* First, some background from the Champaign News-Gazette…

Terry Cosgrove, who cut his political teeth long ago as a leader of the Gay Illini group on the University of Illinois campus, was the target of some heated rhetoric last week on the floor of the Illinois Senate.

Cosgrove, the president and CEO of the pro-choice Personal PAC political action committee in Chicago, was up for reappointment to his $46,960 a year position on the Illinois Human Rights Commission.

He won reappointment on a 36-30 roll call, with no Republicans supporting the appointment and only two Democrats (southern Illinois senators Gary Forby and William Haine) voting no. All area senators voted no, except Sen. Mike Frerichs, D-Champaign.

But the vote came after Sen. Dan Duffy, R-Barrington, delivered a blistering attack on Cosgrove, calling him “unethical and immoral” and a liar.

“Besides being on the Human Rights Commission, he will not leave the Personal PAC, the PAC that he’s set up and where he’s worked since 1989. So he’s been conducting this unethical and immoral behavior, according to himself and his own testimony, since 1989,” Duffy said. “He is also a highly paid lobbyist and he’s worked as a lobbyist for decades with Personal PAC. As you all know it’s against our ethics code in the state of Illinois to appoint anybody to a board who has been a paid lobbyist. Now Terry Cosgrove will tell you that he’s not actually a paid lobbyist.”

Duffy also said that Cosgrove lists himself as a political independent but has voted in only one Republican primary election in the last 25 years.

* Not mentioned is that Sen. Kirk Dillard voted for Cosgrove in committee. Dillard’s campaign spokesman explained the vote… kinda…

GOP gubernatorial candidate State Senator Kirk Dillard says there was confusion about the qualifications for Human Rights Commission appointees, and that while he voted in committee to approve an pro-abortion activist for the spot, he opposed the nomination on the Senate floor.

“Senator Dillard voted ‘no’ on the floor to Terry Cosgrove … the actual or ‘real’ recorded vote,” Dillard campaign spokesman Wes Blood told Illinois Review. “There was some confusion over qualifications in committee. Sen. Dillard definitely opposes Mr. Cosgrove’s appointment to the Human Rights Committee.”

During the October 15th Executive Appointments hearing, Senator Dillard was the only Republican that joined the Democrats in approving abortion activist Terry Cosgrove for re-assignment to the Human Rights Commission. Cosgrove, who actively raises campaign funds for abortion supporters through Personal PAC, will be paid $46,960 annually for serving on the commission from March 2013 until November 2017.

24 Comments

|

Different ADM tax break proposed

Thursday, Oct 31, 2013 - Posted by Rich Miller

* Sen. Andy Manar has worked out a deal with ADM on its tax break request…

Under the new version, both the 100 headquarters jobs and the 100 tech jobs would have to be created for ADM to get its tax incentives. They would be in Chicago.

Beyond that, the company would have to relocate at least 100 full-time positions from out of state to Illinois — specifically to “an Illinois municipality that is a county seat and has as population” of 50,000 to 100,000: Decatur. And ADM in Decatur would have to hire at least 100 new full-time workers a year for at least five years. Those could be either replacement or net new jobs.

Mr. Manar said his goal is to ensure that jobs now in Decatur do not slowly trickle up to a Chicago headquarters and are, at a minimum, replaced.

The additional Decatur jobs would be eligible for EDGE credits under the bill. Mr. Manar said he does not yet know how much that would get the company, but believes it would be well under the $1.2 million per year for the headquarters jobs since they’d pay less.

Thoughts?

…Adding… Manar press release…

State Senator Andy Manar (D–Bunker Hill) today filed legislation that will help create hundreds of new jobs across the state, including Decatur, and keep ADM headquarters in Illinois.

ADM announced in September its intentions to relocate its world headquarters and sought state incentives to keep it in Illinois. Manar opposed the initial bill filed in the House citing its failure to provide adequate assurances that investments would be made and jobs would be created to offset the loss of jobs and economic activity in Decatur created by the move.

