* The bill, Rep. Lou Lang’s HB 689, would take effect if voters approve a constitutional amendment allowing a graduated income tax…

(A) for taxpayers who are married filing a joint return or head of household:

(i) an amount equal to 3.5% of the portion of the taxpayer’s net income for the taxable year that is $200,000 or less;

(ii) an amount equal to 3.75% of the portion of the taxpayer’s net income for the taxable year that is more than $200,000 but not more than $750,000;

(iii) an amount equal to 8.75% of the portion of the taxpayer’s net income for the taxable year that is more than $750,000 but not more than $1,500,000; and

(iv) an amount equal to 9.75% of the portion of the taxpayer’s net income for the taxable year that is more than $1,500,000; and

(B) for all other taxpayers:

(i) an amount equal to 3.5% of the portion of the taxpayer’s net income for the taxable year that is $100,000 or less;

(ii) an amount equal to 3.75% of the portion of the taxpayer’s net income for the taxable year that is more than $100,000 but not more than $500,000;

(iii) an amount equal to 8.75% of the portion of the taxpayer’s net income for the taxable year that is more than $500,000 but not more than $1,000,000; and

(iv) an amount equal to 9.75% of the portion of the taxpayer’s net income for the taxable year that is more than $1,000,000.

*** UPDATE 1 *** From Emily Miller…

Hi Rich,

I noticed that you posted about the new fair tax proposal introduced by Leader Lang. This proposal is the result of years of negotiations and hard work. The bill introduced reflects feedback and input from members on both sides of the aisle, and should be viewed as an opportunity for lawmakers and the Governor to come together to reform our outdated tax code.

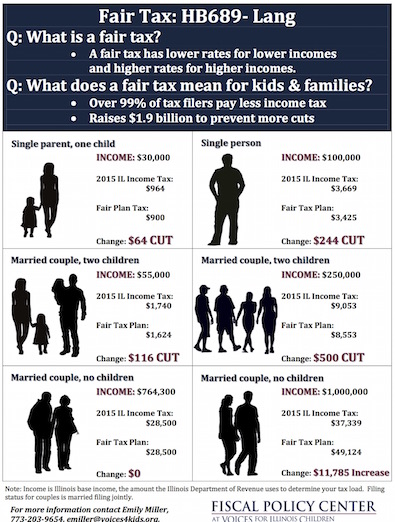

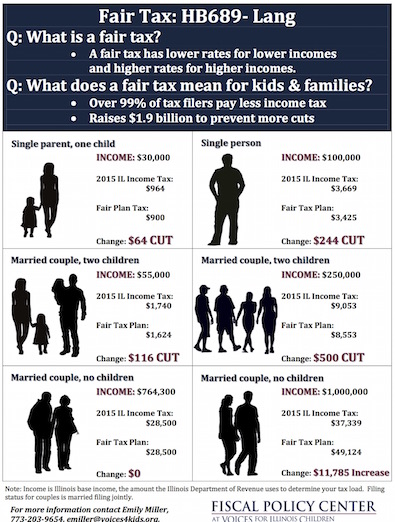

Most notably, the measure provides a tax cut for over 99% of Illinois taxpayers and provides $1.9 billion in new revenue to restore cuts to vital services.

Attached is a fact sheet from Voices for Illinois Children to help folks understand the impact of a fair tax on children and families in Illinois.

Thanks.

Emily Miller

Voices for Illinois Children

* The attachment…

*** UPDATE 2 *** From AFP Illinois…

Rich,

Lang’s graduated income tax proposal– ironically introduced on Tax Day- is merely the camel getting his nose in the tent and would likely result in greater job loss and continual tax hikes by a General Assembly that seems to be unable to control its appetite for more tax dollars.

Illinoisans should not trust the General Assembly enough to give them carte blanche ability to add brackets, increase the rates or lower the income threshold at which higher rates apply. It’s no accident a recent Gallup poll highlighted that a mere 25% of Illinoisans “are confident in their state government” – worse than any other state. Illinois has one of the highest outbound migration rates in the nation and higher taxes on job creators is not going to help that situation. It will exacerbate it.

Lang’s proposal is more about the election year politics we’ve seen on display across the nation. However, punishing job creators is not the answer to moving Illinois in the right direction, nor is removing legislative barriers that prevent continual tax hikes by a General Assembly that has an addiction to tax dollars.

Regards,

David From

Illinois State Director

Americans for Prosperity

- Chicago 20 - Friday, Apr 15, 16 @ 11:39 am:

Finally.

Thank you Lou Lang.

- anon - Friday, Apr 15, 16 @ 11:40 am:

This proposal is DOA because there are not 71 votes in the House for a graduated income tax. There will be zero GOP votes, and Democratic targets and downstaters will not support it. The last time such a proposal (sponsored by Rep. Smith in 2007) came up on the House floor, it got 53 votes as I recall.

- Anonymous - Friday, Apr 15, 16 @ 11:40 am:

Excellent! Let there be debate, revisions if needed, and then a vote!

- Anonymous - Friday, Apr 15, 16 @ 11:41 am:

Workable. Could squeeze iii and iv downward a bit. Now, if we could just get Agency to pay their share……

- Trolling Troll - Friday, Apr 15, 16 @ 11:41 am:

Yeah!!! Finally!! IPI saying that the moving trucks are on their way for the millionaires in 5,4,3…

- Anonymous - Friday, Apr 15, 16 @ 11:41 am:

Ag

- Foster brooks - Friday, Apr 15, 16 @ 11:41 am:

Long long overdue

- Tone - Friday, Apr 15, 16 @ 11:42 am:

I’m not opposed to a graduated income tax in the state. It also must be tied to an elimination of the outrageously unfair protections public employees receive in this state. Also, those rates are absolutely stupid. Why not something like this for married filing jointly:

3.0% up to $50,000

4.0% from $50,000-200,000

5.0% from $200,001+

- Blue dog dem - Friday, Apr 15, 16 @ 11:42 am:

Anonymous was me.

- Anon - Friday, Apr 15, 16 @ 11:42 am:

Yes please

- No Longer a Lurker - Friday, Apr 15, 16 @ 11:44 am:

Did someone run the numbers on HB 689 to determine how much more money will be brought in as compared to the current flat rate?

- AlabamaShake - Friday, Apr 15, 16 @ 11:44 am:

**Democratic targets and downstaters will not support it. **

Which Democrats will be hurt by a tax cut on 99.3% of voters? You think taxing the rich polls poorly where?

- Very fed up - Friday, Apr 15, 16 @ 11:45 am:

Would be wonderful if we actually got a chance to vote on this. Similar to term limits, fair maps, raising the minimum wage I’ve grown pessimistic our elected officials will allow us to vote these in despite overwhelming public support

- UIC Guy - Friday, Apr 15, 16 @ 11:45 am:

Surely those earning well under $100K should pay a lot less? How about 0% on the first $20K,2% on the next $30K, and then something like this plan? That way at least some people—those who need it most—would pay noticeably less than they do now. Also you need a lower point at which you go above 3.75%, but you also need to go up less drastically at first. I like the general idea, though. Not going to happen, of course. (This is Illinois.)

