|

Who’s bailing out whom? These county numbers might surprise you

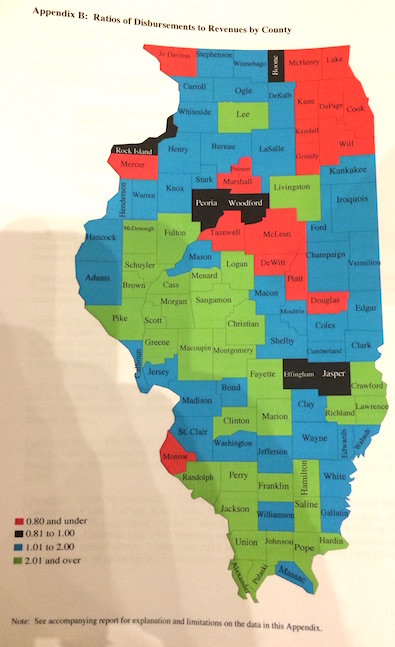

Monday, Aug 14, 2017 - Posted by Rich Miller * Sen. Tom Cullerton asked the Legislative Research Unit for some county-by-county data on how much money counties are getting back from the state compared to what residents put in. Dark red means the counties’ get back 80 cents on the dollar or less from the state. Counties shaded dark black are more break even. The blue counties are doing well and the green counties do the best, getting back at least $2 for every $1 they send to the state. The data is from 2013 (the latest they have) and the LRU warns that it isn’t exactly precise because, for instance, not all revenue and disbursements can be totally verified. So, it’s more of a rough guide. Click the pic for a larger image…  Not a whole lot of surprises for those of us who follow this stuff. Some Downstate Chicago-haters, however, might be enlightened.

|

- 47th Ward - Monday, Aug 14, 17 @ 3:34 pm:

===Some Downstate Chicago-haters, however, might be enlightened.===

Doubtful. They believe the opposite to be true and that’s all there is to it.

- Nick Name - Monday, Aug 14, 17 @ 3:34 pm:

Sangamon County, where Chicago hate is practically a sport, living large.

- blue dog dem - Monday, Aug 14, 17 @ 3:35 pm:

Jackson county. Home of SIUC. seems like a out of poverty as well. Question. I wonder if this is a good or bad thing?

Monroe County. Those folks got it together.

- blue dog dem - Monday, Aug 14, 17 @ 3:36 pm:

..lot of..

- illini97 - Monday, Aug 14, 17 @ 3:36 pm:

Sadly, most Chicago haters refuse to believe data, numbers or facts.

It just feeeeeels like Chicago takes more and gives less, man. And those feelings outweigh any numbers contrary.

- AC - Monday, Aug 14, 17 @ 3:37 pm:

==Some Downstate Chicago-haters, however, might be enlightened.==

I’d like to be proven wrong, but I’m not sure that’s possible. There isn’t enough information in the world to convince any of the “all our money goes to Chicago” crowd downstate that it doesn’t. I’ve given up trying, now I just change the subject if ever that topic comes up, it makes life easier.

- WhoKnew - Monday, Aug 14, 17 @ 3:37 pm:

Saw the numbers on this years ago. Always wonder why it was not more widely known. Didn’t fit their script, I guess!

- Anon - Monday, Aug 14, 17 @ 3:42 pm:

Looking at this map, I am under the assumption that state facilities will skew the map. Not saying there isn’t imbalance but I do not know how EIU necessarily benefits my household or business.

- Anon312 - Monday, Aug 14, 17 @ 3:42 pm:

Watch how much worse this map gets under a progressive income tax…

- Robert the 1st - Monday, Aug 14, 17 @ 3:44 pm:

What does money back from the state mean? I’m guessing more than 1-12 education. So counties with state prisons, state universities and what-not will show as getting the most state money, correct?

- Oswego Willy - Monday, Aug 14, 17 @ 3:45 pm:

Dear Collar Counties,

Aren’t you tired of bailing out downstate?

My beloved Kendall gets less than 80 cents, and Oswego’s SD308 is owed millions due to Rauner, but… even if one were a colorblind sort, the person who can’t tell reds or greens or blues.., the shading of the collars losing their monies to downstate, or central western Illinois as a region… Where’s that anger.

Dear “Green” counties,

Why so blue? Your red-faced anger towards “She-Cau-Go” should be tempered. Counties like my beloved Kendall are green, green with envy that you are confused. Your money is y going into a black hole of Corrupt Chicago. Chicago, Cook, the collars… we keep you flush with the green… while you are yellow, yellow and scared to see the monetary realities.

So, my lil notes, I’ll put a blue ribbon on them both.

Cook and the collars, and the other red counties should be thanked. Petulant defenders of things that monetary realities refute… the red faces now should be for embrassment, while the counties they live in find the green from the “villains” they want created.

- Robert J Hironimus-Wendt - Monday, Aug 14, 17 @ 3:45 pm:

A similar pattern occurs at the national level, and aligns strongly with political affiliation.

- Diogenes in DuPage - Monday, Aug 14, 17 @ 3:46 pm:

I spent the first 18 years of my life in Cass County — a half hour west of Sangamon Co. (And I’ve been back to that area over the years.) I’ve lived and worked for 40 years in that red NE corner of the Illinois map above. As a resident in the metropolitan Chicago area, I’ve had many conversations with high school classmates “defending” the value of Chicago to the state. The cultural divide is just too much for my old friends to cross and understand. (But I don’t mind my tax dollars going disproportionately to Cass County and others. Times are a lot harder there than here.)

- Dirty Red - Monday, Aug 14, 17 @ 3:49 pm:

I thought this information was never to be published again since the mid-1980s?

- JohnnyPyleDriver - Monday, Aug 14, 17 @ 3:49 pm:

==but I do not know how EIU necessarily benefits my household or business.==

By educating and training the workforce of the future that buy and maintain the nice houses in your neighborhood and who frequent your business

- Rich Miller - Monday, Aug 14, 17 @ 3:51 pm:

DR, I thought so too. But, hey, I’m not complaining.

