Radogno turns thumbs down

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* It’ll be up to the Democrats to move this thing forward…

Illinois’ Senate Republican leader says she’s advised her caucus to oppose a plan from Chicago Mayor Rahm Emanuel to bail out two city pension systems.

Christine Radogno of Lemont told a Senate committee Wednesday that the state is in “continual crisis mode” with spending and revenue. She says she wants to see a long-term plan from the city dealing with its other troubled pension funds.

20 Comments

|

Vallas finally enters the arena

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* Tribune…

Gov. Pat Quinn on Wednesday trotted out his running mate Paul Vallas to hammer Republican challenger Bruce Rauner’s position that the state income tax rate should rolled back, saying doing so would result in huge cuts to education and spikes in local property tax rates.

Vallas, the former Chicago Public Schools CEO, contended that lowering the income tax rate would leave at least $1 billion less for school districts across the state – a situation Vallas said would be “absolutely devastating.” […]

Rauner argues the increase should be allowed to expire as scheduled, but so far has not detailed how he would make up for the revenue loss beyond saying there’s room to cut in the state budget.

Vallas said that stance is disingenuous, and accused Rauner of “deferring the tough questions until after the election.”

* Sun-Times…

“I know the impact that major cuts have on the education budget,” Vallas said at a downtown hotel, repeating his credentials as a school superintendant for 17 years. “And these type of draconian cuts which is what would occur if the rates were reduced under the Rauner plan, would have a devastating impact. There’s no way around it.

“Either you don’t understand the budget or in effect, you’re deferring the tough questions until after the election,” he said. […]

Vallas, who also ran school districts in Philadelphia, New Orleans and Bridgeport, Conn., said Rauner’s proposed income tax rollback to 3 percent would result in more than a billion dollars in cuts to education funding. Chicago Public Schools alone would lose some $233 million, according to the campaign’s analysis.

“No district will be able to absorb that impact without borrowing, which is bad, finding some way to raise property taxes, which is even worse, or going out and making draconian cuts to critical programs,” Vallas said.

* Video…

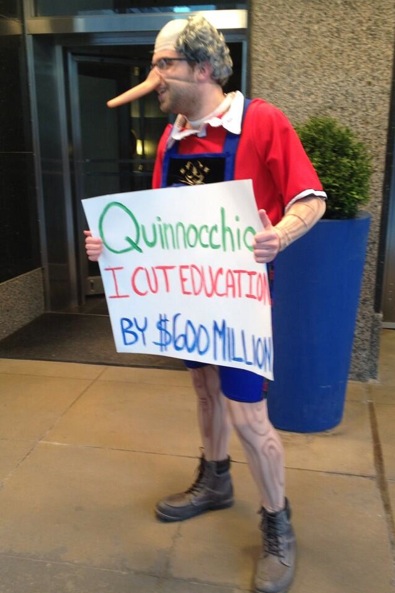

* As noted earlier, Rauner’s campaign sent “Quinnocchio” to the Vallas event. The campaign then responded to what Vallas had to say…

“Pat Quinn broke his promise, raised taxes and still cut education funding by $600 million,” Rauner campaign spokesman Mike Schrimpf said in an email. “Paul Vallas laid off 130 public school teachers and staff while pocketing over $310,000 in taxpayer money for himself. Misleading the voters has been a hallmark of Quinn’s for the last four years and with that kind of record, it’s no surprise the Quinnocchio ticket is now making things up about Bruce.

16 Comments

|

Today’s number: 44 cents

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* From a press release…

Earlier this year, a bipartisan State Senate committee, created by State Senator Andy Manar (D–Bunker Hill), issued a report acknowledging Illinois’ outdated school funding system and recommending changes be made to the system to better reflect students’ needs.

On Wednesday, Manar, along with other Senate Democrats, introduced the School Funding Reform Act of 2014, a proposal to streamline the current hodgepodge of funding sources into one funding formula that would account for school districts’ funding needs.

