*** LIVE VETO SESSION UPDATES ***

Monday, Nov 28, 2011 - Posted by Rich Miller

* Via BlueRoomStream.com through USTREAM, here’s today’s House Revenue Committee meeting, which begins at 1 pm. The topic of discussion will be the tax cut package…

We have no control over the ads, but it’s free, so try do deal with it. You can hit the “mute” button during the infrequent commercial breaks.

* The House and Senate aren’t in session today, so I’m not sure how much updating we’ll see, but the House has scheduled four committee hearings, so here’s the ScribbleLive feed. BlackBerry users click here, iPad and iPhone users remember to use the “two-finger” scrolling method…

1 Comment

|

Question of the day

Monday, Nov 28, 2011 - Posted by Rich Miller

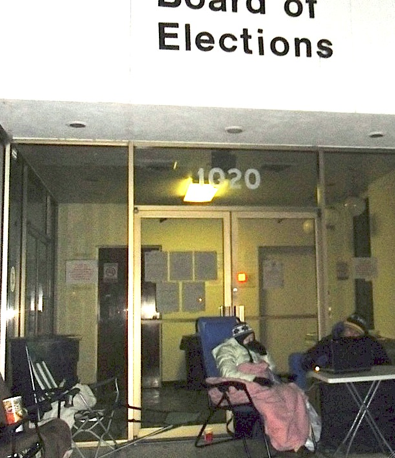

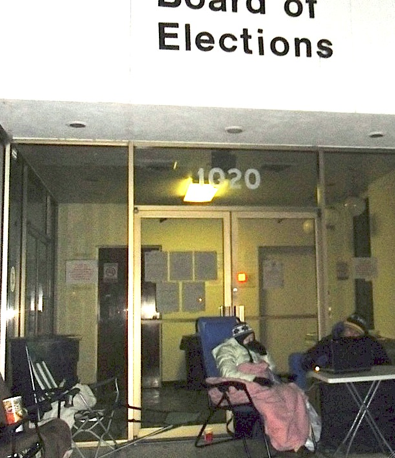

* Illinois Public Radio Statehouse Bureau Chief Amanda Vinicky posted a photo of a couple of House Democratic campaign operatives who were holding a place in line late last night in front of the State Board of Elections. The HDems set up their encampment Friday afternoon. I adjusted the contrast, etc. so you could see it better…

* The Question: Caption?

49 Comments

|

* US Judge James Zagel dumped some pretty cold water on Bill Cellini’s defense motion to overturn his guilty verdict because a juror apparently lied about a criminal record…

Calling the juror dishonest, Cellini’s lawyers filed a motion for a new trial, contending she was ineligible to sit on a federal jury because she is a convicted felon.

In [last week’s] ruling, Zagel disputed that, writing that the juror would have to have “actual bias” shown by Cellini’s attorneys. At the Dec. 1 hearing, it will be “the defendant’s burden to cast sufficient doubt on the juror’s impartiality.”

Zagel further stated, “A juror offers a bias-free explanation which the courts find credible, such as confusion or embarrassment about admitting to felony convictions before a large audience in open court, then bias cannot be presumed.”

With his statement, Judge Zagel basically told the juror how to respond when she’s asked why she didn’t fess up to the convictions. All she has to say is: “I was confused,” or “I was embarrassed,” and that’s that.

* And speaking of uphill criminal battles, Rod Blagojevich’s attorneys are alleging that criminal allegations about star prosecution witness John Wyma may not have been properly investigated by authorities before Wyma agreed to testify against their client…

In filings regarding Rezko’s sentencing, Wyma’s cooperation with the government is discussed, including that Rezko told prosecutors that he tried to extract a campaign contribution through Wyma from Provena Health, whom Wyma represented as a lobbyist at the time.

