* In the end, despite the goofy “Mike Madigan is to blame for everything, including my ouster” stuff, the gay marriage flap actually saved Pat Brady’s hide, at least for now…

The Illinois Republican Party’s central committee backed off an attempt to fire party chairman Pat Brady on Saturday, amid concern that ousting him because of his support for gay marriage could damage GOP efforts to appeal to more moderate voters. […]

Committeemen had scheduled a Saturday meeting in the Chicago suburb of Tinley Park to consider firing him, but it was canceled late Friday, partly because it became clear there weren’t enough votes to remove Brady.

State Sen. Dave Syverson, a committeeman and party treasurer, said the vote would have been close, but members who had concerns about Brady separate from his gay marriage stance “didn’t want to be thrown in with those” concerned about it.

* Oberweis was left with his talking points…

State Sen. Jim Oberweis (R-Sugar Grove) said the issue is Brady’s fitness for the post and loyalty to the party platform.

“It’s got nothing to do with gay marriage,” Oberweis said of the effort to boot Brady. “It could have been ObamaCare.

Yeah, OK. Nothing to do with gay marriage. Right.

* Some of the party’s top dogs worked the phones for the chairman…

U.S. Senator Mark Kirk — the Highland Park Republican who two months ago returned to Congress after suffering a stroke — personally placed calls to committeemen Friday, urging them to change their minds. House Republican Leader Tom Cross, of Oswego, did the same.

“There’s some people on the committee that don’t like him, but Pat Brady has a lot of friends from Springfield to Washington, D.C.,” said State Rep. Jim Durkin, of Western Springs, who was planning to represent Brady at the meeting. “We will defend him as the day is long.”

* This was a nicely planted piece…

The Illinois GOP committeemen calling for Chairman Pat Brady’s ouster say they are doing so because his support for same-sex marriage directly contradicts the party platform, its set of governing principles.

But a look at the party’s 14-page 2012 platform finds some of those committeemen might have also acted in violation of those GOP standards.

Committeemen have taken actions or positions in violation of the party platform on gambling, political contributions and more. […]

Oberweis himself, during a 2002 run for U.S. Senate, stated a position on abortion that differed from party views, though he has since refined his stance to oppose abortion.

Oddly enough, as of 12:30 this afternoon, Illinois Review has no posts on the Brady topic.

* Related…

* Former Illinois governors warn against firing GOP chair over gay marriage flap - Republicans Jim Thompson and Jim Edgar urge a ‘big tent’ approach ahead of a possible vote to oust Pat Brady.

40 Comments

|

The perils of an unconstitutional solution

Monday, Mar 11, 2013 - Posted by Rich Miller

* The IFT’s Dan Montgomery has probably the best argument I’ve seen for avoiding the passage of a pension reform plan that appears unconstitutional…

As reason for their recent downgrade of Illinois’ bond rating, Standard and Poor’s warned that unconstitutional cuts would invite “legal challenges” and cause “several years” of uncertainty. Legislators took an oath of office to support the Constitution, yet many have said the courts should do their jobs for them. Passing an illegal bill to the courts is just passing the buck to taxpayers.

Proponents of the Nekritz-Cross plan are going so far in private as to say the plan probably doesn’t pass constitutional muster, but that the pension funding crisis is so bad that it gives the General Assembly certain latitude, even police-type powers. Even so, that’ll take a while for the courts to sort out.

* My syndicated newspaper column…

Illinois House Speaker Michael Madigan was hoping Thursday to avoid the same dismal results as the previous week when he presented some new, and harsh, pension reform ideas.

The week before, one of his pension proposals received just one vote, his own. None of his other proposals got more than five votes.

That wasn’t supposed to happen. Members of his leadership team thought some of those amendments would get at least a few dozen votes. Oops.

Making matters worse, the House Republicans refused to participate in the process, with not a single member voting up, down or “present” on Madigan’s amendments.

Asked on Wednesday’s “Illinois Lawmakers” television program about the GOP’s refusal to vote, Madigan (D-Chicago) said the Republicans had made a “mistake.”

“They’re elected,” Madigan told host Jak Tichenor. “And their electors tell them to come here and vote. They don’t tell them to come here and not participate.”

