Why did Walgreens stay put?

Wednesday, Aug 6, 2014 - Posted by Rich Miller

* You’ve probably heard already that Walgreens has decided not to pursue an inversion strategy to avoid paying US taxes. Crain’s looks at why…

First, the U.S. Treasury said it is reviewing administrative actions it can take to limit American companies’ ability to engage in so-called tax inversions — corporate shorthand for moving a headquarters overseas to reduce their U.S. tax burden. This development significantly increases the possibility that an inversion could create more trouble than it’s worth down the road for tax-sidestepping multinationals.

“If you thought the only way to kill an inversion was for Congress to change the tax code, no one was worried because Congress can’t get anything accomplished,” said an equity analyst who follows Walgreen but declined to be identified because of company restrictions about speaking to the press. “But if you believe that the Treasury can act without Congress, then you have an issue. Inversions are complicated and require a tremendous amount of work, especially if it might then be completely destroyed by changes in regulation.”

The second, larger issue is that Walgreen lost control of the tax-dodge narrative and got hammered by politicians ranging from U.S. Sen. Dick Durbin of Illinois to President Barack Obama himself.

“Walgreen seems to have been completely unprepared for the public reaction to inversion and wound up embroiled in a national debate,” says pharmaceutical consultant Adam Fein, president of Pembroke Consulting Inc. in Philadelphia.

Mr. Fein points out that several political points used against Walgreen don’t make a lot of sense — but the company has done nothing to publicly refute them.

* More…

“In line with our fiduciary duty to the company and our shareholders, we undertook an extensive and rigorous analysis with a team of leading experts to determine the most optimal — and sustainable — course of action. We took into account all factors, including that we could not arrive at a structure that provided the company and our board with the requisite level of confidence that a transaction of this significance would need to withstand extensive IRS review and scrutiny. As a result the company concluded it was not in the best long-term interest of our shareholders to attempt to redomicile outside the U.S.”

The company also said:

“As part of this process, the company considered a wide range of issues, including the potential financial benefits (and their sustainability) and the technical viability of a restructured inversion transaction under current U.S. law. The company also was mindful of the ongoing public reaction to a potential inversion and Walgreen’s unique role as an iconic American consumer retail company with a major portion of its revenues derived from government-funded reimbursement programs.”

The new holding company is to be named Walgreens Boots Alliance Inc. and is to be based “in the Chicago area,” Walgreen said in a statement. Walgreen’s operations will remain based in north suburban Deerfield, with Boots operations based in its current location in the U.K., the statement said.

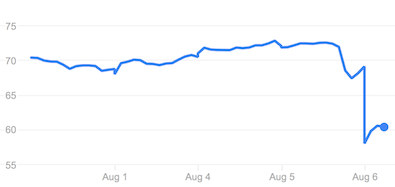

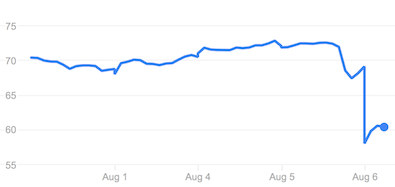

* The company’s stock price is taking a severe beating because of this. The five day trend…

* From Gov. Pat Quinn…

“I commend the Walgreens Corporation for their decision to stay and continue growing in the United States of America, right here in Illinois

“As part of our Illinois family for over a century, Walgreens’ decision respects their thousands of workers, managers and customers who also call our state home.

“Walgreens’ decision is the right one for the company, our state and our nation.“

* From Mayor Rahm Emanuel…

“I applaud and commend Greg Wasson and Walgreens for reaffirming their commitment to the United States, Illinois, and Chicago. Walgreens’ presence across Chicago’s neighborhoods make them an important member of the Chicagoland family and a critical player in our city’s history and our future. Their decision today speaks volumes about their determination to be a strong business, good corporate citizen, and vital community neighbors.”

- Bring Back Boone's - Wednesday, Aug 6, 14 @ 10:26 am:

===”If you thought the only way to kill an inversion was for Congress to change the tax code, no one was worried because Congress can’t get anything accomplished,”

heh.

- A guy... - Wednesday, Aug 6, 14 @ 10:26 am:

Good on Walgreens.

- dupage dan - Wednesday, Aug 6, 14 @ 10:27 am:

I wonder if any of the Illinois pension systems invest in Walgreens?

- A guy... - Wednesday, Aug 6, 14 @ 10:27 am:

Just further proof they are a great Corporate Citizen.