- GA Watcher - Friday, Apr 15, 16 @ 11:45 am:

Lou Lang for Governor 2018.

- RNUG - Friday, Apr 15, 16 @ 11:45 am:

Could be the basis for a grand compromise … but I’ m not going to hold my breath yet.

- CharlieKratos - Friday, Apr 15, 16 @ 11:46 am:

Great idea, but too many people think that a flat tax is “fair”. There would have to be a major education push. Not gonna happen. If people voted in their own best interests, Sanders would have won Illinois.

- Name Withheld - Friday, Apr 15, 16 @ 11:48 am:

For comparison, here is a link to Minnesota’s progressive income tax rates (regularly cited as one of the fairest, if such can be applied, income taxes in the nation)

http://www.revenue.state.mn.us/individuals/individ_income/Pages/Minnesota_Income_Tax_Rates_and_Brackets.aspx

And here’s a link to Wisconsin (which also has a progressive income tax):

https://www.revenue.wi.gov/faqs/pcs/taxrates.html#tx1a

- Bull Moose - Friday, Apr 15, 16 @ 11:49 am:

- anon -

Totally different environment. We now have a full blown budget crisis and a multimillionaire Governor.

- Thoughts Matter - Friday, Apr 15, 16 @ 11:49 am:

Combine A and B at 3.75%. Our goal is to increase revenue. Reducing taxes on the majority of us isn’t going to do it. However, if you want that- then do it by using the federal exemption amount and criteria.

- Bob - Friday, Apr 15, 16 @ 11:50 am:

The Millionaires would all leave Illinois with their company and many tens of thousands of jobs.

- Thoughts Matter - Friday, Apr 15, 16 @ 11:50 am:

Sorry, wrong numbering. Combine I and ii

- Niblets - Friday, Apr 15, 16 @ 11:51 am:

A little steep at the top but excellent!

- SAP - Friday, Apr 15, 16 @ 11:51 am:

I too would like to see a fiscal impact. Looks like a health tax cut for most Illinois residents.

- Norseman - Friday, Apr 15, 16 @ 11:54 am:

Bob, you forgot to put the snark symbol. Someone might think you’re a troll.

- fair is fair - Friday, Apr 15, 16 @ 11:54 am:

I’ll agree to a graduated income tax via constitutional amendment, if on the same “clean” amendment it includes eliminating “impaired or diminished” from the pension protection clause.

- Anonymous - Friday, Apr 15, 16 @ 11:54 am:

Love it but also am skeptical if we will ever get to vote on it. Hope everyone lets their representative and senators know how they feel!

- Mouthy - Friday, Apr 15, 16 @ 11:56 am:

Phony bill. 3.5 for $100K or less is just there for middle class eye candy. More games..

- anon - Friday, Apr 15, 16 @ 11:57 am:

== You think taxing the rich polls poorly where? ==

Among Republicans in the General Assembly. There is no doubt Rauner will oppose any graduated income tax. Even though his signature is not needed to submit an amendment to voters, Rauner controls the votes of every GOP legislator.

- illinoised - Friday, Apr 15, 16 @ 11:57 am:

At last! Best news I have heard in years.

- Tone - Friday, Apr 15, 16 @ 11:58 am:

The millionaires will leave with those ridiculous rates. Lang is a fool, always has been.

- Tone - Friday, Apr 15, 16 @ 11:58 am:

- fair is fair - Friday, Apr 15, 16 @ 11:54 am:

I’ll agree to a graduated income tax via constitutional amendment, if on the same “clean” amendment it includes eliminating “impaired or diminished” from the pension protection clause.

YEP!

- Name Withheld - Friday, Apr 15, 16 @ 11:59 am:

I’m not a numbers guy the way RNUG is, so I’d appreciate some comparative analysis between this bill and Minnesota and Wisconsin. From my remedial layman’s perspective, it seems like Illinois’ rates are quite reasonable. But I’m sure there’s some nuance I’m missing.

- Tone - Friday, Apr 15, 16 @ 12:00 pm:

It’s grotesque that those of us in the private sector are second class citizens to a the coddled public workers.

- Lou Lang - Friday, Apr 15, 16 @ 12:00 pm:

This bill will provide TAX RELIEF for 99 percent of Illinois taxpayers and also create, $1.9 billion in new revenue.

- anon - Friday, Apr 15, 16 @ 12:01 pm:

Does anyone believe Jack Franks would ever vote for this? How about John Bradley and Brandon Phelps? Then there are the suburban targets. The political reality is there will not be a three-fifths majority voting Yes for the Lang proposal.

- Anonymous - Friday, Apr 15, 16 @ 12:01 pm:

No surprise, this is what Dems do best. Why try to change, reform, improve, eliminate?

It is a heck of a lot easier to just tax

- Name Withheld - Friday, Apr 15, 16 @ 12:02 pm:

After reading the Panama Papers, what makes anyone believe the millionaires aren’t already moving their money elsewhere?

- RNUG - Friday, Apr 15, 16 @ 12:02 pm:

== It also must be tied to an elimination of the outrageously unfair protections public employees receive in this state. ==

== if on the same “clean” amendment it includes eliminating “impaired or diminished” from the pension protection clause. ==

A) those protections would have never been put in the 1970 Constitution if the State had lived up to it’s previous promises

B) removing the clause won’t make a bit of difference to current workers OR reduce the debt that is owed, so what is the point?

C) removing the clause would probably need to be a separate amendment

- Person 8 - Friday, Apr 15, 16 @ 12:03 pm:

Few numbers:

Joint — If they make 1.5 mil the effective tax rate would be 6.2%

Indiv — If you make 1 mil the effective tax rate would also be 6.2%

Someone like Bruce’s taxes from 2015 (57.5 mil, just going make have 0 as capitol gains to make it easier, also done jointly)

$5.57 million compared to

$2.16 million using today’s flat rate

- Robert the Bruce - Friday, Apr 15, 16 @ 12:04 pm:

Excellent proposal. DOA but at least it is out there…gives some hope for Illinois to have a graduated income tax some day.

It’d be hard to find a state that is more blue that doesn’t have a progressive income tax. We should have one.

Regarding millionaires leaving, do some thinking and some math please before jumping to this: millionaires do like their homes, their jobs, their kids’ schools, etc. There’s many reasons to stay.

If half the millionaires left, a ridiculously high assumption, the state would still receive more tax revenue from millionaires under Lang’s proposal (9.75%*1/2) than under the status quo.

- Norseman - Friday, Apr 15, 16 @ 12:06 pm:

RNUG, don’t bother trying to response with rational arguments with Tone. He’s a government hating troll. We don’t feed trolls. Thanks.

- illinois manufacturer - Friday, Apr 15, 16 @ 12:08 pm:

Tax cut for 99 …2 billion in New revs. I will take this any day and don’t but garbage about small business. It is a tax cut for me. We can save our schools at all levels and keep up on pensions.If it allows a prop tax freeze it would be a big wow. It’s a better deal than most of the surrounding states.

- Steve - Friday, Apr 15, 16 @ 12:09 pm:

Does Lou Lang secretly work for the state of Florida?

