The harm done by the “pension crisis” narrative

Thursday, Feb 21, 2019 - Posted by Rich Miller

* Press release…

Few will argue that Illinois has significant issues with the underfunding of its five public employee pension systems. In fact, many say the state faces a continuing “pension crisis.”

However, three University of Illinois researchers argue that this “crisis” framework or mentality surrounding the issue actually impedes a sustainable solution. Their new report urges policymakers to rethink the conversation about pensions and Illinois’ finances. Download the report.

“Illinois lawmakers have long sought a silver bullet solution that will not increase (or even lower) the state’s required contributions while simultaneously shoring up pension systems’ finances,” write researchers Robert Bruno, Amanda Kass and David Merriman. “We view such a policy as unattainable and its pursuit a distraction from the job of responsible policymaking.”

Bruno is director of the Project for Middle Class Renewal and is a professor in the School of Labor and Employment Relations at the University of Illinois at Urbana-Champaign. Kass is associate director of the Government Finance Research Center at the University of Illinois at Chicago. Merriman is director of the Fiscal Futures Project and a senior scholar at the University’s Institute of Government and Public Affairs and a professor at the University of Illinois at Chicago.

Their paper makes three arguments: 1) that to resolve the pension underfunding issue the focus should be on long-term trends and peer comparison; 2) that a “pension crisis” is a situation in which the pension system is insolvent and unable to pay benefits – which is not the current case in Illinois; and 3) rather than a singular problem, there are two interrelated and in-conflict issues – the concern over pension finances and state operating budgets where expenses regularly exceed revenue.

Bruno, Kass and Merriman suggest that referring to the issue as a “crisis” leads to focusing only on short-term metrics and solutions. They urge state lawmakers to abandon the crisis rhetoric and to also abandon the practice of reducing that state’s pension contributions in order to balance the state budget.

“Our goal with this paper is to change the conversation about pensions and the state’s finances,” the report says. “We believe this is important for addressing the challenges facing the state in a calm, thoughtful and deliberate manner.”

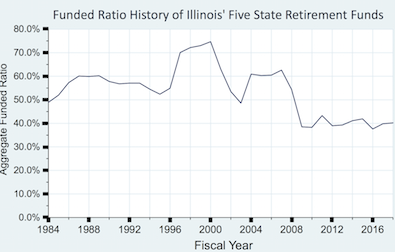

* First, a chart…

* Excerpt…

If future Illinois GDP growth is similar to growth over the past 20 years and if pension contributions increase in-line with the current actuarial projections, then the state’s annual pension payments will stabilize at about one percent of state GDP over the next several decades.

In other words, it’s relatively manageable, but only if you think current contributions are not too high.

* Gov. Pritzker obviously thinks current state pension payments are too high, so he’s proposing several things to deal with it, including extending the ramp out an additional seven years, which will “save” the state $878 million (not “about $800 million” - the actual number is $878 million) this coming fiscal year and about that in each of six years afterward. Pritzker’s “plan” fits right in to this section…

Assuming a “pension crisis” narrative has costs that are evident in Illinois’ legislative history. Not only in how it impacts the finances of the pension systems but also in the way it predetermines approaches to the subject. As Section III highlighted there are two main issues that are interrelated, yet in-conflict: (1) the financial condition of the pension funds, and (2) the state’s annual pension contributions as burdensome for the state budget. Importantly, in moments of political pressure to do something about pensions, what often materializes is legislation that alleviates the short-term pressure with the creation of a future, long-term problem. As a result, Illinois is stuck in a seemingly endless cycle of pension crises and problematic legislation.

Yep.

There’s a whole lot more, so click here to read it all. If Amanda Kass is part of a study, you know it’s good.

- Annonin' - Thursday, Feb 21, 19 @ 2:06 pm:

Ms Kass ran some mope from the policy institute into the dust Wednesday nite on WTTW. he was still pretending all the state needed to do was repeal the pension clause, screw the workers declare the “crisis” solved and buy Tillman another gimlet.