- blue dog dem - Monday, Aug 14, 17 @ 3:51 pm:

Some good points. I wonder the percentage of Chicago students at SIUC. Wonder what percentage of inmates make up Menard(Randolph). Maybe these are data put in that ‘evidence based’ stuff as well.

- ughhh - Monday, Aug 14, 17 @ 3:51 pm:

i would like to see if there is any difference between chicago and suburban cook.

- Oswego Willy - Monday, Aug 14, 17 @ 3:53 pm:

===I do not know how EIU necessarily benefits my household or business.===

What a sheltered life you live, never running into an EIU grad, a grad at work, at a school, former governor, doctor or nurse… Not something I’d personally brag about… but…

- denisquared - Monday, Aug 14, 17 @ 3:57 pm:

Telling a down state voter this is true is like telling a Trump supporter isn’t making us great again…….

- Oswego Willy - Monday, Aug 14, 17 @ 4:00 pm:

===I thought this information was never to be published again since the mid-1980s?===

===I thought so too. But, hey, I’m not complaining===

Sometimes sunshine is found in the oddest places at the oddest times…

- Sherlock - Monday, Aug 14, 17 @ 4:01 pm:

This is only an indicator of dollars in vs dollars out. Let’s see a map with raw dollar amounts.

- Tough Guy - Monday, Aug 14, 17 @ 4:02 pm:

Don’t confuse those Chicago haters with facts. They are a stubborn bunch.

- Amalia - Monday, Aug 14, 17 @ 4:03 pm:

yep, just like the southern states get more than the northern states. but I’m sure the Cook County bashing will continue.

- Oswego Willy - Monday, Aug 14, 17 @ 4:03 pm:

===This is only an indicator of dollars in vs dollars out. Let’s see a map with raw dollar amounts.===

Then I want one that breaks it down in Canadian dollars…

- Shake - Monday, Aug 14, 17 @ 4:03 pm:

Logan County Living Large. Chicago Hater Capital County.

- ArchPundit - Monday, Aug 14, 17 @ 4:04 pm:

Especially as we see the rural exodus I strongly believe that the more urban areas of the state should support the rural areas for roads and schools and infrastructure in general.

http://nprillinois.org/post/illinois-issues-rural-exodus

But it sure would be nice to stop hearing the bellyaching from downstate about Chicago.

- DuPage Saint - Monday, Aug 14, 17 @ 4:04 pm:

Please do not show the Governor this map his head would explode Evidently Madigan not doing as good a job as I thought

- PragmaticR - Monday, Aug 14, 17 @ 4:05 pm:

It is a good figure, but it still treats DeWitt County, population 5,000,000, because it is based on relative payments. This approach disguises the fact that the top right corner of the state generates most of state’s economic activity, and so, the transfer in dollar terms is almost entirely from top right to everywhere else.

- DownstateKid - Monday, Aug 14, 17 @ 4:05 pm:

Tazewell county born & bred. Family from McLean, Rock Island Co. and Peoria county.

You call us Downstate, we call ourselves givers’ not takers’ like those upstate Dekalb county or educated Champaign county.

- Soccermom - Monday, Aug 14, 17 @ 4:05 pm:

DR and Rich — that was my very first thought.

- Try-4-Truth - Monday, Aug 14, 17 @ 4:06 pm:

===== - Sherlock - Monday, Aug 14, 17 @ 4:01 pm:

This is only an indicator of dollars in vs dollars out. Let’s see a map with raw dollar amounts. ====

What would that show? $ for $ means nothing, if not indexed to something constant.

Stats 101.

- PragmaticR - Monday, Aug 14, 17 @ 4:08 pm:

Corrected post.

It is a good figure, but it still treats DeWitt County, population less than 20,000, like Cook County, population more than 5,000,000, because it is based on relative payments. This approach disguises the fact that the top right corner of the state generates most of state’s economic activity, and so, the transfer in dollar terms is almost entirely from top right to everywhere else.

- #5 - Monday, Aug 14, 17 @ 4:08 pm:

- Watson - Monday, Aug 14, 17 @ 3:52 pm:

This is only an indicator of dollars in vs dollars out. Let’s see a map with raw dollar amounts.

- Sherlock - Monday, Aug 14, 17 @ 4:01 pm:

This is only an indicator of dollars in vs dollars out. Let’s see a map with raw dollar amounts.

Why change names when you reposted on the correct article?

- Jazzer - Monday, Aug 14, 17 @ 4:08 pm:

I wonder how many are actually break even now, as this data is 4 years old.

- Johnny Tractor - Monday, Aug 14, 17 @ 4:09 pm:

Hmm … McLean County, home to Illinois State University, is a net giver? I mean, I always knew it was different than other communities with public universities in that insurance companies and not the university drive the community(ies) but I thought it would be black, at best.

- Sherlock - Monday, Aug 14, 17 @ 4:14 pm:

## for $ means nothing, if not indexed to something constant.##

Something like a budget ?

- Oswego Willy - Monday, Aug 14, 17 @ 4:17 pm:

- Sherlock -,

Maybe - Watson - knows on the other Post, or…

- ArchPundit - Monday, Aug 14, 17 @ 4:22 pm:

I’m not sure what the various objections are because they don’t make any sense, but the above is a map showing the number of dollars sent to the state government by the people in a county compared to the number of dollars received by people and entities in the county from the state government.

How is that misrepresenting anything?

- Joe - Monday, Aug 14, 17 @ 4:22 pm:

What’s up with Douglas County? Something to do with the Amish population? The area is the opposite of Chicago in every way.

- Skeptic - Monday, Aug 14, 17 @ 4:24 pm:

“Let’s see a map with raw dollar amounts.” And what would that show? If we’re at a poker table and my pile of chips is bigger than yours, it doesn’t matter how much you or I have, I would wager (pun intended) that I’m winning. That’s what this map is all about.

- Uh ok - Monday, Aug 14, 17 @ 4:25 pm:

When Chicago taxes property at the same rate as downstate, then we can talk fairness. 1/3 of value vs 1/7.