“Illinois has the second-most inequitable school funding system in the nation. Our current funding system is doing a disservice to taxpayers, school districts and, most importantly, our children,” Manar said. “The funding system we are proposing will better address student needs, such as socio-economic background, language ability or special learning needs, while also accounting for a school district’s ability to raise funds locally.”

The current funding formula, unchanged since 1997, only distributes 44 cents for every $1 invested in education on the basis of district need. The other 56 cents is distributed to schools through archaic and complicated grants, not based on need.

Under the new funding system, 92 cents of every $1 invested by the State in the K-12 education system, with the exception of funds for early childhood education, construction projects and high-cost special education, would flow through a single funding formula that provides a simple, straight-forward and equitable means to distribute education funds for Illinois school districts.

According to Manar, the new formula would also increase stability and transparency regarding how much state money is provided, how it gets to school districts and how it is spent.

19 Comments

|

An American tradition gone awry

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* Illinois Review…

This is opening week for America’s 2014 baseball season, and there’s no place where patriotism is more in vogue than at Chicago’s White Sox season opener Monday at U.S. Cellular Field.

Over 100 members of the United States military stretched out this 250 foot flag in front of 40,000 baseball fans. […]

Monday, the game’s opening routine was inspirational seeing the flag and American baseball fans of all political views singing with their hands on their hearts, “the land of the free, and the home of the brave.” Then finishing with the inevitable, “Play ball!”

* Unfortunately, I wasn’t able to be inspired by the pre-game festivities because of another American tradition: Poorly executed security rules…

Fans arriving at U.S. Cellular Field on Monday were greeted by long lines and metal detectors when they tried to enter the stadium to watch the Chicago White Sox take on the Minnesota Twins on opening day.

Major League Baseball has told its 30 teams they must implement security screening for fans by 2015, either with hand-held metal detection or walk-through magnetometers. The White Sox checked fans by hand-held or walkthrough metal detectors depending on where they tried to enter the stadium.

That, and a sellout crowd of 37,422, contributed to lengthy delays trying to see Chris Sale and the White Sox face the Twins.

The White Sox didn’t hire nearly enough security guards, so thousands were still outside waiting in endless lines during the singing of our National Anthem.

* I arrived about an hour early, but got stuck driving through a parking lot near the stadium surrounded by a mass of people trying to get inside. I couldn’t move more than a few feet for a half an hour because nobody was directing foot or auto traffic, except a couple of guys who were sitting on a golf cart doing essentially nothing.

Yeah, I was upset at missing part of the game, but I was really steamed that we were all - drivers and pedestrians - put in a needlessly dangerous situation and I was scared to death that I was going to run over somebody’s foot, or worse. People were literally squeezing by my car and jumping in front of me as I was stuck in the morass.

So, perhaps a legitimate concern for security turned into a potentially dangerous situation elsewhere. Not cool, Mr. Reinsdorf. Not cool at all.

Also, dude, you’re losing money when fans can’t get into your park. There were still people lined up at Gate 3 during the 3rd inning, for crying out loud.

57 Comments

|

Stop the satellite TV tax!

Wednesday, Apr 2, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

The cable TV industry is asking lawmakers to place a NEW 5% tax on satellite TV service. This proposal is an unfair, unjustified tax increase on the 1.3 million Illinois families and businesses who subscribe to satellite TV.

Satellite TV taxes will hurt Illinois families and small businesses

• Residential satellite TV subscribers will see their monthly bills go up 5%.

• This tax will impact every bar, restaurant and hotel that subscribes to satellite TV service, which will translate into higher prices, decreased revenues, and fewer jobs.

• Rural Illinois has no choice: In many parts of Illinois, cable refuses to provide TV service to rural communities. Satellite TV is their only option.

This is not about parity or fairness

• Cable’s claim that this discriminatory tax is justified because satellite TV doesn’t pay local franchise fees could not be further from the truth. Cable pays those fees to local towns and cities in exchange for the right to bury cables in the public rights of way—a right that cable companies value in the tens of billions of dollars in their SEC filings.

• Satellite companies don’t pay franchise fees for one simple reason: We use satellites—unlike cable, we don’t need to dig up streets and sidewalks to deliver our TV service.

