Kasper explains the non-disclosure

Wednesday, Aug 31, 2016 - Posted by Rich Miller

* From an August 10th Chicago Tribune editorial…

If you run for a position on your local school board, Illinois’ campaign finance laws require that you disclose contributions and expenditures. You buy pizza with campaign funds for volunteers? You have to disclose it. You accept free signs from a friend who owns a printing shop? You have to disclose it. You spend $23.56 on gasoline to drive around collecting signatures? You have to disclose it.

That hasn’t been the case with one of the state’s most influential yet obscure groups. The People’s Map, a political organization formed to fight against independently drawn legislative maps, has not disclosed any contributions or expenditures on the forms it filed with the Illinois State Board of Elections. Little is known about the group — like who finances it, who pays the attorney and court fees, or how the group spends its resources. […]

The People’s Map has filed four quarterly reports, all listing zero contributions and zero expenditures.

Meanwhile, six union groups reported on their own filings that they contributed $2,000 each to The People’s Map effort. The groups are Illinois AFL-CIO COPE, Laborers’ Political Action and Education League, Illinois Pipe Trades PEF, Illinois State Conference of IBEW (the group later canceled its payment), SEIU Local 73 and the Illinois Education Association, the union representing most teachers in the state.

Backers of the remap amendment, Support Independent Maps, asked the State Board of Elections to review The People’s Map’s disclosure paperwork. The board agreed and gave The People’s Map until Aug. 19 to file amended reports. At this writing, nothing has been filed.

The editorial was based on an earlier AP story and a press release from the remap reformers demanding an investigation.

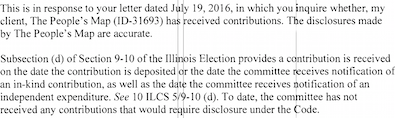

* The group’s attorney Mike Kasper sent a response dated August 15th that was recently posted on the Board of Elections’ website…

And, as I’ve told you before, Kasper doesn’t usually bill a client for fees and/or expenses until after the case is completed. If there’s no invoice, there’s nothing to pay, which means there’s no reason to cash any checks or no debts to report. The guy probably wrote that statute, so he knows how to use it to his clients’ advantage.

- Oswego Willy - Wednesday, Aug 31, 16 @ 11:41 am:

I guess others can try to talk to Kasper and see what was the intent of the law and then use Kasper’s “intent”, then…

Ugh.

===The guy probably wrote that statute, so he knows how to use it to his clients’ advantage.===

Chasing ghosts with this?

- The Captain - Wednesday, Aug 31, 16 @ 11:55 am:

Related: in May of 2015 Governor Rauner’s campaign fund sent contributions to most or all of the Republican caucus. Not all immediately deposited those checks however, some weren’t sure they wanted to accept the Governor’s money and some weren’t sure they especially liked the timing, in late May is typically when all the biggest votes happen. When early July came and reporters started going through the campaign finance filings of Republicans looking for disclosures of the Governors contributions they often found them missing. In those instances the Republican members correctly pointed out that the law now defines a contribution as received the day it is deposited and if they hadn’t yet deposited the Governor’s check then there is no legal requirement to report it.

When asked why a number of organizations have reported donating funds to The People’s Map but Peoples Map hadn’t reported receiving any contributions Kasper makes the same point in his letter above.

- interesting - Wednesday, Aug 31, 16 @ 11:56 am:

Add the request for an investigation to my suspicions about the independent map groups. Those lawyers know clients and counsel often work out various payment arrangements. But what’s another few thousand to pay for a stupid letter if we are already paying $500K in legal fees and it will add to the controversy.

- Amalia - Wednesday, Aug 31, 16 @ 12:03 pm:

this is a trend. in fact, some groups don’t even organize under any laws and spend money through individuals for action. but they criticize those who do operate under laws by way of FOIAs and ridiculous accusations. there are laws against anonymous fliers for elections. there should be laws that groups that organize in name must register with the state and must disclose on a consistent basis their financial dealings. This is not the only group operating in this fashion in Illinois.

- interesting - Wednesday, Aug 31, 16 @ 12:17 pm:

Amalia, I’m not sure I understand your point. The group did register and they say they have disclosed properly.

- Anonymous - Wednesday, Aug 31, 16 @ 12:39 pm:

Per page 24 of the ISBE’s “A Guide to Campaign Disclosure” (http://elections.il.gov/Downloads/CampaignDisclosure/PDF/CampDiscGuide.pdf):

“In determining the in-kind contributions a political committee has received, keep in mind these exemptions: (1) an individual can volunteer his free time and personal services to a committee without it being considered an in-kind contribution…”

The Guide goes on to give examples of in-kind services. Nothing there about attorney services being in-kind.

So perhaps Kasper is driving his figurative truck through that. He’s just volunteering his services. No obligation to report.

But if I were the ISBE (which I’m not), I’d be inclined to think that attorney services are in-kind contributions.

Just sayin’.

- Amalia - Wednesday, Aug 31, 16 @ 1:07 pm:

@ interesting, there are other groups out there skating around even more than just not reporting spending, as this group apparently has not. I’m way more concerned when facing a group that is anonymous than one that does not disclose all spending, but the spending should be disclosed.

- Anonymous - Wednesday, Aug 31, 16 @ 1:47 pm:

What allegations did “Peoples Maps” make about their status in their pleadings and briefs?

- Chicagonk - Wednesday, Aug 31, 16 @ 1:49 pm:

Definitely one of those things that while it may not violate the letter of the law, it sure as heck violates the spirit of it. Unless Kasper is doing this work pro-bono, he should be required to disclose who is on the other end of his contingent contract.

- Rich Miller - Wednesday, Aug 31, 16 @ 1:52 pm:

===it sure as heck violates the spirit of it===

Read the statute. There’s no spiritual violation here. If there’s no invoice, you can’t report it.

- Archiesmom - Wednesday, Aug 31, 16 @ 2:01 pm:

Even better, Rich – until you actually pay it there’s nothing to report.

- titan - Wednesday, Aug 31, 16 @ 3:22 pm:

- Anonymous - Wednesday, Aug 31, 16 @ 12:39 pm

Just because the SBE Guide doesn’t specifically list attorneys free work in the list of examples of volunteer service doesn’t mean it isn’t. The SBE has consistently found that donated legal services are volunteer work in prior cases.

Does anyone know of anything the group would have paid for other than the legal services (that may not have been billed yet)? Were there TV or radio ads? Mailers?

- anon - Wednesday, Aug 31, 16 @ 3:30 pm:

to be more transparent, the statute should make the disclosure based on the organization’s accounting practice. Current definition only fits for cash accounting. The loophole being referenced is where an income/expense is most likely recognized under accrual accounting…