Lawyers question whether bribery was involved when Provena was granted a certificate of need from an Illinois hospital board. Rezko told prosecutors in private sessions that Provena had a dispute with someone on the hospital board and resolved it by paying the board member, according to the Blagojevich defense filing. Prosecutors say the charge was unsubstantiated.

“Blagojevich did not have any knowledge about and was absolutely unaware of the Provena activities of Rezko and Wyma,” the filing says.

It says after Rezko gave the information to prosecutors, Wyma was hit with a subpoena.

“Shortly after Wyma received this grand jury subpoena, he agreed to be, and became, an informant for the government. This allowed the government to obtain a wiretap on Blagojevich’s telephones,” lawyers wrote.

After the taps were secured, Blagojevich’s lawyers said, prosecutors deemed Rezko’s information “not substantiated.”

“If the incriminating evidence against Wyma was not substantiated because it was not investigated, the government’s statement is misleading,” defense lawyers wrote.

Many people believe that Wyma got off way too easy, but that usually happens when you’re the first one to climb aboard the prosecution’s train.

* Meanwhile, say what you want about Bill Cellini, and you could be right, but he made the Teachers Retirement System a whole lot of cash…

How much money did Cellini’s firm make for TRS — the $37 billion retirement fund that provides pensions for suburban Chicago and downstate teachers?

In the 17 years that Commonwealth managed TRS assets, the firm was given $788 million to invest. When the TRS board terminated Commonwealth in 2009, it had nearly doubled that amount to $1.2 billion, according to documents provided by the Cellini camp, which TRS verified are authentic.

Commonwealth averaged a rate of return of 14.38 percent for TRS, according to a 2008 Callan Associates report. And in 2004, Callan ranked Commonwealth as the No. 1 real estate investment firm in the country, internal TRS documents show.

But he didn’t diversify before the international economic collapse, and his returns were much thinner at the end…

Time period, rate of return

Last quarter, 1.27

Last year, 6.65

Last two years, 16.89

Last three years, 17.39

Last five years, 23.10

Last 17 years, 14.38

* In other news, oy…

Steven Preckwinkle’s one day of subbing became a symbol of Illinois’ troubled pension system after that work qualified him for significant state teacher retirement benefits.

The political director of the Illinois Federation of Teachers can base that pension on his years as a union lobbyist and on his six-figure union salary — a lucrative opportunity made possible by state legislators.

It turns out Preckwinkle also is familiar with another state program, legislative scholarships, known for its problems, The Tribune has found.

Two of Preckwinkle’s children and a nephew were awarded the tuition waivers to Illinois State University in the late 1980s and 1990s as part of the legislative scholarship program, according to David Ormsby, the privately paid spokesman for Preckwinkle.

Preckwinkle worked for AFSCME until 1990. Then-Rep. Mike Curran awarded the scholarships. Curran was a huge AFSCME supporter and was even a card-carrying AFSCME member. The two men were very close, so this doesn’t surprise me, but it’s just one more indication that Preckwinkle was gaming the system for himself.

* Other stuff…

* Blagojevich wants tapes played at sentencing

16 Comments

|

* I’ve been reading former Senate President Phil Rock’s autobiography, and one of the things I learned was that 1983 was the first time in all of Illinois history that the House Speaker and the Senate President were both from Cook County.

Here’s another factoid from Wikipedia: Since 1901, twelve out of twenty-one Illinois governors were Republicans. The GOP ratio is much higher if you go back to 1860 and Lincoln’s presidential campaign.

* History shows us that the Republican Party, Downstate and the suburbs have historically done quite well in Illinois. Bill Clinton was enormously popular in Illinois, yet we had Downstate Republican governors throughout his two terms. Back in 1990, both Democratic US Senators were Downstaters.

The main reason for the Democrats’ failure to win the governor’s mansion is that Democrats ran poor candidates and the Republicans didn’t freak out moderate suburban women, who, as i’ve pointed out countless times, have decided the outcome of gubernatorial elections since at least 1990. George Ryan’s troubles ended that streak when the GOP nominated a staunchly conservative candidate (who turned off suburban women) with the same last name as the humiliated Ryan. The hangover was still in effect four years later, amplified by this state’s intensive dislike for George W. Bush in his second midterm election.

