|

Cullerton mulls a solution while the savants incite panic

Friday, Jul 25, 2014 - Posted by Rich Miller * After snidely whacking the “conservative savants” on his own newspaper’s editorial board, the Tribune’s always thoughtful John McCarron turns to Senate President John Cullerton for answers about how to deal with pension reform going forward…

That’s actually brilliant. He’s done it again. Whether the state could get the union to agree to such a change without a strike is another story, but it’s probably worth a shot. * And whether you agree with Cullerton or not, he’s offering up more insight and thought than we’ll ever possibly get from those afore-mentioned “savants,” one of whom throws up her hands in the Tribune today about the future of pension reform and Illinois…

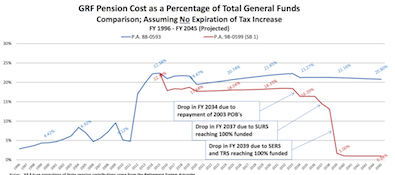

Whatever. * From a March, 2014 report by the Commission on Government Forecasting and Accountability…  As I’ve been telling subscribers, we’re at the top of the Jim Edgar “ramp.” There is another significant bump up next year because the three biggest systems adjusted their ROI percentages after COGFA released its report, but then that’s pretty much it. And, as is obvious by the chart, most of the pension reform law’s savings occur decades from now. But the “savants” at the Trib (or anywhere else) will never tell you that. They’d rather just scare you into believing the worst without any actual facts. It’s utterly and despicably shameful. Not to mention that nobody will ever give up a sweet gig at the Mother Ship and move to Hoosierland or the equivalent because pension reform is in peril. The Trib loves its victimhood.

|

- Demoralized - Friday, Jul 25, 14 @ 9:24 am:

Give up pay raises for the rest of your career? It’s a novel solution but if you’ve got several years to work yet it’s financially tough to freeze your pay for the rest of your working life. Don’t think I would agree to that.

- Oswego Willy - Friday, Jul 25, 14 @ 9:24 am:

@FakeStatehouseChick - oh Rich, it’s “Simple”, being co-opted is more fun than being objective. #DopeyReason

- Demoralized - Friday, Jul 25, 14 @ 9:26 am:

Wait, I think I misread that. Keep your COLA and no pay raises or continue to get pay raises and forgo your retirement COLAs. Sorry to be so dense but is that what he is saying?

- Oswego Willy - Friday, Jul 25, 14 @ 9:27 am:

===“The state constitution,” said Cullerton, “does not guarantee pay raises.”===

Constitutionality.

See, a starting point.

Maybe the question coming up is not if the Unions will strike, but what will a possible “Governor Rauner” do? Rauner said he would shut down government. Cullerton is looking for an end game. Big difference.

- Just Trying to Survive - Friday, Jul 25, 14 @ 9:30 am:

A percentage of every paycheck deduction into the pension fund by the employee was dedicated to that COLA. It was bought and paid for while working. That is a diminishment unless all that was contributed will be refunded–with interest, of course. Why can’t some people get it through their head that these pensions are not gifts from taxpayers(public employees pay those taxes too–every penny of them) Every employee bought their own

pension by working for it and contributing every single paycheck.

- Former Merit Comp Slave - Friday, Jul 25, 14 @ 9:30 am:

Actually quite simple but brilliant. Not sure how many would buy into it since your pension is based on your last 4 years of salary. No raises for 20 years makes for tiny pension. Maybe give up merit raises but keep cost of living raises would be a compromise more employees could live with?

- Obama's Puppy - Friday, Jul 25, 14 @ 9:32 am:

Genius and what about teachers who do not get SS? Freeze your COLA in retirement get pay increases oh and good luck when you retire - hopefully inflation will not eat you alive. Can we wait for the Supreme Court John?

- Steve - Friday, Jul 25, 14 @ 9:33 am:

John Cullerton actually has a decent idea here because this isn’t an actual cut in someone’s public pension.

- Macbeth - Friday, Jul 25, 14 @ 9:34 am:

A good solution. Not optimal, but it’s simple and easy to understand.

Much better than forcing workers to take pay cuts and then forcing them (again) into a 401K. I know this is Rauner’s solution — pay cuts, then a forced 401K. Don’t agree? Then strike. We need time to “rewrite the contracts” anyway.

Rauner said that right out of the gate. He’s been quiet on it since, but I know — I’m absolutely certain — that’s his plan. Rauner hopes to double-whammy the workers — and if they don’t behave, he’ll lock them out until they do.

- abc123 - Friday, Jul 25, 14 @ 9:36 am:

Wasn’t it those conservative savants who said Illinois was broke years ago and who called for action then, which would have been much less painful? Wasn’t it the Cullerton’s McCarrons, Millers and the like who ridiculed that, said ‘no crisis’ and ‘the sky is not falling’? Take your pick who to listen to now.

BTW, Cullerton’s earlier proposal, too, would be unconstitutional under the apparent ruling of Kanerva.

- Oswego Willy - Friday, Jul 25, 14 @ 9:36 am:

===Anyone want to go halvsies on a moving van? Last one out of Illinois, hit the lights.===

@FakeStatehouseChick - well, it sounded good with my tin foil hat on. #KassApproved

@FakeStatehouseChick - I like simple. Simple choices, simple blame, simple sentences, so I came up with a simple solution #SimpleMinded

- Macbeth - Friday, Jul 25, 14 @ 9:36 am:

BTW — there’s flip-side, no? If you agree to no-raises, then your salary can’t be cut — ever. Is that part of the deal, too?

A “freeze” means just that. Frozen. It doesn’t mean, “Well, you can’t go up, but we didn’t say anything about it going down.”

Is that part of the deal?

- Federalist - Friday, Jul 25, 14 @ 9:40 am:

If the ISC rules that 3% AAI is guaranteed for existing employees, why would they agree to no salary increases. Could work for new employees as they would have no choice but to make a choice.

And I do not see how the ISC can rule that the 3% AAI elimination or reduction would not be a diminishment for existing employees particularly in light the health insurance decision.

Sounds like Cullerton is grasping for straws.

If Rauner wins he will try anything. This would give will ISC plenty of work to do for years and years to come.

P.S. The way this reads is that Tier 2 employees have had their 3% AAI reduced or eliminated already since 2011. Is this true? If so they have no say. But if not, they too would contest such a plan as being unconstitutional.

- forwhatitsworth - Friday, Jul 25, 14 @ 9:40 am:

The “normal” cost of funding the pension systems is NOT the major problem. I believe about 2/3 of the current payments are for the debt. It’s just like an individual who has let a credit card get out of control. The obvious solution is to listen to Ralph Martire.

- Soccertease - Friday, Jul 25, 14 @ 9:41 am:

I think Cullerton’s proposal is laughable. A more realistic proposal by Cullerton would be a “temporary pension tax” that would be based on actuarial data. The pension tax could be blamed on prior administrations and required to expire based on and actuarially determined date.

- RNUG - Friday, Jul 25, 14 @ 9:45 am:

It probably won’t fly but at least he (presumably with Eric’s help) is trying to find a constitutional way to deal with the issue.