- Grandson of Man - Monday, Aug 14, 17 @ 4:25 pm:

I personally don’t mind paying more in taxes than I get back to help the rural, red districts in Illinois and America. I am tired of the hypocritical attacks, and by Rauner demonizing Chicago to score political points. The dude made many millions of dollars, thanks to Chicago. He didn’t think it was so bad in Chicago when he was banking the money.

- Roman - Monday, Aug 14, 17 @ 4:29 pm:

== Watch how much worse this map gets under a progressive income tax… ==

That’s true. Yet, most of the support in the GA for progressive taxation comes from the “giver” counties and the opposition is mostly from the “takers.”

- Robert the 1st - Monday, Aug 14, 17 @ 4:32 pm:

=Yet, most of the support in the GA for progressive taxation comes from the “giver” counties and the opposition is mostly from the “takers.”=

Most of the support is from government workers hoping to have their pensions saved from insolvency.

- Oswego Willy - Monday, Aug 14, 17 @ 4:33 pm:

===Most of the support is from government workers hoping to have their pensions saved from insolvency===

The ILSC and that pesky constitution already saved pensions, but you already knew that.

- blue dog dem - Monday, Aug 14, 17 @ 4:36 pm:

This is exactly why I am for a chicago City earnings tax. All the money gets to stay at home. Police/fire pension problem. Solved. CTU pension crisis. Solved. CTA infrastructure upgrade. Solved.

Why the wait? It seems so simple. Put it on a city ballot. Chicago folks are progressive. What governor could refuse.

- Nick Name - Monday, Aug 14, 17 @ 4:37 pm:

Sangamon County GOP: how does that pork taste?

- Oswego Willy - Monday, Aug 14, 17 @ 4:38 pm:

===Why the wait? It seems so simple===

Explain all the steps to enact, in Illinois, a “city” income tax.

Thanks.

- sharkette - Monday, Aug 14, 17 @ 4:39 pm:

2013 is not a reasonable date to be considered valid data.

It’s 2017 folks

- Skeptic - Monday, Aug 14, 17 @ 4:40 pm:

“Explain all the steps to enact, in Illinois, a “city” income tax.” And then explain how you’re going to levy it on people who don’t live in the city. Or Illinois. Or the US. Thanks.

- denisquared - Monday, Aug 14, 17 @ 4:41 pm:

“Uh ok” hmmmmmm. we don’t tax at the higher rate and yet those who do are still taking from us……………

- 100 miles west - Monday, Aug 14, 17 @ 4:42 pm:

The info comes from the County Date Book from LRB, it is on their website. It does show raw dollar amounts in and out, as well as local property tax base. Sometimes Downstate counties are merged for Medicaid spending. Also shows state employees by county.

- Oswego Willy - Monday, Aug 14, 17 @ 4:44 pm:

- Skeptic -

New York City has income tax

- IllinoisBoi - Monday, Aug 14, 17 @ 4:44 pm:

==Looking at this map, I am under the assumption that state facilities will skew the map. Not saying there isn’t imbalance but I do not know how EIU necessarily benefits my household or business.==

Go talk to the owners of pizza parlors, bars, and liquor stores and Charleston and get back to us. Also, the restaurants, theaters, and clothing stores. Students spend money and pay sales taxes. University employees spend money and pay all sorts of taxes.

- TinyDancer(FKASue) - Monday, Aug 14, 17 @ 4:44 pm:

Yeah, so I’ve often wondered if there was any way that Chicago could just go on strike and stop sending taxes to Springfield……until they learn to appreciate us.

Sort of like the south during the civil war - municipal nullification.

- blue dog dem - Monday, Aug 14, 17 @ 4:45 pm:

St. Loo as well.

- Roman - Monday, Aug 14, 17 @ 4:47 pm:

- blue dog -

Would Chicagoans be able to deduct the state tax they pay to help fund $4 billion in annual TRS payments under your plan?

- Jibba - Monday, Aug 14, 17 @ 4:48 pm:

This map would be far more interesting and useful if there were different groupings. For example, 0.8 to 1.2 grouped together. The two top categories are too big to make any sense of (1 to 2, and greater than 2) compared to the others, which are much smaller. Or add more categories (go by 0.25 units). You might find that Douglas County is only a percent or two away from being black, so it would not be as much of an outlier. A cartographer or statistician did not make this.

But even with these criticisms, the message is clear: downstate and rural counties generally benefit.

- Johnny Tractor - Monday, Aug 14, 17 @ 4:50 pm:

For those protesting the date of the data, what has changed in the intervening years to cause you to believe that the map is inaccurate? I think the only argument that could be made is there would be less state funds sent out to higher ed and social service agencies, but state income taxes were lower, too. And since this map is apparently consistent with earlier studies, why do you think that trend has materially changed? I get that the data may not be consistent with populist rhetoric, but, man, at least accept the possibility that it’s correct, and explore whether that would change your position on any issues.

- City Zen - Monday, Aug 14, 17 @ 4:55 pm:

bad - Chicago is a home rule municipality which prohibits them from levying a tax on income

- blue dog dem - Monday, Aug 14, 17 @ 4:57 pm:

Roman. No. Chicago residents are a very generous sort. They like looking out for the simple minded down state and rural folk.

- blue dog dem - Monday, Aug 14, 17 @ 4:59 pm:

City zen. All things are doable if the will is there.

- Oswego Willy - Monday, Aug 14, 17 @ 5:03 pm:

===All things are doable if the will is there.===

Walk me thru the steps. Thanks.

- wordslinger - Monday, Aug 14, 17 @ 5:03 pm:

–But it sure would be nice to stop hearing the bellyaching from downstate about Chicago.–

From my experience, the indoctrination starts at birth. Everyone loves the Chicago pro sports teams (until you get to I-72), but other than that, the city is a convenient whipping boy for all ills.

