Posted under protest

Monday, May 18, 2015 - Posted by Rich Miller

* From Rep. Sara Feigenholtz, whose district includes Wrigley Field…

From: Sara Feigenholtz

To: Rich Miller

Subject: Pretty please put this in Monday’s Capitol Fax

The newly formed Cubs Caucus will celebrate its launch this Wednesday May 20th 8pm at DH Browns

Cubs.vs Padres. First.pitch 9:10pm.

(You don’t have to mention the 6 in a row thing if you dont want…)

Kosher dogs on the grill from Romanian (yum) and a whole lot more.

Who loves you?

* My response…

Ugh

* Her retort…

Pretty

Please

OK, OK.

But should we give the new caucus a slogan?

104 Comments

|

* Moody’s just put out a “FAQ” which explains its Chicago downgrade to junk status. First up, “Future Rating Drivers for Chicago”…

Question: What could cause Moody’s to change its GO rating on Chicago, in either a positive or a negative direction?

Answer: Our future rating actions on Chicago will largely reflect city officials’ actions on pension contributions and, ultimately, the growth of debt and pension leverage on the city’s balance sheet. Chicago’s pension funding requirements are governed by PA 98-0641 (the statute that applies to the Municipal and Laborer plans) and PA 96-1495 (the statute that applies to the Police and Fire plans). Whether or not either statute ultimately stands, we believe that Chicago’s administration will eventually have to increase pension contributions through some combination of operating revenue growth and operating expenditure reduction. The magnitude of those expected budget adjustments will be significant and will force city officials to make difficult decisions for years to come.

If both PA 98-0641 and PA 96-1495 stand, Chicago’s annual pension contributions are projected to increase by 135% in 2016; by an average annual rate of 8% in 2017-21; and by an average annual rate of 3% in 2022-26. To comply with these requirements, Chicago’s administration will need to grow revenue or cut spending by an average annual rate of 12% year-over-year (YOY) for the next decade in order to bring net pension contributions back to historical norms of 10% of annual operating revenue by 2026. (Given the scheduled contribution increases, actual annual revenue increases or spending cuts would likely be greater in 2016 than in 2017-26.) If PA 98-0641 is ultimately overturned, however, future pension funding will depend on how the city responds.

» Chicago officials could respond to an adverse ruling on PA 98-0641 by pursuing new state legislation that authorizes the city to increase contributions to the plans. If Chicago’s administration increases pension contributions in the context of balanced operating budgets that do not rely on non-recurring revenue sources, we could move the rating up or revise our rating outlook to stable.

» Chicago officials could also respond to an adverse ruling on PA 98-0641 by declining to pursue new state legislation that would allow the city to increase contributions to the plans. Chicago’s funding commitments would presumably revert to those which existed prior to the passage of PA 98-0641. Under the prior funding framework, the city’s contributions were well below those called for by plan actuaries, who projected that the Municipal and Laborer funds would deplete assets in the next decade. If the plans reach insolvency, the state could potentially implement legislation forcing Chicago to pay benefits to annuitants, either directly or through the plans. Benefits paid from the city’ four pension plans (Municipal, Laborer, Police and Fire), net of employee contributions, would significantly exceed the city’s employer contributions to those plans, as required under current laws (see Exhibit 2). If Chicago is forced to pay benefits from city operating revenue, we believe the city’s finances and GO credit profile would weaken. Therefore, if PA 98-0641 is overturned, and the city’s response raises the risk of plan insolvency, we could move the rating down.

* And here’s something for all you “We’re the next Detroit!” fanatics…

Meaning of Chicago’s Ba1 Rating in Terms of Default and Loss Potential Upon Default

Question: Does Moody’s Ba1 rating signal an expectation that Chicago will declare bankruptcy or default on its debt?

Answer: No. Moody’s ratings speak to both probability of default and expected loss upon default. The Ba rating range implies speculative elements in the risk profile but only a relatively small risk of default. Historically, approximately 1% of credits rated in the Baa range have defaulted over a three-year horizon. For credits in the Ba rating range, the share is 5%, and for B-rated credits, 15%.

