A new study by the Institute on Taxation and Economic Policy (ITEP) and the Fiscal Policy Center at Voices for Illinois Children finds that the lowest income Illinoisans pay nearly three times more in taxes as a percent of their income compared to the state’s wealthiest residents.

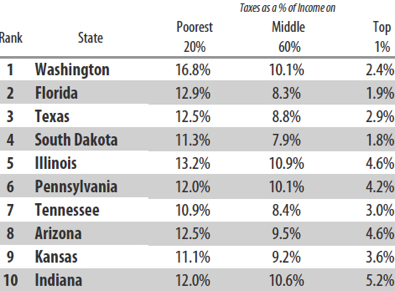

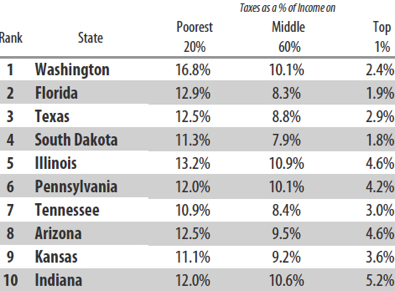

The study, Who Pays?, analyzes tax systems in all 50 states and factors in all major state and local taxes, including personal and corporate income taxes, property taxes, sales and other excise taxes. Unfortunately, Illinois ranks fifth worst in ITEP’s “Terrible 10” states with the most unfair, or regressive, tax systems. Among Midwestern states, Illinois is the worst.

One positive aspect of Illinois’ tax system is the state’s Earned Income Tax Credit, which lets low- and moderate-income working families keep more of their earnings to help pay for things that help them keep working, such as child care and transportation. To improve tax fairness in Illinois, lawmakers should increase the value of the state’s Earned Income Tax Credit.

“Illinois has the most unfair tax system in the Midwest. As a percentage of their income, the poor pay more, and the rich pay less in taxes here than in any of our neighboring states.” said David Lloyd, director of the Fiscal Policy Center. “That’s what happens when taxes are not based on ability to pay, but rather on a flat rate.”

Illinois’ tax system is regressive, because the lower one’s income, the higher one’s tax rate. This is in part because Illinois, unlike most other states, does not have an income tax where taxpayers with higher incomes pay a higher rate and taxpayers with lower incomes pay a lower rate. Without such a fair income tax, there is nothing to offset the higher share of income that poorer taxpayers pay in sales and property taxes.

How Illinois taxes residents matters for a variety of reasons. In recent years, anti-tax advocates have pushed for tax policies across the country that would reduce tax rates for the wealthy and businesses. In Illinois, the recent income tax cut disproportionately benefits the wealthy, while many of the proposed ideas to partially offset the deep revenue losses would increase taxes on poor and middle-income families.

There’s also a more practical reason for Illinois and all states to be concerned about regressive tax structures, according to ITEP. If the nation fails to address its growing income inequality problem, states will have difficulty raising the revenue they need over time. The more income that goes to the wealthy (and the lower a state’s tax rate on the wealthy), the slower a state’s revenue grows over time.

“In recent years, multiple studies have revealed the growing chasm between the wealthy and everyone else,” said Matt Gardner, executive director of ITEP. “Upside down state tax systems didn’t cause the growing income divide, but they certainly exacerbate the problem. State policymakers shouldn’t wring their hands or ignore the problem. They should thoroughly explore and enact tax reform policies that will make their tax systems fairer.”

They’re obviously referring to the governor’s service tax idea when they talk about proposals that would “increase taxes on poor and middle-income families.”

* The study is here.

From the intro…

This study assesses the fairness of each state’s tax system by measuring state and local taxes paid by non-elderly taxpayers in different income groups in 2015 as shares of income for every state and the District of Columbia. The report provides valuable comparisons among the states, showing which states have done the best — and the worst — job of providing a modicum of fairness in their overall tax systems. The Tax Inequality Index (Appendix B) measures the effects of each state’s tax system on income inequality and is used to rank the states from the most regressive to the least regressive.

The ten most regressive…

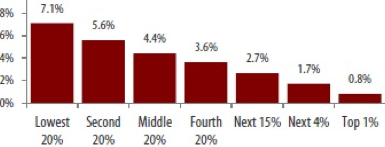

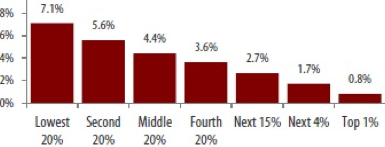

* From the Illinois page, this is the percentage impact of state and local sales and excise taxes based on family income…

- Wordslinger - Thursday, Jan 15, 15 @ 8:37 am:

Gov. Rauner admires Gov. Walker so much he might want to consider the progressive income tax they have up yonder.

- Apocalypse Now - Thursday, Jan 15, 15 @ 8:42 am:

Looks like elected officials are really hitting the poor hard with sales and excise taxes. And this study doesn’t appear to show the impact of thinks like parking meter fees and other local permit or recording fees.