For example, Chicago ranks 6th in the state for violent crime rate. The Top 5 are East. St. Louis, Rockford, Danville, Harvey and Springfield.

https://rebootillinois.com/2016/11/17/illinois-cities-violent-crime-rates/

- Anon221 - Monday, Aug 14, 17 @ 5:04 pm:

Overlays of legislative districts would be interesting. Wonder what the Brady boys think of all the red in their territory. Doesn’t stand for the Republican colors, guys.

- Wallinger Dickus - Monday, Aug 14, 17 @ 5:08 pm:

Wow. Until now I thought I was being an elitist when I viewed Sangamon County as Mississippi.

- Johnny Tractor - Monday, Aug 14, 17 @ 5:12 pm:

Anon221 - they’d say the data is four years old …/s

- PragmaticR - Monday, Aug 14, 17 @ 5:22 pm:

==2013 is not a reasonable date to be considered valid data.==

In 2017, state population and economic activity is even more concentrated in the Northeast corner. I doubt that changes the map dramatically.

==“Let’s see a map with raw dollar amounts.” And what would that show?==

The raw difference between revenue and disbursement for Cook county would be particularly relevant in the education funding debate. Why? If an additional $200 million goes to CPS via SB1, would Cook county still be a massive net giver to the state? If so, why is there so much hostility to Chicago receiving more funding from the rural areas of the state?

- ArchPundit - Monday, Aug 14, 17 @ 5:31 pm:

===, but other than that, the city is a convenient whipping boy for all ills.

Yes, it does. I was brought up in McLean County so I experienced it first hand.

- Mr B. - Monday, Aug 14, 17 @ 5:42 pm:

Thanks collar counties for subsidizing us. We want to protect the pensions. Can’t we properly fund them?

- wondering - Monday, Aug 14, 17 @ 5:46 pm:

I have an idea that a color coded map on educational level would look the same.

- FTR - Monday, Aug 14, 17 @ 5:52 pm:

PramaticR, the extra $200 million might be canceled out by Chicago’s contributions to the $4 billion TRS bill, none of which comes back to Chicago.

- Anonymous - Monday, Aug 14, 17 @ 6:09 pm:

The plebes in rural areas need to be cut off the government teet. The state should not send them dime.

- Anonymous - Monday, Aug 14, 17 @ 6:15 pm:

This is a map of Trump’s America, where poor uneducated rural folk take my money and hate me for it.

- Anonymous - Monday, Aug 14, 17 @ 6:17 pm:

Point of Information

County Assessment Levels

– “When Chicago taxes property at the same rate as downstate, then we can talk fairness. 1/3 of value vs 1/7.”–

Under Cook County’s classification system, real estate is assessed at different levels according to use, from 10 percent for vacant land, residential property, and apartments, to 25 percent for most commercial and industrial property. As a result, in the 2015 levy year, for property taxes paid in 2016, the most recent for which data is available, the county’s three-year average assessment level was 12.49 for all property. However, the state Department of Revenue is required by law to issue an equalization factor– the so-called “multiplier”– to raise a county’s assessment level to 33.33 percent. For the 2015 levy year, IDOR issued Cook County a multiplier of 2.6685, thus raising its equalized assessment level to 33.33 percent.

Source: Illinois Department of Revenue, Property Tax Statistics, Table 3, Final Equalization Factors, 2015. http://tax.illinois.gov/AboutIdor/TaxStats/

Charlie Wheeler

2015 Equalization Factors, Illinois Department of Revenue.

- Perrid - Monday, Aug 14, 17 @ 6:19 pm:

Any chance the report would be made public? I’d like to know details.

- Jibba - Monday, Aug 14, 17 @ 6:20 pm:

Let’s be honest and say the dislike goes both ways and is based on a lack of knowledge about the other. For every complaint one side makes, there is a counterpoint that the other can make. Better that we focus on increasing understanding of each other’s strengths and needs, which seems to eliminate the dislike.

- charlie wheeler - Monday, Aug 14, 17 @ 6:21 pm:

My apologies to all– the 6:17 post re county assessment levels was mine.

Charlie Wheeler

- Grandson of Man - Monday, Aug 14, 17 @ 6:24 pm:

“Thanks collar counties for subsidizing us. We want to protect the pensions. Can’t we properly fund them?”

I second that thanks. Public employee pensions made me lots of money. Oh, and those low state income taxes I paid for decades, which helped cause revenue shortages, thanks for that too.

Sincerely,

Bruce

- PragmaticR - Monday, Aug 14, 17 @ 6:47 pm:

==the extra $200 million might be canceled out by Chicago’s contributions to the $4 billion TRS bill, none of which comes back to Chicago.==

I agree FTR. If anything, the additional support to school districts in Cook County, like CPS, would be more than offset by huge difference between revenue from Cook County and disbursements to Cook County. Quoting from Rich’s post several days ago, “Cook County residents paid $5,821,194,532 in income taxes, about 41 percent of the statewide total.” Since Cook county is shaded in red on this map, less than 80% of that tax revenue is disbursed to Cook County. So, CPS could get an another $500 million in state support and Cook County would still be receiving a disbursement of less than 90% of the revenue the county provides to the state. If school funding is delayed for six months, the rural areas are going to suddenly realize how much they depend on state support provided by other counties.

- Ahoy - Monday, Aug 14, 17 @ 7:08 pm:

Would actually like to see the data instead of a map.

- ArchPundit - Monday, Aug 14, 17 @ 7:35 pm:

===. For every complaint one side makes, there is a counterpoint that the other can make. B

Can, but that doesn’t mean it’s equal. Having grown up downstate I’ve heard a lot more anti-Chicago sentiment there then anti-downstate sentiment in Chicago. More to the point, I’ve never heard Chicago folks call downstaters moochers.

- ejhickey - Monday, Aug 14, 17 @ 7:40 pm:

“This is exactly why I am for a chicago City earnings tax.”

