* Press release…

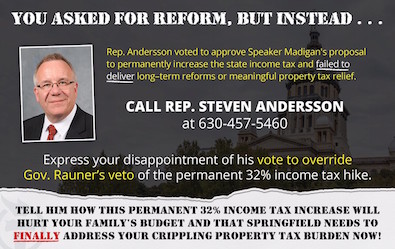

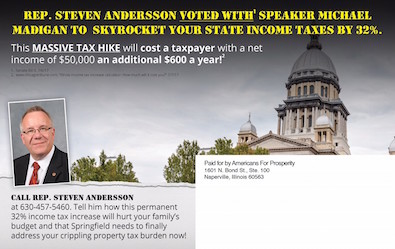

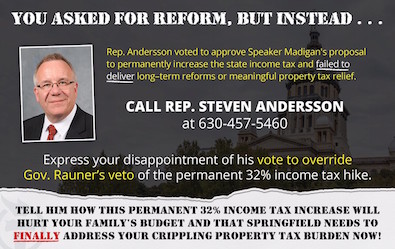

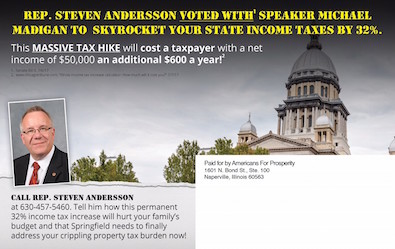

Americans for Prosperity-Illinois (AFP-IL) today announced the roll out of its accountability effort targeting 16 state representatives who voted to override Governor Rauner’s veto of SB9, House Speaker Michael Madigan’s proposal to permanently increase the state income tax by 32 percent. AFP-IL consistently advocated against increasing income taxes throughout the legislative session and has called for a long-term property tax freeze instead. The accountability campaign includes targeted digital ads, direct mail, and grassroots activities.

“We’re disappointed Springfield failed to provide taxpayers relief from their crippling property tax burden yet voted to demand they forfeit more money to the state by permanently increasing their income tax bill by 32%. A bipartisan majority of residents from all over the state supported a long-term property tax freeze, yet lawmakers overrode Gov. Rauner’s veto and passed the permanent income tax hike to help fuel an unbalanced budget,” said AFP-IL State Director Andrew Nelms. “This massive tax increase will cost a taxpayer with a net income of $50,000 a year more than $600 annually. Hardworking Illinoisans are already overtaxed and we want to make sure struggling families know which politicians failed to relieve their property tax burden and instead made living in the Land of Lincoln even more unaffordable.”

* I don’t have the full target list, but here’s one of the mailers…

*** UPDATE 1 *** Here’s the target list…

Steven Andersson - 65th District

Daniel Beiser - 111th District

Deb Conroy - 46th District

Fred Crespo - 44th District

Mike Fortner - 49th District

Michael Halpin - 72nd District

David Harris - 53rd District

Stephanie Kifowit - 84th District

Natalie Manley - 98th District

Bill Mitchell - 101st District

Anna Moeller - 43rd District

Brandon Phelps - 118th District

Sue Scherer - 96th District

Carol Sente - 59th District

Michael Unes - 91st District

Kathleen Willis - 77th District

*** UPDATE 2 *** Pritzker campaign…

The Koch brothers launched new attacks on 16 state legislators who voted to override Bruce Rauner’s reckless budget veto. Americans for Prosperity-Illinois, the local dark money group funded by the Koch brothers, announced their new digital and direct mail campaign earlier today.

Two weeks ago to the day, Bruce Rauner suffered an embarrassing defeat after bipartisan members of the General Assembly successfully overrode his veto four times. In the weeks since, nearly two dozen members of Rauner’s staff were either fired or resigned in protest, as Rauner staffed up with new right-wing hires from the Koch network funded Illinois Policy Institute.

As Bruce Rauner prepares for an all-out war to force his special interest agenda on Illinois, it comes as no surprise that the Koch brothers would send in their attack dogs to do Rauner’s dirty work.

“Bruce Rauner and the Koch brothers are ready to punish anyone who isn’t fully committed to propping up their failing agenda,” said Pritzker campaign spokeswoman Jordan Abudayyeh. “After a mortifying public defeat, it’s clear that Rauner, his new team of radical right-wing staff, and the Koch network will continue working to create devastation across our state.”

- Franklin Delano Bluth - Thursday, Jul 20, 17 @ 9:19 am:

Vengeful and petty. It would be fun to watch the Rauner administration devolve into a high school gossip circle, if it weren’t so scary.

- Red Rider - Thursday, Jul 20, 17 @ 9:19 am:

It’s a good thing we don’t have 4$ gas. Free license plates,lunch,lodgeing and a part time job.

- Mittuns - Thursday, Jul 20, 17 @ 9:22 am:

Nice work. This is how you recapture your beloved super minority status in the legislature.

- Anonymous - Thursday, Jul 20, 17 @ 9:23 am:

This should be helpful to Rauner when the SB 1 (education funding reform bill) override veto vote comes to the floor. Just like Trump in D.C., Rauner is no longer feared by members. SAD! Rude awakening.

- dray - Thursday, Jul 20, 17 @ 9:24 am:

Lions and tigers and ADJECTIVES! Oh my!

$50 /mo or $25 per pay. Massive. #eyeroll

- SAP - Thursday, Jul 20, 17 @ 9:25 am:

== targeting 16 state representatives who voted to override Governor Rauner’s veto of SB9== Wasn’t it 10 Reps and one Sen on the override?

