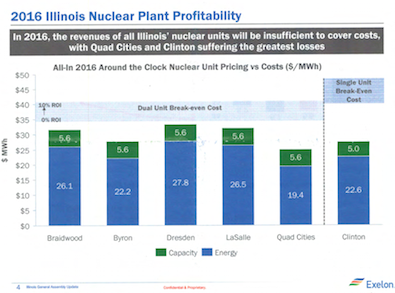

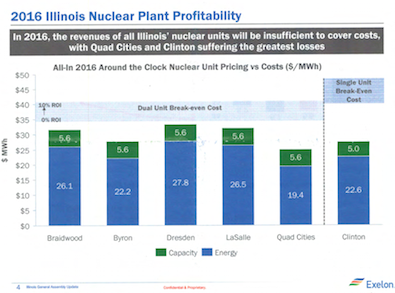

Nuclear facilities produce more than half of the electricity in Illinois and they’re by far the most reliable source of energy we have. As a result, our state’s businesses know they can depend on the electrical grid round-the-clock for their energy needs.

This is a huge asset and a competitive advantage for Illinois businesses, as they are able to operate regardless of weather or the time of year to meet the demands of their customers. Consumers benefit from this too, as affordable, reasonably-priced energy allows them to purchase goods at a lower cost.

That is why it is so important to find a solution to our state’s current energy problems. A recent State of Illinois report found that if some of our nuclear plants were to close early, as they’re projected to do soon, our state would lose $1.2 billion in annual economic activity and nearly 4,200 jobs. Coupled with higher electricity rates, this would be a severe blow to Illinois’ businesses and consumers.

For Illinois’ businesses to thrive, we need to ensure that nuclear energy remains in our state’s energy future. I urge our state legislators to enact energy reform legislation that properly values the contributions of nuclear energy in our state.

Signed,

Omar Duque, President and CEO, Illinois Hispanic Chamber of Commerce

For additional information, read my op-ed that recently appeared in the State Journal-Register.

Comments Off

|

* Makes sense…

To members of the Illinois General Assembly,

After reviewing HC0058 Sponsored by State Representative Jack Franks it is the considered opinion of MALDEF that his proposal would better protect interests of racial and language minorities covered under Section 2 of the Voting Rights Act. The language of HC0058 prioritizes minority voting rights over a number of criteria including respecting the geographic integrity of units of local government. These subordinate criteria must give way when these are in conflict with the goal of protecting minority voting rights. HC0058 (“Franks Bill”) states:

(a) Legislative Districts and Representative Districts shall each, in order of priority, be substantially equal in population; provide racial minorities and language minorities with the equal opportunity to participate in the political process and elect candidates of their choice; provide racial minorities and language minorities who constitute less than a voting-age majority of a District with an opportunity to substantially influence the outcome of an election; be contiguous; be compact; respect, to the extent practical, geographic integrity of units of local government; respect, to the extent practical, communities sharing common social or economic interests; and not discriminate against or in favor of any political party or individual.

By contrast the Independent Maps proposal does not prioritize minority voting rights and the mandatory language it uses sets up a conflict by requiring that “the redistricting plan shall respect the geographic integrity of units of local government.” This creates a new cause of action where any person of any race sitting in a city or town that was not completely within a given legislative district could have standing to sue to challenge the plan’s treatment of their unit of local government. Two Suburban Chicago legislative districts that currently elect Latinos, Districts 24 and 21, cross a number of city and town borders and under the Independent Maps proposal could be challenged on the basis that they do not “respect the geographic integrity of units of local government.” Under the Franks Bill, if Districts like 21 and 24 were challenged the sole fact that a unit of local government was not kept intact would not be a basis to challenge the map as the criteria is less important than minority voting rights and under the plain language is only required to the extent practical.

Another important way that HC0058 is better is that when it refers to discrimination on the basis of party affiliation it does not contemplate a lawsuit based on disparate impact or unintentional discrimination. HC0058 adds a requirement that a redistricting plan “not discriminate against or in favor of any political party or individual.” Placing this at the end of a list of criteria prioritized by importance and in which minority voting rights is near the beginning of the list better protects minority voting rights.