Downstate Republican primary voters had their best chance in eight years to pick a winnable candidate last year, but they chose the guy most likely to freak out those aforementioned moderate suburban women.

The Republicans drew the state legislative map in 1991, but they didn’t draw it well enough to maintain control of the House longer than two years. The Republicans even came within a few votes of losing the Senate in 1996. Democrats did much better ten years later when they won the lottery and drew the new maps. Not only did they maintain control throughout the decade, the Senate ended up with a veto-proof majority (plus one) and the House Democrats were just one vote away from a similar majority.

* Yet, just nine years out of power, and here we have a couple of media hound Downstate Republicans deciding to get some more publicity for themselves by demanding secession…

State Rep. Bill Mitchell said he’s sick of how Cook County politicians run Springfield. So he wants to kick Cook County out of Illinois.

The Forsyth Republican introduced a resolution in Springfield on Tuesday that would ask Illinois voters on a referendum whether Cook County should secede and become the 51st U.S. state. Congress would then have to approve the far-fetched plan.

“They just don’t know how to govern,” Mitchell said Tuesday. “So am I serious? Yes, I’m serious about it. Do I expect this to be adopted? I think it’s an uphill battle.”

“Uphill battle”? More like “impossible battle.”

Read the resolution by clicking here.

* Even Sen. Bill Brady thinks this is silly…

If anyone knows the effect Chicago has on Illinois politics, it is Bill Brady. If not for the voters in Cook County during the 2010 gubernatorial election, the Bloomington Republican would be governor and Democrat Pat Quinn would be bumbling around somewhere else.

“There’s no arguing that, but for Chicago, I would have won the gubernatorial election and Republicans would be in control. I understand their frustration,” Brady said last week when asked about his neighboring representative’s proposal.

But Brady pooh-poohed the whole idea of separating Chicago from Illinois saying it’s just “impractical.”

“Chicago has a lot of economic opportunities that we can’t forget about,” said Brady.

* Downstaters don’t seem to understand that their region is a net tax eater. There just isn’t enough wealth Downstate to fund anything of substance. That’s one reason why Mitchell and his co-sponsor Rep. Adam Brown couldn’t lump the non-Cook suburban counties into a new state with Cook. They’re still gonna need a sugar daddy to pay their bills. But to Brown, it’s all about social issues…

“Our downstate values are being overshadowed by Chicago’s influence over the legislative process,” Brown said. “The 2010 election swept a number of downstate Republicans into office, but the lame-duck Democrats passed a 67% income tax increase, along with civil unions and the abolition of the death penalty in Illinois. These liberal policies are an insult to the traditional values of downstate families.”

Plenty of Downstaters voted for that tax hike, too, and a whole lot of Downstate and suburban Republicans have voted for tax hikes in the past, when the GOP was not so engrossed in its own super-rigid ideology. Heck, Pate Philip even sponsored the 1983 tax hike bill. During Reagan’s presidency. But that was when Reagan was a real, living, breathing person, not the reinvented icon of the current era.

* For Mitchell, it’s about some not-so-subtle code words…

“They want what they want, and what I’m staying as a downstater, ‘OK, go and do what you want to do,’” Mitchell said. “Increase your debt. Spend more money. Add more people on public assistance.”

Considering all the other not-so-subtle campaigning that Mitchell and Brown have done in the past, I suppose this should be no surprise. From last year…

Brown, a Decatur city council member, said illegal immigration is an important issue for him and his constituents, especially because it has an impact on family incomes.

“They’re criminals,” Brown said. “This is based on a fundamental issue that has been ignored by the federal and state governments.”

Mitchell said the issue is especially important to people in Decatur, because of its high unemployment.