- DuPage Saint - Friday, Apr 15, 16 @ 12:09 pm:

Cut ties of real estate taxes to school funding and raise more for education

- From the 'Dale to HP - Friday, Apr 15, 16 @ 12:09 pm:

This is no where close to the revenue Illinois needs. State needs a whole lot more than $1.9 billion.

- JB13 - Friday, Apr 15, 16 @ 12:11 pm:

In a sane environment, this would be part of the Democracts’ opening offer for a compromise to end the stalemate and put Illinois on firmer financial footing. (For the record, I’m not opposed to this.) But in this toxic air, I strongly suspect this IS their “42″ - the answer to life, the universe and everything. Please, prove me wrong.

- Name Withheld - Friday, Apr 15, 16 @ 12:11 pm:

==This is no where close to the revenue Illinois needs. State needs a whole lot more than $1.9 billion.==

Rates and thresholds can be adjusted, but you can’t have the discussion without starting somewhere.

- out of touch - Friday, Apr 15, 16 @ 12:12 pm:

Politically well-played.

Policy: excellent.

- Qui Tam - Friday, Apr 15, 16 @ 12:13 pm:

=It’s grotesque that those of us in the private sector are second class citizens to a the coddled public workers.=

This sentiment runs counter to the fact that private executive pay and perks have experienced double-digit increases and corporate “people” have been buying back debt and piling up cash.

Either Tone hasn’t kept up or is just regurgitating the Scott Walker schtick.

- CharlieKratos - Friday, Apr 15, 16 @ 12:13 pm:

It’s a tax increase for me and I’d vote for it every day, and twice on Sunday.

- Frank Manzo IV - Friday, Apr 15, 16 @ 12:14 pm:

I think their numbers are slightly off. In Illinois, 9.6% of married-couple families earn more than $200,000 a year and 6.4% of “nonfamily households” earn more than $100,000 a year.

Link: http://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ACS_14_5YR_S1901&prodType=table

With the progressivity, this would be a tax cut for closer to 95-96% of all Illinois residents and a hike on about 4-5%. I haven’t investigated the entire proposal, but a cursory look makes it seem more revenue-neutral than revenue-positive. But even if the numbers fully check out, we need more than $1.9 billion.

I also wish it was a bit simpler.

- Mouthy - Friday, Apr 15, 16 @ 12:15 pm:

Will pension payments still be untaxed would be my first question.

Sorry Lou, I just don’t buy your numbers. No millionaire i their right mind is gonna hang around when there’s a Gary Indiana (3.3 flat rate) address so close.

- Name Withheld - Friday, Apr 15, 16 @ 12:15 pm:

==Either Tone hasn’t kept up or is just regurgitating the Scott Walker schtick.==

Ironic since Wisconsin also has a progressive tax, with far lower thresholds and higher rates at many of those thresholds.

- Homer J. Quinn - Friday, Apr 15, 16 @ 12:15 pm:

hey Tone: are your taxes going up or down under this plan? if they’re going up I can understand your complaints. I can also disregard them.

- cdog - Friday, Apr 15, 16 @ 12:16 pm:

Excellent, beyond words!

This has to be “structural reform” that will help the consumer economy!

Excellent for social services!

Even better? Dedicate some of that new revenue to the new school formula and get that darn local school of my property tax bill! (at least reduce it. It is 50% of what we pay!)

Hope, Faith, and Love baby!

- cgo75 - Friday, Apr 15, 16 @ 12:16 pm:

Beautifully done. This could actually receive bipartisan support.

- Steve - Friday, Apr 15, 16 @ 12:16 pm:

Once you get a progressive income tax: everything can be adjusted. So, Chicago sports teams will not be so good. But, heh, I doubt Cook County Democrats care. Now is the time for Wisconsin to get rid of their income tax.

- Carhartt Representative - Friday, Apr 15, 16 @ 12:17 pm:

==The Millionaires would all leave Illinois with their company and many tens of thousands of jobs.==

That makes as much sense as fleeing to Canada to escape Obama’s socialism. Where are they going to go to avoid paying their fair share? Birmingham, Alabama?

- Anon - Friday, Apr 15, 16 @ 12:17 pm:

Would retirement income be subject to state taxes?

- Rich Miller - Friday, Apr 15, 16 @ 12:19 pm:

Anon, read the bill.

No.

- Dee Lay - Friday, Apr 15, 16 @ 12:20 pm:

==The Millionaires would all leave Illinois with their company and many tens of thousands of jobs.==

They could go to one of the seven states without a state income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

My question is: Why haven’t they left already then? Oh that’s right, because they like living in Chicago with everything it has to offer and having access to a highly-educated workforce.

- Bull Moose - Friday, Apr 15, 16 @ 12:23 pm:

- …Adding… Notice, however, this is only a tax “cut” for 99 percent if you compare the rates to what they were in 2015, before the January 1, 2016 rollback.-

Rich, Did rates change in January 2015, not 2016?

http://www.revenue.state.il.us/Publications/Bulletins/2015/FY-2015-09.pdf

- Frank Manzo IV - Friday, Apr 15, 16 @ 12:25 pm:

== I think their numbers are slightly off. In Illinois, 9.6% of married-couple families earn more than $200,000 a year and 6.4% of “nonfamily households” earn more than $100,000 a year. ==

Edit to my own comment: 10.2% of nonfamily households earn more than $100,000 a year.

- Ghost - Friday, Apr 15, 16 @ 12:26 pm:

Has the rbber baron illinois policy institute released a scathing response noting how regan era voodoo economics is the inly wat to go….. despite the complete failure of trickle down economics everywhere it has been tried?

- eat - Friday, Apr 15, 16 @ 12:29 pm:

Complaints from right wingers saying its too much and left wingers saying its not enough. Sounds like a good compromise to me.

- Filmmaker Professor - Friday, Apr 15, 16 @ 12:30 pm:

Yes! finally.

- college dad - Friday, Apr 15, 16 @ 12:30 pm:

I’m no math wiz… but cannot believe IL can cut taxes (revenues) from 99+ % of all people; modestly increase taxes for

- out of touch - Friday, Apr 15, 16 @ 12:30 pm:

Drives a fat wedge between GOP and their wealthy donors, while giving dems an opportunity to vote for a tax CUT that raises revenue.

- @MisterJayEm - Friday, Apr 15, 16 @ 12:31 pm:

“The millionaires will leave with those ridiculous rates.”

Enjoy Sioux Falls, Atlas.

– MrJM

- out of touch - Friday, Apr 15, 16 @ 12:32 pm:

Did someone deactivate Sandack’s Twitter? We haven’t gotten his tweets yet for over an hour, which is a new record by at least 60 minutes.

- Mostly Harmless - Friday, Apr 15, 16 @ 12:33 pm:

@Frank Manzo- your number is the percent whose marginal rate goes up. But, since they paid a lower rate before that, it won’t be until higher income that total taxes paid goes up. That probably accounts for the difference.

