More horrible pension news

Wednesday, Sep 28, 2016 - Posted by Rich Miller

* Mark D. Brodsky, the chairman of Aurelius Capital Management, writing in the Bond Buyer…

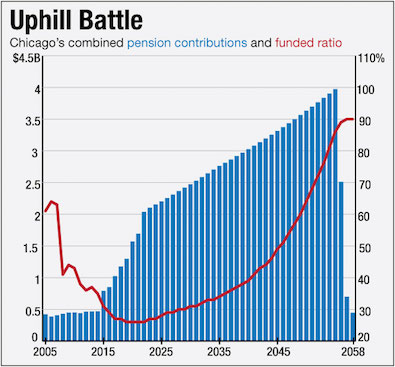

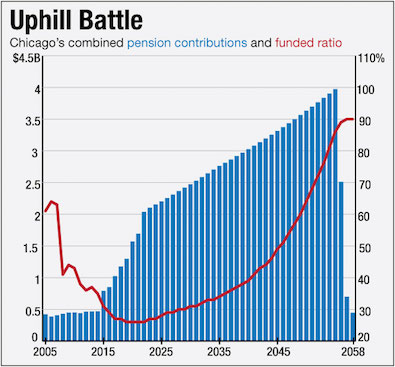

For the 10 years through 2014, Chicago contributed less than $470 million per year to [its four pension plans, not including the school district’s]. These contributions were insufficient even to maintain the funded ratio, which went from a poor 61% at the end of 2005 to a dangerously low 31% at the end of 2015.

By 2019, the city’s annual pension contribution is expected to be $1.3 billion – an increase of $827 million, or 176%, above the 2014 contribution. Over the three years thereafter, the annual contributions are expected to jump another $741 million, to $2.0 billion in 2022. All of Chicago’s recent and proposed tax increases combined will be insufficient to fund these increases. We estimate the shortfall will be $647 million in 2022 alone.

After 2022, we project contributions will increase every year through 2055. Over that period, the annual contribution will increase by another $1.9 billion, to $4.0 billion in 2055 – 8½ times what the city was paying in 2014.

Do these steep increases provide steady progress toward proper funding? No. In fact, the plans’ funded ratio will actually drop over the next several years – from 31% in 2015 to 26% in 2021 – and their unfunded liabilities will increase until 2033. It will take until 2030 for the funded ratio to return to 31%; until 2050 for the funded ratio to be restored to where it was in 2005 (61%); and until 2057 for the ratio to reach 90%. […]

In our view, Chicago must, at a bare minimum, contribute enough every year, including 2016, to ensure that the plans’ funded ratio not drop below, and that their unfunded liabilities not exceed, 2015 levels. We estimate this would add $1.1 billion to the 2016 contribution. If the city cannot muster the resources and political courage to take this first step now, surely the city will lack the resources and discipline needed to dig out of a far bigger hole down the road. [Emphasis added.]

* The accompanying graph…

- @MisterJayEm - Wednesday, Sep 28, 16 @ 12:35 pm:

Good Lord.

– MrJM

- Big Muddy - Wednesday, Sep 28, 16 @ 12:39 pm:

This thread is my answer to a different thread, “The Rauner Question”. Without reforms across the board as a state we are *banned word*!!

- Bobby Catalpa - Wednesday, Sep 28, 16 @ 12:41 pm:

I bet Rauner loves this. This is the kind of leverage that makes grown men weep with joy.

Bad news? This is the best day ever for Rauner.

- Big Muddy - Wednesday, Sep 28, 16 @ 12:49 pm:

=I bet Rauner loves this. This is the kind of leverage that makes grown men weep with joy.

Bad news? This is the best day ever for Rauner.=

This is a foolish comment. Rauner didn’t get us where we are, the Dayley’s and the Madigan’s of the world did. Can-kicking and ostriching for years leads to two things. One, a much bigger problem down the road and two, the end of the road.

Meet the end of the road.

- From the 'Dale to HP - Wednesday, Sep 28, 16 @ 12:50 pm:

@Bobby, the flip side is as Chicago goes, so does Illinois. So if Chicago starts slipping, the entire state starts to slip, and everyone gets (even more) mad at Rauner.

- Anonymous - Wednesday, Sep 28, 16 @ 12:51 pm:

My favorite part is the use of the alien concepts “political courage” and “discipline.”

