Question of the day

Tuesday, May 5, 2015 - Posted by Rich Miller

* Gov. Rauner is to his “Turnaround Agenda” as Speaker Madigan is to ____?

90 Comments

|

[The following is a paid advertisement.]

When it comes to clean air energy in Illinois, nuclear energy is a true powerhouse. Nuclear energy generates more jobs and more income than any other energy source. For every 1,000 MW generated, nuclear employs 500 people – more than twice as many as any other electricity source – with good-paying, middle class jobs. Nearly 90% of the carbon-free, clean air energy consumed in our state comes from nuclear energy, and the industry supports 28,000 jobs right here in Illinois.

But three of the state’s six nuclear plants are economically challenged and at risk of being shuttered prematurely because of outdated energy policies. According to a recent State of Illinois report, these premature closures would result in the loss of nearly 8,000 jobs.

According to an April 2015 report by the Illinois Power Agency, that is more than 10 times as many permanent jobs as have ever been created by the next leading source of low carbon energy in Illinois.

The permanent good-paying, middle class jobs generated by nuclear energy are the key to sustainable communities. We must act to preserve out state’s nuclear facilities.

Members of the General Assembly, vote yes on the Illinois low carbon portfolio standard (HB 3293 / SB 1585).

Comments Off

|

* The Tribune has more on the proposed Chicago casino…

Within the past 10 days, Emanuel held three meetings at his fifth-floor City Hall office to pitch the idea of a Chicago casino and discuss the city’s government worker pension challenges, a source familiar with the discussions said. The mayor had a joint meeting with House Speaker Michael Madigan and Senate President John Cullerton, a second meeting with Rauner and a third with Republican legislative leaders, the source said.

Under Emanuel’s vision, the city would own the casino and keep all profits beyond paying an operator to run the facility and whatever taxes it might owe the state. All of the state’s current casinos are privately owned and the cities in which they’re located make money from local taxes based on how much the casinos make.

* As usual, reporters up there are all over this thing…

The governor stated he knows that “Chicago would very much like to have a casino within the City boundaries,” and he said he is “Very open to considering it.” And, while noting that he is not a “fan of gaming,” he said for the second time this morning that he is “open to considering gambling expansion, whether it is for the city of Chicago or other places [in the state].” Moreover, the Governor noted, “A casino certainly can be a job creator and a tax revenue generator, so those are both two good things.” […]

And then, prompted by yet another question on the “Media’s topic du jour,” the Governor said essentially for the third time within a few minutes, “I will be very open minded to working closely with the City [of Chicago] and with communities around the state to discuss this gaming issue and try to come to some resolution fairly promptly.” He did, however, duck an invitation to weigh in on whether, if there is a Chicago casino, he supported it being State owned or Chicago owned.

The Governor concluded his discussion of this topic, in response to yet another gaming question, by noting that his team was “Studying strategically the gaming industry and looking at the revenue and volume of activity.” He said, “You know you can’t just expand gaming to the sky and get the same benefit relative to the cost. So, you’ve got to be thoughtful and we should look at what maximizes the benefit to the people of Illinois– and try to come to that as the solution.”

* But…

While Rauner didn’t slam the door shut Monday, he also hinted that gambling legislation could get caught up with his own ambitions to win wide-reaching pro-business changes and scale back union power.

“As part of anything else that we talk about, we want to get our turnaround agenda done,” Rauner said when asked if he would require Emanuel’s support for some portions of his agenda in exchange for a Chicago casino.

43 Comments

|

[The following is a paid advertisement.]

My name is Susan Males. In 2011, I was a healthy, vibrant woman in her mid-40’s. I was experiencing some irregular heartbeats and it was recommended that I have a cardiac catheterization procedure to determine the cause.

I was assured by my referring doctor that this procedure was done by the cardiologist daily. They told me I’d show up to the hospital in the morning, they would do the procedure and I’d be home resting comfortably by lunch time. There was no talk of what could happen, no talk of any risks to this procedure.