• Making satellite subscribers pay franchise fees—or, in this case, an equivalent amount in taxes—would be like taxing the air. It’s no different than making airline passengers pay a fee for laying railroad tracks.

Tell your lawmakers to STOP THE SATELLITE TV TAX!

Comments Off

|

SEIU predicts pension reform passage

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* The Chicago pension reform bill is about to start moving as I write this. There’s a noon committee hearing scheduled.

One of the more interesting developments in this legislation was SEIU’s reaction…

.Christine Boardman, president of the Service Employees International Union (SEIU) Local 73, said she supports the “basic constructs” of the pension deal that impacts 10,000 of her members.

“We’re in support of the increase in employee contributions. We’re in support of the Emanuel plan to try to fund it through property tax increases. The bill is going to pass. I know that. You know that,” she said.

“We’re not gonna work against the bill. We’ve told that to Speaker [Mike] Madigan. We’re gonna be neutral, only because of the effect it has on retirees.”

* To the bill, with new stuff bolded…

There shall be printed on each [property tax] bill, or on a separate slip which shall be mailed with the bill: […]

there shall be a separate statement of the dollar amount of tax due which is allocable to the Pension Stabilization Levy under Articles 8 and 11 of the Illinois Pension Code

So, Chicago property taxpayers will get to see how much they’re paying toward this pension fix.

* Also in the bill…

for payment years 2016 through 2055, the annual amount determined by the Fund to be equal to the greater of $0, or the sum of (1) the City’s portion of the projected normal cost for that fiscal year, plus (2) an amount determined on a level percentage of applicable employee payroll basis (reflecting any limits on individual participants’ pay that apply for benefit and contribution purposes under this plan) that is sufficient to bring the total actuarial assets of the Fund up to 90% of the total actuarial liabilities of the Fund by the end of 2055.

* Some Republicans are saying that the above language means there is a mandated property tax increase in the legislation. Yes, there are definitely minimums set, so taxes will absolutely have to rise because of the statute. But aldermen are gonna have to put a little skin in the game as well…

For levy years 2015 through 2020, the city council of the city shall levy a separate tax annually upon all taxable property in the city that shall be known as the Pen Stabilization Levy and shall be at a rate that, when extended, will produce an amount that is no less than one-half of the city’s required contribution amount under subsection (a-2) for each year.

23 Comments

|

Madigan talks minimum wage, voter suppression

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* Those of us who looked at the past to justify a belief that Speaker Madigan would be cool to the idea of raising the minimum wage were just plain wrong…

In a sign Democrats are sticking to their 2014 election playbook, House Speaker Michael Madigan signaled Tuesday a minimum wage increase could be on the horizon in Illinois.

With President Barack Obama, U.S. Sen. Dick Durbin and Gov. Pat Quinn all singing the praises of boosting the minimum wage above $10 per hour, Madigan — who is chairman of the Democratic Party in Illinois — suggested it might have the juice to move through the General Assembly’s lower chamber this spring.

“There’s strong support for the minimum wage in the House,” Madigan told reporters. “I think that it’s a matter of fairness, it’s a matter of equity.”

* Sun-Times has a great take…

Saying he was “adamantly, adamantly opposed” to increasing the state’s minimum wage, [Bruce Rauner] suggested rolling back the current rate in Illinois during a candidates forum in December.

In January, Rauner reversed course and outlined a scenario in which he could favor an increase in the wage, so long as it was paired with a series of business-friendly reforms in state workers compensation and tort laws.

“I think it’s a matter of fairness. It’s a matter of equity,” Madigan said. “I think you’ll find the opposition to raising the minimum wage comes from people who have done pretty well in America. For some strange reason, they don’t want others in America to participate in prosperity.”

Asked if he was describing Rauner, Madigan shot back a one-word response before walking away: “Who?”

