Question of the day

Thursday, Jun 9, 2011 - Posted by Rich Miller

* I got so busy and distracted that I forgot to post a question. Sorry about that. It’s very late in the day, so let’s have a caption contest instead…

62 Comments

|

*** UPDATED x3 *** Don’t freak out just yet

Thursday, Jun 9, 2011 - Posted by Rich Miller

*** UPDATE 3 *** Gov. Quinn talked to the media this afternoon about CME. Quinn said CME Executive Chairman Terry Duffy was a “good friend,” adding the two have had dinner together. “We’ll have an ongoing conversation and dialogue,” Quinn said.

The governor was asked if he now thought the corporate tax hike was a bad idea. “No, not at all,” he replied. Quinn once again called the income tax hike “temporary” to pay off the bills, provide good schools, etc.

Was he worried about a corporate shakedown? “We don’t believe in that kind of approach to life,” he said.

“I don’t think that anybody likes paying taxes,” the governor said “but that’s the price of democracy.”

Audio…

*** UPDATE 2 *** I must’ve missed this…

The Chicago Sun-Times reported that Texas, New York, New Jersey and Indiana are possible alternatives. A CME spokesman declined to comment.

New York? Way high state and local taxes. Same for New Jersey and Indiana. Texas? Have fun with the gross receipts tax.

*** UPDATE 1 *** Mayor Rahm Emanuel said today that he’s talked with top CME officials and is “confident” the business will stay in Chicago…

Mr. Emanuel said he talked both to Mr. Duffy, apparently this morning, and CME Chairman Emeritus Leo Melamed.

“CME has grown and been successful in Chicago. I believe they have many years ahead,” Mr. Emanuel said, adding that he’s “confident” the firm will stay here.

“I know their frustration,” added Mr. Emanuel, who served on the board of predecessor firm Chicago Mercantile Exchange about a decade ago. “I also know they believe they can continue to be here.”

Asked if changes in the state tax hike will be needed, Mr. Emanuel replied, “We’re not at that point.”

[ *** End Of Updates *** ]

* You would think that with the big and, as it turns out, almost totally fake uproar about Caterpillar leaving Illinois after the state raised its income tax rates that reporters might be a bit more circumspect the next time a corporate titan hinted at longing for greener pastures. You’d be wrong…

Chicago business is partly defined by its concentration of financial traders, but the boss of the city’s two dominant futures exchanges said Wednesday that he might pull jobs out of the region in response to a state tax hike on corporations.

Terrence Duffy, chairman of CME Group Inc., said he, Chief Financial Officer James Parisi and the company’s internal staff are evaluating a move to other states. […]

“I’m going to do what’s in the best interests of shareholders,” Duffy said, adding that “if that means opportunities are greater elsewhere, then we’re going to look at those opportunities.” […]

It accounts directly for about 2,000 jobs in the Chicago area, but its ripple impact goes much further. Trading firms set up shop here to be near the downtown trading floors, and banks and other institutions add staff to serve that business.

Some estimates place the job count from the trading industry here, which includes the Chicago Board Options Exchange, at more than 60,000.

The above story claims that Chief Financial Officer James Parisi said the tax hike will cost CME an extra $50 million a year. A CME spokesman said today that Parisi’s statement was accurate.

* But this is also important. Duffy said at the meeting that CME would not be abandoning Chicago…

“We’re investigating what would be in the best interests of our shareholders,” Duffy said, noting that such a move would not mean CME would abandon its presence in Chicago, home to its markets for over a century.

So, the traders can calm down now. They won’t have to move to Alabama or some similarly awful place.

* Duffy also added this…

Duffy tells the Chicago Sun-Times he is upset by the state’s failure to close corporate tax loopholes. He says they favor some companies but leave others, including CME, to pay the full rate.

That’s a good point.

* Chairman Duffy did not mention the state tax situation during his remarks. The state tax hike was also not mentioned in anybody’s multi-media presentation.

When Duffy talked about the problem with his stock’s subpar performance, the executive chairman identified only two factors. “A major overhang,” Duffy said during his prepared remarks, has been the “uncertainty” of federal regulations. The other problem, he said was the company’s “continued focus on new investments for future growth.”