- City Zen - Thursday, Feb 21, 19 @ 2:16 pm:

Interesting nugget regarding Tier 2:

“Consequently, Illinois could be required to

increase the benefit of approximately 78 percent

of the employees not currently enrolled in Social

Security”

This scenario should be used by every actuary forecasting liabilities based on Tier 2 “savings”. So the problem that many here say will solve itself will most likely never be solved.

Can’t wait to see the next set of CAFR’s with this assumption built-in.

- Josie85 - Thursday, Feb 21, 19 @ 2:18 pm:

Amanda Kass has no background in economics or public policy, no idea what she’s talking about, and no solutions to any problems.

She’s a pure political actor and advocate for unions, not a researcher.

This “report” is trash. Every respectable national research group, including left leaning organizations like Pew, acknowledge the pension crisis facing many states. Illinois is always the worst or among the worst.

But I guess this Urban Planning student knows more than professional researchers and ratings agencies, right?

- Honeybear - Thursday, Feb 21, 19 @ 2:19 pm:

Those three just got this Unitarian

do’in a praise dance

- Andy S. - Thursday, Feb 21, 19 @ 2:21 pm:

SURS alone is absorbing a $200 million cut in FY 2020 to its certified state contribution, and this will apparently continue for decades. How serious is this? According to the latest actuarial report, the defined benefit part of SURS will pay out benefits and administrative expenses of about $2.8 billion in FY 2020, and with Pritzker’s contribution cuts will receive about $1.9 billion in state contributions and member contributions. That leaves a cash flow shortfall of $900 million that must be financed from the system’s assets, which as of January 31, 2019 total about $18.7 billion.

One common rule of thumb in financial planning is the so-called 4% rule, which posits that if you have a 25-year planning horizon and increase your withdrawal every year to reflect inflation, you should not withdraw more than 4% of your assets in the first year in order to give yourself a reasonably high probability of not running out of money. Well, $900 million divided by $18.7 billion represents a withdrawal rate of 4.81%, which virtually every knowledgeable professional would consider to be imprudently high. Incidentally, if Pritzker’s contribution cut were not adopted, the withdrawal rate from assets to cover the difference between benefits paid and contributions received would be 3.74%, which many would consider marginally acceptable.

- Donnie Elgin - Thursday, Feb 21, 19 @ 2:21 pm:

Interesting paper, one of the key assumptions that is very relevant in figure 7 ..

” if pension contributions increase in-line with the current actuarial projections”

will be denied by the new administrations 7 year pension ramp extension.

- Da Big Bad Wolf - Thursday, Feb 21, 19 @ 2:24 pm:

Whew, Josie85. What happened? Did Amanda Kass run over your dog?

- Rich Miller - Thursday, Feb 21, 19 @ 2:24 pm:

===Amanda Kass has no background in economics or public policy===

lol

lolol

- Honeybear - Thursday, Feb 21, 19 @ 2:26 pm:

Josie,

I don’t know who you are but I do know Bruno.

He could write the report by himself and it would withstand peer review just fine.

I also know of Merriman and he’s also an academic.

So it doesn’t matter what you

Think you know

This is solid

- Occam - Thursday, Feb 21, 19 @ 2:29 pm:

Good Lord:

“There is also a potentially serious and costly flaw in the Tier II plan. If the rate of inflation is high enough, Tier II benefits will be so low that they will violate federal law, which requires that they be at least equivalent to social security benefits.

Consequently, Illinois could be required to

increase the benefit of approximately 78 percent of the employees not currently enrolled in Social Security (State of Illinois Report of the Pension Modernization Task Force, House Joint Resolution 65, 2009).

The “crisis” framework led lawmakers to create

Tier II without much consideration of its potential pitfalls. A belief that something needed to be done in the present led to too little time and consideration of the future implications of what was being implemented. The Tier II plan passed through both state chambers in a single day.