The Republicans have said their refusal to vote was in protest over Madigan running so-called “gotcha” amendments that were designed solely to make them look bad and provide fodder for negative advertising campaigns.

But in reality, the GOP is going to get zinged no matter what. Refusing to vote on a series of controversial bills easily could be turned into a nasty ad program.

Last week, however, party discipline cracked a little when two House Republicans broke ranks and voted for a Madigan-sponsored amendment to cap the “pensionable” income of government workers at Social Security’s taxable income cap.

That means no further pension benefits can be earned by a state employee making more than $113,000, or whatever Social Security sets the level at in the future.

Reps. David Harris (R-Arlington Heights) and David McSweeney (R-Barrington Hills) both voted “yes” on the amendment, while all other Republicans refused to vote.

McSweeney also voted “yes” on two other Madigan amendments — freezing cost-of-living raises for 10 years and requiring active employees to chip in an extra 4 percent of their pay for their pensions.

Like the week before, when Madigan introduced similarly extreme measures, those two amendments got just a few votes.

A more comprehensive pension reform plan sponsored by state Rep. Elaine Nekritz (D-Northbrook) and House Minority Leader Tom Cross (R-Oswego) is expected to move through a committee this week.

But don’t expect a floor vote any time soon. Cross’ people said publicly that they have 30 votes for the bill, but some insiders are saying otherwise, with one claiming that the number is more like 20. The Democrats may not even have that many.

While the Democrats have a super-majority in the House, they aren’t closer to passing a major pension reform bill now than in the past. Most Democratic legislators by nature just don’t like the idea of forcing cuts on retirees or making them pay more for health insurance or slapping workers with higher pension payments.

And to see how this pension reform problem is stacking up, you might want to take a look at last week’s roll call on a bill to allow people convicted of drug-related felonies to get cash from the Temporary Assistance for Needy Families program.

The bill received 36 “yes” votes, with 80 voting “no.” The roll call provides a pretty good road map for where the real liberals are in the House. The “yes” votes were generally the folks who would be far less willing to cut retiree pensions and to favor alternative solutions such as tax increases and placing the burden on the affluent.

So, doing something like capping pensionable income at $113,000 per year makes sense to most of those more liberal Democrats. Just two members who voted for the TANF drug felony bill voted against the income cap.

Rep. Naomi Jakobsson (D-Urbana) was one of them, for obvious reasons. She has lots of highly paid University of Illinois employees in her district.

“My sense of the attitude of the members of the Legislature is that they’re not yet ready to take this difficult step (voting for pension reform),” Madigan said on Tichenor’s program, adding that he’s holding the pension votes to “better educate the members of the House and the Senate.”

The bottom line is that it’s going to be a while before legislators are “educated” enough to get to a resolution of this very thorny pension issue.

Subscribers know more about the reasoning that AFSCME could be pushed back to the bargaining table and about the Senate’s plans.

* Rep. McSweeney, by the way, explained his vote for Madigan’s amendments in a recent op-ed…

Speaker of the House Michael Madigan finally has started to address pension reform on the House floor. He has designed the process to try to force very tough votes by members. On Thursday, I voted for all three measures that would limit future cost-of-living adjustments, cap the pensionable salary amount, and increase employee contributions.

The stakes are high on passing pension reform. Unless we act immediately, education will continue to be cut and pressure will build to increase taxes. I will strongly oppose any future tax increases. A tax increase would hurt families and kill jobs.

* Related…

* Legal opinion calls pension plan into question - Opinion says plan could be unconstitutional if it covers retired teachers

* Editorial: Quinn Budget a Nonstarter: Gov. Pat Quinn’s budget plan, offered Wednesday, has been met downstate with a resounding thud and even casual disdain or tepid support in Quinn’s hometown of Chicago

* VIDEO: Reactions to Gov Quinn’s Budget Address - We talk with Sen Jim Oberweis (R) about his reaction to the Governor’s FY 2014 Budget Address. The we talk with Joe McCoy Illinois Municipal League — about the impact the Governor’s proposed cuts will have on cities.

