|

*** UPDATED x3 *** Don’t freak out just yet

Thursday, Jun 9, 2011 - Posted by Rich Miller *** UPDATE 3 *** Gov. Quinn talked to the media this afternoon about CME. Quinn said CME Executive Chairman Terry Duffy was a “good friend,” adding the two have had dinner together. “We’ll have an ongoing conversation and dialogue,” Quinn said. The governor was asked if he now thought the corporate tax hike was a bad idea. “No, not at all,” he replied. Quinn once again called the income tax hike “temporary” to pay off the bills, provide good schools, etc. Was he worried about a corporate shakedown? “We don’t believe in that kind of approach to life,” he said. “I don’t think that anybody likes paying taxes,” the governor said “but that’s the price of democracy.” Audio… *** UPDATE 2 *** I must’ve missed this…

New York? Way high state and local taxes. Same for New Jersey and Indiana. Texas? Have fun with the gross receipts tax. *** UPDATE 1 *** Mayor Rahm Emanuel said today that he’s talked with top CME officials and is “confident” the business will stay in Chicago…

* You would think that with the big and, as it turns out, almost totally fake uproar about Caterpillar leaving Illinois after the state raised its income tax rates that reporters might be a bit more circumspect the next time a corporate titan hinted at longing for greener pastures. You’d be wrong…

The above story claims that Chief Financial Officer James Parisi said the tax hike will cost CME an extra $50 million a year. A CME spokesman said today that Parisi’s statement was accurate. * But this is also important. Duffy said at the meeting that CME would not be abandoning Chicago…

So, the traders can calm down now. They won’t have to move to Alabama or some similarly awful place. * Duffy also added this…

That’s a good point. * Chairman Duffy did not mention the state tax situation during his remarks. The state tax hike was also not mentioned in anybody’s multi-media presentation. When Duffy talked about the problem with his stock’s subpar performance, the executive chairman identified only two factors. “A major overhang,” Duffy said during his prepared remarks, has been the “uncertainty” of federal regulations. The other problem, he said was the company’s “continued focus on new investments for future growth.” * I called CME this morning to ask for a further clarification of Duffy’s comments about Illinois’ tax hike. I was told a further clarification wouldn’t be possible and was referred back to his quotes. I asked whether there was already a plan or at least a process in place to look for another CME headquarters site. I was told that the spokesperson couldn’t comment further. The Q&A video with shareholders isn’t online, so I couldn’t find the complete context of Chairman Duffy’s comments. * Former US House Speaker Denny Hastert was elected to the board of directors at yesterday’s shareholder event, but he’s in meetings all day today and I couldn’t reach him to ask whether he would fight to keep the company in his home state. * The company has other problems as well…

* But it’s not exactly a pauper…

|

- Cassiopeia - Thursday, Jun 9, 11 @ 12:35 pm:

The Wall Street Journal had a lead editorial about how the business community has been playing Quinn and DCEO for suckers since they will promise all sorts of tax breaks for anyone who makes noise about leaving. While DCCA has always been big on incentives when directors Lavin and now Ribley changed its name to DCEO they dramatically expanded the give aways. The Wall Street Journal says they also began showing more favortism as well.

- Dwight - Thursday, Jun 9, 11 @ 12:42 pm:

I gotta tell you Rich. You really come across as such an apologist for higher taxes. Always defending. Forever lessening the effects.

- Rich Miller - Thursday, Jun 9, 11 @ 12:52 pm:

Dwight, I’m terribly sorry if you’re disappointed that the state may not be in as much serious trouble as you’d hoped.

- Precinct Captain - Thursday, Jun 9, 11 @ 12:57 pm:

Dwight, Rich is simply pointing out how the rest of the media in the state frame idiotic and often false narratives based on information fed by a few sources. He’s not apologizing for higher taxes. You do know that he has to pay them don’t you? Plus, Rich, as a resident of Illinois, has a vested interest in the state doing well and I’ve never seen Rich be biased on this site for anything except the major league baseball franchise at 35th & Shields.

- CircularFiringSquad - Thursday, Jun 9, 11 @ 1:01 pm:

CME and all the other American exchanges are under pressure because all of the response to their combined, coordinated masterpiece called the Bush Wall Street Housing Disaster suggests some oversight that is making them gag — pardon the pun.