- Liandro - Wednesday, Sep 28, 16 @ 12:54 pm:

The pension crisis was a huge topic at the IML conference last week. Municipalities all across the state are facing very real struggles with this system (that my generation inherited). It’s brutal.

In my first year in office our the council increased the city’s contributions towards public safety pensions by 50%. We thought it was a huge step toward, and would hopefully at least maintain our current funding levels. Wrong.

Our recent annual actuary report stated that our funding level actually went backward (?!) and that our contributions were expected to rise by 4.5% per year. We are tax capped, which means the levy (maxed out–we’re already dipping into general funds) only has been rising by around 1%. That is brutal math.

We’re starting eliminating some positions in the city, including consolidating the retiring City Clerk’s duties onto other staff and not replacing the retired airport manager. We’re putting together a list of more cuts.

The current situation is bad enough, but the future math is even worse. If contributions rise at that pace, the budget slowly becomes one massive pension plan that also provides some municipal services, instead of the other way around. My generation has substantially less money to spend on services, and substantially worse future liabilities.

- Liandro - Wednesday, Sep 28, 16 @ 12:56 pm:

Apologies for the grammar. Almost done with lunch and trying to get back to the office.

- Anonymous - Wednesday, Sep 28, 16 @ 12:58 pm:

Yes let’s all be mad at Rauner instead of Mayor Daley, Finance Chairman Ed Burke, Speaker Madigan, Senate President Cullerton and countless other politicans who are afraid to deal responsibly with organized labor.

After all, they would never do anything to reduce the standard of living for middle class workers (except raise their taxes to cover the pensions)

- cdog - Wednesday, Sep 28, 16 @ 12:59 pm:

I wonder how much Chicago’s pension funds are losing in “undisclosed” performance fees.

http://www.mdpolicy.org/research/detail/the-hidden-wall-street-fees-that-could-be-costing-pensions-20-billion-a-year

- Name/Nickname/Anon - Wednesday, Sep 28, 16 @ 1:00 pm:

Phasing up the contributions is fine. It is impractical to expect any municipality to immediately triple or quadruple their contribution.

- Groucho - Wednesday, Sep 28, 16 @ 1:06 pm:

Is it time to sell the house and move?

- Dan Johnson - Wednesday, Sep 28, 16 @ 1:06 pm:

So maybe criticizing Rahm / City Council for bringing the property tax rate to STILL LOWER THAN THE AVERAGE in the state ought not be done much….

Civic types and thought leaders: Chicago’s property taxes are still too low. And non-Chicago people: the state should pay for CPS pension costs.

- AC - Wednesday, Sep 28, 16 @ 1:10 pm:

Empirical evidence that the biggest issue facing Illinois and its largest city is financial, not collective bargaining, not workers compensation, not non profits, and not universities. Here’s a suggestion, expand collective bargaining rights so that pension funding is a permitted rather than prohibited subject of collective bargaining. Because, from my understanding, and I’m sure someone will correct me if I’m wrong, but the only thing that can be bargainined is the employee/employer pick up, not where that money goes. I mean, if you want CPS teachers to sacrifice for sake of the financial condition of the pension system, then allow pension funding to be part of their contract negotiations.

Also, as a downstate resident, I know that the fate of Illinois and Chicago are linked. So, knowing the dire consequences for continued credit downgrades in Chicago, or worse, I don’t mind being a part of the solution. Having a little more tax money go up north beats the alternative.

- Blue dog dem - Wednesday, Sep 28, 16 @ 1:13 pm:

“If history is any guide, this may be overly optimistic…..” by any sound thinking person, Chicagos pension crisi is irreversable.

- Piece of Work - Wednesday, Sep 28, 16 @ 1:15 pm:

Please remember Bruce Rauner took office in January 2015.

- Keyrock - Wednesday, Sep 28, 16 @ 1:15 pm:

Anonymous 12:58 - it’s possible to be mad at Daley and Burke and Madigan and others for creating this mess — and Rahm for waiting one term to even begin addressing it — and also be mad at Rauner for his actions and inactions.

It’s not just possible, it entirely fair and justified.

- A guy - Wednesday, Sep 28, 16 @ 1:18 pm:

That’s just about as brutal an explanation as has been published.

- Lucky Pierre - Wednesday, Sep 28, 16 @ 1:18 pm:

12:58 was me. I would hope that continued bad news like this would bring both parties to the table to fix the pension crisis

Senator Cullerton wouldn’t even call his own pension bill this spring because he thought it would jeopardize the fall election.

