AFL-CIO executive committee backs Quinn

Friday, Mar 21, 2014 - Posted by Rich Miller

* The Illinois AFL-CIO’s executive committee met at noon today and voted to endorse Gov. Pat Quinn.

There was “no opposition” to the motion, I’m told. Some folks (I’m betting AFSCME and others) didn’t say a word either way. So, not unanimous, but no stated opposition.

No other endorsement votes on other candidates were taken.

…Adding… Sun-Times…

There were no votes of opposition, though the union representing about 35,000 state employees, AFSCME Council 31, abstained from the vote.

AFSCME is suing Quinn in a bid to undo changes to state pension laws that the governor backed that would cut back on post-retirement benefits for its members. The case is being heard in Sangamon County and is expected to eventually go before the Illinois Supreme Court.

Another public-sector union trying to get that law tossed, the Illinois Federation of Teachers, was absent from the meeting.

14 Comments

|

* I don’t see how these horse race numbers released by Lt. Gov. Sheila Simon prove much of anything…

One survey, taken by Lake Research Partners in late January, show that Sheila Simon, who’s giving up her spot as lieutenant governor to run for comptroller, trails veteran GOP incumbent Judy Baar Topinka by a fairly narrow 39 percent to 32 percent among likely general election voters. 29 percent were undecided or not answering.

* And this finding assumes that Simon will have the money to deliver such a punch…

Team Simon also points to a finding that just 35 percent give Ms. Topinka a “good” or “excellent” job rating, while 46 percent rate it “fair” or “poor.” And, when voters were asked about Ms. Topinka’s drawing of a large pension, those surveyed were heavily negative. Look for that to crop up as a line of attack by Ms. Simon against Ms. Topinka this fall.

The survey also found that 44 percent of those surveyed want a change in the comptroller’s office, while 27 percent want to continue current policies. It has an error margin of plus or minus 4 percent.

Simon was using the results of that poll to fundraise in February. We’ll see how she did soon.

* And this is kind of interesting…

The survey found Mr. Cross ahead 34 percent to 30 percent over the Democratic nominee, state Sen. Michael Frerichs, with Mr. Cross getting an impressive 21 percent of the vote in heavily Democratic Chicago.

That poll was taken March 6 and 7 and had an error margin of plus or minus 4.8 percent.

34 Comments

|

[The following is a paid advertisement.]

In any discussion about treatment of mental illness, the interests of the patients and their families should come first. In considering Senate Bill 2187 – sometimes called “RxP” – members of the General Assembly should keep that in mind.

SB 2187 would allow psychologists who have no medical training to prescribe powerful medications to patients. Current Illinois law allows only people who have medical training – doctors, nurse practitioners and physician assistants – to prescribe drugs.

Why does medical training matter? Physical illnesses and mental disorders are often intertwined. Additionally, psychiatric medication, such as drugs for schizophrenia and bipolar disorder, can interact negatively with medication for chronic illnesses. Finally, many drugs are powerful and can create risky side effects. To understand these complexities, psychiatrists go through four years of medical school and four additional years of residency, on top of their college training in the sciences. They learn to treat the whole patient – not just the brain.

The most recent version of the “RxP” bill would require about 30 semester hours, or 10 college courses, plus 10 weeks of supervision by a psychologist to prescribe medication. The course work could be completed online. Would you allow someone trained online to repair your brakes? Fly a plane? Work as a lifeguard? Treat the family dog?

Psychologists who want to prescribe can follow the route taken by Illinois nurse practitioners, physician assistants and doctors. They can obtain medical training – instead of insisting on a law that would put patients at risk. To become involved, join the Coalition for Patient Safety, http://coalitionforpatientsafety.com.

Comments Off

|

Question of the day

Friday, Mar 21, 2014 - Posted by Rich Miller

* A letter to the editor by Nicole Chen, Western Springs, Illinois chapter leader, Moms Demand Action for Gun Sense in America…

The new concealed-carry law in Illinois requires businesses to post a standardized 4-by-6-inch picture of a semiautomatic handgun with a red line through it at their entrances if they wish to prohibit guns in their establishments. […]

Members of the business community need to know about Illinois Senate Bill 2669, which would change the signage requirement.

Instead of business establishments posting signs if they prohibit guns, the bill says businesses are free to post a “Concealed Carry Allowed” sign if they choose. […]

(C)urrently, our state’s new concealed-carry law specifies places where guns are always prohibited (including schools, day-care centers, libraries and museums) — and requires those locations to post the same sign, featuring an image of a semiautomatic gun with a red line through it.

