Is Emanuel bouncing back?

Thursday, Mar 27, 2014 - Posted by Rich Miller

* Partial results of two Anzalone-Liszt-Grove Research polls taken for state Rep. Christian Mitchell’s primary campaign show Mayor Rahm Emanuel apparently bouncing back in March from some big trouble last December with African-American Democratic voters…

Emanuel favorability African Americans 18-64

Emanuel favorability Africa Americans non-college

* Also…

Emanuel has a base of senior African American voters — those over the age of 65 — in this district poll; his standing did not change much in the past months with his favorables holding at 62 per cent.

This is just one House district on the South Side, so it would be better to see broader results. Still, the mayor’s movement is quite interesting.

30 Comments

|

Today’s numbers

Thursday, Mar 27, 2014 - Posted by Rich Miller

* The AP reports on a new study of healthy by county…

The overall health ranking for Cook County, the state’s most populous, was 75 of the 102 Illinois counties.

Collar counties Kendall and DuPage ranked second and third, respectively, and Kane was ninth.

The study looks at factors such as high school graduation rates, access to health providers and healthy foods as well as rates of smoking, obesity and teen births. […]

Not surprisingly, the healthiest Illinois county, Woodford in Central Illinois, had some of the state’s best scores for individual health and social and economic factors. Its childhood poverty rate was 8 percent.

Alexander County in Illinois’ far southern tip was at the bottom. Forty-nine percent of children there were living in poverty and the unemployment rate was 11.4 percent.

The study is here.

11 Comments

|

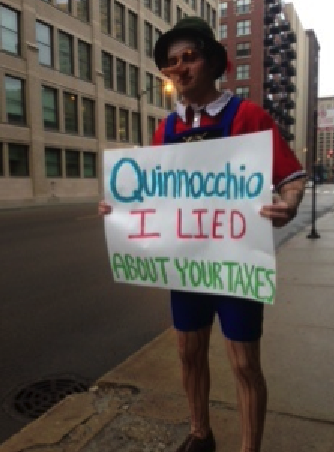

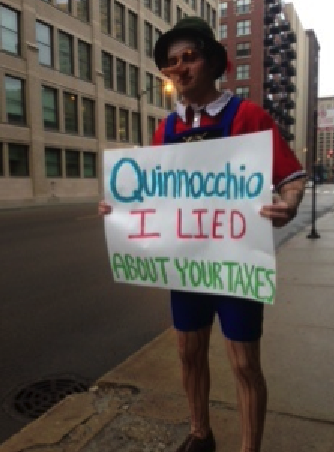

Rauner mascot to hound Quinn

Thursday, Mar 27, 2014 - Posted by Rich Miller

* From the Rauner campaign…

Introducing Quinnocchio

Pat Quinn’s alter-ego, Quinnocchio, is making his first appearance today alongside the governor at his noon campaign stop at Linné Elementary School to remind him of his broken promises.

Discuss.

…Adding… Here’s the governor’s press release for today’s school visit…

Governor Pat Quinn today visited Carl von Linné Elementary School in Chicago and discussed his fiscal year 2015 budget proposal and five-year blueprint to raise state investment in the classroom to its highest point in Illinois history. As a result of tackling the cost drivers behind the financial crisis he inherited, the Governor was able to present a budget that invests an additional $6 billion in education over the next five years.

“The future of Illinois’ economy depends on the quality of our education,” Governor Quinn said. “All students—no matter where they live—deserve to go to a first-rate school. That is why my budget proposal invests like never before in education and support for early childhood development.”

The Governor’s investment in education in the FY15 budget includes:

· Investing $100 million in Birth to Five in FY15, with a total five-year investment of $1.5 billion, a game-changing investment to expand access to prenatal care; early care and learning opportunities for every child; and strong parent support.

· Expanding dual enrollment and early college programs.

· Investing an additional $50 million in the Monetary Assistance Program (MAP) to expand opportunity for 21,000 students to attend college. The proposal calls for doubling MAP scholarships over the next five years.

· Modernizing classrooms across the state to ensure every student attends a first-rate school.

Since taking office, Governor Quinn has fought to preserve education from radical budget cuts, and built and repaired 978 schools. In his Fiscal Year 2015 Budget Address, Governor Quinn laid out an honest and responsible budget for the next fiscal year along with a five-year blueprint that will secure the state’s finances for the long-term, provide significant tax relief to homeowners and working families and invest like never before in education and early childhood.