Elections are always more important than solving the state’s problems

One more reason why term limits are essential

- Federalist - Wednesday, Sep 28, 16 @ 1:20 pm:

Over the last few decades there has been a tremendous expansion in the social welfare state while education, particularly public universities, and pension contributions have been given second and third priority. True to varying degrees whether it be at the federal, state or local levels.

Now it all comes together in the perfect storm as predicted by any number of responsible people. And if HRC is elected it will be very problematic for her to pull a financial rabbit out of the hat to solve all of this regardless of any rhetoric about the ‘rich’ paying their ‘fair share.’ Trump, if elected, will pretty much have a hands off approach for state and local govts. so they will be on their own.

Just remember the Chinese curse: May you live in interesting times.

- Bobby Catalpa - Wednesday, Sep 28, 16 @ 1:24 pm:

—

Please remember Bruce Rauner took office in January 2015.

—

And instead of improving anything — or offering any kind of pragmatic vision for improvement — has left the state in worse shape than it was before he took office.

That sounds like a failure to me. I get a job to fix something my predecessor broke, I don’t get to say — two years after the fact — well, it was broken for 20 years!

Yeah, well, they gave me the job to fix it. Not to whine about all the stuff preventing me from fixing it.

Only a rich guy can afford a whine like that. Everybody else is expected to perform.

- Angry Republican - Wednesday, Sep 28, 16 @ 1:27 pm:

Pensions in IL are so bad even newspapers in WI are talking about it: http://projects.jsonline.com/news/2016/9/26/wisconsins-fully-funded-pension-system-is-one-of-a-kind.html

- Dance Band on the Titanic - Wednesday, Sep 28, 16 @ 1:29 pm:

This is what happens when Chicago suddenly has to fund according to the actuarially required contribution after decades of pretending actuarial science doesn’t exist.

- Keyser Soze - Wednesday, Sep 28, 16 @ 1:35 pm:

So, where will the money come from?

- Chi - Wednesday, Sep 28, 16 @ 1:36 pm:

You can’t get more arbitrary than deciding the funding ratios in 2015, which are different for each fund, are the ratios that the funds must maintain. Makes no sense and is based on nothing but trying to scare.

- Ron - Wednesday, Sep 28, 16 @ 1:43 pm:

This is not news and yet we have not eliminated public employee pensions or amended the state Constitution that provides guarantees that no one receives but public employees.

Welcome to Illinois

- NoGifts - Wednesday, Sep 28, 16 @ 1:52 pm:

Would be good to include the expected city revenue. Current budget shows 9.3 B. for 2016 budget. What about that trend? Put the problem in context. https://www.cityofchicago.org/content/dam/city/depts/obm/supp_info/2016Budget/2016BudgetOverviewCoC.pdf

- wordslinger - Wednesday, Sep 28, 16 @ 1:53 pm:

Yet the Chicago big business community, en masse, mostly Republicans (one’s fixing the roof on a big house in Springfield) thought Daley was the Indispensable Man, and swamped the field with millions in political contributions to him.

What was the reason for that, again? Financial “gravitas,” or something?

Daley’s “Democratic Machine” was fueled by big money Republicans, with guys named Rauner and Griffin at the top of the list.

Next time Rauner goes on and on about “Chicago’s Democratic Machine,” remember that he was a guy who made it run.

- Liandro - Wednesday, Sep 28, 16 @ 1:54 pm:

“I mean, if you want CPS teachers to sacrifice for sake of the financial condition of the pension system, then allow pension funding to be part of their contract negotiations.”

Agreed, it would great for the new employees by ensuring the money went to pensions…but my understanding is that the unions haven’t been interested in allowing this reform to happen. Correct if I’m wrong, but I’m fairly certain its not municipalities that are against the idea.

- Anonymous - Wednesday, Sep 28, 16 @ 1:59 pm:

The pragmatic vision for improvement is

Increase taxes — which there is no political will for really, if that was the case the last tax increase would have been permanent. Also ‘hey we need to raise your taxes so we can fund the pension system for people who get a pension unlike much of anything in the private sector anymore’ isn’t going to play well. It is what it is.

Have an impact on current participants and retirees — by increasing contributions and/or eliminating something from current retirees which seems basically impossible

So the less pragmatic vision is to reduce the cost of government so you can put more of the money government gets via taxes into the pension system.

