Health care, taxes and voting trends

Thursday, Dec 4, 2008 - Posted by Rich Miller

* A new study will be released tomorrow on older uninsured people…

It finds that 13.3 percent of 50 to 64 year old Illinoisans — 287,084 adults — are uninsured. When adults in this age range who are officially poor are considered (an individual earning $10,400 or less a year, a couple earning $14,000 or less), 44 percent are found to lack health insurance (68,406 people).

And check this out…

The report breaks down data for Illinois by the legislative districts in the state. Senate district 13 has the highest number of uninsured 50 to 64 year olds, 8,706 residents, followed by district 17 with 8,482 and district 14 with 8,170.

Senate District 13 is President-elect Barack Obama’s former district.

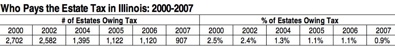

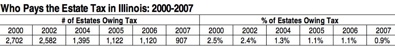

* Meanwhile, another new study shows that last year only 0.9 percent of estates owed federal estate taxes in Illinois. That ain’t much. The reason the study was released…

In 2009 the per-spouse exemption is scheduled to increase to $3.5 million and in 2010 the estate tax is scheduled to disappear altogether for one year. Advocates for tax fairness have called on Congress to act before 2010 to prevent the estate tax from disappearing. If the estate tax is allowed to disappear, they fear, Congress will find it more difficult to resist the lobbyists who will insist that repeal of the estate tax be made permanent.

President-elect Barack Obama has proposed to make permanent the estate tax rules that will be in effect in 2009 under current law, including the $3.5 million per-spouse exemption. This would be an improvement in the sense that it would prevent the estate tax from disappearing. But it would be a regressive and costly giveaway to the very wealthiest families in America, because it would mean that the tax would affect even fewer estates than it does now. […]

…family farms and other closely held businesses get additional breaks from the estate tax (in addition to the exemptions all estates get) including a provision that allows the tax to be paid off over a period of 14 years. The estate tax has always been confined to serving its actual purpose — reducing extreme concentration of wealth in the hands of a few super-wealthy families, and asking these families to contribute to the society that made their wealth possible.

Here’s the Illinois breakdown. Click the pic for a larger image…

* And it doesn’t appear as though the “wealthy” are gonna squawk much about higher taxes, at least that’s not how they voted this year. From The Hill…

Take a guess. Which demographic group doubled its share of the electorate from 2004 to 2008?

Here’s a hint. It’s the same segment that increased its support for the Democratic presidential candidate more than any other.

If you answered younger voters or Latinos, you would be wrong, though we will discuss both below.

Stumped?

Americans who make over $200,000 a year doubled their share of the electorate and, while John Kerry lost that group by 28 points, Barack Obama won them by six — a 34-point shift in the margin — the biggest movement recorded in the exit poll.

In fairness, while the wealthiest segment did double its share of the electorate, it increased from just 3 percent to 6 percent. However, those who make over $100,000 constituted 26 percent of the electorate in 2008, compared to 18 percent in 2004 — nearly a 50 percent increase. Obama tied with this quarter of the electorate; Kerry had lost it by 17 points.

* Related…

* Health insurance sticker shock hits consumers

* AARP’s stealth fees often sting seniors with costlier insurance

* Durbin Concerned Relief To Lenders Could Hurt Student Borrowers

- Rich Miller - Thursday, Dec 4, 08 @ 11:49 am:

C’mon, people, this post has everything: Wonkishness, Obama, taxes, “class warfare.” You’re supposed to be the best commenters in the bidness. Prove it.

- John Bambenek - Thursday, Dec 4, 08 @ 12:03 pm:

Can someone explain to me how a 3.5 mil exemption makes a tax “regressive”? I thought regressive meant that the poor have “too much of a share” in funding government. In this case, the poor and even middle class pay nothing… We are just haggling about the high end.

I don’t see how its a matter of fairness to take away peoples hard earned stuff simply because they died, 14 year payment plans or not. Would you send a condolenses card with an invoice inside?

- Six Degrees of Separation - Thursday, Dec 4, 08 @ 12:14 pm:

The theory behind the “inheritance tax” is that the heirs got something of value without having to work for it, so the least they could do is contribute a small portion of that worth back to society. The exemptions for farmsteads, etc. are meant to encourage continuity in agriculture ownership and operation, for obvious and longstanding principles that benefit the families who are involved in one of America’s few remaining export industries.

If an estate holder does not want the government to collect a tax from his/her heirs, they can always donate a big chunk to charity, in which case a contribution is also made to society.

That’s the theory in a nutshell, anyway.

W/R/T Obama’s proposed freezing the inheritance tax at 2009’s proposed rates, it seems to be a balancing act between keeping investment money in the private sector, keeping his newfound “wealthy constituency” happy, while being able to fund some of of his favored programs with the residual tax income from a rising tide. It almost sounds Republican when you think of it.