Working with ADM executives and local officials in Decatur, Manar crafted a bill that will allow ADM to keep its headquarters, along with 100 corporate headquarter jobs, here in Illinois. In addition, ADM will move 100 jobs from other states to Decatur and, over the next five years, is committed to adding or filling 100 full-time positions annually in Decatur.

“I’ve been in office less than a year, but it is abundantly clear that Illinois faces major challenges,” Manar said. “Illinois’ unemployment rate is 9.2 percent – two points higher than the national average. Decatur’s unemployment rate is even higher, which is why we have to begin addressing chronic unemployment that has plagued certain areas of the state by investing our resources where it will have the greatest impact.”

“Throughout this process, I have said that keeping ADM in Illinois was a priority but not at the expense of taxpayers and jobs,” Manar continued. “The bill I have introduced will allow ADM to continue their long and valued partnership with Illinois, while growing and creating much-needed jobs here.”

Manar’s legislation also creates a job task force to create even more downstate jobs by promoting ADM’s new Midwest Inland Port intermodal facility. Taking advantage of three class one railroads that intersect in Decatur, a coalition of public sector officials and private business leaders will work to maximize and improve our transportation infrastructure, which will lead to long-term economic growth for Decatur and Downstate Illinois.

To ensure taxpayers are protected, strict accountability measures have been included in the proposal. If job creation and investment provisions are not met, ADM will return incentive funds to the taxpayers.

“I appreciate ADM’s willingness to listen and work with both myself and local elected officials to create this important job creation legislation,” Manar concluded. “Our state still has a tough hill to climb and faces many challenges that demand our disciplined attention, but this bill is a step in the right direction – solidifying ADM’s current and future presence in Illinois while helping create jobs in a balanced way throughout the state.”

30 Comments

|

Question of the day

Thursday, Oct 31, 2013 - Posted by Rich Miller

* State Sen. Jim Oberweis talked to the Daily Herald about his likely US Senate race, which would be his third run at the office, fourth statewide campaign and sixth major campaign since 2002, all but one of which he lost…

He said he’s aware he might take some heat for making another bid.

“Oh, I’m sure I will, as did Abraham Lincoln,” Oberweis said.

* More…

Oberweis says he’ll tell voters about his success in the dairy business. But he argues what’s different this time is his 2012 election to the Illinois Senate, where he grabbed attention this year for winning approval of an increase in the rural interstate speed limit to 70 mph. He points to that success to show he got a proposal through a General Assembly controlled by Democrats.

“One of the criticisms of me in the past has always been, well, he’s just a businessman and he won’t be able to get along with Democrats,” Oberweis said. “I’ve got more Democrat friends now that I’ve ever had before.”

* The Question: Do you think Sen. Jim Oberweis will help or hurt the statewide ticket next year? Take the poll and then explain your answer in comments, please.

survey tools

50 Comments

|

Today’s numbers

Thursday, Oct 31, 2013 - Posted by Rich Miller

* Crain’s…

Earnings at Exelon’s Commonwealth Edison Co. were responsible for much of the upside surprise. ComEd generated operating earnings of $127 million, or 19 percent of Exelon’s total, up 41 percent from $90 million during the same period last year, when ComEd accounted for 14 percent of Exelon’s earnings.

The primary reason: higher revenues at ComEd thanks to the 2011 formula rate law enacted in Illinois over Gov. Pat Quinn’s veto, according to Exelon’s earnings release.

Exelon’s CEO Christopher Crane also said that the Clinton nuke plant could be shuttered in a year if wholesale prices don’t improve.

17 Comments

|

The Department of Spin

Thursday, Oct 31, 2013 - Posted by Rich Miller

* Twitter’s embed function doesn’t appear to be working right now, so we’ll have to settle for a screen cap…

What does he want, a medal?

29 Comments

|

Adventures in governance

Thursday, Oct 31, 2013 - Posted by Rich Miller

* Blogger and retired teacher Fred Klonsky is not at all pleased with the way the state is rolling out the new Medicare Advantage program. Reprinted in full with permission…

The deadline for deciding what our retiree health care will look like – whether we go with Medicare Advantage or op out – is December 13th.

Central Management Services is co-sponsoring informational seminars across the state between November 11th and December 11th.