No one runs on fixing the pension system, no one gets elected on raising taxes but not providing any new services, or improving any services.

Here is your somewhat realistic/pragmatic solution in part.

– Increase the contribution (going to need this to make parts more politically palatable)

– Once video poker is done paying for the capital program it starts paying into the state pension system

– Expand video poker into Chicago

– 2% hotel tax statewide

– Figure out how to exploit the tollway, either by lease, sale or something else so increased tolls (or other revenue) can be used for pensions. Make the pension systems the owners of the tollway

That’s all I got so far.

- NoGifts - Wednesday, Sep 28, 16 @ 2:01 pm:

In addition to showing the city revenue, include the amount collected by the school district through property taxes. Let’s take a look at the big picture.

- Cassandra - Wednesday, Sep 28, 16 @ 2:02 pm:

Or, as a couple of friends just reminded me, the city can declare bankruptcy. These are not Rauner supporters, just people who work in finance. Bankruptcy may not be such a remote possibility.

- A Watcher - Wednesday, Sep 28, 16 @ 2:09 pm:

A DB pension scheme is a risk transfer vehicle. Someone is holding that risk. If you are funding to the actuarial required level regularly you will have swings in contribution amounts. That lack of predictability is what drove the private sector out of DB pensions. Government entities are no different in their mentality toward predictability particularly when you have budget needs screaming all across the board. Luckily, MEABF will get some relief when rising interest rates start to push up their discount rate, which I don’t believe is factored into the Bond Buyer article and was the major cause of the negative change in the funded percentage from 2014 to 2015.

- Hit or Miss - Wednesday, Sep 28, 16 @ 2:09 pm:

With the lowest property tax rate in Cook County, Chicago needs to start front loading payments to the pension plans. The longer Chicago waits to fund its pension plans the more it will, in the end, cost the taxpayers. I would give serious consideration to a 25% increase in property taxes in Chicago with all of the money going to front loading the pension plans.

- Dr X - Wednesday, Sep 28, 16 @ 2:11 pm:

What would the tax rate have to be to raise that money?

If there were no unions tomorrow, Madigan dies, term limits passed, redistrictin’ passed, would any of that change the fact that Chicago needs 1 billion?

Some reporter should ask Rauner that and keep askin’.

- Last Bull Moose - Wednesday, Sep 28, 16 @ 2:12 pm:

Is this news or just a different presentation of what we already knew?

The City of Chicago and the State of Illinois have the resources within their borders to pay the pensions and fund government services. Not wanting to pay and not being able to pay are different problems.

- Name/Nickname/Anon - Wednesday, Sep 28, 16 @ 2:13 pm:

==and was the major cause of the negative change in the funded percentage from 2014 to 2015. ==

The major cause of the change from 2014 to 2015 was the ILSC overturning the “pension reform”.

==Or, as a couple of friends just reminded me, the city can declare bankruptcy.==

Pretty sure the city can’t declare bankruptcy without a legislative change

- Old and In the Way - Wednesday, Sep 28, 16 @ 2:13 pm:

Ron

First, changing the state constitution does not impact current workers and Tier 1 pensioners. Tier 2 does indeed cut pensions for state workers. In fact cuts to the level that may not be legal!

Second, All Illinois citizens enjoy the same guarantees that pensioners have. How? The Illinois Constitution confers contractual rights on pensions. It’s not deferred compensation, it’s a contract. The US Constitution guarantees, with very few limitations, on contracts. It’s the basis of our economy some would argue. No state may arbitrarily invalidate contracts or pass laws that impair them Period. In fact not even Congress can pass laws of this nature. (So much for the notion of getting a Fedral law passed allowing Illinois, and others, to Welch on their contractual obligations.) It would literally take amending the US Constitution to avoid paying our contractual obligations! Good luck with that. This is the same law that protects all US citizens and, perhaps more important for this argument, corporations.

However, there is a lot to this report that overstates the problem. Yes, it’s a huge debt and issue but this report makes some dubious assumptions. I’ll leave it to the accountants to explain it.

- TinyDancer(FKASue) - Wednesday, Sep 28, 16 @ 2:18 pm:

Have we all forgotten about Chicago’s bond debt?