By that I guess you mean a city income tax. However why not expand it to a combined city/cook county income tax with the revenue split proportionately relative to population. It could be added on to the state income tax return with the residents of each entity paying a slightly higher rate , say 1-2% , the State collecting the money and rebating back to the City and County thus eliminating the need to set up income tax departments in the City or County. Such a tax could be imposed on everyone living or working in the City or county meaning you could not escape the tax by living outside the county and working downtown. Throw in a business income tax for all corporations excluding small businesses and the city and county’s money problems are solved.

- Responsa - Monday, Aug 14, 17 @ 7:44 pm:

==I’ve never heard Chicago folks call downstaters moochers.==

Did you perhaps miss these two gems further up-thread?

==This is a map of Trump’s America, where poor uneducated rural folk take my money and hate me for it.==

==The plebes in rural areas need to be cut off the government teet. The state should not send them dime.==

- PragmaticR - Monday, Aug 14, 17 @ 7:52 pm:

==For every complaint one side makes, there is a counterpoint that the other can make.==

The data indicates that one side is incorrect. The eight counties in red in the Northeast corner of this figure paid about $10 billion of the total $14 billion collected in state income tax for 2015. Cook county alone paid almost $6 billion. Since all eight of these counties receive total disbursements of less than 80% of state revenue, these eight counties make a net contribution of more than $2 billion to support other counties in the state. Cook county alone makes a net contribution of more than $1 billion to the state. It is absolutely absurd for anyone living in rural counties to claim that Chicago is receiving too much support from the state. For the record, I do not live or work near Chicago.

- Joe M - Monday, Aug 14, 17 @ 8:05 pm:

==When Chicago taxes property at the same rate as downstate, then we can talk fairness. 1/3 of value vs 1/7==

Taxes are determined by how much money the taxing bodies ask for which is the levy applied to the assessment. So it doesn’t make any difference one area assesses at 1/3 of assessed value and another area at 1/7th of assessed value. Its still how much money the taxing bodies ask for. The area that assesses at 1/7th will have a higher percentage levy than the area that assesses at 1/3rd.

Besides, the map is about STATE MONEY, not local property tax money.

- Joe M - Monday, Aug 14, 17 @ 8:21 pm:

If one wants to compare property taxes of different areas, the best way is to ignore assessment levels and see what percent of a home’s value is one paying in property taxes. Its usually 1.5 to 3% of the value of the home. School districts are the biggest determiner. There are huge differences even within counties on what different school districts within a county may levy

- blue dog dem - Monday, Aug 14, 17 @ 8:34 pm:

Just wonderin’. How does little ol’ Monroe County do it? No JUCOs. No higher eD. No prisons. No sales tax of 10%. County looks to be gaining population. All without $1 for $1. Maybe we ought get a few of their types in Springfield

- James R. Anderson - Monday, Aug 14, 17 @ 8:50 pm:

We all know why Downstate considers Chicago to be “moochers,” and it has nothing to do with the city’s or Cook County’s revenue-vs.-disbursement ratio.

- Joe M - Monday, Aug 14, 17 @ 9:32 pm:

Monroe County has become a nice bedroom community for people working in St. Louis and other areas of the metro area. Interstate 355 provides good transportation. In 2010 the median income for a household in Monroe county was $68,253 and the median income for a family was $80,832. By contrast, in adjacent St. Clair County the median income for a household in the county was $48,562 and the median income for a family was $61,042.

- blue dog dem - Monday, Aug 14, 17 @ 9:38 pm:

My son sent me some.info regarding college entrance. 4 high schools. 97.5% went to college this fall. Gotta give em credit. They got it going

.

- Langhorne - Monday, Aug 14, 17 @ 9:56 pm:

Thats one diagram. We need to see data, methodology, etc.

The LRU quit doing those studies in 80s, bec:

–time consuming, labor intensive

–always subject to different interpretations, like whats a public good, value of 5k dupage kids at uiuc, etc,

–states the obvious, the money is in the burbs

- Langhorne - Monday, Aug 14, 17 @ 10:03 pm:

What do you expect, lake woebegone, where every county gets back more than they put in?

- Robert the 1st - Monday, Aug 14, 17 @ 10:03 pm:

=The ILSC and that pesky constitution already saved pensions=

They donated $200-250 billion? I wonder how much was the Justices and how much the Constitution? Very generous.

- Oswego Willy - Monday, Aug 14, 17 @ 10:06 pm:

=== I wonder how much was the Justices and how much the Constitution? Very generous.===

Well, the Constitution guaranteed it, the Justices affirmed the language.

You can thank them both equally.

- Robert the 1st - Monday, Aug 14, 17 @ 10:11 pm:

I believe we’ll all be thanking the appropriate players soon enough. Happy Monday OW.

- Oswego Willy - Monday, Aug 14, 17 @ 10:15 pm:

- Robert the 1st -

Happy Monday.

August is leaving us too soon, fall is peeking over the horizon.

Hope you’re well.

- VanillaMan - Monday, Aug 14, 17 @ 10:35 pm:

Raised Chicagoan. We don’t even think about downstate, let alone complain about it. Us Southsiders are more aware of Ireland, Britain, Wisconsin and Indiana more than we are aware of anything south of I-80.

Downstaters can complain all they want about Chicago - we don’t hear them.

Of course they need us financially. What do they do down there that earns money?

- Jibba - Monday, Aug 14, 17 @ 10:40 pm:

Hey VM…you forgot the snark symbol.

- Jibba - Monday, Aug 14, 17 @ 10:43 pm:

I’ve had 2 long entries today that did not escape moderation. They both talked in detail about moving past stereotypes through understanding and respecting each other’s strengths, and giving each other the help that is needed. Still believe that is the only way out of our regional biases.

- Last Bull Moose - Monday, Aug 14, 17 @ 10:44 pm:

Actually the map indicates some reasonable thinking. Land is cheaper in the rural counties. For the same wage you can better workers. (Compare $100,00 salaries in Springfield vs Chicago). Unless there is a need to be in the high cost counties because direct service clients are there , state workers and facilities should be in low cost counties.

