Fun with numbers

Wednesday, Jan 11, 2012 - Posted by Rich Miller

* The Tribune editorialized again on pension reform today and noted this factoid in the process…

The sorry result: when it sells these bonds, Illinois may face borrowing costs more than four times as high as the average it has paid over the last 10 years, according to Bloomberg.

The Trib does go on to explain that Illinois “is expected to pay 1.82 percentage points more than what top-rated states pay for comparable bonds, Bloomberg said.” But what does this “four times as high” thing mean?

* The answer is in the Bloomberg story…

Illinois state and local general-obligation bonds yielded 182 basis points more than top-rated debt yesterday, according to data compiled by Bloomberg. That’s more than four times the 10-year average of 43 basis points and about triple the 66 points over five years. A basis point is 0.01 percentage point.

So, when compared to AAA ratings, the extra amount Illinois has paid will rise from .43 percentage points above AAA ten years ago to an “expected” 1.82 percentage points above AAA this month. But nobody really knows for sure because these are competitively bid. Nine states had Moody’s highest rating in 2010.

* Back to that same Bloomberg story…

Illinois ended last fiscal year with a $6 billion gap even after the largest tax increase in its history.

Actually, no. Illinois had about that much in long overdue bills, but the structural deficit wasn’t nearly that high.

* Meanwhile, Gov. Pat Quinn pointed out again yesterday that over half the state’s pension costs were for local school districts. He’d like to reduce that amount. House GOP Leader Tom Cross counters…

Cross warned that shifting costs to school districts and universities alone won’t solve the problem.

“That’s not reform,” Cross said. “It’ll result in perhaps a local property tax increase. It’s a different way to pay for it,” Cross said.

But cost-shifting could be an element of any reform package, he said.

“The school of thought would be that it gives school districts a little skin in the game … they will have to analyze what they do for pay raises, both during and at the end of (teachers’) careers,” Cross said.

The very real constitutional problems with pension reform means that cost-shifting will likely be attempted. But you can expect school districts and teachers’ unions to scream bloody murder if this is tried. It won’t be easy, either.

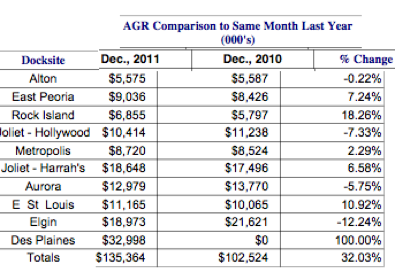

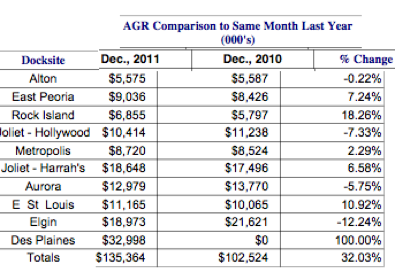

* On to gaming. From the Illinois Gaming Board’s December revenue report…

It’s not too difficult to see why they fight so hard against competition in the legislative arena. Des Plaines has had a huge impact on the Elgin casino. [Fixed chart. Previously posted chart was the wrong one.]

…Adding… A brief roundup…

* Officials report drop in Chicago-area tollway usage: Illinois State Toll Highway Authority officials say the number of cars using the state’s toll roads dipped by 4.5 percent since fees for users nearly doubled on Jan. 1. Spokeswoman Wendy Abrams says the decrease was not as great as the 5.9 percent drop forecast by the agency’s engineers. Despite the expected decrease in auto traffic, tollway officials say they expect a 41.9 percent increase in revenue in 2012. Abrams says during the first week, revenue increased 45.7 percent.

* Quinn Calls for Pension Reform

* Quinn signs earned-income tax credit bill

* Report: Illinois hospitals’ charity care growing

* Funding squabble could kill coal-to-gas plant in IL

- Cassiopeia - Wednesday, Jan 11, 12 @ 10:48 am:

The suggestion that teacher’s pensions be shifted from the state to the local school districts determining the hiring and salaries of the to-be-retired teachers is one of those rare occasions when Quinn is making sense.

If it raises local property taxes then so be it. They are THEIR teachers that are retired.

- RMWStanford - Wednesday, Jan 11, 12 @ 10:56 am:

of course who wants to compete when you keep the market divide among yourseleves.

- wordslinger - Wednesday, Jan 11, 12 @ 10:59 am:

I’m surprised that Elgin still tops Des Plaines in revenue. Rivers has been doing big-time advertising, and it’s the shiny new casino in the market.

I wonder what accounts for the nice bump at Aurora, and the big drop at Metropolis, too.

- MeAgain - Wednesday, Jan 11, 12 @ 10:59 am:

Throw out Des Plaines on the chart and you can put a minus on that

16.% . Your right fun with numbers!