Lawmakers never saw detailed projections from

pension system actuaries of the plan’s impact. “

- Three Dimensional Checkers - Thursday, Feb 21, 19 @ 2:30 pm:

Making pension payments does not get you much attention. I would not be surprised if the General Assembly made Gov. Quinn make the payments not because they thought it was a good idea, but because they did not like Quinn.

There are plenty of other states that have pension funds that are not 90% funded that are not in “crisis.” So, Pritzker’s position makes some sense even though politically he probably can’t come out and say that. But he needs to make some payments even if he the overall payment is a bit less. The systems are underfunded enough, in both Illinois and Chicago (more in Chicago), that further pension holidays will do a lot of damage to the state’s finances in the future.

- wordslinger - Thursday, Feb 21, 19 @ 2:30 pm:

–..a “pension crisis” is a situation in which the pension system is insolvent and unable to pay benefits – which is not the current case in Illinois;–

The “pension crisis” was a Hail Mary by the tronc and civvie types to try to walk away from pension debt in order to head off a move to a graduated income tax.

The Dems and Quinn gave them their law, and the Supremes slapped them down, unanimously.

The current yammering about a Constitutional amendment to walk away from pension debt is a similar pipe dream.

- Driveby - Thursday, Feb 21, 19 @ 2:34 pm:

Hilarious. And check out the performance of Amanda Kass, your new pension expert, on WTTW last night. As always, it’s “I don’t know,” “I’ve been trying to figure that out,” “I’m concerned about this….”

- PublicServant - Thursday, Feb 21, 19 @ 2:35 pm:

Telling IPI and the ILGOP to quit calling it a Pension CRISIS, is like like telling Trump to stop tweeting. Not gonna happen.

- California Guy - Thursday, Feb 21, 19 @ 2:37 pm:

What a great strategy. Solve a financial crisis by simply not calling it a crisis.

To be fair though, other than implement Tier 2, no significant steps have been taken to address the issue that weren’t show down by the State courts anyways.

Also lol @ GDP growth projections

- Oswego Willy - Thursday, Feb 21, 19 @ 2:37 pm:

Odds are, if you’re line of rebuttal is…

Going after Amanda Kass

Not going after the research

… you know nothing of Amanda Kass and the top shelf work she does… or you know Amanda Kass and you know the top shelf work she does.

Please add something other than showing yourself as a silly.

- wordslinger - Thursday, Feb 21, 19 @ 2:38 pm:

–This “report” is trash.–

Go on.

Expand on your conclusion, Speed Reader, citing specifics.

- Evanstonian - Thursday, Feb 21, 19 @ 2:38 pm:

It’s too bad in a layup election for Democrats, they elected a guy who agrees with the Chicken Littles.

- Rich Miller - Thursday, Feb 21, 19 @ 2:39 pm:

OW, the odds are that if they are focusing solely on the one person of the three who is a woman it has something to do with that.

- Rich Miller - Thursday, Feb 21, 19 @ 2:40 pm:

===Solve a financial crisis by simply not calling it a crisis===

Dumbest. Take. Ever.

- Louis G. Atsaves - Thursday, Feb 21, 19 @ 2:41 pm:

Interesting read.

The three authors wish to redefine the definition of “pension crisis” to where the State pension funds are depleted to the point where it is finally unable to pay those entitled to pensions? Pretty heartless stuff. The crisis starts when checks are being bounced.

Years ago I supported William Griffith for State Representative. His opponent, Karen May, during a debate finally exclaimed in frustration that “everyone is getting their checks, there is no crisis.”

Now three college professors are basically saying the same thing.

If surgeons proclaimed they should wait until the body on the operating table bleeds out, then do the necessary surgery? If engineers insist we wait until the bridge collapses before repairing/replacing it? If an electrician claims that smoking frayed wire hasn’t burned down the house . . . yet.