We do believe, however, that the city’s pension-related challenges are significant and introduce speculative elements into the credit profile. Chicago’s pension plans will fund annuitant payments as long as assets remain in the funds. If plan insolvency occurs under the conditions described above, new questions would arise. Illinois law (40 ILCS 5/22-403) defines pension benefit payments as obligations of the pension funds, but if the pension funds are unable to fulfill these obligations, it is unclear which party will be responsible for paying annuitants.

If Chicago is forced to pay net benefit payments directly to annuitants or to the plans, elevated pension costs would compete with essential public services for city resources, creating particularly tough challenges for Chicago’s administration. We expect that this scenario would present city officials with several difficult options.

» One option would be to pursue massive revenue raising and expense cutting initiatives. Given the sheer size of the pension benefit payments that would be required, we believe that the magnitude of such budget adjustments would be extreme and would therefore be difficult to execute.

» A second option could be to pursue bankruptcy. Currently, Illinois local governments cannot file for bankruptcy, but in March 2015, proposed legislation (House Bill 298) was introduced in the Illinois General Assembly that would grant local governments authority to file for protection under Chapter 9 of the federal bankruptcy code.

» A third option would be bondholder impairment. In fact, we note that for cities in distress, pensioners have fared better than bondholders. For example, the City of San Bernardino, CA recently put forth a plan of adjustment that proposes no impairment to pensioners but a 99% loss to holders of the city’s pension obligation bonds (POBs).

Chicago’s decisions on future pension contributions – whether or not current laws stand – will be critical to our placement of the GO rating going forward. [Emphasis added.]

* OK, on to Illinois…

The State of Illinois General Obligation Rating

Question: Why hasn’t Moody’s taken rating action on the State of Illinois when the Illinois Supreme Court ruling concerned the state’s pensions?

Answer: The Illinois Supreme Court’s May 8 ruling has clear implications for the state because it appears to close the door on efforts to reduce accrued liabilities through benefits cuts. However, our credit view and rating was not dependent on the implementation of the state’s 2013 reforms, which had been stayed during the litigation. Our A3 rating on the State of Illinois reflects the state’s broad legal powers and fiscal tools to address its budget challenges, including pensions. Among the state’s options are reversing its recent income tax cuts and reducing revenue sharing with local governments. We note that the state itself also retains the option of shifting pension costs to lower levels of government, notably public universities and school districts (other than CPS), the pension liabilities of which are currently funded by the state. State shifting of pension costs to public universities and school districts would be credit positive for the state but credit negative for affected entities.

The state’s outlook remains negative, which reflects cuts in state income taxes and rising fixed costs, including those associated with pensions that have contributed to a budget gap of approximately 21% in the fiscal year starting July 1. Reliance on one-time or questionable fixes to address this gap – such as deficit financing, reduction in pension contributions or increased payment delays – would put downward pressure on the state’s ratings. [Emphasis added.]

Go read it all.

16 Comments

|

Today’s must-listen audio

Monday, May 18, 2015 - Posted by Rich Miller

* If you have time today, you should listen to Gov. Bruce Rauner’s address to members of the Large Unit District Association Superintendents’ meeting. It’s quite good, particularly the Q and A. The man has this stuff down. He also doesn’t scream about the unions, or whatever. I’m telling you, it could be the best speech I’ve ever heard him give. Yeah, there are some nitpicky little things I’d change, but it was his speech, not mine..

30 Comments

|

Mansion stuff

Monday, May 18, 2015 - Posted by Rich Miller

* I delayed fixing a chimney and it recently cost me a small fortune to have it repaired. The very same short-sighted principle applies here…

Although an initial analysis of deteriorating conditions at the [governor’s] mansion estimated minimal repairs will cost $8.8 million, organizers of the private fundraising campaign expect the figure to be higher when historic restoration experts release a more detailed report later this month. And officials expect the cost of repairs will continue to increase the longer the wait for repairs. […]

Last year, $2.4 million in emergency repairs for the mansion was approved but never spent. The mansion’s roof was patched last summer to prevent leaks that had continued to damage walls, buckle floors and cause mold to grow in the basement.

Problems with the mansion include roof leaks, water damage, wood decay, faded carpets, peeling paint, and outdated mechanical, electrical, plumbing and heating and cooling systems.