- Spliff - Thursday, Jul 20, 17 @ 9:26 am:

Nope no collusion with the Koch Brothers. Please move along, nothing to see here.

- Anonymous - Thursday, Jul 20, 17 @ 9:28 am:

“That outta do it, thanks very much, Ray.”

- Arock - Thursday, Jul 20, 17 @ 9:30 am:

Both sides play the same game, get over it people.

- Oswego Willy - Thursday, Jul 20, 17 @ 9:30 am:

Rauner spent, first $20 million, later $50 million, $70 million just to control the Raunerite Caucuses so no $&@#% problems occurred.

So, now AFP will try to rip apart GOP members tired of Rauner’s purposeful destruction of Illinois so when the time comes Rauner, a sitting governor, will, in actuality, have a whole slate of challengers to his own party’s (Raunerites) incumbent members.

It would be far more honest of Diana and Bruce if Bruce would say…

“I will bury them, I will make them radioactive, they will never get another elected position anywhere, ever. I will bankrupt their credibility with phony ads and mailers. I don’t know if they have families or not, but if they do, they better think twice about putting on the TV or checking the mailbox”

Diana and Bruce might “think” all that. Not hard to imagine Bruce using language like that. Diana will approve, the $9 million to Raunerites to defeat Democrats, like “her” tells me so.

I’m with these GOP members the RaunerS want destroyed.

Their only fault, these Republicans, was the ending of Diana and Bruce’s destruction of Illinois.

- Fixer - Thursday, Jul 20, 17 @ 9:31 am:

Or call them and thank them for voting to halt the destruction of the state by Governor Victim.

- Jocko - Thursday, Jul 20, 17 @ 9:31 am:

Perhaps AFP can share with us how a long-term property tax freeze will lead us to prosperity.

- wordslinger - Thursday, Jul 20, 17 @ 9:33 am:

AFP must be honked that Rauner didn’t use his power to put a brick on the bill for 60 days before vetoing.

If his true objective was to stop the tax increase, targeted mailers before an override vote could have made a difference.

I hear Rauner even has a few dollars in his campaign fund that could have gone toward a targeted anti-tax-increase media campaign.

I wonder why Rauner didn’t do those things?

Now, the effort is just politics. The horse is out of the barn.

- Oswego Willy - Thursday, Jul 20, 17 @ 9:33 am:

- SAP -

We all needed the 16 to finally get to the 11…

- illini - Thursday, Jul 20, 17 @ 9:35 am:

My Rep was one of those who voted to override the veto, but did not vote to approve the final bill.

He had always been a loyal supporter of the Rauner agenda.

I wonder if he will be targeted?

- DownstateKid - Thursday, Jul 20, 17 @ 9:36 am:

Solid mailer - B+. A permanent hike which Moody has said doesn’t address underlying pension issues and the rating agency is still considering junk status.

Hey OW, if Governors own downgrades, then if/when Moody’s pushes CPS bonds to junk in the next 2 years, who owns that? Rauner? Claypool? Unions? Madigan? Bueller?

- A Jack - Thursday, Jul 20, 17 @ 9:36 am:

The best option for these 16 GOP is to continue doing what is right for their constituents and Illinois.

The next issue will be SB1. If Rauner vetoes or AV’s the bill, would your constituents care more about Rauner’s objective of bankrupting pensions or if the schools open in the fall?

- Soccermom - Thursday, Jul 20, 17 @ 9:37 am:

“NET” income. Can someone cleverer than I am please figure out what the likely gross is? (Which, of course, is the number people generally think of when they talk about their income)

- Anon221 - Thursday, Jul 20, 17 @ 9:38 am:

Sorry, AFP-IL, I’m not interested in letting a bonfire grow into a wildfire. And, it wasn’t disappointment I was feeling the day of the override vote. But, I promise, I will recycle your flyer.

- DownstateKid - Thursday, Jul 20, 17 @ 9:42 am:

Effective Ad - B

Hey Willy, you said Governors own downgrades, then what happens when Moody’s pushes CPS rating to junk in the next 24 months? Who owns that doozy: Rauner? Claypool? Madigan? Bueller?

- VanillaMan - Thursday, Jul 20, 17 @ 9:42 am:

Hey ILGOP - heck of a governor you foisted on us, eh? He’s really taking those arrows, isn’t he? You schmoes got played, didn’t you?

When the leader of ILGOP seeds groups committed to your demise, Rauner seems to look more like what popped out of Kane’s chest during the meal scene from the movie Alien, right?

If you care about conservative government and want to bring efficient government to all, well, as you now know - Rauner isn’t going to be a part of that plan. He favors voodoo anarchism to send Illinois to the minor leagues among US states. Rauner listens to Miss Cleo more than experienced ILGOP leaders for governing advice.

You thought the Blago/Quinn years were bad for ILGOP? It was better to lose with Brafy than win with Rauner, wasn’t it?

- Williamson County Resident - Thursday, Jul 20, 17 @ 9:46 am:

The anti-tax sort can’t let go of the 32% increase in taxes line. While mathematically correct it is a rhetorical distortion and ploy to make it sound worse than it really is, a rate increase from 3.75% to 4.95%. [snark on] The AFP is throwing nickels around like they’re manhole covers. [snark off]

- Highland IL - Thursday, Jul 20, 17 @ 9:47 am:

McCarter hosted an AFP meeting in O’Fallon last night. He’s already saying he’s putting up challengers to Meier & Cavaletto.

AFP has also been the money behind Madison County Chairman Kurt Prenzler as well.

- Oswego Willy - Thursday, Jul 20, 17 @ 9:49 am:

Governors own, they always do.