- PragmaticR - Tuesday, Aug 15, 17 @ 6:40 am:

==moving past stereotypes through understanding and respecting each other’s strengths==

Yes, but in this context the mistake in perception is held by those in rural areas. For instance, one side indicates that all poor pupils across the state should receive state support for education funding. Another group says that support for CPS which has a large percentage of poor pupils is a ‘bailout’. Please note that CPS educates about 20% of the students, but even under SB1 with CPS pension language this district would receive only 16% of the state education funding. Where is that missing 4% for CPS? Look at the figure.

- PragmaticR - Tuesday, Aug 15, 17 @ 7:29 am:

My previous post contains a minor calculation error. Based on the comparison of SB1 distribution to SB1 AV distribution provided by the Governor, SB1 without AV provides $1.8 billion to CPS out of a total of $6.6 billion in direct education support and $3.9 billion in payments to TRS for pensions outside of CPS in FY 2018 budget. So, CPS share of all state education support in SB1 is approximately 1.8 divided by 10.5 or 17%. The governor’s AV lowers direct CPS funding to $1.3 billion out of $6.4 billion with separate pension payment (additional appropriation) of $0.2 billion to CPS. CPS receives total support of $1.5 billion out of $10.5 or 14% based on Governor’s AV.

- PublicServant - Tuesday, Aug 15, 17 @ 7:45 am:

Thanks for that, PragmaticR. That’s the clearest explanation that I’ve seen so far. Far from a CPS bailout SB1-pre-AV closes the gap between percentage of students (20%), and state education funding 17%. Still not equitable, but closer to being fair. In contrast, SB1-post-AV makes funding for CPS even less equitable at 14% of education funding to cover their 20% of the state’s students. Far from a bailout, it’s a blatant ripoff of more equitable funding for Chicago Public Schools under the original passed SB1.

- VanillaMan - Tuesday, Aug 15, 17 @ 7:45 am:

Thank you Jibba.

My point, which has been raised a few times before by us transplanted Chicagoans is the revelation that Downstaters feel ignored. They live in a world more common to Terra Haute, than anything in Cook County. Downstaters feel superior to Chicagoans as well. They embrace their little world and protect it from becoming a Chicago. They don’t want what Chicago has - except its money. They won’t admit it. They know. They just use their anti-Chicago feelings to bond and be different from Chicago. They are great people, but definately different from my Chicago folks.

Politicians can unite us and make is happier and stronger together, or be Bruce Rauner who does the polar opposite of what a governor needs to do. Rauner has abused us by dividing us for his selfish goals. Good Illinois governors unite Chicagoland and Downstate. Rauner is a bad governor. On everything.

- Jibba - Tuesday, Aug 15, 17 @ 7:54 am:

Pragmatic…

I tried twice resterday to say that I agree with the map’s conclusions but was referring to solutions to our mutual regional rivalries and finding a way out. Starts with rejecting politicians who fan the flames of regional tensions.

- VanillaMan - Tuesday, Aug 15, 17 @ 8:05 am:

Based upon my experiences, I don’t see any commonalities between Chicagoland and Downstate. We’re in the same state because of 200 year old politics. Illinois could have been another Missouri if not for Cook county.

Politics put us together and politics has to keep us together. Good governors and other statewide leaders do that. Rauner doesn’t.

- Jibba - Tuesday, Aug 15, 17 @ 8:13 am:

VM…I agree with most of what you said, although I have not felt that down staters feel superior. Both sides feel disrespect from each other. Chicago ignores downstate as having nothing but corn and rubes, downstate thinks of Chicago as self centered and full of gangs and traffic.

When someone is ignored or excluded, they naturally deny any feelings if wanting to belong. That is why, despite evidence of self-harm, they would want to secede from Chicago, and many would vote for such a thing.

I grew up that way but had enough exposure to NE IL that I appreciate its benefits. Most Chicagoans I met in school came to love central IL cities Now to expose them to real rural Illinois, like Grayville or any of a thousand other places, but at least it is a start.

- VanillaMan - Tuesday, Aug 15, 17 @ 8:30 am:

Downstaters may believe that Chicagoans disrespect them, but they are absolutely wrong. Chicagoans assume that Downstaters think like them. Because Chicagoans don’t go Downstate. They don’t even think about Downstate. They assume that Downstaters are just like them. They don’t know that there are differences. Downstate doesn’t matter.

But Downstaters have opinions about Chicago. They believe that Chicagoans loik down on them. Downstaters are arrogant. They do believe that they are better than Chicagoans.

Downstaters look for differences between themselves abd Chicago. Chicagoans don’t even think about Downstate.

That’s a reason Downstaters are thinkibg that Chicago lives off of them. It’s just another Downstater’s misconception about Chicagoans.

I fit Downstate fine, as long as I don’t tell them where I’m from. Also being a white Protestant, married hetero with lots of kids help. Downstaters have this misperception, while Chicago lacks any perceptions about Downstate.

It’s one-way, hence this very posting.

- Anonymous - Tuesday, Aug 15, 17 @ 8:43 am:

This is why, as a native of Chicago and the surrounding area, I have no problem littering in Sangamon County./s (sort of)

- Jibba - Tuesday, Aug 15, 17 @ 8:44 am:

VM…we could go on like this forever, but to no purpose. Arrogance can be generated by being excluded or ignored, One thing you said…I think down staters would be genuinely surprised that they are a beneficiary of Chicago wealth. Not that it would make much difference in the SB1 debate, I think.

- PragmaticR - Tuesday, Aug 15, 17 @ 8:44 am:

==Starts with rejecting politicians who fan the flames of regional tensions.==

I agree. Which politicians have made such statements? Dare I ask who uses the word bailout?

==referring to solutions to our mutual regional rivalries==

Mutual regional rivalries might be a two way street, but almost all of the traffic flows in one direction and most of the state money flows in the opposite direction of the traffic. Ignoring a region is not equivalent to demonizing it. This is especially relevant when the perception of selfishness by Chicago ignores the huge transfer of economic resources from Chicago.

I live/work in a blue county, I have never lived in Chicago, and I did not grow up in IL.

