Mautino to sign subpoenas

Wednesday, Jun 25, 2014 - Posted by Rich Miller

* I could see his point, but this was a needless diversion, so getting it over with is a good thing…

5 Comments

|

*** UPDATE *** Read the new plan by clicking here.

Very little new here. This stuff has been floating around Springfield for years, even decades. That doesn’t mean these are not good ideas. It does mean, however, that he’s not truly thinking outside the box. Then again, there’s only so much anybody can do. Maybe he’s finding that out already.

[ *** End Of Update 1 *** ]

* Natasha Korecki has the scoop on Rauner’s “Step 3″ proposal…

Republican gubernatorial candidate Bruce Rauner unveiled a plan today that he says aims to reform “corporate welfare,” offering up taxes on racehorses, private jets and yachts as well as ending a tax break on newsprint. […]

Rauner said he would overhaul the so-called EDGE program, Economic Development for a Growing Economy, as a starting point to broader changes to make Illinois more attractive to business. Rauner said the state has negotiated deals in the past – including for Sears – that allowed tax breaks even if the company is laying off workers. […]

His plan mentions cutting tax breaks for a private jet and yacht inheritances as well as ending an exemption for newsprint and ink from sales taxes, which he said cost the state $32 million a year. […]

Other parts of Rauner’s plan includes many elements that have been attempted in the past in the Illinois Legislature to no avail. That includes Rauner’s proposal to end an incentive the “big oil loophole” that allows oil companies with an Illinois presence to drill off shore without paying state income taxes. […]

Rauner did not specifically say whether he would support a private jet depreciation tax break that’s been discussed nationally as costing an estimated $3 billion nationwide. Instead, he said he would look at the whole tax code in Illinois.

Big props for going after newsprint. But that’ll hurt him with the newspaper industry for sure.

Even so, these are not new ideas. They are regularly rolled out whenever somebody (usually the governor) wants to fund a new program that the state can’t pay for. Just the word “loopholes” has become a bit of a Statehouse joke.

And there were attempts to reform the EDGE credit this year, by Speaker Madigan, and it went nowhere.

*** UPDATE 2 *** The response…

Chicken Budget #2: Billionaire Bruce Directly Lifts Governor Quinn’s Policies

Corporate Welfare King Denounces Corporate Welfare in Latest Illustrated Pamphlet

CHICAGO - Following is the statement of Quinn for Illinois Communications Director Brooke Anderson in response to the latest Billionaire Bruce Rauner illustrated pamphlet - half the size of the original, if you can believe it - revealed today.

“Maybe it was the embarrassment of his chicken budget from two weeks ago. Or maybe it was because he didn’t think anyone was paying attention.

“In any case, the illustrated pamphlet Billionaire Bruce issued today lifts several policies directly from Governor Quinn who has been fighting for tax fairness for years, including repealing the non-combination rule, the oil derrick loophole and EDGE reform, which the Governor worked on and supported this year.

“Billionaire Bruce Rauner - and his chief patron Ken Griffin - both have benefited directly from hundreds of millions of dollars in bank bailout money. Now Rauner wants to pretend he’s a Quinn-like reformer by renouncing the ‘corporate welfare’ and loopholes that he and his friends have benefited from all these years with their yachts and private jets, including the Griffin jet that carts Rauner around the state.

“After two weeks of hiding and more than a year of stonewalling, Rauner has yet to remotely explain how he plans to make up for $6 billion in revenue that will be required to balance the budget next year.

“Instead of giving us a real plan to tackle the massive structural challenges facing Illinois, Billionaire Bruce has given us two chicken budgets, with today’s version including nothing but warmed-over window dressing, stolen Quinn proposals, and hypocritical ideas.

“A corporate welfare king like him hardly has a shred of credibility when it comes to reforming a system that has made him a member of the .01 percent.”

75 Comments

|

Rauner says he’ll unveil “Step three”

Wednesday, Jun 25, 2014 - Posted by Rich Miller

* From a blast e-mail…

Dear Friends:

As Evelyn and I continue to roll out our plans to shake up Springfield, we want to make sure you know about our next big step.

Step One in our “Bring Back Blueprint” is putting term limits on career politicians. Step Two is cutting wasteful spending and reforming state government. And now we’re getting ready to unveil Step Three.

Since you are a key part of our team, we want you to be the first to see what’s next when we roll it out later today. With so many people around Illinois using social media to communicate, we are going to release our next step on Twitter and Facebook. If you haven’t already, you’ll want to click here to like our Facebook page and to follow us on Twitter, click here.

And be sure to invite your friends to follow us on social media too so they don’t miss out.

Together, we are going to bring back Illinois!

Bruce

Considering how poorly conceived and executed his “chicken budget” presser was, I’m not exactly holding my breath.

