* From the ILGOP…

Just yesterday, Mike Madigan called efforts to get lasting property tax relief an “extreme right-wing agenda.”

This comes as Madigan and House Democrats continue to push for massive tax hikes.

Does Rep. Natalie Manley agree with Madigan? Is property tax relief really an extreme agenda?

Manley should stand up for homeowners and speak out against Boss Madigan’s attack on the middle class.

* As you can see from this screen shot of my in-box, they put out a bunch of these…

* But this is from the Center for Tax and Budget Accountability…

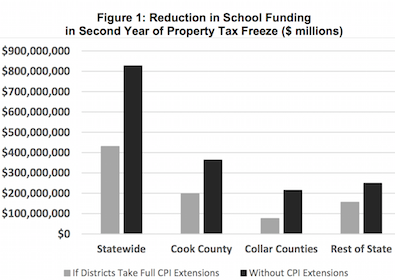

Cost of Property Tax Freeze to IL Schools? Up to $830 Million

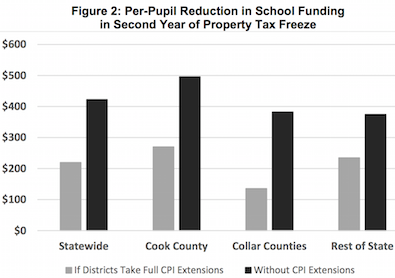

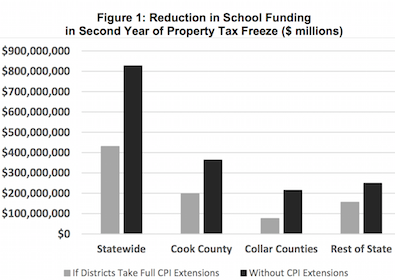

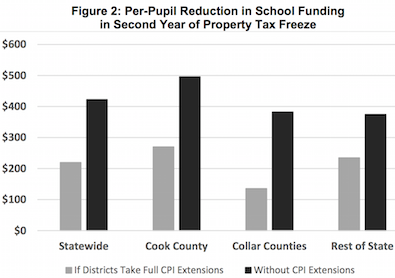

CTBA analysis indicates that a two-year property tax freeze would be devastating for Illinois’ public education system, effectively cutting between $430 million and $830 million from K-12 education per year by the end of 2019.

Late last month, the Illinois Senate passed Senate Bill (SB) 484, which would freeze property tax collections for school districts across the state for two years. Such a measure has been a central demand of Governor Bruce Rauner, who has insisted that he will not sign a full state budget without a property tax freeze.

CTBA’s projection was derived by applying the property tax freeze in SB484 to property tax collections by school districts in 2014 and 2015, the most recent years for which full property tax data is available from the Illinois Department of Revenue. Because the base of collections has increased since then, a funding gap created by the freeze of the same proportion would be greater in nominal dollars today. The smaller amount, $430 million, assumes that every district will increase its levy by the full Consumer Price Index (CPI), which SB484 would allow only for debt and pension payments. The larger amount, $830 million, is the effect of the freeze if no district has debt payments for which it can increase its levy under these terms.

These cuts would hit all areas of the state. Cook County would see an annual schools funding cut of between roughly $200 million and $360 million; the collar counties, between $76 million and $214 million; and districts in the rest of the state, between $156 million and $250 million. On a per-pupil basis, these cuts amount to as much as $496 for every student in Cook County, $382 for every collar county student, and $375 for every student in the rest of Illinois. Figures 1 and 2 illustrate these cuts.

* Attachments…

- Dee Lay - Monday, Jun 26, 17 @ 11:57 am:

Never let the facts stand in the way of a good story…

- so... - Monday, Jun 26, 17 @ 11:59 am:

Uh, it’s a freeze, not a cut.

A school that levies $1 million in property taxes this year, would be able to levy $1 million in property taxes next year under a property tax freeze.

Only in Illinois does denying government the ability to raise taxes count as a “cut.”

- Holy cow - Monday, Jun 26, 17 @ 12:09 pm:

So does this mean I can expect my already highest in the nation property tax to keep going up every year

- Anonish - Monday, Jun 26, 17 @ 12:09 pm:

@so…

Can they pass a bill that will prohibit any vendor to a public school, library, park district, village or township from raising any of their prices for the length of time that a property tax freeze is in effect?

Freezing the revenues from property taxes will result in cuts to services and staffing across many governing bodies outside of public schools.

Oh and it could create problems with meeting funding requirements for IMRF, but why not put another public pension fund through the shredder.

- Perid - Monday, Jun 26, 17 @ 12:09 pm:

Wonder how much the State would make up for it in the new funding formula, if at all. In a way taxpayers would just switch from paying for local schools through property taxes to paying for all schools through higher income taxes. Assuming it all evens out of course, which doesn’t seem likely…

- NeverPoliticallyCorrect - Monday, Jun 26, 17 @ 12:12 pm:

And most of the money goes to teachers, who are in the union, and the Dems are in the pocket of the union so why is anyone surprised that Dems don’t want a freeze.