I’ve always said Cullerton was the adult in the room when pension reform was being discussed.

- Under Further Review - Friday, Jul 25, 14 @ 9:45 am:

John is a “big government” expansionist. If you have ever had a lengthy conversation with him, this becomes obvious within minutes. He is still likeable, but do not discuss politics with him if you prefer lower taxes.

- Morty - Friday, Jul 25, 14 @ 9:51 am:

How could this apply to contracts written across the state? That might be able to work with unions the negotiate with the state directly…what of the rest?

Btw, imo, it’s just another “solution” that puts the burden solely on the backs of the state workers.

I wouldn’t categorize that as “brilliant”.

And I reject the argument that the income tax raise solely benefits the state workers, state workers have to pay the higher taxes just like everybody else.

If there is to be a negotiated settlement, it should be begin with a discussion on a progressive scale: i.e. why is everyone being asked to ‘give up’ the same thing? Why not create a graduated system where people making under $50000 a year continue with the 3% colas until they reach $50000 a year, then the start gettng 2% colas until the next cut point. People earning $100000 a year in pensions wouldn’t recieve a cola- they could be offered the deal that Cullerton has offered.

The break points could be negotated, sb-1 addressed this in one way, but the cut point was way to low.

I’m sure that the sharks would say this is far to generous still, but then again, nothing is every enough for those folks.

Enough with the all or nothing “negotiations”

- From the 'Dale to HP - Friday, Jul 25, 14 @ 9:51 am:

@StatehouseChick has got to go: “You wouldn’t know it by all the hyperbolic, misleading, shameful garbage spewed by union leaders.”

Because the Trib Ed Board doesn’t write “hyperbolic, misleading, shameful garbage” nearly every day?

- Jimbo - Friday, Jul 25, 14 @ 9:52 am:

Well, we know what the merit comp slaves will pick, seeing as they won’t ever get a raise regardless.

On a serious note, I don’t see how this would be possible to implement. Raises aren’t guaranteed that’s right, but the legislature and gov don’t give them to workers out of generousity. They give them because they are negotiated. The union’s effectively force the gov to give those raises. Without the union, well see my comment above. This has no chance of being implemented in a contract. Cullerton needs to accept that they need to find a way to pay what’s owed, instead of searching for some technicality allowing them to welch.

- facts are stubborn things - Friday, Jul 25, 14 @ 9:52 am:

If the ISC rules that AAI is a protected benefit, and it sure seems like they will, then how can the state say to an employee if you want to keep what is already a constitutionally protected benefit you have to give up all your raises for the next 20 years? Not going to work! Plan C anyone?

- Rich Miller - Friday, Jul 25, 14 @ 9:53 am:

===And I reject the argument that the income tax raise solely benefits the state workers, state workers have to pay the higher taxes just like everybody else. ===

Those are two different things.

- facts are stubborn things - Friday, Jul 25, 14 @ 9:54 am:

The state does have every right to negotiate a tough new contract, but no raises for the rest of your career to keep what is already legally protected…. can you spell UNFAIR LABOR PRACTICE.

- forwhatitsworth - Friday, Jul 25, 14 @ 9:57 am:

Why does IMRF, which uses the same formula for pension benefits as TRS, not have a liability problem? Funding payments have to be steady, just like your house mortgage, not erratic, especially when it looks like a balloon that becomes overwhelming.

- Macbeth - Friday, Jul 25, 14 @ 9:57 am:

This also seems to me to be a starting point of pushing the unions out of the picture. Individual workers sign a freeze or don’t sign a freeze — but this takes much of the collective bargaining steam out of the picture. I mean, what’s the point of bargaining collectively if you’re not able to bargain?

Plus, everybody talks about private sector equity. Show me where anyone in the private sector signs a contract to say no more pay raises in return for something that’s already guaranteed?

- Six Degrees of Separation - Friday, Jul 25, 14 @ 9:58 am:

To me, the most interesting part of the COGFA report was the funded ratio of the big 3 retirement systems in the year 2000. TRS 68.2%, SERS 81.7%, and SURS a whopping 88.2%. Without any substantial changes in retirement benefits since then, and with a few years of Tier 2 employees incurring substantially lower pension obligations than their peers, the 2013 funded ratios for the systems dropped to 42.5% for TRS, 35.7% for SERS, and 43.7% for SURS.

- Jechislo - Friday, Jul 25, 14 @ 9:58 am:

If salaries were frozen, wouldn’t that reduce the amount that employees were projected to pay into the retirement system over the life of their careers? I mean, every time a State Employee gets a raise a portion of that raise is paid back into the Retirement System. What would that do to the projected retirement fund balance over the next 20 years?

- anon - Friday, Jul 25, 14 @ 9:59 am:

If one could still get a cola (not a guaranteed 3% but instead tied to inflation) and raises this is reasonable. If not it will leave you in rags when you are very old.

- Sir Reel - Friday, Jul 25, 14 @ 9:59 am:

His idea has merit. Offer employees a choice.

As a former MC employee I faced this situation (it wasn’t a choice in my case) - no raises for years. It factored into my decision to retire sooner rather than later.

- facts are stubborn things - Friday, Jul 25, 14 @ 10:00 am:

You could offer current employees guaranteed employment with a guaranteed 2% per year increase in pay in exchange for a reduced AAI vs. current unknown employment security and future raises and keep 3% compounded AAI. You could give current retirees a choice between 3% compounded or the CPI compounded. I think any consideration needs to include keeping what you have. I think Cullerton’s proposal may be more a shot over the bowl of the unions to try and get them to negotiate when the unions figure why should we now.

- RNUG - Friday, Jul 25, 14 @ 10:01 am:

I think after the ISC rules on the pensions, that something like like what — Soccertease — suggested is what will actually happen … only the implemented rate will be higher than what is actually needed just for the pensions … so the pols have a new pile of cash to play with.

- Old Guy - Friday, Jul 25, 14 @ 10:03 am:

Goofy idea that would never pass any court’s smell test. You can’t put a cyanide pill in front of someone, point a gun to their head and then claim it was their choice to take the pill. Either Cullerton knows better and he’s playing games or he needs to go back to law school.

- Robert the Bruce - Friday, Jul 25, 14 @ 10:03 am:

Good idea by Cullerton.

Does the time a union is on strike cost members service time during the time of the strike?

- Just Trying to Survive - Friday, Jul 25, 14 @ 10:04 am:

At this rate, with now pending legislation awaiting the court, and future proposals that surely would also be challenged in court, it could be a decade or so before anything gets resolved. By that time, the ballooning payments would be on the downside and with responsible payments by the state to the pension funds, there would be some resolution to the “crisis” the Tribbies love to hyperventilate about. But somehow, I just don’t think the powers that be are interested in fixing the problem of skipping payments by the state. It seems that punishment and blood are the only thing many folks are focused on—because there do exist rational solutions.

- Stones - Friday, Jul 25, 14 @ 10:05 am:

So happy that I’m at the end of my State of Illinois working career rather than the beginning.

- Dee Lay - Friday, Jul 25, 14 @ 10:06 am:

forwhatitsworth - Because if you screw around with payments with the IMRF - they are more than willing to boot your municipality from the system.

