*** UPDATE 1 *** As subscribers were warned earlier this week, the governor has appointed three new TRS board members. Martin Noven, Laura Pearl and Anne Marie Splitstone were all appointed this morning. So, the governor can more easily block this move today.

*** UPDATE 2 *** The state statute requires that TRS board members live outside of Chicago…

Each such appointee shall reside in and be a taxpayer in the territory covered by this system

Martin Noven resides in Chicago. Stay tuned.

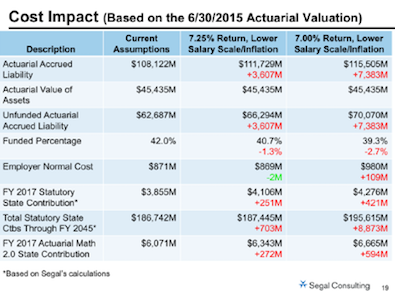

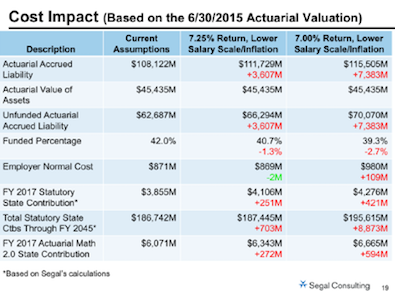

*** UPDATE 3 *** This chart is in today’s TRS package. I’m told by the governor’s office and a Democratic legislative source that it means the additional cost to the state in the coming fiscal year would be $421 million. Wow…

*** UPDATE 4 *** Chicago resident Martin Noven is not at the TRS meeting. I’m told he will withdraw his nomination this afternoon.

*** UPDATE 5 *** The motion was approved. Here comes the big hit, folks, although I would expect a possible legal challenge because of the Open Meetings Act stuff.

[ *** End Of Updates *** ]

* We discussed this earlier in the week…

The board that oversees the Teachers Retirement System is scheduled to vote on whether to lower the expected rate of return on investments, a move Republican Gov. Bruce Rauner’s office has warned could blow a massive hole into the state’s already shaky finances.

The board will convene in Springfield on Friday morning to consider the change. When the board last altered the assumption from 8 percent to 7.5 percent in 2014, the state ended up on the hook for an additional $200 million in pension payments.

It’s an added cost state government can ill afford after going more than a year without a full budget. The Rauner administration suggests it could lead to deeper cuts and the need for even higher taxes down the road.

The TRS board meeting begins at 10 o’clock this morning. Our friends at BlueRoomStream.com will be streaming it live, so click here if you’re interested.

* The governor was asked about the pending TRS vote yesterday. He said he didn’t want a decision to be “rushed” and acted upon “behind closed doors” by a “partial” board. But TRS usually acts in August on these recommendations, the meetings are not private and Rauner has allowed the board’s three vacancies to go unfilled to date.

Raw audio…

There had been word earlier this week that the governor would finally fill the three TRS board vacancies before the meeting, but it didn’t play out (at least, not yet). Plans change in this business.

* As I told subscribers yesterday, there is some potential controversy with the TRS board’s agenda. They changed the document yesterday morning after I wrote that they didn’t have the assumed rate of return listed as an action item. A memo from Georgia Man, Chief Compliance Officer and Deputy General Counsel for the governor was sent out late yesterday afternoon…

As you know, the Teachers’ Retirement System (TRS) scheduled a board meeting to be held on Friday, August 26, 2016. The publicly posted agenda included items for informational purposes and items for which action will be taken, the latter of which were noted with asterisks. That agenda included “Review Assumed Rate of Return” as an item under the Executive Director’s Report, but did not indicate that any action would be taken on that item. Then, on Thursday, August 25, 2016, after media inquiries, the agenda was modified to indicate that action will be taken on the “Review Assumed Rate of Return” item.

As an initial matter, the second agenda posted on Thursday, August 26, 2016 must be disregarded. The Open Meetings Act requires an agenda to be publicly posted at least 48 hours before the meeting. 5 ILCS 120/2.02. The Attorney General has advised that a public body, including TRS, may not change its publicly posted agenda within 48 hours of the meeting. Illinois Open Meetings Act, Frequently Asked Questions for Public Bodies, Ill. Att’y Gen., at p. 5 (Jan. 8, 2013) (hereinafter, “OMA FAQs”) (“A public body cannot change the agenda less than 48 hours before the meeting.”). Therefore, the second agenda posted on Thursday, August 25, 2016 is not compliant with the Open Meetings Act. (It could also be argued that because the initial agenda was removed, the TRS board meeting is no longer in compliance with the Open Meetings Act at all.)

Further, the Open Meetings Act prohibits the TRS board from taking action on the “Review Assumed Rate of Return” item at its meeting on August 26, 2016. The Act permits a public body to “consider” an item not set forth on the agenda (5 ILCS 120/2.02), but Illinois courts and the Attorney General have held that a public body may not take final action on such an item at that meeting. See, e.g., Rice v. Board of Trustees of Adams County, 326 Ill. App. 3d 1120 (4th Dist. 2002) (holding that “consideration of” an item of new business not included on the agenda for the meeting is limited to deliberation and discussion and does not include taking action on such item) and OMA FAQs at p. 4 (advising that the Act “does not permit the taking of a vote on such a matter at that meeting”).

As the court in Rice held, the purpose of the Act is to ensure that the people are informed as to the conduct of public business. The initial TRS agenda specifically indicated that action would not be taken on the “Review Assumed Rate of Return” item. Changing the agenda within the 48-hour period prior to the meeting is an admission to that effect. Taking action on an item not marked for action on the publicly posted agenda would violate both the letter and spirit of the Open Meetings Act.

* I asked Dave Urbanek at TRS for a response to the issue…

The Open Meetings Act is silent on whether “action items” must be specifically identified in an agenda. It is sufficient that items subject to action are identified on the agenda. We add the asterisks to our agendas as a courtesy. We decided today to add that asterisk.

See OMA section 120/2.02 (c)

Dave

* But I also talked yesterday with Mary Patricia Burns, an attorney who represents some state and local pension funds. Sen. Don Harmon is also a partner with her firm.

Burns told me that she believes the board is in “technical violation” of the Open Meetings Act. She pointed out the obvious: The board changed the agenda, so it must have figured it made a mistake. But that change happened within the 48-hour posting period, which is highly problematic.

* Burns pointed to the attorney general’s Open Meetings Act FAQ page…

Can the agenda be changed?

A public body cannot change the agenda less than 48 hours before the meeting.

Can the public body take action on items not on the agenda of regular meetings?

No. While the public body can discuss items that are not on the agenda of a regular meeting, the public body cannot take action or make any decision with regard to items or topics not on the agenda of a regular meeting.

Seems pretty clear to me.

“It’s not something I would’ve done,” Burns said. “I would’ve tried hard to avoid this problem.”

Agreed.

- Not Again - Friday, Aug 26, 16 @ 9:31 am:

Cinda and Dick could not have run this one any worse.