Here’s where the money’s going:

http://apps.chicagotribune.com/bond-debt/

- Anon - Wednesday, Sep 28, 16 @ 2:20 pm:

The Illinois pension debacle has occurred in large part because of economic assumptions that turned out to be wildly incorrect. During the 1980s, inflation averaged more than 5%. Since then inflation has slowed, and over the past decade it has averaged less than 2%. The result is that public pensions, with their compounded annual raises, have become far richer than expected in real terms. They’re “too rich,” said Mike Madigan. They continue to get richer.

- TinyDancer(FKASue) - Wednesday, Sep 28, 16 @ 2:24 pm:

This is a shakedown.

End corporate welfare and there’ll be plenty of money for schools, roads, cops, teachers, AND pensions.

- Piece of Work - Wednesday, Sep 28, 16 @ 2:28 pm:

Bobby Catalpa, MJM shouldn’t have taken his ball and walked home.

- Ron - Wednesday, Sep 28, 16 @ 2:30 pm:

Old and in the way, that’s some amazing mental gymnastics. No one in the private sector has taxpayer guaranteed retirement that can’t be changed.

- Anonymous - Wednesday, Sep 28, 16 @ 2:58 pm:

==This is a shakedown==

Absolutely correct.

- Last Bull Moose - Wednesday, Sep 28, 16 @ 3:17 pm:

If the “end corporate welfare” people get together with the “end waste, fraud, and abuse” people all problems can be solved with no effort by the rest of us. ?s

- In a Minute - Wednesday, Sep 28, 16 @ 3:17 pm:

You can’t video poker your way out of this.

- City Zen - Wednesday, Sep 28, 16 @ 3:18 pm:

What about retiree health care funding?

- Old and In the Way - Wednesday, Sep 28, 16 @ 3:24 pm:

Ron

Wrong. They do if it is a contractual relationship. Most state and private pensions are what is legally referred to as deferred compensation and these can be cut. What makes Illinois pensions different is the contract clause. And yes we ALL benefit from the contract clause in our everyday life and transactions. However, most pensions are not contracts. Even Social Security is NOT a contract. No mental gymnastics, just basic legal principals. You may want to actually read up on this.

- Old and In the Way - Wednesday, Sep 28, 16 @ 3:29 pm:

Ron

One more thing, the Federal government does actually guarantee some pensions through the various pension trust funds that were established in the 70’s. These were to guarantee pension funds from various bankrupt corporations and some that were not bankrupt.

You really need to research this a bit more Ron there is mush you don’t know. You are just repeating the same old half truths and BS lies.

- Ron - Wednesday, Sep 28, 16 @ 3:59 pm:

Nothing but mental gymnastics. No one in the private sector has guaranteed COLA, investment returns, employer matches, locked in retirement ages.

- thechampaignlife - Wednesday, Sep 28, 16 @ 3:59 pm:

That 2056 drop-off, though…

- Ron - Wednesday, Sep 28, 16 @ 4:00 pm:

Time to end public union s in Illinois.

- HangingOn - Wednesday, Sep 28, 16 @ 4:06 pm:

==No one in the private sector==

Funny, I thought my Dad had all of those from Caterpillar.

- JB13 - Wednesday, Sep 28, 16 @ 4:12 pm:

And we get pushed closer to the brink, where “Contractual obligations” meet “economic reality.” Which do you bet will win?

- Ron - Wednesday, Sep 28, 16 @ 4:13 pm:

Funny, cat is lying off workers. DB plans ruin companies and states.

- anon123 - Wednesday, Sep 28, 16 @ 4:20 pm:

@ Liandro

It’s not just Unions. Nobody who is remotely close to retiring on a state pension wants to allow new employees to opt-out or place restrictions their contributions…because if that was on the table, no sane person would volunteer 8% of their salary as the cash supply for current annuitants, while their own mathematically-doomed pension remains under relentless attack. Yeah, a new employee can choose SMP plan, but remember that state employees aren’t eligible for SSA benefits unless they’ve worked 40 quarters somewhere else.

If (let’s stay optimistic and not say “when”) Illinois pension funds really hit the skids, and the Feds were unwilling or unable to bail it out, do you think the market would react favorably to the news that one of the nation’s largest economies is in free-fall? I don’t. So folks who go the “smart route” with Self-managed plans could see their 403(b)s lose 25, 30, heck 60% of their value, and then Wall Street will say, “Thanks for playing,” while SSA says, “Nothing for you here. Live on whatever’s left.”

It’s a staggering choice for new employees to confront, with huge liabilities on either path. Adding to the stress is the fact that this choice is irrevocable, and will follow that employee across departments, universities, employment gaps…whatever. They have to pick Tier II or SMP within a few months of being hired, and pin all of their retirement hopes upon it working out over the next 25-30 years.