- Rich Miller - Wednesday, Jan 11, 12 @ 11:01 am:

===I’m surprised that Elgin still tops Des Plaines in revenue.===

Des Plaines was only in business half a year.

- CircularFiringSquad - Wednesday, Jan 11, 12 @ 11:03 am:

Keep in mind those AGR #s are MILLIONS so let’s not start a fill the boot campaign

BTW if we remember correctly the boats were authorized to have 1,500 spots each and the totals on the charts suggest they about 2000

light….hmmm

- Mary - Wednesday, Jan 11, 12 @ 11:06 am:

Cost shifting is the only way to deal with this. Bring the problem home and make it impact local citizens. I’m with Pat on this one.

There’s going to be a big rift between state workers(who deserve statewide support for their salaries/pensions) and local teachers(who make contracts with local boards which are used to state-wide support for those very generous deals).

- The Elderly Man You Used to Love - Wednesday, Jan 11, 12 @ 11:07 am:

I don’t quite understand why we keep trying to squeeze “pension reform” through the narrow door of the constitution. The framers of the constitution gave us the power to amend it. Of course, people always shoot that down as being “too controversial.” Well, what do you think SB 512 is, a walk in the park? Put this on the ballot, let the voters weigh in, achieve a mandate for reform, then come back and pass 512 or whatever else the legislature desires.

- wordslinger - Wednesday, Jan 11, 12 @ 11:09 am:

My mistake, I thought it was a monthly report, not YTD.

- Fair Share - Wednesday, Jan 11, 12 @ 11:12 am:

Horray for cost shifting. It will raise home values in Chicago (which already pays for its own teacher’s pensions) when all other communities pair their fare share.

- Been There - Wednesday, Jan 11, 12 @ 11:16 am:

Rich, FYI, you are using the chart that shows just YTD revenues from table games. That doesn’t show the correct picture. You should use the chart on page 3.

- PublicServant - Wednesday, Jan 11, 12 @ 11:23 am:

I’m thinking while cost-shifting may appeal to a lot of people, the issue would be shifting the debt from a sovreign government that can’t declare bankruptcy to a governmental unit that can.

- Left Out - Wednesday, Jan 11, 12 @ 11:25 am:

I would ask, is cost shifting for the funding, including of pension funding, of schools a real solution for any problem? As a tax payer is funding schools, including the pensions paid to teachers, by a state tax any different than paying for it by a local tax in the end? Is it not just taking it out of a different pocket for most people (taxpayers)?

- Rich Miller - Wednesday, Jan 11, 12 @ 11:26 am:

Thanks, BT. Fixed. Oops.

- Rich Miller - Wednesday, Jan 11, 12 @ 11:26 am:

===the issue would be shifting the debt from a sovreign government that can’t declare bankruptcy to a governmental unit that can.===

IL local governments aren’t allowed to declare bankruptcy. Courts just ruled again on this not long ago.

- Downstate Illinois - Wednesday, Jan 11, 12 @ 11:27 am:

Part of Metropolis’ one-time problem was the Ohio River flood this year. Their long-term problem is the smoking ban. Their new problem on the horizon will be the new casino in Cape Girardeau, Mo. It’s expected to pull from Southern Illinois as well.

- Been There - Wednesday, Jan 11, 12 @ 11:31 am:

===the issue would be shifting the debt===

I would think the debt would stay with the state but where they get the revenues to fund it would go back to the local level. And I think that is what should happen.

While this isn’t anywhere nearly egregious as having no say over what level the labor guys were being paid and having that be the base for their pensions, the state should still not be in a position where they are on the hook for the pension but did not have a say in what the base salary was.

- Been There - Wednesday, Jan 11, 12 @ 11:35 am:

Ironically, many of the republicans have been screaming to solve the pension problem by cutting jobs and waste. They could cut the entire state payroll and we would still have a huge problem because of the teachers pensions. But I doubt any of the screamers want to see cuts at their local schools.

- walkinfool - Wednesday, Jan 11, 12 @ 11:37 am:

So we won’t actually pay “borrowing costs more than four times as much” for Illinois debt; the pricing gap between us and the best rated states has increased, (not a good thing).

But the false Tribune statement is so much more fun to complain about.

- Deep South - Wednesday, Jan 11, 12 @ 11:39 am:

In fact, the Metropolic casino was closed for more than a month last spring due to heavy flooding along the Ohio River.

- obamas puppy - Wednesday, Jan 11, 12 @ 11:42 am:

Gotta love how the Trib took from Quinns comments that he is committed to addressing current employees benefits. That wet dream they must be having on this issue must be a good one.

- mark walker - Wednesday, Jan 11, 12 @ 11:42 am:

walkinfool above was me. Sorry.