- wordslinger - Wednesday, Aug 6, 14 @ 10:30 am:

Walgreens has spent decades and invested tens of millions every year building their brand as the all-American neighborhood pharmacy and convenience store on the corner.

That’s their real long-term value, not some tax dodge. The cost of being the poster child for inversion just wasn’t worth it in the long run.

The stock hit was to be expected. A lot of short-term money was banking on a quick price bump from inversion. Oh well, you roll the dice and you take your chances. That’s capitalism.

- RNUG - Wednesday, Aug 6, 14 @ 10:31 am:

Good decision by Walgreens regardless of the reason. It’s pretty obvious they didn’t anticipate the level of backlash.

- Wallinger Dickus - Wednesday, Aug 6, 14 @ 10:31 am:

I am ever amazed at the tone deafness of so many companies that for so long have been so successful.

Do they not understand why politicians lean heavily on focus groups? Just because you accumulate riches doesn’t mean you know more than your customers.

This should be a teaching moment for corporate boards of directors. Sometimes their “low information” customers actually pay attention and vote their pockets.

- Almost the Weekend - Wednesday, Aug 6, 14 @ 10:32 am:

Nice work by Durbin’s team they found an issue and drove it home. Wonder if this corporate practice will become a major topic still come election day.

- Yellow Dog Democrat - Wednesday, Aug 6, 14 @ 10:33 am:

The stock will take a short-term hit.

Long term, this is a great move for the company, even the decision not to get into a political food fight.

When Durbin closed with “I don’t think the corner of happy and healthy is in the Swiss Alps,” he pointedly demonstrated how quickly he could invert their brand.

I know many folks argue that Walgreen is a beloved brand. Rather than dispute that, I will just point out that Susan G. Komen Foundation was once pretty popular too. Revenue dropped by 22 percent.

That again is why I think Walgreen was smart not to engage in a pr battle. Doubling down on a bad decision is what killed Komen.

- Senator Clay Davis - Wednesday, Aug 6, 14 @ 10:42 am:

Remove the political rhetoric from Quinn, Rahm and Obama, and there’s a solid point in the Crain’s piece:

“The overseas HQ move would have made sense, Mr. Fein says, because Walgreen will be a truly international company once the Alliance Boots deal is consummated, as scheduled, next year. Alliance Boots has interests in more than a dozen countries, ranging from Russia to Egypt, and is pushing into China…

“It’s not sensible that the U.S. should have the right to tax a transaction made in a pharmacy in Britain by a British citizen on a product that is made in China or elsewhere,” Mr. Fein said.

But Walgreen executives failed to clarify that point to the public, which was constantly bombarded by statements that such an inversion would be unpatriotic.”

- Bogey Golfer - Wednesday, Aug 6, 14 @ 10:46 am:

YDD - Susan G. Komen is a not-for-profit that overpays its staff. Walgreen’s is for-profit and management will be under fire at the next shareholder’s meeting. I get the pr snafu, but it is an apples to oranges comparison.

- VanillaMan - Wednesday, Aug 6, 14 @ 10:46 am:

SELL

- wordslinger - Wednesday, Aug 6, 14 @ 10:50 am:

Actually, if you have any money in the market, Walgreens is a way good buy today. Life expectancies in the United States and Europe mean a lot of scripts for a lot of years as far as the eye can see, and scripts are two-thirds of Walgreens revenues.

- Snucka - Wednesday, Aug 6, 14 @ 10:51 am:

The stock price was likely artificially inflated before the decision. It is still outperforming the market over the last year.

- VanillaMan - Wednesday, Aug 6, 14 @ 10:51 am:

What we have here is a international corporation being hobbled by administrative law. Not laws enacted legislatively. Laws being enacted administratively by a politicized executive branch of the federal government.

It is a lose-lose situation for Walgreens right now. That will change after the election.

Right now, I say sell that Walgreens stock until January. Then I’d buy it again at the lower stock price while the Corporation quietly moves overseas.

- Sunshine - Wednesday, Aug 6, 14 @ 10:51 am:

One would have thought that Walgreen’s would have anticipated this backlash and elected to stay out of the fray? Perhaps a review of top management is in order?

- Whizchigan - Wednesday, Aug 6, 14 @ 10:52 am:

I’m an analyst for WAG, and I’m surprised they stayed put.

- wordslinger - Wednesday, Aug 6, 14 @ 10:55 am:

VMan, what in the world are you talking about? What election?

- Norseman - Wednesday, Aug 6, 14 @ 11:01 am:

Is Vman a low information investor?