- Steve - Friday, Apr 15, 16 @ 12:34 pm:

Everyone knows it’s for the children and the selfless public servants. Gee, it’s not like millionaires haven’t been leaving Chicago lately.

http://www.zerohedge.com/news/2016-04-06/millionaires-are-fleeing-chicago-record-numbers

- BIG R. Ph. - Friday, Apr 15, 16 @ 12:34 pm:

Do these Democrats even think?

Let us do a very simple analysis:

If 1 person in the lower right hand box moves out of Illinois how many people does it take to replace that revenue from the other 5 boxes?

The answer is “Infinity” because all of the other people are paying less. Negative number + Negative number + Negative number + Negative number + zero will NEVER = $11,785.

An economy is not a zero sum game. If you do not grow the economy your tax revenues will never grow.

I will say it again and again until someone listens. Illinois is not an island. The very foundation of our country was ignited by the avoidance of taxes. And people with money will do whatever it takes to hold onto the money that they have earned. All you have to do is look at the gas stations that are just across the border in other States and you will see nothing but Illinois license plates filling up with cheaper gas.

All this talk about voting on a constitutional amendment is BS. We have a representative democracy and for better or worse we the people have elected this crowd to represent us and to do their jobs. Quit playing games and DO YOUR JOBS!

- Bull Moose - Friday, Apr 15, 16 @ 12:34 pm:

- Frank Manzo IV - Friday, Apr 15, 16 @ 12:25 pm:

Keep in mind, these are marginal rates, not effective rates. i.e. someone making $250K, pays 3.5% on everything up to $200K, and pays 3.75% on the last $50K. There effective rate is therefore less.

- Tone - Friday, Apr 15, 16 @ 12:35 pm:

A) those protections would have never been put in the 1970 Constitution if the State had lived up to it’s previous promises

I don’t care. They are grossly unfair. 401ks for all going forward. With no guarantee that the state can’t change its match.

B) removing the clause won’t make a bit of difference to current workers OR reduce the debt that is owed, so what is the point?

I know. The point is our state constitution creates a special class of workers. It is fundamentally unfair.

C) removing the clause would probably need to be a separate amendment

Cool.

- Federalist - Friday, Apr 15, 16 @ 12:36 pm:

Would not hurt me but I am still opposed. I support a flat % tax (not a flat tax as some seemed to be confused on the distinction) at the federal level as well.

Will this pass the GA. Times are different now and the budget mess is bad. But Republicans will not vote for it because they are philosophically opposed and also see it as the first camels nose in the tent. Some downstate Democrats may also balk. Certainly Rauner would veto it.

Also the recent study showing ‘millionaires’ leaving Chicago - http://www.chicagotribune.com/business/ct-chicago-losing-millionaires-0405-biz-20160404-story.html - may not help this proposed legislation.

I still support a three year 1.5% tax surcharge to be specifically designated to pay off past bills and then live within the present 3.75% rate for existing and future government programs.

- Ghost - Friday, Apr 15, 16 @ 12:36 pm:

if the millionares leave where will they go? to a state that is already lower in taxes that they never moved to? or to another state that has roughly the same progressive tax tate?

- @MisterJayEm - Friday, Apr 15, 16 @ 12:38 pm:

“The very foundation of our country was ignited by the avoidance of taxes.”

Nonsense.

The Revolutionary War was ignited by a LACK OF REPRESENTATION.

– MrJM

- SKI - Friday, Apr 15, 16 @ 12:39 pm:

That is a big jump (5 to 6 percent) for the high earners. Especially when the state property taxes are some of the highest in the nation.

Yes Minnesota’s tax rates are higher overall, but there is only about a 2 percent difference between the middle class and top earners. They also have lower property taxes, no sales tax on clothing and groceries, and other incentives to offset the rate.

There has to be some give and take to make it worth while to stay in Illinois, not just take. I personally would not be affected at this time, but I would hate to be the couple that just barely exceeds the $200,000 income threshold.

- steward - Friday, Apr 15, 16 @ 12:41 pm:

Offending the rich by asking them to pay their fair share just makes my heart ache. /s

- out of touch - Friday, Apr 15, 16 @ 12:41 pm:

—If 1 person in the lower right hand box moves out of Illinois how many people does it take to replace that revenue from the other 5 boxes?—

1. There are no fantasy greener pasture to which the poor millionaires could re-locate.

2. The Policy Institute has made all kinds of fuss about our taxation issues driving droves of people out of Illinois. This is the new insulator.

3. The wealthy should pay more, period.

4. Lower and middle classes should shoulder less tax burden, period.

5. Freeing the tax burdens of middle and lower classes allows them more money to spend, which helps the economy and businesses. The wealthy won’t spend more or less as a result of this action.

- Steve - Friday, Apr 15, 16 @ 12:43 pm:

Is Mike Madigan and Lou Lang ready for the “David Tepper” problem?

http://www.bloomberg.com/news/articles/2016-04-05/tepper-s-move-may-affect-new-jersey-budget-forecaster-warns

The decision by billionaire hedge-fund manager David Tepper to quit New Jersey for tax-friendly Florida could complicate estimates of how much tax money the struggling state will collect, the head of the Legislature’s nonpartisan research branch warned lawmakers.

Tepper, 58, registered to vote in Florida in October, listing a Miami Beach condominium as his permanent address, and in December filed a court document declaring that he is now a resident of the state. On Jan. 1, he relocated his Appaloosa Management from New Jersey to Florida, which is free of personal-income and estate taxes.

His move has state revenue officials on alert.

“We may be facing an unusual degree of income-tax forecast risk,” Frank Haines, budget and finance officer with the Office of Legislative Services told a Senate committee Tuesday in Trenton.

New Jersey relies on personal income taxes for about 40 percent of its revenue, and less than 1 percent of taxpayers contribute about a third of those collections, according to the legislative services office. A one percent forecasting error in the income-tax estimate can mean a $140 million gap, Haines said.

- Anonymous - Friday, Apr 15, 16 @ 12:44 pm:

Looks like a plan to get a graduated income tax, promising tax cuts! But beware it may look good now, but income levels can be lowered, and taxes increased, once people vote for it!

- Jimmy H - Friday, Apr 15, 16 @ 12:46 pm:

“would take effect if voters approve a constitutional amendment allowing a graduated income tax…”

Excellent news! Let the voters decide. Great fact sheet!

- Aldyth - Friday, Apr 15, 16 @ 12:46 pm:

Tone, why don’t you go to work for the State of Illinois in one of those cushy jobs and then report back to us how coddled you are. You’d have a lot more credibility than you have now, functioning as a sniper.

- Jersey - Friday, Apr 15, 16 @ 12:46 pm:

Lol Tone. Public vs Private. Always twisting it to your warped view. This isnt about public vs private. But you keep fighting the good fight.

- Frank Manzo IV - Friday, Apr 15, 16 @ 12:48 pm:

Mostly Harmless and Bull Moose,

Right. I know that the progressivity means effective tax rates would be lowered. I’m saying that, even with the progressivity, the 99% number seems a bit rosy.

However, I haven’t done the analysis myself. So I am somewhat skeptical about their numbers, but that doesn’t mean they’re wrong.

In any case, through additional revenue or spending cuts, we need to come up with more than +$2 billion.