NYSE is being bought by “Germans” NASDAQ out to buy something or be bought. They really want to be off shore and away from the icky regulators.

Perhaps CME can structure a state holdup while they are waiting.

Meanwhile the CME honchos will take the 5:15 express to Lake Forest and get yelled at about moving.

Wanna bet Duffy gots reamed by cohorts for not waiting to start his hustle until the families were at the lake?

- 32nd Ward Roscoe Village - Thursday, Jun 9, 11 @ 1:12 pm:

See WSJ opinion piece related to this:

http://online.wsj.com/article/SB10001424052702304474804576370102955207570.html?KEYWORDS=Illinois+Quinn

- Yellow Dog Democrat - Thursday, Jun 9, 11 @ 1:13 pm:

When President Cullerton suggested closing corporate tax loopholes and expanding the state sales tax to lower the overall corporate income tax and sales tax rates, he was roundly criticized by the political punditry.

Sounds like Cullerton might have been on to something after all.

Eliminating all corporate tax loopholes would save $1.4 billion and allow the state to lower the corporate income tax rate around 2 percentage points, according to my back-of-the-envelope calculations.

That would make not only CME, but a bunch of small business owners, very happy.

- Michelle Flaherty - Thursday, Jun 9, 11 @ 1:22 pm:

Dwight, gotta tell you, you really come off as a tool of the corporate elite.

- Sue - Thursday, Jun 9, 11 @ 1:32 pm:

It was reported on WBBM this morning that Quinn’s corporate tax increase will at best generate 300 million a year in additional revenue -unfortunately our fearless leader has already spent 240 million since January in corporate give-aways to convince companies not to flee the state- both numbers were reported on the radio today- Quinn is a disaster and there is no reason defending him

- Been There - Thursday, Jun 9, 11 @ 1:43 pm:

I saw Duffy speak at an event about 6 months ago. He said the same thing then and it made some local news so this is not new talk. As much as I like Terry, he also likes to vent his republican views. And since this state is run by democrats he likes to go to the jugular of those at the top. I think his anti tax view is more aligned with his personal feelings than those of CME. The state income tax, while a significant number to those with profits of their size, it is still a fairly small percent of those profits. Enough to warrant a move? I doubt it. They are set to open an new multi-million data center next year and they are not going to dump that investment down the tube anytime soon.

- chi - Thursday, Jun 9, 11 @ 1:49 pm:

Sue-

Assuming what you state is accurate, you still fail to account for the fact that the $240 million in tax breaks are spread out over many years. Then again, it’s more entertaining to pretend the sky is falling.

- Jimmy CrackCorn - Thursday, Jun 9, 11 @ 1:52 pm:

CME isn’t going anywhere, especially based on UBS’s experience moving out of NYC:

15 Years Ago:

“Some experts suggested that financial firms no longer needed to be in Manhattan and close to Wall Street because of the spectacular growth of computerized trading and telecommunications.

Connecticut sweetened the pot for UBS by dangling what was supposed to be a $120 million package of tax breaks and interest-free loans, although the actual value of the incentives turned out to be substantially less. The bank erected a trading floor the size of two football fields, packed with more than 5,000 computer monitors.”

BUT:

“Now, though, UBS is having buyer’s remorse. It turns out that a suburban location has become a liability in recruiting the best and brightest young bankers, who want to live in Manhattan or Brooklyn, not in Stamford, Conn., which is about 35 miles northeast of Midtown. The firm has also discovered that it would be better to be closer to major clients in the city.

As a result, UBS is seriously considering a reverse migration that would bring its investment banking division and up to 2,000 bankers and traders back to Wall Street and a new skyscraper at the rebuilt World Trade Center, according to real estate executives and city officials.

‘They just can’t hire the bankers and traders they need,’”

http://www.nytimes.com/2011/06/09/nyregion/ubs-may-move-back-to-manhattan-from-stamford.html?_r=1&ref=nyregion

(worth the read)

- Anonymous - Thursday, Jun 9, 11 @ 1:54 pm:

“Eliminating all corporate tax loopholes would save $1.4 billion and allow the state to lower the corporate income tax rate around 2 percentage points, according to my back-of-the-envelope calculations.”

Yes, but if all tax loopholes are eliminated, then Springfield loses a greater deal of power in picking who wins and who loses.

