* Not exactly great news, but it’s still better than the alternative…

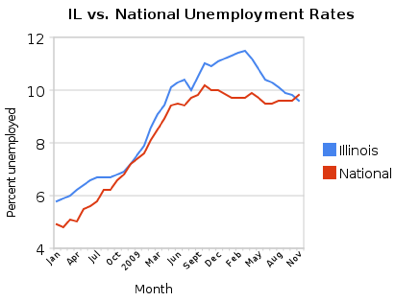

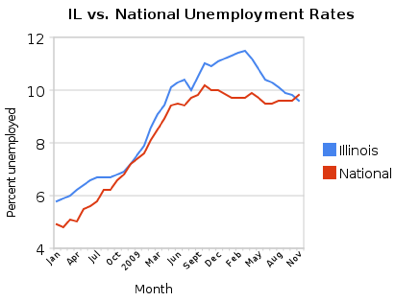

The unemployment rate in Illinois fell to 9.6 percent in November from 9.8 percent in October, the eighth straight decline, the Illinois Department of Employment Security said today. But the state lost 2,600 jobs.

The jobless rate is down from 10.9 percent in November 2009 and fell below the national rate for the first time since January 2007. The national rate is 9.8 percent. […]

The biggest job gains over the year were in professional and business services, up 15,400; educational and health services, up 13,900; and trade , transportation and utilities, up 10,100.

The biggest job declines over the year were in construction, down 7,800; financial activities, down 5,300; and leisure and hospitality, down 3,800.

* Progress Illinois’ chart shows that the state’s rate is now below the national average, which is kinda good news, of sorts…

* And the foreclosure rate dropped as well, but we’re still in a heap of trouble here…

The number of foreclosures in Illinois fell by 24 percent from October to November. A report from Realty-Trac shows 12,941 people filed for foreclosures in November. The number includes default notices, auction sale notices, and bank repossessions.

The rate is 21 percent lower than November of 2009. But it’s still an ominously high number; Illinois ranks 9th in the nation in foreclosures.

* Meanwhile, the Illinois Policy Institute takes a different look at tax burden rankings, which traditionally rate Illinois as a low-tax state. The per capita ranking is far higher…

Illinois’s state and local tax burden per capita ranked 14th-highest in 2008, at $4,346. The “tax burden” measure focuses on the total amount residents pay in state and local taxes, as opposed to how much money state and local governments collect. As citizens will pay taxes to bodies both within and outside of their state of residency, this measurement provides a better understanding of which states’ residents are most burdened by state and local taxes by tallying tax payments in taxpayers’ home states.

All neighboring states, including Wisconsin, Iowa, Missouri, Kentucky, and Indiana, had lower per-capita tax burdens than Illinois in 2008.

The usual way of measuring is tax revenues as a percentage of personal income. This is why IPI claims that measurement skews the results…

…it’s important to note that income levels can skew rankings. High-income states will show lower collections as a percentage of income than low-income states even if the actual tax bill is exactly the same.

Consider Illinois and Indiana. Looking at state revenue collections per capita, Illinois and Indiana are ranked 27th and 26th, respectively. Illinois collected $2,267 per person in 2009, while next-door Indiana collected $2,320 per person—just $53 more. Yet in the measurement of state tax revenues as a percentage of personal income, Indiana ranked twenty slots higher (17th highest) than Illinois (37th highest). This is largely attributable to income levels: Illinois ranks 13th highest for per capita income, at $46,693, while Indiana ranks 40th highest, at $37,279. Illinois is a higher-income state than Indiana. Chicago’s status as a world financial center drives up income figures, and this in turn affects the rankings.

Thoughts?

- Anonymous - Friday, Dec 17, 10 @ 6:08 am:

Comparing these data between states is a meaningful exercise, to the extent that the data may serve as ONE indicator for measuring Illinois’ relative status or rank. The problem with this (like any other study or survey) is that some in the legislature will seize the numbers as all-telling, and essentially say that state A and state B are “better than Illinois”, as doing so may serve their particular political agenda. That’s when we start seeing the hyper-reactive proposals…

- ok - Friday, Dec 17, 10 @ 7:57 am:

Per capita tax rate means nothing. As far as I can tell, children are only paying taxes at the candy store…

- Louis G. Atsaves - Friday, Dec 17, 10 @ 7:59 am:

Unemployment drops ever so slightly last month but in the meantime Illinois lost 2,600 jobs?