I only briefly met the cardiologist who would be doing my procedure. I put my faith in this doctor because he did so many of these “routine” procedures on a daily basis. I trusted him and assumed he knew what he was doing.

As I awoke after the procedure, I was very, very nauseous with an excruciating headache and my vision was very foggy, to the point where I could not see. My “routine” procedure had turned into something much more. I later learned I suffered a stroke after the procedure and it took over 12 hours for someone to recognize the signs. Had the hospital’s staff recognized that my symptoms were consistent with a stroke, my condition could have been treated and I would have returned to my normal self.

Unfortunately, my vision loss is permanent, preventing me from being able to drive and my future earnings potential has been limited.

I turned to the civil justice system to seek recourse. I wanted to hold the doctors and hospital accountable for their lack of response to my stroke symptoms. Using the civil justice system allowed me closure to this difficult time in my life, and has given me the resources to help me live my life the best I can.

To read more about Susan, click here.

Comments Off

|

* Sun-Times…

Regional Transportation Authority Chairman Kirk Dillard on Monday made the case for a new tax to help pay for mass transit infrastructure, arguing the agency has a more than $30 billion backlog in projects. […]

“Our gas tax has not been raised in Illinois since 1990. Its buying power today is 60 percent of what it [was], it’s not adjusted for inflation. And our infrastructure in Illinois is crumbling,” Dillard said. “My case on behalf of mass transit is we know for every dollar spent on mass transit, there’s a $4 return.” […]

“I’m open for any place to go for the needed infrastructure money. But if Gov. Rauner and the Legislature broadened the sales tax base in Illinois, sales taxes are a major component of RTA funding and it just makes sense that we be part of the broadening of the sales tax,” Dillard said. “I would gladly trade Springfield’s funding for an ability to have a permanent, stable revenue source either through a sales tax or a service tax.” […]

Asked if Rauner would warm to the idea of a tax to benefit mass transit in Illinois, a spokesperson responded: “Gov. Rauner supports investing in the state’s infrastructure but believes government reform is essential before revenue can be discussed,” spokeswoman Catherine Kelly wrote in an email. “Uncompetitive bidding is costing taxpayers millions of dollars every year, and we need to drive value in our capital projects.”

* Hinz…

Even though RTA is very cost-efficient compared with its peers, the agency will “get out a pencil” to change things further if need be, he said, mentioning the possibility of establishing public-private partnerships and getting venture capital involved. “Whatever the cut, we have to handle it.”

But the capital situation is truly dire, Dillard continued. Illinois’ 19-cents-a-gallon gasoline tax for transportation needs is barely worth half of what it was when it was established in 1990, he noted, and the federal 18.4-cents-a-gallon levy has lost 39 percent of its buying power since 1993.

“More than 20 states have initiatives pending to increase their gas tax or sales tax on gasoline or in some way fund transportation,” he said. “Even the folks in Iowa—Iowa—approved a (10-cent-a-gallon) fuel tax. And Los Angeles passed a referendum to fund mass transit.”

Dillard said ridership and property values along the CTA’s Brown Line have risen far more than citywide figures since it was rebuilt a decade ago.

* Meanwhile…

As Congress struggles to renew the federal transportation law and Illinois considers revenue options for transportation, a new report from the Illinois Public Interest Research Group and Frontier Group finds that drivers currently pay less than half the total cost of roads, and argues that while increasing gas taxes could fill the shortfall, it would leave other problems unaddressed.

The new report, “Who Pays for Roads? How the ‘Users Pays’ Myth Gets in the Way of Solutions to America’s Transportation Problems” exposes the widening gap between how we think we pay for transportation – through gas taxes and other fees – and how we actually do. […]

The new report pulls back the veil on the “users pay” myth, finding that:

· Gas taxes and other fees paid by drivers now cover less than half of road construction and maintenance costs nationally – down from more than 70 percent in the 1960s – with the balance coming chiefly from income, sales and property taxes and other levies on general taxpayers.