No municipality is willing to take that risk.

- Formerly Known As... - Friday, Jul 25, 14 @ 10:07 am:

== “conservative savants” ==

Which makes their counterparts on the Sun-Times board “liberal savants”. Funny monikers, both.

- RNUG - Friday, Jul 25, 14 @ 10:07 am:

- anon - Friday, Jul 25, 14 @ 9:59 am:

That’s logical but the State will never do it. When the AAI was put in, they wanted a fixed number they could budget to. They didn’t want one that could fluctuate between 1.9% and to 13.5% as it did in the late 70’s / early 80’s.

- facts are stubborn things - Friday, Jul 25, 14 @ 10:09 am:

@Robert the Bruce - Friday, Jul 25, 14 @ 10:03 am:

=Good idea by Cullerton. =

I don’t think telling employees they have to give up a constitutionally protected benefit if they want to have any chance at any pay increased for the rest of their career is a good idea. He is just trying to send a message to the unions that they still need to have a seat at the table because there are some scary crazy ideas out there.

- facts are stubborn things - Friday, Jul 25, 14 @ 10:12 am:

I suspect the unions will not be willing to negotiate a darn thing and will say pensions are off the table so they are not an item to be negotiated for. The unions will then stick to everyday bargain issues such as contract language, work conditions, pay increases etc. etc. and see where the chips fall. Why should the unions allow pensions (constitutional protected) to be leverage for the state. Off the table and lets get to work with the next fair agreement is the union message.

- Andrew Szakmary - Friday, Jul 25, 14 @ 10:12 am:

I think Cullerton’s latest idea is probably legal. However, aside from the likelyhood of a strike by the unions in response, it would have a devastating effect on the state universities. Most good professors in their 30’s and 40’s who are actively publishing and are marketable will leave if they are presented with such an awful choice. Over time, this will have a strongly negative effect on Illinois, much worse, in my humble opinion, than keeping the income tax at 5% or even raising it to 6% would.

- Norseman - Friday, Jul 25, 14 @ 10:13 am:

Merit Comp employees have already gone without raises since 2006. So now they get a proposal to stop them for their entire careers. I wonder if Cullerton is factoring in the large increase in early retirements.

- facts are stubborn things - Friday, Jul 25, 14 @ 10:18 am:

=Current retiree benefits wouldn’t be touched, and since 2011, new “Tier 2″ hires already have had their promised benefits reduced.=

Tier 2 hires have not had any promised benefits reduced. They have a new deal a new set of constitutionally protected benefits.

- A guy... - Friday, Jul 25, 14 @ 10:26 am:

It does appear to accelerate the proportion of Tier 1 to Tier 2 pensioners by creating less incentive to stay in their positions longer than they may have wanted to. The ISC decision is going to spur more solutions like this. Hard to be much more creative when you’re in a corner. Financially…we’re in a corner.

- jim - Friday, Jul 25, 14 @ 10:29 am:

Brilliant? Not so sure about that.

But embracing this idea, as rich appears to do, shows just how desperate the situation is.

I think the real question is not whether there is some theoretical solution to the pension problem, but whether there is something that is reasonably realistic in the overall context. I suspect Cullerton is embracing it for the shock value, but I’m all for that.

- John Twig - Friday, Jul 25, 14 @ 10:29 am:

As has been pointed out many times, the actual cost of pensions is not the problem. The real problems is what to do about the huge debt the State has run up by not making their required modest payments to the systems for decades. Compound interest is a powerful tool that can either work for you or, in the Illinois pension case, against you.

It seems as if our elected officials either are ignorant of the mathematics of the systems they have created to replace Social Security for most state employees – or more likely have chosen to ignore the math for political gain.

An analysis of the mathematics of Illinois’ retirement systems clearly shows that, when properly funded, they provide a good bargain for both employees and taxpayer employers.

Way back in 2009 (almost ancient history) I did a comparison of two similar retirement systems that, I think, clearly shows how Illinois taxpayers could have been saved billions of dollars rather that presented with billions of dollars of debt. If only our elected leaders had chosen to have compound interest work for Illinois taxpayers rather than against them.

Take a look at the slightly dated comparison at: www.geocities.com/johnt_suaa/taletwo.pdf

Want to try your own assumptions – go to: http://www.illinoissqueezy.com/questions.html

- Formerly Known As... - Friday, Jul 25, 14 @ 10:30 am:

== a scaling back of the COLA they’ve been promised in retirement or forgo any pay raises while they’re still working ==

I share @Demoralized’s confusion. If I work the same job I love my entire career, let’s say as an administrative assistant, state trooper, research assistant at U of I, middle management or maintenance tech, this means my choices are

I can start at $40,000, I also finish at $40,000 in 20 or 30 years but get a higher COLA?

Or I can start at $40,000, finish around twice that amount, but get a miniscule COLA or none at all?

Inflation kills me either way. It either gets me during my working years, or it gets me during retirement.

If you thought term limits would lead to a loss on institutional knowledge…

- Formerly Known As... - Friday, Jul 25, 14 @ 10:32 am:

@Norseman - you are reading minds this morning. Mine, at least.

- Madison - Friday, Jul 25, 14 @ 10:32 am:

I predict that big R makes an example of his targetted unions and everybody else falls into place. He will impose his will on a bargaing unit with access to to the finest labor relations counsel and tier one employees will be few and far between in the medium term future. Pension reform, hedge fund style, from the newest GOP icon.

Scott Walker, you’re working for me now.

- Demoralized - Friday, Jul 25, 14 @ 10:33 am:

Guys, I understand the anger over pensions. I’m directly affected and don’t want my pension touched. But I also live in the real world and realize that the status quo can’t be maintained because eventually there will be a problem. At least Cullerton is looking for alternate solutions. To continue to reject everything out of hand isn’t helpful. I realize that something will eventually have to be done and I would rather the best possible deal with the least amount of impact on me be negotiated. Simply pounding your fist and saying we won’t agree to anything is absurd. It would be nice if we could all be adults in this conversation.

- Demoralized - Friday, Jul 25, 14 @ 10:35 am:

By the way I don’t particularly like Cullerton’s idea but at least he’s trying to think of alternate ways to solve the problem.

- archimedes - Friday, Jul 25, 14 @ 10:35 am:

Cullerton is signaling that compromise on pensions (by employees/unions) is not over if the presumed ISC ruling gets rid of SB1. He had a deal before, he’ll expect to get some compromise again.

No raises is a starting point - and it would be legal if it were consideration for a change in the AAI. A raise, at some point, is surely expected - but there is no legal obligation.

It is a matter of degree.

I think Cullerton wants to send the message, that, should the ISC rule in favor of pension members don’t assume you will not be part of a solution going forward.

- Just Trying to Survive - Friday, Jul 25, 14 @ 10:39 am:

There are alternative solutions. Read Ralph Martire’s proposal. There are lots of adults in the room with lots of solutions that don’t condemn retirees to poverty after paying into a system that would have protected them from that. As said earlier, for some reason, reasonable solutions don’t make it to the table. Only hacking even more from public workers and retirees. Why is that?