The one for retirees who live in Chicago is at the Thompson Center on December 6th.

That gives me seven days to figure out what I will do. And if I opt out I can’t get back in. And all the money I paid into the plan over thirty years is gone.

For good.

Seven days.

If you live in Belleville the seminar is at Southwest Community College on December 11th.

That will allow you one day to decide.

One day.

If you live in the north suburbs of Chicago you can attend a seminar on the far north side. Or Palatine.

That’s it. It is an area in which thousands of Illinois teacher retirees live.

More seminars are being held downstate. But teachers tell me that in some cases they will have to drive more than two hours each way to attend one.

CMS is willing to set up additional seminars if we pay for them.

Over $300 bucks a pop.

And we find the space.

Fred’s a pretty informed guy, but he does have a point about everybody else.

21 Comments

|

* From the Illinois Hunger Coalition and Voices for Illinois Children…

More than 2 million low-income people in Illinois who will have their food assistance cut when a boost to the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) expires this Friday, Nov. 1. SNAP benefits will average only about $1.40 per person per meal after the cut.

The cut will affect all of the nearly 47 million Americans, including 22 million children, who receive SNAP. For a family of three, this cut will amount to $29 a month. That’s a serious loss given SNAP’s already low benefit levels and the very low incomes of SNAP participants — over 80 percent of SNAP households live in poverty. “I cannot imagine what the proponents of this cut are thinking since we know that SNAP has provided an important stepping stone for struggling Illinois families and the 886,000 children who will be affected by this cut,” says Diane Doherty, Executive Director of the Illinois Hunger Coalition.

In Illinois, the benefit cut through September 2014 will total $220 million, which will further undermine the economy in communities across our state as families reduce their spending at local stores. These cuts will most certainly result in more households seeking help from the Illinois emergency food network, which is already strained. A caller to the IL Hunger Coalition’s state-wide Hunger Hotline, Ms. Bunny Patterson, a senior citizen living in Lake County says, “even though I get the minimum SNAP benefit of $16, this cut will make it more difficult for me to get by. I do not understand why they would cut this benefit even more.” Ms. Patterson is one of the 349,000 elderly or disabled individuals in IL who will be affected by the cuts on Nov. 1.

On top of the across-the-board cut that will take effect on Friday, the U.S. House of Representatives recently passed legislation cutting $40 billion from SNAP, potentially eliminating assistance for nearly 4 million people nationwide, including at least 182,000 people in Illinois – representing families with children, seniors, people who have lost a job and are unable to find work, and veterans.

“SNAP has been a powerful tool in helping to keep families out of poverty,” stated Gaylord Gieseke, president of Voices for Illinois Children. “The House-passed SNAP cuts on top of the cuts beginning this Friday would deal another significant blow to millions of Americans who continue to struggle to make ends meet as the economy continues to slowly recover. Our representatives in Congress must not ignore the hundreds of thousands of Illinois children whose nutrition and healthy development depends on SNAP. When Congress cuts SNAP, it undermines the well-being of some of the most vulnerable children and families in America.”

The legislation would provide strong financial incentives for states to reduce their caseloads, making it significantly harder for struggling families to put food on the table, and would eliminate assistance for some of the poorest Americans. The House-passed SNAP plan coupled with the November 1 cuts would deal a significant blow to millions of Americans who continue to struggle to make ends meet.

* But that’s not a problem, says a nutritionist with the University of Illinois’ Extension service…

Illinois is reducing EBT payments for two million families in Illinois who get the assistance, but the smaller benefits are neither a surprise nor a problem.

The 2009 federal expansion of the SNAP program, what most people call food stamps, has expired, forcing reductions across the country, Illinois Department of Human Service’s spokeswoman Januari Smith said.

Benefits for family of four in Illinois could decrease by $36 a month, she said.

But the family won’t go hungry, still getting more than $600 each month to spend on groceries. The maximum food stamp benefit for a family of four is set to slide from $668 to $632, each month.

McKenzie Riley, a nutritionist with the University of Illinois Extension office, said that’s well above an average monthly allowance for food.

“A lot of places, (the average) is $100 per person, per month,” Riley said. “Depending of course … on what your household is made up of.”

