* As you’re probably aware by now, the House has left town without acting on the proposed tax hike…

“The votes aren’t here in the House yet,” said Rep. Frank Mautino, D-Spring Valley, a House budget expert. “There’s not 60 votes.”

House Speaker Michael Madigan has not commented on the proposal yet, but was expected to meet with Gov. Pat Quinn behind closed doors today to fine-tune the plan.

The governor also has been asking individual lawmakers into his office to lobby them for support. […]

Rep. Susana Mendoza, D-Chicago, said she doesn’t support the plan as it stands because it would not provide any additional money for cities, even though the state has recently forced local municipalities to pay more into their pension retirement systems. Mendoza is running for Chicago city clerk in the Feb. 22 election.

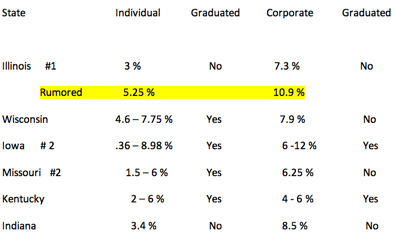

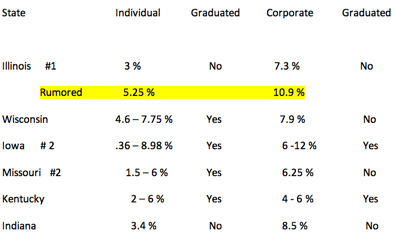

* Meanwhile, the Taxpayers Federation of Illinois sent over this handy little chart. Click the pic for a larger image…

Note that corporate tax rate. Pretty much all the media coverage has claimed the rate would rise to 8.4 percent. Not true. Corporations also pay a Personal Property Replacement Tax of 2.5 percent of income. That means the total corporate rate will rise to 10.9 percent. More from the Taxpayers Federation…

# 1. Includes both regular and personal property replacement tax rate. Taxpayers’ only compare total rates. It is not important to them that the state split the proceeds.

# 2. Both Iowa and Missouri, unlike most states allow a deduction for federal income taxes paid therefore the effective rates are about 20% lower than the stated rate.

That federal deduction means our effective tax rate will be higher than Iowa’s. And that means we will have the highest effective corporate tax rate in the nation if this bill passes.

Discuss.

*** UPDATE *** From the Tax Foundation…

Under the plan, Illinois’s one-rate individual income tax will rise from 3% to 5.25%, a 75 percent increase. The corporate income tax will rise from 7.3%[3] to 10.9%, a 49 percent increase and becoming the highest state corporate income tax in the United States and the highest combined national-local corporate income tax in the industrialized world. [Emphasis added]

Yikes.

- Logical Thinker - Friday, Jan 7, 11 @ 2:20 pm:

Bye Bye Business, especially in towns that border these states.

Disaster.

- Realist - Friday, Jan 7, 11 @ 2:23 pm:

This needed be be run through quickly. Since it apparently didn’t have the votes today I don’t see how it will have them in 2 to 3 days. No one will be calling up the legislators in competitive districts telling them to vote for a tax increase. They are likely only to here from those against. Many will see the vote for a tax increase in Illinois, while those in other states are going the cutting expenditure route, as political suicide.

- Ghost of John Brown - Friday, Jan 7, 11 @ 2:29 pm:

I see a growing U-Haul business.

- Cal Skinner - Friday, Jan 7, 11 @ 2:33 pm:

The Chicago Tribune’s headline saves the day again.

Nothing like telling people that the increase is 75%, not 2.25%.

- Davey Boy Smithe - Friday, Jan 7, 11 @ 2:37 pm:

Cal, the Tribune headline seems correct to me. It would be raised 75%, or one could say it’s being raised 2.25 percentage points.

- Rich Miller - Friday, Jan 7, 11 @ 2:37 pm:

Cal, nobody in the media is saying 2.25 percent that I can find. I checked that out yesterday after Don & Roma complained on-air. The media is reporting points, not percent, which is wholly accurate.

- wordslinger - Friday, Jan 7, 11 @ 2:38 pm:

Just like when Cook County’s sales tax increase pushed up Chicago’s rate, that corporate effective rate breaks what I think is the 10% psychological barrier. A real hard sell.

Happily, now that there’s an actual pencil-to-paper proposal on the table that goes a long way toward paying bills and getting the deficit in line, the GOP loyal opposition can come back with an alternative.

