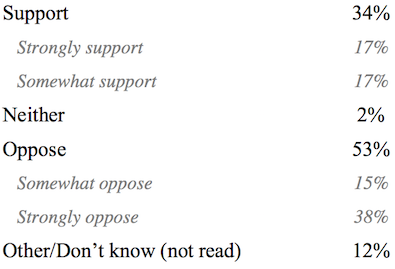

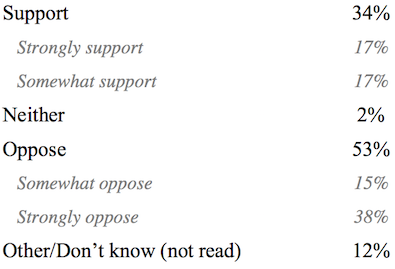

* According to the Paul Simon Public Policy Institute’s latest poll, the federal tax reform law isn’t yet helping the Republicans. “Do you support or oppose the tax reform plan passed last December by the Republican Congressional majorities?”…

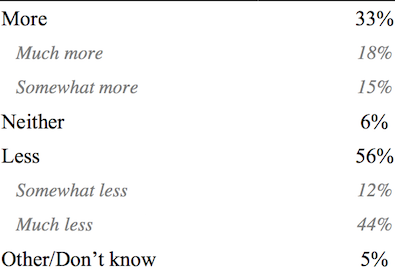

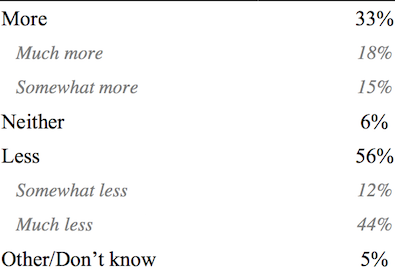

* “Does your view on tax reform make you more or less likely to vote for Republican Congressional candidates in November?”…

* From the Institute’s press release…

Well over a majority, 53% of Illinois voters say they opposed the tax cut with 15% strongly opposed and 38% who opposed and 2% who said “neither”. The state is deeply polarized on this issue with 80% of Democrats opposed while 75% of Republicans supported the tax cuts. Independents were in the middle with 36% who supported and 48% who opposed the cuts.

Central city Chicago voters opposed the tax cuts by a margin of 63% who opposed and 28% who supported. Downstate voters were more closely divided over the tax cuts with 40% who supported and 41% who opposed. 33% of suburban Chicago and the collar counties voters supported and 55% opposed the tax cuts.

Illinois voters were asked whether the tax cuts would make them more or less likely to vote for Republican congressional candidates in November. 33% of the respondents said the tax cuts would make them more likely to vote Republican in the fall while 56% said less likely with 6% choosing neither.

85% of Democrats said less likely; 80% of Republicans said more likely while 29% of Independents said more likely and 49% said less likely.

Downstate voters chose more likely over less likely by a margin of 48% to 42%. Chicago voters chose less likely by 70% to 19%. Suburban Chicago and the collar counties voters chose less likely over more likely by a margin of 58% to 31%.

The question of which party “best represents your interest in the U. S. Congress” produced a solid advantage for the Democrats. 43% of the respondents overall chose the Democrats; 28% chose the Republicans while 2% chose the Green Party, 6% the Libertarians, and 12% chose some other party.

40% of downstate chose the Republicans and 31% chose the Democrats while 2% chose the Greens and 7% the Libertarians. In Chicago, 55% favored the Democrats and 15% favored the Republicans. 6% took the Libertarians and 3% the Greens in Chicago. 45% of Chicago suburban and collar counties voters chose the Democrats and 25% the Republicans while 2% chose the Greens and 5% the Libertarians.

Keep in mind that these are registered voters, not likely voters. And more men were polled than women. Both of those things are not at all optimal.

* Methodology…

The margin of error of the entire sample of 1,001 voters is plus or minus 3.1 percentage points. […]

Live telephone interviews were conducted by Customer Research International of San Marcos, Texas using the random digit dialing method. The telephone sample was provided to Customer Research International by Scientific Telephone Samples. Potential interviewees were screened based on whether they were registered voters and quotas based on area code and sex (<60% female). The sample obtained 51% male and 49% female respondents. Interviewers asked to speak to the youngest registered voter at home at the time of the call. Cell phone interviews accounted for 60 percent of the sample. A Spanish language version of the questionnaire and a Spanish-speaking interviewer were made available.