Riley says it will cost a little more to feed two teenagers than to feed two children younger than 5.

Illinois’ average food stamp family — a parent and a child — gets $367 a month for groceries, but that falls to $347 Friday.

Cook your own food and do a little bargain shopping, and that should be plenty, Riley says.

Discuss.

50 Comments

|

* From Chicagoist…

Government watchdog group The Better Government Association is getting under Michael Madigan’s skin. At least that’s how we see it after the Illinois House Speaker sent a letter to fellow Democratic lawmakers accusing BGA and its President and CEO Andy Shaw of trying to “become a kingmaker in Illinois politics” and having an agenda to “impugn the Democratic Party.”

Madigan, himself a kingmaker in Illinois politics, probably wrote that without irony.

Madigan sent the letter on Illinois Democratic Party letterhead—because that’s what a political power broker does—to the House Democratic caucus and members of the Democratic State Central Committee. Madigan wrote the letter in response to a Sun-Times/BGA investigation into how 29 of 30 people who circulated petitions in 2011 to get Madigan on the ballot for re-election either had or have government jobs. Those 29 people cost taxpayers nearly $2 million a year; contributed $200,000 to the campaign funds of Madigan or his daughter, Illinois Attorney General Lisa Madigan; and some are drawing public pensions while still working for government agencies.

Madigan’s “kingmaker” claim is just plain laughable, as I’ve already discussed at length today in the subscriber-only section.

* But let’s also take another look at what Shaw said in his fundraising letter yesterday…

This is a story about the intersection of government, politics and money. Watchdogs tell those stories because citizens of Illinois deserve to know how their government works.

The irony of fundraising off a story that’s supposedly about “the intersection of government, politics and money” is pretty darned rich, particularly considering Shaw’s own contributors.

* Some commenters were busy bees and looked at Shaw’s organization. From an anon commenter…

In 2008, Jay Stewart (then Executive Director), was paid $57,765.

In 2009, When Andy Shaw took over the reigns, Shaw was paid $76,667 to be Executive Director.

In 2011, Andy Shaw was paid $174,175 to be executive director.

It all jives with my theory that the BGA is only interested in creating headlines that will help its fundraising so that they can boost their own salaries at the “non profit” BGA.

* “Juvenal” followed up…

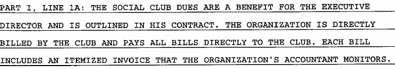

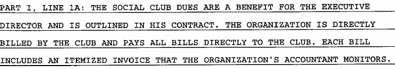

Anonymous: You omitted that Shaw received an additional $19K in non-salary compensation. Oh yeah, and BGA pays his social club membership dues too.

Look, I don’t begrudge nonprofit employees being compensated. But guys who make more than the governor should not be casting themselves as “a small watchdog organization”.

From the BGA’s tax return…

The most recent BGA disclosure report is here.

* Others looked at the backgrounds of some of the BGA’s top funders. From hisgirlfriday…

Only $200,000 to MJM or Lisa by the workers?

Well if that makes the workers corrupt, how corrupt does that make the honorees, co-chairs and hosts of the BGA’s 90th anniversary luncheon who have donated wayyyyyyyyyyyy more than $200,000 to Democrats and Republicans over the years?

Here’s a link to a list of these folks:

http://www.bettergov.org/events/90th_anniversary_luncheon.aspx

Just a sampling…

BGA honoree RICHARD DRIEHAUS donated $100,000 to Richard M. Daley in 2007, even after Hired Truck and Bob Sorich’s conviction. What a hero of better government!

Co-Chair RON GIDWITZ has personally donated more than $200,000 to one GOP governor candidate and now is raising hundreds of thousands of dollars for another GOP candidate. Oh and he gave $30,000 over the years to Lee Daniels, whose chief of staff was convicted of public corruption.

Co-chair J.B. PRITZKER donated $100,000 to the campaign of former governor Rod Blagojevich, who was sent to prison for 14 years for public corruption.

Co-chair ANNE GRIFFIN made a mockery of campaign finance limits by funneling her contributions to Republican candidates via Downstate Republican county party chairmen.