- anon - Friday, Apr 15, 16 @ 12:49 pm:

=== This could actually receive bipartisan support. ===

Not so long as Rauner is governor.

The IPI and AFP would depict this as class warfare with a 260 percent tax rate hike.

Why is it that when regressive tax hikes are proposed, no one worries about the working poor fleeing the state, which already has one of the most regressive state and local tax systems in the nation?

- @MisterJayEm - Friday, Apr 15, 16 @ 12:51 pm:

‘If 1 person in the lower right hand box moves out of Illinois how many people does it take to replace that revenue from the other 5 boxes? The answer is “Infinity” because all of the other people are paying less. Negative number + Negative number + Negative number + Negative number + zero will NEVER = $11,785.’

Paying less ≠ negative amount

Paying less ≠ zero

Paying less = $900, or $3,425, or $1,624, or $8,553, or $28,500.

Do you not understand the boxes?

Or are you being dishonest?

In either event, you should probably refrain from asking if others “even think”.

– MrJM

- Bull Moose - Friday, Apr 15, 16 @ 12:52 pm:

- BIG R. Ph. “If 1 person in the lower right hand box moves out of Illinois how many people does it take to replace that revenue from the other 5 boxes?”-

Where are they gonna go, to Scott Walker’s Wisconsin where the income tax rates are HIGHER than IL? How about Terry Branstad’s Iowa where the income tax is HIGHER than IL? How about Minnesota…opps, still higher there too.

Maybe they should stick around here in the low-tax state of Illinois.

- 47th Ward - Friday, Apr 15, 16 @ 12:53 pm:

I’ve been telling my organization that we’ll know we’re close to a solution only when a serious tax hike proposal is put forward. I don’t know if Lang’s bill will get serious attention or not, and even if it does, this is not the beginning of the end of the impasse.

It might, however, be the end of the beginning.

- Langhorne - Friday, Apr 15, 16 @ 12:53 pm:

Authorize graduation, maybe w a maximum, but don’t put rates in the constitution

- Bigtwich - Friday, Apr 15, 16 @ 12:54 pm:

I read a book on the Vanderbilts a few years ago. During the debate on a national income tax in the 1890s an argument against the tax was a threat that the millionaires would all leave the country. A federal income tax was imposed in 1913. The high federal tax rate in 1944 was 94%. It did not drop below 70% until the 1980s. The millionaires have been here all that time. You just can’t trust those people to do as they say.

- Steve - Friday, Apr 15, 16 @ 12:54 pm:

To - Bull Moose

What about Indiana or Florida?

- Anonymous - Friday, Apr 15, 16 @ 12:56 pm:

Does anybody really believe 99% of taxpayers will pay less?????

- Tone - Friday, Apr 15, 16 @ 12:57 pm:

- Langhorne - Friday, Apr 15, 16 @ 12:53 pm:

Authorize graduation, maybe w a maximum, but don’t put rates in the constitution

I agree, as long as public worker protections are eliminated completely.

- Tone - Friday, Apr 15, 16 @ 12:58 pm:

- Anonymous - Friday, Apr 15, 16 @ 12:56 pm:

Does anybody really believe 99% of taxpayers will pay less?????

Sane people don’t.

- Just Me - Friday, Apr 15, 16 @ 12:58 pm:

I absolutely love when special interests with a controversial idea say it has been negotiated. Yea, negotiated by people who think like them.

This is NOT a negotiated agreed bill. Don’t embarrass yourself by trying to say it is.

- onemoretime - Friday, Apr 15, 16 @ 12:59 pm:

@ Tone 12:00PM:

Such incredible juvenile whining — why blame others for your poor choices / fortune?

- RNUG - Friday, Apr 15, 16 @ 1:03 pm:

== Is Mike Madigan and Lou Lang ready for the “David Tepper” problem? ==

IDOR is pretty good at estimating the effects of tax changes, including avoidance.

- RNUG - Friday, Apr 15, 16 @ 1:04 pm:

The only person with less credibility than Tone is Rauner …

- Saluki - Friday, Apr 15, 16 @ 1:05 pm:

Pass it.

- Steve - Friday, Apr 15, 16 @ 1:08 pm:

In all fairness, the less wealthy people around, the less problems for Lou Lang and Mike Madigan. Maybe, that’s the overall plan : less millionaires more migrants from Syria.

- @MisterJayEm - Friday, Apr 15, 16 @ 1:11 pm:

Tone,

First, you say you oppose the change because millionaires will flee. Then, you say you oppose the change because it won’t reduce taxes for 99% of taxpayers. But all along, you’re willing to accept the change if “public worker protections are eliminated completely.”

Golly. If one didn’t know better, one might think that, instead of having conclusions based on reasoning, your reasoning followed from your conclusions.

If one didn’t know better…

– MrJM

- Jack Stephens - Friday, Apr 15, 16 @ 1:12 pm:

@Tone

Corrected:

It’s grotesque that those of us in the bottom 99% are second class citizens to the Elitist 1% of all incomes.

- Anonymous - Friday, Apr 15, 16 @ 1:13 pm:

Can we see a source for the 99% number? The IDOR AGI tax filing striations available on their website do not break down along these lines.

- Joe M - Friday, Apr 15, 16 @ 1:16 pm:

Is $1.9 billion enough? In the current fy we are about $4 billion short when adding higher ed and social programs. And that still leaves catching up with paying vendors and paying down the pension debt to be dealt with.

- Mad Brown - Friday, Apr 15, 16 @ 1:17 pm:

‘Bitter’ party of (T)One. Your table is ready.

- Grandson of Man - Friday, Apr 15, 16 @ 1:17 pm:

I like it. It would be a tax cut for lots of people. Who wouldn’t want that?

Yes it will be nearly impossible to pass, but since playing politics is a part of life, it could give Democrats great ammunition against Republicans and Rauner.

Something along the lines of : “Republicans would rather protect the super-wealthy than give tax cuts to the 99%.”

“The IPI and AFP would depict this as class warfare with a 260 percent tax rate hike.”

Boo hoo hoo. The super rich have done so poorly lately. They can cry me a rivah. Those people wage warfare against millions of middle class workers. Rauner wages so much warfare that he said he’ll continue fighting to get rid of fair share fees in the courts after the Friedrichs defeat.

- Steve - Friday, Apr 15, 16 @ 1:18 pm:

It will be interesting to see how much legal business gets “billed” from out of state after a progressive income tax. After all, if you are a senior partner you could be saving a lot of money by billing from the Florida office and living in Florida , at least part of the year. Just a reminder to those who think taxes don’t have consequences.

- Ducky LaMoore - Friday, Apr 15, 16 @ 1:19 pm:

I would have liked to see it a little more graduated with respect to the +$200,000 range being between 5% and 6%, but whatever. I am sure the rates were determined via polling. If it ain’t gonna pass, what is the point of presenting it, right? So, I get it. It’s not perfect, but it’s better.

- Jack Stephens - Friday, Apr 15, 16 @ 1:19 pm:

@tone:

Dont want to join a union? Then dont take a job there. Thats your problem. Not societies.

But its time to end Unconstitutional Protections for the Elitist Private Class.