- Anonymous - Friday, Jul 25, 14 @ 10:39 am:

This is a great idea, unless you’re an employee affected by this sort of law. I wonder how many of you unaffected would feel if the legislature decided that some of your constitutional guarantees/rights were subject to consideration.

- Ahoy! - Friday, Jul 25, 14 @ 10:42 am:

It’s time to adjust the ramp and make it more feasible. This should be the first action taken if the supreme’s rule the law unconstitutional.

- Yellow Dog Democrat - Friday, Jul 25, 14 @ 10:48 am:

Cullerton’s idea must be brilliant. I had it over a year ago.

I tossed it for a few reasons, ultimately because I believe it will end up costing the state more money, not less, although it will produce phantom savings.

Pay raises are counted as a current cost, but we do not consider increases in state payroll as a compounding future cost as we do for pension obligations. While a pay raise does not de jure increase payroll ten or 20 years down the road, it is a de facto increase in future obligations. This offsets pension savings considerably.

Secondly, you could force a contract that makes state employees chose between getting their COLA and never getting a pay raise…but a future contract could give that pay raise back.

Thirdly, state employees have over the years self-selected as a risk averse bunch, highly valuing the certain benefit of their pensions. In order to lure even younger workers away from their certain benefit, you would have to offer a raise that is many times higher in actual benefit than their COLA. What would that be? eight percent? 12 percent?

I dunno. But whatever it is, it would probably be such a large one-time windfall that the employer could not afford it.

Lastly, how do you force employers to go along? I can see how the governor could do this, but how do you compel school districts to go along? Tell them if they don’t, the state won’t pick up the tab? politically, you are right back where we started.

Someone see an angle here that I do not?

- Pacman - Friday, Jul 25, 14 @ 10:48 am:

Using coercion to change contracts are usually frowned upon by the courts. Instead of trying to figure ways to not pay its debt they should look for ways to legally meet its obligations.

- Retired Teacher - Friday, Jul 25, 14 @ 10:51 am:

Stop trying to ramp up the funding from 40% to 90% in an unreasonable time frame.

- FWIW - Friday, Jul 25, 14 @ 10:52 am:

Imagine a world where state workers can’t be fired (tenure, unions, etc) and nothing they do will earn a raise. I hope the people of Illinois like waiting in line.

- Empty Suit - Friday, Jul 25, 14 @ 10:53 am:

Ok so how much time and money have we wasted with the pension fix that everyone including Cullerton knew was unconstitutional?

- Leo - Friday, Jul 25, 14 @ 10:54 am:

If the state would go this route the unions could always force arbitration. The FOP just won their case before an arbitrator. 2% per year COLA retroactive for three years with back pay.

- Jack Handy - Friday, Jul 25, 14 @ 10:57 am:

You have a choice, take less or take less.

It’s two branches of government and a majority of the citizenship

verses one branch of government and a minority of the citizenship.

- Albert - Friday, Jul 25, 14 @ 10:58 am:

– “Sounds like Cullerton is grasping for straws.” –

That’s absolutely what he’s doing…unfortunately, that’s all that’s left. Cullerton is being an actual problem solver here,

something that is in short supply in Illinois.

– “hyberbole” –

Yes, something the unions and the Trib are equally guilty of on this issue. A pox on both their houses.

- wordslinger - Friday, Jul 25, 14 @ 10:59 am:

I’ve often wondered how McCarron gets through the days dealing with Big Brain Bruce and the other savants.

Statehouse Chick reads like “The Onion.” She could make a living as a Colbert-like satirist of the uninformed and irrational without changing a comma.

But as she’s doing it for real, she’s an embarrassment to statehouses and chicks everywhere.

- Mason born - Friday, Jul 25, 14 @ 11:06 am:

Isn’t the rub on this that Cullerton is guaranteeing nothing long term. He isn’t guaranteeing employees will receive raises in fact he is explicitly stating the state doesn’t have to give raises. So isn’t his offer keep what you have and we will give you nothing or give it up and we may give you something if we decide that it is prudent. Talk about something for nothing.

I also wonder how he would cover promotions. IF you keep your cola and become a PSA no raise? Might be hard to fill spots.

- Bobbysox - Friday, Jul 25, 14 @ 11:08 am:

Salary is a major component of pension calculations. Arbitrary freezing of all future salaries (for the purpose of reducing pensions) diminishes pensions. This would also be challenged in court and likely ruled unconstitutional.

- Demoralized - Friday, Jul 25, 14 @ 11:09 am:

@Mason:

And it’s not hard to see your thoughts in action given that the General Assembly has gone down the path of refusing to fund union contractual raises in recent times.

- Grandson of Man - Friday, Jul 25, 14 @ 11:09 am:

What Demoralized said at 10:33 a.m.

I don’t want to strike and do not find it “romantic” to wonder when my next paycheck will be coming. I worked very hard to build up my credit and keep my ship afloat.

On the other hand, if we get cuts and put on 401(k) type of plans from a governor whose company had and has billions of dollars in defined pension business, I would support striking.

- Demoralized - Friday, Jul 25, 14 @ 11:11 am:

@Bobbysox:

I’m not sure how anybody arrives at the conclusion that salary increases are guaranteed by the Constitution. You can’t say that you must give me a salary increase because if you don’t you are reducing my pension. That’s just silly.

- Just Trying to Survive - Friday, Jul 25, 14 @ 11:17 am:

Might be hard to fill spots? Who in their right mind would want to work for the public in any capacity? What promise for a worker’s future is there? Only thing guaranteed is that whatever you’re given, someone will be trying to take it back or change it or stiff you.

- FWIW - Friday, Jul 25, 14 @ 11:18 am:

But if salaries are frozen explicitly as a way to diminish pension payments, bobbysox may have a good point. In any case, coercive renegotiation like this would likely not be well received by ISC.

- PublicServant - Friday, Jul 25, 14 @ 11:22 am:

===Might be hard to fill spots.===

It already is, Mason.

- Andy Taylor - Friday, Jul 25, 14 @ 11:22 am:

Why wouldn’t younger workers take the COLA and then strike for higher pay or better working conditions - like 6 months of vacation - to cover your greatly reduced financial package to the guy standing right next to you who will retire with raises and a COLA?

- Bobbysox - Friday, Jul 25, 14 @ 11:24 am:

It is silly that the legislature continues to contort themselves to do anything other than raise taxes to pay for their debts or cut services elsewhere.

The ISC just ruled that healthcare premiums, not contained in the pension clause, are protected under the diminishment clause. How is it silly that they would not rule that a threat to withhold all future salary increases for the rest of your career is not likewise a diminishment?

I might be wrong. But I am not being silly.

- Andy Taylor - Friday, Jul 25, 14 @ 11:28 am:

Another thing to ponder…under Karnerva vs. Weems, it seems like retirees are entitled to have their healthcare benefits paid for by the state but the opinion does not address the network of doctors. It certainly can be argued that benefits will be diminished or impaired but if you limit network choices to a reasonable number Illinois doctors, the state would be providing retiree healthcare benefits paid in accordance with prior laws and contracts. It could end up being like a VA system for state retirees. Ugh.