As we enter my 4-year-old’s preschool, this is the only sign on the door.

Parents and teachers are vocalizing concerns about the effect these signs have on our children, and how to address the fears and questions of little ones who face this image every day as they enter their schools.

These signs on our schools and libraries are 100 percent redundant, and Senate Bill 2669 would eliminate them.

* The bill is sponsored by Sen. Don Harmon. It has no co-sponsors and is still in a subcommittee. From the synopsis…

Amends the Firearm Concealed Carry Act. Provides that a person shall not carry a concealed firearm onto private real property of any type without prior permission from the property owner. Provides that a real property owner shall indicate permission to carry concealed firearms onto the property by clearly and conspicuously posting a sign at the entrance of a building, premises, or real property under his or her control, except this posting is not required if the property is a private residence. Provides that the sign shall be at least 4 inches by 6 inches in size (rather than exactly that size). Effective immediately.

* The Question: Should SB 2699 pass? Take the poll and then explain your answer in comments, please.

survey services

51 Comments

|

* From the twitters…

* So, I took a look. It appears that the Senate Republicans are still claiming that there’s plenty of money to go around, even with the expiration of most of the income tax hike, and that the Democrats are just trying to scare people by laying out what programs will have to be cut. This rhetoric flies in the face of projections from the bipartisan, bicameral projections by the Commission on Government Forecasting and Accountability, which are incorporated into today’s testimony.

*** UPDATE *** I’ve experienced a bit of gnarly push-back, so let me be clear here.

The Senate Republicans have said for years that the Democrats weren’t cutting nearly enough to avoid a catastrophe when the income tax hike expired. The SGOPs have also complained for years that not enough was being cut so the state could pay down old bills.

But now, when their predictions appear to be coming true, the SGOPs say “All is well!!!”

They claim they can prove this is a nefarious Democratic conspiracy. I have no doubt, after years of watching budget battles, that some of the administration’s numbers are inflated. That’s usual. But I told Sen. Matt Murphy today to get me the proof. He pledges to do so.

[ *** End Of Update *** ]

Anyway, have a look at what’s going down…

7 Comments

|

* On Tuesday, about five percent of Chicago’s precincts held a non-binding referendum on raising the minimum wage to $15 an hour. From the Nation…

With 100 of the 103 precincts where the issue was on the ballot reporting, 87 percent of voters were backing the $15-an-hour wage. Just 13 percent voted against the advisory referendum.

* Two days later…

A bill gradually raising the state’s minimum wage to $10.65 an hour cleared a Senate committee Thursday.

However, the bill’s sponsor was unsure when she would call the bill for a vote in the full Senate.

“I am trying to move this measure to the floor. However, I’ve identified some areas that I believe we should have further discussion” on, Sen. Kimberly Lightford, D-Maywood, said after the hearing.

That includes discussions about the teen subminimum wage and tip-wage provisions. Both allow employers to pay affected employees less than the minimum wage.

* There was opposition…

Business groups oppose the plan. The Illinois Retail Merchants’ Association says the legislation would “hinder local retailers and their employees.”

The group says raising the minimum wage would force employers to cut jobs, especially affecting those between the ages of 16 and 24.

* And…

Opponents say the increase could negatively affect workers by forcing businesses to cut jobs, especially for those between the ages of 16 and 24.

“While there are some winners in this, there are unquestionably some losers, too,” said Sen. Matt Murphy, a Republican from Palatine.

* The outcome is far from certain…

Cullerton said passage in the full Senate is “still probably a few votes short, but we’re working on it.”

* Gov. Quinn got into the act…

Gov. Pat Quinn is making his push to increase Illinois’ minimum wage by shopping at a Gap clothing store in downtown Chicago.

The chain has instituted a policy of paying entry-level employees a higher minimum wage.

Quinn bought three sweaters for his young nieces on Thursday. The total was about $77 and he paid cash. Quinn called the store an example and added that he got quality clothes at a good price.

* The numbers…

Currently, some 400,000 people hold minimum wage jobs in Illinois. A full-time minimum wage worker makes a little more than $17,000 a year before taxes.