- Huh? - Friday, Aug 26, 16 @ 9:33 am:

Easy to remedy, put on agenda for the next meeting or call a special meeting to address the issue.

There is no need to create problems for themselves by getting into trouble with the open meetings act. This just gives 1.4% fodder for his campaign rhetoric.

- Freeport FOIA Guy - Friday, Aug 26, 16 @ 9:33 am:

seems pretty clear to me that TRS can’t take final action on this. And screwing up the agenda posting? Hoo boy.

- Anonymous - Friday, Aug 26, 16 @ 9:34 am:

The Springfield School District often posts an “Addendum” to their agendas a few hours before they meet. Is this also illegal?

- Precinct Captain - Friday, Aug 26, 16 @ 9:35 am:

In short, the board should have left the agenda as it was, which seemed to provide stronger legal ground than the updated version. What’s being highlighted less in this fiasco is that Rauner wants TRS to cook the books and make calculations based on a knowingly and actuarialy false rate of return. TRS needs to realize that Rauner’s end goal is the very elimination of their existence and the complete subservience of their beneficiaries to the billionaire investor class.

- Norseman - Friday, Aug 26, 16 @ 9:37 am:

The agenda issue is significant. Whether the board action on the rate is simply ministerial or not doesn’t matter when you have Rauner and his minions wanting the action postponed. The agenda mess-up gives Rauner the perfect cause of action attack a decision today.

- Anonymous - Friday, Aug 26, 16 @ 9:40 am:

** Is this also illegal **

It is if they take action on any of those items added to the agenda.

- Hit or Miss - Friday, Aug 26, 16 @ 9:41 am:

===vote on whether to lower the expected rate of return on investments, a move Republican Gov. Bruce Rauner’s office has warned could blow a massive hole into the state’s already shaky finances.===

I do not see that a change in the expected rate of return on TRS investments creates a ‘massive hole’ in anything. Rather to me it only points out puts into writing a clearer picture of the pension systems financial picture. The current expected rate of return of the TRS investments in my opinion is unrealistically optimistic. What is needed today, and has been needed for years, is more tax dollars to fund the pension systems.

- SAP - Friday, Aug 26, 16 @ 9:42 am:

Two questions: (1) Isn’t pretending that State finances are better than they really are who we got into this financial mess? (2) Isn’t governmental refusal to face budget realities something that Bruce V. Rauner based his governorship on?

- Stunt double - Friday, Aug 26, 16 @ 9:51 am:

No offense Ms Mann, but you’re not the lawyer for TRS and you’re not the Attorney General.

- Honeybear - Friday, Aug 26, 16 @ 9:53 am:

Ugh, I hate moments like this. My point is that we should face reality and lower the expectations. It’s some superstars fault for not realizing this might hit and not planning for it. Governor Rauners gamble didn’t pay out and now one of Rauners get away vehicles didn’t get gassed up before the hostage operation. Superstar forgot to fill it. Now there’s a huge problem with the plan that’s been discovered. The problem is not the adjustment of the rate. The problem is the hostage situation we’re in is going to get hostages killed and the Governor in his hubris can’t admit that he botched his own operation.

- Sue - Friday, Aug 26, 16 @ 9:54 am:

As I said earlier in the week, if the Governor wants more input or oversight at TRS why is he leaving three of his seats vacant? He had it in his power to better influence not only this issue but management of the portfolio.

- Twirling Towards Freedom - Friday, Aug 26, 16 @ 9:54 am:

This is an interesting one. The rate of return was “on the agenda”, but my understanding is it was identified as something to be discussed, not acted upon. I don’t know that the OMA requires the agenda to specify that items would be acted upon, but if the agenda suggests that final action will not be taken, I wouldn’t think you could take final action. Changing the agenda within 48 hours doesn’t fix anything for OMA purposes (absent emergency).

- walker - Friday, Aug 26, 16 @ 9:55 am:

The TRS board has done good forecasts in the past, though they missed the depth and length of the 2007/8 crash just like everybody else. Now you’re going to bureaucratically delay them, in the hopes of somehow changing their view of likely financial market realities, based on its immediate fiscal impact?

Please, politicians, leave them alone.

- 47th Ward - Friday, Aug 26, 16 @ 9:56 am:

OK, whether they do it at today’s meeting or the next, TRS still needs to do this, no? Is Rauner or anyone else arguing that they should not adjust the expected rate of return to more accurately calculate the pension obligations?

To be on the safe side, TRS might want to discuss this today but defer action. Maybe by then, the Governor will get around to naming some folks to serve on this board. Any time he wants to start governin’ will be fine with me.

- Pot calling kettle - Friday, Aug 26, 16 @ 9:57 am:

I have been on a board for 12+ years. Training and legal advice on the Open Meetings Act is very clear. If an item is not listed as an action item on the posted agenda at least 48 hours prior to the meeting, you cannot take action on it. This is one of the most fundamental requirements of the Act.

- Dance Band on the Titanic - Friday, Aug 26, 16 @ 9:58 am:

Rich - You noted elsewhere that there are currently three vacancies on the TRS board. Assuming these seats have been vacant since their terms expired in July, why the delay in Gov. Rauner naming replacements?

- Ron - Friday, Aug 26, 16 @ 10:01 am:

Time to give the financial responsibility of paying teachers pensions where they belong, with the school districts that created the obligations. The state must also allow municipal bankruptcy so those school districts that can’t pay (which is probably have of them) can have an orderly financial reorganization.

- Henry Francis - Friday, Aug 26, 16 @ 10:02 am:

As some have noted, don’t get distracted by the procedural gamesmanship here. What is most important is that the Guv doesn’t want TRS to admit facts. To admit what pension boards all over the country are doing. To admit that returns will most probably be lower than currently expected. That is the most prudent thing to do given current and forecasted market expectations. This is obvious to an investor as savvy as the Guv.

But in doing so, it would trigger an additional payment required by his administration. And we all know they don’t have the funds while they maintain the lower tax rate. This is like refusing to lower the expected temperature with winter approaching, because you don’t want to have to allocate addiional funds for heating oil. Guess what? The bill is eventually going to come, why not prepare for it?

- illini97 - Friday, Aug 26, 16 @ 10:03 am:

If everyone knows the outcome of this meeting will be contentious, why make things worse by treading into OMA “grey area” (though I think they’re well past grey and into a violation)?

You screwed up the agenda. It happens. Admit the oops and call a special meeting with adequate notification time per OMA. Fix it now rather than beg for forgiveness later.

- Anon - Friday, Aug 26, 16 @ 10:04 am:

Welcome to Illinois!

We owe money to ourselves, but spend an awful lot of time trying to avoid paying ourselves.

Seriously — the governor wants to talk about driving people away from Illinois — back loading these pension payments till y’all are dead or retired doesn’t exactly make a professional in their 20s or 30s want to hang out and pay your bills after y’all have skipped out on the check.

- cdog - Friday, Aug 26, 16 @ 10:08 am:

What’s another “massive hole” in the land of MASSIVE HOLES?

(Rauner’s track record is to pick and choose what bills to pay, so unless this is an automatic sweep from some fund, there is a good chance he would just talk his talk and not send the funds.)