· General taxpayers at all levels of government now subsidize highway construction and maintenance to the tune of $69 billion per year – an amount exceeding the expenditure of general tax funds to support transit, bicycling, walking and passenger rail combined.

· Regardless of how much they drive, the average American household bears an annual financial burden of more than $1,100 in taxes and indirect costs from driving – over and above any gas taxes or other fees they pay that are connected with driving.

“The ‘users pay’ myth is deeply ingrained in U.S. transportation policy, shaping how billions of dollars in transportation funds are raised and spent each year,” said Tony Dutzik, co-author of the report and Senior Analyst at Frontier Group, a non-profit think tank. “More and more, though, all of us are bearing the cost of transportation in our tax bills, regardless of how much we drive.”

The full report is here.

17 Comments

|

Rauner asks foreign countries for biz input

Tuesday, May 5, 2015 - Posted by Rich Miller

* Tribune…

Foreign companies considering investment in Illinois are turned off by the state’s high taxes, its aging infrastructure and its lack of vocational training for the next generation of skilled workers, according to a survey of countries released by the state Monday.

The survey focused on 10 nations that are the state’s largest trading partners and was aimed at getting an independent assessment of the state’s competitiveness, according to Gov. Bruce Rauner’s office, which conducted the survey. […]

A major concern cited in the survey was the state’s level of corporate and property taxes, and the fear that they could rise given the state’s dire fiscal problems.

“There is persistent budget uncertainty for companies in Illinois,” one nation wrote. “Companies want stability in tax and regulatory framework, especially if they are building a manufacturing site and thus committing to the state for a period of time.”

* From the report…

• “Top Concern: tax issues-too high, property & corporate, worries about further increases due to financial condition of the state”

• “There are large (and growing) perceptions that infrastructure improvements are not keeping up”

• “Foreign firms place a premium on opportunities to “cluster” – to work with concentrations of talent in their sector”

• “The plethora of universities, research institutions & accelerators headquartered in the region constitute a significant positive – firms and entrepreneurs are drawn here by the world-class innovation taking place”

• “Chicago is attractive to college students – which therefore enhances the quality of the workforce pool”

• “Vast difference in perception between Chicago and downstate Illinois. While the former has plenty of positives, the latter is not seen to be competitive with Indiana, Wisconsin, etc.”

• “Costs in particular linked to Unions are high. It’s a problem, especially with Wisconsin and Indiana as neighbors – if there is a legal dispute with workers….Cook County is known for being anti-boss or pro-employee”

• “Right to Work is being used by other states to position them favorably compared to Illinois. This is similar to other labor market regulations and workers compensation, unemployment insurance levels, etc. that put Illinois at a disadvantage compared with other states”

• “The manufacturing workforce is aging and vocational training for the next generation of skilled employees is lacking”

• “Chicago is one of the most expensive trade show locations in the world. Being an expensive/bureaucratic trade show location often carries over to the state being perceived as a high cost/bureaucratic location for investing”

• “Illinois overseas offices are primarily focused on exports not investment attraction, which is two very different tasks”

• “Many states have modernized their structure by founding Economic Development Corporations tasked specifically with pursuing investors”

So, they want a modern, highly educated workforce pool, but think workers are paid too much. Great. They also want better infrastructure, but complain about taxation. Wonderful.

But it is interesting that our overseas offices are too focused on exports and not on attracting investments.

Any other thoughts?

68 Comments

|

Medicaid - Know The Facts

Tuesday, May 5, 2015 - Posted by Advertising Department

[The following is a paid advertisement.]

Oppose $810 million in proposed FY 2016 hospital Medicaid cuts because:

• Hospitals did take a $27 million hit to address the FY2015 budget gap by paying an additional $27 million in assessments to the State – effectively the same as a cut.

• Hospitals are targeted for MORE THAN HALF – $810 million – of the Governor’s proposed overall Medicaid cut of $1.5 billion – even though they are only about ONE THIRD of the Medicaid budget.