18 Comments

|

Madigan, in his own words

Friday, Mar 21, 2014 - Posted by Rich Miller

* Reboot quotes House Speaker Michael Madigan about his tax hike plan…

It sounds like an easy sell to the Democrats who control the General Assembly and, should it succeed, to voters in November. And as Madigan pointed out, it’ll be a difficult “no” vote to a lot of Republicans.

“I would think that there would be Republicans from areas of the state where they don’t have any millionaires and they ought to take a good hard look at this and say, ‘Why not let the people decide,’” Madigan said. […]

Madigan even had an answer to those who will argue that his 3 percent “surcharge” will drive millionaires and their taxable incomes from the state.

“Well, if they’re in Illinois today they’re probably so much in love with Illinois that they’re not going to leave,” Madigan said at his press conference. “And they’ll be grateful for this opportunity to support lower education.”

I’m not sure many people are “in love” with Illinois government these days. And, also, “lower education”?

* The schools angle…

“I think that what we’re doing here is calling upon people in Illinois who are well-equipped to provide support for our education which is available to everybody in the state,” Madigan said.

Madigan says this works out to about $550 per student. Springfield’s District 186 is cutting staff, programs and security to deal with a $4.7 million shortfall. The so-called “millionaires tax” would give the struggling district $8.3 million to fill the hole and then some.

“If you’re a district, this is money you don’t have today,” Madigan said.

Rep. Rich Brauer says that’s not how schools should get relief. The Springfield Republican said the state should increase education funding by taking it out of entitlement programs.

I’d like to see Rep. Brauer’s list.

* How many people are we talking about here?…

Madigan said there are 13,675 millionaires in the state.

* Color me skeptical…

Madigan, who is also state chairman of the Democratic Party, said the amendment is not a shot at Rauner.

“It’s introduced today because we had some time to discuss it with our members in the House and it’s been well received,” Madigan said. “I happen to think this is a good idea. I’ve given a lot of thought to this. What we’re doing here is calling upon people who are well-equipped to provide support for education.

Yeah. Nothing about Rauner. Sure.

* Same goes for this…

On Thursday, Madigan said he had “not yet” decided how to address the question of whether the current 5 percent income tax rate should be kept in place.

“That’s a separate issue,” Madigan said. “This is separate from the question of whether the income tax increase would be extended.”

* Best line of the day…

The speaker was asked if the tax hike would apply to him. “Do I make a million dollars…The answer to your question, in a good year, I would be subject to this,” Madigan replied.

Asked if he’s been having good years, the soon-to-be 72-year-old speaker replied, “At my age, any year is a good year.”

* Reboot also compiled video highlights…

* Meanwhile, let’s look at some react to Madigan’s millionaires tax hike from a different angle. First, the Illinois Federation of Teachers…

“Given the drastic cuts to education in recent years, and the threat of cutting nearly $1 billion more in this year’s budget, we are encouraged by the Speaker’s proposal to invest more money in public education for our children. This is a very positive first step in moving us toward a fair tax system in Illinois, with lower rates for lower incomes and higher rates for higher incomes. It also begins to address our twin problems of inadequate and inequitable school funding, and we look forward to discussing it further.”

The so-called Fair Tax has long been dead and Madigan’s proposal just sticks yet another fork in it.

* A Better Illinois is the group pushing that “Fair Tax” proposal…

We agree with Speaker Madigan that millionaires should pay a higher tax rate than minimum wage workers and the middle class.

We appreciate the Speaker’s first step toward averting the pending fiscal cliff, and remain committed to long-term, structural reform that addresses our need for stable and sustainable revenues to invest in our state’s most important priorities – education, health and human services, and public safety.

Our campaign also remains committed to giving a voice to the 77% of Illinoisans who support a Fair Tax – including tax cuts for the overwhelming majority of lower and middle income families – by working with legislators in both chambers so voters can make the ultimate decision on this November’s ballot.

* A Better Illinois carefully tested the language of support for the proposal. But We Ask America also tested the proposal three different ways in three different polls in order to test various messages and came up with these results…

* Illinois currently has a flat-rate income tax where lower-income wage earners pay the same percentage as those making millions of dollars a year. Supporters of a proposed graduated income tax say they have a plan that would lower tax rates for 90 percent of Illinois taxpayers while increasing rates on higher earners. Would you support, or oppose such a plan?

Support 57%

Oppose 29%

Not Sure 14%

* Would you support or oppose a change in Illinois’ income tax that would grant lawmakers broad authority to more easily raise tax rates—even on middle class workers?