80 Comments

|

Question of the day

Monday, Mar 11, 2013 - Posted by Rich Miller

* Lynn Sweet…

Illinois Attorney General Lisa Madigan, I’m told, now is very close to deciding to run for governor in 2014, where she would face Illinois Gov. Pat Quinn and possibly former White House Chief of Staff/Commerce Secretary Bill Daley in a Democratic primary.

Madigan has a major fund-raiser set for March 18 at Wildfire, 159 W. Erie, with the price tiers running from $1,000 to $5,000. The theme is to mark her 10 years as Illinois’ attorney general — and all her accomplishments.

* Greg Hinz says Daley is hanging back for now…

Sources close to Mr. Daley say he understands that his probability of winning the March 2014 Democratic primary would be pretty low in a three-way race with Ms. Madigan and incumbent Gov. Pat Quinn, who has said he’ll seek a new term.

As a result, Mr. Daley has told friends, it’s highly unlikely he will run if she does.

* The Question: Do you think Lisa Madigan will run for governor? Take the poll and then explain your answer in comments, please.

web survey

80 Comments

|

A familiar story

Monday, Mar 11, 2013 - Posted by Rich Miller

* The Tribune ran a story not long ago about a $90 million bond sold by the Field Museum that it didn’t have enough resources to service. Some of the juicier parts…

Although the bonds, issued in September 2002, were rated as investment grade, there were signs that the Field might not be ready to take on that much debt. Less than a year before, museum staff assessed the Field’s bond capacity at only $50 million, according to a letter submitted to the state. […]

The loan was risky not just in size but in structure. Unlike previous bonds the Field took out, it allowed the museum to make lower interest payments up front and push off bigger ones until later. Meanwhile, no principal was due until the loan matures in 2036.

The bond pushed the museum’s total liability to $200 million — more than the $189 million in assets it had available to pay off debt, according to the Field’s audited financial statements. The Field’s total annual bond debt payment rose from $2.4 million in 2002 to $4.9 million in 2003 It now stands at $7.5 million.

Looks like those crazy no-principal mortgage loans which were all the rage right before the economy collapsed.

Keep in mind that Chicago’s elite financiers have always played a huge role on the Field Museum’s board (and on Bruce Rauner’s campaign, but that’s another story). And those guys appeared to do to the Field what some of them also did to the entire planet.

* Cooking the numbers…

After nine years of deficits, the Field finally started showing an operating surplus in 2009. But the improvement was due mostly to a change in accounting practices rather than a financial turnaround, according to a Tribune analysis of the museum’s financial reports. That year, the museum stopped counting depreciation — wear and tear on the museum’s building and exhibits — as an annual operating expense. […]

Yet the museum pointed out the surplus to its lenders in an August 2012 bond document filed a month before McCarter’s retirement. The filing did not highlight the new accounting method, asserting instead that positive operating results were accomplished through “the continued implementation” of the fiscal stability plan launched in 2010.

* Golden parachutes…

That same year, McCarter announced he would retire and the museum paid him an $874,375 bonus that more than doubled his overall pay from the previous year, according to tax filings.

* Which combined, of course, to force the Field to do things like eat its seed corn…

By 2011, the rating agency Standard & Poor’s had lowered its outlook on the Field’s 2002 bond. Facing the threat of a slip in its credit rating, the museum used money from its endowment to pay down $12 million of its debt — a move that most museums try to avoid because they depend on investment income from endowments to operate.

* And jack up entrance fees and cut the budget…

Lariviere also plans to cut the museum’s budget, which was about $63 million in 2011, by $5 million. He has said $3 million of the cuts could come from what used to be the museum’s century-old science departments, now merged into one.

The Field employs 27 curators, scientists who discover new species and uncover artifacts that illuminate ancient cultures. They help design exhibits but also collect specimens around the world and publish internationally known research. The Field had 37 curators in 2000 but lost 10 and has not replaced them.

Oy.

19 Comments

|

*** UPDATE *** Check this out from the October 25, 2005 edition of the Bond Buyer…

Republican lawmakers yesterday charged Illinois Democratic Gov. Rod Blagojevich’s administration with including misleading information regarding the state’s financial condition in the offering documents for a $300 million general obligation bond deal that sold last month.

The information being disputed was included on page 21 of the competitive transaction’s preliminary official statement under the section, “Fiscal Year 2006 Budget.”