37 Comments

|

Question of the day

Wednesday, Jun 25, 2014 - Posted by Rich Miller

* Mayor Rahm Emanuel on the decision to construct the Lucas Museum of Narrative Art in Chicago…

“George Lucas has revolutionized the art of storytelling over the last four decades and we are honored to be the recipient of this incredible legacy investment that will allow everyone to learn about and experience narrative arts. Like Marshall Field, John G. Shedd and Max Adler before him, George’s philanthropy will inspire and educate for generations. No other museum like this exists in the world, making it a tremendous educational, cultural and job creation asset for all Chicagoans, as well as an unparalleled draw for international tourists.”

* The Question: Can you come up with a more appropriately Chicagoesque name than the “Lucas Museum of Narrative Art”?

66 Comments

|

TRS move creates huge state budget hole

Wednesday, Jun 25, 2014 - Posted by Rich Miller

* Illinois Public Radio…

The Illinois Teachers’ Retirement System says it expects a lower return on its pension investments in the next year. That means the state will have to cover more of the cost of teacher pensions.

TRS says it’s still a good assumed rate of investment return at 7.5 percent. That falls in line with similar pension systems nationwide. But it’s not as profitable as 8-percent, which TRS had been using for the previous few years.

Before they were using 8 percent, they were using 8.5 percent.

* More context from the SJ-R…

Reducing the estimated rate of return brings TRS more in line with other major state and municipal pension systems. The National Association of State Retirement Administrators found 37 of 126 systems set a rate of return of 7 percent to 7.5 percent. Another 45 had a rate of 8 percent. The average return of those systems was 7.72 percent.

The average was 7.72 percent.

* Crain’s drills down…

To give a sense of TRS’ bigger obligations, it helps to consider that if the new 7.5 percent rate had been used to calculate the liability for fiscal 2013, it would have been $99.9 billion, not $93.9 billion, under the 8 percent rate. As a result, the pension’s unfunded liability would have been 60 percent, as opposed to 57.5 percent.

Lowering the rate also automatically increases the amount the state must contribute to the TRS fund, Mr. Urbanek noted. If the 2015 fiscal year contribution had been calculated using the new 7.5 percent rate, the budgeted $3.4 billion contribution would have had to be $500 million higher, he said.

That’s a huge budgetary hit. Huge.

This problem never ends.

* Speaking of the budget…

No state historic sites will close for now because of budget cuts, but many could see reduced hours after the Labor Day holiday.

“The governor’s office has given us some direction in how we will move forward with budget implementation,” said Amy Martin, director of the Illinois Historic Preservation Agency. “We will be looking to maintain services as best possible through the rest of this calendar year and hope the budget for IHPA will be restored in November or January.” […]

In addition to reducing hours, the agency will postpone filling vacancies until it sees if its budget will be restored. That will have an immediate effect on the Vachel Lindsay Home Historic Site in Springfield. The site superintendent is scheduled to retire July 1. After that, the home may be open by appointment only or for special events.

31 Comments

|

Poultry pranksters proliferate

Wednesday, Jun 25, 2014 - Posted by Rich Miller

* You gotta be kidding me…

The symbolism may have been lost for anyone traveling down 153rd Street Monday. However, two people dressed up as poultry and a guy in a Pinocchio costume were all part of the current campaign for governor of Illinois.

It started when Governor Pat Quinn’s campaign sent a man to put on a chicken suit outside an Orland Park country club. As nearby lawn signs indicated, inside Republican Bruce Rauner was raising campaign cash from about 100 supporters.

Suddenly, a van dispatched by the Rauner campaign raced to the scene. First out, the costumed character they call ‘Quinn-ochio,’ soon joined by another chicken. […]

The governor’s campaign finally got in the game Monday, debuting its own poultry prank. A campaign press release claimed Rauner’s been too chicken for over a year now to offer voters a plan for a truly balanced budget.

Give Rauner’s team tons of credit for its rapid chicken response effort, but this campaign season has already jumped the shark… to mix a metaphor.

…Adding… Quinn’s chicken was delivered by a Floridian.

* Meanwhile, could yet another underpaid “actor” in a silly fowl suit appear on the campaign trail? From a press release…

Tax Hike Mike Frerichs Ducks Debate

Refuses to Defend his Tax Hike Votes and New Service Tax Plans

PLAINFIELD…Democrat Senator Mike Frerichs ducked out of the first scheduled debate between himself and Republican Tom Cross. Frerichs had agreed to participate in the debate, hosted by Bill Cameron of WLS, but then ducked out.

* And, yes, you can buy goofy duck costumes…

…Adding… Speaking of costumes, does an $18 watch clash with a white tuxedo?…

36 Comments

|

* So, I take it, then, that he’s a “No” vote this November?…

GOP gubernatorial nominee Bruce Rauner says he has no problem with a November ballot measure that will ask Illinois voters whether the state should increase the minimum wage.

“The voters are going to be allowed to make their voices heard on a nonbinding referendum. I’m supportive of that,” he said Tuesday.

Rauner, a wealthy venture capitalist from Winnetka, also said he’d support raising the minimum wage under two scenarios: If it were increased nationwide; and/or if it were tied to pro-business reforms in Illinois.