Sheesh. Send them back and have them start over please.

- Oswego Willy - Thursday, Feb 21, 19 @ 2:45 pm:

Rich, I must admit, I blew past that.

That’s on me.

- Anonymous - Thursday, Feb 21, 19 @ 2:51 pm:

Wordslinger at 2:30 hit the bullseye. Some people need a pension crisis like they need car; it’s the only thing that gets them where they want to go.

The criticism that the budget address “lacked new ideas” was off the mark for the same reason. The new ideas they want are the old ideas that the Supreme Court already shut down. But that doesn’t help them avoid the graduated income tax, so keep on keepin on.

- Josie85 - Thursday, Feb 21, 19 @ 2:53 pm:

I’m a woman, Rich, and that was a sexist comment.

I could also point out that Bruno is a “labor economist” i.e. not a real economist and that he shills for unions.

You were the one who singled out Kass so that’s what I responded to.

- Chicagonk - Thursday, Feb 21, 19 @ 2:54 pm:

There is a strong parallel between the Illinois pension crisis and the climate change crisis. There are a lot of people that figure that somehow it won’t impact them (maybe they will be dead or have moved somewhere safer), so they don’t care about kicking the can down the road. Pensions should have been budgeted for when they were accrued by the employees. I’m fine with Pritzker buying some time to get a graduated income tax in place, but the state should be focusing on how to increase other revenue streams in the meantime.

- City Zen - Thursday, Feb 21, 19 @ 2:55 pm:

==This “report” is trash.==

That’s unduly harsh and unwarranted. It’s a pretty good marketing piece and branding exercise.

- Rich Miller - Thursday, Feb 21, 19 @ 2:58 pm:

===and that was a sexist comment===

Right. lol

- Sue - Thursday, Feb 21, 19 @ 3:00 pm:

Why is it that no one spends more energy directed at enhancing returns. Being satisfied with the actuarial gurgle rate or the Plans target rate of return is nonsense. Without inviting in corrupt actors- Pritzker should focus on introducing a higher caliber of Trustees and or managers. TRS was often criticized about the Carlyle relationship but had Carlyle been given even more money and similar managers been hired rather then piling into poor performing hedge funds - the State could be required to contribute less money. It is time to recognize the taxpayers interest is equal to the interest of the beneficiaries and the State needs to increase oversight as to how the money is invested. Increasing ACA rags returns by a percent or two would pay for repairing a lot of roads and bridges

- SAP - Thursday, Feb 21, 19 @ 3:00 pm:

Merriman is the only one of the 3 that I know, and his work is solid. Did yeoman’s work on the 7% “solution” on Cook County property taxes some years back.

- Demoralized - Thursday, Feb 21, 19 @ 3:03 pm:

==i.e. not a real economist==

lol. Any other declarations of what people are or are not you want to make?

You’ve now attacked two of the three people and the best argument you have is that they are “shills” for unions. That’s an intelligent retort.

You’re out of your league. I’d suggest you stop before further embarrassing yourself.

- JS Mill - Thursday, Feb 21, 19 @ 3:04 pm:

=She’s a pure political actor and advocate for unions, not a researcher.=

Specifically, and supported by data, make the argument. If you can’t, we know what the trash is.

=The three authors wish to redefine the definition of “pension crisis” =

They are not wrong. Problems are not the same as crisis. The funding point for TRS is almost the exact same as it was in 1970 so your surgeon analogy comes up about 65 years short.

The underfunding needs to be addressed, just not with a sky is falling approach.

- Demoralized - Thursday, Feb 21, 19 @ 3:04 pm:

==and that was a sexist comment.==

There’s always at least one victim in the crowd.

- Anonymous - Thursday, Feb 21, 19 @ 3:05 pm:

Sue, some good points. One issue though. Pensioners and taxpayers are not equal. Taxpayers that don’t receive pension benefits far outnumber those that do. We should have much more say.