You can bet Rep. Cross, Sen. Radogno and their staffs will be burning the midnight oil this weekend crafting a solution to the current crisis. Godspeed.

- Rahm's Parking Meter - Friday, Jan 7, 11 @ 2:38 pm:

Rich, Could you find out if there is a tax increase exemption for low income tax payers, or this clearly across the board?

- davidh - Friday, Jan 7, 11 @ 2:40 pm:

The corporate rate gives me pause, the individual rate not so much (however the Tribune chooses to characterize it). It is easy to howl about these increases but they need to be considered against the alternatives. We aren’t going to cut our way out of this, which leaves doing nothing. Doing nothing is not exactly going to foster a good climate for businesses or individuals.

- John - Friday, Jan 7, 11 @ 2:40 pm:

We can’t afford this at all. Especially in this economy. The Corporate Tax Rate that is just awful, makes me want to move NOW! Though I wouldn’t be shocked if they have to stiff arm to hit 60.

- Secret Square - Friday, Jan 7, 11 @ 2:41 pm:

If I’m not mistaken, the Ill. Constitution says corporate income tax rates cannot exceed personal income tax rates by MORE than an 8-to-5 ratio. However, that provision wouldn’t prevent the state from setting a LOWER corporate tax rate (closer to the individual rate). Could that provide an avenue for compromise here?

- Hank - Friday, Jan 7, 11 @ 2:41 pm:

The firestorm will rage for a couple of days, then a leaders conference will be called and a revised proposal of 4% will emerge and be passed with many claiming credit for standing up for the taxpayer

- Bill Baar - Friday, Jan 7, 11 @ 2:43 pm:

Via Clout Street, Dec 4, 2009. The Speaker owes Illinois an explaination on what’s changed from a year ago, and what’s changed.

Madigan, a powerful veteran Southwest Side leader, predicts that the economy might get worse before it gets better, meaning fewer jobs and fewer people paying taxes.

“For those that think that tax increases are the answer, it’s a partial answer,” Madigan told an audience gathered for a panel discussion at the annual Illinois Legislative Latino Caucus Foundation meeting in Rosemont on Thursday. “Because you can raise the rate on the Illinois income tax, but if the economy is not performing you’re not going to get an increase in money out of the increase in rate.”

The state budget deficit is as much as $12 billion, depending on who is doing the estimating.

Madigan said while the public may be aware of the financial help provided to major banks under the federal stimulus package, many don’t know that institutions also borrowed from private lenders, and those loans come due next year. He said the banks may have a hard time making those payments, therefore there is a “major threat of further contraction” in the economy during the first part of 2010.

“Everybody should understand… we are in a very difficult economic situation,” Madigan said. “Not everybody in the country fully appreciates the gravity of the situation.”

The corp tax looks like a perfect job killer.

- Rich Miller - Friday, Jan 7, 11 @ 2:43 pm:

RPM, we have a flat tax here. Also, this site isn’t Google and neither am I.

- Logical Thinker - Friday, Jan 7, 11 @ 2:46 pm:

Wordslinger:

“Happily, now that there’s an actual pencil-to-paper proposal on the table that goes a long way toward paying bills and getting the deficit in line, the GOP loyal opposition can come back with an alternative.”

I would be ok paying an additional 2.25% if the following happened:

1. All pensions for State employees were immediately ended and replaced with defined contribution plans. Benefits already accrued under such pensions would be honored, but there would be no future accrual.

2. The tax hike would be mandated by law and without repeal or adjustment to have a sunset provision. Additionally, under such provision, there could not be another tax hike for 5 years following the termination of this one.

3. Freezing the state budget for the length of time the tax hike is in effect. Therefore, “increased revenues”–a misnomer–could only be used to improve the financial condition of the state.

4. Corporations have a tax rate closer to 6-7% to allow for some growth in the job market.

- TD - Friday, Jan 7, 11 @ 2:47 pm:

We have high unemployment, slow population growth, a massive budget deficit, and a troubled political climate. How can we make Illinois less attractive for employers and citizens? Simply tax corporations more than any other state and considerably raise personal income tax, along with bumps and increases in a variety of other taxes.

Add that to a once-in-a-generation change of leadership in Chicago, and folks in Illinois’ top board rooms may search for calmer waters.

