* Crain’s…

The state’s pension funding is improving but not as fast as in other states, according to Moody’s Investors Service, which warns that favorable economic tailwinds may subside.

Illinois’ adjusted net pension liability dropped by an estimated 2 percent to 5 percent because of rising interest rates and better investment returns, the rating agency said in a report today. But “weak contributions and rising payouts” mean that Illinois continues to have the largest unfunded pension liabilities of any state, the report said.

“Like other U.S. public pension systems, Illinois’ pensions remain vulnerable to stock-market volatility,” Moody’s wrote. “Illinois also cannot rely on continually rising interest rates to keep reducing the adjusted value of its reported pension liabilities.” […]

Moody’s said that among U.S. state plans that have issued figures this year, all saw more funding gains than Illinois’ biggest, the $51.8 billion-asset Illinois Teachers’ Retirement System, which covers 417,292 members. The adjusted net pension liability for the plan dropped by less than 3 percent, compared with a 14 percent average decline for Indiana’s two teacher pension systems. TRS’ unfunded liabilities actually increased by 2.1 percent, to $75 billion.

* And now the bad news…

Moody’s has issued its adjusted net pension liabilities (ANPL) for the 50 largest local government (ranked by debt outstanding) for fiscal 2017, and most saw their unfunded liabilities rise due to poor investment returns and low market interest rates. Since most local governments report pension funding with up to a one-year lag, favorable investment returns in fiscal 2017 and 2018 will lead to a decline in ANPLs through many of those governments’ 2019 reporting. Nonetheless, pensions continue to drive historically high leverage and elevated annual costs for some governments, and risks from potential pension investment losses are significant.

The report’s highlights are:

ANPLs reached an aggregate $481 billion in fiscal 2017 for the 50 largest local governments, up 9% from fiscal 2016. Most individual governments’ ANPL increases were more significant, while several governments that report more current pension data had ANPL declines. San Francisco’s (rated Aaa/stable outlook) ANPL increased 82% due in part to recognition of certain benefit restorations from a judicial decision. New York City (Aa2/stable) saw the largest absolute decline (-$13.8 billion). ANPLs continue to far exceed bonded debt and unfunded other post-employment benefit (OPEB) liabilities.

Favorable investment returns and revenue growth will drive lower ANPLs and leverage ratios through many governments’ fiscal 2019 reporting. Liabilities are also falling in cities such as Dallas (A1/stable) and Houston (Aa3/stable) due to benefit reforms.

Risks from pension investment volatility vary widely across governments. As of fiscal 2017, nine of the 50 largest had a greater than 10% one-year probability of pension investment losses amounting to at least 25% of revenues. Negative non-investment cash flow (NICF), which occurs when a pension system’s benefit payments exceed its contributions, also constrains the ability of many funds to grow assets.

The combination of debt service, pension and retiree healthcare (OPEB) payments consumed more than 30% of some governments’ revenues, but less than 15% for others. Highlighting the general weakness of government pension contributions, only 10 of the largest 50 exceeded our “tread water” indicator in fiscal 2017.

Unfunded OPEBs are becoming material for some of the largest local governments. Using new disclosures based on updated accounting rules for OPEBs, adjusted net OPEB liabilities are very large for Suffolk County, New York (Baa1/stable) but relatively insignificant for Texas schools and Clark County School District, Nevada (A1/negative).