* Annual reports? Maybe they should reconsider and do them quarterly…

Governor’s spokeswoman Catherine Kelly said donations will be made public in annual reports. The campaign also has a website: illinoismansion.org.

* Could this allow the governor to get around prevailing wage requirements?…

Van Meter, a Springfield businessman who chairs the Sangamon County Board, said legislative leaders will be asked to highlight the fundraising campaign with constituents. But he said the Rauners were specific when it came to tax dollars.

“It’s 100 percent private funding,” Van Meter said. “It will be through memberships to the association and donations to the association.”

Gotta wonder if the unions will picket.

* And, look, if the swells wanna kick in I’m fine with that because the repairs are definitely needed. But will kids really care?…

Van Meter said the coming campaign will be statewide for donations large and small, perhaps including a “pennies for the mansion” appeal to schools.

42 Comments

|

Unsolicited advice

Monday, May 18, 2015 - Posted by Rich Miller

* Andy Shaw of the BGA writes in the Sun-Times…

…Rauner’s communications deputy, Mike Schrimpf… answered my email request to interview his boss this way:

“We aren’t going to do this while your organization continues fishing expeditions into individuals who work for the administration. This randomly trying to dig up dirt on people is sickening.”

The “dirt” apparently refers to some of our document requests, and these BGA stories about the new administration’s appointments and associates:

A Gaming Board selection heads a law enforcement group that took donations from a suburban casino that’s regulated by the board.

A campaign committee created by the new head of the Department of Natural Resources received money from a giant downstate coal company.

Rauner’s former campaign manager joined a lobbying firm that may lobby the governor’s office.

The stories expose potential conflicts the public should know about and the Rauner administration should care about.

That’s not “dirt” — it’s the road to “better government” and the goal of our investigations.

I can certainly understand how the BGA would be peeved.

But, from what I’m told, those requests are not what necessarily ticked off the governor’s office.

* Instead, the BGA FOIA’d Rauner spokesman Lance Trover’s Internet browsing history - not once, but twice (once through the governor’s office and a second time through CMS). Both BGA fishing expeditions were denied. And then they threw out their net again when they FOIA’d Schrimpf’s personnel file.

Seems a bit much, particularly if you know how the Internet system at the governor’s office works (any sites remotely political or otherwise prohibited are blocked) and personnel records are supposed to be private.

* I recommended Andy Shaw for the BGA job. 90 percent of what his group does is valuable. But maybe 10 percent is just weird. Nobody’s perfect, of course, but, c’mon, man. How about disclosing those three incendiary FOIA’s?

Also, Schrimpf probably needs to take yet another nap. That was a bit harsh, dude.

33 Comments

|

A lesson that must be learned

Monday, May 18, 2015 - Posted by Rich Miller

* Paul Krugman’s point is about some national and international stuff, which we really do not need to get into here because, well, this is a state blog. But his conclusion is well worth discussing in the context of Illinois’ failed “pension reform” law…

It doesn’t matter that the skeptics have been proved right. Simply raising questions about the orthodoxies of the moment leads to excommunication, from which there is no coming back. So the only “experts” left standing are those who made all the approved mistakes. It’s kind of a fraternity of failure: men and women united by a shared history of getting everything wrong, and refusing to admit it. Will they get the chance to add more chapters to their reign of error?

This is most definitely a conversation we need to have in Illinois. We were misled into this battle by people and institutions who shouted down anyone who dared to object or so much as voiced concerns.

* From a column I wrote back in 2013…

The Civic Committee, a group of wealthy business executives headed up by former Republican Attorney General Ty Fahner, also has claimed that [Senate President John Cullerton’s] proposal wouldn’t save enough money. But last year, Fahner supported a bill that actually would have increased state costs in the short term and saved the state just a few billion dollars over the long term.

Fahner has been all over the place. He supported a pension bill sponsored by House Speaker Michael Madigan last year, then claimed a few months later that the pension problem was “unfixable.” He demanded that cost-of-living increases be eliminated altogether, but now backs a plan that allows COLAs on the first $30,000 of pension income.

