* From the Senate Democrats on the budget/revenue plan…

The comprehensive budget for Fiscal Year 2018 is the product of more than a dozen negotiating sessions with Senate Republicans on a balanced FY 18 budget and is heavily influenced by the budget package Senator Bill Brady filed on March 28, specifically SB2181 and 2182. It eliminates a $10 billion deficit through a mix of cuts, savings and new revenue. […]

Negotiations left a $475 million gap between spending and revenue. This plan closes it by means testing certain income tax breaks, adjusting the borrowing to pay old bills plan and making $60 million in additional reductions.

* More…

Negotiation highlights:

• Sen. Brady presented the group with a spending base of $41 billion

• Based on current revenues, that spending level would exceed revenues by over $10 billion

• Sen. Brady offered a combination of revenue and budget cuts to achieve a balanced budget

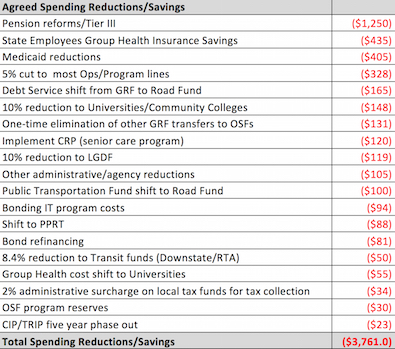

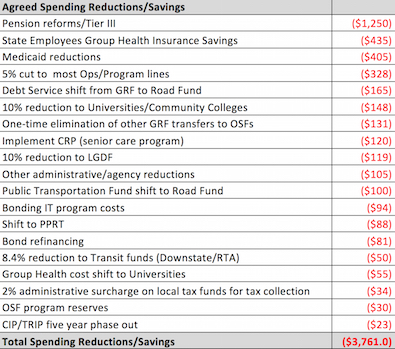

• We (Senate Democrats) agreed to 22 (of 26 proposed) items that would reduce state spending by $3.8 billion

• The group collectively agreed to $5.7 billion in additional resources to help reach a balanced budget

• We came to a point where we had a deficit of $475 million and have not been able to make progress on how to close the gap

• We offered to adjust the amount and terms of a borrowing plan to pay down the bill backlog in order to adjust spending levels

• The plan we are proposing today incorporates that borrowing plan along with other spending reductions and a limit on an income tax break for mansion owners in order to close the gap and achieve a balanced FY18 budget

Key GOP priorities included in the proposals:

1. Uses 4.95 tax rate.

2. Reform the state pension system, including moving to a defined benefit program proposed by Gov. Rauner

3. Reduces Medicaid spending by over $400 million (5 percent)

4. Cuts the amount of state revenue dollars that are shared with local governments

5. Increases p-12 spending by over $350 million

6. Reduces state agency spending by 5 percent compared to the governor’s proposed budget.

7. Cost reductions for group health insurance program.

Revenue:

Personal income tax: Increases to 4.95 percent from current 3.75 percent.

• Generates $4.453 billion annually.

• This is a 1.2 percentage point increase, or a 32 percent increase in the tax rate.

• The rate will return to 3.75% after seven years

Corporate income tax: Increases to 7 percent from 5.25 percent.

• Generates $514 million annually.

Eliminates three corporate tax loopholes worth a combined $125 million a year:

• Eliminates the domestic production deduction (decouples Illinois from federal tax law; Wisconsin and Indiana already did this.)

• Repeals the non-combination rule

• Eliminates loophole exempting areas outside of standard U.S. from taxation, “outer continental shelf”

Imposes a cap of $1,000 a month on the tax rebate that retailer’s receive: $83 million

Implements a sales tax on services. Total: $149 million

• repair and maintenance of personal property 44 million

• landscaping services $14m

• laundry and dry-cleaning $4m

• storage (cars, boats, property) $18m

• cable/satellite/streaming services $46m

• pest control $4m

• private detective, alarm and security services $5m

• personal care $16m

Means testing applied to state income tax breaks: $81 million

Individuals making more than $250,000 and joint filers making over $500,000 would not be eligible for the person exemption ($18M), property tax credit ($59m)and education expense credit ($4M).

Example: homeowners get a tax credit equal to 5 percent of their property tax bill. The more expensive the mansion, the higher the tax break. Gov. Rauner gets a $4,500 credit on his income taxes. This closes that tax break to those whose taxable income exceeds a half million ($500,000) a year jointly or a quarter million ($250,000) individually.

Tax credits: cost of $264 million state

• Increases the Earn Income Tax Credit (EITC) by 50 percent over a 5 year period. This benefits lower income workers.

• Increases the family cap on the Education Expense Credit to $750 from $500.

• Creates a $250 tax credit for teachers who spend their money on classroom supplies.

• Reinstates and makes permanent the Research and Development Tax Credit Extends the Film Tax Credit to Jan. 1, 2027.

• Rolls the currently expired Manufacturing Purchase Credit and Graphic Arts Equipment sales tax exemption into the existing Manufacturing Machinery & Equipment sales tax exemption (streamlines the exemptions and puts us in line with how other states provide the exemption).

* Cuts and savings…

The budget passed this afternoon. The revenue package has not been voted on as I write this. The budget implementation bill, however, was defeated. Click here for the text of that legislation.

*** UPDATE *** From the Senate Democrats…

We won’t proceed to revenue. Many of the budget cuts were in the bimp.

It’s needed for the whole budget package. Our side of the aisle can’t, on its own, pass the list of cuts that Republicans brought to the table and we included.

* Related…

* Illinois Senate OKs budget, but defeats power to implement it

- VanillaMan - Wednesday, May 17, 17 @ 4:01 pm:

TIER 3!

What’s that - state employees paying for the RTW to be a state employee?

A Rauner defined benefits package means state workers can buy used computer parts!

ILGOP has lost their marbles.

- Shemp - Wednesday, May 17, 17 @ 4:04 pm:

“Cuts the amount of state revenue dollars that are shared with local governments”

So just a cost shift… More local taxes or fewer police and firefighters.