I don’t know if I am ready to live in that Illinois.

- Dwight - Thursday, Jun 9, 11 @ 1:55 pm:

Rich, do you really believe that this state and nation)is not in very serious economic trouble? And what kind of idiot would root for serious trouble? I assure you I do not! But it seems you often excuse the harmful effects of high taxes. If they are good why stop with 5%? Let’s go 10%. No doubt our legislators can find useful purposes to spend the extra “revenue”. There is in fact no end to those good ideas, so 10% is likely too little. So please keep supporting and excusing high taxes. Surely the good times are just around the corner!

- A Different Belle - Thursday, Jun 9, 11 @ 2:02 pm:

They were chided over having 33 board members and yet they are adding ANOTHER one…I’m sure Hastert is not coming cheap. Talk about yapping out of both sides of your mouth but I guess Duffy feels Denny can help him get his tax breaks?

- siriusly - Thursday, Jun 9, 11 @ 2:03 pm:

Any sort of incentives or tax rebates used to keep businesses here must be established as an across-the-board policy. By continuing to give unequal incentives and bend over backwards for the next company that is “about to leave” we create bad policies and inequitable taxing structures.

We already have unmatched assets in our metro-region that employers want. So they need more? Then let’s create a business-friendly tax structure and make it an across the board policy. The will-nilly nature of DCEO’s goodies makes for bad policy and gives away more than we need to most of the time = corporate welfare perhaps.

- siriusly

- Plutocrat03 - Thursday, Jun 9, 11 @ 2:47 pm:

Used to be that when you saw a story in the paper, it had been checked and you could rely on the accuracy. Now, not so much. In the rush to be first with a piece of news, accuracy suffers.

I’m not sure about the UBS story because in this job market, I believe that there are qualified individuals who would be willing to commute. People who work in NY frequently have long commutes into town. They could certainly commute in the reverse direction if they want a job.

The fundamental problem is that if every mobile employer who threatens to leave gets a break, then they will all threaten to leave in order to get the same brake their competition gets. The good news is the politicians who ‘help’ will also have their campaign coffers filled.

Who makes up for the special deals? Those companies and people who are not mobile.

- D.P. Gumby - Thursday, Jun 9, 11 @ 2:50 pm:

Whatever happened to the Green Party proposal for a very minimal % tax on Board of Trade transactions that would bring gazillion $$ into the state???

- CircularFiringSquad - Thursday, Jun 9, 11 @ 2:51 pm:

Dwight

The nation is in trouble because the Wall Street hustlers and their friends refuse to be controlled. they want to unleash every scam they can think of and then claim they can self police.

In the meantime the housing industry, commercial real estate, pension funds, personal retirements accounts have been trashed, lost two+ years of growth and could face another dip.

High taxes are not the enemy. High taxes just pay for all the programs the pols enact to satisfy the Dwights of the World.

The hustlers and their destructive practices are the enemy.

Wake up

- Thoughts... - Thursday, Jun 9, 11 @ 3:29 pm:

I just want someone to tell me when I *can* freak out. I’m totally ready.

- Captain Angrypants - Thursday, Jun 9, 11 @ 3:36 pm:

I’d love it if we as a country could turn away from the idea that higher taxes are forever and always a bad thing and anyone who raises them must, somehow, be anticapitalist. I’m no more thrilled than anyone else that my taxes went up this year, but at some point, there’s also a certain patriotism to saying, “This mess is my problem, too, and paying extra taxes is equally as valid a way to fix this mess than any other way.” And if Citizens United has taught us anything, it’s that corporations are people too, and should be equally able to share a little pain for the common good.

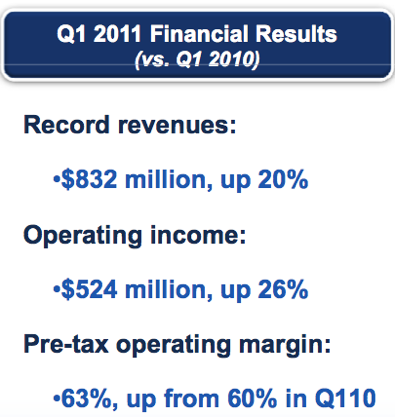

I’d be interested to see how the above profit & income figures compare to how the CME Group did in 2007-2008.