For more than 100 years Carl von Linné School has been providing a world-class education to children in the Avondale neighborhood of Chicago. The mission of Carl Von Linné Elementary School is to prepare students for college and career by providing a rigorous research-based instructional program, aligned to the Common Core State Standards, with a focus on educating the “whole child.”

106 Comments

|

* The House Revenue Committee has voted down a proposed constitutional amendment for a graduated income tax while approving Speaker Madigan’s “millionaire’s tax” - a three percent surcharge on income over $1 million.

Today, by the way, was the “Fair Tax” Statehouse lobby day. The group has focused more of its progressive tax efforts on the Senate, but it got a taste of harsh reality in House Revenue today. A rally is scheduled for noon.

52 Comments

|

Good government is good (partisan) politics

Thursday, Mar 27, 2014 - Posted by Rich Miller

* This sounds like a pretty interesting idea…

The state’s shuttered juvenile prison in Murphysboro could be reopened as a special adult prison for drunk driving offenders under Gov. Pat Quinn’s budget proposal.

The plan, which relies on the General Assembly making the 67 percent income tax increase permanent, could bring jobs to a Southern Illinois facility that Quinn closed less than two years ago.

According to the governor’s budget office, an estimated 2,500 inmates housed throughout the state’s sprawling prison system are serving time for multiple drunk driving offenses.

Moving some of them to the former minimum-security institution for juveniles could ease overcrowding in other facilities and provide them with specialized services designed to help them after release.

“Murphysboro could be re-purposed fairly easily,” said Abdon Pallasch, assistant director of the Governor’s Office of Management and Budget. “This center will help us reduce recidivism and save taxpayer money over time.”

Looks like decent policy to me.

Re-opening the facility also has a political benefit, however. State Rep. Mike Bost (R-Murphysboro) is running for Congress. The House Democrats pushed Bill Kilquist through the Democratic primary and have high hopes for his November chances. Creating a few jobs in an area that is so heavily dependent upon state employment probably won’t hurt at all.

27 Comments

|

Quick legislative hits

Thursday, Mar 27, 2014 - Posted by Rich Miller

* The Daily Herald writes about how the state’s ultra-exclusive golf country clubs are working the system for huge property tax breaks…

(I)f Medinah officials have their way, those schools and other local government entities will have to give back nearly $1 million to golf course operators, who say Medinah’s tax assessment was far too high for the past three years.

It would also shift that tax burden onto the private golf course’s mostly residential neighbors in the future.

In 2013, the country club’s property tax bill amounted to $391,554, according to assessment records from Bloomingdale Township. If the appeal is successful, the tax bill could shrink to $84,257, a 78.5 percent decrease. […]

Medinah officials are basing their appeal on the state’s disputed definition of “open space.” State law allows golf courses to be classified as open space for assessment purposes. Township assessors, county boards of review and the state’s Property Tax Appeal Board have always maintained that the open space designation only applies to golf course land that is either undeveloped or used for actual golfing.

Lawyers for the Onwentsia Golf Club in Lake Forest challenged that definition in 2006 and argued that land with buildings, parking lots and additional improvements helped conserve all the other open space and should be considered open space by proxy.

Legislation is now moving to address this. I doubt Medinah is gonna get its full break.

* Sun-Times…

New regulations governing petcoke, as currently written, don’t appear to have the votes to get out of the Illinois House Environment Committee, according to vote counters on both sides of the issue.

Although Friday is the deadline for bills to get out of committee, in Springfield there are always ways to get around the rules. But there isn’t a way to get around a shortage of committee votes.

The legislation is being pushed by Illinois Attorney General Lisa Madigan and has 40 listed co-sponsors. It would require minimum setbacks for coal and petcoke facilities; set limits on dust; regulate storage, loading and unloading; require new permits; and require monitoring and testing. The bill is separate from the Illinois Environmental Protection Agency’s plan to draw up new rules on petcoke storage. The IEPA has been talking to members of the industry, both refiners and bulk operators, and to the environmental community. Environmentalists say new rules are needed, while industry calls the whole effort a solution in search of a problem.

Even if this bill as written doesn’t get out of committee, a bill with new language that resolves legislators’ concerns could be placed on a shell bill, circumventing the Friday deadline.

I spoke to a gathering of the Illinois Petroleum Council this week. They claim there has been just one reported problem with petcoke storage in Illinois. Whether that’s true or not, it’s a talking point that they’ve been relentlessly hammering home with legislators. One problem shouldn’t result in a major regulatory bill. Again, you may disagree with that, but it’s the argument they’re using and it appears to be successful so far.