And I meant “the false Trib statement is so much more fun [for them] to complain about”.

- Bluefish - Wednesday, Jan 11, 12 @ 11:44 am:

I can understand passing the cost of the actual pension on to the school districts but who picks up TRS’s massive unfunded liability that the state has run up?

- Dale - Wednesday, Jan 11, 12 @ 11:54 am:

There was also a great editorial in today’s Tribune regarding Cook County and ICE.

- Irish - Wednesday, Jan 11, 12 @ 12:01 pm:

And the folks in Springfield wonder why they are held in such contempt. They are paid full time wages for a part time job that they are incapable of doing. Once again they can spend and do what they want to preserve their power and wealth and then they look to someone else to bail them out.

Instead of taking reponsibility for the fiscal mess and maybe taking some cuts themselves in their benefits and in the handouts and programs they create to stay in office; they want the employees and other government entities to pay for their mistakes. Not enough money for pension payments because of the State nonpayment? Make the employee pay more or let the local governments make up the difference because we were fiscally irresponsible.

Instead of moratoriums on pension payments lets take a couple years moratorium on grants to everyone to get re-elected. If the Governor has the right to do what he wants with tax money in the interest of the state; eliminate raises and steps, sweep dedicated funds, why can’t he stop handing out grant money for the same reason?

The Governor handed out many millions this year to local communitities to spruce up and make infrastructure repairs to their parks, yet we have buildings in the State parks that are falling apart for lack of money. Does that even seem right?

- anonymice - Wednesday, Jan 11, 12 @ 12:03 pm:

==I don’t quite understand why we keep trying to squeeze “pension reform” through the narrow door of the constitution. The framers of the constitution gave us the power to amend it.==

The federal constitution prohibits states from enacting laws impairing their contractual obligations, which would prohibit the State from using a constitutional amendment to enact reform whenever the existing constitutional declaration that retirees have contractual rights to their benefits would prohibit the same reform.

- mokenavince - Wednesday, Jan 11, 12 @ 12:04 pm:

This 1.82 mod on our bonds is a real killer, if we

don’t address our pension crisis soon we are doomed. Other states will kick our butts if we don’t remedy this soon.I hope that the boys in Springfield get serious about this.But I’m sure they will just kick it down the road.Take a look at our leaders, will any of them try to fix it?

I truly doubt it.As my Cub friends say maybe next year.

- mokenavince - Wednesday, Jan 11, 12 @ 12:06 pm:

Irish is 100% correct.

- titan - Wednesday, Jan 11, 12 @ 12:07 pm:

School Districts agreeing to pay the “teachers’ share” wopuld still go on (and it does lower the amount of the ultimate pensions paid.

It might, however, further the disparity between wealthy districts (generally, upper income, very white communities) and poorer ones (often urban, high minority concentration communities)

- Cincinnatus - Wednesday, Jan 11, 12 @ 12:09 pm:

The way the current pension system is running, there is a disconnect between the local residents and the people paying the pensions, not necessarily the same group of people. This does much to explain why pension costs are such a large state burden, local school boards are negotiating a benefit that, “someone else” is paying for. Moral hazard in my opinion.

Of course, I would expect that if pension funding is no longer part of a state responsibility, that money would be sent back to the district, and the associated portion of the taxes eliminated. (I’m currently oxygen deprived…)

- PublicServant - Wednesday, Jan 11, 12 @ 12:09 pm:

Has Steve Schnorf been appointed to the Pension Panel yet?

- Louie - Wednesday, Jan 11, 12 @ 12:18 pm:

Teachers and public pensions are too high and unsustainable. We will all end up paying higher taxes for pensions that generally are above levels in the private sector.

- Confused - Wednesday, Jan 11, 12 @ 12:53 pm:

Funny how the press uses AAA credits as a comparison to IL when there is only 1 or 2 state that actually hold that rating. Investors use these stories to demand more interest for their investments…remember Moody’s gets paid by investors too.

Also it forgets to mention that we are in a historically low interest rate environment so the State is paying way less than 10 years ago.

- reformer - Wednesday, Jan 11, 12 @ 1:08 pm:

Cost shifting of teacher pensions would require a huge property tax hike.

The least popular tax, the property tax is already higher in the Land of Lincoln than in most states. It’s also regressive.

Illinois also ranks last in the percent of funding for education that comes from the state. If this expensive new mandate were imposed on the districts, they’d be in real trouble.

In short, it’s a bad idea.

- Anonymous - Wednesday, Jan 11, 12 @ 1:18 pm:

cost-shifting will likely be attempted. But you can expect school districts and teachers’ unions to scream

I don’t think this is entirely accurate and I really wish the doom-saying from the pundits would stop. I think everyone realizes the funding problem is big enough they need to be part of the solution. If the state finally commits to paying its share, I don’t think it is far-fetched to imagine other employers like school districts and universities agreeing to contribute something as well.