To the post. I’m glad Walgreens came to this decision.

- Yellow Dog Democrat - Wednesday, Aug 6, 14 @ 11:05 am:

Bogey Golfer:

Walgreen management will be under fire from whom?

The guys who got in to make a quick buck?

Read “Good to Great.” Walgreen didn’t become a great company by putting short term gains ahead of its long term interests.

In fact, Jim Collins points out that Walgreen was so committed to the concept of the corner drug store that if they had an opportunity to by a corner retail lot! even if it was on the same block as an existing store! they would do it and tear the old store down. For Walgreen, it is all about traffic, and you get so much more traffic in the long run with a corner location that they will take the short term loss over the long term gain every time.

Anyone who does not understand this does not understand the culture and strength of Walgreen and had no business buying stock in a company they knew so little about. If they lost money or didn’t profit as much or as quickly as they like…tough break.

As for Komen, ignore their lesson about brand management if you like.

- zatoichi - Wednesday, Aug 6, 14 @ 11:07 am:

Decisions for any company are a balance of many items which requires a broad view. It’s common to get the calculator out and show the numbers which indicate feasibility. Not so easy to judge the impact of PR, tradition, customer expectation, politics, and a changing marketplace. I would have loved to sit in the Walgreen’s board rooms and hear this entire project get whacked around. They have a responsibility to their stock holders for good returns so checking out inversion makes sense, but they also have responsibilities to expectations of their customer base who could easily walk away if it all goes wrong. Look at any number of large retail/restaurant chains who are no longer here or are fading fast. Glad they are staying.

- 47th Ward - Wednesday, Aug 6, 14 @ 11:08 am:

It sure seems like the Walgreen’s executives never wanted to do the inversion in the first place, most likely with the strong approval of the Walgreens family. Then some hedge fund brainiacs tried a shareholder push to earn a few extra nickels at Uncle Sam’s expense. Short term financial gain, long term damage to the brand and the family name.

Looks like management told the hedgies to take a hike. Good move.

- A guy... - Wednesday, Aug 6, 14 @ 11:10 am:

Walgreens could very well be set up as a strong example of why Federal tax policy needs to be changed. Now that Durbin has treated them like a pinata, he has an obligation to get to work for them and all Illinois and domestic businesses to enact changes not to make this such a tough decision. Get going Dick, you owe that to Walgreens personally.

- Reality - Wednesday, Aug 6, 14 @ 11:11 am:

An inversion would not allow Walgreens to escape taxation on the money it makes in the USA. It’s the foreign operations that the USA want’s taxes on that are at issue. So now Walgreens will not repatriate its cash earned in other countries to the USA because the amounts would be taxed if it does so. In the future if Walgreens wants to limit USA taxes it will simply pay a management fee to the foreign Corporation. Much ado about nothing except now Walgreens foreign cash will not come back to the USA for investment in domestic operations.

- VanillaMan - Wednesday, Aug 6, 14 @ 11:11 am:

I believe that the tax inversion issue will be addressed in the next US Congress. This isn’t just about Walgreens.

- Team Sleep - Wednesday, Aug 6, 14 @ 11:12 am:

Yeah - I’m not buying that Walgreen’s didn’t anticipate the backlash. Not to harp too much on yesterday’s posts, but the whole “low-info” voter debate certainly can be construed and reframed as “low-info consumer” or “low-info investor”. Corporate america - especially companies like Walgreen’s who employ an arsenal of lobbyists and former political staffers - has a pretty good pulse on how the general population views the current market and economy. I think Walgreen’s is playing dumb and acting conciliatory in the aftermath of a bungled maneuver.

- facts are stubborn things - Wednesday, Aug 6, 14 @ 11:22 am:

Norseman - Wednesday, Aug 6, 14 @ 11:01 am:

=Is Vman a low information investor?=

No, I have learned there is no such thing as low information voter or investor or anything else. We are all the same and it does not matter what level we wish to educate ourselves too. Below I have pasted a few quotes from Thomas Jefferson on the importance of an informed citizenry.