By contrast the Independent Maps language states:

The redistricting plan shall not either intentionally or unduly discriminate against or intentionally or unduly favor any political party, political group or particular person.

Stating that the plan won’t intentionally “or” unduly favor a political party, group or person, sets up “intentionally” and “unduly” as separate, and distinct forms of discrimination. This allows what is essentially an effects test (or disparate impact) to creep into (ultimately) a court’s assessment about whether a plan “unduly discriminates” even if it does not “intentionally” discriminate.

Historically effects tests have been limited to cases where a protected class cannot show discriminatory intent but can show a discriminatory impact or effect – like under Title VII. These effects tests exist because for the most part people and institutions don’t state that they intend to discriminate against members of protected classes but often adopt policies that do so in effect, and where intentional discrimination may be difficult if not impossible to prove. The language in the Independent Maps amendment puts political discrimination on par with race discrimination. In the voting rights context, Section 2 of the Voting Rights Act actually requires a showing of discriminatory effect plus a finding under the totality of the circumstances that a map discriminates – this is a higher standard than that arguably required to show political discrimination under the Independent Maps language.

Finally, the Franks bill decouples State Senate Districts from State Representative districts by striking the requirement that two representative districts be nestled within one senate district […]

In Illinois, this measure would likely give more flexibility to the map drawers to create majority minority districts when doing so would otherwise be complicated by the nesting requirement.

Very truly yours,

Jorge Sánchez

Senior Litigator MALDEF

Midwest Regional Office

Rep. Franks’ proposal passed the House today by a vote of 105-7.

11 Comments

|

Open thread

Tuesday, May 3, 2016 - Posted by Rich Miller

* I have to go give a speech at noon, so blogging will be light for awhile. So, talk amongst yourselves. Be kind to each other and please keep it state-related. Thanks!

54 Comments

|

Lead, follow or get the heck out of the way

Tuesday, May 3, 2016 - Posted by Rich Miller

* This intransigence by the governor needs to end…

Republican Gov. Bruce Rauner came under fire Monday as the doctors, nurses and patients on a state panel that recommends whether to expand Illinois’ medical marijuana test program complained their suggestions are routinely ignored.

The Medical Cannabis Advisory Board suggested that 10 previously recommended ailments receive approval, as well two new ones: Type 1 diabetes and panic disorder.

As some at a hearing celebrated the diabetes recommendation, board member and pediatrician Dr. Nestor Ramirez cautioned the crowd to “wait for what the governor says.” […]

Rauner’s Illinois Department of Public Health has rejected the board’s past recommendations. The governor, who inherited the medical marijuana program, has been reluctant to broaden access, instead calling for further study of the drug’s benefits and risks.

Ugh.

* More…

Board chairwoman Leslie Mendoza Temple, who is a primary care doctor, said it’s hard to get top quality research on medical cannabis because it’s an illegal drug. She said the Rauner administration’s standards on approving the conditions are too strict.

“Pharmaceutical medications often have randomized controlled trials, so if we put medical cannabis research requirements at that level, of FDA drug approval status, we’re never going to get there,” she said.

The governor’s office has said not enough time has passed to fully evaluate it. […]

A decision by Rauner is expected by July. The pilot program started in 2013, but sales didn’t start until late last year.

Don’t hold your breath.

51 Comments

|

Daley’s tinfoil hat

Tuesday, May 3, 2016 - Posted by Rich Miller

* Tribune…

When Dennis FitzSimons described how the Independent Map coalition would need to take a truck to the State Board of Elections to deliver their nearly 600,000 petition signatures, Bill Daley had some advice.

“I think you ought to get a decoy truck,” said the former White House chief of staff and brother and son of two Chicago mayors.

“I wouldn’t be so open about how we’re going to get these petitions (delivered) because, over the years, I’ve been around and strange things happen with petitions that look like they’re going to make a change,” Daley said.

FitzSimons is the chairman of the Independent Map drive, which is attempting to put on the November ballot a proposed state constitutional amendment asking voters to remove some of the partisanship in the way legislative districts are drawn.

That conspiracy theory neatly and succinctly sums up how the monied elite feel about Speaker Madigan. In their minds, he’ll do anything, even hijack a truck, to win.