Support 7%

Oppose 86%

Not Sure 7%

* Some Illinois lawmakers have proposed a constitutional amendment to change this state’s income tax from a flat rate where everyone pays the same percentage, to a graduated rate that requires a higher percentage paid as your income increases. We’d like to know whether you generally approve, or disapprove of a constitutional amendment that would change the state’s income tax from a flat rate to a graduated rate.

Support 33%

Oppose 49%

Not Sure 17%

38 Comments

|

[The following is a paid advertisement.]

Credit unions were first exempted from federal income tax in 1917 because of their unique structure as not-for-profit financial cooperatives. Contrary to what some banks may suggest, credit unions pay property, payroll, and sales taxes. Yet while banks decry the credit union tax exemption, nearly 40 percent of banks in Illinois elect Subchapter S status under the Internal Revenue Code to avoid federal income taxation. That’s $59 million in diverted tax dollars. These for-profit Sub-S banks also pay dividends and fees — not to customers, but to directors/investors/stockholders who may or may not be depositors — to the tune of nearly $1.3 billion. This is far in excess of the estimated federal income tax credit unions would pay. In contrast, credit unions return net revenue to their members. The banker argument against the credit union tax exemption is simply disingenuous. If banks really believed that credit unions operate with an unfair competitive advantage, they would restructure their institutions to credit union charters. None would, however, because doing so would expose them to becoming democratically controlled, locally-owned financial cooperatives governed by their very own volunteer members that put people before profits — all the virtues that define the credit union difference.

Comments Off

|

Today’s number: 373

Friday, Mar 21, 2014 - Posted by Rich Miller

* From Site Selection Magazine…

By securing more corporate facility investment projects than any other metro area in the U.S. last year, Chicago took home the trophy as the Top Metro in America.

With 373 facility deals, Illinois’ largest city easily outdistanced its closest competition — second-place Houston with 255 projects and third-place Dallas-Fort Worth with 178. Atlanta (164) and Detroit (129) rounded out the top five. […]

A case in point is Chicago’s emergence as a data center hub for the Midwest. Last year, the Chicago area won significant data center facility investments from Equinix, Latisys and others, as well as significant IT infrastructure investments from Google, Gogo, Groupon, Paylocity and Huron Consulting. And in February, Hyatt Hotels moved 60 IT jobs downtown from the suburbs.

“We have basically two major locations in Chicago — one downtown and another one in Elk Grove Village near O’Hare,” says Howard Horowitz, senior vice president of global real estate for Equinix, the world’s largest data center colocation facility provider. “We have done several phases of buildout of 275,000 sq. ft. [25,547 sq. m.] over time. To date, we have invested over $200 million in the Elk Grove Village project. We have incrementally increased our presence in downtown Chicago, and we are currently involved in a project for a new build in the McCormick Place area.”

18 Comments

|

Sen. Kirk lashes out at SEIU

Friday, Mar 21, 2014 - Posted by Rich Miller

* Sen. Kirk probably should’ve stopped with this…

“With Rauner’s victory, it showed that a pro-choice Republican can be nominated by the party and go on to win,” said U.S. Sen. Mark Kirk, R-Ill., who also supports abortion rights. “If you are a social moderate and a fiscal conservative, you’re likely to win in Illinois.”

* As we’ve discussed before, Rauner has abandoned his constant attacks on organized labor, but Kirk may not have received the memo or acted as a surrogate…

“I would say that the national significance of this race for governor is that the toxic left … would do anything to make sure that Illinois stays safely in the dull, gray, union-controlled, dumb economy that we have,” he said.

Kirk singled out the Service Employees International Union, calling the group “particularly corrupt.”

“I would particularly say that there’s been one union that’s run the state of Illinois called the SEIU, a particularly corrupt union,” Kirk said. “The SEIU — it’s no mistake that Rod Blagojevich wanted to leave his job as governor and go work for them. It’s because he saw the SEIU as more powerful than the state of Illinois.”

* Beniamino Capellupo, executive director for the Service Employees International Union Illinois Council, responded…

“It is obvious that this politically motivated attack was orchestrated by the Rauner campaign. Rauner’s surrogate in this matter, Mark Kirk, did not harbor these same feelings toward SEIU as a Congressman when he asked for, and received a $2,500 contribution from us,” Capellupo said in a statement released to the Sun-Times. […]

“Just two days after the primary election, it is clear that billionaire Bruce Rauner will continue his attacks on the working men and women of Illinois. Only now he is using surrogates like Senator Kirk to level false accusations that malign the thousands of janitors, security officers, healthcare and child care workers and educational support staff that make-up the more than 150,000 members of Illinois SEIU.”