* Meanwhile, I haven’t seen much conservative anger about this Madigan proposal, but maybe it’ll happen in time…

Current laws against discrimination aren’t good enough, says the speaker of the Illinois House of Representatives. Speaker Mike Madigan (D-Chicago) is sponsoring a constitutional amendment which today (Tuesday) unanimously passed a House committee. “Eight states have attempted to enact photo ID laws,” he told the committee.

“According to the Brennan Center, approximately 25 percent of eligible African-Americans and 16 percent of Hispanics don’t have photo IDs.” If both chambers approve, this would be a question on the ballot in November and could help turnout in a year that includes the race for governor.

* Again, let’s go to the Sun-Times…

David Morrison, policy advisor for government watchdog group, Illinois Campaign for Political Reform, testified on behalf of Madigan’s measure and said it would simplify the process to seek justice because aggrieved voters would be able to point directly to a violation of the state constitution.

“If anyone today did feel like there were an undue burden on their right to vote, this would give them a right to challenge it,” Morrison said. “Not only would get you a trial court action, but constitutional challenges are appealable directly to the Supreme Court.”

But Ron Sandack, R-Downers Grove, who voted for the measure, questioned the need for Madigan’s change in the state constitution.

“Is there an instance of voter suppression or access denied to register or cast a ballot here in Illinois?” Sandack asked the speaker.

Madigan couldn’t cite an example but said he wanted to prevent potential examples from cropping up.

The proposal received unanimous support in the committee.

* Tribune…

The measure seeks to counter a U.S. Supreme Court June 2013 ruling that dislodged part of the 1965 Voting Rights Act and prompted eight states to attempt to restrict access to polling booths, Madigan said. States have required some voters to show photo identifications, a move that Madigan said has “disproportionally” impacted minorities and the poor.

If it makes the fall ballot and is approved, the amendment would prohibit both future General Assemblies and local election authorities from imposing various restrictions, the speaker said.

45 Comments

|

I just don’t understand this story

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* I really don’t see why this is a problem. A guy gets a ticket. He pays the ticket. He thinks the law is wrong, so he tries to change the law. But when the guy is a lobbyist with the NRA, well, we just can’t have that…

After a state conservation officer ticketed the National Rifle Association’s Illinois lobbyist last December for breaking a hunting law, the gun-rights advocate dutifully paid his $120 fine.

But Todd Vandermyde, one of Springfield’s most powerful and effective lobbyists, didn’t stop there.

A month later, he worked with one legislator to rewrite the law he broke.

And not long after that, he enlisted help from House Minority Leader Jim Durkin, R-Western Springs, to carry legislation that, at least initially, would have greatly restrained the authority of Department of Natural Resources police officers to venture onto private property.

* If you read the whole story, Vandermyde was hunting on private land. He had a loaded crossbow while on an ATV. You’re not supposed to do that, even on private land. So, he got a ticket from a conservation officer. On private land, mind you.

Vandermyde’s crossbow bill was pretty uncontroversial. It passed the House last week 84-28.

And, frankly, DNR needed some restraining, if you ask me. Too many of their officers think they don’t need a warrant to go into somebody’s house because state law doesn’t specifically require one. That’s just plain goofy and even DNR is not opposing the Durkin bill, which will require a warrant before conservation officers can enter someone’s house or yard.

…Adding… Some of you aren’t reading carefully enough. The Durkin bill does not apply to private hunting grounds, only to someone’s house and yard. Plus, it’s long-standing constitutional policy that a cop can bust someone even in a yard or a house if the cop witnesses a crime being committed.

* And then there’s this…

“Look, I like Todd. I do, in spite of myself,” said state Rep. Kelly Cassidy, D-Chicago, a gun-control advocate and a lead architect of the state’s same-sex marriage law. “But if I got a ticket and changed the law because I got a ticket, people would be screaming bloody murder. I don’t think it’s any different when someone with the level of influence and access that he has does it, too,” she said. […]

Cassidy stood by her belief that Vandermyde, in trying to change law because of his own misfortune, was wrong and ridiculed his comparison to her work on behalf of same-sex marriage.

“It’s a little different to change the law when you’re being discriminated against than to change a law when you break it,” she said. “There’s a little difference.”