26 Comments

|

30-day pause in Lucas lawsuit

Tuesday, May 3, 2016 - Posted by Rich Miller

* Tribune…

Friends of the Parks has suspended its lawsuit against the proposed Lucas Museum on Chicago’s lakefront, the group announced Tuesday.

The nonprofit group, which has blocked the push by “Star Wars” creator George Lucas and Mayor Rahm Emanuel to build an arts museum near Soldier Field, said in a news release that the stay “gives all parties the opportunity to have a more direct and productive dialogue to reach a potential solution about a museum site.”

It said it has informed U.S. District Court Judge John Darrah of its decision but added that it could restart its lawsuit, if necessary. City officials asked the group to halt its lawsuit and the group said it agreed “because the city is now prioritizing another site” for the museum.

The suspension is only for 30 days.

* The Sun-Times has more, including the list of demands…

* Active and serious investigation of other possible non-lakefront sites that include the Michael Reese Hospital site acquired by former Mayor Richard M. Daley as the site of an Olympic Village before Chicago’s first-round flame-out in the 2016 Olympics sweepstakes, an 18th Street site across from the Soldier Field site, and the marshalling yards for trucks and recreational vehicles west of McCormick Place.

* A “strong grasp of the impact” the Lucas museum would have on “jobs, particularly for South Side residents, tourism and the economic in general, taxes and other costs to Chicago residents and educational benefits.”

* “Clear specifics” about any proposed site and plan that promises to generate the most viability and create more park space for residents and visitors.

The Chicago Sun-Times reported exclusively in mid-April that Emanuel has shifted his focus from Soldier Field’s south parking lot to the site of McCormick Place East to avoid a protracted legal battle over the Soldier Field site and satisfy Lucas’ demand to get moving on the legacy project.

Emanuel’s plan calls for tearing down the above-ground portion of McCormick Place East, building the museum on a portion of the site that includes Arie Crown Theater and replacing the lost convention space by building a $500 million McCormick Place expansion over Martin Luther King Drive.

Any deal would have to be approved by the GA and the governor.

13 Comments

|

Brady amendment kills lite guv proposal

Tuesday, May 3, 2016 - Posted by Rich Miller

* Petrella…

Also scheduled for a hearing Tuesday [in the Senate] is the House’s lieutenant governor amendment. Despite voting against the previous version, Sen. Bill Brady, R-Bloomington, is sponsoring the House version.

Brady said he plans to propose changing the line of succession the amendment would establish, having a vacancy in the governor’s office filled by the highest-ranking official of the same party rather than by the attorney general, who might be of the opposite party.

That would address a major concern for Republicans who voted against the Senate version, he said, but it would mean the amendment won’t make it to the November ballot.

* The Tribune editorial board is not happy with this Brady development and addressed a missive to the Senate sponsor…

Your amendment changes the succession order to the next highest-ranking official of the governor’s political party: attorney general, secretary of state, comptroller, treasurer, and then majority or minority leader in the Senate and House — someone who is of the same political stripe as the outgoing governor. That is, your amendment would keep the office of governor in the same political party.

But if you demand those changes, voters won’t have the chance to weigh in on this proposed constitutional amendment. They have been waiting decades. Literally. Various proposals to eliminate the office of lieutenant governor have swirled around Springfield since the 1970s. […]

Senator, you co-sponsored the exact same bill in 2013 that would give the attorney general line-of-succession powers should the governor be unable to serve.

Now, all of a sudden, that’s a problem for you.

Don’t block the one chance voters have in November to eliminate an unnecessary state office. None of us has forgotten that you ran as the Republican gubernatorial nominee in 2010 promising to shrink government.

A whole lot of ink has been used up by editorial boards on this mainly symbolic constitutional amendment. Most are upset that Rauner and the Senate Republicans have flip-flopped. And I suppose they believe that if legislators can’t even eliminate this office then shrinking other governments would be out of the question. Maybe, but I doubt it.

But with all the real carnage out there, I find it kinda ridiculous that so much “outrage” is expressed on something that doesn’t really matter either way. I mean, the Tribune did not ever express one bit of concern when the governor submitted grossly unbalanced budgets two years in a row, but they’re somehow all fired up about a million or two bucks a year?

Weird.