- wordslinger - Thursday, Feb 21, 19 @ 3:06 pm:

Louis, if lawyers yammer on with irrelevant, non-sensical analogies should they be taken seriously?

Given your deep thoughts on the matter, at what percentage funded ratio did it become a crisis, and at what percentage will it cease to be a crisis?

- GV - Thursday, Feb 21, 19 @ 3:07 pm:

Christopher Pissarides is also a labor economist, not a real economist, and recipient of the 2010 Nobel Prize in Economics.

- City Zen - Thursday, Feb 21, 19 @ 3:11 pm:

==The funding point for TRS is almost the exact same as it was in 1970==

Would have to know the active/retired ratio of pension participants, what % of the budget pension payments consumed, and pension benefit levels in 1970 to make a relevant comparison.

- Lester Holt’s Mustache - Thursday, Feb 21, 19 @ 3:11 pm:

It’s an interesting paper, and it puts forth a coherent argument for their position but unless I missed it, nowhere does it address the feasibility of the plan. You have to take into account the almost-cottage industry that has risen, specifically on the right, for purveyors of doom and the “Illinois-is-Detroit” arguments repeated ad-nauseum by the raunerites here at Capfax. Taking the view that the author suggests - reframing the pension issue as a manageable long-term problem instead of an imminent disaster that will occur any time now - would remove the foundation for the rights most beloved boogeyman argument: that public employees and the unions that represent them are destroying Illinois. ILGOP won’t sacrifice their framing in order to “change the conversation”, and politically speaking they probably shouldn’t - their base would never forgive them for it.

- Demoralized - Thursday, Feb 21, 19 @ 3:12 pm:

==Pensioners and taxpayers are not equal.==

Sigh. Are we really going down this absurd road again?

==Taxpayers that don’t receive pension benefits far outnumber those that do. We should have much more say.==

I’m tried to follow the logic there until I realized there is no logic.

- lake county democrat - Thursday, Feb 21, 19 @ 3:15 pm:

–that a “pension crisis” is a situation in which the pension system is insolvent and unable to pay benefits – which is not the current case in Illinois –

Mindful of Rich’s “dumbest take ever” response to what appeared to be another reference to this, I’m going to criticize this contention. Do you really have to be -insolvent- for it to be a “pension crisis”? Come on - Illinois could be twice, three, four times as bad off as it is now and could still meet its pension obligations, even if it made us the new Mississippi in terms of quality of life. I’d argue what I think that George Mason study I linked to earlier was saying: it’s a “crisis” when the only way to get out of it presents a real risk of a “death cycle” where the pain of dealing with it slows growth and prompts reactions so severe it makes the problem worse.

The authors even seem to agree with this as the measuring of a…”really really bad situation”. They say “If future Illinois GDP growth is similar to growth over the past 20 years” the pension burden will stabilize. OK, and if it isn’t? What was last year’s growth? How are we trending? How will Pritzker’s moves affect the state’s growth rate ( huge unknowns, such as how elastic or inelastic are wealthy taxpayers and tax paying businesses if hit with steep progressive taxes)?

Last comment: they claim the reason this isn’t just a matter of semantic games is because “the

framing of Illinois’ pension problems is inextricably linked to how we conceptualize their solutions.” Given the near-universal acknowledgement that we have been kicking the pension “problem” down the road for decades, maybe the language, even if they think it’s unduly alarmist, isn’t such a bad thing.

- Rich Miller - Thursday, Feb 21, 19 @ 3:19 pm:

===the almost-cottage industry that has risen===

It’s much bigger than that.

- Lester Holt’s Mustache - Thursday, Feb 21, 19 @ 3:19 pm:

==You’re out of your league. I’d suggest you stop before further embarrassing yourself==

Speak for yourself, pal. I for one am greatly enjoying this slow-motion train wreck.