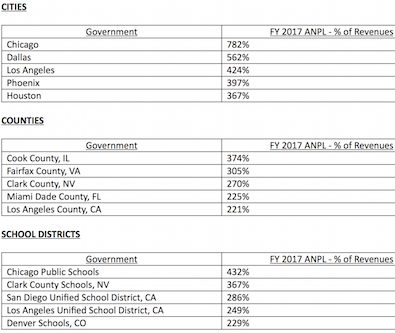

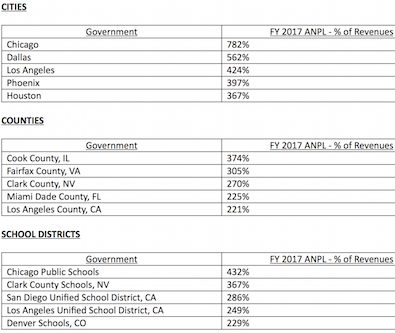

This year we broke down the top 50 local governments into cities, counties, school districts, and special districts. After determining the dollar amount of the municipality’s unfunded pension liabilities, we translate that number into a percentage of the municipality’s revenue. The higher the percentage, the higher the unfunded pension liability for that municipality. Here are the top five in each category except special districts:

* Whew…

* Related…

* Hedge fund rebel to leave Illinois pension board - Marc Levine led a charge against hedge fund investing on two Illinois pension fund boards. Now he plans to step away as a new administration arrives in Springfield.

- Anonymous - Wednesday, Dec 19, 18 @ 11:00 am:

I thought pensions invested in lower interest paying instruments to avoid liability.

- Anonymous - Wednesday, Dec 19, 18 @ 11:01 am:

Sorry, I said liability, I meant volititilty.

- Downstate - Wednesday, Dec 19, 18 @ 11:10 am:

Hmmm.

Well who is to blame for BOTH Cook County and the city of Chicago leading these lists?

It’s a Democrat caused problem.

Seems pretty easy.

Just hike property taxes, implement an income tax on Cook County and Chicago residents, and increase the gas tax.

If it’s such a great idea for the state of Illinois, let’s see the experiment started in Chicago/Cook County first.

- Anonymous - Wednesday, Dec 19, 18 @ 11:21 am:

Exactly Downstate, keep the checkbook away from the D’s.

- Anon324 - Wednesday, Dec 19, 18 @ 11:33 am:

If Chicago and Cook County taxpayers didn’t have to subsidize downstate Illinois, the numbers would look a lot different. Feel free to lobby your reps to stop taking handouts from the Dems in Chicago and Cook (and now the collars, too, after the last election).

- Downstate - Wednesday, Dec 19, 18 @ 11:35 am:

Anon,

The income tax on Cook and Chicago residents would require legislation to be passed by the Illinois Senate and House and signed by the governor. Luckily they are all controlled by the same party as that of Cook and Chicago.

- Perrid - Wednesday, Dec 19, 18 @ 11:47 am:

@Downstate, it must be good to sit on the sidelines and throw snide comments. If you have a solution I personally am all ears. Specifics please though, and try to make them legal.

Or, you could continue to make yourself feel better by convincing yourself that your political opposites are the bane of all that is good in the world, and only you yourself are good, pure, and intelligent. Sheesh man.

- City Zen - Wednesday, Dec 19, 18 @ 11:53 am:

Can we connect @TinyDancer(FKASue) to Moody’s so she can tell them the pensions and OPEB don’t need to be 100% funded today because not everyone is retiring today? Maybe that will alleviate some of their confusion on the matter.

- Anon324 - Wednesday, Dec 19, 18 @ 11:55 am:

Downstate–

Why do you need to get handouts from a bunch of no-good, fiscally irresponsible Dems?

- Smalls - Wednesday, Dec 19, 18 @ 12:08 pm:

Bill Daley - Nope, we don’t need to raise taxes in Chicago (with head planted firmly in the sand).

- El Conquistador - Wednesday, Dec 19, 18 @ 12:33 pm:

Downstate - you’ve obviously bought in to the old ILGOP story that Chicago is dragging the state and you down when it’s actually the opposite is true. Cook and the collars subsidize downstate at ridiculously high levels. Do some research and educate yourself. As it is, you’re only reinforcing the stereotype of downstaters being uninformed country bumpkins.

- Anonymous - Wednesday, Dec 19, 18 @ 12:59 pm:

El, so what you are saying is downstate real estate taxes would be even higher than they are, sales taxes would be what, roughly 12-14%, state income tax would 7-8-9% and gas taxes would be 50 cents more per gallon if not for Chicago.