Illegal immigration is not a criminal issue. They’re deported, not imprisoned. Also, the Decatur metro area has so few Latinos that it was obvious last year the twosome were merely tossing racially tainted red meat to their electoral base. It’s no different this time, either.

* I’ve been writing about Illinois politics for almost 22 years now, and not once during the Democrats’ long exile do I ever remember hearing a Chicagoan say the city should secede. But the issue has come up in the past, and if Mitchell and Brown think Downstaters are getting the shaft, they ought to read a little history…

In the 1920s, lawmakers in Springfield refused to redraw legislative districts to take into account the city’s fast-growing population.

The City Council approved a resolution by Ald. John Toman calling for the city to secede from Illinois, and aldermen said they would give the state two years before they started moving toward secession, Erwin recalls.

* I couldn’t agree more with the Pantagraph…

There already is too much of an “us” vs. “them” mentality when it comes to “downstate” Illinois and Chicago, Cook County and/or the collar counties — on both sides. We need politicians who can bridge that gap, not ones who fan the flames and feed the divisions.

Exactly.

67 Comments

|

Filing day open thread

Monday, Nov 28, 2011 - Posted by Rich Miller

* Today is the first day to file candidate nominating petitions in Illinois. You can take a look at the early filers at the Board of Elections by clicking here.

…Adding… Background…

Toward the front of the line was Lennie Jarratt, a Lake County Tea Party leader who’s running in a probable four-way primary race for Illinois Senate as a Republican. He said he had been in line since 4:30 a.m., standing on the sidewalk with an American flag lawn chair.

“It’s been fun out talking to everybody,” Jarratt said.

Why so early?

Everyone in line at 8 a.m. is eligible to get his or her name listed first on the ballot for that race. Conventional political wisdom and at least one study suggest that being the top name in a crowded field of relative unknowns can boost a candidate’s chances of winning.

At 8 a.m., a state police officer stood at the end of the line, and anyone ahead of the officer is eligible for the top spot. If more than one candidate for any race is in line at the time, the top spot is decided by lottery.

8 Comments

|

* The latest rant from the Tribune editorial board…

More broadly, this state has to revamp a tax policy that gives all employers incentive to leave the state, but tries to lure select employers to stay. The state imposed a whopping increase in personal and corporate income taxes early this year. Yet, as the Tribune reported Friday, since Gov. Pat Quinn took office he has pledged at least $636.5 million in tax credits, grants and training funds to companies to hire or to keep jobs in the state.

“All employers”? Really? How is the Tribune gonna leave? And when?

Snark aside, the story about the total incentives follows the usual pattern of focusing on the largest possible number. That $636.5 million is spread out over at least ten years, so the fiscal impact each year is minimal. And the Trib buried this valuable nugget deep inside the piece…

[Greg LeRoy, executive director of Good Jobs First, a nonprofit that researches economic development subsidies] said he was pleasantly surprised by the cost per job on the 2011 packages. Many states, he said, offer more than $100,000 per job. A company in upstate New York, he added, got a package worth $1 million per job.

So, we have reasonable incentives? Really? Huh. That doesn’t jibe with the common refrain of “We’re so screwed up we have to offer huge bribes to keep businesses here.”

No Illinois incentive comes even close to the $100,000 per job that “many states” offer. And keep in mind that even that $100,000 is spread out over many years. The highest per-job incentive Illinois offered was spread out over 13 years…

The state pledged nearly $61,000 for each of the 70 jobs Evraz Inc. North America promised to create in Chicago. That figure includes $4.2 million in tax credits the company can claim over the next 13 years and $50,000 in training funds.

And it’s not actually $61,000 per job because instead of 70 jobs, the company already has 100 employees in Chicago. And many of these jobs are high-paying executive positions.

We should definitely keep a watchful eye on these incentive programs, but let’s also put the annual cost in perspective.