- Anonymous - Thursday, Jun 9, 11 @ 3:48 pm:

CME is not going anywhere. Their members aren’t going to move en masse anywhere, and open outcry is still an edge in the market. It’s not like the NASDAQ.

Plus, where are you going to go? Low-tax enclaves like Manhattan, London or Tokyo?

These guys aren’t going to move out to the sticks — but they will make some noise for a break of some sort.

- Bill Baar - Thursday, Jun 9, 11 @ 4:15 pm:

Re: “This mess is my problem, too, and paying extra taxes is equally as valid a way to fix this mess than any other way.”

Please recall Speaker Madigan’s quote form Clout Street back in Dec 2009,

“For those that think that tax increases are the answer, it’s a partial answer,” Madigan told an audience gathered for a panel discussion at the annual Illinois Legislative Latino Caucus Foundation meeting in Rosemont on Thursday. “Because you can raise the rate on the Illinois income tax, but if the economy is not performing you’re not going to get an increase in money out of the increase in rate.”

And this…

“Everybody should understand… we are in a very difficult economic situation,” Madigan said. “Not everybody in the country fully appreciates the gravity of the situation.”

As far as I can tell, not much has changed since 2009 and now. Maybe just worse. Tax hike isn’t going to fix much for the reason’s the Speaker cited.

- Don't Worry, Be Happy - Thursday, Jun 9, 11 @ 4:24 pm:

As Rich has pointed out in the past, the state income tax is paid on money earned in Illinois. It has nothing to do with the location of the company. If CME moves some back office stuff to another state but continues to operate the exchanges here it will not save them a penny on their income taxes.

For them to talk about this in the context of taxes if just a red herring, and probably an attempt to scam the state for tax breaks.

- Easy - Thursday, Jun 9, 11 @ 4:32 pm:

Maybe the cme shareholders should question Duffy as to why he donated $100k to speaker madigan last fall only to see madigan push through the very tax increase Duffy now says may force him out of state. Bad strategic decisions seem chronic at cme.

- Rich Miller - Thursday, Jun 9, 11 @ 4:33 pm:

LOL, Easy. Good point.

- Captain Angrypants - Thursday, Jun 9, 11 @ 4:39 pm:

Bill, I’m not saying that we should triple the state taxes and sit back smiling while the cash rolls in and all state workers get 75% raises. I am, however, saying that we should move beyond the idea that taxation is, somehow, invalid and anticapitalist. It’s a dangerous narrative that we’ve gotten into as a country. Equally bad is the idea that “the government is stealing my hard-earned money”. As Rich has pointed out, our state income tax compares very favorably to that of other states, and our federal income tax is the lowest it’s been in decades. The idea that we can’t stomach some additional taxes to pay for roads, unemployment benefits and state and local employees is just stupid.

Hey, I work two jobs to make ends meet, and my live-in girlfriend hasn’t been able to find work in two years. It’s tough, and I could have used that 2% federal payroll tax holiday to pay down money I owe. However, I really, really don’t begrudge the state that money. I also wouldn’t begrudge the federal government that 2% (or a bit more) if it meant paying down the federal debt.

Citizenship has obligations, and paying taxes is one of them. I can be for a sensible tax increase at both the state and federal level without sounding like I want to pack up and move to Sweden.

- Angry Chicagoan - Thursday, Jun 9, 11 @ 4:40 pm:

Sad fact of the matter is businesses have figured out that it’s easy to roll Illinois for special interest considerations. With other states, it’s a bit trickier to pull this. Not as difficult as it should be, but still, a bit tricky. The idea that any other location for CME to do business is going to get them a lower cost of business is a bit far fetched. Even with the income tax increase, Chicago is cheap for business compared to America’s other major cities (conventions excepted).

- dave - Thursday, Jun 9, 11 @ 4:40 pm:

**Rich, do you really believe that this state and nation)is not in very serious economic trouble? **

Huh? Where did Rich say this?

- Bill Baar - Thursday, Jun 9, 11 @ 4:59 pm:

Re: Citizenship has obligations, and paying taxes is one of them.

I agree and it’s a good argument for a flatter tax. Everyone, even the less well of, should pay something as part of being a citizen.

Madigan just made the point in 2009 that a tax rate increase probably wasn’t going to raise revenues given the economy and certainly not enough to deal with the States fiscal problems.