- Rich Miller - Wednesday, Jan 11, 12 @ 1:23 pm:

===I don’t think it is far-fetched to imagine other employers like school districts and universities agreeing to contribute something as well. ===

Have you ever been to the Statehouse? Nobody wants to pay anything more than they have to. Not a dime.

- Peter - Wednesday, Jan 11, 12 @ 1:28 pm:

“It’s not too difficult to see why they fight so hard against competition in the legislative arena. Des Plaines has had a huge impact on the Elgin casino”

This is what happens when the state is granted the power to pick winners and losers.

- Anonymous - Wednesday, Jan 11, 12 @ 1:57 pm:

Quinn is right on this issue. Putting the burden on the source is the right move.

- Anonymous 1:18 p.m. - Wednesday, Jan 11, 12 @ 2:13 pm:

===I don’t think it is far-fetched to imagine other employers like school districts and universities agreeing to contribute something as well. ===

Have you ever been to the Statehouse? Nobody wants to pay anything more than they have to. Not a dime.

Many, many times. So I guess we will just see which one of us is right. I happen to think the school districts and the universities are civic-minded and want to fix the pension funding problem in a way that is real and fair. Same for the unions. The CEOs maybe not so much.

- Robert - Wednesday, Jan 11, 12 @ 2:50 pm:

Regarding shifting the burden to school districts, I agree with Quinn here as well.

The problem — or perhaps the ultimate unfortunate solution — is that if a school district can’t meet pension obligations, it may eventually need to declare bankrupcy to get out of those obligations.

- Left Out - Wednesday, Jan 11, 12 @ 2:55 pm:

I can understand why fewer people are using the Illinois Tollway now that there has been yet another large toll increase. I have stopped using it myself. I will continue to do so until the promise to make the roads free once the bonds used to build them were paid off takes place. I think that former Gov. Bill Stratton would be very unhappy over the toll increases and the fact that the promise has not been kept.

- Rich Miller - Wednesday, Jan 11, 12 @ 2:56 pm:

===I will continue to do so until the promise to make the roads free once the bonds used to build them were paid off takes place.===

I see long commutes for the rest of your life.

- reformer - Wednesday, Jan 11, 12 @ 3:11 pm:

Anon 1:18

It’s not a matter of civic-mindedness. State aid declining. There are property tax caps in the Chicago area. There is growing resistance to tax referendums. Where do you think the school districts would come up with extra tens of $millions to contribute to the pensions?

- TCB - Wednesday, Jan 11, 12 @ 4:00 pm:

=This is really deceiving. I’m really sick of the media latching on to these quotes that have high shock value because most citizens don’t understand.

Listen, we all know Illinois has been downgraded 3-4 times in as many years & we all know that the cost of these downgrades are significant. However, comparing the growth of the basis point spread of Illinois paper to that of top-rated paper is just silly. Isn’t it somewhat likely that in this day & age of downgrades, that the value of top-rated paper is actually artificially inflated, thus making the spread large than it has in the past?

Obviously the State’s rating is going in the wrong direction, but Illinois will not be paying $4 on the $1 it paid 10 years ago, and it won’t even be paying 4 times the average cost of borrowing for the last 10 years. Hell, I’m no expert, but it’s actually fairly likely that the State will be paying LESS than or equal to its average cost of borrowing over the last 10 years due to the extremely low rates right now……why can’t the media just allow Illinois to take advantage of low rates & fund a large capital investment in infrastructure of our schools, roads, bridges, and rail system? Reporting like this actually undermines what the state is trying to do. Hopefully these negative headlines don’t contribute to driving up the state’s cost of borrowing, that would truly be a shame.=

Don’t mind me, I’ll just be over here patting myself on the back.

- Yellow Dog Democrat - Wednesday, Jan 11, 12 @ 4:26 pm:

Factoid: teacher and administrator salaries — and thus pension costs — are higher in the suburban GOP districts.

What Illinois ought to do is cap what it pays for pensions tell school districts the rest is on them.

The first….$80k?

- steve schnorf - Wednesday, Jan 11, 12 @ 5:48 pm:

I have assumed from the discussions I have heard that only the normal costs, not the debt, would be shifted. I have also assumed that the current normal cost would be funded by the state into the districts’ base.

- Been There - Wednesday, Jan 11, 12 @ 7:59 pm:

===Where do you think the school districts would come up with extra tens of $millions to contribute to the pensions?===

Maybe this is a place to make some of those cuts that the repubs have been screaming about. Or get real about their rhetoric.