That last statement is just not true. The entire civil rights movement was fueled by people deliberately breaking stupid laws.

There was a problem, it’s being fixed. What’s the big deal?

90 Comments

|

[The following is a paid advertisement.]

In any discussion of the treatment of mental illness, patients and their families should come first. But according to recent editorials in the Chicago Sun-Times and the Chicago Tribune, Senate Bill 2187 fails that test.

SB 2187 – sometimes called “RxP” – would allow psychologists with no medical training to prescribe medications to patients. Current Illinois law allows only people with medical training – doctors, nurse practitioners and physician assistants – to prescribe.

“It would create too many medical risks without doing enough to make drug treatment for mental health more widely available,” the Sun-Times wrote on Feb. 20, 2014. “We need to provide much better mental health care for our citizenry. But expanding prescription-writing rights is not a safe way to do it.”

Why does medical training matter? Physical illnesses and mental disorders are often intertwined. Additionally, psychiatric medication, such as drugs for schizophrenia and bipolar disorder, can interact negatively with medication for chronic illnesses. Finally, many drugs are powerful and can create risky side effects. To understand these complexities, psychiatrists go through four years of medical school and four additional years of residency, on top of their college training in the sciences. They learn to treat the whole patient – not just the brain.

“We didn’t support this effort in the spring and we still don’t because this bill does not require sufficiently stringent training and oversight,” wrote the Chicago Tribune in its March 22, 2014 editorial.

To become involved, join the Coalition for Patient Safety, http://coalitionforpatientsafety.com.

Comments Off

|

* AP…

The Supreme Court struck down limits Wednesday in federal law on the overall campaign contributions the biggest individual donors may make to candidates, political parties and political action committees.

The justices said in a 5-4 vote that Americans have a right to give the legal maximum to candidates for Congress and president, as well as to parties and PACs, without worrying that they will violate the law when they bump up against a limit on all contributions, set at $123,200 for 2013 and 2014. That includes a separate $48,600 cap on contributions to candidates.

But their decision does not undermine limits on individual contributions to candidates for president or Congress, now $2,600 an election.

Chief Justice John Roberts announced the decision, which split the court’s liberal and conservative justices. Roberts said the aggregate limits do not act to prevent corruption, the rationale the court has upheld as justifying contribution limits.

The full decision is here.

* New York Times…

The decision chipped away at the central distinction drawn by the Supreme Court in its seminal 1976 campaign finance decision, Buckley v. Valeo.

Independent spending, the court said in Buckley, is political speech protected by the First Amendment. But contributions may be capped, the court said, in the name of preventing corruption. The court added that aggregate contribution limits were a “quite modest restraint upon protected political activity” that “serves to prevent evasion” of the base limits.

Wednesday’s decision only concerned contributions from individuals. Federal law continues to ban contributions by corporations and unions.

The court led by Chief Justice John G. Roberts Jr. has been consistently hostile to campaign finance limits in its half-dozen decisions in argued cases on the subject so far. The five more conservative justices have voted together in all of those cases, though Chief Justice Roberts and Justice Samuel A. Alito Jr. have taken a more incremental approach than the bolder one called for by Justices Antonin Scalia, Clarence Thomas and Anthony M. Kennedy.

Wednesday’s decision may increase overall campaign spending, but it may also rechannel some of it away from “super PACs” and toward candidates and parties.

* Washington Post…

This [restriction] meant that donors weren’t able to spread around donations to multiple party committees and candidates and would have to be more selective about whom they contributed to.

In its decision, the court compared the overall contribution limits to restricting the number of candidates a newspaper can endorse.

“Contributing money to a candidate is an exercise of an individual’s right to participate in the electoral process through both political expression and political association,” the justices wrote. “A restriction on how many candidates and committees an individual may support is hardly a ‘modest Restraint’ on those rights. The Government may no more restrict how many candidates or causes a donor may support than it may tell a newspaper how many candidates it may endorse.” […]

Most Republicans, though, praised the ruling for allowing Americans to have more voice in the political process through political donations.