Rauner can choose to address the downgrades, or not in his time left, but all the downgrades since Rauner raised the wrong hand but took the oath anyway, they are all on Rauner, Mike Schrimpf and Candidate Rauner tell me so…

===“Illinois’ credit rating has been downgraded 13 times under Pat Quinn and now, because of his failed leadership, our state’s economy and finances are still broken. Pat Quinn put special interest politics ahead of Illinois workers. We need to change direction before it’s too late.” – Rauner campaign spokesperson Mike Schrimpf […]===

Capiche?

- The Way I See It - Thursday, Jul 20, 17 @ 9:52 am:

Excellent point, Wordslinger. Forgotten whether the tax hike was retroactive - if not, the prompt veto cost everyone taxes (horrors!) by sending it back for an immediate override.

What I actually hate about this is that the alternative was junk status - and these Republicans could have done nothing to avoid it by failing to override.

- DownstateKid - Thursday, Jul 20, 17 @ 9:58 am:

Interesting. So, by using that baseline, can we agree that Gov. Edgar is the real reason behind the mess since his delays in pension payments will only hamstring the ability of the general assembly to maintain services, much less improve them?

Especially since Moody’s noted that without structural changes, the odds of a ratings increase is slim. And this all goes back to a handful of Governor decisions over the past several decades?

- Oswego Willy - Thursday, Jul 20, 17 @ 10:04 am:

Aw, - DownstateKid -

Your beef is with Mike Schrimpf. You should take all that up with him.

According to Rauner and Schrimpf, it was Quinn, under Quinn’s watch that nothing was done to fix it.

Now, Rauner gets to wear the jacket.

Good try, thou… but… reading is fundamental.

They call it the Edgar Ramp because… governors own.

The “after”, what other governors ha e done / not done, that’s on them.

Schrimpf and Rauner understood that, why don’t you? LOL

- Bigtwich - Thursday, Jul 20, 17 @ 10:05 am:

President Roosevelt during the 1938 primary was at a campaign appearance that included Senator Walter George. After saying what a personal friend George was Roosevelt endorsed George’s primary opponent. After he was reelected and during a conference on a bill one Senator said “Franklin is his own worst enemy.” And Walter George said - “Not as long as I’m alive, he’s not.”

- Skeptic - Thursday, Jul 20, 17 @ 10:09 am:

@Williamson County Resident: And don’t forget that Rauner campaigned that by keeping the 2014 tax rate at 5% in 2015 (i.e., not raising or lowering) it was a 67% tax increase. There’s logic to support that I suppose, but man is it twisted.

- DownstateKid - Thursday, Jul 20, 17 @ 10:13 am:

Aww, Oswego, you think I am some Raunerite, which is precisely where your argument deteriorates.

See, because I analyze municipal finance, I am merely a steward of black and red. Some of top municipal finance analysts in the industry are blinking exhortatory signals to the state simply stating that current trends are unsustainable.

Population emigration + weak economic growth + increased % of rev. going towards pension payments + destabilized manufacturing base in Central Ill. = trouble.

Hence, why Moody cited a potential downgrade to Junk despite the permanent income tax. So when JB, Bliss, Kennedy (lol) are the next Gov., how do they solve this? I’ve never gotten a halfway decent answer to that on here besides banal, platitudes about compromise.

If anyone can answer that, I would happily switch back to lurker mode.

- James Knell - Thursday, Jul 20, 17 @ 10:15 am:

AFP = We don’t need no stinking government. Let us run everything and you will be JUST FINE.

- Last Bull Moose - Thursday, Jul 20, 17 @ 10:16 am:

The Republicans that survive this onslaught may be the kernel of a new party. Republicans need to consider their Plan B if Rauner loses.

- illini - Thursday, Jul 20, 17 @ 10:19 am:

@Highland - it is interesting to note that McCarter already has two candidates who intend to run in the Primary for the seat he is vacating. From what I can determine each is trying hard as they can to be carbon copies of him.

- AC - Thursday, Jul 20, 17 @ 10:19 am:

Wow, it looks like Sara Wojcicki Jimenez isn’t on that list.

- Rich Miller - Thursday, Jul 20, 17 @ 10:19 am:

===Aww, Oswego, you think I am some Raunerite, which is precisely where your argument deteriorates. ===

Posted by “DownstateKid,” Tuesday, Jul 11, 2017…

===As a Rauner supporter, Pritzker is my top choice. Good luck motivating the base with a billionaire with inherited his entire net worth. ===

https://capitolfax.com/2017/07/11/kennedys-latest-poll-has-him-holding-at-44-percent/#comment-12774184

- DownstateKid - Thursday, Jul 20, 17 @ 10:24 am:

Yes, I am a Rauner supporter considering there is no official primary challenge yet. Being a supporter of someone does not = hero worship.

Rauner made critical mistakes that have been documented here repeatedly and in your columns Rich.

There is also millions of Clinton supporters who were Bernie Sanders folk who plugged their nose and voted away.

Chris Kennedy was someone I was eyeing but he is swimming in the chum right now.

- i - Thursday, Jul 20, 17 @ 10:25 am:

Thanks Rich - there is always a paper trail.

- illini - Thursday, Jul 20, 17 @ 10:26 am:

Sorry - “i” was me.

- Oswego Willy - Thursday, Jul 20, 17 @ 10:28 am:

===…you think I am some Raunerite, which is precisely where your argument deteriorates.===

No, you asked who owns it now, I answered. You stick with numbers. I don’t care your thought processes within your lil cocoon, that’s the governing and the politics to it.

===See, because I analyze municipal finance, I am merely a steward of black and red.===

Ok. Congratulations?