- Yellow Dog Democrat - Friday, Jul 25, 14 @ 11:35 am:

@wordslinger -

The Tribune editorial board is not that different from any other opinion…when they agree with us they are geniuses, if they have a different point of view they must be shills.

The Tribune is embracing a service tax. As they have in the past.

They insisted Rauner release details. He did.

They’ve thrown in the towel on SB 1…some Democrats still haven’t done that.

Just this week, they praised Quinn on government reform.

They even supported ending the cost shift from suburban schools to the state for pensions, not exactly popular with the GOP or many of their readers.

Do I always agree with the tribune? Not even close.

Do I always like their writing style? No. And I am sure folks have said the same about me. I know they have said it about Rich and Willy.

But if we’re gonna be media critics, let’s be fair.

The Sun-times rarely seems to write much these days on its opinion pages that is worth opening on.

Mary Mitchell’s column this week was a pretty weak apology for Quinn.

And Laura Washington? Cajoles progressives for their failure to get it together in Chicago. Funny, I don’t recall Laura Washington doing much opining in 2007 to elect progressives, but I do recall her having a lot of nice things to say about James Cappleman. You know, the guy who wants to make being poor illegal?

On the other hand, a shout out to the Daily Herald editorial board for this:

“We doubt Rauner could get the measure passed in the legislature. But if he succeeded, it would so handcuff local governments already burdened with plentiful state expense mandates that it could severely cut the services they provide.”

While I would like to see more realism like that from the Chicago Tribune, they have always been more of an idealistic (or ideological) voice.

When it is a voice for marriage equality, or ending the death penalty, or banning assault weapons, we love them.

So, I try hard to respect them even when that means respectfully disagreeing. Some days I do better than others.

- Demoralized - Friday, Jul 25, 14 @ 11:36 am:

@Bobbysox:

The healthcare issue is completely different than salary increases. Healthcare was a promised benefit that they changed after the fact. Nobody is ever guaranteed increases to their salary in the future (beyond contractually negotiated increases).

- Demoralized - Friday, Jul 25, 14 @ 11:39 am:

==It is silly that the legislature continues to contort themselves to do anything other than raise taxes to pay for their debts or cut services elsewhere.==

I don’t think it is silly. I think it’s a reality that people better get used to accepting, which is why everyone has to be willing to negotiate.

- east central - Friday, Jul 25, 14 @ 11:40 am:

Do not TRS and SURS represent more than 75% of the total accrued liability of the total for the 5 pension systems?

Is the State going to force school districts, universities and colleges to give their employees the choice between receiving raises during employment and AAIs during retirement?

Good luck with that.

- RNUG - Friday, Jul 25, 14 @ 11:48 am:

The State will never be able to offer a raise high enough to persuade someone that does the math to give up the guaranteed fixed AAI. The one time the State actually tried to do a performance based pay system for the Merit Comp staff, the CMS panicked when raises soared and effectively pulled the plug on it (capped the max raise at something like 4% plus installed a quota system for the various rating levels) after a couple of years.

Government just doesn’t operate the same way as private industry, and can’t deal with a risk / reward based incentive system. Plus such a system can be abused to reward the politically connected and punish naysayer’s.

Once the political posturing is over, what we’re going to end up with next year or the year after, is a large tax increase / expansion blamed on the pensions and the ISC. As I stated above, it will be much bigger than the amount actually needed for the pensions because it will be structured to pay for all the State’s problem and debts plus designed to create a new pile of cash the politicians can dole out. And, looking back at history, I’ll predict that new tax hike will be good for 3 - 4 years before the GA has spent all the cash and again starting to short whatever programs they can.

- Bobbysox - Friday, Jul 25, 14 @ 11:52 am:

@Demoralized

You are correct that it is not silly that the legislators will do anything — constitutional or not — to avoid raising taxes and cutting spending. It has been that way for decades and it will continue. My choice of words was an emotional reaction to your use of the word. I retract.

But the idea that a purposeful salary freeze for the purpose of reducing pensions one way or the other is Unconstitutional is not silly either. Neither premiums nor salary is in the pension code. The purpose of such a move would be clear.

And for those that cannot recall, SB2404 was the result of the Unions being willing to negotiate with Cullerton. The Speaker did not allow it to be called for a vote or it would have passed.

- Mason born - Friday, Jul 25, 14 @ 11:53 am:

Might be hard to fill spots. Was meant tongue in cheek.

- Mason born - Friday, Jul 25, 14 @ 11:55 am:

RNUG 11:48

You’ve nailed it. Want to bet the Fix won’t have any sunset?

- Formerly Known As... - Friday, Jul 25, 14 @ 11:56 am:

== At least Cullerton is looking for alternate solutions. ==

It appears we share more than just confusion on this.

If just half the ILGA, or even one-tenth, were to come up with new suggestions on this issue like Cullerton is, we would all be in a much better place.

He also gained a great deal of respect with the way he handled the “dueling pension bills” situation towards the end of session a year ago. Mr. Madigan came off looking like a petulant child and Mr. Cullerton the elder statesman.

More like this, please.

- Norseman - Friday, Jul 25, 14 @ 11:57 am:

Empty Suit - and we’re still wasting it. The litigation is going to continue for awhile. Especially, if Judge Belz takes this all the way to trial.

- Oswego Willy - Friday, Jul 25, 14 @ 11:58 am:

- YDD - ya haveta drag me into it, lol

Much respect, as always.

To your Point, specific to @StatehouseChick,

She whines and complains about schools and school choice, and the Obama school location, and championing for kids and Chcago schools, but is “fine” with Payton Prep Clouting…

She calls the choice of Rauner ” Simple, change” while not even knowing what he stands for,

She wears a tin foil hat on the US Attorney sending letters to the LAC,

And now, writes a piece about U-Hauls and turning out lights, with what reads as a Drive-By masquerading as thoughtful writing.

@StatehouseChick use to be a very thoughtful reporter, and is still pleasant and all that, but these Dopey turns make you wonder about what she stands for, or what she has to be, to be on the Editorial Board, and in the past few months, these Dopey moves are that.

- PolPal56 - Friday, Jul 25, 14 @ 11:59 am:

Demoralized, I understand what you are saying about compromise. However, for the last number of years, as a state employee I have felt deeply the abusive things that have been said about state employees, the lies, the deceptions, the feeling of utter betrayal by my employer (the State), and the knowledge that all of the effort and time and skills and knowledge I put into my job are unappreciated, even by many of those I directly serve. My workplace has become more and more unpleasant because everyone is overworked, underappreciated by management, excoriated in the media, and worried to pieces about the future.

The last few years has cost me dearly, both physically and emotionally. For a long time my only emotions were fear and anxiety. But since December 3, my anger has been growing. State employees do not deserve to be treated like this.

State employees and retirees were not given one ounce of respect throughout this entire process. We were never given a seat at the table. We were never given a voice (and I don’t see any plans to give us one now).

So, I say NO. Do not compromise. I’m over being treated like trash. This State needs to show some respect for the people who serve it.

I’m not a dog that can be kicked and beaten for five years and still lick the hand that beat it.