Field work was conducted from February 19 through February 25. No auto-dial or “robo” polling is included. Customer Research International reports no Illinois political clients. The survey was paid for with non-tax dollars from the Institute’s endowment fund. The data were not weighted in any way. Crosstabs for the referenced questions will be on the Institute’s polling web site, simonpoll.org.

- Leahy Jacob - Tuesday, Mar 6, 18 @ 9:50 am:

That’s all Republicans in the 10th District want to talk about. Sooo, there goes that race. Does it take out Roskam as well?

- Dick Turpin - Tuesday, Mar 6, 18 @ 9:54 am:

It’s called the Stockholm Syndrome.

- Ole General - Tuesday, Mar 6, 18 @ 10:02 am:

Check the polls of this nationally before it was passed and people started seeing larger checks.

This was described as the Republican’s Obamcare and that once again was dead wrong.

- Retired Educator - Tuesday, Mar 6, 18 @ 10:04 am:

People understand the only way to pay down the debt, and have programs cost money. Even with the tax increase, our taxes are less then a lot of states. “There is no such thing as a free lunch.”

- Retired Educator - Tuesday, Mar 6, 18 @ 10:06 am:

Sorry I hurried through the poll and did not read properly. It was not about what I thought it was. My apologies. The national tax cut was a good thing, it put money into people pockets to spend how they choose.

- Responsa - Tuesday, Mar 6, 18 @ 10:08 am:

Again, here’s a reminder (link) about something to keep in mind when reading poll results that have used RDD and majority cellphone respondents. This is important information for readers no matter whether they tend to like or dislike the “results” of any such poll. I applaud Rich for regularly mentioning the methodology of polls he posts about here. Methodology matters.

http://www.pewresearch.org/2016/08/01/moving-without-changing-your-cellphone-number-a-predicament-for-pollsters/

- 19th ward guy - Tuesday, Mar 6, 18 @ 10:12 am:

Yeah, most voters are against more money in their paychecks. (snark) Just like they are against having health care. (double snark) As much regard as I have for the Institute, the polling of the last go around is fundamentally useless.

- Pundent - Tuesday, Mar 6, 18 @ 10:16 am:

=This was described as the Republican’s Obamcare and that once again was dead wrong.=

Well for eight years all we heard about was the debt. Heck we even had a political movement that rose from nothing to tell us how all this debt was bad for our country. So you can appreciate why a few folks might be a bit apprehensive about a tax plan that provides significant breaks for large corporations while blowing an even bigger hole in our debt problem.

- Anonymous - Tuesday, Mar 6, 18 @ 10:24 am:

There are some, uh, interesting people that live in Illinois. Opposition to having more take home pay that leads to buying more things, that leads to more jobs and more tax revenue and…..

Yep, I understand the opposition. Sigh

- CrazyHorse - Tuesday, Mar 6, 18 @ 10:29 am:

People with more knowledge of how these polls are run can probably explain if it’s typical but do pollsters usually ask for the youngest registered voter in the household? IMHO, that could lead to a disproportionate number of “Bernie” voters who list wealth/income inequality as a top concern where older voters are more likely to value a few more dollars in their wallet rather than stress about who received a bigger piece of the pie as the youth is doing.

- Rich Miller - Tuesday, Mar 6, 18 @ 10:35 am:

===Yeah, most voters are against more money in their paychecks. (snark)===

It’s not the tax cut. It’s who passed it and who most benefits from it. The Democrats, for once, did a good job of messaging.

- Nacho - Tuesday, Mar 6, 18 @ 10:37 am:

==People with more knowledge of how these polls are run can probably explain if it’s typical but do pollsters usually ask for the youngest registered voter in the household?==

No, pollsters don’t choose to conduct their polls in a way that obviously biases the results. This should be obvious.

- PJ - Tuesday, Mar 6, 18 @ 10:42 am:

===Opposition to having more take home pay that leads to buying more things===

lol. Sorta like saying the opposition to Obamacare was opposition to people being healthy.

- Nacho - Tuesday, Mar 6, 18 @ 10:46 am:

Republicans are desperate for this to be a major positive issue for them because it’s the only real legislative success they can point to. The problem is it’s not turning out to move the needle the way they thought it would (see the shift in messaging AWAY from tax cuts in the PA special election). And especially with the SALT provisions, you’d expect it to be less popular in Illinois than it is on average.

Keep on thinking that blue wave isn’t coming.

- blue dog dem - Tuesday, Mar 6, 18 @ 10:47 am:

This is why I know a Chicago city earnings tax ballot initiative would pass with ease.