- VanillaMan - Thursday, Jan 15, 15 @ 8:48 am:

as a percent of their income

Oh please. My fourth grader can tell you why this happens using basic math and it is no revelation on tax unfairness.

- Anonymous - Thursday, Jan 15, 15 @ 8:50 am:

It is no mistake that the pension funds had to be raided to pay for other peoples’ things. It has to come from somewhere. And the people with the greatest ability to pay are writing passes for themselves. Shame on Illinois for being so reckless with fair revenue generation. No matter how much the 1% would like to shift the burden to the low income citizen, the unemployed and homeless–snark–we won’t keep up with other states finances. It’s time to enter the 21st century and act like grown ups.

- Apocalypse Now - Thursday, Jan 15, 15 @ 8:52 am:

=Gov. Rauner admires Gov. Walker so much he might want to consider the progressive income tax they have up yonder=

Maybe, Madigan and Cullerton can get the legislators to vote to put this on the ballot, as a constitutional amendment. Pass a progressive income tax and Untied Van Lines will be busier.

- PublicServant - Thursday, Jan 15, 15 @ 8:55 am:

===Pass a progressive income tax and Untied Van Lines will be busier.===

I say pass a progressive income tax and provide a moving van subsidy to the clowns leaving the state for ideological reasons. Good riddance!

- Anonymous - Thursday, Jan 15, 15 @ 8:56 am:

United Van Lines will be busier? Hah! Where will they go? Not many places to run to. Most states will charge them more!

- Sun - Thursday, Jan 15, 15 @ 8:56 am:

Whenever listed in the top 5 with the likes of Texas and Florida you know you’re doing it wrong.

- RonOglesby - Now in TX - Thursday, Jan 15, 15 @ 9:06 am:

Texas, Florida, Tenn… all not state income taxes. But funny enough, having lived here in texas for 6 months now there are Now Hiring signs every where. Even on the side of highways and hiring events for Toyota plant that run like every 2 months.

I dont like the % of income thing. It means you make more than you spend on the baseline (food clothing, etc) and that you then need to pay more. Even in texas things like Food are not taxed. I need to dig into their data here a little more as you can almost always make data say what you want.

- walker - Thursday, Jan 15, 15 @ 9:11 am:

VMan: relative position with other states on taxation does matter, as we are constantly told by the other side of these tax arguments

One of our Illinois ironies is that our flat income tax and generally regressive tax structures are what conservatives in other states are pushing to solve their own economic ills.

- Statistics - Thursday, Jan 15, 15 @ 9:12 am:

% of income? Include the various assistances the so called poor get in their income and then see the %’s drop.

- SAP - Thursday, Jan 15, 15 @ 9:12 am:

Too bad the Democrats didn’t use their super-majorities to amend the Constitution to create a graduated income tax so they could use the issue for political reasons instead.

- Apocalypse Now - Thursday, Jan 15, 15 @ 9:12 am:

=United Van Lines will be busier? Hah! Where will they go? Not many places to run to. Most states will charge them more! = I am not sure, but United Van Lines statistics show Illinois has one of the highest outbound movers in the country.

- Jack - Thursday, Jan 15, 15 @ 9:16 am:

Well, they already lowered the state income tax so the wealthy elite will be paying even less. It makes the police powers argument even weaker.

- Very Fed Up - Thursday, Jan 15, 15 @ 9:24 am:

This is primarily what turned me off from Quinn so much. He had over 6 years with super majorities and an electorate that would of voted for a graduated income tax in a heartbeat if allowed to. Just makes no sense for Illinois to be on this list.

- MrJM (@MisterJayEm) - Thursday, Jan 15, 15 @ 9:28 am:

“[taxes as a percent of income] is no revelation on tax unfairness.”

Classic magical thinking.

– MrJM

- Annoyed - Thursday, Jan 15, 15 @ 9:31 am:

Illinois should raise it’s income tax on the wealthy to fix the fact that property and sales taxes are so high that they are a burden on the poor…

- Wordslinger - Thursday, Jan 15, 15 @ 9:34 am:

Ron, I think you’re going to find very soon that oil that six months ago was $107 a barrel and is now at $45 and dropping like a rock has a lot more to do with things than the existence of a state income tax.

The Texas economy is more diverse than it was in the 80s, but this is going to sting, especially in the Houston and Midland areas.

As I’m sure you’ve been reading in the Texas papers, there already have been oilpatch-related layoffs and bankruptcies, with the promise of many more to come.

Those small drillers borrowed to the max based on $100 a barrel. Consolidation or failure is on the way for many.

You see, state governments have a marginal effect on the economy. Much bigger forces at work.

- Joe M - Thursday, Jan 15, 15 @ 9:34 am:

A few years ago, an organization, United for a Fair Economy came out with a Flip it to Fix it report for each state. The middle 60% would be left alone and pay the same rate of their income towards taxes as they had been.

For Illinois they then said if we switched to having the bottom 20% pay the percent of income in taxes that the top 20% pay — and have the top 20% pay the percent of their income that the bottom 20% pay, that that would generate an additional $32.5 billion annually in state and local revenue.