- Ron - Wednesday, May 17, 17 @ 4:04 pm:

Some good stuff in there. Some tweaks, like no corporate tax increase and if needed higher personal income tax. More cuts would be welcome.

very nice starting point though

- 47th Ward - Wednesday, May 17, 17 @ 4:06 pm:

===We (Senate Democrats) agreed to 22 (of 26 proposed) items that would reduce state spending by $3.8 billion===

It’s still not enough though. But we’re close, and getting closer every day. Lol.

- Montrose - Wednesday, May 17, 17 @ 4:07 pm:

I’m so glad they are sunsetting the income tax increase, because that worked so well last time around. /s

- Ron - Wednesday, May 17, 17 @ 4:07 pm:

Ideally, we would eliminate corporate income taxes altogether.

- Anon - Wednesday, May 17, 17 @ 4:07 pm:

Excuse my ignorance, but what was the bill number of the budget that passed this afternoon? Also, is there a bill number for the revenue?

- Saluki - Wednesday, May 17, 17 @ 4:10 pm:

I think we might actually get somewhere here today. However the house still needs to get their arms around it, and the BIMP bill failed, so I don’t know if that kills this or not.

- illini97 - Wednesday, May 17, 17 @ 4:12 pm:

10% cut to LGDF? That’ll go over well with mayors of all political persuasions.

- don the legend - Wednesday, May 17, 17 @ 4:13 pm:

Two years of destruction and no mention of term limits, w/c reforms, property tax freeze. Illinois’ chief lobbyist Bruce won’t be in favor.

- Get a Job!! - Wednesday, May 17, 17 @ 4:15 pm:

So 1/3 of the agreed upon cuts are tied to a pension bill that we won’t know the constitutionality of for a year or 2?

Sure seems like the same budget magic that we’ve grown accustomed to.

- Ron - Wednesday, May 17, 17 @ 4:15 pm:

Montrose, 50% of Illinoisans want out of this state. And the first reason is taxes.

- RNUG - Wednesday, May 17, 17 @ 4:17 pm:

== 1. Uses 4.95 tax rate. ==

Personally think it needs to be higher but Rauner will never agree to a rate equal or higher than the level Quinn had. It is also temporary, which is a mistake.

== 2. Reform the state pension system, including moving to a defined benefit program proposed by Gov. Rauner ==

Don’t count those savings yet. The Tier 1 changes won’t be found legal. And the new Tier 3 will end up costing more than Tier 2.

== 3. Reduces Medicaid spending by over $400 million (5 percent) ==

This will end costing more later.

== 4. Cuts the amount of state revenue dollars that are shared with local governments ==

Increases pressure on local governments to raise local taxes.

== 5. Increases p-12 spending by over $350 million ==

Is this a real increase in classroom spending or are they counting increased teacher pension payments in this total?

== 6. Reduces state agency spending by 5 percent compared to the governor’s proposed budget. ==

Be interesting to see which programs this 5% reduction comes from.

== 7. Cost reductions for group health insurance program. ==

The State is currently between 1 and 2 years behind paying claims. How much longer will this cut drag payments out? The State needs to be catching up on these bills, not falling further behind. Or is this counting on the health insurance cuts that are part of the disputed AFSCME contract?

Also note the additional cost shift of University health insurance costs and the phase-out of the TRIPS program.

- Keyrock - Wednesday, May 17, 17 @ 4:20 pm:

Even with magic pension beans included, it didn’t pass.

- Montrose - Wednesday, May 17, 17 @ 4:25 pm:

Ron, putting your point aside for a moment, voting for a temporary tax hike is no less politically damaging than a permanent tax hike. No one is sticking around IL because the hike would go away after seven years. If you are going to take a tough vote, might as make it permanent so you don’t have to do it again in 2024.

- Flynn's Mom - Wednesday, May 17, 17 @ 4:26 pm:

Cost shifting and beating up on poor people isn’t going to cut it.

- 47th Ward - Wednesday, May 17, 17 @ 4:27 pm:

===That’ll go over well with mayors of all political persuasions.===

10% cut to revenue sharing on top of the property tax freeze…

- Ron - Wednesday, May 17, 17 @ 4:28 pm:

A temporary tax increase is much more palatable to me. The goons in springfield will always find ways to spend money if they have it.

- City Zen - Wednesday, May 17, 17 @ 4:37 pm:

==Rauner will never agree to a rate equal or higher than the level Quinn had. It is also temporary, which is a mistake.==

Today’s 3.75% rate is temporary too. It’s supposed to be 3.25% in 2025.

- DaMayor - Wednesday, May 17, 17 @ 4:40 pm:

It’s comical how all the state employees feeding at the public trough have no clue how pensions and 401k plans work in the real world. They expect to be taken care of, period! Your greed is what has put our great state close to bankruptcy. We are the laughing stock of the country. It is time that you come back to reality. All those promises the Dems have made over the years and legislation they passed to give it to you are not sustainable without driving all the residents into bankruptcy or out of the state. But they all think the state should just raise the taxes even higher! Fools.

- Oswego Willy - Wednesday, May 17, 17 @ 4:44 pm:

===All those promises the Dems have made over the years and legislation they passed to give it to you are not sustainable without driving all the residents into bankruptcy or out of the state.===

You mean that pesky constitution and then not paying into the pensions what was owed, then the ILSC saying “pay what’s owed!”

… that Dems doing that.

Oh, when did Thompson, Edgar, and GHR become Dems?

That’s fun…

- Norseman - Wednesday, May 17, 17 @ 4:48 pm:

Pass the stopgap and tell Rauner caucuses to let Cullerton know when they want to get to business.

- Ron - Wednesday, May 17, 17 @ 4:50 pm:

DaMayor, I agree with much of what you wrote, but Republicans are very much at fault too. Especially Mr. Edgar.

And the fools in the 70s that condemned private sector workers in Illinois to second class status.

- Rogue Roni - Wednesday, May 17, 17 @ 4:52 pm:

Second class status? Seriously? Maybe if you quit blaming all your problems on someone else you could get somewhere in life.

- City Zen - Wednesday, May 17, 17 @ 4:58 pm:

Looking more like a tax hike won’t be retroactive to Jan 1.

- illinoised - Wednesday, May 17, 17 @ 4:59 pm:

And when the pension “reform” is found unconstitutional? The problem will not be fixed until Governor Priztker takes office.