- jwk - Tuesday, Mar 6, 18 @ 10:54 am:

my daughter works a full 40 hours makes a little over 18$ per hour got an extra 6$ a week said not worth it

- Ole General - Tuesday, Mar 6, 18 @ 10:54 am:

- It’s not the tax cut. It’s who passed it and who most benefits from it. The Democrats, for once, did a good job of messaging. -

Data doesn’t bare this out.

https://www.nytimes.com/2018/02/19/business/economy/tax-overhaul-survey.html

- City Zen - Tuesday, Mar 6, 18 @ 11:20 am:

==Even with the tax increase, our taxes are less then a lot of states.==

Insert property tax comment here.

- a drop in - Tuesday, Mar 6, 18 @ 11:23 am:

“People with more knowledge of how these polls are run can probably explain if it’s typical but do pollsters usually ask for the youngest registered voter in the household? IMHO, that could lead to a disproportionate number of “Bernie” voters who list wealth/income inequality as a top concern where older voters are more likely to value a few more dollars in their wallet rather than stress about who received a bigger piece of the pie as the youth is doing.”

You are wrong. The young is stressed out by the fact that the burden of the deficit will fall on them. They future is mortgaged and they know it.

- Grandson of Man - Tuesday, Mar 6, 18 @ 11:27 am:

When multibillion dollar corporations who’ve made record revenues/profits pay a smaller marginal tax rate than so many working-class people, it’s very bad policy.

When one party screams about debt and deficit when tax dollars are used to help the poor, sick, workers and vulnerable but then turns around and starts the process of driving up debt/deficits with handouts that go largely to the wealthiest, it’s bad policy and immoral.

I’ve read recently that the corporate tax cut is largely going to corporations/management and not employees. Why didn’t working class America get the lion’s share of tax cuts? The Republican Party is the subsidiary of megarich corporations. It is so owned that it could literally do nothing without passing these huge tax cuts, lest their funding get cut off.

- blue dog dem - Tuesday, Mar 6, 18 @ 11:43 am:

GOM. If what you say is true, how come progressives like Rham Emmanuel fall all over themselves to gives progressives like AMAZONS’Bezos billions more.

- VanillaMan - Tuesday, Mar 6, 18 @ 11:47 am:

53 opposed?

LOL

Illinois is so blue it is downright silly sometimes.

- Ron - Tuesday, Mar 6, 18 @ 12:05 pm:

The state pension plans are starving for cash. Legalizing pot would provide $100s of $1,000,000s annually.

- blue dog dem - Tuesday, Mar 6, 18 @ 12:14 pm:

I think any increase in revenue should be used to repair or crumbling roads.

- Louis G. Atsaves - Tuesday, Mar 6, 18 @ 12:14 pm:

Makes me wonder if the results would have differed if the question was phrased as “Federal Tax Reform” instead of “Republican Tax Reform.”

- Grandson of Man - Tuesday, Mar 6, 18 @ 12:17 pm:

“GOM. If what you say is true, how come progressives like Rham Emmanuel fall all over themselves to gives progressives like AMAZONS’Bezos billions more.”

First, thanks for responding. I sure hope you and other conservatives make this November unpleasant for Rauner (if not later this month).

It’s not the same thing, to give some corporations tax breaks as opposed to giving all corporations tax breaks. This is a problem because not only will Amazon get tax breaks for opening its HQ, but it gets a 14% tax cut on top of that.

I thought conservatives hate crony capitalism and debt and deficits—or is it only when we help insurance companies offset losses that are incurred because too many sick people sign up for the ACA, or when we pay government employees well, expand Medicaid, etc.?

Rahm Emanuel is not a progressive. Some or many on the right thought a moderate like Hillary Clinton was a socialist. They thought Obama was a flat-out communist.

Amazon will create high-paying jobs. Foxconn, less high-paying—with a massive tax break. If it was Foxconn instead of Amazon that came to Illinois, with what Wisconsin offered, my opinion might have been different.

I would rather grow the economy with bigger breaks for less wealthy people. We literally shoveled massive amounts of cash to the wealthiest just as we were trying to repeal the ACA and take health insurance away from millions of people. I prefer marijuana legalization, because it would help grow the economy with people giving us tax dollars instead of us giving tax breaks to wealthy corporations.

- Chris P. Bacon - Tuesday, Mar 6, 18 @ 12:20 pm:

So are those 53% going to give back the extra take-home pay from the tax cut? Nothing is stopping them.