- Just Asking - Friday, Jan 7, 11 @ 2:49 pm:

How often is it that, when a business threatens to move if a tax raise occurs, the business actually does so? It’s not as if it’s free or easy to just change locations. It doesn’t cost a dime to threaten to move, though, especially if the press serves as your mouthpiece.

With so many states dealing with deficits by cutting infrastructure, education, and social spending, might not Illinois actually be at an advantage in a few years by going this route? Sure, taxes will be higher, but we might end up getting a lot more for our tax dollar– businesses located here could offer employees and partners better transit, better schools, and less disordered communities than in states undergoing austerity budgets. And finally, it’s not as if the states at the bottom of the business tax spectrum are all world-beaters (Mississippi, Arkansas, Michigan, South Carolina). I’m not saying it’s as simple as high taxes=success, but it’s not as if the inverse is any more true.

- Old Milwaukee - Friday, Jan 7, 11 @ 2:51 pm:

Wordslinger,

The Democratic majority has spent several years with Blagojevich and Quinn overspending and overborrowing despite the repeated warnings from Republicans like Bill Black and others that this path would lead to bankruptcy.

I’m sure the Republicans are more than happy to let the Democratic majority fix their problem the way they want to fix it.

- Rich Miller - Friday, Jan 7, 11 @ 2:51 pm:

===Additionally, under such provision, there could not be another tax hike for 5 years following the termination of this one.===

Completely unconstitutional. You’d need a JRCA for that.

- MrJM - Friday, Jan 7, 11 @ 2:56 pm:

Hooray!

Illinois is in the Industrialized World!

– MrJM

- soccermom - Friday, Jan 7, 11 @ 2:57 pm:

I actually have a similar question to RPM. Does this include a big increase in the state EITC and the personal exemption? Those would help to mitigate the impact of this increase in the flat rate on low-income earners.

- Ahoy - Friday, Jan 7, 11 @ 2:57 pm:

I’ve always thought we needed a balanced approach to our fiscal mess. We need budget cuts, pension reform that affects currently employees, Medicaid reform and a modest temporary tax increase. There is nothing modest about this nor is it a balanced approach. This is asking the taxpayers to bare the sole burden of bailing out our state government and politicians.

My hope is that this is the red herring and a deal can be reached between the two parties that calls for shared pain and more balance. Unfortunately our state does not have rational and cooperating people governing it.

- Rich Miller - Friday, Jan 7, 11 @ 2:57 pm:

Not as of yet, soccermom.

- Anonymous - Friday, Jan 7, 11 @ 2:59 pm:

How often is it that, when a business threatens to move if a tax raise occurs, the business actually does so? It’s not as if it’s free or easy to just change locations. It doesn’t cost a dime to threaten to move, though, especially if the press serves as your mouthpiece.

————–

The companies threatening to move are the ones who have the means to do so (and are large enough to get press coverage when they threaten to). I’d be more worried about the small businesses who are already struggling to make ends meet.

- KGB - Friday, Jan 7, 11 @ 3:00 pm:

I’m not excited about the corporate tax rate increase. But what’s the alternative? 3% tax hike (100% tax increase)? At this point, I don’t think there is much difference in the voter’s minds between a 2.25% increase and a 3% increase.

- Trusth Seeker - Friday, Jan 7, 11 @ 3:11 pm:

Rich and all great stuff. I appreciate the depth of knowledge and the diversity of opinion. I always feel smarter after reading the posts. Keep up the good work everybody.

- Just Asking - Friday, Jan 7, 11 @ 3:12 pm:

“The companies threatening to move are the ones who have the means to do so (and are large enough to get press coverage when they threaten to). I’d be more worried about the small businesses who are already struggling to make ends meet.”

They may have the means to do so, but that doesn’t mean it is cost-effective or otherwise pragmatic.

Also, a lot of this discussion is making me wonder why Illinois is so content to cling to its flat tax system. I know it’s in the state constitution and all, but I think it’s strange how little talk exists about an amendment allowing for a graduated tax.

- wordslinger - Friday, Jan 7, 11 @ 3:12 pm:

–I’m sure the Republicans are more than happy to let the Democratic majority fix their problem the way they want to fix it–

That’s swell, I’m sure that’s incorporated in the oath they’ll all take in a few days.

Which is it though? They cash their checks and offer no alternative out of spite or because they have no game? Either way, they cash the checks.