What or who isn’t being counted?

How many jobs has the state lost since November 2009 so we can make a better comparison?

- Small Town Liberal - Friday, Dec 17, 10 @ 8:35 am:

So according to the IPI, if I make more money than someone else, but we each pay about the same total amount in taxes, our burden is equal?

- dave - Friday, Dec 17, 10 @ 8:49 am:

IPI really is a joke. Every analysis they do is so incredibly flawed.

As “ok” stated - using per capita income is a joke. Basically what IPI is saying, without acknowledging it, is that IL does have a low tax burden, but that it is disproportionately shared by the low- and middle-classes, which is they they per cap tax burden is higher than the % of total income.

Higher income states SHOULD have a higher per capita tax burden than lower income states.

- Linus - Friday, Dec 17, 10 @ 8:49 am:

Yeah, not a big fan of IPI’s way of measuring tax burden here. As discussed above, it removes the real-life, real-world context of household earnings that are included in percentage-of-income measures. And it seems important to keep in mind the relative income of each state’s residents, instead of abandoning that important part of the overall story.

- Cincinnatus - Friday, Dec 17, 10 @ 9:13 am:

Louis G. Atsaves,

Traditionally, the unemployment rate is calculated using the number of people actively seeking employment. In your example, it is possible that the number of people seeking employment dropped by some number, let’s say 5000. this would then show a net decrease in the unemployment rate since less people are looking for work, and it is possible that total jobs have decreased while the rate also decreases since the discouraged workers are leaving the workforce faster than the number of jobs is decreasing.

And this minor detail is something few consider. Expect unemployment rate to spike higher as the economy improves and employers begin hiring. Discouraged workers will enter the job market, and begin to be totaled as part of the unemployed where before they were off the map.

I am most familiar with national numbers, but the reported weekly national new unemployment claims must be around 325,00 before the economy is adding jobs (this week was around 425k, the 325k number accounts for normal movement in the job market). With anything greater than 325k, the job picture is stagnant or shedding jobs.

Another good indicator is the number of new jobs added. The past couple of months, the number has been around 30k, and may drop due to the removal of seasonal hiring requirements (we should probably expect an uptick in unemployment claims for the same reason). In order to the unemployment rate down to pre-recession levels by 2016, we need 250k added jobs per month.

- Emanuel Collective - Friday, Dec 17, 10 @ 9:16 am:

A per capita tax rate just muddies up IPI’s data-again, kids aren’t paying taxes- and if they wanted to show that Illinois was a high tax state, they just should have studied middle class earners.

While we have a very low income tax rate, our property and sales taxes are through the roof. Illinois is only a low tax state for buisnesses and the wealthy.

- zatoichi - Friday, Dec 17, 10 @ 9:21 am:

The tax burden issue is classic on how to use stats to make your point. The IPI approach works, so does simple revenue collection per person, so does total tax as a ratio of total salary, so does any number of other approaches as are regularly discussed here. Which is right? I gotta guess it depends on your political leaning. Feel taxes impede growth? Any method that shows current taxes are too high is right for you. Feel taxes serve a good purpose for everyone? Then the low burden studies are what you want. Overall costs never stop growing even if you do not want to pay for them. No matter how you cut it, at some point if revenue does not continually expand (by whatever means), costs catch up and some tough decisions are needed. Illinois is pretty deep into the cost exceeding revenue equation. Look at all the tax burden studies you want. At some point the GA has to really act.

- dave - Friday, Dec 17, 10 @ 9:25 am:

**Illinois is pretty deep into the cost exceeding revenue equation. Look at all the tax burden studies you want. At some point the GA has to really act.**

Agreed… but it is important to also point out that IL also has one of the lowest spending levels in the country. IL doesn’t have a spending problem.

- muon - Friday, Dec 17, 10 @ 9:26 am:

As ok noted per capita rates have problems. The feds often use totals or rates per household for that reason. It would make sense for Illinois to do the same.

The other problem is that both total and per capita measures quote the median value. If the distribution of incomes were shaped like a bell curve that would work pretty well. Of course the incomes are not symmetrical, so a better measure is to quote the median in each of five quintiles. That is what is the median tax paid by those in the bottom 20%, the next 20% up, and so on up to the top 20%. That would help answer the questions about the relative fairness of a system.

