* From the Center for Tax and Budget Accountability’s budget director Bobby Otter on the two competing deficit projections…

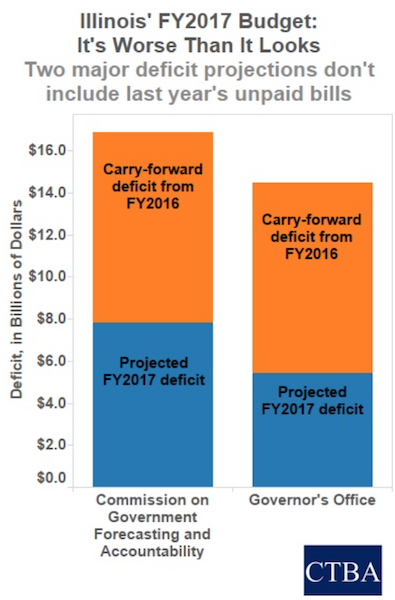

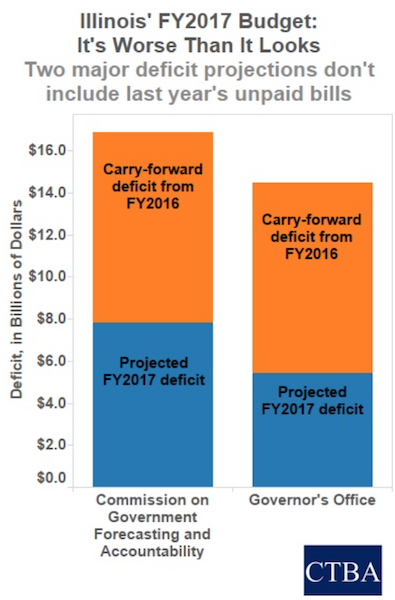

The Commission on Government Forecasting and Accountability (COGFA) - the Illinois General Assembly’s independent budget analysts, projected that total state spending for the current fiscal year (FY2017) which began on July 1, will ultimately be $39.5 billion, but that revenue would only come in at $31.8 billion, leaving nearly a $7.8 billion deficit. On Wednesday, Rauner’s administration disagreed maintaining the budget deficit would be $5.4 billion. Budget Director Tim Nuding said the commission didn’t factor in several key sources of revenue, including the full amount of federal reimbursements to the state for Medicaid anticipated for FY2017.

What’s really troubling is that both of these projections of the General Fund deficit only compare anticipated, year-in, FY2017 spending to FY2017 revenues. Neither are factoring the accumulated deficit left over at the end of FY2016-and thus both COGFA and the Governor’s Budget Office understate the true General Fund deficit in Illinois. (The “General Fund” is the part of the state budget that pays for the services that affect most people-education, healthcare, public safety, and human services.)

HERE’S WHY.

At the end of FY2015, the state’s General Fund deficit was $5.97 billion. CTBA’s analysis shows that the accumulated deficit grew by some $3.13 billion over the course of FY2016, to a total of $9.1 billion.

In other words, Illinois began FY2017 with $9.1 billion in unpaid bills. That means that even if we balanced this year’s revenue with this year’s expenses, we’d still have a $9.1 billion deficit.

Of course, that means both deficit projections quoted in the Sun-Times article understate the true accumulated deficit by that $9.1 billion carry forward. After this carry forward deficit is included, the projected FY2017 General Fund deficit balloons to either $14.5 billion using the Governor’s estimates, or $16.9 billion using COGFA’s.

Another way to look at the General Fund deficit is as a percentage of General Fund service appropriations. CTBA analysis projects the state to spend $24.69 billion on General Fund services in FY2017. Using the Governor’s projected FY2017 deficit figures, 58.7 percent of all General Fund service appropriations aren’t paid for by FY2017 revenues. Since COGFA projects the FY2017 deficit to be even greater, using its numbers, that figure is 68.4 percent.

What does this all mean? The state’s financial condition continues to deteriorate due to a lack of revenue. Whether the General Fund deficit is $14.5 billion or $16.9 billion, it’s definitely unstainable. Between 59 percent and 68 percent of FY2017 spending is deficit spending. And Illinois will continue on this deficit spending path until it increases revenue. But in order to do that, the state needs to fix its flawed tax policy in order to generate additional revenue (see “It Is All About Revenue: A Common Sense Solution for Illinois’ Fiscal Solvency” for CTBA’s suggestions to fix the state’s revenue problems). Until then, the trend of growth in the accumulated deficit is likely to occur past FY2017.

* The accompanying chart…

- Spiritualized - Friday, Sep 30, 16 @ 1:56 pm:

What will this look like come the end of Rauner’s first term, when only stopgap budgets are likely to be passed?

- Honeybear - Friday, Sep 30, 16 @ 2:04 pm:

Broadside on to the wave.

- walker - Friday, Sep 30, 16 @ 2:05 pm:

Numbers are accurate as usual for CBTA, but it depends on what questions we are trying to answer. CBTA just added a third factor, carry over, to complete either picture as to an end point status.

I wish CBTA had answered the question: Which of the two numbers originally provided by COGFA and GOMB were a better reflection of the 2017 Projected deficit? and Why?

- Honeybear - Friday, Sep 30, 16 @ 2:06 pm:

They are also assuming that Revenue will come in like they expect it to. What if our continued deterioration causes revenue to not come in like we thought? I would think all the contracts that haven’t been paid would have an effect on our revenue. Our state owes businesses billions. Doesn’t some of that come back into the coffers in the form of revenue?

- Linus - Friday, Sep 30, 16 @ 2:11 pm:

People, please: Term limits will fix this.

- RNUG - Friday, Sep 30, 16 @ 2:14 pm:

== Term limits will fix this ==

No. Honestly matching revenue to expenses will fix it.

- Angry Chicagoan - Friday, Sep 30, 16 @ 2:17 pm:

So it quickly gets to the point where the five percent income tax fixing this has left the station. We’re going to need seven or eight percent.

- Big Muddy - Friday, Sep 30, 16 @ 2:20 pm:

=No. Honestly matching revenue to expenses will fix it.=

No. Honestly matching expenses to revenue will fix it.

- cdog - Friday, Sep 30, 16 @ 2:21 pm:

The crazy thing about this truth, is Rauner is still thinking his TA 1.4% ROI is relevant and a rational path to address either total.

Cut this guy off. Take the keys.

- Linus - Friday, Sep 30, 16 @ 2:29 pm:

(Apparently, we still have to clearly label our snark as “snark.”)

- Hit or Miss - Friday, Sep 30, 16 @ 2:32 pm:

“People, please: Term limits will fix this.

The fix to the problem is: 1) a substantial cut in spending, or 2) a substantial increase in tax revenue, or 3) both #1 and #2 at the same time.

- Huh? - Friday, Sep 30, 16 @ 2:42 pm:

No. No. Passing the turn around agenda will fix this. Our brilliant businessman governor who knows what is best for us told us this was true. /s

- Keyrock - Friday, Sep 30, 16 @ 2:43 pm:

Linus - I saw your blanket snapping when you posted.

- Leaving Eventually - Friday, Sep 30, 16 @ 3:23 pm:

Every budget looks more and more grim. I, for one, am starting my 3 year plan to leave Illinois. It’s frustrating, because I’ve spent the last 12 years here. In that time, I’ve seen the economy crash and slightly rebound. And by the end of 2019, I’ll have moved to another state that can get its financial house in order.

- Linus - Friday, Sep 30, 16 @ 4:13 pm:

Keyrock, your handle should be “YouRock”