Have a special meeting Saturday, do the deal, and go downtown and have a beer with some Blues.

- Honeybear - Friday, Aug 26, 16 @ 10:09 am:

–As I said earlier in the week, if the Governor wants more input or oversight at TRS why is he leaving three of his seats vacant?–

Some superstar is going to get fired over this I would think.

This isn’t a small screw up. But there again this is what you’re going to get when you don’t invest in good competent staff. When Rauner constantly bashes the workforce, does he expect to find anyone to work for him? I know of more than a few upper management who are trying desperately to get off the ship.

- Nieva - Friday, Aug 26, 16 @ 10:10 am:

If not this meeting then next meeting. If the rate needs to be lowered then it will be lowered. All this means is the state will have to put in some serious cash to make up the short fall. I have yet to see a governor that can get board appointments made in a timely manor. I would bet these positions will be filled before the next meeting.

- 47th Ward - Friday, Aug 26, 16 @ 10:11 am:

===Martin Noven, Laura Pearl and Anne Marie Splitstone were all appointed this morning. So, the governor can more easily block this move today.===

Did they instruct the new appointees that blocking this move means denying reality? Don’t the appointees have a fiduciary duty to the pension fund? It sure seems like “blocking this move” would be a huge mistake. Delaying? Maybe, but blocking? I wouldn’t want that on my record.

Also, there is a Stu Levine joke in here somewhere, but I’m not going to make it. I’m taking the high road today.

- DuPage Bard - Friday, Aug 26, 16 @ 10:18 am:

Sadly this is turning into a political deal, like everything else. The rate needs to be adjusted, if the actuaries call for it. The State cannot afford more tricks of rates of return, pension holidays, pension borrowing or anything else.

- Man with a plan - Friday, Aug 26, 16 @ 10:21 am:

If Rauner votes to stop them from lowering the expected rate of return, he is actually worsening the pension crisis. This is a move to curtail underperformance, but stopping them from doing it is only making the problem worse.

- A guy - Friday, Aug 26, 16 @ 10:21 am:

=== the procedural gamesmanship===

Is that the new term for “breaking the law”. If you’ve followed government for 3 months you’d recognize this is an utterly obvious violation of the Public Meetings Act.

The arrogance of just simply not obeying it is arresting. It’s as if there simply are no rules. Heck of a way to run the show. Liars and cheats!

===No offense Ms Mann, but you’re not the lawyer for TRS and you’re not the Attorney General.===

Yeah right. This is what you’re going with. The AG wouldn’t even have to get off her chair to offer an opinion on this. The decision wouldn’t even make it that far up the pole. It’s illegal to take action without proper notice. All of them know it. Saying otherwise is a fraud.

Disgusting.

- Not Again - Friday, Aug 26, 16 @ 10:21 am:

Admitting “reality” is one thing. It is another thing when the TRS won’t publicly release data that will impact the lives of every resident of Illinois.

Hard to admit “reality” when they don’t want you to know what the situation is.

- Ahoy! - Friday, Aug 26, 16 @ 10:23 am:

It makes sense for TRS to prolong the vote due to the budget hit and the desire for the chief executive of the State to implement a smoothing payment which is standard budget practice. The current leadership on TRS’s Board is wrapped up in political gamesmanship which they should not be in.

If TRS believes this is necessary (which it might be) they should work with the governor and general assembly on the best way to implement the policy. Folks, this isn’t that hard.

- Honeybear - Friday, Aug 26, 16 @ 10:29 am:

Really interesting stuff. Raunerites are losing control of bowel and bladder over this. They know the gamble is up and it will have been a total disaster.

- Davos Seaworth - Friday, Aug 26, 16 @ 10:31 am:

I wonder how many of these 3 new appointees reside in Chicago, thus making them ineligible for service as an appointed trustee (40 ILCS 5/16-164)? Given the rush to appoint, wouldn’t be surprised if this slipped through the cracks.

- Southside Markie - Friday, Aug 26, 16 @ 10:33 am:

They can fix the problem by calling an emergency meeting pursuant to Section 2.02(a) of the Open Meetings Act.

- X-prof - Friday, Aug 26, 16 @ 10:36 am:

The expected rate of return should be a straight actuarial calculation; it should not be “smoothed” or otherwise adjusted to please TRS, the governor, or taxpayers. The terms and assumptions of that calculation can and should be debated to find the method most likely to predict future performance. At least that’s the ideal everyone should agree to, even if political reality falls short.

The OMA should be respected. When the issue does come to a vote, we will learn (again) whether or not Rauner, Inc. is more interested in his T-agenda than the good of the state. If his agenda takes precedence, Rauner will provide one more data point to demonstrate that the GOP and the Dems have been and are both complicit in creating and growing the pension deficit over time.

I just checked the make-up of the board. Not 100% sure I have it right, but it looks like with these three appointments Rauner appointees will have a 1-vote majority on the board over the 6 elected by TRS contributors and annuitants.

- Sue - Friday, Aug 26, 16 @ 10:37 am:

Would be nice if TRS spent as much time on its portfolio construction so this vote would be a non-issue. Those hedge fund investments should cost Stan Rupnik his job. I guess his investment gurus are smarter then the ones at Calpers Calsters and the dozens of other large public funds that have figured out that Hedge funds are no longer worth the expense given the returns

- Nick Name - Friday, Aug 26, 16 @ 10:37 am:

Almost 40 minutes past the hour, the meeting still apparently hasn’t started, to judge by what it says on Livestream. Oh to be a fly on the wall in the closed-door session.

- Anonymous - Friday, Aug 26, 16 @ 10:39 am:

So the governor found 3 people who will assist him in cooking the books. Didn’t he campaign against such smoke and mirror tactics?

- Yiddishcowboy - Friday, Aug 26, 16 @ 10:45 am:

@Stunt Double. Actually, Ms. Man is the Deputy General Counsel & Chief Compliance Officer for the Gov’s Office. TRS is under the jurisdiction of the Gov’s office, so Ms. Man has plenty of authority to counsel and direct TRS to take certain legal actions.

- Arthur Andersen - Friday, Aug 26, 16 @ 10:51 am:

Yiddish, TRS and SURS are not under the jurisdiction of the Governor. No way, no how.

Davos, the answer is none. Five minutes with the Google coulda told you that. Quinn was the one that didn’t get that law.

- atsuishin - Friday, Aug 26, 16 @ 10:55 am:

the people bellowing about constitutionally on the maps post are now sweeping aside whether or not these actions are legal. its rank hypocrisy.

- Davos Seaworth - Friday, Aug 26, 16 @ 10:56 am:

Arthur,

You sure about Noven? He appears to have a Chicago address according to my google search.

- Honeybear - Friday, Aug 26, 16 @ 10:59 am:

The deal with the devil at the crossroads at midnight was this. That we’d “hold the line on taxes”, as the Kay flyer said, till after November. Well, TRS would call the debt in early and the devil would get his soul sooner than Raunerites expected. Ya can’t cheat the devil folks.