For the life of me, I can’t understand how or why the Illinois GOP did not see the last few years as an opportunity to present a sober, intelligent alternative to Democratic rule. Between the mush-mouth “I don’t know the extent of the problem” stuff from Brady and the tomb-like silence of Cross and Radogno, I can only conclude the GOP establishment is content with the crumbs in members, staff and pork-barrel projects that the Dems give them.

Not exactly “Profiles in Courage” stuff.

You did register the GOP landslide in state legislatures across the rest of the country last year, right?

- Nuance - Friday, Jan 7, 11 @ 3:13 pm:

You have to be just as concerned with not being able to attract new businesses as losing existing businesses that move to another state. Of course with technology what it is today, there are certainly a number of businesses that could move easier than in the past.

- Matt - Friday, Jan 7, 11 @ 3:13 pm:

The tax increase got a mention on Drudge. It was even a RED link! We should be proud!

“Illinois Pols Push Plan To Boost Income Tax — By 75%!”

- OneMan - Friday, Jan 7, 11 @ 3:21 pm:

2:59 Anonymous… In some ways it is easier for some companies to leave the state (or any location for that matter) for tax reasons. As can be seen by concepts large companies use today to avoid paying taxes such as the Dutch sandwich or the double Irish sandwich.

As the tax rate goes up, it becomes more cost effective for more and more companies to do just that for example google “Microsoft Nevada Taxes” to find out what Microsoft does to reduce just one part of their tax burden.

This change is going to have a positive employment impact for those folks who are going to help more mid-sized companies set up branches in other states where revenues will go. It’s going to be smaller companies that are going to take it in the shorts.

- Union - Friday, Jan 7, 11 @ 3:22 pm:

Well it has been stated that 2/3rd of all corporations pay no income tax. Is that just federal or state? Can we find out how many corporations actually pay the tax, or is it reduced through deductions and credits?

I know I do not pay the stated rate for federal income taxes. When I do deductions, my rate is lower. Even with the state flat tax. I always get a refund ($150) because I get to deduct property taxes so I do not pay the full 3%. Corporations may never pay the 10% rate with deductions.

- Rod - Friday, Jan 7, 11 @ 3:25 pm:

Only one day ago several Democrats were telling people an tax increase could not include more funds for education. Is it possible that the Speaker does not believe such a proposal can really pass and its failure could making a lower increase eaiser to pass because it would look so much better?

- wordslinger - Friday, Jan 7, 11 @ 3:30 pm:

Well, the update headline ought to end all that. My compliments to the Tax Foundation writer.

There’s no way you can spin out of that. TV, the Trib (bankrupt) and the Drudge types will knock it out of the park.

I hope, though, that someone in the Department of Revenue would give us regular schmucks an idea as to what corporations actually pay — in real money — after deductions, depreciation allowances, incentives, blah, blah, blah.

If you think they’re paying the actual straight rate, ask yourself why the tax code is so long and has so many forms.

- Deep South - Friday, Jan 7, 11 @ 3:31 pm:

===For the life of me, I can’t understand how or why the Illinois GOP did not see the last few years as an opportunity to present a sober, intelligent alternative to Democratic rule. Between the mush-mouth “I don’t know the extent of the problem” stuff from Brady and the tomb-like silence of Cross and Radogno, I can only conclude the GOP establishment is content with the crumbs in members, staff and pork-barrel projects that the Dems give them.===

BINGO!!!

- Fed up - Friday, Jan 7, 11 @ 3:34 pm:

Yes some companies will leave the state especially Internet companies,you know the ones with good jobs will flee the attempt by Ill. to collect sales tax (cant wait for the legal bills to pile up there), even more important it will be impossible to get a start up or a growing company to locate here, the business environment is just terrible

- Steve Bartin - Friday, Jan 7, 11 @ 3:36 pm:

Percentages are for comparison sake. It’s both correct to say there’s going to be a 75% increase or a 2.25% rise in the state income tax. Anyway, there’s better places to do business. Much better. Many taxpayers , about now, don’t want to hear about how spending more money on public education is an “investment”: unless you are getting one of those generous pensions.

- George - Friday, Jan 7, 11 @ 3:43 pm:

Constitutional amendment to go to graduated tax in order to raise taxes = non-starter.

Constitutional amendment to go to graduated tax in order to lower taxes = ….