- Ron - Wednesday, May 17, 17 @ 5:02 pm:

Rogue Roni, public employees in Illinois have protections no else has. Yes, second class.

- Ron - Wednesday, May 17, 17 @ 5:03 pm:

The quickest way to reform Tier 1 pensions is to lay off those employees.

- Ron - Wednesday, May 17, 17 @ 5:14 pm:

And Rogue Roni, Illinois has massive problems caused by decades of horrendous politicians coddling a public workforce. Illinois is losing population faster than almost any state and 50% of its citizens want to leave. The main reason is taxes.

I will be fine, I can leave and will when it becomes to much. I prefer to try to make Illinois a better place for all its citizens though, not just its politicians and public employees.

- RNUG - Wednesday, May 17, 17 @ 5:15 pm:

== then not paying into the pensions what was owed ==

If a private business tried to pull what the State did in terms of non-funding pensions, the business would be paying fines and some of the principal’s may be facing jail time or personal fines also.

- Anonymous - Wednesday, May 17, 17 @ 5:27 pm:

Wrong RNUG, benefits are constantly changed in the private sector.

- BK Bro - Wednesday, May 17, 17 @ 5:32 pm:

Those are some big revenue moves by the GOP. Surprised. Even more surprised that those increases just aren’t enough. Further convinced that Illinois is just a sinking financial ship due to the lawmakers running the State. When lawmakers can’t even agree on modest (5% or less cuts), you know you aren’t getting budget anytime soon.

- Robert the 1st - Wednesday, May 17, 17 @ 5:32 pm:

=If a private business tried to pull what the State did in terms= of retirement ages and payout formulas they would have gone bankrupt decades ago.

- RNUG - Wednesday, May 17, 17 @ 5:36 pm:

== The quickest way to reform Tier 1 pensions is to lay off those employees. ==

This isn’t the private sector where you can just fire someone or lay someone off. There are rules in place that must be followed; these rules exist to prevent undue influence and patronage. Better be sure it is done as required by either the union contract or civil service tenure rules … which means you will be laying off the junior Tier 2 people, not the senior Tier 1 people.

Otherwise you will be paying out more in wrongful termination lawsuits than you might save in reduced pensions. In fact, a judge would likely force reinstatement with back pay AND back pension service credits, which would be a net loss to the State.

The only people in State employment who can be fired without cause are “at will” employees: single exempt or double exempt people like agency directors, deputy directors, and bureau chiefs. In other words, top policy making management.

The next layer down of management and top level professional talent (SPSA and some PSA titles for the most part) are “4 year term appointment / Vinson Bill” employees. You can only legally fire those people at the end of their 4 year term. And technically you don’t fire them; the Governor just doesn’t reappointment them. And a few of those SPSA titles have been granted an exemption to the Vinson Bill by some Governor, making them subject to the Civil Service protections.

Along with Pensions, I also know a bit about the State Personnel Code, the Vinson Bill, and exemptions from up close and personal experience.

- wordslinger - Wednesday, May 17, 17 @ 5:37 pm:

Gee, and they were so close and getting closer all the time, what with the months of good-faith negotiations and such.

I’m pretty sure now that the bought-and-paid-for Senate GOP caucus has just been providing cover for Rauner.

As long as they were “negotiating,” the heat is off Rauner for this destruction. The Boss can play like some passive bystander (he does that a lot, for a governor who’s the bank for the GOP).

One thing Rauner certainly has changed in his tenure: the GOP GA caucuses have abandoned all pretense of any independence from the executive, of being part of a separate branch of government with shared powers and oversight responsibility.

I can’t think of any governor in my lifetime who exercised total, lockstep control in all matters over the members of his party in the legislative branch.

I guess they all understood that McCann lesson. Buck Rauner once on a meaningless vote, and he’ll go after you with millions.

The timing of the Griff contribution makes sense now, too.

- RNUG - Wednesday, May 17, 17 @ 5:38 pm:

== Wrong RNUG, benefits are constantly changed in the private sector. ==

Re-read what I said. I didn’t say a thing about the benefits, or whether or not they could be cut. My comments were about failure to fund pensions.

- RNUG - Wednesday, May 17, 17 @ 5:42 pm:

== Wrong RNUG, benefits are constantly changed in the private sector. ==

Or if you were referring to my earlier comment that Tier 1 changes will be found illegal, I’ll cite Kavera and SB-1. Go read those decisions.

- Anonymous - Wednesday, May 17, 17 @ 5:42 pm:

I read it. Benefits are cut all the time in the private sector. Companies change 401k matches, etc.

- Exasperated - Wednesday, May 17, 17 @ 5:45 pm:

Sure, Ron. Let’s lay off all the tier 1 teachers in the state. Even if it were legal, and it is not, do you honestly believe we have enough newly licensed teachers in this state to fill even a fraction of the openings that would leave? If you’re about to write that we can rehire those teachers as new tier 2 or tier 3 teachers, just stop. If they were in TRS before 2011, they will still be tier 1 teachers. So, to be clear, we’d need thousands of new teachers to appear overnight even though we are currently facing a massive shortage of qualified teachers since, shockingly, few people want to put up with abuse heaped upon their heads by those who don’t understand that public school employees are taxpayers just like you.

- RNUG - Wednesday, May 17, 17 @ 5:50 pm:

== I read it. Benefits are cut all the time in the private sector. Companies change 401k matches, etc.==

Then you know this isn’t the private sector and the benefits can’t be unilaterally changed.

- Ron - Wednesday, May 17, 17 @ 5:50 pm:

Municipal bankruptcy solves the teacher issue. Allow it like most states do.

- Anonymous - Wednesday, May 17, 17 @ 5:51 pm:

RNUG thanks for pointing out the gross inequality of Illinois labor forces.

- RNUG - Wednesday, May 17, 17 @ 5:52 pm:

== Municipal bankruptcy solves the teacher issue. Allow it like most states do. ==

Teacher’s pensions are a STATE obligation. EXACTLY how does LOCAL bankruptcy solve that?

- RNUG - Wednesday, May 17, 17 @ 5:54 pm:

== RNUG thanks for pointing out the gross inequality of Illinois labor forces. ==

Apparently Illinois citizens were OK with that; they approved the 1970 Constitution.