Putting aside the over-sampling of Democrats, this poll is ridiculous.

- Rich Miller - Tuesday, Mar 6, 18 @ 12:23 pm:

===Putting aside the over-sampling of Democrats===

You ever been to Illinois?

- Ron - Tuesday, Mar 6, 18 @ 12:36 pm:

Trumps tax cuts are stupid. Though my family is a huge beneficiary of them. Taking all the tax savings and putting into my kids 529. Sorry Donnie.

- Oswego Willy - Tuesday, Mar 6, 18 @ 1:20 pm:

The Roskam district will be fascinating to watch with a gubernatorial race that likely will be the most expensive ever and the Trump factors weighing in as they seem to be weighing in since 2016.

- blue dog dem - Tuesday, Mar 6, 18 @ 1:23 pm:

Informal poll at the old widget factory(now up to 19, large in part to the Trump tax cut). All thumbs up. But most would like some sort of transaction tax outta LaSalle st. Just the messenger here. Just reporting on what the working middle class are thinking.

- Ron - Tuesday, Mar 6, 18 @ 1:35 pm:

Bets on how large the federal deficit gets?

- blue dog dem - Tuesday, Mar 6, 18 @ 1:43 pm:

QE1,QE2,QE3. $1.1,$1.2,$1.3 trillion respectively. Marginally paid back. Compliments of you know who.

- Keyser Soze - Tuesday, Mar 6, 18 @ 1:46 pm:

This poll is suspect, intuitively so. Linking the tax reform to Republicans, rather than simply calling it “tax reform” (period) must have skewed the response, rendering the poll as essentially worthless. The PP Institute needs to rethink its methodology.

- JohnnyPyleDriver - Tuesday, Mar 6, 18 @ 2:09 pm:

Other data showing most voters aren’t seeing bigger paychecks, and a plurality agree that the middle class is getting crumbs:

https://www.politico.com/story/2018/02/21/paychecks-tax-law-poll-417884

https://www.usnews.com/news/national-news/articles/2018-03-02/poll-finds-more-americans-agree-with-pelosi-that-gop-tax-cut-delivered-crumbs

- I Miss Bentohs - Tuesday, Mar 6, 18 @ 2:19 pm:

I do not understand how any Republican thinks this is a good idea. Why am I all alone in caring about national debt? I need to create a knew party as Republicans have failed since H.W. did something insane … spend less money and have an excess.

- Demoralized - Tuesday, Mar 6, 18 @ 3:30 pm:

==53 opposed==

I’m assuming some of that opposition is on the distribution of the tax cuts and also how the tax cuts for all but the rich are set to expire in several years.

The tax bill favored the rich immensely.

- Ron - Tuesday, Mar 6, 18 @ 4:13 pm:

I’m not rich, but it certainly has showed up bigly in my paycheck. Won’t spend a dime of it though. All to savings. Don’t want to juice the economy for Donnie.

- CrazyHorse - Tuesday, Mar 6, 18 @ 4:14 pm:

=You are wrong. The young is stressed out by the fact that the burden of the deficit will fall on them. They future is mortgaged and they know it.=

Disagree. I would dare say that the youth (if they are stressed out about finances at all) are most concerned with their tuition bill and if they can afford their cell phones/car insurance. I can’t see many 19 year old kids stressing out about paying for Trump’s tax cuts down the road. These kids want universal healthcare for all/free college tuition/etc. If they are young deficit hawks in the making they sure coulda fooled me.

On the other hand if we’re talking young professionals maybe late 20’s/early 30’s I can see a shift away from some of these socialist type ideas. It’s funny that when you start actually making decent money you begin to care a whole lot more about where your tax dollars are going.

- Original Rambler - Tuesday, Mar 6, 18 @ 5:13 pm:

I’m not in favor of $10 more in my pocket if it puts $50 more in the pockets of the 1% and it costs the next generation $100 to pay for it.

- Anon - Tuesday, Mar 6, 18 @ 5:21 pm:

Everyone, read Ole General’s link above. Other reputable polls tell a different story. And, no the Dems have not messaged this well either, according to the data sited in link.

- Whatever - Tuesday, Mar 6, 18 @ 7:26 pm:

Totally useless poll for evaluating the tax cut act itself. 99.9% of the population don’t even know 1% of what’s in the act. Their answers are based on what someone said on tv about one small part of the bill. I agree with Mr. Miller that the Democrats have done a great job with their messaging, and believe it shows in the results. That is important, especially in an election year, but says nothing about the law itself.