- wordslinger - Friday, Jan 7, 11 @ 3:44 pm:

Since no increases have been passed yet, and before we accept the Tax Foundation’s analysis of the Western world’s corporate tax burden as Gospel, let’s consider this chestnut from their press release:

–Our 2011 State Business Tax Climate Index ranked Illinois 23rd in the country, middle-of-the-pack compared with its immediate neighbors.[5] Illinois’s low, one-rate individual income tax offers the advantages of simplicity, stability, and a competitive rate relative to other states, outweighing more negative elements of the state’s tax system.–

- Just the Facts - Friday, Jan 7, 11 @ 3:53 pm:

The increase in the personal income tax rate will be largely invisible during the current calendar year in light of the reduction of the FICA tax by 2%. If I did my math correctly, an individual with taxable income of $50,000 would notice an additional annual total tax withholding (assuming that you characterize FICA as a tax) of roughly $125 or about $5 per bi-weekly paycheck. (This doesn’t take into account the difference in the income tax base and the FICA tax base - for example the lack of income tax on certain benefits - which means that there might even be less than a $5 increase in many instances).

If that person itemizes at the federal level they will receive an additional deduction for state taxes of $1125 per year - a single individual is in the 25% bracket federally with $50,000 in taxable income while a married couple filing jointly are in the 15% - so that gives an indication of the amount of the reduction in federal income taxes that will result from the increase in state income taxes.

So, for calendar year 2011, the individual income tax increase shouldn’t generate much pain in terms of a very noticeable reduction of paychecks. If the federal FICA tax reduction is a one time thing it will be noticeable in 2012.

The foregoing is not an opinion about the tax increase, or an endorsement, but rather an attempt to estimate the practical impact of the increase this year on individual paychecks.

- Fed up - Friday, Jan 7, 11 @ 3:53 pm:

Wordslinger

I guess we can stake the words low and stable out of that now, and do away with the competitive talk. Apparently Quinn Madigan and Cullerton weren’t happy with just losing one congressional seat by time the next reallocation rolls around Illinois will be losing two or more.

- cassandra - Friday, Jan 7, 11 @ 3:59 pm:

I knew this was all sounding too easy yesterday. If you read the local papers quickly (many of us are working two jobs, you know, to make ends meet), you could be forgiven if you concluded that the whole package was passed and done with.

Impromptu festivities in the Statehouse, and so on. So inappropriate. Liberal Dems just don’t get it.

Will the Dems who are running this thing cave

on the corporate tax while leaving the middle class taxpayer at the same increase. That’ll be popular.

There is a solution which supports business to a reasonable extent, is more progressive so as to protect the middle class, and insists on more efficient and better-value govt.

But it’s complicated and you have to run a lot of scenarios and explain everything very very thoroughly. Apparently, Pat and his money-hungry Dem pals in the legislature aren’t up to that part. Will they try to ram it through anyway I wonder.Do they have a choice.

- Small Town Liberal - Friday, Jan 7, 11 @ 4:08 pm:

- There is a solution which supports business to a reasonable extent, is more progressive so as to protect the middle class, and insists on more efficient and better-value govt. -

Care to share that with the rest of us?

- Just the Facts - Friday, Jan 7, 11 @ 4:08 pm:

The corporate tax increase is imposed on “C” corporations. Subchapter S corporations and partnership taxation at the S corporation and partnership level would not be increased. (Of course, individual S corporation shareholders and partners of partnerships would incur higher taxes on their income from the partnerships and the S corporations.

As to the corporate income tax, a corporation would pay an additional $36,000 in Illinois tax on each $1,000,000 of income taxable by Illinois. This additional tax would be subject to being reduced by any credits to which the corporation might otherwise be entitled.

- Anon - Friday, Jan 7, 11 @ 4:09 pm:

==There is a solution which supports business to a reasonable extent, is more progressive so as to protect the middle class, and insists on more efficient and better-value govt.==

cassandra - I’m interested. What’s this solution you speak of? I’d take the time to listen and understand if you lay it out.

- Rick J. - Friday, Jan 7, 11 @ 4:12 pm:

Highest combined corporate income tax rate in the industrial world…..can that really be true given the way Western Europe taxes????

- Just the Facts - Friday, Jan 7, 11 @ 4:29 pm:

According to Senator Cullerton in the You Tube video posted here, beginning in 2012 homeowners will receive an annual check for $325 for “property tax relief.” However, he also apparently stated that this check would be in lieu of the property tax credit currently provided by Illinois. Currently, there is an Illinois credit equal to 5% of property taxes paid a on personal residence.