Oh and the people on this list have donated at least tens of thousands to Madigan and his daughter too.

* Wordslinger…

To add to HGFs list of the BGA annual meeting co-chairs and honorees and their experiences at “the intersection of government, politics and money.”

There’s John Canning, grand poohbah of Madison Dearborn, one of those private equity firms that hustles public employee pension fund money to invest (taking 1.5% off the top, and 20% of returns).

His Better Government bona fides in recent years include dropping $100K on Richard M. Daley, $30K on Emanuel, $50K on Anne Burke and $40K on Claypool.

And $25K on Michael J. Madigan.

Canning also is the subject of an FEC complaint for blowing the doors off last year on individual contribution limits to candidates, parties and PACs, primarily Republicans, including Romney, Boehner, Cantor and Illinois GOP congressional candidates including Walsh.

http://www.citizensforethics.org/page/-/PDFs/Legal/Letters/FEC/05_08_13_CREW_CLC_FEC_Excessive_Donor_Complaint.pdf?nocdn=1

* More Wordslinger…

Other interesting names from the BGA invite for their annual luncheon. These guys know their way around the “intersection of government, money and politics.”

Lester Crown, of the BGA Civic Leadership Committee. General Dynamics. Material Services Corp. From the Trib:

–Crown was an unindicted co-conspirator in the 1972 scandal in which construction executives bribed (Illinois) state legislators in an attempt to get highway weight limits raised for ready-mix concrete trucks. Crown was chairman of Material Service Corp., a major ready-mix company.

He received immunity from prosecution in return for testimony used to convict the politicians. At the 1976 trial, Crown admitted contributing $23,000 to a fund that financed the bribes.–

Jerry Reinsdorf. Nice ballpark. Nice restaurant. How much did they cost you? Who paid for it? Pay a lot in rent? Sweet.

Bruce Rauner, Civic Leadership Committee. Who?

* Walkinfool summed it up…

Some of the biggest, (some would say “worst”) examples of the “intersection of government, politics, and money”, are key supporters, and honorees of BGA itself.

Using Andy Shaw’s own logic, they should be a major target of an “investigation” in the name of “better government.”

Have at it Andy, and prove you are who you claim to be.

And then there’s a story told by Joe Berrios and pointed to by another commenter. Click here to read that one.

* Look, despite what some commenters may have implied above, there is absolutely nothing wrong with taking money from those folks. There’s also nothing wrong with having your organization pick up your “social club” membership dues, or making a decent buck.

The point, I think, is that if the BGA was a campaign organization, the media might be all over this stuff and impugning the leader’s integrity. Smoke, fire, etc. It’s usually just nonsense, but that’s how it goes.

Another point, I believe, is that there is also nothing intrinsically wrong with a government employee or retiree circulating nominating petitions and contributing rather smallish amounts to the organization for which he or she volunteers. Yet, that’s a story.

64 Comments

|

*** UPDATED x1 *** Today’s quotes

Thursday, Oct 31, 2013 - Posted by Rich Miller

* Joe Walsh interviewed Sen. Kirk Dillard this week for his ongoing series about Republican gubernatorial candidates. Listen to the whole thing if you have time…

* Silliest question…

“Do you like freedom, and why?”

* Silliest claim by the candidate…

“i ran an administration that left a billion and a half surplus.”

It left that surplus six years after Dillard left the chief of staff job.

* Something I don’t think I knew: Dillard’s law school classmate was Tom Paprocki, who is now Springfield’s Catholic bishop.

* Best hit on an opponent: The far right is freaking out over the Obama administration’s “Common Core” learning program. One of Walsh’s callers referred to it as “Communist Core.” Dillard then connected Bruce Rauner to Common Core through Rauner’s financial support of Stand for Children.

*** UPDATE *** The Rauner campaign passed along some OR…

From Tribune Questionnaire: http://primaries2012.elections.chicagotribune.com/editorial/kirk-w-dillard/

“I support many of the proposals of Stand for Children. When I ran for governor in the 2010 primary, I offered a lengthy plan called “”Best in Class - Helping Children Succeed for the Jobs of Tomorrow”" which included improving student performance and closing the achievement gap, developing a 21st century workforce, and raising the bar on higher education. I believe in merit pay, and we must not renege on our commitment on rewarding teacher excellence. We need to encourage corporations and foundation to establish funds to reward our best teachers.”