- Yiddishcowboy - Friday, Aug 26, 16 @ 11:01 am:

@AA. You are not correct. Why do you think that Ms. Man got involved with this issue in the first place? We’ll have to agree to disagree.

- Anonymous - Friday, Aug 26, 16 @ 11:01 am:

TRS is not wanting to make things appear better than they are. They’re trying to face reality. It is the governor who would like to run this into the ground, since constitutionally, he can’t touch it. He’d also do anything to avoid a tax hike which everyone who is breathing recognizes we need.

- Flynn's Mom - Friday, Aug 26, 16 @ 11:03 am:

From the lyrics to Jesus Christ Superstar and with a nod to Bruce’s superstars:

Every time I look at you I don’t understand

Why you let the things you did get so out of hand

You’d have managed better if you’d had it planned

Why’d you choose such a backward time in such a strange land?

- Dr X - Friday, Aug 26, 16 @ 11:04 am:

Have the appointees been vetted? Rauner promised that all appointees would be vetted by a federal overseer. If not, they should resign.

So we have a Gum maker, a equity investor, and a TIAA Cref guy. You would think that Noven (TIAA) and Pearl (equity) would have the smarts to see the downgrade as needed. Maybe they’ll only drop .25% at a time

- Juice - Friday, Aug 26, 16 @ 11:05 am:

Ahoy!, the Governor’s proposed smoothing practice is not typical budget practice. I’m not familiar with any pension fund that smooths out the changes in actuarial assumptions.

Smoothing of the asset returns is something that is a fairly common practice, that the Governor has proposed ending. Anything that lowers the contribution and pushes payments on to future taxpayers is what his aims appear to be.

- Sue - Friday, Aug 26, 16 @ 11:05 am:

TRS is not under the Gov control other then thru his appointments to the Board. Once appointed they all serve as fiduciaries obligated to act in best interest of the Fund.

- Arthur Andersen - Friday, Aug 26, 16 @ 11:07 am:

Yiddish, I couldn’t be more positive. I would suspect the Gov’s office has taken an extraordinary interest in TRS in the past few days, hence the memo.

- Anonymous - Friday, Aug 26, 16 @ 11:10 am:

Fiduciaries. Yeah

- Honeybear - Friday, Aug 26, 16 @ 11:10 am:

–TRS is not under the Gov control other then thru his appointments to the Board. Once appointed they all serve as fiduciaries obligated to act in best interest of the Fund.–

Oh Sue. That is without a doubt the funniest thing I’ve read in a long time. Paaaaleeeeeaase Girl. Don’t even….fiduciaries……oh my God….even for you Sue. Loving Jesus

- Henry Francis - Friday, Aug 26, 16 @ 11:15 am:

A Guy - the OMA is to promote transparency and ensure no one is hiding the ball when conducting public business. Considering the glass house your Guv and his administration have been living in (certainly hiding more than the previous administration) I would be careful when throwing stones.

No one was trying to hide anything here. The matter was clearly set forth on the initial agenda. It just wasn’t clear that action was going to take place. And it isn’t entirely clear whether that would violate the OMA. TRS then stupidly issued a revised agenda with less than 48 hours before the meeting. Fine, take care of it at the next meeting. But take care of it and don’t make the pension crisi worse.

- Sue - Friday, Aug 26, 16 @ 11:15 am:

Best thing is there are now finally a few trustees to challenge the staff and consultant as opposed to just saying Aye

- Just Chilling - Friday, Aug 26, 16 @ 11:18 am:

Couple things going on here —

1. Political gamesmanship between TRS and the Raunerites freaking over potential TRS action that is consistent with mission and financial reality.

2. Clear violation of OMA by TRS. In addition to 48 hour rule violation, contra Mr. Urbanek’s response to Rich, OMA and Pubic Access Counselor opinions stipulate that action items must be identified on the agenda with sufficient info for citizens to understand the action under consideration. See http://www.illinoisattorneygeneral.gov under “open and honest government.”

- NoGifts - Friday, Aug 26, 16 @ 11:34 am:

On the one hand, why wouldn’t the governor want the pension issue to look even worse? It seems to me it just helps him. On the other hand, if the pension problems are going to be addressed, we have to understand the ACTUAL size of the problem.

- Davos Seaworth - Friday, Aug 26, 16 @ 11:35 am:

=Davos, the answer is none. Five minutes with the Google coulda told you that. Quinn was the one that didn’t get that law.=

AA - Looks like you should have spent 5 minutes doing homework on your end before dismissing my point so quickly.

My point had nothing to do with the candidates, as I’ve met Mr. Noven before and respect his background and knowledge. I think he’d be a good fit for the TRS Board if he were eligible.

- Norseman - Friday, Aug 26, 16 @ 11:36 am:

=== Martin Noven resides in Chicago. Stay tuned. ===

Superstar staffing at work?

- Retired SURS Employee - Friday, Aug 26, 16 @ 11:37 am:

The TRS board should take a conservative approach. Listen to the rate assumption presentation and then schedule a special meeting for a formal vote. No big deal!

- Henry Francis - Friday, Aug 26, 16 @ 11:42 am:

Hey A Guy, considering the Guv just technically broke the law, I eagerly await for you to shriek “the arrogance of just simply not obeying it is arresting. It’s as if there (sic) simply no rules. Heck of a way to ru. The show. Liars and cheats!”

- Retired SURS Employee - Friday, Aug 26, 16 @ 11:42 am:

Also, don’t forget that the SURS board, as well as the SRS/GARS/JRS board might also choose to lower their rate assumptions in the near future, thereby adding to the Governor’s woes.

- Arthur Andersen - Friday, Aug 26, 16 @ 11:45 am:

Davos, you are absolutely correct. I apologize for the snark. I got some bad info and didn’t double-check it.

I concur with your opinion of Noven.

- JS Mill - Friday, Aug 26, 16 @ 11:48 am:

OMA- an item can be acted on even if it is not listed as an “action” item so long as it appears on the agenda (typically discussion/new business/old business).

What is not clear to me is whether or not the “rate of return projections” or something to that effect was listed on the agenda as a discussion or other non action item.

While the TRS board may have messed up the agenda, I think the more serious issue is the governor’s lackadaisical approach to filling Board vacancies and his incompetence at meeting the residential requirements for Board Members. Funny how he does not want the Board to rush (aka handling business when they normally do) and then rushes his appointments.

Maybe that is why he has never proposed a balanced budget? He waited because he didn’t want to rush and then screwed it up anyway.

- A guy - Friday, Aug 26, 16 @ 11:48 am:

== It just wasn’t clear that action was going to take place. And it isn’t entirely clear whether that would violate the OMA. TRS then stupidly issued a revised agenda with less than 48 hours before the meeting.===

Hank Frank, you’ll see my comments were pointedly directed at the OMA. For discussion only is a category. Action items is a category. Playing it cute is what idiots do.

TRS did NOT stupidly revise. I’ll bet you everything in your pocket that their Lawyers required them too. The cat had left the bag.