The document informs readers that a reduction in some pension benefits adopted during the most recent legislative session would result in a lowering of the state’s required annual contribution to the underfunded pension systems over the next 40 years. The reforms allowed the state to lower its payment owed to the pension systems in fiscal 2006 by $1.2 billion from an original $2.5 billion.

Citing estimates provided by the independent actuary of the General Assembly’s bipartisan Commission on Government Forecasting and Accountability, the document notes that the combination of reduced benefits and revised contributions would result “in a range of net savings totaling approximately $3 billion over” the 40-year term. The state had pulled the information from a commission report that outlined three fiscal scenarios that could occur as a result of the pension legislation. After seeing the bond documents, the commission’s executive director, Dan Long, late last month sent a memorandum to Democratic and Republican Senate leaders criticizing the content.

“The above statement implies that CGFA’s estimate of the fiscal impact … is a long-term state contribution savings of $3 billion, which we believe is misleading,” Long wrote. “The impact of the three scenarios ranged from a long-term cost of almost $4.7 billion to a long-term savings of $3.1 billion. It is still too early to determine the precise impact of the significant changes to the pension system.”

Republicans, who represent the minority in the Senate, jumped on Long’s statements to criticize the governor as he was poised to address the legislature to promote passage of a program to expand health care coverage to all children living in the state. The General Assembly convened yesterday for its two-week long annual veto session. “Instead of being honest with the taxpayers, legislators, and credit rating agencies, the administration appears to have deliberately tried to mislead everyone about the state’s financial condition,” Sen. Christine Radogno, R-Lemont, said in a statement issued by Senate Republicans, who have forwarded the information to the Securities and Exchange Commission.

Prescient.

[ *** End Of Update *** ]

* Barn door, horses, etc. From an SEC press release…

The Securities and Exchange Commission today charged the State of Illinois with securities fraud for misleading municipal bond investors about the state’s approach to funding its pension obligations.

An SEC investigation revealed that Illinois failed to inform investors about the impact of problems with its pension funding schedule as the state offered and sold more than $2.2 billion worth of municipal bonds from 2005 to early 2009. Illinois failed to disclose that its statutory plan significantly underfunded the state’s pension obligations and increased the risk to its overall financial condition. The state also misled investors about the effect of changes to its statutory plan.

Illinois, which implemented a number of remedial actions and issued corrective disclosures beginning in 2009, agreed to settle the SEC’s charges.

Nice to see that the SEC is so Johnnie on the spot. We could’ve used those insights when Blagojevich was still governor. Four years later, they push for a settlement.

From the governor’s office…

The State of Illinois and the U.S. Securities and Exchange Commission (SEC) entered into a settlement order Monday ending an inquiry into pension disclosures in bond offerings made by the State between 2005 and early 2009. The order acknowledged the proactive steps taken by the State to enhance its pension disclosures and related processes since 2009. The State began these enhancements prior to being contacted by the SEC.

The State believed it to be in its best interests to enter into a settlement with the SEC. The State has cooperated fully with the SEC throughout the inquiry. The State neither admits nor denies the findings in the order, which carries no fines or penalties.

The settlement order describes the long, complicated history of Illinois’ pension-funding issues over the decades. After taking office in early 2009, the Quinn administration began taking steps to proactively address these issues, including forming a Pension Modernization Task Force and providing additional information in its bond offering documents.

In August 2010, the SEC announced it was entering into a cease and desist order with the state of New Jersey concerning its pension disclosures. In response to the SEC’s New Jersey action, the State thought it prudent to proactively hire legal counsel to review Illinois’ pension disclosures. The State subsequently enhanced its pension disclosures in its bond offering documents and made changes to its disclosure practices, including:

· The retention of a single law firm to act as disclosure counsel to provide a consistent, proactive and continuing review of the State’s bond disclosures; and

· The adoption of formal policies and procedures that include review of the State’s pension disclosures by the pension systems themselves.

A month after the New Jersey order was issued, and after the State had hired legal counsel to review its pension disclosures, the State was notified by the SEC that the agency would be examining Illinois’ pension disclosures. The State has disclosed the SEC’s inquiry in all bond offerings since the inquiry began in September, 2010, as widely covered in the press.