- Anon221 - Tuesday, Aug 15, 17 @ 8:50 am:

Why all the divisiveness this morning on Chicago vs Downstate? It doesn’t help, and it is far too generic in thought. We don’t live in bubbles people. Bubbles tend to burst. They are a very fragile cocoon to live in.

- Anonymous - Tuesday, Aug 15, 17 @ 9:01 am:

Anon221,downstaters apparently live in bubbles.

- Anonymous - Tuesday, Aug 15, 17 @ 9:01 am:

From the post -LRU warns that it isn’t exactly precise because, for instance, not all revenue and disbursements can be totally verified-

Wow that seems kind of odd? Would all expenditures have a zip code for where the service/product was provided?

I am amazed the comptroller’s office does not have an interactive map that shows money in/ money out

- Anonymous - Tuesday, Aug 15, 17 @ 9:03 am:

I’ve yet to be convinced that the red corner in the top right-hand side of the map wouldn’t be better off without everything else. Sorry. Still willing to carry the rest of the state because it’s the right thing to do, but more gratitude and less racist/classist dog whistles from south of I-80 would be nice.

- Jibba - Tuesday, Aug 15, 17 @ 9:06 am:

It is helpful to acknowledge that we have divisions any why. Getting past them is the trick, and it is far easier to exploit those divisions than it is to unite. But let’s bring it back to SB1. Chicago gets less than its share of education money, and SB1 gets us much closer. As a down stater, I care about Chicago’s kids almost as much as my own, so they need to get sufficient funding.

- Jibba - Tuesday, Aug 15, 17 @ 9:10 am:

Stay classy, Anonymous.

We’re in this together, and we got where we are today together. And I mean that for good…Chicago would not have reached self sustaining without the wealth of the agricultural economy to feed it in the early days.

- Robert the 1st - Tuesday, Aug 15, 17 @ 9:12 am:

I wonder if the people posting about the “taker” down state folks are themselves net tax contributors or not? I doubt it.

- Austinman - Tuesday, Aug 15, 17 @ 9:20 am:

Honestly I’m a Chicagoan and I never hear anyone talk about downstate in any negative fashion. But when im downstate oh gosh the negative stuff I hear. They say us Chicagoans get all the state dollars. All I do is shake me head and think about how we have a sugar tax and bag tax to help us make up for what we give to the downstate folks. Yeah sometime I do wish NE Il folks just said no money going to Springfield this month until downstate feel the pain like we do

- Jibba - Tuesday, Aug 15, 17 @ 9:39 am:

Like most ethnic or national divisions (think Israel or Northern Ireland), it is not typically helpful to try to pin blame or to say who started it. Each side can state and restate ad nauseum. My experience is different than yours, and yours from mine. We can go into great detail over what each of us pays locally and to the state versus what each receives in services and facilities, but in the end that will not help us figure out who is right and it will not help us bridge any divides. I like Chicago and many Chicagoans (though I would not want to live there). Let’s address the need of CPS and override the AV, or at least go back to the original SB1 as Rich suggested.

- VanillaMan - Tuesday, Aug 15, 17 @ 9:42 am:

I agree with you Austinman.

Growing up Chicagoan, I never heard anyone talk about Downstate, let alone insult it. No one hates on farmland, corn, farmers or people living outside Chicago. Chicagoans assume Downstaters think like them. They have no urge to insult people that they believe think like them.

However Downstaters do have opinions about Chicago and Chicagoans, and it isn’t complimentary. It’s like not being a Chicagoan makes them better people. My Downstate friends do feel superior to me - more moral, more practical. more honest than me. I found this surprising because the feeling in Chicago about Downstate doesn’t exist. What’s to dislike about Downstaters?

There is a rift. Our politicians need to ensure that Downstaters get the attention they feel they need to stay happy.

Seperatist movements don’t come from Chicago. They usually form Downstate, don’t they? It’s not because Chicagoans are afraid of losing Downstate, it’s just that few in Chicago ever thinks about Downstate. Ever.

- Jibba - Tuesday, Aug 15, 17 @ 9:43 am:

And here is another argument that may appeal to the more self serving crowd. If Chicago is a source of wealth to the state, does it serve anyone for it to devolve into chaos? Investing in making it more appealing to the young and the mobile increases the returns, yes?

- Anonymous - Tuesday, Aug 15, 17 @ 9:45 am:

Agricultural resources from all over the midwest were moved through and sold in Chicago in the early days. It had a lot more to do with market forces than state boundaries.

- Anonymous - Tuesday, Aug 15, 17 @ 9:46 am:

Sigh. So many sweeping generalizations of the “other side” and sadly typical of the state of discourse in our country today. People are individuals, not part of groupthink monoliths. The city of Chicago itself is hardly homogeneous and monolithic with its diversity of neighborhoods. The same can certainly be said of metro Chicago, and absolutely for downstate. Do Andersonville and Roseland share the same concerns? What about Schaumburg and Harvey? Or how about Galena and Cairo?

I grew up in metro Chicago, have deep family roots in southern Illinois that took me there often to visit family, and have spent most of my career in central Illinois. I do wish there was less anti-Chicago sentiment downstate and a realization that despite its myriad of issues, Chicago is truly an asset that greatly benefits the entire state. I also wish metro Chicago was more invested in its own state and less so in Wisconsin, Michigan, etc. Happenings in Madison and Lansing really don’t affect our lives as Illinoisans, but what happens in Springfield certainly does. I’ve honestly never understood the disconnect of metro Chicago from its own state in favor of neighboring states.

- PragmaticR - Tuesday, Aug 15, 17 @ 10:11 am:

==or at least go back to the original SB1 as Rich suggested.==

I do not want to disagree with Rich, but please understand the outcome before supporting the recommendation. SB1 without formula amendment recognizing CPS pension contributions provides about $1.6 billion to CPS out of a total of $6.6 billion in direct education support and the $3.9 billion in payments to TRS. So, CPS share in SB1 without CPS pension recognition is approximately 1.6 divided by 10.5 or 15%. While this distribution would be more equitable than the Governor’s AV, it should be self-evident that it is still not appropriate when CPS serves approximately 20% of the state’s students in a relatively high-cost location with a relatively large fraction of poor students.