- Ron - Friday, Aug 26, 16 @ 11:50 am:

“thereby adding to the Governor’s woes”

You mean adding to the citizen’s of this state’s woes.

- Annonin' - Friday, Aug 26, 16 @ 11:51 am:

Who vetted these people? Former TRS Board member/BigBrain paid consultant Stu Levine?

- 47th Ward - Friday, Aug 26, 16 @ 11:56 am:

===The cat had left the bag.===

Lol, Rich Miller yanked the cat out of the bag. I doubt anybody would be talking about this today if he hadn’t posted about the changing agenda and the budget implications of a revised rate of return.

- Davos Seaworth - Friday, Aug 26, 16 @ 11:57 am:

AA - I appreciate your response, I should have been less snarky in my response, for that I apologize.

Retired SURS employee - SERS/GARS/JRS have all lowered their assumed rate. You may remember Rich posting about SERS Board’s action back in July. SERS dropped from 7.25% to 7.0%, while GARS/JRS lowered from 7.0% to 6.75%.

GARS/JRS is a drop in the bucket, the action by SERS to lower to 7.0% is projected to cause an increase of $70M for FY 18 from what was previously projected.

- steve schnorf - Friday, Aug 26, 16 @ 11:59 am:

I may not understand this correctly, but I think what is being debated is a distinction without a difference. If I understand it correctly, a decision by the Board to lower the assumed rate of return raises the underfunded liability calculation and requires the state to raise its contribution. BUT, if the assumed rate of return is not lowered and should have been, then that portion of the fund’s assumed revenue will underperform, meaning the total income will be less than assumed for the coming year and the state will have to make up the deficit in next year’s contribution, plus the shortage from lowering of the estimated return at some date after the certifying deadline has passed. In other words, pay me now or pay me late, plus interest. Am I incorrect?

- Retired SURS Employee - Friday, Aug 26, 16 @ 11:59 am:

@Ron - Yes, and I am a citizen of this state who believes that public pension funds should be properly funded. I understand that I will pay more in taxes; heck, I even believe that retirees should pay income tax on retiree benefits over, say $50,000.

- Ron - Friday, Aug 26, 16 @ 12:04 pm:

I am citizen of Illinois that believes municipal bankruptcy is a must and all teacher obligations should be the responsibility of school districts that created the obligation.

I also believe the State Constitution should be amended to eliminate the outrageous protections that public workers receive in this banana republic of a state.

- Ron - Friday, Aug 26, 16 @ 12:07 pm:

Illinois has one of the highest state and local tax burdens in the nation. It is also losing population at a faster rate than all but West Virginia. Do we need the highest tax burden in the nation? I’m sure that will encourage people to move or stay here. I mean, we have the natural beauty and weather going for us, right?

- Winnin' - Friday, Aug 26, 16 @ 12:09 pm:

The Governor shows he is interested in Politics and not substance.

His old pal and employee Stuart Levin comes to mind.

- northsider (the original) - Friday, Aug 26, 16 @ 12:09 pm:

Senate executive appointments committee can’t confirm an appointee who doesn’t meet the residency requirements.

TRS should schedule a special meeting for this one agenda item. In the interest of caution, schedule it today for Wednesday, and post the damn agenda this afternoon.

- Original Rambler - Friday, Aug 26, 16 @ 12:10 pm:

I’ve checked a lot of State board and commission agendas over the years. It’s amazing the breadth of styles that are used. Having said that, the use of the * by SURS is puzzling. At a minimum, there should have been a disclaimer. But for all of you who are “certain” it is an OMA violation, I wouldn’t be so sure. And the same goes for those of you who are sure it is in compliance. The prudent move here is to discuss it, allow the new members to get up to speed, and then take action at a special meeting next week solely for this purpose.

- cdog - Friday, Aug 26, 16 @ 12:11 pm:

The outrage about the OMA protocol is a straw man that spontaneously combusts in 48 hours, if its played that way.

Not looking forward to the new debt, but hopefully the board plays it safe. Meet after 48 hours and keep this nonsense out of the courts.

Too bad the real issues here don’t fizzle in 48, pensions and hokey appointments.

- Retired SURS Employee - Friday, Aug 26, 16 @ 12:14 pm:

- I also believe the State Constitution should be amended to eliminate the outrageous protections that public workers receive in this banana republic of a state. -

You do realize that amending the Illinois Constitution will not change the situation with respect to current employees and retirees?

- Whatever - Friday, Aug 26, 16 @ 12:16 pm:

“. . .it is a tale told by an idiot, full of sound and fury, signifying nothing.”

Hit or Miss, SAP, Honeybear and several others have said all that really needs to be said. If the proposed lower return on investment is accurate, the board’s action or inaction, and the legality of any action, are totally irrelevant. The “new” hole in the budget created by the lower rate of return exists, and the proposal would just recognize and more accurately measure it. Any attempt to continue to use the current rate of return is just kicking the can down the road.

- Ghost - Friday, Aug 26, 16 @ 12:19 pm:

what is interesting is there is no mention of the actual payment obligation v the contribution amount.

This is important becuase if changes in actuarial valuations may include amounts paid in to reduce long term liability. That number can be adjusted. so if they need 250mil to pay everybody, and the rest of the controbution is towards future liability, the. that remaining contribution amount cam be adjusted and acounted for over a longer period of time as part of a plan to fix pensions. ramping up the pension obligation payments today creates an artifical severity.

- Ron - Friday, Aug 26, 16 @ 12:20 pm:

I do realize that, which is of course a catastrophe, but we must stop the madness for future generations.

- Henry Francis - Friday, Aug 26, 16 @ 12:22 pm:

Oh Guy. You want to say TRS wasn’t stupid, because you speculate they were following the advice of its lawyer. Fine, then that advice was stupid because it made something that was arguably compliant (I agree with Orignal Rambler above and Mary Pat Burns) - and turned it into clearly noncompliant.

Again, no one was trying to hide the ball here. If it won’t get addressed today because of a “technical” issue, then fine, get a meeting next week and address it then. But address it, that is the most important thing here.

Still waiting for your outrage over the Guv violating the law here.

- Earnest - Friday, Aug 26, 16 @ 12:24 pm:

>In other words, pay me now or pay me late, plus interest

I think we should use that phrase to replace this one: State Sovereignty, National Union

- Honeybear - Friday, Aug 26, 16 @ 12:37 pm:

–Do we need the highest tax burden in the nation?–

Here’s the fallacy in that statement. It’s the wrong figure that you’re highlighting. What is most important is NOT the assessed burden. That’s irrelevant. It’s what people actually pay that’s important to the revenue function of a state. It wouldn’t matter if corporations paid 1% or 100% in our current system because of the way tax laws and loopholes allow them out of paying them. Most large corporations don’t pay anything at all! On top of that we let corporations not turn in 215million in income tax withholdings because of EDGE agreements. Same goes for the wealthy and their taxes. They employ battalions of accountants to limit liability. Thus it’s not the assessed “burden” that is the issue. It’s what do you allow people and corporations to get away with NOT paying. THAT is the important issue. I’d be more than happy to advocate lower tax rates if you took away all the loopholes and deductions! You’re not being cheated by fellow citizens who you perceive don’t pay their fairshare. You are being cheated legally by corporations who buy our elections and exploit complex loopholes that normal folks do not know about or have access too. That’s who you should spew your vitriol too.