However their report claimed the bottom 20% were paying 13.2% of their income to state and local taxes - and the top 20% were paying something like 3% of their income.

- Tom Joad - Thursday, Jan 15, 15 @ 9:36 am:

A bill to create a graduated income tax in Illinois was voted down by the Republicans in the 1980’s on a straight party vote in committee. their minds haven’t changed even though the names have changed. Rauner’s views on expanding sales and excise taxes will move us up to number one on the regressive taxing list.

- Let'sMovetoTexas - Thursday, Jan 15, 15 @ 9:39 am:

This study is goofy and the math is all wrong. It also ignores public benefits and deductions. Sales tax is a consumption tax- the wealthy pay more in sales tax. Property tax and income tax also hit the wealthy more. These people never met a tax increase they didn’t like! Fortunately, saner hands are now in control of the Governorship!

- Bill White - Thursday, Jan 15, 15 @ 9:39 am:

Switching to sales and excise taxes also means our citizens will send even more money to Uncle Sam pushing Illinois further down the list that balances payments to the federal government versus payments from the federal government.

- Arizona Bob - Thursday, Jan 15, 15 @ 9:40 am:

Sales taxes, motor fuel taxes, taxes on utilities, taxes on things like cable and phones and other user fees typically hit the lower income taxpayers the worst.

I wonder what share of state and local revenues come from the “wealthy” 1%, 10% and upper quartile in Illinois

Federally, I believe the top 1% of earners foot the bill for about 40% of Federal income tax revenues, and probably are paying more indirectly through the excessive Federal corporate tax rates.

It’s also interesting to note that states with the greatest “inequality” seem to be growing the fastest and gaining the most population. Can we then infer that state income inequality and regressive tax systems result in the greatest job and population growth?

It seems that Illinois is just about the only state on the list that fails in tax regressivity, population influx and economic growth. There are many reasons for this, and most of them come from the people the Illinois voters elect and the poor governing decisions they make.

Remember “stagflation”, where there was double digit inflation and unemployment, and the malaise of the Jimmy Carter regime in the 70s? It seems Illinois leadership is “Carteresque” in it’s ability to fail on just about every level.

What are the odds that the Illinois electorate will ever wake up and stop electing the Madigans, Blago’s, Ryan’s and Quinn’s whose policies created and sustained this dysfunctional mess?

- Grandson of Man - Thursday, Jan 15, 15 @ 9:47 am:

Texas’ economy is not booming only because of taxes. It’s booming also because of natural resources, like oil. Texas has its share of problems, like percentages of people without health insurance and working at or below the minimum wage. Same with Florida.

How are tax cuts and tax breaks working out in Kansas, New Jersey and Wisconsin? Not so good. How are tax increases on the wealthy working out in California and Minnesota? Pretty good. Vermont and Minnesota have high top income tax rates and low unemployment.

One of the more communistic of the socialist organizations, S&P, released a study that says there has been a long-term and substantial decline in states’ revenue growth, due to increased income inequality.

We need to pass a millionaire surcharge in Illinois to start reversing tax inequality.

- Let'sMovetoTexas - Thursday, Jan 15, 15 @ 9:47 am:

“As a percentage of income” betrays the logical flaw in this report. As a percentage of income, the poor pay more for bread, medicine, and clothing, for examples, than do the wealthy. This is trivially true, and meaningless. The key is that in gross amounts of taxes, the wealthy pay for more than do the unwealthy.

- illinoised - Thursday, Jan 15, 15 @ 9:52 am:

Progressive income and eliminate tax loopholes. The nominal tax rate s a joke, because the loopholes reduce the effective tax rate of high earners and corporations to zero in some cases. Quit picking on the working class and make the 1% start paying their fair share. Rauner will have a huge awakening when he takes his protect-the-rich budget ideas to the opposition party-controlled legislature. My guess is four more years of a growing fiscal deficit, and then he is not re-elected.

- Pamela - Thursday, Jan 15, 15 @ 9:56 am:

Illinois received 22 billion in income tax in 2014. 11 billion in 2010. It was not enough due to spending. Not due to rich

Not paying their fair share. Although this rhetoric is popular.

- Johnny Q Suburban - Thursday, Jan 15, 15 @ 9:59 am:

Must be those gosh darned Republicans that have been controlling this state so long.

- Very Fed Up - Thursday, Jan 15, 15 @ 10:03 am:

Whats funny is Quinn kept saying he favored his extremely regressive tax hike due to “ability to pay.” Never had the spine to step up and drive the progressive tax amendment that’s needed.

- Anonymous - Thursday, Jan 15, 15 @ 10:05 am:

Illinois has had and continues to have a revenue problem. Does it make sense to ask for those with multi-millions to pay a bit more or the middle class family or minimum wage earner to pitch in more? Does common sense have any part in this discussion? I fear there will never be any common sense here since only moneyed people get into politics and they will make sure their interests are protected above anyone else’s. It makes you wonder how other states have managed to be more fair to their citizens?