* I called CME this morning to ask for a further clarification of Duffy’s comments about Illinois’ tax hike. I was told a further clarification wouldn’t be possible and was referred back to his quotes. I asked whether there was already a plan or at least a process in place to look for another CME headquarters site. I was told that the spokesperson couldn’t comment further.

The Q&A video with shareholders isn’t online, so I couldn’t find the complete context of Chairman Duffy’s comments.

* Former US House Speaker Denny Hastert was elected to the board of directors at yesterday’s shareholder event, but he’s in meetings all day today and I couldn’t reach him to ask whether he would fight to keep the company in his home state.

* The company has other problems as well…

In response to a shareholder who questioned the need for a 33-member board, Mr. Duffy said that the company will pare the size of the board over time because he realizes it’s costly for it to be so large. Contractual obligations will only allow cutting it by a couple of members starting next year, but there will be bigger decreases between 2013 and 2014, he said.

Executives also blamed uncertainty over regulatory changes for hampering the exchange operator’s shares, adding it would look to global partnerships — not acquisitions — for growth.

Shares of CME, the world’s largest futures exchange operator, are down 18% so far this year vs. a 4% drop in the Dow Jones Global Exchange index.

The company’s shares have dropped 8% so far this month as government data showed the U.S. economic recovery stumbled — making an interest rate rise less likely and hurting the outlook for CME’s treasury and eurodollar trading.

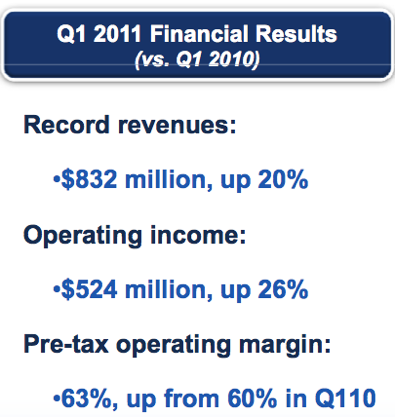

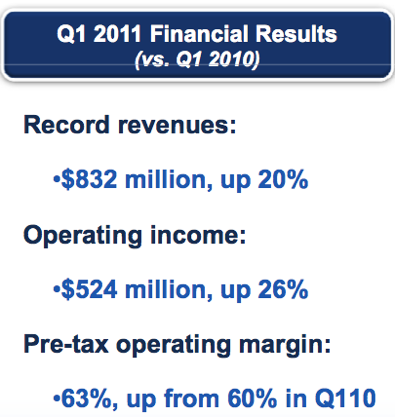

* But it’s not exactly a pauper…

39 Comments

|

* Madigan has always been against this idea, going back to the Constitutional Convention, so this is no big shock…

A constitutional amendment to merge the offices of the state treasurer and comptroller is stalled in the Illinois House because of opposition by House Speaker Michael Madigan, D-Chicago.

The amendment unanimously passed the Illinois Senate, but is stuck in the House Rules Committee, which is tightly controlled by the speaker.

Madigan spokesman Steve Brown said merger proponents, including the two current officeholders, have never sufficiently countered the reasons two offices were created at the 1970 constitutional convention.

“They’re radically different offices, as anybody who’s spent any time around them knows. They’re not similar in any way,” Brown said. “While the offices both deal with finance, in reality, they have hugely different activities. You can’t just say, well because they’re both about finance you can consolidate them and that makes sense.”

* Meanwhile, oops…

The state’s Bright Start College Savings Program has come under fire again after a promotion promising a $250 match for contributions made this month quickly ran through its budget, leaving families feeling they were duped into adding money to their accounts.

The Illinois treasurer’s office said Wednesday that it is investigating why a website touting the promotion was not updated for nearly 24 hours after it had paid its limit of 2,500 bonuses. Participants complain that they continued to put money into their Bright Start funds expecting the match even though the program was finished by 3 p.m. Friday. […]

Some said they didn’t even get notice of the promotion until Saturday — a day after the matching funds were gone. […]

“It’s sort of a crass move to dole out these funds as a publicity stunt, but what you’ve done is worse by inducing people to invest in exchange for a promise you knew (at least by Friday afternoon) you couldn’t keep,” he said in an email to Bright Start and copied to the Tribune.