===Some of top municipal finance analysts in the industry are blinking exhortatory signals to the state simply stating that current trends are unsustainable.===

Oh, and…

===why Moody cited a potential downgrade to Junk despite the permanent income tax===

The sole sitting governor of Illinois tells me to ignore Moody’s.

=== So when JB, Bliss, Kennedy (lol) are the next Gov., how do they solve this===

When… JB, Bliss, Kennedy (lol) or the next Gov. have me speak for their campaigns and let me know their plans, I’ll issue a press release.

Maybe you should ask them? With your celebrated background you could give the financial answer that… now you may want to check… is constitutional.

===If anyone can answer that, I would happily switch back to lurker mode.===

Or you could reach out to any/every campaign with your own answer or you could put out an answer here and maybe someone can pick it up?

You asked a political diagnosis and wanted a policy answer with the baser including the solution.

Numbers are your thing maybe.

- Lucky Pierre - Thursday, Jul 20, 17 @ 10:28 am:

Population emigration + weak economic growth + increased % of rev. going towards pension payments + destabilized manufacturing base in Central Ill. = trouble.

Hence, why Moody cited a potential downgrade to Junk despite the permanent income tax. So when JB, Bliss, Kennedy (lol) are the next Gov., how do they solve this? I’ve never gotten a halfway decent answer to that on here besides banal, platitudes about compromise.

Again the Democrats have no plans for economic development.

JB sends out mailers all of the time that say nothing about fixing Illinois.

Now that they have permanently raised taxes, the Speaker promised to address needed reforms. Who believes him?

- walker - Thursday, Jul 20, 17 @ 10:34 am:

Looks like AFP now has two “field” offices in and near Roskam’s district, and are stepping up training and recruiting of canvassers, phoners, and other political volunteers. Never saw them seriously build a field force before.

- Mockingjay - Thursday, Jul 20, 17 @ 10:34 am:

DownstateKid, please keep posting, this site needs you

- Earnest - Thursday, Jul 20, 17 @ 10:40 am:

>Especially since Moody’s noted that without structural changes….

>See, because I analyze municipal finance, I am merely a steward of black and red….

>So when JB, Bliss, Kennedy (lol) are the next Gov., how do they solve this? I’ve never gotten a halfway decent answer to that on here besides banal, platitudes about compromise.

>If anyone can answer that, I would happily switch back to lurker mode.

I don’t want you to go back to lurker mode. You’re one of the rare pro-Rauner commenters who phrases things in different words than the talking points, and whose replies relate to what you’re talking a bout instead of bringing it right back to the talking points.

Can you help me understand how the current Republican candidate for governor would solve this if he were elected? What structural reforms do you think would help our rating and what would be their impact in red and white dollars? Can you help me understand the difference between the current annual costs of pensions versus the debt we ran up? Do you feel that passing a budget that was sort-of balanced and a permanent tax increase is going to make things worse than the way Rauner was spending out of control and running up debt since elected? /snark, but also hopeful for some honest conversations about the future of the state.

- Grandson of Man - Thursday, Jul 20, 17 @ 10:42 am:

AFP attacks after a tax hike are more certain than sunrise. I have tremendous respect and admiration for the Republicans who’d had enough of the budget crisis. I will never again say these people are owned by Rauner and his millions.

If this was indeed a ploy by Rauner, to get much-needed revenue without voting for it, he’s pretty darn cruel with his staff firings. It seems like he’s very angry at failure to stop the tax hike. If he needed it and refused to fight the override–which is what happened–wow, his staff was used terribly.

Either way, I’m relieved that Rauner lost a key leverage point–revenue. I found it very cruel to use the most vulnerable, higher ed, vendors and the rest as hostages for irrelevant nonsense like term limits, and for a long time, anti-union demands.

- Nick Name - Thursday, Jul 20, 17 @ 10:45 am:

How did Rep. Jiménez escape being on the list?

- walker - Thursday, Jul 20, 17 @ 10:46 am:

Mine above about AFP field force, reflected my own ignorance. They apparently have been around for a while, and call their many canvassers “torch bearers.” I just haven’t run into them in the field before this year. They are clearly focusing on Roskam.

- Oswego Willy - Thursday, Jul 20, 17 @ 10:52 am:

- Lucky Pierre -

For only the 756th time (but rising), Rauner told me to ignore Moody’s

You find out why Rauner keeps ignoring Moody’s, for your own sake.

And, yet again, please note the Schrimpf comment about Quinn and downgrades.

What I’m gathering…

Rauner, who said governors own downgrades, and wants us all to ignore Moody’s… must not care too much that he will get blamed fit the downgrade… and that ignoring Moody’s is Rauner welcoming the downgrade?

Why are you not up in arms, - Lucky Pierre -, lol

- Norseman - Thursday, Jul 20, 17 @ 10:53 am:

These legislators knew they would be the target of the AFP et al. but still voted to do what had to be done to end Rauner’s devastating impasse. They are true profiles in courage. Good luck to all.

- Saluki - Thursday, Jul 20, 17 @ 10:53 am:

This may be a leap of logic, but I don’t a large on.

I don’t think Rauner or the IPI understand that most of the talent pool available to run in a primary against the Reps they are seeking to oust have long standing relationships with those very same elected reps.

So in many cases it is going to take a serious scrapping of the bottom of the barrel to find a candidate, who even if they win, are going to find dealing with a general election difficult.

Be careful what you ask for IPI/Rauner. Your primary challenges may in the end in primary victories, but general election flops.

- Sir Prized - Thursday, Jul 20, 17 @ 10:57 am:

How come Sara W J missed the hit list?