- OneMan - Friday, Apr 15, 16 @ 1:21 pm:

Tbh…

It seems keeping it even for the 250K wouldn’t be a bad idea.

The worry I have about this, is the urge will be to tax the rich which will have longer term issues. Some sort of requirement in the amendment is that the top rate can only be X times the lowest rate would not be a bad idea.

- Jack Stephens - Friday, Apr 15, 16 @ 1:21 pm:

@mister jay:

Thank you. That was THE reason for the Boston Tea Party….Taxation without representation.

Not “bathroom” laws to protect imaginary religious freedoms.

- wordslinger - Friday, Apr 15, 16 @ 1:22 pm:

–“The very foundation of our country was ignited by the avoidance of taxes.”–

LOL, no, that was the Cayman Islands.

You’re confusing the meaning of “Taxation without representation is tyranny.”

And, in truth, during the Whiskey Rebellion, when there was armed resistance to the first tax imposed by the federal government on a domestic product, Pres. Washington led an army of militia to put down the seditionists.

- A Jack - Friday, Apr 15, 16 @ 1:25 pm:

If this does not pass, it will still serve to show that Rauner and his allies are anti-middle class and pro-wealthy.

This will certainly be good campaign material going into the fall. The Democrats are trying to turn the tables on Rauner by saying, “Hey, we are for a tax decrease for working people, while all the Republicans care about are their rich friends.”

- blue dog dem - Friday, Apr 15, 16 @ 1:25 pm:

I beg for fair taxes. This is ok. Emily needs to worry about social services, not lecturing people on what is fair taxation.

- Homer J. Quinn - Friday, Apr 15, 16 @ 1:25 pm:

I was reminded last night of what FDR had to say to those 1%-ers who argued against social security:

“Let them emigrate and try their lot under some foreign flag in which they have more confidence.”

- Federalist - Friday, Apr 15, 16 @ 1:27 pm:

The proposal does not seem to be indexed to inflation from the information presented. Obviously with the same results as the AMT and now the ObamaCare tax on investments which is also not indexed. WE all know where this leads.

If this is to have a fighting chance, the rates must be in the Constitution and that it is indexed to the CPI.

Who knows, it might gain some credibility at some time and be implemented- after Rauner.

- AC - Friday, Apr 15, 16 @ 1:32 pm:

It’s a step in the right direction, but requires more revenue, perhaps a tweaking of the rates and income levels would be sufficient to make the numbers work.

- Ahoy! - Friday, Apr 15, 16 @ 1:34 pm:

Personally I would benefit by a tax reduction of around $150 bucks. Although, I am concerned that we already have an exceedingly high out migration of wealth in our State. When I look at this and contrast it to a state like Florida that does not have an income tax, if I’m a millionaire, I’m moving there.

I think this is a nice political piece for the Democrats, but I’m not sure about the implications for our state’s wealth creation.

- Yiddish cowboy - Friday, Apr 15, 16 @ 1:36 pm:

Tone, I sincerely hope you’re a millionaire. I take it you’ll be departing the great state of Illinois if Lang’s bill passes?

We’ll miss you. /s

- Jack Stephens - Friday, Apr 15, 16 @ 1:38 pm:

I agree. A graduated income tax. And it has nothing to do with Unions or Pensions.

If you make more, you pay more. Dont like it. Move to Wisconsin and pay more.

- Earnest - Friday, Apr 15, 16 @ 1:41 pm:

I don’t think any of you understand:

If Illinois’ income taxes are lower than surrounding states, it doesn’t matter.

If Illinois raises income taxes everyone will move away and there will be no one left to pay income taxes.

If Illinois lowers income taxes, it won’t help one lick. Evidently no one moves to Illinois because of lower income taxes, they only leave if taxes are ever increased.

Get it right. /troll-like snark

- Apocalypse - Friday, Apr 15, 16 @ 1:45 pm:

The moving van companies will be happy. More people leaving Illinois. Maybe, Lang should think about taxing retirement income! Where is the property tax relief, cell phone tax relief, and sales tax relief?

- Former State Employee - Friday, Apr 15, 16 @ 1:53 pm:

Not being obtuse, why is Emily Miller characterized here as a voice of millions of taxpayers? Seriously. Am I missing something?

- Joe M - Friday, Apr 15, 16 @ 1:55 pm:

It worked in Minnesota. “This Billionaire Governor Taxed the Rich and Increased the Minimum Wage — Now, His State’s Economy Is One of the Best in the Country.” Updated Feb 19, 2016

http://www.huffingtonpost.com/carl-gibson/mark-dayton-minnesota-economy_b_6737786.html

- Formerpol - Friday, Apr 15, 16 @ 2:00 pm:

Actually, a Fair Tax is one with the same % for everyone - what we have now. The rich pay more, and the middle class pays less. the truly poor pay nothing.

- Steve - Friday, Apr 15, 16 @ 2:02 pm:

To - Joe M -

Not all is well in high tax Minnesota

http://tcbmag.com/Industries/Politics-Public-Policy/Minnesota-s-Great-Wealth-Migration

- Name Withheld - Friday, Apr 15, 16 @ 2:03 pm:

No - a fair tax is one that is appropriate for each bracket. You’re advocating an equal tax - the same rate for everyone, which has been rightfully noted as unfair for those making lower income (and whom their expenditures on on housing, utilities, and food constitute a higher percentage than for those in the higher brackets.

- Trolling Troll - Friday, Apr 15, 16 @ 2:09 pm:

I encourage every millionaire to leave now. Myself and a lot of like minded entrepreneurs would love to take your business and customers. I have no problem paying Union scale, great bennies, paid leave, and the upper tax rate.

If you’re whining about being rich, you have bigger problems than tax rates. No one feels sorry for you.

- Anonymous - Friday, Apr 15, 16 @ 2:12 pm:

Good plan but needs to be indexed.

- The Man on 6 - Friday, Apr 15, 16 @ 2:18 pm:

The bill is all well and good, but HJRCA 59 has to be passed with it, and has to be passed with 71 affirmative votes. As has been said several times in this comment thread, those votes are not there.

MJM needs to be pressed on why this is not just another political stunt, like the failed pension amendment from 2012. Without a serious plan to move the amendment through the G.A., this whole effort is just sound and fury, signifying nothing.

- SAP - Friday, Apr 15, 16 @ 2:24 pm:

== No millionaire i their right mind is gonna hang around when there’s a Gary Indiana (3.3 flat rate) address so close== Yup, that’s right, Gold Coast millionaires are all going to flock to beautiful Gary, Indiana.

- Rich Miller - Friday, Apr 15, 16 @ 2:27 pm:

===beautiful Gary, Indiana===

They have a nice little neighborhood right on the lake.

Plus, remember that Oprah used to have a place in Indiana.

It’s not that far-fetched.

The problem with raising taxes is you have to show people you’re cleaning up the mess or they’re gonna freak out. Rauner gets that, although I disagree with his anti-union stuff. The Dems - and several commenters here - don’t seem to get it in the least. People hate the government of this state. It’s not a partisan issue, either.