- Ron - Friday, Aug 26, 16 @ 12:39 pm:

Um tax burden is not the issue? where did you learn math?

- Ron - Friday, Aug 26, 16 @ 12:40 pm:

Corporations shouldn’t be taxed. They are not people. They also should not be allowed to make political contributions, they are not people.

- Ron - Friday, Aug 26, 16 @ 12:43 pm:

I reserve my vitriol for the politicians and coddled public workers that have bankrupted the State. Pensions should have been eliminated years ago. No one in the private sector receives a defined benefit pension. You know why? Because they are outrageously expensive and have destroyed companies. We have a state constitution set up to protect the public workfore and politicians as we the ordinary citizens are bled to death. I’m beginning to think this state is a lost cause. Way too many people have their heads in the sand.

- Ron - Friday, Aug 26, 16 @ 12:47 pm:

illinois has yet to recover all the jobs lost in the last recession, yet people advocate ever higher corporate taxes. I’m sure that will encourage job creators to locate here.

- Retired SURS Employee - Friday, Aug 26, 16 @ 12:47 pm:

- I do realize that, which is of course a catastrophe, but we must stop the madness for future generations. -

It has been fixed for future generations; per Tier II (which itself is a mess, but that is a whole different conversation).

- Keyrock - Friday, Aug 26, 16 @ 12:55 pm:

I forget– was Stu Levine a fiduciary?

- walker - Friday, Aug 26, 16 @ 12:56 pm:

Ron: Kudos to you.

Though we often disagree, your comments and positions are clear, succinct, and consistent.

- allknowingmasterofracoondom - Friday, Aug 26, 16 @ 12:59 pm:

Oh but Quinn made all the required pension payments! What a joke…this adjustment to returns should have been made years ago. This state blows.

- Anonymous - Friday, Aug 26, 16 @ 1:02 pm:

convicted felon Stuart Levin

- Norseman - Friday, Aug 26, 16 @ 1:02 pm:

Walker, I generally appreciate your comments, but the last one was off kilter. Consistently spewing insults and inaccuracies is not something deserving kudos.

- Annonin' - Friday, Aug 26, 16 @ 1:07 pm:

Mr.Ms Schnorf

You are right, but BigBrain thinks he will pass some razzle dazzle pension “reform” that drops the numbered needed to cover the costs. We all know such a plan does not exist but no one ever tells BigBrain so he wastes his time on this stuff.

- steve schnorf - Friday, Aug 26, 16 @ 1:09 pm:

Ron your first (purported) statement of fact at 12:43 is absolutely untrue. Given that, I stopped reading

- steve schnorf - Friday, Aug 26, 16 @ 1:17 pm:

Annonon’, I don’t agree. There are some things that can be done. For example, a wage freeze reduces future liability because that calculation assumes future wage increases in its formula. My point was that this specific debate only changes “when” the bill will come due, not “if”, if the actuary is correct that the assumption should be lowered..

- Honeybear - Friday, Aug 26, 16 @ 1:26 pm:

Um tax burden is not the issue? where did you learn math?

Northwestern University

Nice dance Ron but you totally

- Honeybear - Friday, Aug 26, 16 @ 1:27 pm:

Sorry, hit the button too soon.

Nice dance Ron but you totally didn’t address my point.

- 32nd Ward Roscoe Village - Friday, Aug 26, 16 @ 1:27 pm:

===The cat had left the bag.===

“Lol, Rich Miller yanked the cat out of the bag.”

The cat’s in the bag and the bag’s in the river.

[courtesy of The Sweet Smell of Success]

- Honeybear - Friday, Aug 26, 16 @ 1:30 pm:

–Corporations shouldn’t be taxed. They are not people.–

So they should be able to utilize the assets and infrastructure of the state and not pay for it.

Well, point in fact they mostly do not pay for it now. Most large corporations pay little if nothing in actuality now. For a lot of them WE actually have to give them a refund. Which is my point. It’s irrelevant what they are assessed if they pay almost none of it.

- Anonymous - Friday, Aug 26, 16 @ 1:42 pm:

“So they should be able to utilize the assets and infrastructure of the state and not pay for it.

Well, point in fact they mostly do not pay for it now. Most large corporations pay little if nothing in actuality now. For a lot of them WE actually have to give them a refund. Which is my point. It’s irrelevant what they are assessed if they pay almost none of it.”

They are not people. The people that work for corporations, utilizing those assets and infrastructure should be and are taxed. I would support higher personal income taxes if we eliminated corporate income taxes, just so that’s out there.

- Michelle Flaherty - Friday, Aug 26, 16 @ 1:44 pm:

Martin Noven, we hardly knew ye.

- Honeybear - Friday, Aug 26, 16 @ 1:46 pm:

–coddled public workers that have bankrupted the State.–

Nope, we didn’t. I’m with you that the politicians did though. They didn’t pay the credit card, raided the funds and left this mess to deal with. We wouldn’t be here if they had just paid what was owed, which at the time was totally manageable, and stopped paying for other things with pension money. (OW- who’s the guy who wrote the great article on this? I’m blanking) So it’s not the workers who have faithfully served the state. It’s the politicians who screwed this up. As to whether I as a state worker should get a pension, I think you need to address your jealousy issues. Let’s be self differentiated. But just so you know I’m tier II and will retire at 67 to total poverty.

As to the expense for companies. Wow, I guess you really don’t know that companies are stashing trillions offshore. They are more profitable than they have been in human history. True small business is getting killed every day. Mainstreet is not going to survive in Illinois. That’s why we absolutely HAVE to address the loopholes and deductions that large corporations get to not pay anything. Dude, stop with the anger and jealousy. I work for my state every day. I served my country in the Navy. Don’t dishonor me or my coworkers when we bust our butts to help the people of our state.

- A Jack - Friday, Aug 26, 16 @ 1:52 pm:

Well Ron, you obviously don’t have a clue as to the laws of incorporation. Corporations are legal entities, can own property, pay taxes, and be sued in court.

- Honeybear - Friday, Aug 26, 16 @ 1:52 pm:

– The people that work for corporations, utilizing those assets and infrastructure should be and are taxed.–

So we shouldn’t tax a company that dumps crap in our rivers or uses electricity or roads for the people THEY hired to be there. The assets wouldn’t be used if the company did not exist. Look it’s a taxable entity. The important point is how much revenue are we assessing and how much of that are we ACTUALLY getting. We can say that corporate taxes are too high all we want but it’s hollow when you discover how much they are actually paying, which in most cases is zero or that we, the state owe them a refund. What’s the point in raising or lowering the taxes if they aren’t paying any anyway? You’ve got to stop the loopholes and deductions.