• Drastic hospital cuts will mean:

o The loss of critical health care services like pediatrics, obstetrics, and mental health for everyone, not just Medicaid patients.

o Working families and businesses will have to pay more for health care.

o The loss of more than 12,800 jobs and $1.8 billion in economic activity statewide.

• $1 billion in Illinois hospital Medicaid cuts have been imposed since 2011.

• $1.9 billion in Illinois hospital Medicare cuts have been imposed since 2010.

• As a result, 40% of hospitals across Illinois are operating in the red.

Cutting Medicaid in the FY2016 budget is shortsighted and will result in real harm to people and communities.

For more information, go to www.TransformingIllinoisHealthCare.org.

Comments Off

|

Giving back to its members – A Credit Union Difference

Tuesday, May 5, 2015 - Posted by Advertising Department

[The following is a paid advertisement.]

As financial cooperatives, credit unions function as economic democracies. Because of their cooperative structure, earnings are returned to members in the form of lower loan rates, higher interest on deposits, and lower fees. When credit unions – both large and small — exceed expectations, their members share even more in those benefits.

Hershey Robinson, $2.8 million, 500-member employee-based credit union, is one of many that provide extra value. Most recently, the credit union delivered more than $12,000 in gift cards to members as an International Credit Union Week “Thank You”. This was a first-of-its-kind giveaway for this credit union and very well-received by its members – as well as its volunteer board of directors which unanimously approved the initiative.

In Illinois, by most recent estimates credit unions annually provide nearly $205 million in direct financial benefits to almost three million members. Credit unions like Hershey Robinson ECU exemplify how these crucial institutions play a vital role in delivering that value.

Credit unions remain true to one principle - people before profits - and represent a highly valued resource by consumers.

Comments Off

|

Revenue options detailed

Tuesday, May 5, 2015 - Posted by Rich Miller

* From a press release…

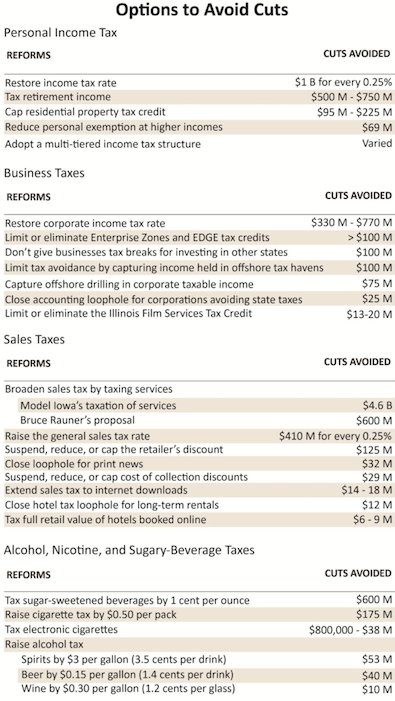

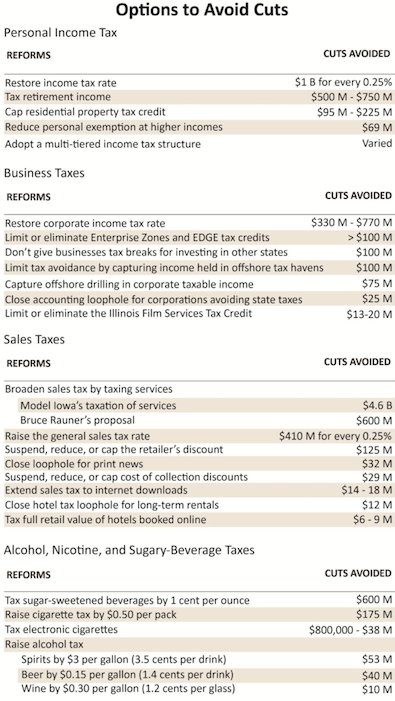

A new report by the Fiscal Policy Center at Voices for Illinois Children shows that lawmakers can avoid cutting services for families and communities by choosing to raise revenue.

By allowing income tax rates to roll back in January, lawmakers created an over $6 billion hole in the state budget for next fiscal year. So far, Governor Rauner has maintained deep cuts that hurt children, families, and communities are necessary to balance the budget.