- Anonymous - Friday, Apr 15, 16 @ 2:28 pm:

we lost 4billion with the sunset of the 5% tax so how does 1.9billion fill the gap. Raise taxes on the rich and cut 2b from the poor–the def of shared sacrifice!

- Anonymous - Friday, Apr 15, 16 @ 2:28 pm:

Let me see if I got this. A tax reform package that needs to pass both houses in and perhaps a veto override in an election year. Then with plenty of voter anger and distrust voters are asked to pass a constitutional amendment on the income tax at the same election that they will be voting in one of the strangest presidential elections ever. How do the warring parties make that happen?

- Grandson of Man - Friday, Apr 15, 16 @ 2:30 pm:

I would like to apologize for my previous comments and glee over this bill. I was blowin’ off steam from all the attacks on labor rights by Rauner and certain others.

This bill really hits the wealthy. I could live with more progressivity and would be willing to pay a little higher tax, it it would ease the burden on top earners a little bit.

The point I’m trying to make is that we shouldn’t scapegoat and demonize each other. We should try to work together for fairness. It’s the naive optimist in me that wishes this.

- SAP - Friday, Apr 15, 16 @ 2:36 pm:

==ironically introduced on Tax Day== Today is Emancipation Day in Washington. D.C. Tax day is not until Monday guys.

- Jack Stephens - Friday, Apr 15, 16 @ 2:37 pm:

Along with a Graduated Income Tax, lets legalize Marijuana and empty the Prisons of low-level drug offenders. This will add revenue and save money at the same time.

- Formerly Known As... - Friday, Apr 15, 16 @ 2:38 pm:

==The political reality is there will not be a three-fifths majority voting Yes for the Lang proposal.==

Then this bill is a non starter.

We should save our breath and not let this empty gesture of a bill distract from the other urgent issues looming over Springfield’s head.

- SAP - Friday, Apr 15, 16 @ 2:42 pm:

==Emily needs to worry about social services, not lecturing people on what is fair taxation. == Not to speak for Emily, but I think her point is that fair taxes would help fund social services.

- wordslinger - Friday, Apr 15, 16 @ 2:49 pm:

Oprah didn’t move to Santa Monica for the low Cali graduated income tax rates on the rich.

13.3% in Oprah’s neighborhood.

- SAP - Friday, Apr 15, 16 @ 2:49 pm:

==The problem with raising taxes is you have to show people you’re cleaning up the mess or they’re gonna freak out. Rauner gets that, although I disagree with his anti-union stuff. The Dems - and several commenters here - don’t seem to get it in the least. People hate the government of this state. It’s not a partisan issue, either. == I’m with you on that, and Mr. Lang’s tax increase will not close the gap by itself. If used as a piece of the puzzle along with workers comp and other stuff that might be doable in Illinois, I think its a hell of a first step and would benefit most of the state.

- Too much - Friday, Apr 15, 16 @ 2:49 pm:

“fair tax” I love these silly names they use. I am so happy Rich and others continue to refer to it as a “graduated income tax” because they don’t see the people as being stupid. I am for tax reform, but that said, the percentages are just silly. 9.75% on income over 1 million, why not make it 50% or 25%? Those are all “feels right” numbers, rather than practical numbers. 3.75% on income above 100K for a single filer? Why not 3.78% or 4.12%, those number feel good too.

- atsuishin - Friday, Apr 15, 16 @ 2:52 pm:

Is this enough revenue to satisfy Illinois spending? Probably not, the graduated income tax makes sense on the merits but I think the needs to be a serious cut in spending i.e. laying off government workers to actually balance the budget. Also does the plan incorporate the consequences of illinois’ continued population decline?

- Formerly Known As... - Friday, Apr 15, 16 @ 2:53 pm:

@Grandson of Man - well said, Grandson. Labor has been hit hard for years now, and it is unpleasant. Everyone here gets upset at times about different things. You make strong comments. Don’t stop.

- Too much - Friday, Apr 15, 16 @ 2:55 pm:

I wish there was more discussion of the percentages were derived and why we should support those percentages as well as how extra state revenue will be used. I just don’t trust it would be used to address the problems that have been ongoing for 10 years plus since the current legislative leaders have not addressed such concerns in the past.

- 39th Ward - Friday, Apr 15, 16 @ 2:57 pm:

The claim that 99% of the people in Illinois would get a reduced tax rate is simply incorrect. The $200k bracket (at which taxes would increase) reaches about the top 3% of earners. I know that’s still a small number of taxpayers affected, but it’s triple the number of folks who are going to yell.

- 39th Ward - Friday, Apr 15, 16 @ 2:58 pm:

Strike my last comment. I misread the chart. Sorry.

- Lomez - Friday, Apr 15, 16 @ 3:01 pm:

Could Emily Miller follow up with some more details on the backbreaking years of negotiations that went into this?

- Anonymous - Friday, Apr 15, 16 @ 3:03 pm:

“No millionaire i their right mind is gonna hang around when there’s a Gary Indiana (3.3 flat rate) address so close.”

Indiana also has a county-level tax rate, the amount of which varies from county to county. In some cases the Indiana state flat rate + the county flat rate is higher than the Illinois state flat rate.

But what really fries me is this oft-repeated scare tactic - “the millionaires and job creators will flee!” - which has no bearing on reality. In just one example, GE did not pick Massachusetts over Illinois because of the state tax rate.

How about arguing like a grown-up?

- Nick Name - Friday, Apr 15, 16 @ 3:03 pm:

Anonymous 3:03 p.m. was me.

- Tone - Friday, Apr 15, 16 @ 3:11 pm:

- wordslinger - Friday, Apr 15, 16 @ 2:49 pm:

Oprah didn’t move to Santa Monica for the low Cali graduated income tax rates on the rich.

13.3% in Oprah’s neighborhood.

Exactly. But if IL top rate is 9.75% and CA top rate is 13.3% I would be outta here in a heart beat. Illinois is pretty boring outside of Chicago.

- Lomez - Friday, Apr 15, 16 @ 3:12 pm:

It must be doubly offensive for the rich. Not only does the GA scheme to soak you for more with brackets someone could have come up with in 90 seconds, but to have to give it to *this* GA, led by true stewards. I would hire the best accountant and tax attorney out there to figure how to shield it.

- Name Withheld - Friday, Apr 15, 16 @ 3:12 pm:

Don’t let the door hitcha on the way out, Tone.

- here we go - Friday, Apr 15, 16 @ 3:13 pm:

Correct me if I am wrong, but the rate bill would only require a simple majority, right?

It’s the constitutional amendment to put it to the voters that would require a super majority?

Can Franks, Drury, and the likes vote YES to put it to the voters and NO on the tax rate?

That seems like a reasonable option.

- Montrose - Friday, Apr 15, 16 @ 3:13 pm:

To those that are arguing that $1.9 b is not enough revenue - I don’t believe anyone is saying it is. That doesn’t make this proposal a bad thing. It is a critical structural reform that will big a role in filling the revenue hole.

- Tone - Friday, Apr 15, 16 @ 3:15 pm:

“People hate the government of this state.”

This. One of the worst governments in the country. Decades of awfulness.