- illinifan - Wednesday, May 17, 17 @ 6:01 pm:

Ron also note what RNUG says, if private industry did what the state did on state pensions it would most likely cause people to go to jail. Regulators monitor private plans to ensure contributions are made and obligations met. When plans are divested from a company when a company closes they often are insured by the PBGC which then gets the funds to distribute. Public employees are not protected by the PBGC but rather our guarantee is from the public and the ability to tax. No matter how much people yell about the public pensions the obligation has to be met. Rather than wasting time arguing about how to get out from under more time has to be spent figuring out how to meet the obligation.

- Robert the 1st - Wednesday, May 17, 17 @ 6:05 pm:

Once again. If private industry did what the state did with retirement ages, payout formulas, and COLAs, bankruptcy would have occurred decades ago.

- wordslinger - Wednesday, May 17, 17 @ 6:08 pm:

–Once again. If private industry did what the state did with retirement ages, payout formulas, and COLAs, bankruptcy would have occurred decades ago.–

Show your work. Like arithmetic, rather than tantrum in written form.

- Robert the 1st - Wednesday, May 17, 17 @ 6:14 pm:

A prison guard starts at age 21 making 45K. Retires at 50 making $113k (assuming 3.25% annual raises). Using the 17% (8.5% x 2) contribution and even assuming a generous 7.5% annual return every year, the pension is underwater before he turns 67, the age his private sector friends finally retire.

- Rogue Roni - Wednesday, May 17, 17 @ 6:15 pm:

“I prefer to try to make Illinois a better place for all its citizens though, not just its politicians and public employees.”

Thanks for all your service on the cap fax comment board. The people of Illinois thank you.

- illinifan - Wednesday, May 17, 17 @ 6:15 pm:

Robert I have friends in private industry that retired at age 49 with annual pensions (AT&T and another US Steel). They also have guaranteed health care. Private industry used to have these kind of plans. Bottom line there are many people in private industry who have great employment packages, some have lousy ones. Unfortunately when we are young we don’t think of asking about this stuff. Some got lucky with taking a job with a company that had great benefits. It is time for us to get over envying what the other has.

- Oswego Willy - Wednesday, May 17, 17 @ 6:15 pm:

===A prison guard…===

You wanna be a prison guard?

Think on that.

- wordslinger - Wednesday, May 17, 17 @ 6:16 pm:

Robert, where’s the bankruptcy part?

- Fixer - Wednesday, May 17, 17 @ 6:20 pm:

Thanks for explaining the differences, RNUG.

- Robert the 1st - Wednesday, May 17, 17 @ 6:23 pm:

The pension fund is completely exhausted. Bankruptcy.

I have many high school friends who are COs and most of them like their job.

Change my scenario to any other state worker coming on at 25, retiring at 55. Then the funds make it to 74. Better, but not sustainable.

- wordslinger - Wednesday, May 17, 17 @ 6:25 pm:

–The pension fund is completely exhausted. Bankruptcy.–

What a scoop. There’s only one pension fund and it’s bankrupt? When did that happen?

- Fixer - Wednesday, May 17, 17 @ 6:29 pm:

Tier 2 Robert. Your numbers and logic don’t work using Tier 2.

- Robert the 1st - Wednesday, May 17, 17 @ 6:30 pm:

Because we keep diverting more and more funds to the pensions. If a business did similar they’d go under. This all started with =If private industry did what the state did=

- Anonymous - Wednesday, May 17, 17 @ 6:34 pm:

RNUG, can you answer this question please? If Tier 2 pensions cost the state very little, how can they even think of Tier 3 that will cost them a match they have to pay? And if Tier 2 is the preferred option, why doesn’t the state do an ERI to get rid of Tier 1 pay and replace with cheaper people? Let’s face it, the Tier 1 obligation is there and must be paid.

- Cardsfan - Wednesday, May 17, 17 @ 6:44 pm:

=If private industry did what the state did=

I wish people would understand you can’t run gov’t like a business.

Don’t believe me? I’m sure your local college/university, has a Public Administration 101 class. All you “if the state did what the private sector does” need to enroll so you can learn/understand why they can’t do things the same.

- Robert the 1st - Wednesday, May 17, 17 @ 6:48 pm:

Cardsfan- but math works the same in private and public sector. And don’t be so condescending to RNUG. He’s a respected poster here.

- wordslinger - Wednesday, May 17, 17 @ 6:52 pm:

–It’s still not enough though. But we’re close, and getting closer every day. Lol.–

I’m certain now that the GOP Senators have just been providing cover for Rauner.

As long as they are “negotiating,” he can play innocent bystander on the sidelines and not take heat for the destruction he’s orchestrating, and for which the GOP caucuses are complicit.

- Dandy Edward - Wednesday, May 17, 17 @ 6:55 pm:

Priztker and the Democrats would have to raise individual income tax rates to at least 10% permanently to cover pensions and pay for all the spending they want. That would only be a temporary fix as more residents leave the state.

- wordslinger - Wednesday, May 17, 17 @ 6:57 pm:

–Priztker and the Democrats would have to raise individual income tax rates to at least 10% permanently to cover pensions and pay for all the spending they want.–

Really? Can you break down the numbers for us?

- Cardsfan - Wednesday, May 17, 17 @ 6:58 pm:

Robert the 1st-I meant no disrespect to RNUG or anyone else. I did not mean anyone specifically when I said “people.” I was being generic because I simply meant, people in general. The public. The Rauner administration.

I often hear people say “if only the state would do it like the private sector” but what most of the general public does not understand is this can’t work. And the Rauner administration could use a little lesson in Public Admin 101 because they obviously don’t understand why you can’t run the gov’t like a business.

Again, my apologizes. I honestly meant no disrespect to you, RNUG or anyone else on this blog. I’m an avid reader, but rarely comment and I appreciate everyone’s insight here.

- Oswego Willy - Wednesday, May 17, 17 @ 6:59 pm:

===Priztker and the Democrats would have to raise individual income tax rates to at least 10% permanently to cover pensions and pay for all the spending they want.===

… and yet, when negotiating, they only wanted 4.99% for a deal.

Explain the additional 5.01%

“No, I’ll wait.”