- Demoralized - Thursday, Jul 20, 17 @ 11:13 am:

==how do they solve this?==

Rauner hasn’t figured it out and he’s the Governor now.

==JB sends out mailers all of the time that say nothing about fixing Illinois.==

He’s not the Governor. He’s campaigning. And he’s got pretty good material right now if he can stay on message. We’ve got a Governor who hasn’t accomplished anything. I’d beat that drum all day long.

==besides banal, platitudes about compromise.==

LOL. Hasn’t that been your talking point day in and day out about Madigan? That he won’t compromise.

- Demoralized - Thursday, Jul 20, 17 @ 11:16 am:

More evidence that the Governor is writing off the remainder of his term. This is completely about the election now. I don’t think anyone should waste time talking to him anymore. If they can keep this coalition of Republicans going on budget issues then they keep the Governor as an irrelevant person.

- ILGOV2018 - Thursday, Jul 20, 17 @ 11:19 am:

Lucky Pierre:

Rauner never gave specifics on how he was going to fix things either. Blame Madigan, blame Cullerton, Shake up Sprinfield. Ummmm…. and blame Madigan.

- Lance Mannion - Thursday, Jul 20, 17 @ 11:20 am:

#AnderssonIsToast

- Lamont - Thursday, Jul 20, 17 @ 11:22 am:

I think a progressive tax coupled with a property tax reduction is a good starter to restoring Illinois’ finances. The tax burden would be lessened on those most affected (middle and working poor classes) and raised on those that can afford it (the JBs, Rauners, Griffins, etc). Mix in some workers comp reform, tax credits for companies that keep and maintain employment instate, along with reductions in the budget. I know Rauners heads of departments can’t find anywhere to cut, but I know if you ask the rank and file you’d find plenty places to cut. I know we can cut in my section for sure. It doesn’t necessarily have to lead to layoffs, but you could choose to not fill positions when they become vacant and slowly phase them out. My unit, for instance, has 10 employees. We could easily lose 2 employees and not skip a beat, but our t/o mandates 10. We could have a 20% reduction in expenses almost immediately (I’m not advocating layoffs, but we have two people retiring in the next 3 years—why fill their spots?). Anyway, that’s my 2 cents, and I’m just a grunt.

- James - Thursday, Jul 20, 17 @ 11:39 am:

You can’t govern effectively if you don’t make and develop allies where there is mutual trust. This mailing may hurt him in a future override vote–some of these folks have nothing left to lose.

I wonder if the housecleaning is another of his “emotional reactions”, and that IPI employees were the only ones positioned to make a quick, group transition. My guess is that there has been nonstop steam coming out of his ears since around July 1st.

- DownstateKid - Thursday, Jul 20, 17 @ 11:40 am:

Here is what Willy keeps referring on Rauner and Rating Agencies:

—–Don’t listen to some Wall St. firm. That’s not what matters. Listen to the people of Illinois. It’s their concern, it’s their lives… Don’t listen to Wall St., don’t listen to a bunch of politicians who want power and to stay in power like they’ve been for 35 years. Listen to the people of Illinois. People of Illinois don’t want more taxes on their lives. People of Illinois want more jobs. People of Illinois want property tax relief. People of Illinois want a better future for their kids and their grandkids. People of Illinois want a political system that works for them not for the political insiders. And term limits can help get that done. And the people of Illinois want those things.—-

What Rauner was saying throughout the budget was simply: If the state doesn’t structurally change itself for the LONG-TERM, then any budget (balanced or unbalanced) is irrelevant because the pension payments will necessitate a larger share of future revenue. In traditional economics, you basically have two ways to raise rev. increased growth or taxation.

Now here is Moody’s after the budget was passed: “Unfunded pension liabilities remain a fundamental credit challenge and they are still rising,” Moody’s said. “Illinois has failed to enact pension reform measures that improve the long-term sustainability of its pension burden without running afoul of its constitutional protection of pension benefits.”

Again, this isn’t IPI, Rauner, Bliss, Me, Madigan or any spinning here. It’s flat out saying that the Illinois economy is facing FUNDAMENTAL issues. This is the single biggest question that every single Governor hopeful should be able to answer explicitly and clearly throughout the election season.

I’m not some anti-taxation yo-yo, but I (like anyone) believe that if taxes rise there should be a corresponding service the Gov. is providing. Maybe that’s strengthening our Universities or helping DCFS staff-up or maybe even roads that are destroyed every March.

But that’s not going to happen in Illinois. Or Connecticut. Or Kentucky. Or Puerto Rico. This isn’t a democrat vs republican issue. It’s a math problem.

“Can you help me understand how the current Republican candidate for governor would solve this if he were elected?”

Again, Rauner has stated a billion times that you have to grow your way out of a crisis. That’s a fact. Like stated above, if you want more rev. you need your existing tax base to grow through an improving economy or through taxation. Wallethub said ILL is the most burdened tax public in the nation, so the odds that increased taxation is possibly is null for either party. *Maybe progressive taxation, but I am highly skeptical of that after New Jersey and Maryland experienced a disaster when they enacted a millionaire tax*

The City of Chicago is trying to use both strategies, but consumers react to changing market forces and rarely meet the actuarial predictions in revenue forecasts. See (https://www.dnainfo.com/chicago/20170705/lincoln-square/huge-drop-bag-use-due-bag-tax-could-cost-city-millions-study-finds)

What structural reforms do you think would help our rating and what would be their impact in red and white dollars?