*** UPDATE *** I forgot to add this story, since it’s semi-related…

The chief investment officer of the College Illinois prepaid tuition program has left that post for a newly created position within the Illinois Student Assistance Commission.

Frank Bello, a former deputy treasurer for the city of Chicago who joined the Illinois Student Assistance Commission as chief investment officer three years ago, was named director and chief credit officer for the Illinois Designated Account Purchase Program last month without an announcement, an ISAC spokesman confirmed Wednesday. That program, administered by ISAC, services a $1.1-billion portfolio of student loans and counsels student loan recipients in danger of defaulting. It’s the primary source of revenue to fund ISAC’s operations.

Mr. Bello was ISAC Executive Director Andrew Davis’ key lieutenant in dramatically overhauling the $1.2-billion investment fund for the prepaid tuition program, which allows parents to purchase contracts at a fixed price for future tuition at state universities and colleges and acts as a potential hedge against tuition inflation.

In a bid to close a 31% gap between assets and future liabilities in College Illinois, Messrs. Davis and Bello moved to shift nearly half the fund’s assets from stocks and bonds to “alternative” assets like hedge funds and private equity—a level of exposure to exotic asset classes well above those of other state prepaid tuition plans or pension funds its size.

* Related…

Illinois Attorney General Lisa Madigan’s office has launched an investigation of the agency running the College Illinois prepaid tuition program, which has suffered steep losses.

“We’re looking into it,” said Natalie Bauer, a spokeswoman for the AG’s office.

The investigation of the Illinois Student Assistance Commission began early this spring, she said, declining to provide further details.

* And then there’s this…

Over the last two years, the state of Illinois in order to pay its basic bills has seized more than $1.6 million from at least 15 different “charity” funds, to which Illinoisans voluntarily donate for causes like feeding the hungry and helping the homeless.

Each year, the Illinois Department of Revenue invites taxpayers to donate their tax refunds or other money to a handful of funds described as “charities” and avenues to “make a difference” and “make giving easy.” The “voluntary charitable donation funds,” of which there have been more than 50 different varieties over the years, are commonly called “check-off” funds and range in purpose from preserving wildlife and researching diseases to supporting military families and promoting healthy smiles.

For the 2008 tax year, Illinois workers donated a total of $1.4 million to 10 different funds. But, with the approval of the General Assembly, Gov. Pat Quinn authorized $434,300 in sweeps from seven of the funds in Fiscal Year 2010, when the 2008 tax year donations were first available for spending. Sweeps are transfers from special funds with specific purposes to the general revenue fund, the state’s largest pool of money, which pays for basic government operations.

For the 2009 tax year, Illinois taxpayers donated $1.37 million to 10 different funds, but during the current fiscal year, FY2011, Quinn has borrowed $1,176,100 from seven of those funds as well as five other check-off funds that are no longer listed on tax forms but were holding donated money from previous years.

While the state is required by law to repay the borrowed sums within 18 months, the state will not return any swept funds.

* As long as we’re updating, let’s do a quick roundup…

* Report: Gambling revenue continues decline

* Ill. Supreme Court hopes to modernize procedures

* Press release: State Cemetery Board Urges Passage of Legislation to Address Implementation of Cemetery Oversight Act

19 Comments

|

The family business

Thursday, Jun 9, 2011 - Posted by Rich Miller

* Congressman Jerry Costello’s son is getting into the family business…

State Rep. Dan Reitz said Wednesday he’ll likely leave office before his current term expires, and that he thinks a good appointee to finish his term would be Jerry Costello II, son of U.S. Rep. Jerry Costello.

“I’m leaning now toward not finishing out the term,” said Reitz, a Democrat from Steeleville. […]

“I’ve definitely decided I’m not going to run again. Having made that decision, it’s just a matter of sitting down to figure out when it’s in everyone’s best interest when to retire,” Reitz said. “I thought long and hard about running the last time.” […]

Jerry Costello II, a Democrat, has been rumored to be a replacement for Reitz. When new legislative maps were released a couple of weeks ago, state Sen. Dave Luechtefeld, R-Okawville, said he was told that one factor in deciding the legislative boundaries was having a district where Jerry Costello II could run. […]

“I think he’d do a good job,” Reitz said. “I’ve spoken with him on a number of occasions on different things, that being one of them. He was interested in running last time.”