But the Fiscal Policy Center report highlights a broad range of available revenue options, and shows that Governor Rauner and lawmakers have many choices they can make to avoid cutting services for children with epilepsy and autism, police and fire protection, and in-home services for seniors and people with disabilities that help keep them out of expensive nursing homes.

Choosing to invest in children, families, and communities is the best thing we can do to propel our state toward economic prosperity. That’s why lawmakers and the Governor must choose to develop new revenue instead of cutting the services that make Illinois families and communities strong.

* The full report is here. Revenue options…

Which ones do you like/hate the most?

63 Comments

|

The hazards of outsourcing

Tuesday, May 5, 2015 - Posted by Rich Miller

* WSIU…

After spending nearly 65 million dollars… Governor Bruce Rauner’s campaign has been assessed a penalty by the State Board of Elections.

Director Steve Sandvoss confirms it’s because of a late report filing … but says he can’t give details.

“In light of fairness to the respondent and due fairness principles, we don’t comment publicly on the nature of an ongoing proceeding. But rather, we’ll let the process bear itself out.”

A spokesman for the governor says there was a “snafu.” He says a firm hired to file contributions paperwork prepared a report … but failed to upload it. The mistake was corrected eight hours later.

Hilarious.

18 Comments

|

Talking past each other

Tuesday, May 5, 2015 - Posted by Rich Miller

* Finke…

Senate President John Cullerton said Monday it’s time for Gov. Bruce Rauner to focus on budget talks and spend less time promoting his “turnaround agenda.”

Speaking to The State Journal-Register editorial board, Cullerton, a Chicago Democrat, repeated his belief that the spending plan the Republican governor submitted to lawmakers is wildly out of balance and could result in significant cuts to education and human services unless he opens a discussion for bringing in additional state revenue. […]

“It seems ever since the governor proposed his budget, there was an assumption he actually had a budget that was balanced,” Cullerton said. “That’s not even close. There’s his take-it-or-leave it turnaround agenda, which has nothing to do with the state budget. Let’s refocus on the budget.”

* But the governor believes the Turnaround Agenda is an integral part of balancing the budget…

“The governor is committed to reforming the broken structure of state government so taxpayers get value for their money,” Rauner spokesman Mike Schrimpf said Monday. “Absent reform, the governor is prepared to implement a balanced budget without new revenue. Major reforms are essential or whatever balanced budget we craft this year will be undone by special interests and insider deals. The structural reforms outlined in the Turnaround Agenda are absolutely necessary.”

Reneging on the $26 million “Good Friday Massacre” cuts probably undercut the governor’s threat to “implement a balanced budget without new revenue.” If he can’t stand the heat from $26 million, how’s he gonna deal with the massive meltdown caused by a $6 billion cut?

I get a bunch of press releases every day about the governor’s proposed FY 16 budget, which, as Cullerton rightly points out, is full of gimmicks and holes. But, even so, there are some astonishing programmatic slashes…

Advocates and state lawmakers will hold a press conference on Wednesday, May 6, to call on the full legislature to reject Governor Bruce Rauner’s FY 2016 budget plan to eliminate pre-school, medical care, and other specialized services at the Chicago-based Children’s Place Association.

The pre-school, located in Humboldt Park, serves 73 Chicago-area toddlers struggling with HIV/AIDS, epilepsy, autism, spina bifida, and other medical conditions.

Yeah, let’s kick autistic HIV-positive toddlers off the public dole. Why don’t they just “Get a job”?

* Then again, one reason he backed off those cuts is because it was obvious that legislators believed he had broken a deal. He’d damaged his ability to negotiate a FY 16 deal, so it was walked back.