19 Comments

|

* Bloomberg on the impasse…

Rape crisis centers, owed about $5 million, are depleting reserves, leaving positions unfilled and creating waiting lists for victims of sexual assault. Homeless shelters haven’t gotten state aid this year, which is also jeopardizing matching funds from the federal government, according to the Chicago Coalition for the Homeless.

“The whole social services safety net is starting to wear away,” Bob Gilligan, executive director of the Catholic Conference of Illinois told lawmakers last week. The state owes Catholic Charities of Chicago $18 million. “Once it goes, it’s virtually impossible to rebuild.”

Illinois bonds aren’t in danger of defaulting because state law mandates monthly transfers to ensure that semi-annual debt payments are made. But the the turmoil hasn’t gone unnoticed: Investors are demanding an extra 1.8 percentage points to hold Illinois’s 10-year debt, the most among the 20 states tracked by Bloomberg and up from as little as 1.1 percentage point two years ago.

“Bondholders pay attention to distress in social services for the borrower,” said Adam Buchanan, senior vice president of sales and trading at Ziegler, a broker-dealer in Chicago. “It’s a signal of weakness of potentially greater problems in the future.”

No question, the pre-Rauner status quo was bad. But the current status quo is much worse at the moment.

24 Comments

|

* Dan Petrella…

Although they wouldn’t name any names, Democratic Reps. Lou Lang of Skokie and Christian Mitchell of Chicago said at a Statehouse news conference Monday that they think some Republicans will support their plan to introduce a graduated state income tax.

“This is an issue whose time has come,” said Mitchell, who is sponsoring the amendment. “I believe that this is going to pass with bipartisan support.” […]

Emily Miller of Voices for Illinois Children, an advocacy group that’s backing the amendment and a companion bill from Lang that would cut taxes for more than 99 percent of taxpayers while raising rates on the wealthiest Illinoisans, said she expects the House to vote Tuesday to approve the amendment.

“This does have some very promising bipartisan support,” she said, adding that the group has been working with members of both parties.

They’ll likely need at least three GOP votes in the House to overcome expected Democratic opposition. But they could need more. And Gov. Rauner is dead set against the proposal.

* Illinois is one of just eight states with a flat income tax among the 43 states which tax incomes. But not everybody thinks Rep. Lang’s companion bill, with its 9.75 percent top rate, is a good idea, including those who support the concept of a graduated income tax…

In general, it’s a good idea to consider when the state is short on revenue, [Don Fullerton, a tax policy expert and the associate director of the Institute of Government and Public Affairs at the University of Illinois] said, adding that a graduated system eases the burden on lower-income taxpayers while drawing in more revenue from those who have more disposable income.

That said, Fullerton thinks the upper end of Lang’s proposal may be asking too much.

Kim Rueben, senior fellow at the Urban-Brookings Tax Policy Center in Washington, agrees on both counts.

“Having a graduated income tax makes sense, but I would think that you don’t necessarily want to immediately go to one of the most graduated income taxes that we see in the country,” Rueben said. […]

Rueben said it might make more sense to have a smaller increase at the top of the scale and also raise rates on individuals earning between $100,000 and $500,000.

54 Comments

|

More bad news for Exelon

Tuesday, May 3, 2016 - Posted by Rich Miller

* Steve Daniels…

Exelon’s board got a stern rebuke from company shareholders, who voted overwhelmingly to oppose how much the company paid CEO Chris Crane last year.

The 62 percent vote against the Chicago-based electricity giant’s 2015 compensation package in an advisory “say on pay” vote is the largest margin so far this year against any company’s pay, according to proxy advisory firm Institutional Shareholder Services. Exelon disclosed the results of the shareholder vote late on April 29. […]

In its report, ISS cited relatively easy goals Exelon set for Crane in order to earn the nearly $16 million in cash, stock and other rewards he received last year.

“Exelon’s stock performance lagged many of its peers over the last three- to five-year periods,” ISS said in a March 29 report. “However, nearly every component of CEO pay increased during FY2015 and incentive awards, both long and short, were earned at above-target levels and based on nearly flat or lowered performance goals.”

7 Comments

|

Civic Federation rips Rauner budget proposal

Tuesday, May 3, 2016 - Posted by Rich Miller

* Tribune…

Gov. Rauner’s latest budget proposal is at least $3.5 billion out of balance, according to a new analysis released Tuesday by the Civic Federation, a government finance watchdog group.