If am doing the algebra correctly, a $325 property tax check would be an amount equal to the credit someone who pays $6500 in property taxes currently receives. Therefore, under this new plan, anyone who pays less than $6500 per year in property taxes is better off under the new plan, while any anyone who pays more than $6500 in property taxes is worse off under the new plan.

Also, currently, you get a credit up to the amount of you the tax you pay on your taxable income - so, if for example, you are retired, have most of your income in the form of nontaxable pension income and little taxable investment income you may not be able to get the benefit of the full amount of the credit. I don’t know whether the $325 check under the new plan would be subject to reduction based on taxable income, or would just be paid to everyone who pays at least $325 in property taxes.

- Wensicia - Friday, Jan 7, 11 @ 4:32 pm:

Bad move.

- cassandra - Friday, Jan 7, 11 @ 4:33 pm:

There are many corporate tax experts in the state to help with that part, but I’d start with the elimination of the most egregious loopholes. There are fewer than there used to be but more could be addressed. Do this before you raise the rates and see where it gets you financially.

Use the personal exemption more aggressively to shelter more middle class taxpayers from the increase and allow them to keep all of this payroll tax holiday savings (and stimulate the

economny as intended). Up to $100,000 for a family of four, at a minimum. The feds are protecting up to $250,000k. If somebody threatens to sue that it’s a violation of the flat tax–let them. It’s worth the effort.

The Democrats have had 8 years to propose and work for a progressive income tax in this state.

Instead, they prefer to hit the easy button and let the sinking middle class pay for the poor. Time to do some work and get a progressive income tax going.Or there will be no middle class.

Somebody should be running a spreadsheet with the capacity to run all of the various options and immediately see the possible results. Actually, it should be a public spreadsheet, but I doubt transparency has gone that far yet.

Work. Show a little creativity. Sigh. Not this crew, I’m afraid.

- titan - Friday, Jan 7, 11 @ 4:34 pm:

Rick J. - it can be true, the WSJ has been reporting for years about how US business taxes are way at the high end of things. Indivual tax rates are a little different story though

- Plutocrat03 - Friday, Jan 7, 11 @ 4:35 pm:

Yea! Euro taxes for third world services.

I’m so proud!

- Cuban Pilot - Friday, Jan 7, 11 @ 4:35 pm:

The more I think about this, the more I get the feeling that this tax increase proposal is just another brilliant jedi mind trick by overlord madigan to get a few more republicans to vote for a smaller increase of say 4-4.5 percent. Madigan knew that the State GoP would have had the same reaction they had yesterday if he only proposed a small rate increase to 4 percent and a slight increase in corporate taxes. So, Madigan makes a outrageous proposal that caught a lot of people off-guard (I think many people thought that the proposed increase would have been much smaller). Now, a lot of conservatives have freaked out, including business groups. So now on Tuesday, when everyone is in full panic mood, overlord madigan shows up with a 4 or 4.5 increase which a lot more republicans might vote for out of panic; Thus, giving the democratic caucus a little more political cover. Plus, this trick also provides cover for a few republican’s who want to support some tax increase but they would get destroyed back home. Now, those republican members can go back to their district and say the tax increase was wrong, but at least I sought compromise to keep the increase as low as possible.

This has to be it because why else would cullerton strike this deal on thursday night and then fly right back to Chicago. If Madigan and Cullerton really supported this large of an increase, the Senate would have been kept in town over the weekend or at least until Friday night.

Once again, the maestro is playing everyone like a fiddle.

- Shemp - Friday, Jan 7, 11 @ 4:35 pm:

And don’t forget we’re close to the top for property tax rates too! Only Wisconsin tops us out of all of our neighbors! Seriously, how are we supposed to create jobs in Illinois outside of Chicago? Downstate will lose out every time to adjoining areas because DCEO is about as inept and politically watered down as any other agency.

- Yellow Dog Democrat - Friday, Jan 7, 11 @ 4:36 pm:

Perhaps the business community should have spent a little less time lobbying on workers’ compensation over the last week?

I’m just saying.

That figure is a little disingenuous, because Illinois corporations receive over $367 million in tax breaks - 17% off the top of their tax bill - every year, and another $1.3 billion in tax breaks every year.