Me personally, the state of Illinois needs to target manufacturing reform. Decatur, Quad Cities and Peoria are anchored by big manufacturing companies. Right-to-work isn’t as big of a deal for them as it is on teacher union’s front, but overhauling corporate taxes (both nationally & locally) to allow these companies to repatriate foreign earnings and changing compensation laws would be a great start. If central Illinois gets hollowed out, the rest of the state is going to feel it and already is feeling it.

Can you help me understand the difference between the current annual costs of pensions versus the debt we ran up?

Pension debt is a long-term problem and the $15 billion in backlog bills is a short-term problem.

Do you feel that passing a budget that was sort-of balanced and a permanent tax increase is going to make things worse than the way Rauner was spending out of control and running up debt since elected?

Snark as indicated, but again the budgets of Bruce Rauner, JB Pritzker or Daniel Bliss are materially unimportant if the state continues to see an eroding tax base and a growing percentage of state rev. going towards pensions. People will only see their tax bill grow or remain steady, all while state services decrease. And this is coming now. Not 10 years from now. Not in another lifetime. Now. This isn’t a doomsday, Alex Jones-esque conspiracy. It’s simply promises that were made that now have be kept by constitutional law.

Derek Thompson from the Atlantic wrote a great piece on this: https://www.theatlantic.com/business/archive/2017/07/connecticut-tax-inequality-cities/532623/

- downstate commissioner - Thursday, Jul 20, 17 @ 11:42 am:

Lamont-Progressive income tax-okay. Property tax reduction does (capitalized) not help the state; it only hurts local governments and schools. Property tax Reform would be okay, but to just cut the locals’s income without replacement income is just stupid…

- Oswego Willy - Thursday, Jul 20, 17 @ 11:51 am:

===What Rauner was saying throughout the budget was simply…===

“Ignore Moody’s”

If you’re explaing you’re losing.

Lots of words.

You’re a money guy, you told me.

You told me it’s all about the financials.

All those words…

All. Those. Words.

Not one number did you use. Not one dollar(s) did you cite. You have nothing but hollowness in your argument, and as a “money, numbers” person, you used a lot of words to stay away from… “dollars, financials”

All you yap about had been measured to 1.4% or $500+ million, and it since a nothing.

Good luck - DownstateKid -

lol

- GOP Extremist - Thursday, Jul 20, 17 @ 12:02 pm:

Why isn’t Rep Jiminez on hit list?? It’s very possible she voted exactly as instructed. Follow the money for her coming campaign .

- DownstateKid - Thursday, Jul 20, 17 @ 12:09 pm:

Numbers aren’t much fun to read for your average person, hence why municipal bond reports get little traction except when it affects people’s paychecks.

But here are some numbers: Since 2001, pension systems have projected growth of their underlying assets (mutual funds, IRA, money market accounts, etc.) to average 12.3% per annum. 2008/2009 destroyed those future returns.

In 2015, things got worse: Source: http://cgfa.ilga.gov/Upload/FinConditionILStateRetirementSysMar2017.pdf

Currently, Illinois owes $130 billion to workers’ pension funds.The Illinois Teachers’ Retirement System has a $73 billion shortfall.

The new budget saves roughly $900 million over five years because it phases in the payments. With a funding ratio of roughly 40% and total liabilities exceeding $200 billion, around 25% of the state’s budget will go towards servicing pension debt in the next few years.

If that’s too many words, I can shorten Willy.

- Oswego Willy - Thursday, Jul 20, 17 @ 12:10 pm:

===Why isn’t Rep Jiminez on hit list?? It’s very possible she voted exactly as instructed. Follow the money for her coming campaign .===

The 20+ Rauner firings seem to be a factor you may want to consider when thinking a pass might be given.

Just something to consider.

- Oswego Willy - Thursday, Jul 20, 17 @ 12:15 pm:

===Numbers aren’t much fun to read for your average person, hence why municipal bond reports get little traction except when it affects people’s paychecks===

Are you now saying I’m not smart enough to understand numbers?

Sounds an awful lot like you think I can’t understand numbers.

Rauner says 1.4% and $500+ million ARE the measurables.

You have other numbers, have at it.

I’m sure - RNUG - might be interested. We all aren’t rubes.

===The new budget…===

Rauner vetoed the new budget. So there’s that.

Plus, pointing to the broken plate, according to you, isn’t fixing the plate.

What are your solutions?

- GOP Extremist - Thursday, Jul 20, 17 @ 12:16 pm:

Something else to consider is Rauner was gifted with a functioning government and a campaign issue.

- Paddy - Thursday, Jul 20, 17 @ 12:20 pm:

Any idea why Terri Bryant wasn’t included on the list?

- DownstateKid - Thursday, Jul 20, 17 @ 12:28 pm:

–Are you now saying I’m not smart enough to understand numbers? Sounds an awful lot like you think I can’t understand numbers.–

No? I said your average person doesn’t have time to read 163 page report on pension return expectations and performance. I’m paid to do so, so I did.

I don’t know you, but from reading your posts over these past couple years, it appears that politics and messaging are important to you. I would say it’s important to the electorate too, but it means hogwash to me.

In the end, if the pension problem isn’t solved, it will be the average IL. citizen that is hurt.

- Oswego Willy - Thursday, Jul 20, 17 @ 12:31 pm:

===end, if the pension problem isn’t solved, it will be the average IL. citizen that is hurt.===

So.

In other words, you have nothing.

Thanks for asking your question of me. lol

- COPN - Thursday, Jul 20, 17 @ 12:31 pm:

Looks like the Republicans in a university town and/or high concentration state employee districts were left off the list

- Arthur Andersen - Thursday, Jul 20, 17 @ 12:38 pm:

In my experience, OW understands pension funding as well as any commenter on this blog. No newbie needs to make assumptions on his or anyone else’s behalf. Put out the figures and we’ll go from there.