- Cincinnatus - Friday, Dec 17, 10 @ 9:31 am:

I am always amazed at how the GA is incapable of planning its fiscal picture. Oftentimes, a recession (or boom) comes on too quickly to change a budget. I understand when a government runs a very short term deficit. But here in Illinois, we are on year 3 of depressed government revenues, and only a half-hearted attempt to reign in the profligate spending to more closely align it with incoming revenues (which are always over projected) has taken place.

And I’m not too sure what’s worse, lean times, or boom times. During the boom times, government expands at a prodigious rate, one that cannot be sustained in future recessions.

Nate Silver (538 Blog) had an interesting article a while back showing how you cannot use your gut when projecting outcomes. I’m not too sure this is a universal law. Right now my gut says we’d better reduce government in a HUGE way, special interests be damned, or Illinois will not be positioned to take advantage of the upcoming recovery. I think we will see marginal efforts, and the recovery will get Illinois to a break even point in a couple of years. Everyone will run around claiming victory. But Illinois will still have endemic financial difficulties from which we may not recover the next time the economy goes south.

- Statewide - Friday, Dec 17, 10 @ 9:44 am:

The IPI per-capita tax burden (il)logic is so D.O.A. it barely deserves response. So IPI thinks it would be better to live in Indiana with a lower salary level, lower state GDP, and lower standard of living in order to pay lower percentage taxes, even though they would end up with less money, just to feel better about their anti-tax principles? It’s like saying they wouldn’t want to vacation on the beach in Cancun in January because they might get a sunburn. This is the same GOP hate-taxes-on-principle thinking that says the nation’s mega-millionaires and billionaires deserve another tax break even if it dents the national deficit another trillion.

- Cincinnatus - Friday, Dec 17, 10 @ 9:44 am:

- dave - Friday, Dec 17, 10 @ 9:25 am:

“IL doesn’t have a spending problem.”

Yoikes!

Assumption 1: It ain’t the government’s money to begin with.

Assumption 2: Illinois voters support the current tax structure (no matter how hosed it is, if they wanted something different, we’d have it).

The Illinois government is running a deficit. The Illinois voters have only given the government permission to take a certain amount of its money. This amount defines the amount of programs the citizens are willing to support. If the government is exceeding the amount of money given to it by its citizens, it is spending too much money, and we indeed DO have a spending problem.

There is a constitutional amendment requiring a balanced budget (Lisa Madigan, when will the prosecutions begin?). A responsible government would balance the budget NO MATTER WHO IS HARMED. That is the role of government, who is required to work under the parameters set by the citizenry.

What we have here is both a spending problem, and a political leadership problem. These chuckleheads in Springfield are/have/will always be a failure.

Deficit? You need less spending or more revenue.

Less spending is straightforward (though politically difficult) to do. Increasing revenue has more options; new streams, higher taxes (which can be argued to inhibit higher revenues, the more you tax something, the less of it you get), or a more efficient environment that promotes the growth of wealth.

These questions are far too difficult for the current crop of “leaders” to handle, at least if we use the past few years as a baseline.

- dave - Friday, Dec 17, 10 @ 9:49 am:

**Right now my gut says we’d better reduce government in a HUGE way, special interests be damned, or Illinois will not be positioned to take advantage of the upcoming recovery. **

Illinois already HAS reduced government significantly. Again, IL has one of the lowest spending levels in the country. It is 49th or 50th in state worker/per cap.

** A responsible government would balance the budget NO MATTER WHO IS HARMED.**

That sounds quite IRresponsible to me. Seriously? No matter who is harmed? Wow.

**What we have here is both a spending problem, and a political leadership problem.**

I agree with the second, but again, the facts simply don’t align with the first assertion.

We have a low-revenue, low-spending state, and we still have deficit. In turn, what makes sense it to increase revenue.

- Commonsense in Illinois - Friday, Dec 17, 10 @ 9:50 am:

@Louis G. Atsaves - “How many jobs has the state lost since November 2009 so we can make a better comparison?”