* AP…

A proposal that would allow truck stops to have twice as many video gaming machines as other establishments is moving through the Illinois Legislature.

A Senate committee on Tuesday approved the measure with a 9-2 vote. It would allow truck stops to have ten video gaming terminals. Currently, establishments with video gaming can operate five machines.

State Sen. Dave Syverson is sponsoring the proposal. He says it will create more revenue from truckers who are often from out of state. The Republican from Rockford says it wouldn’t affect other gaming businesses because truckers already don’t leave truck stops to gamble.

Before legalization and regulation, some truck stops had dozens of poker machines. They were like mini casinos.

* Here’s an interesting piece of legislation…

A plan to let Rosemont and three other Illinois cities apply their local cigarette taxes to cigars and other forms of tobacco won initial approval in the state Senate Wednesday.

The legislation from state Sen. Dan Kotowski, a Park Ridge Democrat, would apply to Rosemont, Chicago, Evanston and Cicero, the four towns in Illinois that have local taxes.

The Rosemont tax, which is 5 cents per pack on top of state and federal cigarette taxes, will not be increased or decreased under Kotowski’s proposal. But it would be applied to other forms of tobacco based on weight.

Senate GOP Leader Christine Radogno asked before voting against it: “If it’s good for these four communities, wouldn’t it be good for the rest of the state?”

* Other stuff…

* Ride-sharing crackdown advances in House: Rep. Tom Morrison, R-Palatine, said those steps contained in Zalewski’s legislation limited new upstart competitors to the taxicab industry too severely. “I voted against this bill because it unfairly locks out competing companies and limits choices for consumers,” Morrison said. Candice Taylor, a Lyft representative who testified before the committee, said the bill’s “burdensome” requirements would mean “the end of companies like Lyft and Uber in Illinois.”

* Bill at Statehouse would allow early release for older inmates

* Illinois gun ranges busy, trying to meet demand

* Illinois set to put major limits on charter schools.

* Unes Opposes bill to Assess ISBE Takeover of IHSA

23 Comments

|

Question of the day

Thursday, Mar 27, 2014 - Posted by Rich Miller

* Sun-Times…

Quinn’s announcement Wednesday that he intends to push for a permanent extension of a temporary income tax he enacted in 2011 represents a huge political Achilles’ heel for him in his campaign against Republican Bruce Rauner.

But will it be fatal?

It’s too early to judge, though Dawn Clark Netsch’s 1994 campaign for governor largely was derailed by early summer that year because of her advocacy for an income-tax increase as part of a school-funding, tax-swap plan.

Quinn, by contrast, ran and narrowly won the Executive Mansion in 2010 when he embraced a 1-percentage point increase in what then was Illinois’ 3-percent individual income tax.

* SJ-R…

In his speech, Quinn said such a reduction in revenue would mean 13,000 teachers would be laid off, 30,000 fewer students receiving assistance for college expenses, 21,000 fewer seniors receiving home care services and 41,000 fewer children in child care.

By extending the tax, Quinn said “we can stabilize the budget for the long term in a way that provides targeted tax relief where it’s needed most, to homeowners and working families raising kids.”

* Illinois Issues…

Quinn offered property tax relief and an incremental doubling of the Earned Income Tax Credit as potential sweetener that might help the income tax proposal go down with voters. […]

Not surprisingly, a recent poll from the Paul Simon Public Policy Institute at Southern Illinois Carbondale found that 60 percent of voters oppose making the tax rates permanent. However, the majority of respondents liked major state services and were opposed to cutting them. Voters were also opposed to taxing retirement income or increasing sales taxes. The only new revenue source that more than half of those polled supported was expanding gambling. […]

Quinn’s proposal has the backing of the legislative leaders in his party. “I would commend the governor for his political courage and honesty,” House Speaker Michael Madigan told Illinois Public Television’s Jak Tichenor, host of Illinois Lawmakers. Madigan said that he “demanded” property tax relief be included in a proposal to make the tax rates permanent. “I plan to support the governor’s position on the extension of the income tax increase,” said Madigan. “If we wish to continue to provide the level of services which we’ve become accustomed to for education and other purposes, then the income tax increase should be extended.”