…Adding… From our always valuable commenter Wordslinger…

–More broadly, this state has to revamp a tax policy that gives all employers incentive to leave the state, but tries to lure select employers to stay.–

More than 60% of Illinois corporations don’t pay any state income tax. That would seem to be a marketing tool to attract business, not a reason to leave.

* Meanwhile, speaking of taxes, I told subscribers about this deal on Friday morning…

House Democrats on Sunday offered a scaled-back, $250 million-a-year, tax-break package designed to keep Chicago’s two financial exchanges and Sears Holdings Corp. from moving out of Illinois.

The package would provide approximately $100 million in combined tax relief annually for CME Group Inc., which owns the Board of Trade and the Chicago Mercantile Exchange; and Sears Holdings Corp. It also proposes new tax credits for Chicago’s theater scene.

The 220-page amendment filed Sunday by Rep. John Bradley (D-Marion) has been tweaked so there will be a continuing source of revenue unlike earlier versions where taxpayers eventually would have been on the hook.

“The biggest change is we can now actually pay for this,” Bradley told the Chicago Sun-Times.

* The funding mechanism…

The cost would be completely offset by a resurgence in state corporate income tax receipts that is expected with the expiration of a [federal] tax break that allows businesses to accelerate their deductions for capital investments through 2012, Bradley said.

* Details…

The new package, like the earlier one, would reinstate companies’ abilities to use past net operating losses to offset corporate income tax liabilities, but only up to $100,000 a year. That tax break has been temporarily suspended to help ease the state’s budget crisis.

The estate tax deduction would rise from $2 million to $3.5 million over two years, rather than to $5 million, as had been proposed earlier.

The earned income tax credit for low- and middle-income families would rise from 5 percent to about 7.5 percent, rather than the 15 percent put forward earlier.

Personal income tax exemptions would be adjusted upward for inflation in fiscal 2013 only, but an earlier proposal to index the exemptions to inflation longer-term was dropped, Bradley said.

* But, there are problems…

Leaders of Community Unit District 300 in Carpentersville have come out strong against the new plan to give Sears Holdings Corp. tax breaks, saying it goes against a tentative agreement reached two weeks ago.

“The rug has once again been pulled out from under 21,000 students at the last minute,” Superintendent Michael Bregy said in a statement late Sunday night. “We were so close to feeling that democracy still had a home in Illinois, and now we’re back to square one.”

How that will play out in Springfield will become clear this afternoon, when a House committee is scheduled to have the first public hearing on the new proposal.

* And the chief sponsor of the underlying legislation is, as always, pessimistic and unenthusiastic…

The chief sponsor of the measure, House Majority Leader Barbara Flynn Currie, D-Chicago, told me on Sunday that she doesn’t yet know what’s in the deal and cautioned that it still may be too fat for the cash-strapped state.

“It sounds somewhat stripped down, but I don’t know how much stripped down,” she said. “I think that (the bill as first proposed) is a little top-heavy.”

“A lot of pressure” is coming from Mayor Rahm Emanuel and Gov. Pat Quinn to save the exchanges, Ms. Currie said. If the Legislature goes along, it “makes sense” to also help working people with a companion increase in the state’s earned-income tax credit, rather than just enacting “corporate welfare.”

The deal — if there is one — will be filed as an amendment shortly before the committee’s scheduled 1 p.m. meeting, Ms. Currie said. Asked if the votes are there for the House and the Senate to pass something when they convene for a one-day session Tuesday, she replied, “I don’t know.”

The full legislation is here.

21 Comments

|

We’ve seen this problem before

Monday, Nov 28, 2011 - Posted by Rich Miller

* My Sun-Times column last Friday was about the gaming bill’s prospects. I’ve essentially written this same column a few times in the past, whenever a gaming bill appeared to be floundering due to a lack of support by all the leaders. Still, it’s worth the reminder…

The last two decades give us a pretty simple Illinois history lesson: Unless all four state legislative leaders and the governor are pulling hard in the same direction, no gambling expansion bill can become law.