- Texas Red - Wednesday, May 17, 17 @ 7:01 pm:

Expanding the EITC ? Really ? that is the worst possible program to expand - free money rather than a deduction. The incentive for abuse is huge.

- VanillaMan - Wednesday, May 17, 17 @ 7:09 pm:

In the scenarios presented by Rauner and his huster supporters, no one ever dies. It’s crisis time all the time.

NOTHING BUT A FUTURE OF MISERY!

- wordslinger - Wednesday, May 17, 17 @ 7:12 pm:

–Expanding the EITC ? Really ? that is the worst possible program to expand - free money rather than a deduction. The incentive for abuse is huge.–

Yeah, Milton Friedman and Ronald Reagan were some red-hot Bolsheviks.

- Michelle Flaherty - Wednesday, May 17, 17 @ 7:13 pm:

Texas,

Are we talking about the Reagan supported, reward work over welfare EITC program?

- Robert the 1st - Wednesday, May 17, 17 @ 7:14 pm:

You’re right of course, VanillaMan. If everyone dies by 67 the math in my scenario plays out fine, assuming that 7.5% market return each and every year.

- Texas Red - Wednesday, May 17, 17 @ 7:15 pm:

Simple idea- any pension plan has at its core a number of uncertainties that can impact its future and the burden on taxpayers . Market returns, funding levels, the ratio of workers to retirees, sweetheart ERI programs, longer life expantancies and the list could go on and on. A 401k type plan has none of those uncertainties, a good CFO or finance manager can reasonably predict the exact cost of the retirement benefit for today and for 30 years from now.

- wordslinger - Wednesday, May 17, 17 @ 7:24 pm:

Tex, why don’t you find Sherman and see if he can hook you up with Mr. Peabody and his WABAC machine.

You could go back to 1969 and sell your term paper at the Constitutional Convention.

Here in present-day, non-cartoon land, the Supremes ruled unanimously that the pension liability has to be paid.

- Texas Red - Wednesday, May 17, 17 @ 7:33 pm:

=Word=

Your are right of course ( about the IL const) and there always need to be one state that is last in the nation. And while you are reveling in your certitude, another day goes by with dozens of families leaving just a small part of the massive exodus out of Illinois. But hey at least your are right

- James - Wednesday, May 17, 17 @ 7:37 pm:

For Rauner, I believe there is no intention on agreeing to a Grand Bargain–this posturing is all about the election. Rauner knows he needs a second term and more GOP legislators in a 2020 midterm before he can hope to pass his red-state legislation, which appears to be his only goal.

So what does he need for a second term? Two things: the first is a property tax freeze. That would be his one distinctive win, and it is popular. Can you picture $20 million in campaign ads with him riding his motorcycle, in his carhartt, pulling over to the curb and saying to the camera with a big smile: “what other Governor ever froze your property taxes?”

The second thing he needs for a second term is K-12 funding. Rich Goldberg recently sounded the alarm for a stand-alone bill. If schools don’t open, the low information voters and all parents will suddenly pay attention to the State impasse, and the entire electorate will be deciding whom to blame. Rauner obviously thinks it’s too risky to his own future to let that happen.

K-12 appears to be the only hostage Rauner fears to take, so how do the Democrats play it now or later this year? Also the AFSCME cases now pending may move forward in a way that introduces a new element to the election.

- wordslinger - Wednesday, May 17, 17 @ 7:38 pm:

Gee Tex, that sounds bad. I was just pointing out that your term paper synopsis was irrelevant to any issues of the day.

- Robert the 1st - Wednesday, May 17, 17 @ 7:46 pm:

You sure seem cranky today Wordslinger… did you hear about some tax cut somewhere that got you all exasperated?

- wordslinger - Wednesday, May 17, 17 @ 7:49 pm:

Sorry, Robert. You and Tex have fun up in the dorm with your irrelevant hypothetical situations.

Nothing but squeeze-the-beast is going to get done anyway. After two years, reality should sink into even the thickest of heads.

- Texas Red - Wednesday, May 17, 17 @ 7:52 pm:

=James

Seems to me that the true low information voter’s are the ones that don’t want to change things. The agenda that Rauner is trying to implement will be the only thing to right the ship. So your supposed red-state legislation is actually the cure. The Dems who refuse to play ball are the real problem. Oh and the leader you have had for 30 years is no help either. As for hostage takers let’s not forget the AFSCME/SEIU folks that might represent 70,000residents , they are holding the rest of us hostage.

- RNUG - Wednesday, May 17, 17 @ 7:56 pm:

== If Tier 2 pensions cost the state very little, how can they even think of Tier 3 that will cost them a match they have to pay? ==

That is one of those “it depends” answers. It will cost the State money overall. If you break it down by individual funds, and make some assumptions, the exact answer kind of varies.

I’ll start by noting you have to use Tier 2 as the baseline because that is the status of any new hire. Tier 1 costs and benefits are irrelevant to this discussion. I’ll also note I’m going to round things here and there for simplicity’s sake.

TRS - roughly 50% of all “state” employees - currently not in SS and paying into Tier 2 has a more or less zero cost to the State. (I’m ignoring whether or not the local districts is picking up the employee contribution because it would be with local property tax funds and not relevant to the State’s cost.)

If you put the new people in both SS and a 401K with 3% match, the annual cost to the State would be around 9%. I don’t see how the State paying 9% is cheaper; the only way it saves money is if the State is also going to shift the full annual cost of the employer portion of the pension to the local districts. Conversely, if you only do the 401K with 3% match (and hope you don’t violate IRS safe harbor rules), then it only costs the State 3% compared to Tier 2.

SERS - roughly 24% of all “state” employees, or what I tend to think of as the actual state employees working for the various State agencies. A fair amount of them (except life/safety like some IDOC or some IDOT) pay into both SS and the State pension. Under Tier 2, the State is more or less paying nothing towards those pensions but they are paying the 6% SS employer contribution. A 401K with 3% match would be an increased 3% cost. But if you just did the 401K with 3% match and no SS, you would save 3% (and hope you don’t violate safe harbor).

The other group of SERS, life/safety, don’t currently contribute to SS. Again, with Tier 2, it isn’t costing the State anything today. So changing to a 401K will cost the State whatever percentage the State contributes, either 3% or some higher level since law enforcement has traditionally had a better pension formula with higher contribution rate.