* Bruce Rauner…

“Pat Quinn first promised the working people of Illinois he wouldn’t raise taxes by 67%. He broke that promise, taking away nearly a week’s worth of pay for Illinois families. Then he promised his tax hike would be temporary. Today he broke that promise too and is doubling down on his failed policies. After five years of Pat Quinn’s failed leadership, we have record tax hikes, outrageously high unemployment, massive cuts in education, and there’s still a giant budget mess in Springfield. It’s now or never to save Illinois. We can balance the budget without more tax increases, if we create a growth economy, and restructure and reform our broken government. That’s what I’ll do as governor.”

* Back to the SJ-R…

In his speech, Quinn ruled out two other options that have been floated as ways for the state to collect more revenue. He said the state sales tax should not be extended to services.

“I won’t institute any new, unfair taxes on everyday services that working people rely on,” Quinn said. “It hurts working families the most to tax basic services like going to the Laundromat, like taking your child to day care, like visiting the barbershop, like taking your dog to the vet.”

Rauner has said he’s open to both the service and retirement income taxes.

* The Question: On balance, were the governor’s proposals yesterday a help or a hindrance to his reelection prospects? Take the poll and then explain your answer in comments, please.

survey software

99 Comments

|

Here we go again

Thursday, Mar 27, 2014 - Posted by Rich Miller

* Tribune…

Quinn sought to portray his fiscal blueprint as part of an effort to end a cycle of budget game-playing by his predecessors that left state finances in shambles. He said part of his strategy was the controversial pension overhaul law last year that he argued would dramatically cut retirement costs and let more tax revenue flow to schools, health care and other services.

Rauner contends that Quinn’s pension alterations are too timid and will save the state far less than the governor contends. That argument may have gotten a boost Wednesday when the state’s bipartisan fiscal forecasting agency revised downward by several billion dollars its long-term savings projection for the pension overhaul.

* That snippet may have been based on this Bruce Rauner campaign press release…

On the same day of Pat Quinn’s budget address in which he broke his promise to keep the 67% personal income tax temporary, the Commission on Government Forecasting and Accountability released an analysis of the so-called pension reform law that shows it will save $22.6 billion less than was promised when the legislation was passed.

* This isn’t much different than the same stupid canard I dealt with in the subscriber section back in January. Here’s what I wrote back then. Substitute $15 billion with $22.7 billion and adjust everything else and you’ll get the same sort of results…

ONE OF THE DUMBEST ARGUMENTS EVER There’s been much screaming and hollering about how new calculations show that the pension reform law is projected to save $15 billion less than originally advertised last fall when the bill passed.

The complaints are based mainly on a recent Chicago Tribune article entitled “Illinois pension law saves $15 billion less than first thought.” The ultra-conservative Illinois Policy Institute, Bruce Rauner and other pension bill opponents have used the story as ammunition to claim that the law is based on a tissue of lies.

But the premise of that article was completely off base because it looked at the wrong number. The only truly valuable number is what taxpayers will end up shoveling into the pension system. Like everything else, it’s all about the final bottom line.

OK, we’re gonna get into a little math here, but it’s really easy so stay with me a minute.

The basic thing to remember here is that calculations originally showed last fall that pension reforms meant taxpayers would owe the pension systems $220 billion over 30 years. A recalculation with updated numbers, however, showed the total taxpayer obligation is now at $205 billion. That’s really good news, but it’s being irresponsibly spun as bad news.

The original estimates were based on Fiscal Year 2012 data. Without the new pension law, the data showed that taxpayers were on the hook for $380 billion in pension payments over 30 years. The reform law reduced that obligation estimate to $220 billion, which was a 42.1 percent reduction in what the government would have to give the pension funds.

When the numbers were updated to include Fiscal Year 2013 data (which included some pretty high investment returns), the new research found that taxpayers were now on the hook for $350 billion over the next 30 years without the reforms. The reform law would result in a 41.4 percent reduction to just $205 billion.

So, what about that $15 billion difference touted by the opponents? Where does it come from?

It’s not that hard to figure out and here’s an easy little example if you’re still scratching your head.

Let’s say you’re looking for a new watch. You find one at Macy’s that’s originally priced at $109 and is on sale at 40 percent off. You’d save $43.60 for a final price of $65.40. That’s still more expensive than Rauner’s watch, but not a bad deal at all.

But then you go next door to Bergner’s and you see the exact same watch listed at $100 and it’s also on sale for 40 percent off. You’d save $40 with the 40 percent sale, but your final bottom line price would be $60, compared to $65.40 at Macy’s,

It doesn’t take Einstein to figure out the better bottom line deal here. Yeah, your 40 percent “savings” are higher with the more expensive Macy’s watch, but the bottom line price you pay is significantly lower at Bergner’s.