If you look only at November 09 to November 10, the state has added 32,900 to total non-farm employment. However, if you look at November 2006 as a comparison point prior to the recession, Illinois has 367,500 fewer employed in non-farm. Here’s the raw numbers from IDES:

Nov.06 - 5,947,500

Nov.09 - 5,580,000

Nov.10 - 5,612,900

- dave - Friday, Dec 17, 10 @ 9:51 am:

**The Illinois voters have only given the government permission to take a certain amount of its money.**

I must have missed that question on the ballot.

Illinois voters have not only given permission to take a certain amount of money. Illinois voters have given permission (through voting for them) to the current elected officials to tax and spend as they see fit to meet the needs of the state.

- Statewide - Friday, Dec 17, 10 @ 10:05 am:

Cincinnatus: “A responsible government would balance the budget NO MATTER WHO IS HARMED.”

Wow, you and Ebenezer Scrooge must have really had a fine talk at dinner last night.

And a Merry Christmas to you, too!

- Small Town Liberal - Friday, Dec 17, 10 @ 10:07 am:

- Lisa Madigan, when will the prosecutions begin? -

Maybe if you took a break from generating random right wing talking points you could do a little research (or ask Rich) about how the balanced budget clause isn’t as cut and dried as you desperately want it to be.

- Cincinnatus - Friday, Dec 17, 10 @ 10:10 am:

-dave,

You are correct, but so am I. The voters give their permission though elections. If more spending and taxes were supported, voters would vote in tax and spenders. Since politicians aren’t running on more taxing and more spending, there must be a reason because one of the few, of only, talents a politician has is reading his electorate. A politician who is a leader will teach his electorate based on his superior access to knowledge and his ability to sway the electorate. I’m looking for these individuals, and it’s almost making me go blind from the strain.

- wordslinger - Friday, Dec 17, 10 @ 10:12 am:

–And I’m not too sure what’s worse, lean times, or boom times. During the boom times, government expands at a prodigious rate, one that cannot be sustained in future recessions.–

The exception would be the Clinton years, when debt was paid down. The 30-year T-bond market actually was out of business for a while. Not lately.

- Small Town Liberal - Friday, Dec 17, 10 @ 10:13 am:

Cincinnatus - Pat Quinn ran on a tax increase, you’re saying he has a mandate?

- the Other Anonymous - Friday, Dec 17, 10 @ 10:13 am:

Another problem with the IPI method is that it implicitly invites the comparison between tax burdens in high income/high cost states with the tax burden in low income/low cost states. Illinois, New York, and California, for examples, have high incomes; but the costs of providing services in those states is higher than Indiana, Wisconsin, or Kentucky for examples. As a result, one would expect the per capita tax burden for the same amount of government services to be higher in IL, NY, or CA.

- wordslinger - Friday, Dec 17, 10 @ 10:14 am:

Unfortunately, from what I’ve been reading, the foreclosure drop is a glitch, due to the moratorium that was imposed when it became clear many (bailed-out) banks were just rubber-stamping the suits. Next year is supposed to be worse.

- Cincinnatus - Friday, Dec 17, 10 @ 10:14 am:

- Small Town Liberal - Friday, Dec 17, 10 @ 10:07 am:

- Lisa Madigan, when will the prosecutions begin? -

“Maybe if you took a break from generating random right wing talking points you could do a little research (or ask Rich) about how the balanced budget clause isn’t as cut and dried as you desperately want it to be.”

And perhaps if liberals would take advantage of their complete lock on state government, they’d fix the amendment, or eliminate it as the toothless pile of words it must be. Another choice may be just to comply with the letter and intent of the amendment, but that may interrupt their stranglehold on this state.

- Cincinnatus - Friday, Dec 17, 10 @ 10:21 am:

wordslinger,

Split government worked pretty well during Clinton. I’ve said this for years, and couldn’t agree with you more (although the dotcom bubble influenced the growth during Clinton, and when it burst, the 2000 recession). Look also to the Coolidge years which is the last time an actual reduction of the size of government occurred and set off the Roarin’ 20’s.

STL,

Mandate, no. Ability to do so, yes. Should he? I think that a tax increase will do more harm than good (c.f. Bush tax cut extension. Democrats must agree since it had more Democrat support than Republican) Will he? let’s see…

- piling on - Friday, Dec 17, 10 @ 10:26 am:

liberals have a lock on state government?

Democrats maybe. Liberals, no. Madigan’s downstate members, by and large, are far more conservative than Cross’ suburban members.