Cullerton took the plan endorsed by Fahner and grafted his own pension reform language onto it. Cullerton’s “consideration” proposal wouldn’t take effect unless and/or until the courts ruled that the Fahner-backed proposal was unconstitutional.

Fahner didn’t like that idea, either. And he and lots of big-business types lobbied hard against it, along with a certain editorial board down the street, and forced Republicans off the bill. That killed the proposal, and the Fahner-backed bill was defeated as well.

* And from a Tribune editorial around the same time…

The person who leads the Senate and who holds significant influence over his members prefers his own pension bill. Cullerton’s Senate Bill 1, which also could come to a vote Wednesday, includes the provisions of Biss’ bill. But it also does something odd: It says if the courts strike down those provisions, a Plan B would kick in.

Cullerton’s Plan B comes up far short of the savings needed to restore fiscal health to the pension plans. It depends on multiple choice: Government workers would choose between the much-coveted, compounded cost-of-living increases they receive in retirement, or access to the state’s health care plan. Cullerton believes his bill has a better chance of being found constitutional by the courts.

But the real message from lawmakers to the courts would be this: Hey, we don’t really trust Plan A, so be our guest, throw it out, we’ll live with Plan B. No, really. We beg you.

Both Fahner and the Tribune were on exactly the same messaging track. And they were both wrong.

That’s not to say that Cullerton’s proposal at the time would’ve necessarily passed constitutional muster. It’s just that anyone who objected to the Fahner/Tribune orthodoxy (Cullerton, Ralph Martire, public employee unions, etc.) was marginalized by the powers that be. Debate was stifled, and that was ridiculous.

Even I felt so beaten down by the end of that debate that I wanted the darned thing passed just to get it off the table for a while and let the courts decide.

We can never let that happen again.

46 Comments

|

Fighting fire with fire?

Monday, May 18, 2015 - Posted by Rich Miller

* Gov. Bruce Rauner during an April 25 speech to the Society of American Business Editors and Writers…

Rauner, who was pushing his “turnaround agenda,” including right-to-work zones, also said in that speech: “We have bipartisan failure. … The problem is which members in each party are on the take with the insiders. … And we’re gonna take ‘em on.”

The governor also told the group that “crisis creates opportunity.”

* So, if you think you have members in your own party who are “on the take” - particularly from unions - and you want to create a little “opportunity” ahead of the “right to work” House floor vote, what do you do? Well, perhaps you give your folks some money to put ‘em in your own back pocket…

Gov. Bruce Rauner has started doling out money from his campaign fund to fellow Republicans as the Illinois Legislature approaches what could be difficult votes on several big issues.

Rauner divided $400,000 among every Republican member of the Illinois House and Senate, spokeswoman Catherine Kelly said Saturday.

The contributions, made [last] Monday, come with just weeks to go before the May 31 end to the spring legislative session, and with Rauner looking to his GOP allies to support his pro-business agenda in the Democrat-controlled General Assembly. […]

Kent Redfield, a professor emeritus of political science at the University of Illinois at Springfield, called the donations and their timing in such close proximity to possible votes “very unusual.” While labor unions, businesses and other groups often ramp up their contributions this time of year, a governor or other elected official doing so “really isn’t something we’ve seen,” he said.

Redfield also said it could create a perception issue for Rauner, a multimillionaire who ran for office on a promise to “shake up Springfield.”

Yeah, it’s a cynical explanation, but those contributions weren’t exactly uncynical. However, accepting those contributions could sure raise questions for Republicans who abandoned the unions last week.

Your thoughts?

58 Comments

|

Counting the tax money

Monday, May 18, 2015 - Posted by Rich Miller

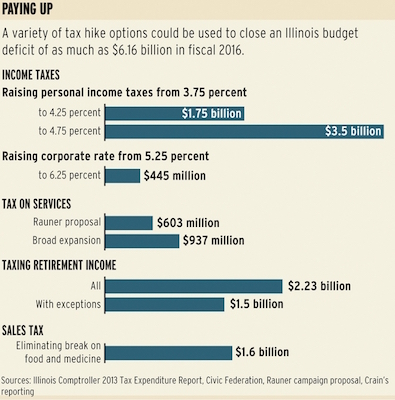

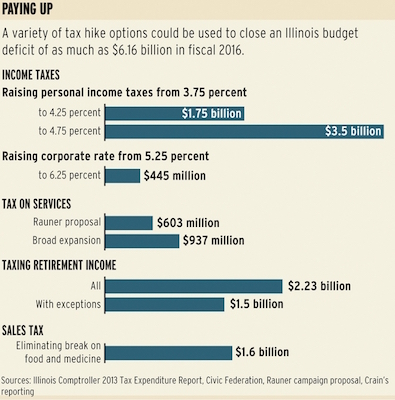

* Tom Corfman writes in Crain’s about revenue options for fixing the budget hole…