- angelo mysterioso - Friday, Jul 25, 14 @ 12:03 pm:

Assuming the ISC goes the route we’re expecting and from a non-union worker standpoint, my understanding of contract law is that both areas of “offer” and “consideration” are voided if one of the areas is unconstitutional. Perhaps better legal scholars than me (like RNUG) could weigh in?

- RNUG - Friday, Jul 25, 14 @ 12:04 pm:

- Bobbysox - Friday, Jul 25, 14 @ 11:52 am:

SB2404 was still unconstitutional because it did not legally modify the existing pension “contract”; no choice to keep what had, the only choices were coersive in nature.

Plus the union does not represent any retiree and not all of the employees.

- RNUG - Friday, Jul 25, 14 @ 12:05 pm:

- Mason born - Friday, Jul 25, 14 @ 11:55 am:

I only bet on sure things if it is in my favor!

- Anon. - Friday, Jul 25, 14 @ 12:07 pm:

At last, a constitutional proposal. There is a huge practical problem (other than getting it enacted in the first place): What about promotions? There is no way you can deny higher pay to someone who takes a new job, especially if it is a promotion to a job that requires more talent, experience, etc. than the old one. If this becomes law, you will see union contracts that create all kinds of new “positions” in what would be a single position today, so that transfer to these new positions will merit higher pay that looks a lot like the step increase or longevity increases today. And the clouted employees will get promotions left and right.

- Raising Kane - Friday, Jul 25, 14 @ 12:11 pm:

That’s not “brilliant” Rich, it’s such a tiny band aid it’s laughable. Tier 2 means future employees are “donors” to the system so they can’t be harmed any more than already are. There are twice as many retirees than active employees and you don’t touch their pensions and cola’s and half of the current employees won’t take the deal so their cola won’t be touched. So how do you get significant savings on such a small sliver of annuitants? You just don’t.

I would love to see an actuarial analysis of this plan because based on the millions of scenario’s I have run over time, I am quite certain this “brilliant plan” is about worthless.

- Makandadawg - Friday, Jul 25, 14 @ 12:14 pm:

Workers not getting raises they deserve or the pensions they have already earned and being made out to be the enemy. Come on folks these are not good ideas, this is class warfare at its best. Business Owner Class vs the Working Class. Wars have started over this kind of thinking. Remember in America we are suppose to be able to work hard and get ahead.

- Person 8 - Friday, Jul 25, 14 @ 12:15 pm:

I don’t see how this would work with TRS employees, as the school districts pay the salaries.

- east central - Friday, Jul 25, 14 @ 12:26 pm:

Why did Cullerton bring this up now? Is he trying to further antagonize the unions and other members of the retirement systems before the election?

- RNUG - Friday, Jul 25, 14 @ 12:34 pm:

- angelo mysterioso - Friday, Jul 25, 14 @ 12:03 pm:

To oversimplify things…

You can contract for almost any legal purpose, including giving up a lot of your contractual rights under federal and state law, if it is properly offered and accepted. Generally you do so voluntarily in exchange for something that you believe is of more value to you.

The real question is why would you voluntarily give up constitutionally protected benefits? What would be valuable enough to persuade you to do so?

Assuming the courts continue to rule as expected in favor of the retirees / Tier 1 employees, this is the problem the State and General Assembly has. Health insurance is off the table. 3% AAI is off the table. Changing the current retirement formula in a detrimental way is off the table.

About the only thing left on the table is figuring a way to minimize future salary increases for current Tier 1 employees so as to minimize their final average compensation used in the pension calculation. You can try to hold down the raises but that may not succeed.

One item that should be looked at is the timing and amount of the automatic step increases earned by SERS union employees in addition to a COLA. From a historical perspective, pre-union the step increases were designed to reward employees who were becoming more skilled at their job; once x time had elapsed you automatically got the raise. At the time the State didn’t have a formal COLA process so the steps kind of made up for that. But today with an annual COLA process (union negotiated), a lot of state employees end up with 2 raises a year, one COLA and one step.

Another place the State could get a bit of salary reduction is an idea that was tried before but then reneged on by the State (which some people, myself included, still resent to this day the State’s reneging on). At one time, instead of giving state employees a raise, the State agreed to pick up the 4% employee portion of the retirement contribution. This had the effect of reducing the final average compensation going forward by 4% plus. This would lower the projected future cost of current Tier 1 employee pensions a bit, resulting in a small amount of pension funding savings. However, if the State were to take this approach, it should be structured that the State can not renege on it in the future. Don’t know why us employees didn’t sue over it at the time … guess we still believe din public service and the amount of outrage wasn’t there.

Anyway, the way forward will be a lot of small incremental steps … plus the aforementioned tax expansion that will have to happen.

Note: the above suggestions pretty much only apply to SERS positions. As others have noted, the elephants in the room are TRS and SURS. Until you get the local school boards to hold down salaries, you can’t affect things much. That is why the normal cost shift will happen, now probably sooner than later, so the school boards have a reason to hold down salaries.

- RNUG - Friday, Jul 25, 14 @ 12:36 pm:

- east central - Friday, Jul 25, 14 @ 12:26 pm:

Don’t really think so. He’s just showing what constitutional solutions might look like as an alternative to the tax expansion we all know has to happen. Called building political cover …

- Oswego Willy - Friday, Jul 25, 14 @ 12:40 pm:

You did say you take that drink …”tall “?

Well done, thanks, as always, for your insight.

- Ghost - Friday, Jul 25, 14 @ 12:45 pm:

I appreciate that cullerton is looking for ideas. unfrotunetly this would be illegal

it would be bad faith to require somone to give up a legal right in exchange for raises.

Just like I cant ask my female staff to give up the ability to sue me for sexual harrassment in exchnage for their raises etc.

The State can hold back raises for financial reasons, but mandated workers, like police and guards, the ones who cant strike, get to have an arbitrator decide whether to accpet the States offer or the unions.

the arbitrator cant craft a compromise. So if the State says 0 because we want you to give up constitutional right, and afscme says we want 5% per year, afscme will most likely win for those folks; the ones with the expensive pensions.

Those are the folks with the expensive

- Bobbysox - Friday, Jul 25, 14 @ 12:47 pm:

Probably the only way to constitutionally limit state liability for future salary increases for TRS/SURS would be to cost shift them to the employers, as has been mentioned here recently.

The benefits would not be diminished, so no issue there. But the employers will be oh so more reluctant to grant them (see the current 6% parameter), and if they do, they pay for them rather than the state. The state is still on the hook for its current debt however. There is no way around that one.

- Yellow Dog Democrat - Friday, Jul 25, 14 @ 1:04 pm:

@Willy -

Did the Tribune say flouting your kid into Peyton, claiming to live in two different places at once, and fraudulently claiming homestead exemptions was okay? I must have missed that.

I read - and reread - the linked piece. On its whole, I thought it pretty thoughtful.

She reminded union leaders they were complicit in the underfunding of pensions and even benefitted, which I have myself.

She declared SB 1 mostly dead, in a Princess Bride kind of way. If you believe in unicorns, keep on believing.