SURS - roughly 24% of all “state” employees, actually universities and community colleges, both teachers and other employee classifications. This is the toughest system to describe because some members match SERS, some match TRS, and they also have the “self managed” plan. I’m going to gloss over the specifics here, since they will vary by individual, and just say portions of TRS and SERS apply. In general, you can figure it will cost the State more unless they plan to offload the annual employer costs to the individual schools.

GARS/JRS - less than 2%, legislature, top government executives, and judges. Pretty much s rounding error. The latest proposal is to eliminate GARS, but I’m not clear what they intend to do with the executives. And, quite frankly, for this discussion, the judges are such a small number is less than a rounding error.

I need to qualify the above a bit. Tier 2 also has a potential safe harbor issue of the benefits eventually falling below SS level. This could cause the State to have to make some additional contributions to the pension funds for those, like teachers and life/safety, who don’t currently contribute to SS. Do the costs or savings could be different, depending on which assumptions and time frames you use.

- Oswego Willy - Wednesday, May 17, 17 @ 8:03 pm:

===The agenda that Rauner is trying to implement will be the only thing to right the ship===

Nope.

1.4% and $500 million. That’s the real measurable payoff.

Those are Rauner’s own numbers. Not nearly evough to cover the Rauner damage.

===The Dems who refuse to play ball are the real problem.===

Spoken like a real hostage taker.

“They won’t pay the ransom. So, the hostages…”

Not the best argument.

===Oh and the leader you have had for 30 years is no help either.===

That includes Thompson, Edgar and Ryan. When did they become Democrats?

===As for hostage takers let’s not forget the AFSCME/SEIU folks that might represent 70,000residents , they are holding the rest of us hostage.===

Nah.

It’s that pesky constitution, protecting workers from “you”, not low information, but more likely either willfully ignorant or blissfully unaware.

Had the pensions been paid, things would be better.

You could be a state employee, a prison guard, if it’s such a great deal, why won’t you?

- Texas Red - Wednesday, May 17, 17 @ 8:05 pm:

=RNUG

“If you put the new people in both SS and a 401K with 3% match, the annual cost to the State would be around 9%. I don’t see how the State paying 9% is cheaper”

It is a simple question of the time period of the states liability. You may be correct that the 401 type plan seems more expensive at least initially. What you fail to take into account is that under a tier 3 plan the state’s (taxpayers) liability is limited to only the years an employee is actually working for the state. We do not need to have actuaries figure out the liabilities for the employees life or even for his spouses life as we do with Tiers 1 and 2. In the long run a 401k type plan always will win out in term of cost.

- wordslinger - Wednesday, May 17, 17 @ 8:05 pm:

– Seems to me that the true low information voter’s are the ones that don’t want to change things. The agenda that Rauner is trying to implement will be the only thing to right the ship. So your supposed red-state legislation is actually the cure.–

LOL, perhaps Rauner could mitigate that “low information” problem by actually articulating any sort of projected ROI on whatever his agenda is this week.

Beyond the dorm-room talking points, that is. He tried it once, and it didn’t go very well.

But the consequences of his pre-conditions before engaging in his Constitutionally mandated duties are reflected in the exploding, record GRF operating debt and the bleeding of core state responsibilities.

Those are measurable and real, and not so much fun as playing with word-salad-shooters.

- Robert the 1st - Wednesday, May 17, 17 @ 8:07 pm:

To be fair Willy, the ship has sailed on the good pensions. I’d take a 401k with a measly 4.25% match over an IL tier II pension.

- City Zen - Wednesday, May 17, 17 @ 8:09 pm:

==If a private business tried to pull what the State did in terms of non-funding pensions, the business would be paying fines and some of the principal’s may be facing jail time or personal fines also.==

A private business never would have assumed 8% returns on pension investments like the public sector.

- Oswego Willy - Wednesday, May 17, 17 @ 8:10 pm:

===…the ship has sailed on the good pensions. I’d take a 401k with a measly 4.25% match over an IL tier II pension.===

I’d run the numbers by - RNUG -

I hear Diet Coke and Rum is how he rolls, but don’t tell him I sent you.

- Robert the 1st - Wednesday, May 17, 17 @ 8:17 pm:

It depends a whole lot on market conditions. But you could potentially retire years earlier with a more generous pension. Plus your kids will do a lot better when you bite the bullet. Not to mention switch companies throughout your career.

- wordslinger - Wednesday, May 17, 17 @ 8:18 pm:

–A private business never would have assumed 8% returns on pension investments like the public sector.–

You can’t be serious. What the heck do you think guys like Griff and Rauner were selling to corporate investors?

- Illinoyed - Wednesday, May 17, 17 @ 8:20 pm:

Robert 1st - I’m gonna have ta call ya on some male cattle excrement here. I started at IDOC at age 20 and retired at 50 (not by “choice”). I was CO - 16yr., PA - 8 yr., and CJS - 6 yr. I warn’t not makin” no six figga” no yare. So if you’re going to comment here. please use actual facts and figures, out of respect for our host and other guests, if nothing else…

- Robert the 1st - Wednesday, May 17, 17 @ 8:21 pm:

Run the numbers, I’m not wrong with my example. Sorry it didn’t mirror your situation. I have a CO friend who’s was 24 and made $104,000 in 2014. I didn’t use his numbers in my example either.

- Robert the 1st - Wednesday, May 17, 17 @ 8:23 pm:

I could have had the CO end with $30k and the funds would still end at 67. The amounts don’t really matter, it’s the percentages and compounded interest.

- Anonymous - Wednesday, May 17, 17 @ 8:27 pm:

Thanks RNUG. So either Tier 2 or Tier 3 is the way to go. The Tier 1 employees need to be replaced by younger and cheaper workers. As unpopular as it would be, an ERI could save the state money

- RNUG - Wednesday, May 17, 17 @ 8:47 pm:

== == And if Tier 2 is the preferred option, why doesn’t the state do an ERI to get rid of Tier 1 pay and replace with cheaper people? ==

I have a question: would it only apply to SERS or all “state” employees?

Probably because it would, overall, cost the State more than it would save. I’m going to use the more generous SERS 2002 ERI as a basis for explanation.