“Whenever the people are well-informed,they can be trusted with their own government;… whenever things get so far wrong as to attract their notice, they may be relied on to set them to rights.” –Thomas Jefferson to Richard Price, 1789. ME 7:253

Every government degenerates when trusted to the rulers of the people alone. The people themselves, therefore, are its only safe depositories. And to render even them safe, their minds must be improved to a certain degree.” –Thomas Jefferson: Notes on Virginia Q.XIV, 1782. ME 2:207

“The most effectual means of preventing [the perversion of power into tyranny are] to illuminate, as far as practicable, the minds of the people at large, and more especially to give them knowledge of those facts which history exhibits, that possessed thereby of the experience of other ages and countries, they may be enabled to know ambition under all its shapes, and prompt to exert their natural powers to defeat its purposes.” –Thomas Jefferson: Diffusion of Knowledge Bill, 1779. FE 2:221, Papers 2:526

“If a nation expects to be ignorant and free in a state of civilization, it expects what never was and never will be.” –Thomas Jefferson to Charles Yancey, 1816. ME 14:384

“Freedom [is] the first-born daughter of science.” –Thomas Jefferson to Francois D’Ivernois, 1795. ME 9:297

- PublicServant - Wednesday, Aug 6, 14 @ 11:27 am:

Walgreens opened a can of worms then closed it. Case closed. I wonder if it was Bruce dumping his Walgreens stock holdings that caused the dip? Anyway gotta go buy Walgreens stck TTYL.

- VanillaMan - Wednesday, Aug 6, 14 @ 11:27 am:

I think Walgreen’s is playing dumb and acting conciliatory in the aftermath of a bungled maneuver.

I agree with Team Sleep.

- Grandson of Man - Wednesday, Aug 6, 14 @ 11:29 am:

I also strongly commend Walgreens for its HQ staying in the US. I am a loyal shopper and will continue to be so.

I believe that there is a correlation between income inequality and taxation, and though the US corporate tax rate is the highest in the world or in the top two or three, it’s still lower historically than it has been in the past.

From the data I’ve seen, I believe the current effective US corporate tax rate is around 17%. The effective corporate tax rate around 1950 was 50%.

I believe that there is strong enough evidence to prove that lowering taxes does not create significant job growth. Two recent examples are California and Minnesota. Both states recently raised their income taxes, and both have had relatively good job growth in the last year.

I wish that the people who argue that cutting the top tax rates stimulates economic growth would just admit that the reason, or a significant reason, they support this is so that the wealthiest keep more of their money.

- Been There - Wednesday, Aug 6, 14 @ 11:31 am:

===if they had an opportunity to by a corner retail lot! even if it was on the same block as an existing store! they would do it and tear the old store down====

Doing that right now in my neighborhood.

===The company’s stock price is taking a severe beating because of this. The five day trend…

===

As Snucka said, long range the stock is still at a good price. Take a look at the 6 month to 2 year graphs. Todays stock price of $76 is $30 higher than a year ago.

- Formerly Known As... - Wednesday, Aug 6, 14 @ 11:36 am:

America has the highest statutory tax rate in the industrialized world. American corporate offshore profit stockpiles increased 11.8% last year, to $1.95 trillion.

But why talk about addressing the cause of this issue when you can talk about “patriotism” and make it a campaign issue instead?

Maybe the House and Senate could one day address the issue or close a few of the loopholes allowing some corporations to get away with absurdly low tax rates. If they could ever get anything accomplished, that is.

- Formerly Known As... - Wednesday, Aug 6, 14 @ 11:42 am:

== the U.S. Treasury said it is reviewing administrative actions it can take to limit American companies’ ability to engage in so-called tax inversions ==

== to withstand extensive IRS review and scrutiny ==

Does this mean the Treasury and IRS are now targeting companies for political purposes rather than just the tea party? lol /s

- Anonymoiis - Wednesday, Aug 6, 14 @ 11:43 am:

So far today Walgreens stock has down about 12.5% from yesterday’s close

- DuPage - Wednesday, Aug 6, 14 @ 11:45 am:

Walgreens makes a lot off of money from selling medicines to seniors and everyone else for that matter. If any restrictions were put on Medicare, Medicaid, government employees, from buying at Walgreens, it would cause them to lose way more then the tax dodge would save.

Walgreens did the right thing by staying put.

- Anonymous - Wednesday, Aug 6, 14 @ 11:51 am:

–In fact, Jim Collins points out that Walgreen was so committed to the concept of the corner drug store that if they had an opportunity to by a corner retail lot! even if it was on the same block as an existing store! they would do it and tear the old store down.–

They do it all the time, all over the country. They have a huge real estate team up in Deerfield that does nothing but. They’re all about the best, high traffic corners.

They also aggressively market the fact that they’ll make an offer on any independent pharmacy in the country (what’s left of them), if for no other reason than to shut it down and move into the neighborhood.