In your case, Boy, yours are wrong. I don’t know where you got that 12.3% growth number, but it doesn’t correlate with the actuarial return assumptions, historical growth, or projected asset growth. Further, the 40% funding ratio and $200 billion unfunded liability (a SWAG on your part) are calculated using different discount rates and don’t belong in the same paragraph. Finally, the new smoothing requirements only moderate the growth in the unfunded, not eliminate it. Payment is deferred, not saved.

Now what does this have to do with a target list?

- DownstateKid - Thursday, Jul 20, 17 @ 12:42 pm:

– In other words, you have nothing. Thanks for asking your question of me. lol –

I answered it. Cut corporate tax rate, reduce worker’s comp, target central Il. for emigration problem by tax credits to manufacturing jobs, transition all workers to a 401k or 403b style in state government by changing the constitution, request a Federal arbitrator to deal with a CPS bankruptcy similar to New York in the 70’s and prayer the economy doesn’t tank in the next 5 years. These are both national and Illinois combined reforms because I think rate-to-work gets a national law over the next few years.

- Oswego Willy - Thursday, Jul 20, 17 @ 12:42 pm:

- AA -, thanks.

I’m also smart enough to know to defer to you, and - RNUG - to really go deep and break it down, as far as commenters go.

Much respect,

OW

- Oswego Willy - Thursday, Jul 20, 17 @ 12:46 pm:

- DownstateKid -

Numbers.

Where o where are the numbers?

And you want bankruptcy fir CPS… AND … a constitutional change?

Hmm.

The numbers. You bemoan the numbers. Where are your numbers.

Rauner’s are 1.4% and $500+ million.

No help.

- Earnest - Thursday, Jul 20, 17 @ 12:49 pm:

>DownstateKid - Thursday, Jul 20, 17 @ 11:40 am

Thank you–I appreciate your thoughtful response. I think, for me, I don’t like the criticisms by many of the current budget and tax increase which talk about the long or even medium term future. It’s a start at living within our means and a permanent tax increase is what I would consider a structural reform that hasn’t been done before. I think it’s the most positive thing that’s happened for the states economic environment in decades. Lots and lots I hate in there, but I admire and celebrate the fact that it’s been done.

Without diminishing that, I agree we should have a high sense of urgency to get more done in terms of our approach to revenue and spending strengthening our economy. We can’t cope with the next recession at this point. There’s a lot of room to discuss the business environment in the state or the role of unions. There were some really interesting discussions on the role of unions a number of years ago when contract negotiations with Quinn were pretty inflamed and the pension reform bill was being passed. If memory doesn’t fail me, a number of our commenters currently being painted as being in the unions’ pockets now were then being painted as very anti-union.

I’d love to see the bipartisan efforts of the legislators continue. I think there’s a lot of potential for Illinois at this time with divided government in the legislative branch.

- DownstateKid - Thursday, Jul 20, 17 @ 12:52 pm:

-Further, the 40% funding ratio and $200 billion unfunded liability (a SWAG on your part) are calculated using different discount rates and don’t belong in the same paragraph.-

They disagree with you:

http://www.gasb.org/jsp/GASB/Pronouncement_C/GASBSummaryPage&cid=1176160219444

- DownstateKid - Thursday, Jul 20, 17 @ 12:55 pm:

Earnest, I agree.

Moving back to Lurker mode because I can’t concentrate at work. Plus, this issue won’t be settled till after the election.

God speed.

- don the legend - Thursday, Jul 20, 17 @ 1:04 pm:

I thank OW and DK for their arguments.

My anger is that Rauner has wasted years and billions of dollars offering only buzz phrases.

He was elected to fix the problem or at least articulate, promote and negotiate solutions both short and long term. All he has done is lie, lie and lie some more all the while campaigning and not governing.

Rauner failed.

- Highland IL - Thursday, Jul 20, 17 @ 1:28 pm:

@ illini - I’ve read about Rafael Him’s intent to run. Who is the other?

- SAP - Thursday, Jul 20, 17 @ 1:53 pm:

=We all needed the 16 to finally get to the 11…= Agreed. I thought that the half-brave 5 were on probation, pending their votes on SB 1 override.

- Roman - Thursday, Jul 20, 17 @ 2:10 pm:

== How did Rep. Jiménez escape being on the list?==

Maybe the First Lady picked the targets???

- RNUG - Thursday, Jul 20, 17 @ 2:56 pm:

== , transition all workers to a 401k or 403b style in state government by changing the constitution ==

First, - DownStateKid - has a (mostly) valid point that the the portion of the budget going to the pensions is going to consume about 25% of the State budget going forward if nothing changes.

And the pension changes in the most recent bills really aren’t going to fix things. They did allow the creation of a new Tier 3 like -kid- is proposing but, I anticipate, will cost more than Tier 2. They also allow for a voluntary shift from Tier 1 to Tier 2, or Tier 2 to Tier 3. All of that is nibbling at the problem, which is the hest you can do within the legal constraints. Mostly the changes will actually make things worse, especially in the short term.

But, and it is a really big BUT, changing the State Constitution won’t let you get out of the Tier 1 pensions. They are a contract, and you can’t unilaterally change contracts. Period, end of discussion … since State’s aren’t allowed bankruptcy. The IL SC has been crystal clear, you have to pay the pension promised to existing workers and retirees. So you have to come up with a way to afford to pay the pensions.