- Growing the blue wave - Thursday, Feb 21, 19 @ 3:19 pm:

Reading these comments confirms the accuracy of the title - - Harm has been done by the politically driven “pension crisis” narrative

- wordslinger - Thursday, Feb 21, 19 @ 3:25 pm:

===the almost-cottage industry that has risen===

It’s much bigger than that.–

Has been for some time. Rauner’s bankroll may be gone (for now) but Uiehlein is still signing checks and Baise has found himself a secret Sugar Family that may or may not include the owners of a North Side ball club.

- Fairycat - Thursday, Feb 21, 19 @ 3:26 pm:

Anon @ 3:05–I’m a hopeful pensioner-to-be, and a taxpayer now. Are you saying your opinion as a taxpayer matters more than my opinion as a taxpayer? What a load of malarkey.

- Anonymous - Thursday, Feb 21, 19 @ 3:28 pm:

Yes, very few taxpayers get state funded pensions. We should have more say.

- wordslinger - Thursday, Feb 21, 19 @ 3:31 pm:

–We should have more say.–

What are you trying to say? Use your words.

- City Zen - Thursday, Feb 21, 19 @ 3:31 pm:

==Do you really have to be -insolvent- for it to be a “pension crisis”?==

Agreed. This is merely an attempt to re-brand what is indeed a serious issue. You don’t have to know authors’ benefactors to figure out the soft sell in play here. Whether or not it persuades anyone outside their circles is another matter.

- Phil King - Thursday, Feb 21, 19 @ 3:32 pm:

Below 50% funding ratio is often considered the point of no return, because at that point assets are so small that investment returns aren’t sufficient to keep up with rising benefit costs.

That’s a better definition of crisis than “insolvency” which is beyond crisis. At that point, it’s a catastrophe.

- Da Big Bad Wolf - Thursday, Feb 21, 19 @ 3:34 pm:

A crisis is when your house is on fire. A problem is when you have to hire electricians to rewire your home.

- Earnest - Thursday, Feb 21, 19 @ 3:38 pm:

It challenged my own thinking of the issue as a debt problem, that we need to pay back what we borrowed when we skipped payments. It makes more sense to let go of the history and frame things in terms of short-term actions to attain appropriate levels of funding. That make for a more effective conversation than old recriminations.

Also the creation of Tier II is an important omission from the general conversation and so often goes unacknowledged by those who frame things as a need for reform of pensions.

- Anonymous - Thursday, Feb 21, 19 @ 3:39 pm:

How much does the average taxpayer pay towards the pensions

Does anyone really know.

Does is come out of the income tax they pay

Sales tax

Gas tax.

We hear so many complaining about paying for the pensions

It would be helpful if we had a number or a % to get a better idea of how much money actually comes out of the avg taxpayer pocket and is going towards the pension

- City Zen - Thursday, Feb 21, 19 @ 3:40 pm:

==A crisis is when your house is on fire. A problem is when you have to hire electricians to rewire your home.==

Except our pension home is built with matchsticks.

- Honeybear - Thursday, Feb 21, 19 @ 3:45 pm:

“soft sell in play here”

versus

the hard sell

of ILGOP still lead by Rauners disciples

to take away

the retirement benefits

of loyal, hardworking

Illinoisans

who are being made the

sin eater

for public service to their state.

No

Stop

it just wrong.

What exactly is the source of your hatred

for state workers like me?

- Anonymous - Thursday, Feb 21, 19 @ 3:45 pm:

The pension costs come out of our taxes paid to Illinois and apparently require ever more of our tax money. That’s all I need to know.

- Da Big Bad Wolf - Thursday, Feb 21, 19 @ 3:46 pm:

==You don’t have to know authors’ benefactors ==

So anything the University of Illinois funds is poison?

- Da Big Bad Wolf - Thursday, Feb 21, 19 @ 3:48 pm:

==Except our pension home is built with matchsticks.==

Since you are having trouble figuring it out, the difference between a crisis and a problem is time.