- Joe M - Thursday, Jan 15, 15 @ 10:06 am:

The vast majority of states have a progressive tax structure for individual state income taxes. See for yourself at: http://taxfoundation.org/article/state-individual-income-tax-rates

But Illinois must have it right - and the vast majority of other states have it wrong, since Illinois’ finances are so great (snark)

- Jack - Thursday, Jan 15, 15 @ 10:08 am:

+1 on that illinoised. Also a lot of major corps here collect their employees state income tax. Some effectively pay 0. Stop the corporate welfare.

- MrJM (@MisterJayEm) - Thursday, Jan 15, 15 @ 10:08 am:

“The key is that in gross amounts of taxes, the wealthy pay for more than do the unwealthy.”

And the suffering of the wealthy has been taken under advisement.

– MrJM

- 47th Ward - Thursday, Jan 15, 15 @ 10:15 am:

===The key is that in gross amounts of taxes, the wealthy pay for more than do the unwealthy.===

And we’ve found VanillaMan’s fourth-grader.

- RonOglesby - Now in Texas - Thursday, Jan 15, 15 @ 10:59 am:

@wordslinger,

“The Texas economy is more diverse than it was in the 80s, but this is going to sting, especially in the Houston and Midland areas.”

Exactly. there will be some Oil layoffs. But of course not all the energy sector in Texas is in Oil. NatGas, even Wind are big (many in Illinois would be surprised by the number of wind setups rolling down I10 on a daily basis).

Anyway, Texas made corrections for the gov budget after that 80’s and started moving oil money out of the general budget and not really depending on it.

I am a fundamental believer in growth of the economy to raise gov revenues. Can’t argue that Texas has had growth while Illinois growth has been extremely slow or non-existant. Yes Oil played into that some, but manufacturing is huge in Texas, construction is good, Huston has a huge healthcare industry, Austin is becoming the new “valley” when it comes to tech…

Illinois has things to learn from other states. Those that simply dismiss what any other state has ever done (kind of like the arguments against IL CHLs when that went on) are simply blinded thinking no one else is as smart as them.

Is texas perfect? no. But there are lessons to learn all around.

- Fix It - Thursday, Jan 15, 15 @ 11:31 am:

Put another way, Illinois has the most regressive tax system in then nation of all states that have an income tax–indisputably the fairest way, at least in theory, for government to raise revenue. It really isn’t fair to put those other four states in with Illinois, given that none have income taxes. And Illinois has higher property taxes, by far, than Washington, Florida, Texas or South Dakota. From what he’s said, it appears Rauner may be moving us up the list, in the wrong direction.

- Arizona Bob - Thursday, Jan 15, 15 @ 11:52 am:

One thing rarely mentioned is that while Texas has oil, Illinois is one of the biggest corn and soybean producers in the world. That’s the Illinois natural resource. Illinois also has more tourism than Texas, IIRC, and that’s a big tax revenue source. Between Houston and Chicago, there’s no question which is a better place to visit.

Illinois also has transportation with roads, rail, air and shipping with far greater assets than most of Texas.

The assets for more than adequate revenues are there in Illinois. The problem is with the corrupt and dysfunctional way its governed.

- Rich Miller - Thursday, Jan 15, 15 @ 11:54 am:

=== while Texas has oil, Illinois is one of the biggest corn and soybean producers===

Yeah, but try levying a Texas-sized extraction tax on farmers.

Just sayin…

- Arizona Bob - Thursday, Jan 15, 15 @ 11:58 am:

BTW, Austin is the new “silicon valley” of the Southwest, and Apple, State Farm Insurance, and manufacturing is relocating and growing in Arizona.

There’s no reason that Chicago shouldn’t rival Austin for tech start ups and growth, but it isn’t. Chicago has the universities, the technically educated work force and finances to be a real player there, but the business unfriendly environment and governmental potential liabilities are killing growth prospects there.

Get the government dysfunction fixed and a stable financial plan to deal with the massive liabilities and financial mismanagement from Springfield squared away, and watch Illinois bloom!

- Arizona Bob - Thursday, Jan 15, 15 @ 12:01 pm:

@Rich

=Yeah, but try levying a Texas-sized extraction tax on farmers.=

You’re absolutely right, Rich. If there’s any “unfairness” in the tax structure in Illinois, it’s in the protection of farm profits, not the high earners on the Gold Coast…

Funny how little that’s discussed, isn’t it?

- Samuel - Thursday, Jan 15, 15 @ 12:03 pm:

COGFA just released a report warning against the volatility that comes with a progressive tax.

- Wordslinger - Thursday, Jan 15, 15 @ 12:20 pm:

AB, you have a curious state-capital-centered concept of how economic growth is produced. I really don’t get it. The state has certain functions that can set the table, but capital still rules.

If you look at percentages of population growth in the states over the last sixty years, the lion’s shares have gone to California, Texas and Florida, with lesser percentages to other southwest and sun belt states.

There are many reasons for that — federal water and power projects, interstates and air conditioning making them liveable, being big ones.