- Anon221 - Monday, Jun 26, 17 @ 12:13 pm:

“CTBA analysis indicates that a two-year property tax freeze would be devastating for Illinois’ public education system, effectively cutting between $430 million and $830 million from K-12 education per year by the end of 2019.”

Team Rauner translation- Freezing property taxes is all about local control! Look at how many millions of dollars we will be giving the school districts in local control!

- City Zen - Monday, Jun 26, 17 @ 12:14 pm:

==On a per-pupil basis, these cuts amount to as much as $496 for every student in Cook County, $382 for every collar county student, and $375 for every student in the rest of Illinois.==

That would move Illinois residents in the overall per pupil funding rankings from 13th to 15th in America, a problem school districts in the 35 states below us would love to have.

- Texas Red - Monday, Jun 26, 17 @ 12:16 pm:

Since PTELL guaranteed that districts must always ask for the maximum allowable levy under the law (5% or CPI whichever is lower) it is no wonder these groups call it a “Cut”. All entities that rely on property tax should fist estimate what the income they can generate from a tax levy may be - and then learn to build their operations around that number. PTELL created a monster of an ever increasing levy with no ability to look at cost control, the 2/4 year levy freeze is a step in the right direction. Need to give the power back to individual property owners to decide what is best in their local district.

- Last Bull Moose - Monday, Jun 26, 17 @ 12:18 pm:

The point needs to be hammered home, a property tax freeze is a spending freeze. When prices rise, a freeze in dollar spending results in less being purchased. So the freeze can result in fewer teachers or police. Most people would call that a cut in services.

- Anonymous - Monday, Jun 26, 17 @ 12:22 pm:

So they’re saying property taxes should be raised by a billion more?

- Lance Mannion - Monday, Jun 26, 17 @ 12:22 pm:

Consider the source: CTBA is a union advocacy group.

- alt - Monday, Jun 26, 17 @ 12:23 pm:

work-around to grow property tax revenue is to grow the number of property owners (alternative to annually increasing rates, levies, assessments, etc.)

- so... - Monday, Jun 26, 17 @ 12:27 pm:

==Consider the source: CTBA is a union advocacy group.==

Oh, come on. I’m sure an organization that counts Michael Carrigan and Dan Montgomery as board members is gonna give a you a fair read of the Governor’s policy goals.

- Alternative Logic - Monday, Jun 26, 17 @ 12:28 pm:

==Consider the source: CTBA is a union advocacy group.

==

Hey, the IPI called. They need their Facebook commenters back, stat!

- Anonish - Monday, Jun 26, 17 @ 12:31 pm:

Don’t forget, not just schools are funded by property taxes!

Non-union municipal employees also get paid from those funds too.

- City Zen - Monday, Jun 26, 17 @ 12:31 pm:

CPI has averaged 1.4% the past 5 years. Dare I ask how school district spending compares and what COLA increases have been given in recent contracts? I know my old school district agreed to 3% COLA increases in their last teachers contract, and that’s before steps/lanes.

- Joe M - Monday, Jun 26, 17 @ 12:32 pm:

==So they’re saying property taxes should be raised by a billion more?==

If State became the primary funder of education, as the Illinois Constitution calls for, rather than education relying on local property taxes, then property taxes could go down.

“The State has the primary responsibility for financing the system of public education.”

(Source: Illinois Constitution.)

- Curious - Monday, Jun 26, 17 @ 12:32 pm:

I just wonder, if it is even possible, if the tax money that is tied up in TIF funds would have been given to the schools and other agencies would be making a big difference now? I have heard all the positive things about TIFs since their inception and I do acknowledge that many things have been accomplished by them but wouldn’t it be time to possibly consider putting at least a freeze on new TIFs for a period of time?

Just asking

- Mr Peabody - Monday, Jun 26, 17 @ 12:35 pm:

When class sizes grow, or courses are cut, or the school district can’t fix its leaking roof, they are going to blame Rauner.

Call it a freeze, a cut, or whatever you like.

- monarch - Monday, Jun 26, 17 @ 12:38 pm:

I’m sure my school district will just go out for a referendum sooner.

- Whatever - Monday, Jun 26, 17 @ 12:52 pm:

First ==Mike Madigan called efforts to get lasting property tax relief an “extreme right-wing agenda”==

Then ==Is property tax relief really an extreme agenda?==

So who said a freeze is the only or even best kind of relief? And how did “lasting” get taken out?

If the Speaker said that a permanent freeze is an extreme right-wing notion, he was right, and neither of the quotes is accurate. I despise both sides for these word games, and the media for not calling them out on it. so… @ 11:59 points out another very common game, where a slower rate of increase somehow is a cut.

- Echo The Bunnyman - Monday, Jun 26, 17 @ 12:59 pm:

The reality is, everything needs cuts. K-12 is no different. The idea that we can keep throwing money at the problem isn’t working. Start with the wealthy districts. Force Consolidation of these districts that are in the “black”. Does Lake Forest, New Trier, and Stevenson need feeder schools as separate districts? They pride themselves on working with those districts for preparation at the High School level… So, if Naperville, Geneva, St Charles and others are successful Unit K-12 districts, don’t tell me old studies that don’t show consolidation working as this current concept. All of those married a debtor school to a district in the black… Start now.