Stereotypes are a disservice.

- Statewide - Friday, Dec 17, 10 @ 10:27 am:

-Cincinnatus: “The voters give their permission though elections. If more spending and taxes were supported, voters would vote in tax and spenders.”

Gee, thanks for clearing that up for us! As Small Town Liberal pointed out, Gov. Pat Quinn ran on a tax increase. Also, the Senate already supported a tax increase and the Dems maintained control there. The Dems also maintained control in the House and their Leader Mike Madigan is leaning toward supporting a (negotiated) tax increase of some kind. So I think you should now clearly know the will of the public regarding your issue. Thanks for joining the discussion.

- Rambler - Friday, Dec 17, 10 @ 10:29 am:

According to the US Statistical Abstract — available at www.census.gov — the tax rate as a percentage of income for the working poor in Chicago (13.6%) is above the national average, while the burden on the rich (6.4% — lower if you’re very rich) is well below average.

This is largely because of high sales taxes in Chicago and the state’s flat income tax. Most states have a graduated income tax which evens out the tax burden as a percentage of income.

- Rambler - Friday, Dec 17, 10 @ 10:37 am:

I should have clarified that those percentages are the combined state and local tax burdens.

- anon - Friday, Dec 17, 10 @ 10:46 am:

After all of the deductions and credits the effective state income tax rate for most taxpayers in Illinois is somewhere in the neighborhood of 2.0%. You can see what low state income tax rates have gotten the state–no job growth and a two tiered educational system that results in a $10,000 spread in per pupil spending depending on how much income you make.

- Yellow Dog Democrat - Friday, Dec 17, 10 @ 10:58 am:

Illinoisans paid an average of $4,346 in state and local taxes last year…a completely irrelevant number. You can’t talk about tax burden in a vacuum — what people pay in taxes is COMPLETELY relative to what they make…a $4,346 tax burden is very different for someone making $20K a year than someone making $200K a year.

Not surprising though coming from the IPI Institute, which believes we should roll back the minimum wage and taxpayers should provide vouchers for millionaires to send their kids to private schools.

Their trying to skew the study because the data doesn’t fit the conclusions they’d like to draw.

The research ranking Illinois among the most taxpayer-friendly in to overall tax burden comes from The Tax Foundation, a well respected, non-partisan research group founded over 70 years ago.

- Yellow Dog Democrat - Friday, Dec 17, 10 @ 11:06 am:

Not only is Illinois unemployment rate below the national average, but we rank 5th in the country in new plant openings, according to Site Selection Magazine.

The mountain of empirical evidence contradicting the Chamber of Commerce’s arguments that Illinois is a bad place to do business continues to grow.

DESPITE the fact that the Chamber continues to spend considerable time, energy, and money convincing employers not to come here.

It would be nice for a change if the Chamber would find something nice to say about Illinois in 2011. Not too mention in their best interest, since growing Illinois economy reduces their tax burden and creates more customers, not too mention a revenue stream to pay for all of the tax breaks and benefits they enjoy.

- Plutocrat03 - Friday, Dec 17, 10 @ 11:09 am:

I see we are peddling the fiction that Illinois has a very low nember of employees based on the size of the population. It is simply anothe case of lying with statistics. Its actually quite clever.

Illinois has 6994 local taxing bodies. Each entity has its own tax and has its employees. This number far outstrips any othe state in the Union. Much of the work done in Illinois is done by separate taxing bodies which are part and parcel of a normal State structure in other states. Hence while the State may have few employees, there are more people doing work under the control of the nearly 7000 taxing bodies.

- George - Friday, Dec 17, 10 @ 11:27 am:

Responsible to whom?

- dave - Friday, Dec 17, 10 @ 11:29 am:

**Illinois has 6994 local taxing bodies. Each entity has its own tax and has its employees. This number far outstrips any othe state in the Union. **

Sure… but this has little/nothing to do with the State budget, which is what we are referring to.

- George - Friday, Dec 17, 10 @ 11:31 am:

Plutocrat03 - you can blame the republicans for fighting to preserve their township patronage troughs for that…

- Leroy - Friday, Dec 17, 10 @ 11:41 am:

Yellow Dog -

I desperately want to live in your Illinois.