Look, there are three very simple solutions to easing the corporate income tax rate:

1) Cap the retailer reimbursement from the sales tax so that we’re not stuffing money into Wal-Mart’s pocket, and use that revenue to reduce the corporate tax hike;

2) Expand the sales tax to include services that are taxed in surrounding states and use a portion of those funds to reduce the overall sales tax rate and reduce the corporate tax hike;

3) Sunset some of the $1.6 billion in annual tax breaks that corporations receive, and apply those funds to reducing the overall corporate tax break.

A fourth option which should be considered but would take more time is introducing a Corporate Fair Share Tax; similar to an alternative minimum tax for individuals, companies with more than say $10 million in gross revenues would pay either the 10.5% tax rate or 1% of their gross revenue, whichever is greater. Too many big companies are paying little or no taxes thanks to deductions they’ve written into the tax code and fancy accounting, all at the expense of Main Street businesses.

- wordslinger - Friday, Jan 7, 11 @ 4:39 pm:

–Madigan knew that the State GoP would have had the same reaction they had yesterday if he only proposed a small rate increase to 4 percent and a slight increase in corporate taxes.–

Perhaps. Someone should ask Rep. Cross or Sen. Radogno. Apparently, they’re vacationing as guests of Walt Disney and Ted Williams down in Arizona.

- Rod - Friday, Jan 7, 11 @ 4:45 pm:

Cuban pilot has it correct.

- east central - Friday, Jan 7, 11 @ 4:46 pm:

Reformulating the proposal seems to be a plausible scenario. For individuals, maybe a 1% permanent increase along with a “temporary” 0.5% increase to support the bonds to pay current debts and pension obligations.

The tax plan if passed in its current form is likely to haunt the Democrats for the next few election cycles, perhaps severely. Republicans are sure to campaign against the 75% tax increase. They are also sure to portray the Democrats as dishonest and untrustworthy given the apparent abandonment of Quinn’s pledge to veto income tax increases over 1%. Tough to defend a very unpopular position when you have lost trust.

Granted, the 0.5% for bonds takes it over the Quinn +1%, but it could be sold as a necessary “separate” response to the recession. And of course another problem is there would be a combination of additional cuts and optimistic assumptions required to balance the budget. The question is whether a compromise loses more support than it gains.

Also, the 0.25% income tax increase for $325 of “property tax relief” does not make sense to me if it is not indexed and if it eliminates the existing 5% property tax credit in the current state income tax. For many folks, they will sooner or later lose money with the +0.25% income tax they pay along with the loss of the existing deduction, especially without indexing of the $325.

- Doug - Friday, Jan 7, 11 @ 4:47 pm:

I hope this ends soon, I’m tired of seeing all the Illinois plates being towed behind the UHaul trucks here in Texas…..

- Aaron - Friday, Jan 7, 11 @ 4:50 pm:

It’s clear now that we need to drop the corporate rate. It will be terrible PR for the state and already that number is being buried in people’s minds. Maybe if the Black caucus would drop the social services/school demands and we could concentrate on the deficit AND major spending cuts we could use 2.25 points. Personally, I’d like to see a graduated income tax ranging from 4 to 15%. Since that won’t happen soon, we should be going from 3% to 5.5% while making at least 3 billion in cuts.

- Pat Robertson - Friday, Jan 7, 11 @ 4:51 pm:

==Highest combined corporate income tax rate in the industrial world…..can that really be true given the way Western Europe taxes?==

Easily. European countries rely much more on value added taxes than on corporate income taxes. I saw recently that, now that Japan has lowered its corporate rate, the US rate is now the highest in the world.

- wordslinger - Friday, Jan 7, 11 @ 5:01 pm:

–I hope this ends soon, I’m tired of seeing all the Illinois plates being towed behind the UHaul trucks here in Texas….–

Is that right, Tex? According to the Census Bureau, the 4 million plus in population growth the last decade in Texas was 85% minority, primarily Hispanic.

I’m guessing most of Texas’ growth came from the south of the Rio Grande and Louisiana (remember Katrina?), not Illinois.

But since you’re on the ground there, Tex, I’m sure you know better. How are Willie and Jerry Jeff doing? Is Bob Wills still the king? What brings you to an Illinois blog, anyway?

Funny, anytime I’ve rented a truck, the plates were from a different state.