- HangingOn - Wednesday, Sep 28, 16 @ 4:20 pm:

==DB plans ruin companies==

Funny, the company says because of continued low demand for mining products. I never once saw them blame the workers. Seems only public employees get that privilege. I don’t yell at Walmart that they pay their workers too much when the price of milk goes up and demand they just take it out of their benefits and paychecks.

- Cook County Commoner - Wednesday, Sep 28, 16 @ 4:21 pm:

So-called “corporate welfare” is part of transactional politics. You give me something, and I’ll bring jobs.

The DB pensions are also part of transactional politics. You give me this, and I give you labor peace and campaign support.

It all worked pretty well for a while, so long as there were enough taxpayers with enough money.

Federal Reserve Chmn Yellin and ECB Chmn Draghi both have said that their respective institutions have done what they can and “other policy makers” must act. GDP is flat and shrinking in spots. Increasing funding demands for government DB pensions and other retirement benefits is unsustainable unless you start robbing Peter to pay Paul or living in a fantasyland that businesses and individuals will willingly absorb escalating taxation without matching growth to their revenue stream.

- Demoralized - Wednesday, Sep 28, 16 @ 4:24 pm:

I’m not sure why my comments don’t always post but I’ll try again.

–==Funny, cat is lying off workers. DB plans ruin companies and states.==

CAT is laying off workers because demand for their product is down.

Your continued rants about pensions are getting old.

- Demoralized - Wednesday, Sep 28, 16 @ 4:25 pm:

Test

Why do my posts not show up sometimes?

- TinyDancer(FKASue) - Wednesday, Sep 28, 16 @ 4:25 pm:

== Funny, cat is lying off workers. DB plans ruin companies and states. ==

No, actually it’s the corporations who are ruining companies and states.

Read ‘Retirement Heist by Ellen Schultz or just watch her explain the problem:

https://www.c-span.org/video/?301767-1/retirement-heist

and Caterpillar is one of the main offenders mentioned in the book.

- Demoralized - Wednesday, Sep 28, 16 @ 4:25 pm:

====Funny, cat is lying off workers. DB plans ruin companies and states.==

CAT is laying off workers because demand for their product is down. It has nothing to do with pensions

- TinyDancer(FKASue) - Wednesday, Sep 28, 16 @ 4:29 pm:

Here’s the bankster drill:

http://www.voiceofsandiego.org/investigations/where-borrowing-105-million-will-cost-1-billion-poway-schools/

and

http://www.truthdig.com/report/item/swimming_with_sharks_goldman_sachs_schools_capital_bonds_20150221

- Old and In the Way - Wednesday, Sep 28, 16 @ 4:32 pm:

Don’t mind Ron, he’s living in fantasy land. You know, where there are no contracts and the one percent pays too much in taxes. For Ron the detail of whether the pension is deferred compensation or a binding contract is too complex to understand. Never mind details or reality, he has a meme that he keeps repeating to make him feel better about a world he no longer understands. I thought he just didn’t have enough info, turns out he is determined to be ignorant of the facts and the reality of the situation. Troll somewhere else please.o

- TinyDancer(FKASue) - Wednesday, Sep 28, 16 @ 4:43 pm:

== So-called “corporate welfare” is part of transactional politics. You give me something, and I’ll bring jobs. ==

Nope. It’s extortion.

That’s just the lie they tell you to get you to keep playing their game.

How about we give you patents. We give you a court system to protect your patents. Don’t like it? Go get China to protect your patents.

- Ron - Wednesday, Sep 28, 16 @ 4:46 pm:

The concept that public employees in Illinois receive protections virtually no one else does is of course lost on the public employee.

- Demoralized - Wednesday, Sep 28, 16 @ 4:49 pm:

Ron

Get over it already.

- Ron - Wednesday, Sep 28, 16 @ 4:52 pm:

Not until the pension protection clause is eliminated.

- Ron - Wednesday, Sep 28, 16 @ 4:53 pm:

It’s fundamentally unfair to all workers but state and local workers in Illinois. Even federal workers don’t have these protections. It’s absolutely outrageous.

- Demoralized - Wednesday, Sep 28, 16 @ 4:53 pm:

==Not until the pension protection clause is eliminated.==

That isn’t going to fix what you want it to fix. It won’t affect those already in the system. You can either accept that or continue to rant about pensions. But your rants don’t change reality.