- Huh? - Friday, Aug 26, 16 @ 1:53 pm:

Honeybear have you checked with SERS about buying some of your time in the Navy as credit towards your pension? See the SERS website, left side for the Tier 2 FAQ, optional service.

- Honeybear - Friday, Aug 26, 16 @ 1:58 pm:

–The people that work for corporations, utilizing those assets and infrastructure should be and are taxed.–

You’d think that but in fact if the company has an EDGE tax agreement then the company gets to keep their employees withholdings. DCEO and IDOR let companies do that to the tune of 215,000,000 last year alone. That withholding didn’t go into our coffers. All for an EDGE program that isn’t even monitored. DCEO has no idea if those companies expanded or created/retained those jobs. No Idea.

Conservatives, doesn’t the lack of accountability for bringing and creating jobs make you mad?

- Anonymous - Friday, Aug 26, 16 @ 1:58 pm:

–Liars and cheats!–

Who is lying about what, and who is cheating whom out of what?

Another sideshow to distract from the real fiscal issues.

Without any assistance from TRS, the governor and a bipartisan majority of the General Assembly enacted into law an FY17 budget with an $8 billion deficit.

That’s 19X the $421 million “hit.”

- A guy - Friday, Aug 26, 16 @ 2:13 pm:

==Again, no one was trying to hide the ball here==

Hank Frank, Rich broke it here on CF.

Another person here shared that a person can’t live in Chicago and serve. It’s likely that not a lot of people may have known that, but they sure do now. If the Gov offered a name without knowing that a Chicago resident could not serve, that’s an unfortunate mistake. Surely someone on his staff should’ve known or done more research. While embarrassing and silly, it wasn’t malice intent.

Every public board in Illinois is schooled on the rules of the OMA, every year, often several times a year, and absolutely when they are coming onto a board for the first time.

They tried to sneak one by, and their counsel advised them to clean it up…I’d bet (your) house on it. It happens regularly with John Wayne style boards, and attorneys are usually the ones to catch it. Or watchdog groups. If it’s as simple as 48 hours notice, they could have postponed it to the next meeting or called a special meeting with 48 hours notice.

The 48 hours was a stumbling block; hence they tried to hide the bacon. It’s a dumb trick but not a new one.

- Juice - Friday, Aug 26, 16 @ 2:15 pm:

Honeybear, not sure where the $215 million is coming from, but according to the most recent tax expenditure report, $45 million was given to companies from their employees’ withholdings. You may very well be right, that’s just not the number I’m seeing.

(And the companies that have EDGE agreements are required to file reports, but what then happens with that information is anybody’s guess. But at least some companies have not been able to claim the credit because they have not met their stated goals.)

- Honeybear - Friday, Aug 26, 16 @ 2:25 pm:

I’m so sorry folks. This might be a dumb question but did the downgrade of assumptions, 421 mil, actually happen? I get that the one guy wasn’t there but was the 421 hit approved? Thanks

- Arthur Andersen - Friday, Aug 26, 16 @ 2:27 pm:

For what it’s worth, the Noven scenario has happened in the past. Quinn appointed a Chicagoan who had taken the oath and was at a meeting until a commenter here raised the issue.

Going back a ways, either Edgar or Ryan made the same mistake but it was caught before the meeting.

- Arthur Andersen - Friday, Aug 26, 16 @ 2:28 pm:

Honeybear, yes it was approved

- Southern Dawg - Friday, Aug 26, 16 @ 2:30 pm:

===The cat had left the bag.===

“Lol, Rich Miller yanked the cat out of the bag.”

The cat’s in the bag and the bag’s in the river.

[courtesy of The Sweet Smell of Success]

32nd is today’s Internet winner!!!

- Ron - Friday, Aug 26, 16 @ 2:33 pm:

I am not conservative generally. Just anti public worker unions and special protections in our abomination of a constitution. I hate wasting money as well, which Illinois seems to be expert at.

Socially, I’m quite liberal.

- Rich Miller - Friday, Aug 26, 16 @ 2:35 pm:

===Just anti public worker unions===

Make sure to tell that to the cop or firefighter or nurse or garbage collector or… the next time you get a public service.

Your absolute extremism gets old fast.

- Honeybear - Friday, Aug 26, 16 @ 2:47 pm:

–Just anti public worker unions–

Why out of curiosity?

- Honeybear - Friday, Aug 26, 16 @ 2:50 pm:

Rich I’ll have to send you the pic of the guy in California with a “Less Government and less taxes = more freedom” t-shirt on shaking hands with the firefighters who just worked non-stop for 48hrs to save his home. Irony at it’s sweetest.

- Honeybear - Friday, Aug 26, 16 @ 3:03 pm:

–Honeybear, not sure where the $215 million is coming from, but according to the most recent tax expenditure report,–

Okay sorry let me tell you. Go to the DCEO website

About Us

Legislation and Reporting

Reports required by statute

EDGE 2015

215 million to companies already in the state. I could only find one that came to IL from the outside.

Now true, I don’t actually know the number revenue took from withholding. You might have me there and I was not clear in explaining that if a corp has no tax liability they can keep the withholding up to the EDGE agreement amount. My bad, good call.

- steve schnorf - Friday, Aug 26, 16 @ 3:09 pm:

And, sad to say, on top of all the above, Noven, who is a very good guy, worked for JBT, is a good guy and would have made a good member

- Henry Francis - Friday, Aug 26, 16 @ 3:14 pm:

Guy - you are exhausting. It was on the initial agenda. There was no hiidiing it. Have a nice weekend.

- Lost in the weeds - Friday, Aug 26, 16 @ 3:22 pm:

Pensions deficit has grown since 2000. Look at third chart of US Pensions. https://ig.ft.com/sites/pensions-interestrates-explainer/

- Big foot - Friday, Aug 26, 16 @ 3:28 pm:

When I returned from oversea, I bought my military time for TRS. It was$5

- Bigfoot - Friday, Aug 26, 16 @ 3:35 pm:

I have no idea why that did that …5K it increased my pension by about $250 a month. TRS tried to talk me out of it…

- Honeybear - Friday, Aug 26, 16 @ 3:35 pm:

Ms. t. malkey,

Wow, what’s your problem? What specifically is your problem with me? I think more than a few people value my comments on this blog. Sure I can get off topic and God knows the invisible editor prohibits me posts from even posting more than I care to admit.

BUT, I want to thank you. When I get comments like yours. I know I’ve struck a nerve.

As my union sisters and brothers say

Agitate

Educate

Organize

- atsuishin - Friday, Aug 26, 16 @ 3:44 pm:

hello all tell me how is $400 million of new spending going to be paid for annually? Even more taxes? If there is a manual on how to drive people from your state illinois is writing it.

- Macbeth - Friday, Aug 26, 16 @ 3:50 pm:

–Just anti public worker unions–

Why out of curiosity?

—-

Probably because he lost a state job. It’s sour grapes. Most folks who are “anti-public worker” used to work for the state — got fired, got laid off — and now have an axe to grind.

- Ron - Friday, Aug 26, 16 @ 3:51 pm:

Lol, I have never worked for a government in my life.