- JustRight - Monday, Jun 26, 17 @ 1:15 pm:

IL property taxes are the highest in the Nation. Proposal is for a freeze at the highest rates. Am I missing something? How is this a devastating cut? And isn’t property taxes just a percentage? Even with a freeze, if property values go up so will property tax revenue, even without a “rate” increase.

- Precinct Captain - Monday, Jun 26, 17 @ 1:18 pm:

So much for the education governor!

- Roman - Monday, Jun 26, 17 @ 1:26 pm:

== Need to give the power back to individual property owners to decide what is best in their local district. ==

I believe we have school board elections in Illinois (except for Chicago.) If you don’t like what your local taxing bodies are doing, vote them out, or you could run for a spot on one of those boards yourself. I’m amazed by the number of uncontested village, school, park, and library board elections there are in my neck of the woods.

- Joe M - Monday, Jun 26, 17 @ 1:36 pm:

==IL property taxes are the highest in the Nation. Proposal is for a freeze at the highest rates. Am I missing something? How is this a devastating cut?==

It is a devastating cut because Illinois State budget support for schools is the LOWEST per pupil in the Nation.

- JS Mill - Monday, Jun 26, 17 @ 1:45 pm:

=All entities that rely on property tax should fist estimate what the income they can generate from a tax levy may be - and then learn to build their operations around that number. =

Umm, yeah welcome to how it is done. I am guessing you have a lot of suggestions on how government should “work” but have never run for office, attended a public body meeting, been put on the agenda, made public comment, sat with local leaders to see how they actually work. It is always easier to shout from behind the bushes.

Unfortunately for your theory there are things we are required to do by the state and federal government that also cost money. Money the state and federal government are supposed to provide but do not.

So we should punish kids, fir teachers and other staff, and pay minimum wage because they don’t deserve since you are a ditch digger and only make minimum wage yourself.

=PTELL created a monster of an ever increasing levy with no ability to look at cost control, the 2/4 year levy freeze is a step in the right direction.=

PTELL is a prime example of political pandering. People wanted “tax caps” and they got them. Schools lost out when the value of real property was increasing at historic rates. Now they get CPI and their levy every year which hammers homeowners when values drop.

=Need to give the power back to individual property owners to decide what is best in their local district.=

You already have that. It is called an election. You elect a school board to oversee the district and they hire professionals to run day to day operations.

I know- they are all in cahoots yada, yada, yada….

- Mama - Monday, Jun 26, 17 @ 2:24 pm:

RNUG, what are the pro’s and con’s of a Property Tax Freeze?

- Anonymous - Monday, Jun 26, 17 @ 2:27 pm:

If they don’t do something about property taxes soon you will just have a bunch of empty houses to collect from because everyone left.

- MacombMike - Monday, Jun 26, 17 @ 2:52 pm:

You know what else is costing school districts nearly $800 million o ver 2 years? TIF

Follow California and eliminate TIF from state law.

- Curl of the Burl - Monday, Jun 26, 17 @ 2:55 pm:

Macomb Mike - and the school administrators who “testified” last Friday pretty much admitted what you typed.

- Elliott Ness - Monday, Jun 26, 17 @ 3:19 pm:

The bottom line for many districts is that between property tax freeze and potential pension cost shifts, there is less than half the amount lost going into the new evidence based formula by anyone’s best guess. So, they move one step toward adequacy and then two steps back when the property tax freeze, coupled with a cost shift hits. All the while, Chicago is exalted from the freeze- if they are exempted, all schools in similar shape based on the tier structure should be.

- JS Mill - Monday, Jun 26, 17 @ 3:45 pm:

=You know what else is costing school districts nearly $800 million o ver 2 years? TIF

Follow California and eliminate TIF from state law.=

Bingo!!

But local governments love them some TIF. They are a total rip off!

- Paul - Monday, Jun 26, 17 @ 5:55 pm:

Only reason Madigan is whining is because if there is a freeze, his law firm won’t get any money from any work they provide. Honestly, it’s not that hard to connect the dots

- cdog - Monday, Jun 26, 17 @ 5:59 pm:

This is a truckload of “bs” from the Sale Barn, “assumes that every district will increase its levy by the full Consumer Price Index (CPI).”

It’s good to see a lot of the commenters get it.

The billions of $s spent on education in Illinois are achieving a “33% ready for the next level.”*

Why do democrats think the only solution is throwing more money at a problem?

Having your eye on the next billion in our wallets, is unbelievable. This Blue Mecca State is heading down the slippery slope faster than I thought.

*https://www.illinoisreportcard.com/State.aspx?source=trends&Stateid=IL

- Rich Miller - Monday, Jun 26, 17 @ 6:00 pm:

===his law firm won’t get any money from any work they provide===

The freeze is on the levy. So, if you knock down your shack and build a mansion, I think you’re gonna have to suffer through a higher assessment.