I’d be happy for state government to do its core function well. To pretend that it’s the engine of economic growth is just buying politicians spin.

Put it this way — Moody’s says most states outside the oil patch are going to see increased consumer and business spending and state revenue bumps averaging five percent due to the crash in gasoline prices.

You going to give Pat Quinn and the GA credit for that? It’s silly.

- Backwards - Thursday, Jan 15, 15 @ 12:27 pm:

Summing up Property Tax bills here on farmland. Farmers already pay a huge amount of taxes on farmland for little to no benefit from the localities taking our money.

It’s way past time to look at the spending side of the equation instead of penalizing people for farming or other land intensive businesses.

- Federalist - Thursday, Jan 15, 15 @ 12:37 pm:

Many organizations that analyze tax policy. The two cited in this blog are very liberal/redistributionist in their beliefs just like the IPI goes the other way.

So take your choice depending upon your own values and opinions. That’s what we all do.

- VanillaMan - Thursday, Jan 15, 15 @ 12:38 pm:

You can make percentages say anything because they are subjective figures, not objective and measurable ones.

Look at the chart. Those aren’t real numbers that are provable. Those are percentages crafted to create a political message about “fairness” without any objective proof.

A lot of you guys wouldn’t accept this kind of information from FoxNews, but you seem perfectly fine with it coming from these biased organizations. I don’t accept this kind of information from anyone, and neither should you.

Finally, AB - you are all over the place. Focus please and don’t let all the negative comments misdirect you. Make you case, do your best and then let it ride. Consider changing your name too. It really hinders your postings.

- Backwards - Thursday, Jan 15, 15 @ 12:41 pm:

Agreeing sort of with VM about percentages. Still should send some Freshmen level statistics books to ITEP.

They reverse the mathematical definition of regressive to fit their political bend. Makes it hard to communicate, kind of like calling addition->subtraction, war->peace etc

- Wordslinger - Thursday, Jan 15, 15 @ 12:42 pm:

AB, you’re just making stuff up now.

Google “National Venture Capital Association top 20 cities for tech startup funding” for 2014 and you’ll see Chicago at No. 10 with $402 million, ahead of Austin, Dallas and Phoenix.

Houston and San Antonio didn’t make the list.

That’s risk- taking private money, not government corporate welfare.

You need to sharpen up your rants, son.

- Rich Miller - Thursday, Jan 15, 15 @ 12:43 pm:

===Farmers already pay a huge amount of taxes on farmland===

Based on income, not strictly land value: http://farmdocdaily.illinois.edu/2014/01/impacts-recent-changes-illinois-farmland-assessment-act.html

- walker - Thursday, Jan 15, 15 @ 12:49 pm:

RonO: best wishes with your business and new location

Thanks for staying in touch. It might please you to know that recently that signs for help wanted are popping up all over the industrial parks around O’Hare, and among many small manufacturers. We seem to be doing extremely well with venture capital and start ups as well. Better than Austin I heard the other day — but you know how these comparisons can be biased.

- Backwards - Thursday, Jan 15, 15 @ 12:55 pm:

I don’t know Rich, seems like it has always been done that way. The value of land is proportional to the income derived from it, and the value of land is a component, a major one, in determining real estate taxes.

No matter what the come up with for assessed value, the multipliers are arbitrary. I think the U of I study is probably accurate, but not all that relevant, other than being an academic exercise.

- Precinct Captain - Thursday, Jan 15, 15 @ 12:59 pm:

==- Let’sMovetoTexas - Thursday, Jan 15, 15 @ 9:39 am:==

If wealthy people, say from Winnetka, wanted to live in Robbins and make no home improvements, they could dramatically lower the amount they are paying property taxes. If your property tax rate total comes out to 3% of home value, 3% of 1,000,000 is more than 3% of 250,000 or 20,000. Do you not understand? They are paying more because they are indulging in more expensive things, not because, in and of itself, that they are wealthy.

==- Let’sMovetoTexas - Thursday, Jan 15, 15 @ 9:47 am:==

The “unwealthy” pay less in taxes because they literally do not have the money that the wealthy do. I’d love to pay the amount in taxes that Fred Eychaner or even Rich Miller pays to this state, but I don’t make anywhere near the amount of money that either of those two make.

==- Samuel - Thursday, Jan 15, 15 @ 12:03 pm:==

Of course you leave out that COGFA’s report notes that because of the flat structure of the Illinois income tax the state does not capture in the gains that come with a better economy like graduated income tax states.

COGFA:

“So while Illinois’ tax base is more stable than states with graduated tax structures, Illinois often does

not experience the level of increases that these other states experience. On the other hand, the falloff in

revenues from income taxes will typically be less severe in Illinois than those states with a graduated

tax structure.”

- Arizona Bob - Thursday, Jan 15, 15 @ 1:01 pm:

@Wordslinger, You’re missing my point entirely. State capitol decisions don’t CREATE most of the assets that draw business and economic growth (roads and airports are notable exceptions). Those assets, like workforce, natural resources, workforce, etc. are what attracts business. State and local governments primary power is to create OBSTACLES to growth by tax policy, environmental rules, red tape, and fiscal mismanagement that makes locating to a state a strong negative. That’s what Illinois has done.

