Red ink as far as the eye can see

Wednesday, Jan 8, 2014 - Posted by Rich Miller

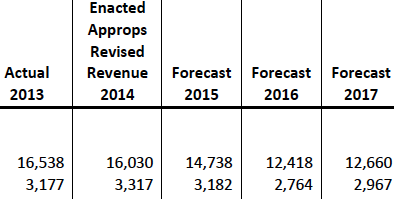

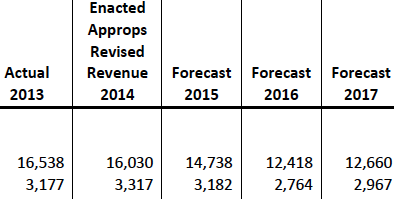

* The governor’s budget office has posted its new three-year projection as required by law. Here’s the projection for revenue losses due to the expiration of the temporary income tax hike. These are fiscal years and the first line is for personal income tax receipts and the second line is for corporate receipts…

* Without changing any state laws or programs, GOMB is projecting a $1.9 billion deficit in FY 2015, $4.1 billion by 2016 and $4.6 billion by 2017. And the state’s bill backlog is projected to grow to $16.2 billion by the end of FY 2017.

The budget office’s spending projections (which you can see here) use existing law with existing programs, and calculate savings from the pension reform bill in FY 16 and 17. So, they’re projecting increases all around. But those increases won’t exist without those income tax revenues.

* From Voices for Illinois Children…

According to GOMB projections, revenue losses due to the scheduled decrease in income tax rates will lead to budget shortfalls of $1.9 billion in fiscal year 2015 (which begins in July 2014), $4.1 billion in FY 2016, and $4.6 billion in FY 2017. Closing gaps of this magnitude would require draconian cuts to programs and services that are essential for the well-being of children, families, and communities across Illinois.

The state’s investments in early childhood education, K-12 education, and higher education — which have eroded over the past five years — would be significantly undermined. Programs such as child care assistance, afterschool programs, child protection services, and a wide range of community-based services for families, people with disabilities, and seniors would be in serious jeopardy.

* From the Senate Republicans…

Because the major portion of the 2011 tax hike is set to expire automatically, the budget office was required to assume that the state will lose those dollars. The drop in that revenue coupled with the anticipated spending growth has the potential to create the largest deficits the state has ever seen.

The figures released by the Governor’s office clearly reveal that without a decrease in spending, the state will be forced to choose between higher taxes and massive deficits. Ever since the tax hike was imposed during a lame-duck legislative session in 2011, Senate Republicans have warned that significant spending reductions were needed to allow for the tax increase to expire as promised.

The projections from Quinn’s budget office reveal the Governor plans to continue to increase state spending regardless of whether or not the state has any money.

Not quite. The projections, as explained above, were put together using existing laws and programs.

- wordslinger - Wednesday, Jan 8, 14 @ 2:38 pm:

Any time the Senate GOP wants to put together a one-page budget summary of spending and revenues based on the tax increases expiring, by all means, go for it.

- RNUG - Wednesday, Jan 8, 14 @ 2:39 pm:

No surprise to the people here. The only question is whether a tax continuation or increase will be an issue in the general election or will be left for the next governor to deal with.

- Demoralized - Wednesday, Jan 8, 14 @ 2:40 pm:

Looking forward to the Senate Republican plan on how to cut $4 billion from the budget. Of course I’m assuming they will go with the refrain that Republicans usually go with which is that it’s not our problem and the Democrats need to solve it. Either offer a solution or shut up.

- Formerly Known As... - Wednesday, Jan 8, 14 @ 2:47 pm:

Nothing to worry about, since we so judiciously used the increase in funds during the “temporary” tax hike to help get our ship in order.

We knew these extra funds were exactly that - “extra” - and wouldn’t last forever, since we designed it as such. Thus, we used those funds well to help get things back on stable footing, exactly as was planned and promised from the beginning.

Right… right? #gulp

- Walter Mitty - Wednesday, Jan 8, 14 @ 2:47 pm:

I am curious to see if the Farmer capitalizes on this. Meaning, more than saying ” See the insiders did this.” If he can lay out ideas that close the deficit, he stands to continue the referendum rhetoric. My hope is someone will. My guess nobody will.

- Anon - Wednesday, Jan 8, 14 @ 2:57 pm:

Speaker Madigan created this problem by putting in the sunset clause, instead of making the 2010 hike a permanent increase in revenues that the state clearly needed. No one seriously expected the state to grow or to cut its way to a balanced budget, not even Leader Radogno.

- drew - Wednesday, Jan 8, 14 @ 3:13 pm:

I’m reading that post from the Senate Republicans, but I’m having trouble finding the part where they spell out an itemized list of the $4 bn of excess spending that should be cut.