The only real solution is going to be growth. That the state can’t seem to get a lid on spending, and then finds-it-self played by businesses with problems of their own e.g. CME, Sears, Motorola; just doesn’t lend any confidence about our politicans. Why bring your business to a State were everyone’s a dealer, and they Pols can’t get a grip on spending.

- Steve Bartin - Thursday, Jun 9, 11 @ 5:32 pm:

This is all less of a story than it appears. The CME will be closing it’s trading floors within the next 5 years , if not sooner. Since most of the volume is on the screen: it doesn’t matter where the CME is located. You don’t have to be in Chicago and pay $25 to park downtown to put on a trade. The CME could move their server anywhere. As options on futures volume gravitates more and more to the computer there’s no way the CME will keep the trading floors open. Just a reminder.

- Cincinnatus - Thursday, Jun 9, 11 @ 5:43 pm:

Perhaps Steve Schnorf can run the numbers.

Calculate receipts that would have occurred just as a result of the small uptick in the economy, and without the tax increase. How much of the $300M in receipts is a result of the economy, and how much is a result of the tax hike. Now, subtract the $230M in tax breaks from the amount that is a result of the tax increase amount. Would it be that the net gain is negative?

- Rich Miller - Thursday, Jun 9, 11 @ 6:20 pm:

===Now, subtract the $230M in tax breaks from the amount===

Very little of that has been paid out yet. I’m gonna address this tomorrow, but this is over a period of time, not this year. The WSJ doesn’t have a clue… again.

- CircularFiringSquad - Thursday, Jun 9, 11 @ 6:27 pm:

OMG

More boring stuff on tax give aways.

Time for a snow day.

- wordslinger - Thursday, Jun 9, 11 @ 6:55 pm:

I would have a lot more respect for anti-tax hysteria if those same “principles” applied to borrowing.

On the state level, GOPers claim they’re against increased taxes, offer no cuts, yet have no problem borrowing from vendors.

On the national level, Bush cut taxes like crazy, added new programs in prescription drugs, massive farm and road bills, plus fought two wars all through borrowing.

The individual federal tax burden is at its lowest level in 60 years, but national debt is at its highest level since shortly after WWII.

That’s not TARP, that’s not Stimulus, that’s not GM and Chrysler; that’s tax cuts, recession, new Bush programs and fighting wars through borrowing.

Read it and weep.

http://www.washingtonpost.com/business/economy/running-in-the-red-how-the-us-on-the-road-to-surplus-detoured-to-massive-debt/2011/04/28/AFFU7rNF_story.html

- JustMe - Thursday, Jun 9, 11 @ 8:15 pm:

==Was he worried about a corporate shakedown? “We don’t believe in that kind of approach to life,” he said.==

Translation: “What, me worry?” Because he sure believes in caving in to corporations threatening to move.

- VanillaMan - Thursday, Jun 9, 11 @ 9:33 pm:

Lets stop pretending this stuff is nothing. Governors don’t run to your side on a whim.

Better yet, hope we don’t lose any more major businesses, or have major businesses threaten to leave in order to cut a deal.

This situation was preventable. The Quinn Tax has secondary consequences that are not good. Stop pretending otherwise and learn something.

We do not yet know the extent of the damage.

- wordslinger - Thursday, Jun 9, 11 @ 9:48 pm:

–Better yet, hope we don’t lose any more major businesses,–

or even one.

- Walter Mitty - Friday, Jun 10, 11 @ 11:34 am:

have some exprience here - worked at CME for a while after politics.

#1) Terry Duffy really ought to be ashamed of himself. He knows they are not moving anywhere. Yes, much of the trading is electronic now and the “pit presence” is not as substantial now, but there are enough traders in Chicago that wouldn’t consider moving.

#2) The huge TIF subsidy they got after the consolidation. I would think they would wind up spending much more than they could ever hope to save by moving.

#3) The shareholders ought to be upset with the top heavy bureaucratic staff they have over there. Try getting rid of some of cronys first, Terry.

One thing to know about Duffy - born and raised in Beverly, he is a great politician. The other thing: its a shame his wife isn’t in his place. She is an absolutely down to earth person who is freindly to everyone - not just the big shots - and hasn’t let any of it get to her head.