Rauner doesn’t need giveaways to increase Illinois’ business attractiveness. He just needs to remove existing obstacles created by Springfield.

Godspeed him in that effort.

- anon - Thursday, Jan 15, 15 @ 1:09 pm:

It’s instructive that Republicans oppose the fairest tax, namely the income tax, and particularly a graduated tax based upon the ability to pay. When Republicans do support tax hikes, those are generally excise and sales taxes and fees, all of which are regressive.

Though conservatives can be counted on the stick up for the most affluent and oppose “soaking the rich,” I never hear an IL conservative rail against soaking the poor, which is what IL does.

- anon - Thursday, Jan 15, 15 @ 1:16 pm:

== Too bad the Democrats didn’t use their super-majorities to amend the Constitution to create a graduated income tax ==

There are conservative Democrats who oppose tax fairness too, so you can’t come up with a three-fifths majority in both houses when not a single Republican will vote to put the amendment on the ballot for voters to decide. When the Smith Amendment for a graduated income tax came up for a vote in 2007, there were about 52 Democrats in favor, with zero Republicans. There’s no question which party is more responsible for the shameful regressivity.

- anon - Thursday, Jan 15, 15 @ 1:19 pm:

== the wealthy pay more in sales tax ==

Not as a percent of income. If percent of income matters when the topic is a graduated income tax, then it ought to matter with regressive taxes too.

- anon - Thursday, Jan 15, 15 @ 1:28 pm:

== “As a percentage of income” betrays the logical flaw in this report…The key is that in gross amounts of taxes, the wealthy pay for more than do the unwealthy. ==

It’s true that the 1% pays several $million in taxes, while the poor pay several $hundred. But percentages matter to people who don’t have enough to eat or a place to live. After paying 13.2% of their incomes, the bottom 20% are dealing with survival, unlike the top 1%.

- Rich Miller - Thursday, Jan 15, 15 @ 1:29 pm:

===After paying 13.2% of their incomes, the bottom 20% are dealing with survival, unlike the top 1%.===

Exactly.

- anon - Thursday, Jan 15, 15 @ 1:31 pm:

Conservatives were not always in favor of regressive taxation. Even the Trib editors used to favor tax fairness. Here are two quotes from Trib editorials in the early 90s:

“A state income tax with modestly graduated rates would be a move toward tax fairness.”

–“The unspoken tax debate,” April 20, 1994

“The rich, because they are able to, should pay a relatively larger portion of their income in taxes.” - “What happened to ‘share the pain,’” Aug. 3, 1993

This shows how much more to the right the GOP has moved since 1993.

- Backwards - Thursday, Jan 15, 15 @ 1:31 pm:

‘After paying 13.2% of their incomes, the bottom 20% are dealing with survival, unlike the top 1%’

Which is why we should have lower taxes across the board.

- Wordslinger - Thursday, Jan 15, 15 @ 1:31 pm:

VMan, can you explain now percentages are subjective and not measurable?

- Rich Miller - Thursday, Jan 15, 15 @ 1:33 pm:

===. If percent of income matters when the topic is a graduated income tax, then it ought to matter with regressive taxes too===

I think you got ‘em there.

- VanillaMan - Thursday, Jan 15, 15 @ 3:24 pm:

After paying 13.2% of their incomes, the bottom 20% are dealing with survival, unlike the top 1%.

So, now we’re trying to say that the higher percentage is hindering the bottom 20% of surviving because the top 1% can?

Oh please.

- Anon. - Thursday, Jan 15, 15 @ 4:01 pm:

You have to take this kind of study with a huge grain of salt, because so much tax revenue comes from business activities and no one can really say which individual’s pocket those taxes are coming from. This includes sales taxes that are in theory collected from the purchaser, but whose imposition can force the seller to reduce the asking price to compete with alternative uses of the purchaser’s money, so that the seller really does pay some of the tax even though this study allocates all of the tax burden to the purchaser. With other taxes (such as taxes on corporations), the study allocates the “incidence” to individuals according to a methodology it doesn’t explain, but which I would happily bet contains a host of value judgments and unverifiable assumptions. Look at Texas — its bottom 20% pay 12.5% of their incomes in taxes, but 5.1% of that amount is allocated business taxes. Washington state comes in at 16.8% on the bottom tier, with 8.8% being allocated business taxes. Magic bean counting. I believe in progressive taxation, but wouldn’t use this study as a basis for any policy decisions.

- VanillaMan - Thursday, Jan 15, 15 @ 4:05 pm:

VMan, can you explain now percentages are subjective and not measurable?

As soon as you can explain the average income and tax for the 20%. If you can tell me that, then we both can know the objective numbers being discussed, the average amount of taxes, the percentage of those taxes and then figure out how much excess taxes those 20% are paying.

I have a hunch that we aren’t discussing a lot of “unfair” tax.