One option to balance the budget is reducing the state’s contributions to the retirement plans, which are the most underfunded in the nation. The state’s scheduled $6.6 billion pension payment in fiscal 2016 is larger than the entire deficit. Such a move would give the state some breathing room “for a few years” but would threaten its credit rating, Durkin says.

One big target to bolster revenue: income taxes. Increasing the personal tax rate to 4.75 percent—a quarter-point below the temporary tax hike—would raise $3.5 billion, according to the Civic Federation, which favors increasing the rate to 4.25 percent. Raising corporate taxes to 6.25 percent from 5.25 percent would add $445 million. The federation supports upping the corporate rate to 6.0 percent. […]

Other options include expanding the sales tax to 32 services, a move Rauner proposed during the campaign as a way to generate more than $600 million in revenue. An even broader expansion would raise $937 million, the federation says. […]

Taxing retirees with an annual income of at least $50,000, not counting Social Security, would generate between $1.5 billion and $2.0 billion a year, the Civic Federation says.

“Everything has to be on the table, at least for discussion,” says state Sen. Kwame Raoul, D-Chicago, co-chairman of the General Assembly’s conference committee that produced the pension bill two years ago. “The pension problem is not just a pension problem. It came about as a result of the state balancing its budget on the back of the pension system.”

When Minnesota jacked up income taxes, it back-dated the hike to January 1st. That would bring in a whole lot more revenue, but it would also hit the poor and middle class particularly hard.

Retiree taxes are almost assuredly off the table, but one never knows, I suppose. Service taxes can’t be implemented right away, but the future revenues can be bonded for a capital plan.

And, of course, the final option is to do essentially nothing and let Gov. Rauner take the heat.

* A handy Crain’s chart…

57 Comments

|

|

Comments Off

|

* My Crain’s Chicago Business column…

Believe it or not, legislators usually try to reflect their constituents’ core values. If the folks back home are convinced that their representatives have strayed too far from those values, those representatives are in danger of losing their jobs.

Some politicians are so popular that they can get away with anything. But few elected officials want to risk sparking up an opponent. Even though they’d likely win, they’d have to actually work during an election year. Politicians are like everybody else. Not many enjoy doing extra work for the same salary.

But sometimes a problem becomes so large that politicians finally have no choice but to stick their necks out.

This is one of those times.

The 2011 income tax hike was reviled. But the truth is it had to be done. The state had skipped and skimmed on pension contributions for so many decades that it needed to start making payments or risk a fiscal catastrophe.

Those payments aren’t small. They amount to several billion dollars a year. Without that tax hike, the state essentially would have had to gut the entire government.

But in an attempt to free up some money for vital services, pension benefits were cut. As you know, the Illinois Supreme Court recently rejected those cuts, in a strongly worded opinion.

Part of the “temporary” income tax hike expired in January, creating a $6.16 billion hole in the budget that begins July 1. Pension benefits can’t be cut to fill even part of that chasm.

Legislators and the governor are scrambling to come up with a solution.

Click here to read the rest before commenting, please. Thanks!

Also, subscribers have crosstabs and the complete polling questions.

67 Comments

|

Behind the “right to work” vote

Monday, May 18, 2015 - Posted by Rich Miller

* My weekly syndicated newspaper column…

Gov. Bruce Rauner had several House Republicans over to the executive mansion last week to ask them to vote “present” when the House Democrats called their “right to work” bill the following day.

Right-to-work laws allow union members to not pay for any of their union’s services, even though unions are required by federal law to service all their members. The laws can cripple unions, which may help businesses, but it tends to drive down wages for working folks.