From the SEC order…

The State has taken significant steps to correct these process deficiencies and enhance its pension disclosures. Among other things, the State issued enhanced disclosures; retained disclosure counsel; instituted written policies and procedures, disclosure controls, and training programs; and designated a disclosure committee.

* The SEC also harshly criticized the 50-year “ramp” devised by former Gov. Jim Edgar…

Enacted in 1994, the Illinois Pension Funding Act (the “Statutory Funding Plan”) established a pension contribution schedule that was not sufficient to cover both (1) the cost of benefits accrued in the current year and (2) a payment to amortize the plans’ unfunded actuarial liability. This methodology structurally underfunded the State’s pension obligations and backloaded the majority of pension contributions far into the future. The resulting systematic underfunding imposed significant stress on the pension systems and on the State’s ability to meet its competing obligations. […]

Rather than controlling the State’s growing pension burden, the Statutory Funding Plan’s contribution schedule increased the unfunded liability, underfunded the State’s pension obligations, and deferred pension funding. This resulting underfunding of the pension systems (“Structural Underfunding”) enabled the State to shift the burden associated with its pension costs to the future and, as a result, created significant financial stress and risks for the State. […]

The 90 percent funding target allowed the State to amortize the UAAL in a manner that would not eliminate it entirely. By failing to amortize the UAAL completely, the State was able to lower its contributions. However, by assuring that some portion of the UAAL would remain outstanding, it also increased the economic cost of the pensions and delayed the cash outlays necessary to fulfill its pension obligations.

The State’s plan also spread costs over fifty years, in contrast to the thirty-year amortization period adopted by the pension plans of most other states. The longer amortization period extended the amount of time required to pay down the UAAL, reducing the State’s annual statutory contributions while increasing the real cost of the pensions over time.

The State’s phased contributions during the fifteen-year ramp period accelerated the growth of the UAAL during this time period and amplified the burden and risk associated with the State’s plan.

30 Comments

|

The Rauner oppo dump begins

Monday, Mar 11, 2013 - Posted by Rich Miller

* Greg Hinz has a story which shows some dots that may connect potential Republican gubernatorial candidate Bruce Rauner to admitted felon Stu Levine, who helped bring down Bill Cellini, Ed Vrdolyak and Tony Rezko…

In testimony during the 2008 trial of Blagojevich pal Tony Rezko, Mr. Levine and others said Mr. Levine had had a $25,000-a-month contract “consulting” for CompBenefits Corp., an Atlanta-based dental and vision benefits company once known as CompDent. According to its website, CompBenefits at the time of Mr. Levine’s contract principally was owned by four private-equity firms, including GTCR LLC. Mr. Rauner, a founder of GTCR, is the “R” in the acronym.

Mr. Levine said his job was to get work for CompBenefits through whatever means were needed, including payoffs. A 2005 Sun-Times article says the firm then held contracts covering tens of thousands of workers at Chicago Public Schools and with the state.

Mr. Levine testified that he’d paid a bribe to obtain the CPS work, worked with insiders Bill Cellini and Ed Vrdolyak on other deals (both men later were convicted in unrelated federal cases) and plotted with Mr. Rezko to get work with Cook County via Orlando Jones, a key insider who later committed suicide.

Messrs. Levine and Rezko eventually went to prison on other matters, and prosecutors never took any action on CompBenefits. Perhaps that’s because they could not corroborate Mr. Levine’s testimony, or perhaps it’s because some major figures were going to prison anyway. I don’t know. Neither do I know whether Mr. Rauner or GTCR knew the details of what the firm was up to prior to the federal probe.

But I do know that Mr. Rauner, GTCR and Stu Levine had another interaction. That came in 2003, when the board of the Illinois Teachers’ Retirement System—on which Mr. Levine served—first tabled and then approved GTCR’s bid to get a $50 million investment from the giant pension fund.

According to a Sun-Times account, the bid stalled at the board’s February 2003 meeting after Mr. Levine objected but then was zipped through in May, when Mr. Rauner attended the board session. Now-retired TRS Executive Director Jon Bauman corroborates the gist of the newspaper report. He adds that he believes the February flop mostly was because of a bad presentation by GTCR but also says he does not know the particulars of Mr. Levine’s motives.