- Norseman - Thursday, Feb 21, 19 @ 3:50 pm:

The bottom line is that the crisis histrionics focused on reducing benefits has not resulted in a solution.

- A Jack - Thursday, Feb 21, 19 @ 3:51 pm:

I certainly agree with the idea of not calling it a pension “crisis.” In fact I wrote a college paper in the early 90’s on Illinois’ funding of pensions and how inadequate it was then. But no one called it a crisis. Suddenly the Commercial Club comes along and calls it a crisis and we are in crisis mode.

- Nonbeleiver - Thursday, Feb 21, 19 @ 3:51 pm:

I used to think I wasn’t confused on this issue.

Now, I know I am confused.

- Harvest76 - Thursday, Feb 21, 19 @ 3:53 pm:

When three accomplished and well respected professionals author a substantial paper on a contentious topic, and your response is ad hominem attacks, we all know who the shill is.

- Generic Drone - Thursday, Feb 21, 19 @ 3:53 pm:

We should have more say. So the person who pays the most in taxes should make the laws?

- don the legend - Thursday, Feb 21, 19 @ 3:56 pm:

==Yes, very few taxpayers get state funded pensions. We should have more say.==

According to your thinking you already have more voters thus more votes. You already have more say.

- Nonbeleiver - Thursday, Feb 21, 19 @ 3:56 pm:

On the more serious side thanks to Andy S. for his analysis:

- Andy S. - Thursday, Feb 21, 19 @ 2:21 pm:

SURS alone is absorbing a $200 million cut in FY 2020 to its certified state contribution, and this will apparently continue for decades. How serious is this? According to the latest actuarial report, the defined benefit part of SURS will pay out benefits and administrative expenses of about $2.8 billion in FY 2020, and with Pritzker’s contribution cuts will receive about $1.9 billion in state contributions and member contributions. That leaves a cash flow shortfall of $900 million that must be financed from the system’s assets, which as of January 31, 2019 total about $18.7 billion.

- Louis G. Atsaves - Thursday, Feb 21, 19 @ 3:57 pm:

===Louis, if lawyers yammer on with irrelevant, non-sensical analogies should they be taken seriously?===

@wordslinger, so that means the laugh is on you? I see that I’m not the only one with concerns over the approach used by those three professors around here.

- Grandson of Man - Thursday, Feb 21, 19 @ 3:58 pm:

“Baise has found himself a secret Sugar Family that may or may not include the owners of a North Side ball club.”

Huge phony victims, these Rickettses. These billionaires are crying about “socialism” and hating public employee unions as if their fortunes were hurt. They are poster children for why we need a graduated income tax in Illinois.

- A Jack - Thursday, Feb 21, 19 @ 4:05 pm:

I am also not keen on the ramp restructure. I would like to hear more about the asset transfer.

If the asset transfer is done as a sale-leaseback that airlines and other major companies use then it would be more in-line with the spirit of this report.

The transfer could be any state asset, that the state then “leases” back from the pension fund.

The lease payment would have to be large enough to meet current pension payouts.

Meanwhile, the assets on the pension’s balance sheet would increase funding levels.

So for example, the state “sells” the Capital building to the pension fund in exchange for that portion of its debt. That asset increases the funds balance sheet. In turn the state leases back the capital. I know it sounds like accounting magic, but big companies do a similar process to free up cash. But I haven’t heard enough of their idea to determine if that is their intention.

- Six Degrees of Separation - Thursday, Feb 21, 19 @ 4:10 pm:

===Below 50% funding ratio is often considered the point of no return===

Well, the state pensions were about 40% funded when the constitutional protection was added in 1970, and somehow they climbed to near 80% funded in the year 2000 (as shown in the chart) before slumping off again. We would do well to do more of the stuff that made it climb, and less of the stuff that made it descend.

- City Zen - Thursday, Feb 21, 19 @ 4:12 pm:

==So anything the University of Illinois funds is poison?==

A bit of a naive take, no? Is your contention the Labor Education Program is funded entirely by tuition/enrollment and receives zero grants from outside organizations? If you do, you’re gonna be disappointed.