Discuss.

44 Comments

|

Hire this man

Friday, Mar 21, 2014 - Posted by Rich Miller

* Commenter Yellow Dog Democrat took a break for a while, but he has reappeared on the blog with a vengeance. From earlier this week…

The GOP is a failed brand, so weak that Rauner was able to stage a hostile takeover, which the unions almost trumped with a hostile takeover of their own

YDD also noted that Rauner is no longer branding himself as a “businessman” but as a “community leader.”

* And YDD posted this gem yesterday, after Bruce Rauner’s campaign manager Chip Englander announced opposition to Speaker Madigan’s millionaire tax surcharge…

Yellow Dog Democrat responds to Bruce Rauner campaign:

“Bruce Rauner thinks the voters ought to get to decide whether or not gay couples can marry, but not whether or not millionaires ought to pay their fair share to fund schools.”

“Bruce Rauner believes every option ought to be on the table, including taxing the retirements of middle class seniors, but not asking millionaires to pay a little bit more.”

Welcome to the big leagues, Chip.

* Those two comments by YDD are infinitely better than any spin we’ve ever seen out of the Quinn campaign, which goofed up badly yesterday. Remember the Simpon’s video which attacked Rauner? It claimed that the video was “Courtesty of 20th Century Fox,” but the network gave no such approval…

Within an hour Thursday afternoon of the Chicago Sun-Times inquiring with Fox Broadcasting whether Quinn’s campaign had sought permission to use the image and voice of “Mr. Burns,” the link to the online ad went dark, replaced by this statement: “This video contains content from Fox, who has blocked it on copyright grounds.”

A Fox spokesman told the Sun-Times by email that the company does not allow campaigns, like Quinn’s, to use characters, voices or footage from the long-running animated series, even though the online world legally remains the Wild West when it comes to copyright protection.

“Fox doesn’t authorize use of Simpsons imagery in any political campaign,” Fox spokesman Scott Grogin said.

Rauner’s campaign pounced on the Quinn campaign snafu.

“Looks like Pat Quinn is running his campaign as poorly as he’s running the state,” Rauner spokesman Mike Schrimpf told the Sun-Times. “At least this mistake didn’t cost taxpayers money.”

…Adding… Do you think maybe YDD can outspin the Quinnsters on this Rauner press release? My money is on our guy…

At the same time Illinois’ top Democrats announced a plan to raise taxes on small businesses and family farms, the Illinois Department of Employment Security announced another month of dismal jobs numbers and a horrible unemployment rate.

IDES announced the unemployment rate for February remained unchanged at 8.7%. That’s by far the worst unemployment rate in the Midwest and second worst in the entire nation.

“Pat Quinn’s policies have led to fewer jobs and lower incomes. He is failing Illinois,” said Bruce Rauner. “He’s run out of new ideas and the working people of Illinois are running out of time. We need a new direction.”

How many family farmers make more than a million bucks a year?

48 Comments

|

Minow also backed George Ryan over Poshard

Friday, Mar 21, 2014 - Posted by Rich Miller

* The day before Bruce Rauner announced his list of Democratic and independent supporters, the Chicago Tribune editorial board graciously assisted the Rauner campaign by running an op-ed by Newton Minow about why he’s backing Bruce Rauner…

President John F. Kennedy once said that “sometimes party loyalty asks too much.”

I believe Kennedy was right as we consider the election for Illinois governor this year. As a longtime member of the Democratic Party, I’m taking a leave of absence from the Democratic Party’s campaign for governor in November and will vote for Republican Bruce Rauner for governor. Here is why.

First, my Democratic credentials. I served as assistant counsel to Gov. Adlai E. Stevenson in Springfield in 1952. I’ve been active in the campaigns of Sen. Paul Simon, Congressman Abner Mikva and Sen. Adlai E. Stevenson III. I’ve been a member of Illinois delegations to five Democratic National Conventions. […]

Is Rauner perfect? Of course not. I disagree with him on some issues, especially guns. But on the issue of financial survival of our state, he is right.