- John Bambenek - Thursday, Dec 4, 08 @ 12:27 pm:

Oh, I know the theory. Its inherently socialistic… “You didn’t really earn this money so we are going to take it”. You don’t “give back to society” by paying taxes… A gift is an act of the will. Further, you limit what giving back means… What about starting a business with that money? Bankrolling innovation maybe? Heck, contributing to reform-minded candidate for political office in a thoroughly corrupt and dysfunctional state like… Well, Illinois?

I don’t see the justification of tax collectors as grave robbers.

- Six Degrees of Separation - Thursday, Dec 4, 08 @ 12:33 pm:

Or the heirs could act like stereotypical trust fund babies and spend their idle lives blowing their money on parties, travel and toys. Either way, they are pumping money back into the economy, so the conservative argument holds water, too.

- wordslinger - Thursday, Dec 4, 08 @ 1:04 pm:

200 grand ain’t what it used to be.

–The estate tax has always been confined to serving its actual purpose — reducing extreme concentration of wealth in the hands of a few super-wealthy families, and asking these families to contribute to the society that made their wealth possible.–

How’s that working out? There will always be a way to beat the system if you have the dough.

- Rich Miller - Thursday, Dec 4, 08 @ 1:07 pm:

wordslinger, your argument, at its very core, is an argument against laws themselves. Since people will break laws or find ways around them, they’re useless.

- Cassandra - Thursday, Dec 4, 08 @ 1:09 pm:

Ive been saying for some time that I don’t believe a progressive income tax which falls with significantly more heft on the wealthy (by wealthy, I’ll use Obama’s and Hillary’s numbers during the campaign–over $250,000)is going to be resisted mightily by this group.

It’s the people who believe that some day they will be wealthy who are probably the nay-sayers on this issue. Of course, statistically, one’s chances of reaching that salary amount in the future (adjusted for inflation, of course), is rather small, given the current distribution of income in the US.

And there are other issues as well. A high-earner with no pension who has to fund his or her health

care is in a totally different financial situation than a high-earner with low-deductible employee health care and a defined benefit pension.

In any case, if we are going to be rescued by the income tax, our wealthier fellow citizens are going to have to cough up. We members of the middle class can’t afford higher taxes at this point in time–federal or state. Obama seems to see this and speaks often of middle class federal tax cuts but our local, greedy Democratic pols (not Blago, I hasten to add) and their cronies and liberal pals continue to advocate for soaking the middle class as well as the well-off. They just can’t pass up the chance to grab up any extra money we may have destined for our 401k’s or our out of pocket medical expenses our our kids’ college education.

- wordslinger - Thursday, Dec 4, 08 @ 1:14 pm:

Rich, I don’t think so. I think history has shown over and over again that if you have a lot of cash, you can get around things. Not everything, but more than the average schnook. That’s just like the sun coming up in the east.

The rich, they’re different than you and I.

- Rich Miller - Thursday, Dec 4, 08 @ 1:26 pm:

So, therefore we shouldn’t even bother passing laws that impact the rich? I still don’t get your logic.

- Boscobud - Thursday, Dec 4, 08 @ 1:29 pm:

Rich,

Your right people get around the laws and the people who obey the laws and rules get slammed by the people who don’t.

- wordslinger - Thursday, Dec 4, 08 @ 1:35 pm:

Rich, no. You do the best you can.

- Estate Tax Maven - Thursday, Dec 4, 08 @ 2:18 pm:

The reason for the percentage going below 2% from 2002 to 2004 is that the estate tax exemption has been steadily rising from $1 million to $3.5 million since Bush’s 2001 Tax Act. But more importantly to the states, the 2001 Tax Act, phased out more quickly (2 to 4 years I believe) the state death tax credit. It was a form of revenue sharing with the states. That is now gone. Before, the 55% rate would be shared between the feds who would get the bulk and the state where the person died, who would get up to maximum of 12% of the 55%. The statistics I heard in 2001 was that Illinois would lose out on $400 million a year when the phase out of the state death tax credit was complete. Therefore, shortly after, Illinois “decoupled” from the federal system and passed its own stand-alone estate tax with an exemption capped at $2 million. So next year for the first time, Illinois residents dying in 2009 will have a $3.5 million federal exemption but only a $2 million Illinois exemption. Also, the Illinois Attorney General enforces the estate tax in Illinois, NOT the Illinois Department of Revenue, go figure. I don’t know if they have the staff to enforce the compliance of those estates between the two exemptions; another benefit of the state death tax credit system was that the states could piggypack on the IRS audit system.

- Estate Tax Maven - Thursday, Dec 4, 08 @ 2:36 pm:

I remembered why the AG enforces it; the Illinois estate tax predates the creation of the Illinois Department of Revenue.