Walgreens could care less what any senator, governor or president has to say in the short term. They’ve been around a lot longer than any of them, and will be around a lot longer after they’re all gone.

What they do care about is the opinions of their 300 million-plus potential customer base in the United States. They’re constantly conducting focus groups and polling on what consumers think about the Walgreens brand.

You can bet they’ve done plenty of consumer research on inversion in the past few weeks, and the results factored heavily into their decision.

You can get scripts filled at the grocery store, Walmart, or through the mail. You go to Walgreens because of the brand they’ve built, and to them, brand equity is the ballgame.

- Anonymous - Wednesday, Aug 6, 14 @ 12:00 pm:

“Why, this isn’t tax evasion, suh, this heah is good ol tax InVERSION”. You gotta hate how the weasels twist the truth with terms intended to deceive

- OldSmoky2 - Wednesday, Aug 6, 14 @ 12:07 pm:

This was a smart decision. Far too many companies these days succumb to the pressure of the vultures on Wall Street and make decisions based on short-term profits and today’s closing stock price. It’s refreshing to see a company the size of Walgreens resist that urge and focus on its long-term image with its customers. That kind of thinking seems to be serving Walgreens investors very well in recent years and will continue to do so.

- Precinct Captain - Wednesday, Aug 6, 14 @ 12:11 pm:

==- VanillaMan - Wednesday, Aug 6, 14 @ 10:51 am:==

LOL. Walgreens selectively disclosed information to certain shareholders, leaving others in the dark. That’s not administrative law. That’s basic stock investment law that has existed for decades in the federal code.

http://www.theguardian.com/world/2014/jul/17/walgreens-ploy-move-tax-hq-spurs-complaint

- VanillaMan - Wednesday, Aug 6, 14 @ 12:16 pm:

These people are not tax evaders. They are following law. Don’t call them weasels. If you don’t like what they’re doing, demand that the law be changed.

Why should they give the government more of their money if the government itself is being ran by politicians who are claiming they are unpatriotic?

Honey - not vinegar.

- ChrisB - Wednesday, Aug 6, 14 @ 12:19 pm:

It might make you guys feel good, but if you believe in efficient markets, this was a pretty bad decision.

- wordslinger - Wednesday, Aug 6, 14 @ 12:26 pm:

==I believe that the tax inversion issue will be addressed in the next US Congress. –

I’m trying to think what would lead anyone to believe that the next Congress and the president could find common ground on this issue, or even agree as to what the issue “is.”

I’ve got nothing. Where does your faith come from? What does the “solution” look like?

Anon. 11:51 is me. Gadget hiccups.

- VanillaMan - Wednesday, Aug 6, 14 @ 12:39 pm:

I’m trying to think what would lead anyone to believe that the next Congress and the president could find common ground on this issue, or even agree as to what the issue “is.”

Obama wants more money. So does Congress. If the tax codes were fixed so that corporations can avoid leaving the country and pay less in taxes - that can be done so that more money will come into the Treasury in taxes. The tax rate is so high it becomes feasible to leave the US. Lower the tax rate so that it is no longer feasible. This will keep more corporations in the US and give us more taxes.

Right now, we are seeing a flood of corporations bolting.

Both Obama and Congress will benefit from a remedy that gives us more revenue and lowers taxes on corporations as well. Win-win.

- MOON - Wednesday, Aug 6, 14 @ 12:48 pm:

VM

There is some logic to what you are saying.

However, the Dems in Congress and Obama want to raise taxes above and beyond the current level by doing away with writeoffs and not lowering the tax rate.

- Nearly Normal - Wednesday, Aug 6, 14 @ 12:54 pm:

Glad to see that Myrtle Walgreen’s drug store is staying put in Illinois for the time being. Myrtle was from BloNo in case you did not know this. She was Myrtle Norton before her marriage to Charles Walgreen, an up and coming druggist from Dixon, Illinois who moved to Chicago to make his fortune.

It was her suggestion that her husband’s drug stores serve hot food in the winter and she made up the menus. Those of us of a certain age can remember eating in a Walgreen’s.

OK, history lesson over for the day.

- Formerly Known As... - Wednesday, Aug 6, 14 @ 12:56 pm:

Greg Hinz puts it very well.

== Sen. Dick Durbin, Gov. Pat Quinn, Mayor Rahm Emanuel, I’ve heard from all of them, and to the extent that their jawboning indeed helped keep the big drug retailer in the Chicago area, good for them.