- Bogart - Wednesday, Jan 8, 14 @ 3:14 pm:

It’s the Illinois “Sequester”. The GA’s mistake was not putting in automatic across the board program cuts tied to the roll back of the tax increase. The good news, however, is that this should make it obvious to the Supremes that they must uphold the pension reforms.

- dupage dan - Wednesday, Jan 8, 14 @ 3:14 pm:

I could see Rauner railing against this problem and promising to cut the “waste, fraud and abuse” to balance the budget. If he wins, I can see him coming to the electorate and telling us that now that he is in office, he sees what is really happening and supporting making the tax permanent.

Unless, that is, he decides to act differently than so many other candidates who get schooled upon taking office.

There is nothing new here. Only those in total denial would see this differently. Other candidates who promise to allow the temp tax to expire may have different solutions but will likely come to the same conclusion if elected. Same old same old.

- Bogart - Wednesday, Jan 8, 14 @ 3:16 pm:

Further, it’s the Party in Power that should propose the cuts.

- Rich Miller - Wednesday, Jan 8, 14 @ 3:17 pm:

===it’s the Party in Power that should propose the cuts. ===

Actually, the SGOPs did propose a menu of cuts in 2012 and the Dems used that list to whack the living tar outta their candidates.

- RNUG - Wednesday, Jan 8, 14 @ 3:25 pm:

Bogart - Wednesday, Jan 8, 14 @ 3:16 pm:

Actually, it doesn’t.

As the IL SC made clear in Jorgenson v Blagojevich (2004):

“No principle of law permits us to suspend constitutional requirements for economic reasons, no matter how compelling those reasons may seem.”

- PublicServant - Wednesday, Jan 8, 14 @ 3:28 pm:

The reality is and always was that there is a structural revenue shortfall causing the fiscal problems here in Illinois. Why not look at the CTBA plan that will lower current income taxes for 94% of Illinois taxpayers?

- Bogart - Wednesday, Jan 8, 14 @ 3:35 pm:

When the “compelling reasons become reality”, I trust the court will act to save the State.

- RNUG - Wednesday, Jan 8, 14 @ 3:42 pm:

PublicServant - Wednesday, Jan 8, 14 @ 3:28 pm:

I agree. It makes a lot of sense.

The problem with the CTBA progressive income tax plan is it requires a Constitutional Amendment that must be approved by the GA, and then approved by the voters. To get the approval of the voters it will have to be sold … and I don’t see anyone who could sell it. Where is the Adlai Stevenson or Richard Ogilvie or Jim Thompson that could take it and run with it?

The solution I joked about last year could be implemented just by the GA: raise the flat income tax rate really high and exempt the first $100K or $150K on income. At that level, you could even do a “fairness reform” and tax pension / Social Security income. The down side to such a proposal is it would also increase the corporate tax rate, so there may need to be a new exemption there also.

- PublicServant - Wednesday, Jan 8, 14 @ 3:44 pm:

And wait, wasn’t the line “Cut pensions or you’ll have to cut education and welfare.”? So, since the pension gut has occurred, then there’s no problem right? Oops, reality rears its ugly head again.

- PublicServant - Wednesday, Jan 8, 14 @ 3:48 pm:

@RNUG - If your plan would accomplish the elimination of the structural revenue deficit by taxing marginal income over a certain amount, then I could support that. Oh, and when will the pension lawsuits begin to be heard? Any news on that RNUG?

- RNUG - Wednesday, Jan 8, 14 @ 4:01 pm:

I don’t expect the pension lawsuits to be fast tracked any time soon. Right now there is a holding pattern of sorts while everyone waits to see how many suits get filed. Then you will probably see them all get consolidated into one action but it’s possible, given the different classes, several could move forward. How it moves from there will depends on the arguments made. Remember, we are still waiting for a ruling on the “Maag” that was fast tracked.

I was a bit disappointed reading the TRS suit filed in Cook County because it pretty much ignored the underlying contract law issues and concentrated on making the “pension clause” claim. I really want to read the RSEA suit filed here in Sangamon County but haven’t found an online copy. I’ve been sick and haven’t gotten out to get a copy of the paperwork from the courthouse.

- Rich Miller - Wednesday, Jan 8, 14 @ 4:05 pm:

RNUG, I emailed you a copy of the RSEA suit.

- Charlie Wheeler - Wednesday, Jan 8, 14 @ 4:08 pm:

Point of Information:

Section 3(a) of Article IX of the Illinois Constitution says in relevant part: “In any such (income) tax imposed upon corporations the rate shall not exceed the rate imposed on individuals by more than a ratio of 8 to 5.”