Growing State revenue is one way. You can do that through getting more businesses earning more money, so they pay more in taxes (what -kid- is advocating). There is some room to improve Work Comp. And you could address the corporate tax rate (also requires a constitutional amendment) by detaching it from the personal rate. My personal preference would be a complete reset eliminating all business tax loopholes and a very low rate every business has to pay.

Alternatively, you just raise the various tax rates to bring in more money, which is what was done this go around.

Reducing state expenses is another. To date, Rauner has failed at that. We can argue about the specific numbers, but the D enacted budget (even with some gimmicks) spends less than the R proposed budget (and their greater gimmicks). A lot of excess spending got squeezed out, but I’m sure a competent administrator who actually governed could find some savings … but that would require an engaged Governor who, do far, has been mostly AWOL.

So how do we get out of this mess? I’ve outlined various possibilities in the past; I may forget to o list some of them here. And some of these suggestions will get contradictory to other suggestions.

You start by recognizing you can’t negate the pension debt, you have to pay it. It’s too big to fix in one try, so you chip away at it. And you recognize the more money you can pay into it now (at least actuarial level if not more), the less money you will have to pay both later and overall.

When the Blago pension bonds are paid off, use that cash flow to make additional payments into the 5 pension funds. Don’t, as Harris is already floating the idea, use it to finance more General Obligation bonds.

The most recent bills made the local school districts liable for certain excessive teachers (loosely speaking) pensions. Go further and start the process of transferring the normal cost of the TRS pensions to the local school districts. Use the freed up State level money to pay into the TRS fund (or all 5 funds). Yes, it will cause local property taxes to go up if the local school boards can’t find other places to cut spending.

You can even do this for the Community Colleges since they also have taxing authority.

SURS is the other big pension fund, but there isn’t an easy solution for it. No way to shift the normal pension cost. About the only real difference you can make I’d to try to strictly control the salary component … but I don’t see big savings there.

SERS is the actual State employees, so you can’t cost shift either. Just going to have to bite the bullet on the existing debt there.

Same for JRS and GARS. GARS, I believe, was closed to new hires. But, honestly, these two are rounding error in the problem.

Another approach would be to change to a progressive income tax that brings in more money than today. If the State did that, I would like to see a specific percentage dedicated to paying off the pension debt and another specific percentage dedicated to school funding for a $ for $ school property tax reduction. But I would also want language to o prevent a “bait and switch” like happened with the Lottery funding of schools.

The bottom line is the debts have to he paid. All these ideas just pick who would be winners or losers under any new tax policy … but they would at least stand a chance of eventually digging the State out of debt.

- RNUG - Thursday, Jul 20, 17 @ 2:58 pm:

Rich, just put a really long post up. You might want to make sure it didn’t get trapped by one of the banned words.

- Anonymous - Thursday, Jul 20, 17 @ 3:47 pm:

> RNUG-Thursday,Jul 20, 17 @ 2:56 pm

Great post-and-amen. Broken down, stripped of hyperbole and with accurate information, there non-catastrophic solutions to Illinois’ financial problems. I’m not saying painless solutions, but a decent path for us to leave the place in better shape to those who come after.

- Oswego Willy - Thursday, Jul 20, 17 @ 3:52 pm:

“Because… Retired Non-Union Guy”

Much, much respect.

OW

- Earnest - Thursday, Jul 20, 17 @ 4:04 pm:

- Anonymous - Thursday, Jul 20, 17 @ 3:47 pm:

That was me–sorry about that I almost missed it because I never read posts labelled “Anonymous.”

- Just the Facts - Thursday, Jul 20, 17 @ 5:07 pm:

A couple of observations about RNUG’s post above. First - to the corporate rate - I’m a bit unclear what is being advocated - raising or lowering the corporate rate. If it’s lowering the rate, there is no need for a constitutional amendment. The 8 to 5 ratio limitation in the constitution establishes a ceiling on the corporate rate vis a vis the individual rate. The current rates 4.95% and 7% are below the ratio limit.

RNUG raises the old canard about “corporate tax loopholes.” What are these “loopholes” of which you speak. SB 9 went after so-called loopholes. SB 9just decoupled from IRC Section 199 and eliminated the unitary business non-combination rule. What else do you want eliminate? Go review the Comptroller’s Tax Expenditure Report. The big money with regard to credits, deductions and incentives is on the personal income tax, and sales tax exemption for individuals side.

- RNUG - Thursday, Jul 20, 17 @ 5:36 pm:

Advocating lowering the corporate tax rate. Didn’t realize you could skew the ratio downward without a change.

And doing away with various tax breaks or credits for specific sectors; I don’t think government should be picking 2nd and losers. It’s not big, big money … but you have to do what you can.

- RNUG - Thursday, Jul 20, 17 @ 5:37 pm:

picking winners and losers

- Fredo Corleone - Thursday, Jul 20, 17 @ 6:14 pm:

I appreciate the path spelled out by RNUG. Unfortunately the level of frustration that many business owners and residents feel because of the long term mismanagement by Madigan & Co., the exodus from Illinois will continue. This only makes it more difficult to dig our way out. Add to this that other states smell blood and are picking off Illinois businesses. Once they start taxing retirement income, which is unavoidable, the number of people leaving will increase further. I will likely be among them. Good luck to everybody.

- Northside Dude - Thursday, Jul 20, 17 @ 10:40 pm:

High taxes and big government make Illinois similar to New Jersey and Connecticut - fiscally insolvent and in decline. Instead, we should be more like Tennessee and Texas - low tax, growing, and AAA-rated. The fight to make us more like TX and TN is the right choice every time.