But not one has mentioned today North Chicago-based AbbVie Inc., another big Illinois company that not only is talking about inverting its headquarters overseas but is actually doing so. And waiting in the wings potentially are Lake Forest-based Hospira Inc. and other local companies.

Hold the Champagne, guys. Your work has really just started.

The core problem is the screwed-up American tax code. The tax rate is too high to be competitive, largely because the base has been whittled down with too many loopholes. Everyone in Washington knows it, even if they’re too busy pointing the finger at someone else for not fixing it. ==

- Precinct Captain - Wednesday, Aug 6, 14 @ 12:58 pm:

==Obama wants more money. So does Congress. ==

You must have missed Dave Camp’s whiff on tax reform, with Wall Street threatening to end all fundraising for the GOP, even though is bill was DOA anyway.

http://www.politico.com/story/2014/02/wall-street-republicans-dave-camp-bank-tax-reform-104065.html

- VanillaMan - Wednesday, Aug 6, 14 @ 2:03 pm:

That was so February.

When these things become campaign weapons, and the Congress is in the hands of the targeted party of that political weaponry - there is often a change.

- LisleMike - Wednesday, Aug 6, 14 @ 2:45 pm:

Maybe I missed it, but has Walgreens decided to stay in Illinois? If the inversion was rooted in tax issues, wouldn’t it make sense for plan B to perhaps include an analysis of States besides Illinois (long term view) in which to do business, given our apparent unwillingness to deal with our finances?

- redleg - Wednesday, Aug 6, 14 @ 2:46 pm:

And I do realize that the Bloomington GE factory was not their headquarters. I know because i worked there. Eureka? Not so sure it was their headquarters but might have been.

Anybody here know the history of GE going offshore? I do. They were some of the first to abandon USA workers.

Again, I wish this sort of backlash existed then. Would have been a life changer for some of us, our children and our grandchildren.

- walker - Wednesday, Aug 6, 14 @ 3:26 pm:

Because the Walgreen’s Board and CEO fully met their fiduciary responsibility to the stockholders. It’s never only about short-term earnings. It’s about the long term health and value of the company.

- Yellow Dog Democrat - Wednesday, Aug 6, 14 @ 4:27 pm:

Anonymous 11:51 -

Great insight.

I think the earlier poster might also have been spot-on about management believing this was a bad idea from the get-go but needing to walk the Bruce Rauner’s of the world through it.

Back to the post:

I am tired of hearing the “It’s not tax evasion, it’s perfectly legal” argument.

The folks who wrote the tax code don’t get to make that argument. Perfectly legal does not equal perfectly moral or sound public policy or beyond criticism.

I apply that rule to Pat Quinn, applied it to Rod Blagojevich, and Republicans ought to have the integrity to apply it to Bruce Rauner.

So, stop arguing Rauner didn’t break the law and start explaining why we should choose Jack Sparrow as governor.

- wordslinger - Wednesday, Aug 6, 14 @ 4:48 pm:

The U.S. tax code is nearly four million words — that’s “War and Peace” times seven.

These ducks and dodges didn’t get in there by accident. A lot of K Street lobbyists and lawyers pull down big money every year to get the tax code just how their clients like it.

You can say “simplify” or “tax reform” but big money likes the way they can manipulate it right now.

- Yellow Dog Democrat - Wednesday, Aug 6, 14 @ 11:19 pm:

Word -

Word.

It is especially grating to hear the folks who wrote the tax code brag that their shenanigans are legal.

I know they mean it as a defense, but it comes across like they are spiking the ball in the end zone.

- Anonymoiis - Thursday, Aug 7, 14 @ 8:44 am:

==start explaining why we should choose Jack Sparrow as governor.==

Because Jack Sparrow is better than Pat “Davy Jones” Quinn, trying his best to drag us down and keep us there

- Anonymous - Tuesday, Aug 12, 14 @ 10:55 am:

Thank you Walgreens! I am proud of Walgreens for making the decision to stay in the United States of America. Until all of this surfaced I had no idea that our tax code for business is 35%. Outrageous! Yes we do need to overhaul the tax we put on businesses. I agree that it is much too high! Again I congratulate Walgreens, you are truly an American icon.

- Anonymous - Tuesday, Aug 12, 14 @ 10:55 am:

Thank you Walgreens! I am proud of Walgreens for making the decision to stay in the United States of America. Until all of this surfaced I had no idea that our tax code for business is 35%. Outrageous! Yes we do need to overhaul the tax we put on businesses. I agree that it is much too high! Again I congratulate Walgreens, you are truly an American icon.