The theory was that the State could shed workers, and where needed, hire new workers at a lower cost.

First, the 2002 deal gave 5 years of age, effectively lowering the “Rule of 85″ to a “Rule of 80″. In other words, current age + years of service => 80. It was limited to age 50 minimum, but also lead to a lot of those “retired at 50″ stories … although the life/safety group could already retire at age 50. The extra 5 years of age didn’t really have a direct cost; it just expanded the size of the eligible group, which increased indirect costs.

Second, the 2002 offer didn’t change the actual formula. You got the same percentage for each year as if the ERI did not exist … but see #3.

Third, and this is where the costs start, employees were allowed to buy up to 5 years of service. The idea was to again expand the number of eligible people. The cost to buy a year was the employee’s normal yearly contribution, generally either 4% (those with SS) or +8% (no SS). In theory, the State was supposed to also put a matching % in. This offer was a bit over generous. And although the State did get up to 5 years of immediate employer contributions, it lost the investment earnings of those 5 years. And the State was so o eager to shed employees, the State would even LOAN you the money to buy the extra 5 years and then take the payments out of your (now larger) pension check!

Fourth, since it was the long term employees retiring, the State owed them for unused vacation and, in some cases, even sick time. This was an immediate expense / cash outflow from GRF. Since vacation time could be accumulated for up to 3 years of earned vacation before you lost it, some of the payouts were quite large.

Fifth, the ERI did not reduce employee health insurance costs, since the State was still responsible for any retiree who had a total of 30 years of service. In fact, it increased health insurance costs because the State had to cover the new hires that replaced the retired employees.

Sixth, it started a larger drain on the SERS pension earlier than the actuaries were expecting. Yes, they got a big cash influx, but they did also have a larger than planned cash outflow. And because of the younger age of the retirees, the payouts will be longer and larger due to the 3% compounding AAI.

Whether or not the 2002 ERI was a success or failure depends on how you measure it. Since about 11,000 employees jumped on it and retired, it DID shift a lot of payroll expense from GRF to the pension fund. It DID reduce the overall headcount at the State. It DIDN’T save any health insurance costs. And it caused a large loss of institutional knowledge the State has yet to recover from. That was also an actual fiscal cost because some agencies ended up hiring back their key employees under the 75 day rule. Or they had to hire other contractors to fill the gaps. In some cases, that is still happening today.

The biggest flaw was the cost of buying the extra years. Frankly, it was set too low. Once you ran the numbers, it was literally a no-brainer to buy the years whether you needed them or not.

So that is a really long answer on the pros and cons of the 2002 ERI.

I will note that the much less generous 2004 ERI had a much smaller participation rate.

So offering an ERI today could be problematic. It would have to he a balancing act between generous enough to get high participation but stingy enough to not break the bank, so maybe something in between the 2002 and 2004 deals.

Full disclosure: I am one of the 2002 ERI group, and I didn’t need to buy the 5 years of service to retire, but I did. I’ll also note I was already within a couple of years of hitting the Rule of 85 anyway.

- efudd - Wednesday, May 17, 17 @ 8:51 pm:

So many jealous, bitter people who are so willing to take what has been promised to others under the guise of “it happens everywhere else.”

When the breaking of contracts, promises and oaths become accepted and even triumphed we are all doomed.

No, I’m not a state employee.

- Timmy - Wednesday, May 17, 17 @ 8:59 pm:

Why don’t we tax retirement income? These citizens caused most of these problems in the first place by kicking the can down the road for over 30 years.

Oh, because one party panders to unions and the other panders to the elderly!

- Oswego Willy - Wednesday, May 17, 17 @ 9:04 pm:

===These citizens caused most of these problems in the first place by kicking the can down the road for over 30 years.===

So, “because… longevity”?

So, if you’re over “x”, you are to blame for Illinois’ woes?

We’re rooting for shorter life spans or tax people for the gift of more years on this earth… because 30 years ago, they showed up to work.

How could they be so callous?

- City Zen - Wednesday, May 17, 17 @ 9:09 pm:

Word - Would you care to identify any corporate pension plan that uses an effective interest rate above 7%?

- RNUG - Wednesday, May 17, 17 @ 9:13 pm:

== Again, my apologizes. I honestly meant no disrespect to you, RNUG or anyone else on this blog. ==

I don’t take offense easily, except when it comes to people that repeat talking points without some facts or original ideas to back them up.

- Grandson of Man - Wednesday, May 17, 17 @ 9:17 pm:

“the other panders to the elderly”

The other is owned by two of the richest people in Illinois and protects them at all costs from paying even a penny more in state income tax.

“The Tier 1 employees need to be replaced by younger and cheaper workers.”

Rauner gorged himself on public employee pensions for decades and got very wealthy off of them, but it’s okay to spit out the middle class public employees who enriched him, like husks? I don’t think so.

- City Zen - Wednesday, May 17, 17 @ 9:19 pm:

==So, if you’re over “x”, you are to blame for Illinois’ woes?==

Not to blame, but were the consumer of services that for whatever reason weren’t fully paid for the people who consumed them.

The other option is to visit any nursery in Illinois as gaze lovingly upon all the newborns that will be paying for those services consumed by previous generations via increased taxes and/or reduced services.

Which is more callous?

- City Zen - Wednesday, May 17, 17 @ 9:23 pm:

For those who like a good horror story before bedtime, I leave you with the latest study on pension debt: Hidden Debt, Hidden Deficits:

2017 Edition

http://www.hoover.org/sites/default/files/research/docs/rauh_hiddendebt2017_final_webreadypdf1.pdf

On second thought, save it for the morning. Page 13 can’t be unseen.

- Oswego Willy - Wednesday, May 17, 17 @ 9:26 pm:

===Not to blame, but were the consumer of services that for whatever reason weren’t fully paid for the people who consumed them.===

They paid taxes all those years. So there’s that. Because legislators and governors didn’t pay into what the pensions as they should, a person working, who did pay into, shouldn’t be held accountable.

As to your hand wringing, “for the children”… as the income tax sun setted… Rauner, as candidate, and Gov-Elect ran on lowering the income tax that paid into those pensions, and helped pay bills, and…

That wasn’t 30 years ago, it was barely 30 months ago.