The Policy Institute and Rauner would have you believe that Bergner’s is somehow ripping you off because the sale’s 40 percent reduction amount is lower than Macy’s. But that’s just plainly ridiculous. Who thinks like that?

Discuss.

24 Comments

|

Fun with numbers

Thursday, Mar 27, 2014 - Posted by Rich Miller

* From Illinois Watchdog…

Illinois lawmakers have proposed a budget that tops $34 billion, but doesn’t rely on the 2011 tax money. If Quinn gets his wish and a permanent tax hike, state spending could increase to almost $36 billion for the next year.

That would mean Illinois is spending $12 billion a year more than in 2000.

Using a handy-dandy online inflation calculator from the US Bureau of Labor Statistics, $24 billion in 2000 equals $32.7 billion today. So, using the Watchdog’s budget numbers, the state is spending, in real dollars, just $1.3 billion more than it was back then, without half the tax hike revenue, or $3.3 billion with it. But the state is also making full pension payments these days. It was spending a whole lot less on pensions back in 2000.

25 Comments

|

About that property tax proposal

Thursday, Mar 27, 2014 - Posted by Rich Miller

* Mark Brown discusses Gov. Pat Quinn’s proposed $500 property tax refund…

The governor proposed the property tax refund Wednesday as the sweetener to help Illinoisans swallow his decision to make permanent the “temporary” income tax hike he signed into law in 2011.

If the Legislature goes along, Quinn plans to start sending out the $500 checks this summer so that voters might feel a little more kindly toward him when they step into the voting booth this November. […]

The average credit currently is $247, says the Quinn administration, which equates to a net gain to a taxpayer of $253 after trading off the credit for the refund. Your net gain will be more or less than that, depending on how much you pay in property taxes.

Quinn didn’t really make that clear, just as he failed to mention altogether that for anyone who currently pays more than $10,000 a year in property taxes, his plan will result in a net tax increase.

The governor’s office says that will effect fewer than 10 percent of Illinois homeowners, which sounds about right, but I’m pretty sure nearly all of them live in the high-tax Chicago metro area.

* The net effect of this is that the vast majority will get a small property tax break (which isn’t really a property tax break, it’s an income tax refund loosely based on property taxes), while the upper middle class and the wealthy will see a smaller break.

My own property taxes are above $10K in Springfield. The proposed plan means I’ll lose about $125. Mark Brown also admitted that the proposal would cost him a few dollars, but wrote that he doesn’t “begrudge the state the extra hundred bucks or so a year.”

* Bruce Rauner lowered his 2012 Illinois taxes by $3,007 with the state’s property tax credit. So, if this new $500 credit passes, Rauner will have to pay about $2,500 more next time around.

By the way, Rauner paid about $2.6 million in state taxes for 2012, but he made $3.5 million in estimated payments, so he got a state tax refund check worth about $880,000.

* Also, Speaker Madigan claimed yesterday that the tax refund was his own idea…

Madigan said during a public television interview, adding, “My demand as part of this program is relief for homeowners on their real estate taxes.”

* The Republicans were not amused…

[Sen. Matt Murphy] said Quinn’s proposal to roughly double the current amount of overall property tax relief is equivalent to a $600 million “kickback” that would raise the overall amount of state relief for homeowners to more than $1.2 billion a year.

I think it’s actually $700 million in net new spending for a total of $1.3 billion, but whatever the case, it’s a lot of new money. More cuts in other areas will have to be made to pay for this, and that’s always one of the biggest problems with ideas like these.

50 Comments

|

[The following is a paid advertisement.]

As not-for-profit financial cooperatives, credit unions exist to help people, not make a profit. With a goal to serve all members well - including those of modest means - every member counts. The movement’s “People Helping People” philosophy causes credit unions and their employees to volunteer in community charitable activities and worthwhile causes. Take for instance SIU Credit Union in Carbondale. They know all too well the damage natural disasters can cause, having seen the impact of tornadoes that have ravaged their nearby communities, including Harrisburg and Brookport. In the immediate wake of those storms, the credit union sent employees, already trained as members of a local Community Emergency Response Team, to assist in the emergency supply relief effort. In addition, the credit union donated numerous cases of water and hosted a pizza lunch for the community. It also utilized all of its branches as places where members could make monetary and other donations of needed items. Credit union members know their credit union will be there for them in bad times, as well as good. And they are fiercely loyal for this reason.

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|