* From that 2005 Sun-Times story about the federal subpoenas of CompBenefits-related records…

TRS had already given GTCR at least $70 million to invest when GTCR made a new $50 million pitch in February 2003, said TRS executive director Jon Bauman.

GTCR sent only one representative, “which is usually not a good idea [because] you don’t have somebody to help you out if you get in trouble. He got in trouble,” Bauman said.

Levine questioned the representative so aggressively that, rather than approving the deal, the board of trustees decided to table it, Bauman said.

Three months later, in May 2003, three GTCR representatives showed up, including partner Bruce Rauner. This time around, Levine was much more low-key. In fact, Bauman said, he couldn’t recall Levine asking any questions, and Levine and other board members approved the $50 million deal with GTCR.

Herron wouldn’t disclose the timing of Levine’s work for CompBenefits, but Bauman said if that work overlapped with Levine’s TRS service, TRS board members would have wanted to know about it at the time of Levine’s GTCR vote.

The timing is an issue here. If Levine got that CompBenefits gig after the first unsuccessful TRS vote and before the second vote, then there’s a very serious problem. If not, then it’s not as bad. Neither article has that info, and I wasn’t able to find it online.

But stay tuned. There’s more oppo coming.

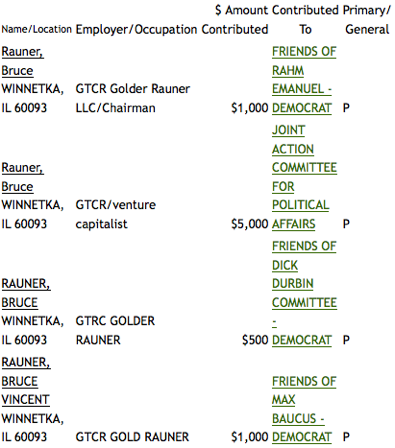

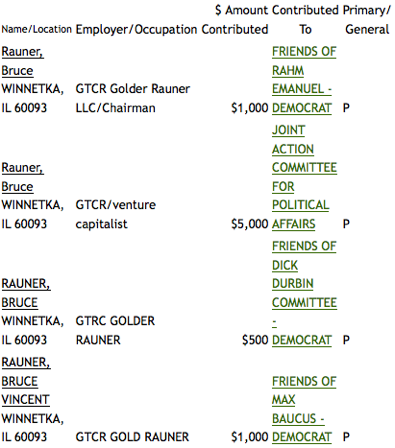

* Illinois Review took a look at Rauner’s 2002 campaign contributions…

Rauner’s state contributions are here.

32 Comments

|

Durbin will run again

Monday, Mar 11, 2013 - Posted by Rich Miller

* The Tribune had the unsurprising scoop…

Dick Durbin, Illinois’ senior U.S. senator and the No. 2 Democrat in the chamber, is telling top Democrats he will seek a fourth term in 2014, sources familiar with his decision said Friday.

Durbin’s re-election bid alleviates any concerns from Democrats nationally and in Illinois that the 68-year-old lawmaker would step down from the seat previously held by his mentor, the late U.S. Sen. Paul Simon. […]

In 2010, Durbin underwent surgery to remove a non-cancerous mass from his stomach.

Durbin easily won re-election in 2008, scoring 68 percent of the vote against little-known Republican physician Steve Sauerberg.

It is questionable whether the GOP will try to recruit a high-profile candidate for a tough race against Durbin in 2014 when Republicans have been placing a greater priority on winning the Illinois governor’s office back from Democrats.

Weeks ago, I told subscribers that Durbin had zero interest in an Obama cabinet position. That decision seemed to point to another run.

* Lynn Sweet…

Durbin is in absolutely no rush to make any official announcement and his core supporters have understood for some time that he will seek re-election, I’m told.

Durbin has held more than 20 fund-raisers since November and as of Dec. 31 had $2,590,707 cash-on-hand in his campaign fund.

Starting in early April, Durbin will step up his political travel, I’m told, speaking around the country for other Democrats and for himself. […]

Durbin has no opponent on the horizon–either for a Democratic primary or a Republican. Illinois Republicans who are looking for statewide races are far more interested so far in running for governor.