She and I interpret the SC statement about funding differently. She took it as a slap in the warning to taxpayers. I can see that; but I actually took it to be obiter that the Court would not be entertaining any suit from unions requiring lawmakers to make pension payments. The Tribune ought to embrace that.

Does the one statement about moving vans distract for some readers? Sure. But for as many or more it reflects a frustration with a state government that oftentimes appears lethargic. I’ve only been pushing for education funding reform since 1989, so I tend to agree. Go Manar!!

- ah HA - Friday, Jul 25, 14 @ 1:15 pm:

I wonder if in the future will there be a point where the State stops the pension. Just stops. I have 12 years and worry about that. Several companies have done just that. IBM revoked their employees and retirees’ pensions then brought them back (if I read the correctly). I’m just curious that there will be a point that there will be NO pensions. What the government gives you and take it away just as easily.

- Norseman - Friday, Jul 25, 14 @ 1:21 pm:

I was able to get a super secret copy of a draft of Cullerton’s bill. It follows:

Be it enacted by the State of Indebtedness …

Sec. 1. This Act shall be named the “Stick It to Our Employees Act.”

Sec. 2. Upon the effective date of this Act, all Tier One employees will be have 60 days to choose one of the following options:

Keep their annual 3% compounded annuity increases and be prohibited from ever, ever receiving a salary increase.

Agree to reject their annual 3% compounded annuity increases and be guaranteed that if raises are budgeted and funded by the Governor and General Assembly and further upon the approval of their supervisors in the instance of merit comp employees they will receive a raise. Nothing in this provision shall be construed to prohibit the state from imposing non-paid furlough days.

Sec. 3. This Act shall take effect upon it’s becoming law.

- OneMan - Friday, Jul 25, 14 @ 1:21 pm:

The thing I don’t understand if the courts rule that the COLA and the like are a constitutional right can the unions negotiate that away?

It seems any deal based off a reduction in benefits would run the risk of the first person to go to court rendering it null and void.

It seems a negotiated lower/no raise, increase in state contribution would be more likely to have success in the courtroom.

- Formerly Known As... - Friday, Jul 25, 14 @ 1:30 pm:

== as a state employee I have felt deeply the abusive things that have been said about state employees ==

It’s not just the public or the media, either. Our politicians set the tone.

In their haste to avoid “blame” for this crisis, our elected officials from both parties chose to cast unions as the “bad guys” instead of owning their choices.

- RNUG - Friday, Jul 25, 14 @ 1:33 pm:

- ah HA - Friday, Jul 25, 14 @ 1:15 pm:

IL government can’t easily do that. It’s one of the reasons the Pension Clause exists in the IL Constitution. The State can’t bail on it’s existing contract with current employees, both Tier 1 and Tier 2. The ISC has been consistent in it’s rulings that the Pension Clause applies as of date of hiring. Removing the Pension Clause from the Constitution would only apply going forward.

The only way the State can get out of the pension business is to create a new Tier 3; then the State will have to start paying Social Security for almost all of the new hires. That’s a big problem because the State currently does not pay SS for most of the current JRS, GARS, TRS & SURS members, plus some of the SERS members. I didn’t go total up the numbers again but that’s probably about 85% - 90% of all the current “state” employees … and the Feds won’t let you skip that 6.2% SS payment.

- facts are stubborn things - Friday, Jul 25, 14 @ 1:40 pm:

Assuming the ISC rules as most people now expect, the pensions are set. The only thing the state can do is keep cutting costs and raising revenue. Certainly that includes lean employee contracts, but to say to people choose between a constitutionally protected benefit and giving up all your future raises is a non starter. RNUG is correct, at the end of the day pensions will be paid as promised. The political path is just not quite in place yet to do that.

- Formerly Known As... - Friday, Jul 25, 14 @ 1:42 pm:

I can see why the idea is “brilliant”, even if I don’t think it will work or is legal.

From a raw political angle, this could give the state leverage and put enormous pressure on the unions, essentially forcing them to give up one of these or the other and decreasing the state’s costs. In theory, it is a brilliant maneuver.

From a practical angle, it does not seem like it will work in the court of law or public opinion, making the idea a non-starter.

Again, it is a good thing Cullerton is at least still trying to come up with something.

- facts are stubborn things - Friday, Jul 25, 14 @ 1:45 pm:

RNUG,

I just don’t see how you can bargain with a constitutionally protected benefit as far as using the loss of that benefit to leverage someone into excepting a terrible deal. The leverage does not exist.

- Oswego Willy - Friday, Jul 25, 14 @ 1:51 pm:

- YDD -,

With respect,

===Did the Tribune say flouting your kid into Peyton, claiming to live in two different places at once, and fraudulently claiming homestead exemptions was okay? I must have missed that.===

I was only commenting on @StatehouseChick, and further, an Eric Zorn video discussing the GOP Primary, and her dismissal of the Payton Prep issue.

I thought I made it clear it was about her recent comments, which I listed above. We can go over those specifically if you would like.

===Does the one statement about moving vans distract for some readers? Sure.===

As does her tweets…

She may be a fine person, many vouch for her, including Rich, who posted what he did, and I will leave it there, Rich can speak for himself.

I stand by my comments. Her record and her tweets and writings recently seem to teeter away from rational thought and more about drive-by Dopiness, including calling the US Attorney sending letters, as she described that.

- RNUG - Friday, Jul 25, 14 @ 1:51 pm:

facts,

Based on other court rulings about constitutional rights, you most likely can’t legally do so, but contract law allows you do do a lot of stuff you wouldn’t think was possible. Remember, I said I was oversimplifying the situation.

- Arthur Andersen - Friday, Jul 25, 14 @ 2:05 pm:

RNUG-if I recall correctly, the projected future cost of the AAI for TRS is about 3% of payroll. Likely SURS would be about the same and SERS maybe a bit lower. If my math is right, Cullerton’s idea would save the State money, as annual pay growth for all systems has averaged above 3% per year, and the savings are immediate.

Does any of that make sense?

- efudd - Friday, Jul 25, 14 @ 2:09 pm:

Sir Reel @ 9:59-unless you hired in as merit comp, then you chose to accept a merit comp position, and all that goes with it.

- Apocolypse Now - Friday, Jul 25, 14 @ 2:22 pm:

Cullerton’s proposal is simply a bad idea for many reasons. It is a nice trial balloon.

- facts are stubborn things - Friday, Jul 25, 14 @ 2:23 pm:

RNUG - Friday, Jul 25, 14 @ 1:51 pm:

A fair point.

- Ghost - Friday, Jul 25, 14 @ 2:32 pm:

OneMan, excellent question. The courts have said there are certain civil rights that a union cannot negotiate away on behalf of an employee.

My specualtion, the union can negotiate a choice, such that any individual would not have a change in heir benefits if they do not agree/elect it. They couldnt not however just agree to a change without the employee being able to opt in or out individually.

and machiavellian choices dont count

- Anonymous - Friday, Jul 25, 14 @ 2:33 pm:

@efudd

When us merit comp employees take the position of merit comp (at least those of us hired on in the last 8-10 years) we realize that a lack of raises is a possibility, but it’s not a certainty….nor should it be.