Some have said Costello’s congressional district might not be winnable by a Democrat when he retires. But his son would have the same name, so if he gets his feet wet in the Illinois House, he could conceivably then move up the ladder to DC. I’m not saying this is the plan, but it sure looks that way.

* Former Congressman Bill Foster is already releasing a poll to knock back a potential opponent…

Former Rep. Bill Foster (D-Ill.), making a 2012 comeback bid in the new 11th congressional district, starts the contest in a much stronger position than potential Democratic rival John Atkinson, according to a poll Foster commissioned.

I was shown the entire Foster poll–by the Global Strategy Group–as Atkinson is weighing whether to run in the new 11th district–or stay with his original plan, to challenge Rep. Dan Lipinski (D-Ill.) in the 3rd congressional district. Either way, Atkinson would face a Democratic primary.

The poll of 400 likely Democratic 2012 primary voters was taken between June 2 and June 5 and has a 4.9 percent margin of error.

Atkinson’s problem, the poll shows, is that he is virtually totally unknown, while Foster has a running start as a former House member. Just six percent of the voters in the new district are familiar with Atkinson, compared to 41 percent for Foster.

In a head-to-head, voters in the survey gave Foster a 30 point lead, 36 percent to Atkinson, 6 percent.

Atkinson, however, could decide to run against incumbent Democrat Dan Lipinski, the son of former Congressman Bill Lipinski. And Atkinson isn’t the only one looking at the 11th. From a press release…

Today, Aurora Alderman-At-Large, Richard Irvin, announced that he will form an exploratory committee to consider a bid for the Republican nomination for U.S. Congress in Illinois’ new 11th Congressional District. Richard Irvin was first elected Alderman-At-Large in 2007 and was re-elected to a second term in April.

Richard Irvin is a life-long resident of Aurora. After graduating from East Aurora High School, he joined the United States Army where he served in the first Gulf War. Upon returning, he earned a law degree from Northern Illinois University. After serving for several years as an Assistant State’s Attorney in both Cook and Kane counties, Richard formed his own successful law firm.

* Republican Congresscritter Bobby Schilling has been hit with a round of Medicare robocalls…

The Democratic Congressional Campaign Committee has launched a round of robocalls targeting 13 Republicans. The calls, according to a sample script released by the DCCC, hammer away at Democrats’ message of criticizing the GOP’s budget plan to dramatically overhaul Medicare.

The calls hit Members for voting in favor of Budget Chairman Paul Ryan’s (R-Wis.) budget blueprint, noting the GOP’s “plan to end Medicare actually increases the debt by almost $2 trillion because of more tax breaks for millionaires and corporations.”

Democrats believe their Medicare messaging was a key component of their win in New York’s 26th Congressional district, where now-Rep. Kathy Hochul beat Republican Jane Corwin.

Schilling was the only Illinois Republican targeted in this round. Also, Schilling’s family was also just sued…

The lawsuit, filed this week in Henry County Circuit Court, says [18 year old Thomas Reese] was at a birthday party for the Schillings’ son Levi in May of 2007.

That’s when Reese claims Levi Schilling along with Croegart, Dragolovich and Walters took gasoline from an unlocked area in the garage, filled the hopper part of a toy dump truck, and lit the gasoline on fire.

Then, according to the suit, one or more of the boys pushed the truck toward Reese, catching his shorts on fire.

Reese says as a result, he suffered severe burns on one third of his body and still deals with mental and physical pain.

The suit claims the four boys are at fault because they failed to warn Reese and the Schillings are responsible because they didn’t safeguard the dangerous substance. […]

Representative Bobby Schilling’s camp released a statement Wednesday saying “Some kids were over at the house, they were horsing around. An accident happened. The mom and dad are friends of ours. We see them at church every week. They donate to my campaign. They weren’t able to settle with the insurance company, so they have to do what they’ve got to do. That’s what happened. I just thank God Tom wasn’t hurt worse.”