“Today’s Court decision in McCutcheon v. FEC is an important first step toward restoring the voice of candidates and party committees and a vindication for all those who support robust, transparent political discourse,” said Reince Priebus, the chairman of the Republican National Committee.

*** UPDATE *** From the Sunlight Foundation…

In the current election cycle, those nearing the limits include 11 donors who derive their wealth from private equity and investment firms. During the first three quarters of 2013, there were 13 who gave solely to Republican candidates and parties and four who gave only to Democrats. Only three of the donors contributed to candidates of both parties, but they heavily favored (95 percent or more) one party over the other. While just three led companies that are currently lobbying the federal government, 17 of them made large contributions to super PACs. And many of them are trying to influence the government.

Go read it all.

43 Comments

|

Fun with numbers

Wednesday, Apr 2, 2014 - Posted by Rich Miller

* From the Bruce Rauner campaign…

CHICAGO – Quinnocchio will highlight Pat Quinn’s education funding cuts.

WHEN: 10:30 a.m.

WHERE: Hotel Allegro

171 W. Randolph St

Chicago, 60601

The Old Promise: “We have to invest in education. We have to be custodians of the future.” (Quinn video statement to ABC 7 on December 30, 2009: http://www.youtube.com/watch?v=kisEvjk7Nt4)

The Reality: Pat Quinn has cut elementary and secondary education funding by more than $600 million. (CGFA 2014 Budget Summary p. 165)

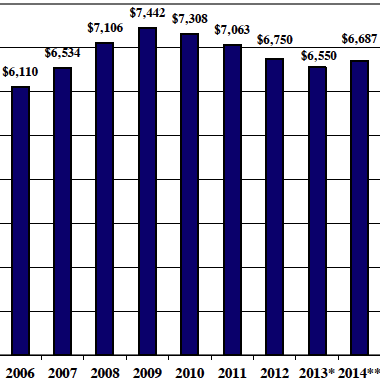

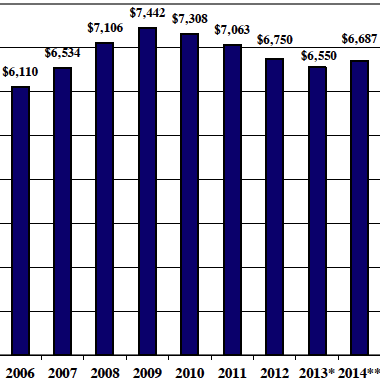

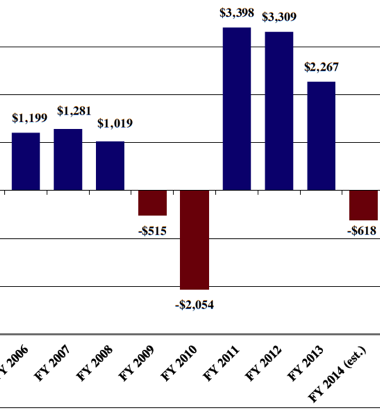

* That COGFA budget summary is here. From a graph on page 165 of appropriations to the State Board of Education from FY06 to the current fiscal year…

Keep in mind, however, that this graph excludes teacher pension funding, which has ramped up every year. The state, not local school boards, covers those payments.

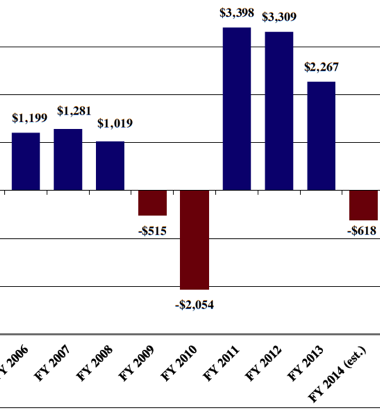

* And here’s another graph from the same COGFA document which represents the annual change in state revenues over the same time period…

Anybody wanna guess what would’ve happened to education funding if the tax hike that Rauner despises and pledges to eliminate hadn’t passed in 2011?

69 Comments

|

|

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|