That would suggest that the General Assembly and the governor could increase the individual income tax rate to whatever level they chose, with no legal requirement to enact a similar increase in the corporate income tax rate.

- walker - Wednesday, Jan 8, 14 @ 4:14 pm:

Charlie: yes, and that was one of the options initially evaluated. mark

- Formerly Known As... - Wednesday, Jan 8, 14 @ 4:24 pm:

Besides, Gov. Quinn told me this was supposed to simply be a 1% “education surcharge”. And we gave him double!

Our schools are now flush with cash. Just wait until you see their balance sheets!

Right… right? #gulp

- Norseman - Wednesday, Jan 8, 14 @ 4:36 pm:

Snark alert

Perhaps if we someone who can craft a really really compelling preamble, maybe the GA can pass a graduated tax that will convince the Supreme Court to disregard another portion of the Illinois Constitution.

- Rich Miller - Wednesday, Jan 8, 14 @ 4:39 pm:

Good snark, Norseman.

- PublicServant - Wednesday, Jan 8, 14 @ 4:51 pm:

Maybe even a preamble to a preamble, or is that preramble?

- a drop in - Wednesday, Jan 8, 14 @ 4:51 pm:

Everybody will be campaigning on the income tax sunset depending on whatever party they represent. In 2015 whomever wins will look at the tax revenue Colorado generates on pot and start drooling.

- Liberty First - Wednesday, Jan 8, 14 @ 5:03 pm:

RNUG - the teachers suit your referring too didn’t include contracts (I would imagine) because they are not a union organization but a professional organization. I understand the various groups have been in touch with each other. The various teachers unions suits will follow.

- Soccermom - Wednesday, Jan 8, 14 @ 5:11 pm:

Wait. i thought that reducing taxes increases revenues. It’s magic!

- RNUG - Wednesday, Jan 8, 14 @ 5:23 pm:

Rich,

Thanks. Saves me making some county clerk sick.

- RNUG - Wednesday, Jan 8, 14 @ 5:27 pm:

Liberty First - Wednesday, Jan 8, 14 @ 5:03 pm:

Unions have nothing to do with whether or not it was a contract.

It has to do with the offer of employment with certain terms (which may have varied in some things like salary and job protection from person to person) and the individual acceptance of those terms.

- Anon - Wednesday, Jan 8, 14 @ 5:37 pm:

Does any informed person doubt the State is chronically short of revenue to pay its bills, even though it´s a low-spending state?

- Fed up - Wednesday, Jan 8, 14 @ 6:20 pm:

Well the cracking money needs to start rolling in. Maybe someone will pull “soy boy” aside amd explain a Chicago casino with some video poker machines at midway and Ohare( think of the revenue from stranded flyers this week ) would enrich the state tresurary. Legalize and tax pot, and write a legal Internet sales tax bill. New York was able too. After all that a bake sale( after pot Is legal) at Gov mansion it’s not being used for anything.

- William Place - Thursday, Jan 9, 14 @ 12:44 am:

I believe the States “investment in lower education’ has been producing a huge negative return for decades. What is it they say about insanity, doing the same thing over and over while expecting a different result?

- PublicServant - Thursday, Jan 9, 14 @ 5:47 am:

@William Place - Did you run out of room to tell us about your proposal to rectify the situation, or are you just driving by bud?

- PublicServant - Thursday, Jan 9, 14 @ 5:50 am:

@FedUp - Your suggestions for new revenue sources seem to hit the poor and middle class where none of the wealth has gone these last 30 years. Follow the money pal, and raise the new revenue from those whose income has been growing by leaps and bounds while the rest of up have been left to pick up the scraps. Your suggestions seem to go after the scraps too. Nice.

- Pacman - Thursday, Jan 9, 14 @ 6:28 am:

Thanks RNUG for pointing out the contractual issue as it relates to pensions. I’m not a legal beagle, but I would think the contract argument is as compelling an argument as the constitutional aspect. Both seem to go hand in hand as the constitution refers to pensions as an “enforceable contractual relationship.”

- wordslinger - Thursday, Jan 9, 14 @ 6:46 am:

–believe the States “investment in lower education’ has been producing a huge negative return for decades. What is it they say about insanity, doing the same thing over and over while expecting a different result?–

What do you say about crazy people who think the world would be better off without schools?

- wordslinger - Thursday, Jan 9, 14 @ 9:49 am:

–This has nothing to do with no schools,–

Quit showing off that “excellent public education.”

- William Place - Thursday, Jan 9, 14 @ 9:59 am:

Interesting how my response has been redacted. wordslinger, that was snotty, I used no invective to you.

- William Place - Thursday, Jan 9, 14 @ 10:02 am:

I must have stepped on some union toes!