What percentage of the 20%’s income is derived from state aid? Is the excess “unfair” tax fair when considering the amount of average state aid to each citizen within the 20%?

We can’t know any of this because the entire report is based on a subjective definition of what is a “fair” tax, which assumes that it is not fair for citizens in the bottom 20% to pay a higher percentage of their annual income, compared to what a 1% citizen pays.

I have a hunch, since we don’t have any real numbers here, that the proposal is to save each citizen in the bottom 20% under $1000 a year in order to gain literally thousands of dollars more from other citizens. Yet those other citizens do not get thousands of dollars in state aid annually.

Yet, we are talking what is fair?

Just don’t.

Give us real numbers. Give us real arguments. Please don’t tell me children are unfairly starving or not surviving by telling me percentages.

Everyone really wants to help. I am not heartless. I’m just wondering how it is fair that some citizens are taxed at a higher percentage than others, because of their income. Every person, one vote. Every person, same tax rate. Why is that so unfair?

- Wordslinger - Thursday, Jan 15, 15 @ 4:09 pm:

– So now we’re trying to say that the higher percentage is hindering the bottom 20% of surviving because the top 1% can?–

Somebody’s trying to say something with that sentence, but I don’t know what.

- MrJM (@MisterJayEm) - Thursday, Jan 15, 15 @ 4:10 pm:

“I’m just wondering how it is fair that some citizens are taxed at a higher percentage than others, because of their income. Every person, one vote. Every person, same tax rate. Why is that so unfair?”

The unfair suffering of the very wealthy is almost too heartbreaking to bear…

– MrJM

- Backwards - Thursday, Jan 15, 15 @ 4:17 pm:

Anon 4:01

‘no one can really say which individual’s pocket those taxes are coming from’

As I have been organizing and paying taxes all day, it’s pretty clear that the business owner is on the hook to the State for Sales Tax and FICA, and withholding State and Federal Income tax.

The check goes from the business owner to the Government. No one would pay these ridiculous tax rates if everyone had to submit their own payment for sales tax, FICA etc.

- Wordslinger - Thursday, Jan 15, 15 @ 4:39 pm:

VMan, you don’t understand, but it’s pretty simple.

Sales taxes are regressive because they require a higher percentage of income from low income earners for the same basket of products and services that everyone needs to function.

- Wordslinger - Thursday, Jan 15, 15 @ 4:48 pm:

-As I’ve been organizing and paying taxes all day, it’s pretty clear that the business owner is on the hook to the State for Sales Tax and FICA…–

If you’ve been paying FICA to the state, you might want to get someone else to do your taxes.

- Enviro - Thursday, Jan 15, 15 @ 4:58 pm:

The fair tax goal should be shared and equal sacrifice by all, which will require a progressive state income tax and include retirement income.

- Federalist - Thursday, Jan 15, 15 @ 5:15 pm:

The following data is based upon Tax Returns filed by AGI for 2012. Total Tax provides for BASIC, 65+ and Blind exemptions but as far as I can tell does not include property tax or EIC.

Unfortunately, the data did not copy as a linear chart.

Report ID TDWR-IITEOY-018

But based upon AGI as defined above those making $500,0000 or above were .9% (less than 1%) of one percent and paid 24.66% of such taxes.

65+

BLIND

Net Income

Total Tax

Source: ILLINOIS DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX RETURNS FILED BY ADJUSTED GROSS INCOME - TAX YEAR: 2012 - FINAL

Source: Final 1040 IIT Return File Dated Aug. 2014

Exemptions

Property Tax

% of NI

Return

Amounts

Return

Amounts

Less than-$25,000

2,072,235

$19,909,857,772

3,004,664

406,695

5,933

$15,796,590,117

$786,950,393

5.00%

201,976

$26,806,575

644,991

$124,351,321

$25,001-$50,000

1,248,268

$45,319,030,536

2,525,676

238,596

3,030

$33,896,970,130

$1,693,387,428

5.00%

394,915

$63,799,979

247,944

$34,124,235

$50,001-$100,000

1,289,754

$92,380,073,380

2,940,579

313,443

3,562

$70,350,641,295

$3,516,020,503

5.00%

810,698

$165,439,156

249

$1,018

$100,001-$500,000

883,993

$147,315,953,167

2,483,278

218,486

1,984

$123,448,007,217

$6,170,767,570

5.00%

744,058

$252,880,613

0

$0

$500,001 OR MORE

50,954

$84,358,940,879

155,805

13,650

84

$79,681,036,362

$3,983,960,883

5.00%

45,631

$35,894,458

0

$0

Illinois Totals

5,545,204

$389,283,855,734

11,110,002

1,190,870

14,593

$323,173,245,122

$16,151,086,776

5.00%

2,197,278

$544,820,781

893,184

$158,476,574

Non-Illinois Totals*

475,552

$201,685,822,870

955,013

78,320

1,033

$24,187,434,802

$1,176,582,633

38,765

$11,618,059

44,219

$5,722,550

Totals

6,020,756

$590,969,678,604

12,065,015

1,269,190

15,626

$347,360,679,924

$17,327,669,409

5.00%

2,236,043

$556,438,840

937,403

$164,199,124

*Returns with Non-Illinois Zip Codes (Non-Residents) or Invalid Illinois Zip Codes

Report ID: TDWR-IITEOY-018

Data Source: 2012_FNL2014

Report Date: 8/7/2014 10:03:11 AM

- Backwards - Thursday, Jan 15, 15 @ 5:17 pm:

“shared and equal” in this case meaning arbitrary depending upon political influence. One of the saving graces of Illinois has been the tax rate is pretty much applied across the board. So political pandering has not been a big part of Illinois income tax favoring one group or another.