Is that what you are saying?

- Stuntman Bob's Brother - Wednesday, Dec 19, 18 @ 1:23 pm:

The report cites “positive 2018 returns”. They may want to revise that downward unless Santa Claus is really, really, really good to the markets in the next ten days, as 2018 market gains are largely gone at this point.

- El Conquistador - Wednesday, Dec 19, 18 @ 1:42 pm:

No. Property taxes are local taxes (city,county and school district). I’m referring to state service expenditures.

- Downstate - Wednesday, Dec 19, 18 @ 2:07 pm:

The state of Illinois (and I suspect Cook and Chicago) are increasing their spending at rates far in excess of CPI.

Go back to 2008. Reduce spending to those levels (with a CPI kicker) and start budgeting from there. It’s a modified version of zero-based budgeting.

- Perrid - Wednesday, Dec 19, 18 @ 2:09 pm:

LOL, hey Rich, did you see this? Evidently you and Greg Hinz are the liberal media lying to Illinoisans to promote some hidden agenda about our fiscal state.

https://www.illinoisreview.com/illinoisreview/2018/12/media-aids-democrats-in-easing-taxpayer-concerns-about-states-finances.html

- very old soil - Wednesday, Dec 19, 18 @ 2:32 pm:

Perrid “Springfield media ruler Rich Miller”. I love it.

- 17% Solution - Wednesday, Dec 19, 18 @ 3:10 pm:

It’s Mark Glennon and the flat earthers.(He calls himself and his followers that, I don’t know why.)They are upset because no one takes their ideas about changing the constitution and bankruptcy seriously.

Check out the comments following Glennon’s post. Seems some snowflakes got their comments removed and are lashing out at some prolific and popular Republican commentators to this blog.

https://www.wirepoints.com/when-journalists-spin-away-illinois-fiscal-crisis-two-new-examples/

- Demoralized - Wednesday, Dec 19, 18 @ 4:18 pm:

==Go back to 2008. Reduce spending to those levels==

And you came up with that magic number how?

- JS Mill - Wednesday, Dec 19, 18 @ 4:27 pm:

=increasing their spending far in excess of CPI=

What in the wide wide world of sports does CPI have to do with government spending?

Maybe check and see what state and local governments spend money on, they are not going to the grocery store. Pegging spending to CPI is Rauner level silly.

- Dan Sheehan - Wednesday, Dec 19, 18 @ 5:15 pm:

Chicago’s ANPL is 782%.Thank Rahm & Daley & their city council floor leader Alderman Pat O’Connor (40th ward)The created TIF zones have siphoned money from pensions & public school & infrastructure to the tune of over $2 billion

- Anonymous - Wednesday, Dec 19, 18 @ 5:23 pm:

Dan, TIF do not take any money from CPS. They are a higher tax rate.

- Oswego Willy - Wednesday, Dec 19, 18 @ 5:48 pm:

Illinois is not giving $3 billion to Somalia… or anyone considered migrants.

Please stop spamming.

- Anonymous - Wednesday, Dec 19, 18 @ 6:06 pm:

Where does that number come from, $3 billion to immigrants?

- Last Bull Moose - Wednesday, Dec 19, 18 @ 6:24 pm:

I am surprised that inflation has not moved up. We are at high employment and high government deficits. Historically that leads to inflation. A few years at 5% inflation would greatly help our pension funds.

- Anonymous - Thursday, Dec 20, 18 @ 7:18 am:

“Dan, TIF do not take any money from CPS.”

Wrong.

The property taxes that go to the schools are frozen at the rate the TIF starts at. When the property tax goes up, the school only gets the money at the old rate not the new rate. In the early 90s I paid $400 a year and now I pay $7000 a year. So now, the schools only gets a portion of $400. The rest goes into the TIF.