So there’s that too.

- Robert the 1st - Wednesday, May 17, 17 @ 9:30 pm:

But what about the “artificially low” income tax argument we always hear here? Didn’t current retirees not pay their fair share for decades?

Just like tier II, make the next group pay the check, in my opinion.

- RNUG - Wednesday, May 17, 17 @ 9:33 pm:

== I hear Diet Coke and Rum is how he rolls, but don’t tell him I sent you. ==

The rum and Coke is my wife’s choice.

I prefer 7-Up and good aged Canadian Whiskey, usually one of the 12+ year CC variations. Yeah, it’s probably a waste of good whiskey but I can’t have much these days with some of my meds.

If you really want to get my attention, find an unopened bottle of Seagram’s 1776 in the original Tiffany crystal decanter. I only have one drink a year out of it at Christmas but mine is almost empty.

- RNUG - Wednesday, May 17, 17 @ 9:53 pm:

== What you fail to take into account is that under a tier 3 plan the state’s (taxpayers) liability is limited to only the years an employee is actually working for the state. We do not need to have actuaries figure out the liabilities for the employees life or even for his spouses life as we do with Tiers 1 and 2. ==

Actually, if the employee is NOT also in SS, the State does have to go those calculations to make sure they won’t violate the IRS Safe Harbor rule.

And I’ll point out that, in the private sector, the employer is paying both the employer SS portion and some level of 401K match. If the State has to start paying SS for TRS and non-coordinated SURS, SERS & JRS, that would be a new employer expense for roughly 75% of new hires. Admittedly, it will ramp up, but it could become a pretty big number.

BTW, you DO realize the reason the State has a non-coordinated plan DB for TRS is that they calculated it was cheaper than SS and a small DB plan?

- Chicago Cynic - Wednesday, May 17, 17 @ 9:55 pm:

Anyone know what the votes were for the budget and the BIMP?

- Anonymous - Wednesday, May 17, 17 @ 10:25 pm:

Is it just me or does it seem like the IPI sent some operatives for a lot of these comments today…. just saying.

- Anonymous - Wednesday, May 17, 17 @ 10:36 pm:

The drama queens are out tonight! So much jealousy and anger that is totally misplaced, misguided souls that they are.

But, alas, you cannot educate some people, as I have learned. Just can’t. Their thinking is narrow and totally governed by their emotional side rather than the rational brain.

So we’ll have to continue to read their hysteria when they can’t control their “feelings” about things.

The jealousy and envy over defined benefit pensions is so thick it can be cut with a knife. Again, they had the opportunity to work in a job that had one too, but the money wasn’t enough for them. Too shortsighted to see down the road. Surely, too shortsighted to save and invest enough to have a hearty retirement income of their own, I’ll bet. I guess that would make one angry at those with self discipline and foresight.

- RNUG - Wednesday, May 17, 17 @ 10:46 pm:

Speaking of education …

If it was the SSU of old (back when I attended), just for the heck of it, I’d be tempted to turn in the last 4 years of my writing on pensions as a doctoral dissertation.

- Oswego Willy - Wednesday, May 17, 17 @ 10:59 pm:

===really want to get my attention, find an unopened bottle of Seagram’s 1776 in the original Tiffany crystal decanter. I only have one drink a year out of it at Christmas but mine is almost empty.===

Noted.

Thanks for all the insight you give. Always learning from you, and a CC and 7 isn’t half bad either.

Nite.

- blue dog dem - Wednesday, May 17, 17 @ 11:03 pm:

I believe a poll by the Simon Institute should ask the following question. A) should Illinois politicians lobby the Feds to allow bankruptcy, or B) Illinois politicians should raise taxes to levels necessary to fix our debt.

Just curious on the results.

- RNUG - Wednesday, May 17, 17 @ 11:09 pm:

Corrention to my @ 8:47 pm post:

I had a typo in point 5. The State was on the hook for health care for anyone with 20 (twenty) years of service.

Hard to type and proof read on a phone.

- RNUG - Wednesday, May 17, 17 @ 11:18 pm:

== Just curious on the results. –

LOL! -Blue dog-, given a choice between paying little or paying a lot, I think both of us can accurately predict the outcome of that poll.

- Robert the 1st - Wednesday, May 17, 17 @ 11:59 pm:

=Their thinking is narrow and totally governed by their emotional side rather than the rational brain.=

Funny coming from someone claiming others are showing =jealousy and envy= when we try to discuss how public dollars are being spent.

=Surely, too shortsighted to save and invest enough to have a hearty retirement income of their own=

Have another drink grandpa. Some of us are in our 20s…

- Illinoise - Thursday, May 18, 17 @ 12:16 am:

** Again, they had the opportunity to work in a job that had one too, but the money wasn’t enough for them **

The public sector is the only place you can find a defined benefit plan these days, because those entities that have to actually come up with a business plan to earn their income figured out long ago that defined benefit plans were unsustainable. Its easy to be smug when you have your retirement financed by the taxpayer and can retire 15 years earlier than the typical private sector worker, as opposed to saving for your own retirement. I would rather you just say “thank you” and be on your way.

- GOP Extremist - Thursday, May 18, 17 @ 12:20 am:

Big talk do little

- Rod - Thursday, May 18, 17 @ 7:20 am:

Please note that Senator Manar voted present on his own bill SB 42 the budget implementation bill. If the cuts were too deep why did he and Sen Trotter support it to begin with?

- Nick - Thursday, May 18, 17 @ 7:49 am:

Thank you

- John Mc - Thursday, May 18, 17 @ 7:58 am:

=Anonymous - Wednesday, May 17, 17 @ 5:27 pm:

Wrong RNUG, benefits are constantly changed in the private sector.

You obviously don’t understand how pensions work ,period. If you did, you would have kept your mouth shut.

- Obamas Puppy - Thursday, May 18, 17 @ 8:44 am:

John Cullerton abandons his partys principles on appropriations and thinks its a success. Let him be the poster boy for term limits and hopefully retirement.

- illinifan - Thursday, May 18, 17 @ 9:29 am:

illinoise just FYI about 11% of private sector still has DB plans here is a link to data and employment sectors https://www.bls.gov/ncs/ebs/benefits/2016/ownership/private/table01a.pdf