- steve schnorf - Friday, Dec 17, 10 @ 11:42 am:

Here my fiscal conservatism shows thru big time. IF our leaders consistently refuse to raise revenues, then they MUST cut spending more significantly than they would otherwise need to, even though people will be hurt. They should never be allowed the option of doing neither over any extended period of time.

Cincinnatus, this most recent period of declining revenue bothers me less than the last one. Quinn is cutting spending (perhaps not enough yet) this time. Last time our new Governor never noticed the recession, and just kept blasting spending higher. That hurt more, and we are still recovering from it.

- Statewide - Friday, Dec 17, 10 @ 12:02 pm:

My own quick back-of-the-envelope look at other states’ 2010 income tax rates for the 40 states that tax income (not including IL, DC, or the states which tax only dividends/interest), shows an average top-end state income tax rate of 6.77% (includes both flat-rates and progressive rates). So for those trickle-down theory GOPer’s who are so concerned about the rich folks’ taxes, Illinois looks like a very good place to be wealthy. This is especially true for a high population state with a high standard of living and large capital needs. While we need to switch to a progressive income tax structure here, Illinois could responsibly raise our flat income tax rate and still be below the average high-end tax-rate of the other states noted.

And most importantly, I myself have never had a desire to live in any of the states which have no state income tax anyway.

- Cincinnatus - Friday, Dec 17, 10 @ 12:34 pm:

steve schnorf,

It would appear that there has not been any significant effort by past administrations (Democrats and Republicans alike) and legislatures (ibid) to restrain the growth of government, and certainly no restraint by Rod and his GA.

As the resident economic historian, is the previous profligate spending the result of the expansion of existing programs, the creation of new ones, assuming responsibilities of other government entities (Federal or local), or capital improvements? Can you provide a SWAG at the breakdown among those categories?

Statewide,

Looking only at income tax is deceptive, as the study points out and some of the commenter have said, too. Total tax burden including all levels of taxing authority is the only way to look at things, and your comparison between income tax and trickle down economics would be better made if you included total tax burden.

- Statewide - Friday, Dec 17, 10 @ 12:45 pm:

Cincinnatus, re: total tax burden,

Yellow Dog Democrat already stated it above: “…research ranking Illinois among the most taxpayer-friendly in …overall tax burden comes from The Tax Foundation, a well respected, non-partisan research group founded over 70 years ago.”

- steve schnorf - Friday, Dec 17, 10 @ 1:51 pm:

I think, IPI’s comments notwithstanding, any measure of tax “burden” has to consider ability to pay that burden out of discretionary income, otherwise it’s still taxes but not much of a bureden. By that measure, Illinois total state and local tax burden is very high for people in the lower quartile income wise, somewhere around average for people in the middle 50% (high average to low average), and very low for people in the upper quartile. I just don’t think the actual numbers make that disputable.

C, as to your questions, I don’t think that a lot of new services have been offered by the state in the past 30 or 40 years or so (some will probably dispute this). There have been very substantial expansions in existing services, both in terms of scope and of eligibility. Examples would include such things as community alternatives for the mentally ill and developmentally disabled, adoption services for abused children, home services for the elderly, prison beds for the criminals, AllKids/Family Care, and so forth.

Our outstanding debt for capital programs, both as a per capita number and debt service as a percentage of total state GDP, has grown, but the last time I checked it still wasn’t out the roof high.

- Greg - Friday, Dec 17, 10 @ 2:00 pm:

Kristina is making a point we’ve long made regarding using only taxes as a percentage of personal income. It hides the total amount of taxes paid. It’s good for some measurements but not others and it isn’t the only measurement as some would have us believe. And Kristina does say it’s a valid comparison.

Illinois is moderate to highly taxed comparatively –more so on the moderate side but that isn’t saying all that much. When we use rankings we have tendency to argue there is a big difference to… say a state ranking 15th and a state ranking 30th. There may not be because states are going to bunch toward the mean. Small changes can lead to big jumps in ranking a small n of 50.

- jake - Friday, Dec 17, 10 @ 3:16 pm:

Illinois is a low tax state for high income individuals (top 1% in income pay 6% of their income in state and local taxes)and a high tax state for low income individuals. (bottom 20% in income pay 13% of their income in state and local taxes). Check out

http://www.fairtaxillinois.org/tax-fairness-facts/

for links to more numbers and analysis.