Why would the Democrats bring an anti-union bill to the House floor? Various reasons, one of them being that they are so opposed to the idea and the governor has pushed it so forcefully that they wanted to finally get the issue off the table by killing it dead. They also wanted to put the Republicans in a tight spot of choosing between the governor and their friends in organized labor.

Anyway, the governor’s push last week was resisted by a handful of Republicans, even after House GOP Leader Jim Durkin demanded that they stick with the governor and vote “present.”

Several eventually relented, and the governor reportedly said that they would be free to vote “no” when a “real” bill is presented but that they all needed to stick together and hit their yellow buttons to protest House Speaker Michael Madigan’s ploy to put them all on the hot seat. It probably didn’t hurt that Rauner contributed a grand total of $400,000 earlier in the week to what his staff said was every Republican legislator in Springfield.

The meeting at the mansion was often tense, insiders say, although there was reportedly a moment of levity when one of the governor’s beloved dogs made a doo-doo in front of legislators while Rauner was giving his pitch.

Believe it or not, quite a few unions in this state have spent years wooing Republican legislators. The Illinois Education Association has a strong presence in suburbia and downstate and the union has long endorsed a significant number of GOP candidates—including in Tier One races against Democrats. Getting on their wrong side can be a hazard to one’s political health, which is just one reason so many Republican legislators were nervous last week.

The IEA sent House Republicans a “simple” message last week: “We expect a ‘no’ vote,” said one IEA lobbyist. “Show that you are supportive of the middle class. A vote to the contrary and they will have to explain themselves to our members.”

The Republicans pleaded their case that the bill was mainly just political theater designed to make them look bad. But the IEA and other unions wouldn’t budge, leaving legislators to choose between their party’s governor (and his tens of millions of dollars in campaign cash) and their union allies.

Illinois AFL-CIO President Mike Carrigan said last week that “anything but a solid ‘no’ vote” will “not be tolerated and will be considered as an inexcusable vote against labor.”

Carrigan also specifically said that “present” votes weren’t acceptable. Skipping the vote altogether wouldn’t be a good idea, either, he warned. “House member absences will be reviewed with suspicious eyes.”

In the end, only one Republican sided openly with the unions and Democrats by voting “no” on the bill, Rep. Raymond Poe of Springfield. Four union-friendly Republicans didn’t vote at all (Reps. John Anthony, Bill Mitchell, Michael McAuliffe and John Cabello). A few others didn’t vote, either, but that likely had more to do with the process and/or their relationships with their party leaders than anything else.

Some Republicans with past union ties voted with the governor. Rep. Dwight Kay, for instance, was endorsed by the IEA for the first time last year, but he voted “present.”

One of Rauner’s main goals is to split the Republican Party from all union ties. If the unions follow through with their threats, some of those ties will most certainly be broken.

And the Republicans aren’t the ones that unions have to be worried about. The House Black Caucus sent a clear message to trade unions during the debate that they need to start admitting more minorities or they’ll face retaliation.

Rauner has tried to peel off black and Latino legislators from labor by playing up the historic “whiteness” of the trade unions and promising affirmative-action-style reforms. In remarks planned in advance with other Black Caucus members, Rep. Ken Dunkin, D-Chicago, said during debate that the problem needed to be addressed soon or trouble could arise.

Almost all minority legislators stood during his speech and stared at the gallery where labor leaders were seated.

Thoughts?

29 Comments

|

Looking on the bright side

Monday, May 18, 2015 - Posted by Rich Miller

* Becky Vevea at WBEZ has an excellent look at the history of Chicago Public Schools. I’m probably excerpting more than I should but you should still go read the whole thing…

There’s a growing body of evidence that Chicago’s schools are improving quickly and — for certain populations of students — doing better than other districts. U.S. News and World Report just released its annual rankings of the nation’s best high schools: Six of the top 10 in Illinois are in CPS and another three in the top 20.

“When the state’s not doing well or not making great progress, there’s always some number of people who say, ‘Well maybe that’s just because Chicago’s not doing well. Maybe they’re just dragging down the rest of the state,’” says Robin Steans, executive director of Advance Illinois, a bipartisan group focused on improving the state’s education policy. “What we found is that’s not true. Chicago has made steady gains both academically and in terms of some critical outcomes, like graduation.”