Assuming that Reel was hired some time ago (and that seems likely given that he’s now retired) it was likely not even considered that regardless of performance that he’d have to go without a single increase for the better part of a decade. Also, let’s not ignore the furlough program that took something like 2 months of pay away from merit comp employees over the course of 3. It’s totally unreasonable to pretend that these people didn’t do plenty to share in the sacrifice.

- Anon - Friday, Jul 25, 14 @ 2:34 pm:

So, under Cullertons plan, if a state employee, who chose to forgo raises, takes another job within the state how will the salary be determined? Would you give the state employee a lesser salary than someone new? How would you determine how that person fits in the pay grade if its a promotion? How would you calculate temporary assignment pay?

Seems very impractical for a lot of reasons.

- Just Trying to Survive - Friday, Jul 25, 14 @ 2:41 pm:

More big plans for any pension money that can be stolen from our seniors:

http://www.nationofchange.org/stadium-subsidies-financed-pension-cuts-1406298613

- Anon - Friday, Jul 25, 14 @ 2:43 pm:

Just to make further stress the impracticality of this solution, two people, with the same title, who both agreed to give up raises for AAI could make vastly different salaries depending on when they started working.

- facts are stubborn things - Friday, Jul 25, 14 @ 2:45 pm:

Cullerton has until now been a voice of reason. I am not sure you could even do this because it would in effect destroy the entire right to bargain system. We the state will take your constitutionally protected benefit if you don’t give up the single biggest bargaining issue that you have in the future…salaries. I am not sure this whole thing would even be legal if it was possible.

- Finally Out (formerly Ready to Get Out) - Friday, Jul 25, 14 @ 2:48 pm:

My decision to retire this past January is looking better and better!

- facts are stubborn things - Friday, Jul 25, 14 @ 2:58 pm:

“The state constitution,” said Cullerton, “does not guarantee pay raises.”

Ok so what is your point — pensions are! let me get this strait, I am to give up my constitutionally protected pension benefit so I can have a few raises in the next 20 years? That is brilliant…come on! If I give up some pension benefits then can the state ever freeze my salary in the future over say a 4 year contract? I gave up pension benefits for raises?

- Macbeth - Friday, Jul 25, 14 @ 3:08 pm:

Another point: “frozen” salaries aren’t constitutionally protected either. I freeze my salary as-is for a COLA — and then what? We get someone like Rauner in 4 years or 8 years and decides to “revisit” the issue and decides, hey, those IT folks in agency X are making too much money. Let’s cut their salaries by 10%.

Now what? I get no more raises, get a *lower* salary — and my pension benefit goes down. If my salary is frozen — and I can’t have any more raises — then my salary can only go down, never up. I essentially signed away potential pension earnings that are salary-based.

That seems like a diminished to me — especially if I’ve contractually signed away my future earnings.

- facts are stubborn things - Friday, Jul 25, 14 @ 3:19 pm:

I think Cullertons proposal is dangerous, and mean spirited. He would freeze hardworking public servants salaries for - in some cases - up to 25 years or more so that those very same public servants can receive the benefits of their constitutionally protected pension contract. That is not just holding the public servants hostage but even more importantly the Illinois Constitution.

- RNUG - Friday, Jul 25, 14 @ 3:27 pm:

AA,

Cullerton’s proposal, if we gut it back to just having frozen / lower salary growth that would probably result in a lower final average compensation, would result in some savings to the pension systems. Only a small portion of the pension funding savings would be immediate; the salary savings would be immediate.

I pretty much said that when I referred to the deal the State did (and later reneged on) years ago in lieu of a 4% raise.

- steve schnorf - Friday, Jul 25, 14 @ 3:32 pm:

I’m glad I’m not going to be in charge of those union negotiations

- Madison - Friday, Jul 25, 14 @ 3:35 pm:

Memo

To: John Cullerton

from: Madistocrates

Re: Uncommon wisdom

Dear John, (sic)

Consider bonding the pension problems while interest rates are at 40 year lows. If your financial situation improves you could even refinance down the road. It seems as though you have reached the end of all your options other than taking responsibility for your actions.

Your most humble and obedient servant,

Madistocrates.

PS. Try to get it done before Bruce arrives at the train station.

- facts are stubborn things - Friday, Jul 25, 14 @ 3:41 pm:

What Cullerton is really proposing is that you must give up your constitutional rights or have something of great value taken from you. I think that is such a dangerous idea and if done to state employees could be employed against other citizens in all kinds of ways. Heck the federal government could say you can keep your first amendment rights but only if you pay higher taxes.

- Rich Miller - Friday, Jul 25, 14 @ 3:49 pm:

===What Cullerton is really proposing===

Meh. Take out the health insurance component and it’s pretty darned similar to what We Are One agreed to a while back.

- RNUG - Friday, Jul 25, 14 @ 3:59 pm:

- Rich Miller - Friday, Jul 25, 14 @ 3:49 pm:

But now there is no reason for the unions to agree … other than the political image of contributing to a solution.

In that spirit, I could see the unions agreeing to up the employee contribution a bit (0.5% to 1%?) in exchange for some other (non-monetary?) benefit like extra time off or possibly a minor change to part of the pension formula, such as lowering the “Rule of 85″ down a bit or possibly changing the age 60 threshold to 58 or even a guarantee against any more furloughs for x number of years.

- facts are stubborn things - Friday, Jul 25, 14 @ 4:21 pm:

@- Rich Miller - Friday, Jul 25, 14 @ 3:49 pm:

The big difference is that the ISC has now spoken very clearly that the pension clause of the IL Const. means exactly what it says. To now propose that to keep this protected benefit you must give up all your raises for your entire career is incredible. The pension benefits are protected! The negotiations on the next contract will be about wages, job security, contract language etc. and perhaps that could include some pension contribution changes in exchange for something else. After the ISC ruling the unions would get run out of town if they negotiated.

- Chris - Friday, Jul 25, 14 @ 4:25 pm:

“That’s actually brilliant. He’s done it again. Whether the state could get the union to agree to such a change without a strike is another story, but it’s probably worth a shot.”

Wow, so John’s come around to thinking “What might Rauner propose that is toxic to discuss in a campaign?”

Then John sez “I can’t possibly propose firing everyone (upon contract expirations) and offering their jobs back under Tier 2 rules, bc the Constitution also doesn’t guarantee *jobs* for public employees. So I’ll propose ‘no raises’.”

It’s hardly ‘brilliant’, but it is actually *thinking* for a change.

- Chris - Friday, Jul 25, 14 @ 4:35 pm:

“Heck the federal government could say you can keep your first amendment rights but only if you pay higher taxes.”

Um, they don’t have to do that with a threat, they just raise the tax rate, and if you don’t pay, you have the choice of (1) jail, for evasion, where you lose a lot more than your 1A rights, or (2) renouncing your citizenship which ALSO would lose you your 1A rights.

So, yeah, I’ll agree that what Cullerton is proposing is just like the US Congress raising the federal income tax rate. That is, it is a *completely* ordinary and permissible exercise of legislative power.