25 Comments

|

Today’s quote

Monday, Mar 11, 2013 - Posted by Rich Miller

* This quote comes from 1994, after the House Republicans had won control of the chamber in the national GOP landslide…

Steve Brown, House Speaker Michael Madigan’s spokesman, said at the time: “We’re obviously surprised by the overall outcome. [Republicans] are all out of excuses now. They’ll have to produce.”

Discuss.

25 Comments

|

The old way will always be the best way

Monday, Mar 11, 2013 - Posted by Rich Miller

* Andrew Sullivan highlighted this WaPo WonkBlog post over the weekend, and I thought it was worth sharing. The excerpt is from an interview of Sasha Issenberg, the author of “The Victory Lab: The Secret Science of Winning Campaigns.” Most of the pros here will already know this stuff, but it always helps to repeat it…

Two political scientists at Yale, Donald Green and Alan Gerber, went out and did a field experiment, which was a big deal at the time because political science lagged behind other social sciences in using field experiments to measure cause and effect in elections.

The first experiment was that they created a local GOTV [get out the vote] drive in New Haven and had voters get a reminder from a postcard, a canvasser, or paid callers, and then had a control group, who got nothing. And we learn there that the phone call group had no increase in voting, mail had a small increase, and there was a big boost from the in-person contact. It was hard to get the paper published because they made no theoretical contributions to debates going on in the discipline. It was almost embarrassingly practical. But it was the first time that anyone had developed a method for assessing the effectiveness of anything the campaigns spent money on.

The campaigns went out and did a bunch more of these comparative effectiveness studies, as opposed to mass media, where it’s really hard to isolate voters and implement controls. When you’re measuring turnout and registration rates, it’s very easy to select some people to get your mail. In that case, the dependent variable is whether they voted or registered, which is an easy thing to track. In the last few years it’s moved a lot to the behavioral psychology-informed bent, trying to demonstrate things that have been demonstrated in lab experiments about how to change motivations around voting.

In-person doorstep contact is more effective at mobilizing voters than phone calls. Volunteer phone calls are better than paid phone calls. Voters are able to sense the difference. We know that what people in politics now call “chatty scripts,” where the caller or canvasser is encouraged to have an open-ended back and forth, are much more effective than robotic scripts.

Now there’s been a whole body of work on which types of language are better at getting people to vote. Almost all of them have to do with changing the dynamic around voting. The best messages often don’t have much to do with the candidates or issues but with mobilizing voting and getting people excited for the election. Referring to people as voters has been shown to increase somebody’s likelihood of voting. We have a whole sort of body of research about the contact and the quality of contact that we didn’t 15 years ago.

This is one big reason why Republican candidates in Illinois are often at a disadvantage. They rely too much on robocalls and not nearly enough on in-person contacts. The House Democrats, on the other hand, make sure their candidates walk 40-50 hours a week for months. They have people in the precincts every day, not just bused-in folks for Saturday afternoon blitzes.

* I often tell the story of my paternal Grandmother, a lifelong Democrat. Back in, I think 1959, she met John F. Kennedy at a Teamsters Union event where he put his arm around her, kissed her on the cheek and told my grandfather that he had a beautiful wife. You just couldn’t say a bad word about JFK to her, ever - or a Democrat, for that matter. But Grandma voted for a Republican in a county race years ago because he came to her door and asked for her vote. She had known the Democratic candidate for decades, but he didn’t ask for her vote that year.

There is absolutely no substitute for physically touching voters. And there never will be. Talk all you want about technology. But unless the tech is directly related to helping a physical street canvass, then it’s mostly a waste of money.

And if you can’t touch them, using volunteers to talk with voters is the next best thing. Robocalls are cheap, which is why they’re so over-used. And while they might have an impact at the margins, they’re nowhere near as effective as real people telling real stories about why they are voting for a candidate.

This is one big reason why Joe Walsh was able to ride the Republican wave in 2010 and defeat what many thought was a fairly safe incumbent Democratic congressperson. Walsh had people in the streets. He walked. His people walked. His organization reached out and touched them. He won and blew the establishment’s collective mind. That same year, the Statehouse Democrats held onto their majority by doing the same sort of thing, without the histrionics, of course, but you get the idea.

55 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|