The last significant bill passed a few months after Gov. Pat Quinn was sworn into office. That proposal got rid of the illegal and unregulated video poker machines in taverns, truck stops and fraternal organizations such as Veterans of Foreign Wars posts and replaced them with a new system controlled by the state.

The unprecedented expansion was designed to help fund Illinois’ massive infrastructure program and was backed by all the biggest players, including the governor, the House speaker, the Senate president and both Republican minority leaders.

Prior to that, former Gov. George Ryan was able to pass a gaming bill that moved a long-dormant casino from near Galena to Rosemont. The move looked simple on paper, but the intricacies of all the deals that had to be cut with existing casino owners, Chicago’s mayor and racetrack owners were mind-boggling.

The other casino owners did everything they could to protect their monopolies, and the track owners, after years of decline, wanted a piece of the pie. But even Ryan, a master of the legislative process, couldn’t pass the big plan he really wanted, which would’ve allowed riverboat casinos in Cook County.

Three gambling expansion plans died under Gov. Rod Blagojevich, and the same fate befell a huge expansion proposal under Gov. Jim Edgar. The common denominator was the lack of unanimous support by the five biggies.

So, it’s really no surprise that the current gaming proposal is stuck in the mud. That bill would give Chicago a casino, plus one each in the Southland, Lake County, Rockford and Danville, along with allowing the racetracks to offer slot machines.

Back in early 2010, Quinn seemed to be leaning in favor of slots at the tracks, or “racinos,” or at least that’s what he is reported to have indicated in a couple of private meetings. But now, Quinn is totally against the idea.

Some say it’s because he received hundreds of thousands of dollars for his campaign last year from two prominent Illinois gaming families — the Pritzkers (who own a big chunk of the Elgin casino) and the Bluhms (whose patriarch, Neil Bluhm, owns the new Des Plaines casino).

Frankly, it doesn’t matter why Quinn opposes racinos or the rest of the proposed legislation. Take him at his word that he believes the expansion plan is just too top-heavy. The only thing that matters is that Quinn opposes it.

The General Assembly tried to go around the governor during the fall veto session, but the revised bill got fewer votes in the House than it did during the spring session.

Some members were absent, another had resigned and a couple of Republicans flipped their votes because they were angry about another bill to give Chicago authority to install speed-enforcement cameras.

But, again, it doesn’t matter why the bill fell so far short. What matters is that Quinn isn’t on board. It can’t become law without him.

The governor took himself out of the legislative game this year with more stupid moves than I have space to recount. His job approval rating among Illinois voters is somewhere around 30 percent. His approval rating in the General Assembly is far lower than that.

But while Quinn has shown all year that he can’t pass a bill to save his life, he still has that veto pen. As long as he does, there’s just no getting around him on a gambling bill.

* Meanwhile, I looked through a new gaming expansion report that the governor’s office is touting. Read the full report by clicking here. The study claims that Illinois would collect only about $160 million in new gaming taxes from the proposed casino expansion.

Most of the media coverage appears based on the study’s summary, but the study itself has some flaws. For instance, the Chicago casino’s “draw” is projected to be limited to almost only the city, and conventioneers and tourists are not fully incorporated into the projections.

The summary also underplays the $500 million in license fees Illinois would receive from the expansion, and an estimated $1.2 billion via a special “reconciliation fee” four years from enactment. And, according to the study, admissions at casinos and racinos would increase 137 percent and gaming revenues would rise by 110 percent.

* Related…

* Sneed: A racetrack deal?