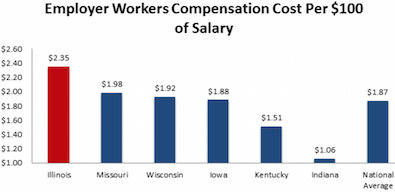

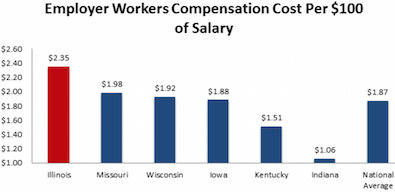

* But, back to the problem described in the headline. Rauner is right that addressing the state’s budget problems involves more than just working out appropriation line items. The state absolutely needs some structural changes. The state and the City of Chicago spend a fortune on workers’ comp, for instance. Some reforms there could most definitely ease their fiscal burdens.

And growth is another issue where Rauner is right. If we want revenues to grow, the state’s economy has to grow at a much faster rate. Again, let’s look at workers’ comp…

In all, the [2011 workers’ comp reform law] saved Illinois employers $315 million during the first few years they were in effect, according to the state workers’ compensation commission. Employers say that’s nowhere close to the minimum $500 million a year in savings billed by then-Democratic Gov. Pat Quinn when he signed the measure into law.

That’s $315 million in total savings versus a promised $2 billion.

* I’ve made no bones about the fact that the governor’s “right to work” idea is stupid and harmful and I told that to the governor’s face (using as many f-bombs as I could muster, btw). And while he may go too far with some of his workers’ comp ideas, he’s not wrong about everything. Our workers’ comp system is a disaster.

From the governor’s office…

Illinois currently has the 7th highest workers’ compensation costs in the country, more than double neighboring Indiana:

37 Comments

|

Your daily “right to work” update

Tuesday, May 5, 2015 - Posted by Rich Miller

* Nothing yet from the governor’s office, but the Edwardsville City Council voted down Gov. Rauner’s “right to work” resolution last night. I didn’t see any news coverage, but this is from a local resident, who is also a commenter here…

About a hundred union members showed up. (The pic was taken about 6:45 and it got so crowded that people filled the hall outside the chamber). Five people were allowed to speak (of which I was one and all five were local people).

At first the Mayor explained that they would discuss the measure then table it. Several of the council members during their discussion advocated voting immediately. They made a motion to table the agenda, but the council voted that down! They then called for a vote with brief discussion (the conservative members grousing about not getting to table the issue. Obviously this was not the plan) They then proceeded to vote the Agenda down. All was civil but you could tell the Mayor Patton was [upset] and embarrassed.

I can honestly say all the union folks I saw there were local and many if not most I recognized. Not a Rauner person in sight, although the three conservatives all mentioned that they had just spoken to the Rauner folks.

The pic…

* From the Illinois AFL-CIO…

Evanston unanimously rejects Rauner anti-worker resolution tonight.

Girard City Council votes down Rauner anti-worker resolution 4-1 tonight.

* From Evanston Now…

Jason Hays, of 712 Dobson St., a member of Evanston Firefighters Local 742, said the governor cried for shared sacrifice, “but left it to workers to do the heavy lifting.”

He said the governor’s proposal for “right to work” legislation would create a “‘right to work’ — for less — less representation, less safety, less protection and less equity.”

Alderman Ann Rainey, 8th Ward, calling the governor’s proposal “wrongheaded,” moved that the Rules Committee reject the endorsement resolution and send a copy of the video of public comment at the meeting to the governor.

“We should stand by the people in the audience tonight,” Rainey added.

Her motion was approved on a unanimous roll-call vote.

* Meanwhile, in Rockford…

Union workers rallied Monday outside City Hall to protest the City Council’s support of Gov. Bruce Rauner’s “Turnaround Agenda.”

A divided council endorsed Rauner’s plan April 20 in an 8-5 vote on a nonbinding resolution. Workers at the rally want aldermen to reconsider their support of the plan, which includes reforming pensions, eliminating unfunded mandates, creating right-to-work zones and eliminating statewide prevailing wages on government contracts.

It’s the proposed right-to-work zones that earned the ire of ralliers. They say right-to-work laws are bad for the economy because they drive down wages for all workers. Nearly 300 people from several local labor groups attended the rally.

A pic from the protest…

56 Comments

|

|

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|