The report found Rauner’s budget plan “does not fully account for the actual cost of essential state services and is based on projected savings that are unlikely to be realized.”

Those unlikely savings include reducing pension contributions by almost $750 million, largely by deferring payments, as well as cutting employee health insurance costs by $445 million. An additional $475 million in one-time savings would come from emptying the state’s rainy day fund and the sale of the James R. Thompson Center in Chicago, which requires legislative approval.

If that deficit is not addressed, the Civic Federation estimates the state’s backlog of unpaid bills could reach a new high of $12.8 billion by the end of the next fiscal year.

* Greg Hinz…

In a beyond-blistering report being issued today, the Chicago watchdog says the budget’s reported $3.5 billion deficit—a shortfall Rauner has suggested might be filled with spending cuts and perhaps some tax hikes—in fact is “more like $4.5 billion to $5 billion,” federation President Laurence Msall told me in a phone interview last evening.

* From the report…

The Civic Federation opposes Governor Rauner’s recommended FY2017 budget because it has an operating deficit of at least $3.5 billion and presents an insufficiently detailed plan for closing the gap. The $3.5 billion figure appears to be understated because it does not fully account for the actual cost of essential State services and is based on projected savings that are unlikely to be realized.

And how is this deficit understated? Read on…

The Civic Federation is concerned about the following aspects of the Governor recommended FY2017 budget:

* The General Funds budget has an operating deficit of at least $3.5 billion and an insufficiently detailed plan to close the gap between revenues and expenditures;

* After declining for the past three years, the State’s backlog of unpaid bills is expected to be significantly higher in FY2016 and FY2017 due largely to the phaseout of temporary income tax rate increases in the middle of FY2015;

* The State’s pension contributions are reduced by $748 million partly by deferring costs to future years;

* The proposal budgets a reduction of nearly one-fourth in group health insurance costs, with savings that depend on either a successful resolution to labor negotiations or the removal of health insurance from collective bargaining; and

* The Budget Stabilization Fund, the State’s only rainy day fund, is depleted to help balance the budget.

* The proposal to save nearly $198 million by moving seniors who are not eligible for Medicaid from the Community Care Program to a much less costly program could lead to increased institutionalization of elderly residents; and

* The use of one-time resources to pay for ongoing operating costs guarantees future deficits and continues the ongoing budget imbalance. These include fully depleting the Budget Stabilization Fund and the sale of the James R. Thompson Center and savings from not repaying FY2015 interfund borrowing.

* One big problem…

Because of the FY2016 budget impasse, the backlog of unpaid claims had grown to $2.9 billion by the end of February 2016 and was expected to increase by $200 million per month. Group health insurance is one of the main areas of government that has not received funding during the budget standoff. However, the costs of the program must be paid eventually due to State law and union contracts, and interest penalties will be paid at the same time.

* More…

The administration arrives at the $3.5 billion operating deficit for FY2017 by beginning with a maintenance budget that has a $6.6 billion shortfall. The Governor’s recommended FY2017 budget reduces the operating deficit to $3.5 billion through projected spending cuts of $2.6 billion and the use of $476 million in one-time revenues.

The $3.5 billion figure appears to significantly understate the shortfall because it does not fully account for the actual cost of essential State services and is based on projected savings that are unlikely to be realized. The administration has not released details about its proposed cuts to the Community Care Program, which seeks to keep elderly residents out of nursing homes, or any actuarial reviews of its proposal to save money on pension contributions. The recommended savings on overtime pay and group health insurance depend on changes that have so far been rejected by the State’s largest labor union.

The administration is also seeking to transform other areas of government, including streamlining the procurement process and modernizing the information technology system, according to the FY2017 budget document and the Governor’s State of the State speech in January 2016.

The Civic Federation supports efforts to increase the efficiency and effectiveness of government through major reforms. However, it is imprudent to base so many deficit-reduction measures on untested initiatives. Given the State’s dire financial plight and long history of fiscal mismanagement, the State cannot afford to ignore the discipline of budgetary balance. […]

The backlog of unpaid bills declined from $8.1 billion at the end of FY2012 to $5.2 billion at the end of FY2015. If additional appropriations are enacted with no additional revenues, the backlog is expected to reach $9.3 billion at the end of FY2016. It will remain at that level in FY2017 if the operating deficit in the proposed budget is closed. If the gap is not eliminated, the backlog could grow to $12.8 billion, or 37.5% of projected FY2018 revenues.