- Ron - Wednesday, Sep 28, 16 @ 4:55 pm:

Illinois is losing population. I’m surw the continued coddling of this protected class and the massive tax burden required has nothing to do with it.

- Demoralized - Wednesday, Sep 28, 16 @ 4:55 pm:

==It’s fundamentally unfair==

Life isn’t fair. Get over it. Don’t like your pension plan? Get another job. But this constant ranting about public pensions is borderline trolling.

- Ron - Wednesday, Sep 28, 16 @ 4:56 pm:

Demoralized, you don’t get it. I know we are stuck with the current obligation, but why in the world wouldn’t we end the insanity going forward?

- Ron - Wednesday, Sep 28, 16 @ 4:57 pm:

Trolling? This site is an echo chamber of public employees and never ending taxes. Get over it.

- Pepper Brooks - Wednesday, Sep 28, 16 @ 4:59 pm:

This math is not new. What would be new is public awareness on actually how terrible is Chicago’s financial position. It’s hard for media to report what they don’t understand and aren’t particularly curious to get to the bottom of, which is a large part of the problem.

There is zero chance Chicago can make this work. The question is simply when. Any serious recession and the city is financially crippled.

- Demoralized - Wednesday, Sep 28, 16 @ 5:00 pm:

==you don’t get it.==

I get it perfectly.

==but why in the world wouldn’t we end the insanity going forward==

They did some of that with the Tier II system.

You don’t want the pension system changed. You want pensions for public employees eliminated altogether.

- Old and In the Way - Wednesday, Sep 28, 16 @ 5:00 pm:

So I guess Ron is going to push now to have the US Constitution amended. Good luck Ron! Not only will you need to convince 38 states to ratify this change but I suspect that corporate America will not exactly welcome changes that let legislatures alter existing contracts at will. Yeah, that will happen. I’m afraid Ron is doomed to his anger and frustration for a long long time. All because he doesn’t care to know the facts………oh well.

- Ron - Wednesday, Sep 28, 16 @ 5:04 pm:

I am not equal to a public employee under the Illinois Constitution.

- Ron - Wednesday, Sep 28, 16 @ 5:05 pm:

I have less protection under our Constitution

- Pepper Brooks - Wednesday, Sep 28, 16 @ 5:07 pm:

Old and in the Way

Contracts clause protects nothing in bankruptcy. That’s the whole purpose of bankruptcy, to break contracts that are impossible.

If you want to see something truly ugly, just wait for Illinois munis up to and including Chicago to hit the wall of insolvency and need to restructure why the Gen Assembly pretends that bankruptcy authorization is unnecessary.

It’s not that bankruptcy will be good, because frankly it will be a mess. It’s that the alternative — insolvent but unable to restructure — will be horrific.

- Old and In the Way - Wednesday, Sep 28, 16 @ 5:21 pm:

Pepper

I don’t disagree. States of course cannot declare bankruptcy. I suspect that Chicago will not declare bankruptcy but rather a restructure of its debt will take place. (See Puerto Rico) City bankruptcies certainly do not have any winners but past experience suggests that pensioners will fare better than most other creditors. (See Detroit)

My issue with Ron is that he fails to understand that what makes Illinois state pensions very different and very difficult to change is that they are specifically a contract between the worker and the state. Most public and private pensions are not. It’s why California was able to unilaterally alter their state pensions and Illinois could not. The state constitution only indirectly protects the pension rights by conferring contract status. It’s the US Constitution that the protects the contractual rights of the pensioner. Ron, in his simple world cannot grasp that simple concept. State workers incidentally are not the only workers in Illinois with contractually guaranteed pensions.

- Ron - Wednesday, Sep 28, 16 @ 5:23 pm:

Lol, which is exactly why Illinois has to change the way it functions. The state will implode form these obligations. Why do we continue with the insanity?

- Molly Maguire - Wednesday, Sep 28, 16 @ 5:28 pm:

Ignoring all the posturing, if we want to solve this problem, all sides need to start figuring out what they can live without, and what they can’t — and get to negotiating. It is in everyone’s interests to give up something to get a solution, because the future that this chart projects does not serve the workers, the city, or the taxpayers. It can be done, and you will probably get some help as interest rates rise over the next decade.