* Thanks to a Democratic reader, we have Newton Minow’s 1998 Tribune op-ed diatribe against Democratic gubernatorial nominee Glenn Poshard…

After I read about the tragic shooting of Wentworth District Patrolman Michael Ceriale while he was on surveillance drug duty, I decided that I could not vote for the Democratic candidate for governor, Glenn Poshard. As a lifelong Democrat, it pains me to reach this conclusion, but party loyalty must be subordinate to conscience. Voters who agree with the Democratic Party’s gun-control policy should take a pass on the party’s candidate for governor of Illinois. Here’s why […]

Gun control is a transcendent issue, one that must reflect the conscience of voters because it is an issue about life and death. We already have too many guns in the hands of people in this country. Should we encourage more? Should we make it easy for people who are in trouble with the law to gain access to assault weapons? Should our police officers continue to be shot by known criminals with assault weapons? In his ad in a 1984 Illinois Senate campaign, Poshard pronounced that “Glenn Poshard is firm! He opposes any form of gun control.”

What reason does Poshard make in defense of his congressional record? I’ve never met Poshard, but mutual friends tell me the reason he voted against gun control is to reflect the views of his constituents. I understand and respect that thinking. But I learned years ago, when I was a young assistant in 1952 to then-Gov. Adlai E. Stevenson, that Illinois is a big, diverse state and that the governor’s job is to represent all of the state’s people, not just those in one congressional district. Today, Illinois is much bigger and much more diverse, but the job of the governor remains the same; to represent all of us. If Poshard wants to reflect that view only of his own area, he should continue to run for Congress from his district, not for governor. Of if he wants national office, he could run for governor of the National Rifle Association.

* Meanwhile, Manny Sanchez’s name on the list of Rauner supporters was interesting for two reasons. First, he is Rahm Emanuel’s guy. He makes a whole lot of money off of city bond work. And second, you will recall that Gov. Quinn replaced Sanchez on the Illinois Sports Facilities Authority because Sanchez refused to support Quinn’s pick to run the Illinois Sports Facilities Authority…

Sanchez said he didn’t find out that he would be replaced on the board until he showed up for Thursday’s meeting.

“I’ve known Pat Quinn for four decades … the least he could have done was call me himself,” Sanchez said.

Replacing Sanzhez – who supported Emanuel’s choice of Ferguson for the top job at ISFA – with Young also allowed the governor to get Kraft appointed instead, despite Emanuel’s opposition.

Mayor Emanuel appeared with Quinn after the election and joined in the condemnation of Rauner. So, either this Rauner endorsement was done out of pique, or Rahm now has at least one of his own guys on that GOP campaign.

* Asked about this topic yesterday, Sanchez kinda sorta denied that he endorsed Rauner out of spite, but he didn’t do a very good of it…

“Oh no, no, that’s a good question. No absolutely not,” Sanchez said when asked if his Rauner endorsement amounted to political payback. “That’s a very fair question. Absolutely not. It has nothing to do with that. It has a lot to do with an annoyance that has festered in my belly in the state of Illinois as a lifelong resident of Chicago.

“I was appointed initially by Jim Edgar, proudly in 1996, reappointed, not so proudly, but reappointed by [George] Ryan. Then [Rod] Blagojevich never got around to it, and then shortly after Pat succeeded following the impeachment, I was reappointed to Northern Illinois University’s board. At my request because I’m a lifetime White Sox fan, I was appointed to the Illinois Sports Facility Authority by Pat Quinn,” Sanchez said.

“This has nothing to do with Pat Quinn. This has a lot to do with going with my ethical constraints, which are do the right thing regardless of what the political consequences are. When I was asked to support a candidate that I did not believe who was nearly as qualified as the other candidate, and you know who I’m talking about,” he said, referring to Kraft, “I did the right thing and I called the governor and said I could not support his candidate. I would support the other. Well that resulted in my getting fired. So be it.

“This is not a payback,” Sanchez said.

* Related…

* Rauner touts Democratic, independent support: Rauner chose the Hotel Allegro to make the announcement—the longtime headquarters for Cook County Democrats as well as Quinn events and news conferences. Rauner’s wife, Diana, also made her first public statements about the campaign. A longtime Democrat, she said “leadership is more important than partisanship” in urging others to support her husband.