* New gambling plan pushed before last one in effect

* Editorial: Put video gaming into place before more expansion

* Quinn’s office: Gambling bill not as lucrative as promised

* IL gov report doubts hefty gambling revenues

* Quinn report says ‘racinos’ would cut state’s gambling income

* Pulse: Gaming back in Springfield again

* Warren: The Casino Roadblock

2 Comments

|

The pension dilemma

Monday, Nov 28, 2011 - Posted by Rich Miller

* My weekly syndicated newspaper column is about the pension problems…

You may have read the stories about how next year’s mandatory state pension payment will rise by a whopping one billion dollars.

The new numbers show the state’s total pension payment, with debt service, will be over $7.4 billion next fiscal year. This year’s pension payment was originally set at $6.4 billion back in March, but is now $6.5 billion.

Not including federal money, the state budget is around $30 billion. So one out of every four state tax dollars spent next year will go to the pension funds, and every last penny from January’s “temporary” state income tax increase will be used for that pension payment next year.

Add an expected $450 million increase for Medicaid costs, plus higher costs for state employee and retiree healthcare and other natural programmatic growth, and the state could be looking at yet another major fiscal crisis next year - not to mention that last May the state pushed over a billion dollars in Medicaid payments into next year in order to “balance” this year’s budget.

Gov. Pat Quinn’s budget office expects state revenues to grow by a billion dollars next fiscal year. The amount of the increased pension payment alone will eat up all of it. There’s no doubt that, without some immediate action, more bigtime budget cuts are on the horizon.

The state’s certified pension payment amount can rise for various reasons. The largest increase this time came from the State University Retirement System, which factored in lower future payroll growth, the recently passed two-tiered pension system for new employees and longer life expectancy.

So, obviously, we need reform, right? Make employees pay more of the cost and force the rest of them into “optional” 401(k) programs, even though it’s pretty obvious that the Illinois Constitution forbids a solution like that.

Well, a bill to do just that is sitting in the House waiting on a floor vote. But the proposal, crafted by the Civic Committee of the Commercial Club of Chicago, would also jack up the state’s annual pension payment next fiscal year by more than a billion dollars from where it is right now.

Yes, you read that right. If the Illinois General Assembly does nothing, pension costs will rise a billion dollars next year. If legislators approve the much-touted reform bill, pension costs will rise a billion dollars next year.

The pension reform bill is designed to ease pension payment increases down the road. But in the short term, at least, costs will actually rise at a higher rate, depriving the rest of the budget of badly needed funds.

Most of the money owed next fiscal year, like every year, is due to a decades-long practice of not paying or grossly underfunding pension obligations, plus paying off loans that were taken out so the state could skip some more pension payments.

This underfunding problem is as old as the pension systems themselves. Way back in 1950, for example, the Teachers’ Retirement System had what’s called an “unfunded liability” of 77 percent. Yet, the system is still taking in lots more than it’s paying out and no teacher has ever missed a pension check.

The unfunded liability is the amount the system will owe to every potential retiree over the next 30 years. A state law passed in the 1990s put Illinois on track to reach a goal of 90 percent funding for all the pension systems by 2045. The ramp started slow, but then shot straight up over the past several years. The state’s total annual pension payment has doubled in just the past three years because it’s tied to that 90 percent goal.

Asked whether the governor had given any thought to adjusting the “ramp” and lowering the 90 percent target, a spokesperson said the current law remains the administration’s goal. However, she added, “If legislators want to have discussions about that, they can bring it to the table, but we haven’t had serious discussions about that.”

It may be time to rethink this 90 percent solution. The state definitely needs to have enough cash to make sure checks are cut, plus a cushion. But if the Constitution stops Illinois from changing employee benefits, then maybe we can have a discussion about setting a less lofty end goal.

60 Comments

|

|

Comments Off

|

*** All-Day ScribbleLive News Updates ***

Monday, Nov 28, 2011 - Posted by Rich Miller

* I’ll open a separate ScribbleLive thread later today for session updates. This one will be for all news updates. BlackBerry users click here, iPad and iPhone users remember to use the “two-finger” scrolling method. Enjoy…

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|