- Pepper Brooks - Wednesday, Sep 28, 16 @ 5:35 pm:

Old,

That’s likely true for state workers unless there are tricks at the federal level to allow some sort of state bankruptcy.

Local government workers are not actually protected because if bankruptcy is needed then it is needed.

I do agree with Ron that minimally a constitutional change should be attempted to change tier 1 benefits on a prospective basis. But the politics aren’t there right now.

- Pepper Brooks - Wednesday, Sep 28, 16 @ 5:51 pm:

Molly,

Are you sure a deal can be done?

If so, what’s the tax rate that gets these things funded? And how many Chicago homeowners can survive that tax rate on top of every other nickel and dime the city is getting out of them? Remember, Chicago’s property rate might be lower, but their overall tax burden is higher than most every other place in Illinois.

Alternatively, what (massive) benefits might the unions give up in order to avoid the increasingly likely catastrophe? Do Chicago’s unions really have that much more foresight than Detroit’s? Does CTU look ready to make massive concessions?

- striketoo - Wednesday, Sep 28, 16 @ 6:13 pm:

One way or another, a form of bankruptcy is the only answer. Oh, and sooner is better than later.

- Fred - Wednesday, Sep 28, 16 @ 6:20 pm:

Close corporate tax loopholes

Legalize and tax marijuana

Pass a progressive income tax

Pass a financial transaction tax

Tax millionaires at 40% for income over $2 million

Raise minimum wage to $15 over the next 4 years

Force all schools to consolidate into unit districts

Eliminate township governments in metropolitan areas

- Big Muddy - Wednesday, Sep 28, 16 @ 6:42 pm:

Fred said “Pass a progressive income tax”

Fred, Fred, Fred. Please read the Illinois Constitution. It doesn’t allow for a progressive tax. Want to change it? Me too! That pesky pension part, that part about citizen initiatives that the Supremes just gutted and adding term limits.

- Ron - Wednesday, Sep 28, 16 @ 7:25 pm:

The Illinois Constitution is an abomination to logic and reason.

- Ebenezer - Wednesday, Sep 28, 16 @ 8:10 pm:

This means increasing tax collections by an average of ~$550 per person per year for the the 10 years. $2200/yr for a family of 4. Beginning now.

This does not account for the same families portion of the state pension mess.

Tell your kids to stay out of politics, it ain’t gonna be any fun for a long time.

- Ron - Wednesday, Sep 28, 16 @ 8:15 pm:

And Ebenezer, the taxpayer will get Noth mg for it other than a coddled unionized workforce of course.

- Anti-m - Wednesday, Sep 28, 16 @ 9:00 pm:

===- Ron - Wednesday, Sep 28, 16 @ 7:25 pm: The Illinois Constitution is an abomination to logic and reason.===

And constantly tilting at the same windmill isn’t? I’ve watched your ‘discussions’ on this topic for a while- your childishness is amazing. Geez, you’re nothing more than a broken record: unionized workforce “bad”, Illinois constitution “an abomination” to either logic or reason (or both)and should be changed, this situation is “insane”. Etc. Etc. Cut the melodrama, actually READ what you are arguing against and actually cone to some constructive conclusion as to how this can be solved (no, changing the constitution isn’t viable- as you already know, and many here have shown, the threshold is too high). If you can’t add anything constructive, then go away.

- Last Bull Moose - Wednesday, Sep 28, 16 @ 9:13 pm:

The Illinois Constitution tried to require politicians to balance the budget, honor agreements, and not single out small groups for extra taxation. The drafters underestimated politicians ability to bypass the requirements.

- Big Muddy - Wednesday, Sep 28, 16 @ 10:00 pm:

Last Bull Moose,

You win the internet today. Drop the mic and walk away.

- RNUG - Wednesday, Sep 28, 16 @ 10:06 pm:

Ron, I don’t know where to begin with all your misunderstandings.

You seem unaware that pensions have alteady been changed for new hires

- Anonymous - Wednesday, Sep 28, 16 @ 10:19 pm:

Eliminate corporate taxes

Legalize and tax marijuana

Eliminate pension protections

End pensions for all new employees

Allow municipal bankruptcy

Force all schools to consolidate into unit districts

Eliminate township governments in metropolitan areas

Force all school districts to pay their teachers pensions

Eliminate public employee unions

Then we can talk about progressive income taxes

- Pension Priest - Thursday, Sep 29, 16 @ 9:45 am:

We will pray for all those who will have to live off just Social Security if it can survive too. Amen