- Demoralized - Friday, Apr 15, 16 @ 3:18 pm:

Tone:

Then leave. Seriously. I’ve never seen a person so bitter and unhappy as you apparently are. I would have left a long time ago if I were as bitter as you.

- Montrose - Friday, Apr 15, 16 @ 3:21 pm:

==Emily needs to worry about social services, not lecturing people on what is fair taxation. ==

To worry about social services is to care about Illinois’ structural deficit and the need for new revenue. If Voices stayed out of that conversation, they would both be ignoring reality and not doing their job.

- Markus - Friday, Apr 15, 16 @ 3:21 pm:

Are “job creators” really job creators if the jobs they create result in employees living below the federal poverty level?

Don’t we all just end up subsidizing that situation with tax dollars and perpetuating a life in poverty? Non-owner wages below FPL should not be deductible as a business expense nor should they qualify as “jobs created”.

- Lester Holt's Mustache - Friday, Apr 15, 16 @ 3:22 pm:

==The Dems - and several commenters here - don’t seem to get it in the least. People hate the government of this state. It’s not a partisan issue, either.==

Ok, I’ll bite. What is it that we don’t get? I would argue the people don’t hate state government because Dems haven’t passed tort reform or stronger workers comp rules or redistricting. They sure as heck don’t hate state government because Dems haven’t passed right to work. Maybe term limits?

The people, the same ones who also continue to elect and re-elect democratic candidates to the house and senate, just overwhelmingly approved a non-binding referendum on this very same issue not two years ago. So today, a legislator introduces a measure to allow the people to reaffirm their stance on this issue, and the Raunerites expectedly freak out and proceed to bash poor Emily Miller for simply making an observation. And then we’re told “well, you just don’t get it”. Perhaps someone could explain to a poor member of the commentariat?

- Aldyth - Friday, Apr 15, 16 @ 3:23 pm:

Americans for Prosperity: Representing the interests of the very, very rich and nobody else.

- Rich Miller - Friday, Apr 15, 16 @ 3:27 pm:

===then we’re told “well, you just don’t get it”. Perhaps someone could explain===

I would if I had the time. Working on something else. But go read that poll link on my comment. It’s real. And you’re a fool to ignore it.

- Tone - Friday, Apr 15, 16 @ 3:28 pm:

If Chicago didn’t exist, I would have left two decades ago. I love this City.

- Lester Holt's Mustache - Friday, Apr 15, 16 @ 3:29 pm:

The argument that the rich will move to Indiana if this passes is complete hogwash. Everyone said the same thing about New Jersey, and it didn’t happen. They said the same thing about Minnesota, and it didn’t happen. It isn’t happening in California now. For crying out loud, that mope from Jimmy Johns has been threatening to leave for 6 years and still hasn’t done it yet. If they were going to do it, they would have done so by now. We’ve been repeatedly threatened that all the rich are going to move to a state with no state tax like Texas or Florida or Tennessee but they still haven’t left.

- ryan - Friday, Apr 15, 16 @ 3:29 pm:

==Correct me if I am wrong, but the rate bill would only require a simple majority, right?

It’s the constitutional amendment to put it to the voters that would require a super majority?==

I believe this is correct. However, if the rates are passed first, that makes passing the amendment much easier, as they can sell it as a tax cut to 99%.

- Tone - Friday, Apr 15, 16 @ 3:31 pm:

Again, no millionaire is going to move to the dump that Indiana is. It’s worse than Illinois. But why the heck would one pay confiscatory tax rates here? CA is much nicer. So is Miami.

- Tone - Friday, Apr 15, 16 @ 3:32 pm:

Remember, IL has the 4th highest tax burden in the country now. Higher taxes won’t help our demographics. We have lost population two years in a row now.

- Chicago 20 - Friday, Apr 15, 16 @ 3:35 pm:

- Beautiful Gary Indiana

Your income tax rate is based on where you earn your money, not just where you live.

Illinois and Indiana stopped their reciprocal income tax agreement years ago.

Indiana residents who work in Illinois pay Illinois income tax, and since Indiana’s income tax rate is higher in some areas you may also need to pay the difference of the two state income tax rates to Indiana.

Illinois residents who work in Indiana, pay Indiana income tax and receive Indiana unemployment if they become unemployed.

- Name Withheld - Friday, Apr 15, 16 @ 3:39 pm:

That higher tax burden is largely due to property taxes.

Our income tax rate is pretty low comparatively. Here’s a link to the Bloomberg article on it.

http://www.bloomberg.com/graphics/2016-state-taxes/

- SAP - Friday, Apr 15, 16 @ 3:40 pm:

Illinois has been bleeding population for decades. If the proposed tax change makes Illinois more hospitable for 99% of the population, presumably we’ll pick up 99 non-millionaire for every millionaire we lose. Could be a decent trade-off.

- Bobby G - Friday, Apr 15, 16 @ 3:40 pm:

Seems better than the Harmon/Mitchell proposal of 2014.

- What the? - Friday, Apr 15, 16 @ 3:43 pm:

let me begin with this - I did not completely read all the comments so if I am repeating something, sorry.

Before we get too giddy about the proposed revenue, take a long hard look at the value. $1.9B. That is quite a lot of cash.

But, the hole is over $3.5B. So give me a graduated income tax, sock it to the rich, save the poor and then what? There is still a hole to fill. This is a sheep in wolf’s clothing.

- Skirmisher - Friday, Apr 15, 16 @ 3:51 pm:

Frankly, Illinois actually does need most of the elements of Rauner’s “turn around agenda”. But Illinois also needs a progressive income tax, and this proposal is a good start, so long as it also taxes so-called “retirement income”. Everyone needs to bleed a bit to put Illinois back on its feet.

- East Central Illinois Smalltown Hick - Friday, Apr 15, 16 @ 4:00 pm:

I may not be the most educated of the bunch BUT - if a business is only making $0.02 on the dollar - how much business are they actually doing in order to make the kind of money that results in an increase in their taxes under this plan? I’m guessing the small businesses in my neck of the woods would be thrilled to have those kinds of gross receipts.

- Tone - Friday, Apr 15, 16 @ 4:02 pm:

- Skirmisher - Friday, Apr 15, 16 @ 3:51 pm:

Frankly, Illinois actually does need most of the elements of Rauner’s “turn around agenda”. But Illinois also needs a progressive income tax, and this proposal is a good start, so long as it also taxes so-called “retirement income”. Everyone needs to bleed a bit to put Illinois back on its feet.

I agree. And when do we start the mass layoffs and goverment spending cuts?

- TinyDancer(FKA Sue) - Friday, Apr 15, 16 @ 4:04 pm:

Americans for Prosperity is against a graduated income tax - shifting the tax burden away from those least able to pay to those who can comfortably afford it?

I’m shocked.

Shocked.

- Shark Sandwich - Friday, Apr 15, 16 @ 4:14 pm:

I want to expand on SAP’s comment about AFP’s findin g of ‘irony’-

“ironically introduced on Tax Day”..

It’s neither Illinois’, nor Federal’s tax day today. That’s Monday, 4/18, for both. So I guess we can add AFP along with Alanis Morissette in the pile of ‘people who don’t understand what irony actually is’.