He made the remarks while taking questions from the media during a campaign stop he and running mate Evelyn Sanguinetti made in Roanoke.

He has also yet to specify what those “pro-business reforms” actually would be. Would his proposed local option “right to work” law be part of that? We don’t know.

20 Comments

|

Why did they get the money in the first place?

Wednesday, Jun 25, 2014 - Posted by Rich Miller

* The whole idea of having “lead agencies” in the governor’s anti-violence initiative oversee grants was because these established, local not-for-profits knew the area well, knew the terrain, knew the needs and knew the providers. So, what the heck happened here?…

Thousands of state anti-violence grant dollars from Gov. Pat Quinn’s scandal-tainted Neighborhood Recovery Initiative went to a south suburban nonprofit to help re-integrate freed teen and young adult prison inmates back into society.

It was a noble idea except for one thing.

The nonprofit that the state paid with anti-violence grant money to handle re-entry services in Thornton Township actually was operating out of a day care center in south suburban Dixmoor.

On top of that, it was later learned, there was really no re-entry program at all — nor any proof that the organization, Project Hope, Inc., did anything for the $15,770 it received from Quinn’s administration to perform re-entry services, state records show.

It took three months for the Healthcare Consortium of Illinois, the larger nonprofit that the Quinn administration put in charge of NRI spending in Thornton Township, to figure out the scheme and to begin the process of turning off the spigot of taxpayer dollars, state records show.

Sheesh.

They never should’ve received that grant in the first place. A daycare center? Are you kidding me?

It appears from the story that one person at the local lead agency, Jaclin Davis, raised numerous red flags. Good for her. But Davis’ higher-ups at HCI really, truly messed up by handing out the grant in the first place.

35 Comments

|

Ever get the feeling you’ve been cheated?

Wednesday, Jun 25, 2014 - Posted by Rich Miller

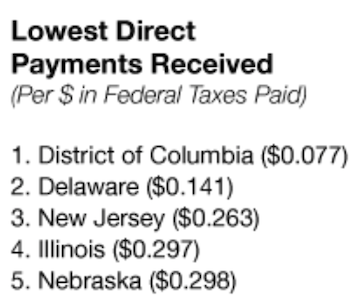

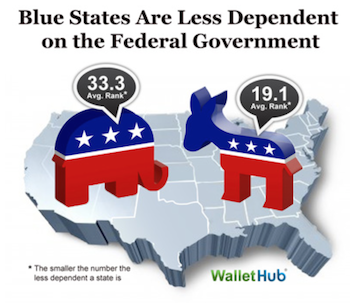

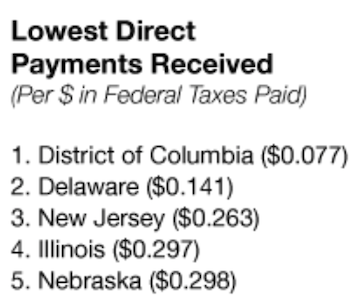

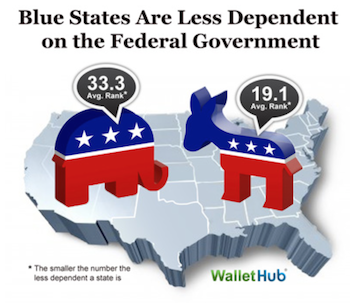

* WalletHub compared “the 50 states and the District of Columbia in terms of three key metrics: 1) Return on Taxes Paid to the Federal Government; 2) Federal Funding as a Percentage of State Revenue; and 3) Number of Federal Employees Per Capita”…

* Overall, Illinois ranked “second least dependent” of all states, behind only Delaware. Here are the categories, the actual numbers for the categories and our individual ranking within those categories…

Return on Taxpayer Investment - $0.56 - 3

Funding as % of Revenue - 26.23% - 8

Federal Employees Per Capita 6.45 - 11

* They weighted the results…

1. Return on Taxes Paid to the Federal Government – Weight: 1

(Federal Funding in $ / Federal Income Taxes in $) This metric illustrates how many dollars in federal funding state taxpayers receive for every one dollar in federal income taxes they pay. We have excluded from the Federal Funding the Loans/Guarantees component because it does not represent permanent transfers from the Federal Government to a state.

2.Federal Funding as a Percentage of State Revenue – Weight: 1

(Federal Funding in $ / State Revenue in $) * 100 This metric shows how much of a state’s annual revenue, and theoretically its spending, is provided by the federal government. Without this money, revenue would have to be found elsewhere – perhaps via tax hikes – or else key state services would suffer.

3. Number of Federal Employees Per Capita – Weight: 0.5

(No. Federal Workers / No. State Residents) This metric speaks to the federal government’s role as a nationwide employer, indicating the percentage of a state’s workforce that owes its very livelihood to Washington.

* They also used some items to put the numbers in context, such as “Direct Payments,” which “reflects the return on taxpayer investment in terms of federal entitlement payouts“…

And…

54 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|