- Jibba - Tuesday, Aug 15, 17 @ 10:20 am:

But what are our choices right now? Override AV, submit previous version of SB1, or start over? Which do you think is most likely to succeed? I would take the bird in the hand if they can override the AV rather than starting over.

- PragmaticR - Tuesday, Aug 15, 17 @ 10:34 am:

Override in House provides about 17% of state education funding to CPS. Override may not occur, but it is probably the best option available. If override fails, there will be a protracted negotiation and schools in poor rural areas may be forced to close or make extreme cuts. I suspect that Democratic leadership will wait as long as necessary until downstate Republicans are willing to vote for a bill that is very similar to SB1. I do not like the strategy, but I understand how the game is played.

- @MisterJayEm - Tuesday, Aug 15, 17 @ 10:36 am:

VanillaMan is absolutely correct.

The suburbanites have snotty opinions about the city and Chicagoans have snotty opinions about the burbs — but neither gives Downstate a first, much less second, thought.

And from the looks of that map, Downstate had best hope it stays that way.

– MrJM

- Jibba - Tuesday, Aug 15, 17 @ 11:55 am:

The more I’ve thought about this map and the analysis that accompanied it, the sillier it seems. The things that make up the map aren’t always (or even often) some sort of largesse from Chicago to the lesser counties. Let’s see some examples:

1) Payroll to state facilities (universities, jails, state offices). Those are not located to benefit downstate alone. They benefit all (housing your criminals, educating your students too), and were located where they are as part of some horse trading of the past. Those things should not count as largesse.

2) State agencies, no matter where located, often work on problems throughout the state. Staff at IDOT (highways, airports), DNR (parks and preserves), EPA, often work on Chicago area problems even if they are located in Springfield or elsewhere. How is that a gift to downstate?

Things that should count in the analysis should be medicaid, road building and maintenance costs alone, and similar items. Then we can see how the numbers fall out. I have no preconceived notion of where the answer will be, but I have a problem with the analysis.

- Jibba - Tuesday, Aug 15, 17 @ 11:57 am:

Add in K-12 school aid, various grants from agencies, etc. Any other suggestions?

- PragmaticR - Tuesday, Aug 15, 17 @ 1:33 pm:

I went through all FY 2017 line item expenditures above $1 billion per year. With the exception of about $1 billion for the Department of Corrections, the large expenditure categories appear to be statewide: Medical Assistance, TRS, General State Aid, and Interest. In short, the posted figure could be tweaked to improve accuracy, but I highly doubt the main features would change substantially.

- Jibba - Tuesday, Aug 15, 17 @ 2:07 pm:

Thanks for the analysis. Again, it comes back to why the figure is being used. If it is to be evidence that downstate is being supported by Chicago, then we should not include anything that Chicago uses as well, so Corrections should be out. Many other things should be out as well (universities, state agencies [with their medical insurance] that deal with Chicago problems, etc.), so the picture might be tremendously skewed if the point is to show how Chicago supports downstate.

My point is that this is an extremely complex issue and this figure is highly simplistic. If you just look at tax dollars, it is true-ish but not informative. If you want to prove that downstate freeloads, then you need a more detailed analysis.

This goes back to school aid. I am for more aid to Chicago, but it is highly complex (leading to the years of negotiating SB1) and can be skewed easily as shown by Rauner’s tweaks that changed the whole deal. Achieving fairness to both Chicago and downstate requires knowledge of a lot more (wealth, property tax rates and available wealth, etc.). Not easy.

- Jibba - Tuesday, Aug 15, 17 @ 2:11 pm:

Hey Rich…what gives? I’m getting tired of writing thoughtful responses that do not escape moderation. What guideline am I violating? Would like to know so I can quit doing whatever I am doing.

- Ron - Tuesday, Aug 15, 17 @ 2:11 pm:

As in the rest of America, rural areas are poor and need the government to support them. Those of us in cities are tired of it.

- wordslinger - Tuesday, Aug 15, 17 @ 2:31 pm:

Ron, are you tired of eating, too?

The Grocery Store Fairy doesn’t magically fill those aisles every night. Lot of work in rural areas goes into it.

- Jibba - Tuesday, Aug 15, 17 @ 2:38 pm:

Second try on some of these thoughts…

The political process is where we fight out who gets what. A new interstate for western Illinois gains the support for other things in Chicago, etc.

We were once all the same rural folk, then Chicago grew in no small part of the rest of the rural area (in and out of state). Should we change capital city location or state boundaries as our situation has changed, or do we continue to pull together and use democracy to split up the gains?

- PragmaticR - Tuesday, Aug 15, 17 @ 2:56 pm:

==If you just look at tax dollars, it is true-ish but not informative.==

I am more than willing to agree that the figure is a bit simplistic. Please pick any government program: Medicaid, K-12 education, county hospitals, road construction, etc. I think that the disbursements from the state’s budget will almost always be less concentrated in the Northeast corner of the state than the revenue raised from state income tax and state sales tax. I could be wrong, but I doubt it.

- Jibba - Tuesday, Aug 15, 17 @ 3:31 pm:

You might be quite right, I have no predetermined opinion. I am only saying that the way the figure is being used in this thread is well beyond its accuracy. I suppose all that talk about metro people wanting gratitude and praise rubbed me the wrong way,

- Ron - Tuesday, Aug 15, 17 @ 9:00 pm:

Wordslinger, I like eating and love supporting local farms with my money. That has nothing to do with my taxes propping up dying areas.

- wordslinger - Tuesday, Aug 15, 17 @ 9:42 pm:

Ron, the “dying areas” you speak of is where your food comes from.

Technology advances have greatly reduced the labor component (ii.e. people) needed for producing that food, but a reasonable standard of living is required to keep them there doing so.

It’s in your interest.