Is a silly discussion as Quinn was defeated for being so far off the political mainstream, that he couldn’t get this sort of things through even with a Democrat supermajority.

- Anonymous - Thursday, Jan 15, 15 @ 6:34 pm:

Flat vs. graduated tax. I wonder why the federal tax rate is graduated and I also wonder why so many states who have state income tax use the graduated tax rate if it’s so unfair. Those states aren’t the ones with financial problems like our state.

- Angry Chicagoan - Thursday, Jan 15, 15 @ 7:29 pm:

Illinois puts a completely unacceptable tax burden on the poor and a very stiff one on the middle class. It’s a problem. It drags our economy down. It’s not fair. Something should be done about it. And I’m glad to see Rich posting the new ITEP report here.

There are states out there that manage to roughly achieve a flat tax outcome — progressive income tax balanced by regressive sales and property taxes. California, Delaware, Montana come to mind. All are in far better shape than we are.

Now, due to constitutional limitations, there’s no easy fix. But perhaps we could start thinking constructively about rearranging taxes. End sales tax on groceries. Lower it somewhat on other goods. Introduce it on services. Increase the personal exemption on state income tax. Restore the five percent rate. That combination of changes would move us a ways out of the top ten list of regressive states. It would also produce a far more balanced tax system. Services have mushroomed from 40 percent of our retail base to 65 percent in the past four decades, yet we still don’t tax them; we put ever more taxes on an ever diminishing base of goods. Why?

With our financial troubles we also need to think innovatively. I’ve said before I believe reform will have to involve thinking not just about cuts and tax increases but about revenue and cash flow. For example, why the massive outsourcing of Illinois government services when those contractors could be on the state payroll, contributing to the pension system as Tier II, rather than leaving government saddled with a very high proportion of Tier I and a very narrow base of pension contributors?

- Backwards - Thursday, Jan 15, 15 @ 9:49 pm:

Nothing says “think innovatively” like raising taxes on people who have decided are your political opponents, and hiring more State Employees.

Granted this may have been innovative thinking around 1820 or so, but maybe the innovation cycle repeats itself every 200 years or so.

- anon - Friday, Jan 16, 15 @ 5:15 am:

== every person, same tax rate. ==

Our conservative friends only argue for an equal tax rate to oppose progressive taxation, but never to oppose the grim reality in this state of regressive taxation. If conservatives really believed in the principle of equal rates for all, they would apply it where it is most needed in Illinois, namely to lower the rate where it is the highest — on those with the least ability to pay.

It’s hard to understand why our Republican friends have so little sympathy for those who actually get soaked by taxes, reserving their sympathy for those with the most ability to pay.

- PublicServant - Friday, Jan 16, 15 @ 6:40 am:

It’s kind of hard to argue that the society one is a part of is not a determining factor in a person’s earnings. Otherwise, Judge Judy wouldn’t be making 25 million when Anton Scalia only makes 250 thousand. Progressive taxation apportions the financial needs (security, infrastructure, regulation of food, drugs, medicine and business, care of our elderly and indigent) of a society to those most able to pay, and to those who, because of their earnings, owe more to the maintenance of that society that has been contributory in enabling their financial success.

On the opposite end of the fairness scale, and actually detrimental to that society, is regressive taxation that results in a greater percentage of a person’s total compensation being taxed because those less financially fortunate people need to spend every penny they make just to survive. Sales and flat income taxes, assume the same worth to the economy from the first dollar made and an individual’s millionth dollar of the year, but those first dollars made are spent across the board. That spending is other’s income, who, in turn, spend it, thus the multiplier effect of spent money. Taxing a dollar that would otherwise be spent hurts the economy and society, more than taxing that millionth dollar would, since that person’s needs have long been met prior to its having been earned. For those reasons, progressive taxes are both better for the economy and better fulfill a person’s obligation to the society that has enabled them to make it.

Don’t believe me, look, for just one example, to that Republican nirvana to the north, as one of the vast majority of states that have progressive taxation.

- Backwards - Friday, Jan 16, 15 @ 7:46 am:

Anon 5:15 tells us

‘namely to lower the rate where it is the highest — on those with the least ability to pay.’

is somehow a conservative Republican idea.

Another noted conservative in 1875.

‘From each according to his ability, to each according to his need’

- Jack - Friday, Jan 16, 15 @ 10:43 am:

Bravo Public Servant…..BRAVO