He also took $10,000 from stand with children and was endorsed by them: http://www.wbez.org/story/stand-children-endorsed-candidates-sweep-elections-97524

[ *** End Of Update *** ]

* A quote that could come back to haunt him: “I thank Dave Smith of the Illinois Family Institute and those who came down to Springfield” for the anti gay marriage rally. Those were his first public remarks about the rally, which featured some pretty darned hateful comments by some speakers.

* Most pandering Dillard comment: A caller lambasted Dillard for not being a true conservative like Walsh. Dillard responded…

“[Joe Walsh is] someone I look up to and model myself after.”

I kid you not.

59 Comments

|

* First, the good news from a TRS press release…

Teachers’ Retirement System investments generated a positive 12.8 percent rate-of-return during fiscal year 2013, net of fees, a result that exceeded internal custom benchmarks set for the $40 billion portfolio.

* Now, the bad news…

Yet, despite these high returns for the year ended on June 30, the System’s unfunded liability officially rose during the 12 month period to $55.73 billion from $52.08 billion at the end of FY 2012. The TRS funded ratio at the end of FY 2013 was 40.6 percent as calculated under state law and 42.5 percent using the market value of the System’s assets. The higher unfunded liability reflects another year of contributions from state government that fell short of full, actuarially-based funding. […]

“The contribution from the state that is required by the law continues to be far short of the amount required to ensure our long-term sustainability,” Ingram said. He noted that in order to prevent any increase in the unfunded liability during FY 2015, the state contribution would have to be $5.3 billion.

“Without changes to the pension code to ensure sustained and adequate funding, TRS faces the very real possibility that in a few decades the System will not have enough money to pay benefits to retirees. We cannot guarantee that TRS will have enough money to pay the pensions promised to every member in the System.”

In other words, we’re not yet at the top of the ramp.

* But…

Based on the System’s funded status, the TRS Board of Trustees gave preliminary approval to a $3.412 billion state contribution for fiscal year 2015, a contribution that is slightly lower than the $3.438 billion state contribution for the current fiscal year.

Total TRS assets at the end of FY 2013 were $39.479 billion, an 8.7 percent increase in total assets from one year ago at the end of FY 2012 — $36.311 billion. At the end of September TRS assets totaled $40.97 billion.

And here’s why…

The statutory state contribution for FY 2015 is calculated under a state formula that does not meet the requirements of standard actuarial practices used in other states.

Because of that difference, the state’s statutory pension contribution never matches the funding level that an actuary would recommend to fully cover the cost of pension in that year. In FY 2014, the state’s statutory contribution to TRS is $3.438 billion. Using actuarial standards, the contribution to TRS would be $4.046 billion. In FY 2015, while the statutory contribution is $3.412 billion, the actuarially-calculated contribution would be $4.062 billion.“

41 Comments

|

[The following is a paid advertisement.]

Credit unions are not-for-profit financial cooperatives. They were first exempted from federal income taxes in 1917 to fulfill a special mission as valuable and affordable cooperative alternatives to for-profit banks. Even though credit unions are exempt from income tax, they still are subject to, and pay, property, payroll, and sales taxes, and a host of governmental regulatory supervision fees. Since their inception, credit unions have more than fulfilled their mission, as evidenced by Congressional codification of the credit union tax exemption in 1951 and 1998. Though the range of services has evolved to effectively serve their members in an increasingly competitive financial marketplace, the cooperative structure, which is the reason for their tax exempt status, has remained constant. Nationally, consumers benefit to the tune of $10 billion annually because credit unions are tax-exempt. In Illinois, by most recent estimates credit unions annually provide more than $185 million in direct financial benefits to almost three million members. In an era that continuously poses economic and financial challenges, credit unions remain true to one principle - people before profits - and represent a highly valued resource by consumers during these uncertain economic times.

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|