57 Comments

|

|

Comments Off

|

When “nonprofit” means “highly profitable”

Monday, May 2, 2016 - Posted by Rich Miller

* AP…

Seven of the 10 most profitable U.S. hospitals are nonprofits, according to new research, including one in Urbana, Illinois, where hospital tax exemptions are headed for a contentious court battle that soon could determine whether medical facilities are paying their fair share of taxes.

The “Top 10″ list accompanies a study published Monday in the journal Health Affairs. The analysis is based on federal data from 2013 on nearly 3,000 hospitals. The authors measured profits using net income from patient care services, disregarding other income such as investments, donations and tuition. Researchers say the measure reflects how hospitals fare from their core work, without income from other activities.

The research comes as cities in New Jersey, Michigan and Wisconsin also wage battles over hospital tax breaks. Officials are scraping for revenue and pressuring hospitals to either pay up or justify their tax-exempt status. […]

But money-making hospitals also include nonprofits such as the Carle Foundation Hospital in Illinois, where a state appeals court in January ruled a state law allowing hospitals to avoid taxes is unconstitutional. The Illinois Supreme Court is expected to review the decision, on appeal by Carle Foundation Hospital.

* More…

Less than two months after Carle Foundation Hospital was removed once again from local property tax rolls, a new study has named it one of the 10 most profitable hospitals in America. […]

The 328-bed Carle earned profits of $163.5 million, or $2,080-per-patient, according to the study. […]

Urbana mayor Laurel Prussing said the study highlights the need for reform at both the state and federal level.

“They’re just overcharging people,” she said of Carle. “They cost more than the Mayo Clinic.”

Wow.

15 Comments

|

50 UIUC students disrupt Rauner visit

Monday, May 2, 2016 - Posted by Rich Miller

* Fox 55…

It was a rude welcome for Governor Bruce Rauner at a stop at the University of Illinois Thursday. Protesters interrupted several events that the governor attended.

The chants were loud and the message was clear; protesters were angry over Illinois politics.

* USA Today…

A handful of the protesters followed Rauner into the ceremony, while security stopped the others from entering. Those outside in the hall banged on the walls repeatedly chanting, “Rauner, go home!” and “Fund higher-ed! Fund higher-ed!” […]

He eventually left the event earlier than planned.

Alex Villanueva, external vice president of the Illinois Student Senate, tells USA TODAY he agrees with the “ends” of the protest but disagrees with the “means … They did not represent Illinois well.”

“To see students hurling expletives in public, running through the student union and chanting and banging on the wall during his speech is disrespectful, not only to him, but far more importantly to the students he was recognizing,” Villanueva tells USA TODAY College.

“Ultimately, I think this behavior will make things worse and will certainly make Governor Rauner wary of visiting campus, which keeps him from seeing firsthand the great things we are doing at Illinois, and how the lack of a budget is hurting everyday students.”

* Daily Illini…

The protesters pursued him to the second floor of the Illini Union and then down to Illini Room C, chanting the whole time.

When Rauner entered the event, about 20 protesters were able to enter the room to hold up signs and “cackle” at the governor; the remaining 30 protesters then went around through the kitchen to the south lounge of Union, Daniels said.

There, they loudly banged on the Illini Room C walls from the outside of the room for the majority of the time Rauner spoke, which made Rauner’s speech almost inaudible. […]

“He spent like 10 minutes on the second floor while we were all chanting, so I doubt he was able to get his message across, and then he spent like 30 seconds speaking and that was supposed to be his main speech,” Daniels said. “There’s no way he was planning on spending this little time here.”

Daniels said the protesters’ main motivation was to send the message that Rauner is not welcome here and Daniels thinks they definitely sent that message.

* Sun-Times…

Gov. Bruce Rauner on Friday said he shares in the “anger” of protesters who heckled him over the state budget impasse the day before at the University of Illinois’s Urbana campus.

70 Comments

|