* Rauner boasting support from Democrats, Independents

* Big Dems back Rauner; Quinn responds with a bigger name: Hillary Clinton

* Quinn reacts to Rauner picking up Democrat and Independent endorsements

36 Comments

|

Millionaire tax react

Friday, Mar 21, 2014 - Posted by Rich Miller

* The reaction to House Speaker Michael Madigan’s proposal to add a three percent surcharge to annual incomes over a million dollars kicked up some dust. Bruce Rauner’s campaign…

Chip Englander, campaign manager for Bruce Rauner, issued the following statement regarding the tax proposal announced by House Speaker Mike Madigan:

“Bruce is happy to pay more to support education - in fact he’s been doing that personally for decades, but he doesn’t support what looks like a first step towards empowering Mike Madigan and Pat Quinn to raise taxes on the middle class, small businesses and family farms. The last time they raised taxes, they hit every Illinoisan with a 67% increase, and they still turned around and cut funding for education. We need to grow our economy and create jobs, so we can fund education at levels far above what we’ve seen under Pat Quinn. We need to take a look at our entire tax system to make Illinois more competitive and lower the tax burden on the people of Illinois.”

* House Republican Leader Jim Durkin…

“The race for Governor has started and today made its way into the Illinois House. Why wasn’t this proposal introduced last month or last week? The timing is obvious. Families and business are fleeing the state, this proposal will only perpetuate this human tragedy.

“Three and a half years ago, the House Democrats passed a 67% income tax increase on Illinois families and business all under the guise to pay our bills.

“That never happened. The Democrats running this state can no longer be trusted.

“This proposal will not grow our economy and will not put Illinoisans back to work.”

* American’s for Prosperity Illinois…

Americans for Prosperity’s Illinois State Director issued the following statement in reaction to Speaker Madigan’s proposal to amend the Illinois Constitution to impose a new tax on millionaires:

“With the second highest unemployment rate in the nation, one would think the Democrat leaders of Illinois would want to grow jobs for our families. Unfortunately, yet again they choose to pursue policies that will push more jobs out of the Land of Lincoln by punishing job creators.

This new tax is designed to further polarize the state in a bid for short-term political gain, while diverting attention from the majority’s intention to go back on its commitment to keep the 67% tax hike permanent.”

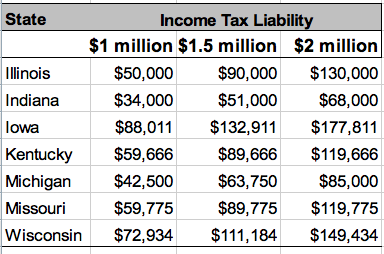

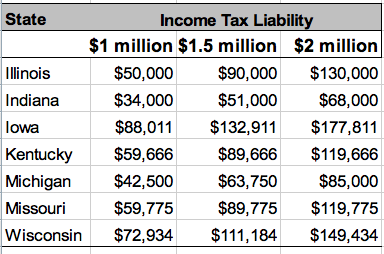

NOTE: The chart provided to media by the Speaker’s Office comparing the tax rate in neighboring states for incomes over $1 million assumes a 5% tax rate, not the 3.75% tax rate scheduled for 2015.

* The chart…

So, yeah, if the scheduled 2015 rates are used, the overall burden would be significantly less here.

91 Comments

|

STOP THE SATELLITE TV TAX!

Friday, Mar 21, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

The cable TV industry is asking lawmakers to place a NEW 5% tax on satellite TV service. This proposal is an unfair, unjustified tax increase on the 1.3 million Illinois families and businesses who subscribe to satellite TV.

Satellite TV taxes will hurt Illinois families and small businesses

• Residential satellite TV subscribers will see their monthly bills go up 5%.

• This tax will impact every bar, restaurant and hotel that subscribes to satellite TV service, which will translate into higher prices, decreased revenues, and fewer jobs.

• Rural Illinois has no choice: In many parts of Illinois, cable refuses to provide TV service to rural communities. Satellite TV is their only option.

This is not about parity or fairness

• Cable’s claim that this discriminatory tax is justified because satellite TV doesn’t pay local franchise fees could not be further from the truth. Cable pays those fees to local towns and cities in exchange for the right to bury cables in the public rights of way—a right that cable companies value in the tens of billions of dollars in their SEC filings.

• Satellite companies don’t pay franchise fees for one simple reason: We use satellites—unlike cable, we don’t need to dig up streets and sidewalks to deliver our TV service.

• Making satellite subscribers pay franchise fees—or, in this case, an equivalent amount in taxes—would be like taxing the air. It’s no different than making airline passengers pay a fee for laying railroad tracks.

Tell your lawmakers to STOP THE SATELLITE TV TAX!

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|