- Arthur Andersen - Friday, Aug 26, 16 @ 3:55 pm:

Schnorf, agree with you on Noven. I hope there is an opening at SURS where the residency isn’t an issue. I believe that’s how the last one worked out under PQ.

- X-prof - Friday, Aug 26, 16 @ 3:56 pm:

Ron, if you are in the top 10% of earners, you should know that IL is not a high tax state for you. If you are in the top 1%, you must know what a spectacular tax haven it is for you. If you have average income, be reassured that as of 2014 IL ranks 13th for state and local tax burden as a percentage of income, not in the top 5 (see here http://taxfoundation.org/sites/taxfoundation.org/files/docs/BURDENS%20MAP.png). In 2014, the IL burden was only 0.8% above the national median. After the expiration of the temporary 5% income tax, IL’s burden should rank lower today. We are not an exceptionally high tax state on average. However, most IL taxpayers carry a personal tax burden that is 200-300% of what the wealthy pay, and in some cases, individual tax burdens can be quite high due to IL’s highly regressive revenue system.

BTW: Since 2010, new state employees receive Tier II pension benefits that are about as low as they can be w/o triggering federal requirements to start paying SS. This is not good policy IMO, but the damage you ask for is already being done to new public employees. There’s no pension reform left to do (within the law) to harm the ‘evil’ public employees.

- Honeybear - Friday, Aug 26, 16 @ 4:06 pm:

–the damage you ask for is already being done to new public employees.–

Thanks for saying that. I kind of doubt he’ll see it though. Ron and Sue are probably at the IPI Friday Cocktail Hour. Just sayin.

- X-prof - Friday, Aug 26, 16 @ 4:10 pm:

–Corporations … are not people.–

Mitt Romney famously disagreed. Also, the conservative wing of the USSC ruled in the Citizens United decision that corporations are people deserving of freedom of speech rights. I agree with you that corps. are not people, but disagree with the conclusions you draw from this obvious fact.

- HangingOn - Friday, Aug 26, 16 @ 4:13 pm:

==hello all tell me how is $400 million of new spending going to be paid for annually?==

See, you’re looking at it wrong. That money will be owed now at 400 mil or later at that plus interest. Just pretending the problem isn’t there doesn’t mean it isn’t owed.

- Ron - Friday, Aug 26, 16 @ 4:14 pm:

I voted for Obama, twice. I don’t care what Romney said. Eliminate corporate income taxes and I will gladly accept higher personal income taxes.

Notice, Illinois has one of the highest unemployment rates in the nation and also one of the slowest job growth rates, while we are losing people faster than any state but West Virginia?

Do you think it’s a coincidence that Illinois has the 5th highest state and local tax burden in the nation?

- Anonymous - Friday, Aug 26, 16 @ 4:17 pm:

HanginOn, but you didn’t answer the question. Where will the money come from in a state with a shrinking population and the 5th highest tax burden in the country?

- Anonymous - Friday, Aug 26, 16 @ 4:18 pm:

BTW: Since 2010, new state employees receive Tier II pension benefits that are about as low as they can be w/o triggering federal requirements to start paying SS. This is not good policy IMO, but the damage you ask for is already being done to new public employees. There’s no pension reform left to do (within the law) to harm the ‘evil’ public employees.”

Thank Madigan and Edgar.

Sure, plenty more to do. Eliminate pensions going forward and amend the state constitution of the unfair protections state workers receive.

- Ahoy! - Friday, Aug 26, 16 @ 4:23 pm:

This is a gift to the Republican’s, the ad’s right themselves. Gary Forby’s allies in Springfield break Illinois State law (OMA) to force an increase in taxes. You get the gist.

- Sue - Friday, Aug 26, 16 @ 4:24 pm:

Hanging on- unfortunately your wrong. TRS annually sends in an actuarial number required under the Edgar Ramp which the State now contributes. Illinois will either increase revenues somehow to pay the bump or more likely the bump comes out of other spending. We literally are sacrificing all other programs desperate for the money in order to pay off the pension obligations. What I don’t understand is why the State hasn’t insisted on greater oversight of the investments. As TRS director hinted at at the close of the meeting June 30 2016 investment performance “sucked”. My word not his

- Honeybear - Friday, Aug 26, 16 @ 4:42 pm:

Ron, Sue, Ahoy et al, Take an economics class would you. But here, read this again.

Ron, if you are in the top 10% of earners, you should know that IL is not a high tax state for you. If you are in the top 1%, you must know what a spectacular tax haven it is for you. If you have average income, be reassured that as of 2014 IL ranks 13th for state and local tax burden as a percentage of income, not in the top 5 (see here http://taxfoundation.org/sites/taxfoundation.org/files/docs/BURDENS%20MAP.png). In 2014, the IL burden was only 0.8% above the national median. After the expiration of the temporary 5% income tax, IL’s burden should rank lower today. We are not an exceptionally high tax state on average. However, most IL taxpayers carry a personal tax burden that is 200-300% of what the wealthy pay, and in some cases, individual tax burdens can be quite high due to IL’s highly regressive revenue system.

- Anonymous - Friday, Aug 26, 16 @ 4:43 pm:

–…while we are losing people faster than any state but West Virginia?–

Census Bureau:

Population estimates, July 1, 2015, (V2015)

12,859,995

Population estimates base, April 1, 2010, (V2015)

12,831,549

i

Population, percent change - April 1, 2010 (estimates base) to July 1, 2015, (V2015)

0.2%

i

Population, Census, April 1, 2010

12,830,632

http://www.census.gov/quickfacts/table/PST045215/17

- Ron - Friday, Aug 26, 16 @ 4:47 pm:

Honey bear, you pulled the wrong year down. Illinois is 5th highest now. So you think that burden has anything to do with our horrific unemployment rate and abysmal job growth?

Do you think people are fleeing Illinois because our taxes are too low?

You need the Econ course.

- Ron - Friday, Aug 26, 16 @ 4:48 pm:

You forgot to look at the last two years anonymous

- Honeybear - Friday, Aug 26, 16 @ 4:49 pm:

–We literally are sacrificing all other programs desperate for the money in order to pay off the pension obligations. –

Sister we are here because Rauner put us in this position. He broke the bank on purpose to “leverage” and create “wedges” to break labor and install the turnaround agenda. It’s as pathetic as someone murdering their parents then asking for leniency because they are an orphan.

It’s all because of Rauners hostage taking tactic.

It didn’t work now,

Over a million Illinoisans are without the services they need.

Thousands of jobs have been lost

Higher Education is in shambles

Contractors have not been paid.

We are billions behind on our bills.

All for the Turnaround Agenda which was never going to get passed.

Instead you guys double down with the perfidy and obfuscation.

- Ron - Friday, Aug 26, 16 @ 4:51 pm:

http://newsroom.niu.edu/2015/03/30/illinois-leads-nation-in-population-decline/

- Ron - Friday, Aug 26, 16 @ 4:54 pm:

http://rebootillinois.com/2015/12/22/census-data-shows-illinois-population-decline-highest-in-u-s-from-2014-2015/50559/