* Is this the first step toward a state legislative campaign announcement? Perhaps…

Former state Rep. Jay Hoffman will have a news conference today to talk about the delays in the Illinois 159 road project.

The $54 million project to straighten and improve Illinois 159 was planned in three phases and is currently in its second phase through Main Street and the downtown district. The third phase widens the road from Johnson Street to Kinloch Avenue, but money so far is only for land acquisition, not actual construction.

Hoffman, 48, a Democrat, was defeated in November by state Rep. Dwight Kay, R-Glen Carbon, after 20 years in the state legislature. Hoffman couldn’t be reached for comment Wednesday.

* Not much of a surprise…

The runner-up in the 2010 gubernatorial race plans to seek another term in the Illinois Senate.

State Sen. Bill Brady, R-Bloomington, announced Wednesday he will run in the reconfigured 44th Senate District in the 2012 election.

Brady, a 50-year-old real estate developer, will run in a district that includes most of Bloomington, none of Normal and a lot of new turf in Tazewell, Logan, Menard and Sangamon counties. […]

The district no longer contains the Central Illinois Regional Airport in Bloomington, but does encompass the Abraham Lincoln Capital Airport in Springfield. He also would no longer represent Illinois State University. But, he would represent the Illinois State Fairgrounds.

I hadn’t noticed that his district went all the way down to the Springfield airport and the fairgrounds. Wow. Downstate Senate districts are all quite large, but that seems a tad strange.

* There was no mention of this story in the piece…

Three contractors have claimed Brady Homes and a related company owe more than $400,000 in unpaid bills — a cash-flow problem the family-owned firm says reveals the depth of the homebuilding industry’s struggles.

The contractors filed at least 19 mechanic’s liens, totaling $402,107, on 10 Twin City residential properties owned by Brady firms in the past month, according to documents in the McLean County Recorder’s office. The liens allege unpaid bills for concrete and electrical work completed this year and other homebuilding materials.

Bob Brady, who owns Bloomington-based Brady Homes with his brothers, Ed and Bill, said Friday the liens were “just a cash flow issue” that would be resolved as each property is sold. Brady said their relationships with contractors and vendors remains good and they are “working civilly with everyone” involved. […]

Bob Brady said the brothers are not considering bankruptcy for Brady Homes, which he noted has five closings scheduled in just the next three weeks. He also stressed that the family’s other companies are financially “solid,” such as Re/Max Choice.

“These are just some bumps in the road,” Brady said.

The homebuilding industry is most certainly hanging on by a thread these days. Brady can’t really be blamed for an international financial calamity. These things happen in business, so it’s best not to make too much of them.

* Roundup…

* Black Power Wanes Amid Rising Hispanic Economic Clout in U.S.

* Senator Cultra ‘perplexed’ by Barickman’s decision to run against him: State Senator Shane Cultra says it “didn’t make my day” when Representative Jason Barickman told him that he plans to run against him for Cultra’s Senate seat next year… “I think I have a lot of experience and basically (Barickman) doesn’t have any,” Cultra said. Cultra says had Barickman decided to stay in the House, he would have had his choice of heavy Republican districts to run for in the next election.

* Shane wants to come back

* Sommer announces 88th District reelection bid

* Know your state rep: Derrick Smith

25 Comments

|

* Hey, VanillaMan! Where the heck are you, dude? I really miss your song parodies, and with the Blagojevich case about to go to the jury, we could sure use some of your magic about now. Also, I’m sure Wordslinger would lighten up on you a little if you decided to come back. Right, Word? We need you, man. Come back, please.

* We had a bit of a problem earlier this week when I banned two commenters for life and had to shut down two different threads. The banned commenters were relative newbies who just couldn’t behave on some emotional topics. The closed threads were also about emotional topics and I was just tired of policing them. Everybody, try to take a deeeeeeep breath before commenting, please. It’s the summer. Let’s relax a little bit.

* I’m working on stories for the Fax and the blog right now, which explains the late postings today. I’ll be back soon. In the meantime, do you have anything you’d like to say to other commenters? Do it here…

*** UPDATE *** VanillaMan is back! I checked his IP address, and it’s really him. Read his latest comment here.

85 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|