Steans’ group looked at scores on the National Assessment of Educational Progress, from 2003 to 2013 and found Chicago students grew 11 points on the 8th grade math test and 7 points on the 4th grade reading test. The state grew just 7 points and 3 points, respectively.

Advance Illinois also compiled state graduation data from 2014 to compare Chicago with other districts for certain subgroups of students. They found that Latino students enrolled in CPS are more likely to graduate high school than their counterparts in many suburban districts, including Maine Township High Schools and Evanston Township High School.

“It’s so counterintuitive to what they think they know about Chicago that they just disregard it,” Steans says of the data. “There’s been so much noise, with the teachers strike and the school closings. The political heat and noise tends to crowd out what’s actually beneath and behind that.”

Paul Zavitkovsky, a leadership coach and assessment specialist at the Urban Education Leadership Program at the University of Illinois - Chicago, may be able to help. In a forthcoming study, Zavitkovsky’s findings mirror what Advance Illinois found.

“On an apples-for-apples basis, if you compare yourself with your counterparts based on race and socioeconomic status in other parts of the state, you have a higher probability of having a better educational experience in Chicago,” he says.

But Zavitkovsky goes further. He shared a preliminary version of the report with WBEZ that showed students in the 75th percentile for 4th grade math achievement grew 20 points between 2003 and 2013. The performance of that subgroup in the rest of the state grew only 3 points in the same amount of time.

Again, go read the whole thing and discuss below.

18 Comments

|

Tom Cullerton says he’s in

Monday, May 18, 2015 - Posted by Rich Miller

* Sen. Tom Cullerton has announced that he’s running for Congress. From a press release…

After spending the last weeks exploring a run for Congress, State Senator Tom Cullerton (D-Villa Park) announced today that he is formally running for the 8th Congressional seat being vacated by Congresswoman Tammy Duckworth, who is running for U.S. Senate.

“Congress is a millionaires club. I want to change that by bringing my blue-collar work ethic and common sense solutions to Congress. I know what it is like to wake up, punch a time clock and put in an honest day’s work, “ Senator Cullerton said. “I believe everyone deserves a good job that allows them to get up each day and put in a hard day’s work. I believe that if you work hard every day, you deserve a good wage that provides for your family and the ability to retire with dignity. “

As a military veteran, Tom has made veterans and their families a cornerstone of his first term in the Illinois Senate, including sponsoring legislation that created Illinois’s first Suicide-Prevention Task Force for Veterans. As a proud Union member and former Hostess Route Salesman, Tom believes that working families need to come first and believes that Congress should increase the minimum wage.

* He’ll be up against Raja Krishnamoorthi in the Democratic primary to replace US Senate candidate Tammy Duckworth. From a Krishnamoorthi fundraising email today…

Democratic leaders are lining up to endorse Raja!

Here are just a few Democratic leaders who are backing Raja’s campaign for Congress:

State Senator David Koehler

Former State Rep. Paul Froehlich

Beth Siela Marcin, President of the Greater Palatine Area Democrats

OPEIU Local 45

And many others!

We’re building a strong grassroots campaign — and we want you there from the very beginning.

* Sen. Mike Noland is another possible candidate…

Have you been keeping tabs on Congress?

Well, I have. And I am tired of standing by while the House Republicans try to carry out their arcane Tea Party agenda.

This is what the Republican Congress has done so far this week:

Passed a ban on abortions after 20 weeks. This bill put an extreme agenda ahead of protecting the health of women.

Delayed a long term funding plan for the Highway Trust Fund. As our infrastructure continues to crumble, Republicans want to play politics with funding improvements and creating jobs.

Issued more subpoenas for its kangaroo court regarding Benghazi. As they continue their witch-hunt against Hillary Clinton, the United States faces real challenges abroad.

When I am elected to Congress I will stand up to these Republicans who are dead set on imposing their backwards thinking on the rest of America.

If you ready to help elect another progressive who will fight for a better tomorrow, I ask you to join our campaign today. If you’ve saved your payment information with ActBlue Express, your donation will go through immediately:

27 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|