- Back to the Future - Thursday, Feb 21, 19 @ 4:20 pm:

I think that Sue’s comment on performance of Illinois Funds is important. I remember reading an article ” All that Glitters is not Gold”- an Analysis of the Public Pension Investments by the American Federation of Teachers that included a study of the Illinois State Board of Investments.

It seemed credible to me. We were really pretty bad in investing. Other states were mentioned in the study.

Someone should look at the consultants, managers and Trustees.

- wondering - Thursday, Feb 21, 19 @ 4:20 pm:

I think what is over looked is the tronc types objections to pension funding is not about money. It is much more viseral than that. They and the class they represent demand fealty, subservience, dependence. Pensioners autonomy is against their world view.

- Smalls - Thursday, Feb 21, 19 @ 4:21 pm:

I have been reading through the report. I think there is a lot of great research in here. Just one comment so far, where it appears they are mixing a little apples and oranges. “Figure 7 shows that the state’s annual pension contributions reached nearly one percent of Illinois GDP in 2018. If future Illinois GDP growth is similar to growth over the past 20 years and if pension contributions increase in-line with the current actuarial projections, then the state’s annual pension payments will stabilize at about one percent of state GDP over the next several decades.”

The current contributions are not based on the actuarial calculations. So you can’t say if the current contribution rise in -line with acturial projections….. Go back and look at Figure 3. They are only paying in 61% of what the actuary recommends for TRS.

- Glengarry - Thursday, Feb 21, 19 @ 4:23 pm:

It’s a good read and it fits perfectly into how I view the pension funding issue. A collective deep breath is needed by all. Too bad there are some partisans here that don’t understand good and useful data and just drag their feet because it doesn’t fit their political narrative.

- Jibba - Thursday, Feb 21, 19 @ 4:35 pm:

AJack…

The lease back idea obviously costs rent money that was not in the budget before, so it will require a tax increase. This is exactly what will happen when the funds are truly exhausted, requiring a huge tax increase. The people will then rue the day they didn’t support a 2% tax increase to fund the pensions way back in 2019.

- wordslinger - Thursday, Feb 21, 19 @ 4:39 pm:

Louis, I missed the part where you stated at what percentage funded ratio it became a “crisis” and at what percentage it would cease to be.

There’s a handy chart in the post. Just point.

- City Zen - Thursday, Feb 21, 19 @ 4:40 pm:

==The people will then rue the day they didn’t support a 2% tax increase to fund the pensions way back in 2019.==

Not if they’re retired.

- wondering - Thursday, Feb 21, 19 @ 4:41 pm:

Glengarry. you got it. Mathmatical arguments go no where because it isn’t about math. It is about class structure. Math is just, as this article infers, a handy rationalization tool. Pension envy and upper class prerogative, bedrock Republicanism in action.

- wordslinger - Thursday, Feb 21, 19 @ 4:42 pm:

–I think what is over looked is the tronc types objections to pension funding is not about money.–

I think there’s some self-loathing that they remained silent while Zell robbed them of their ESOP and then left them the “owners” of a bankrupt company $12.8 billion in debt.

I doubt if that was in the employees retirement plans.

- Anonymous - Thursday, Feb 21, 19 @ 4:45 pm:

So no one knows how much the avg taxpayer actually pays to the pension

- City Zen - Thursday, Feb 21, 19 @ 4:48 pm:

==Mathematical arguments go no where because it isn’t about math. It is about class structure.==

Can you call the holders of my student debt? Because their math is rationalizing me to the poor house.

- Louis G. Atsaves - Thursday, Feb 21, 19 @ 5:20 pm:

@wordslinger, OK then, you wish no proactive measures to stabilize our state pension systems in Illinois. None whatsoever.

Are our pensions the worst funded in the nation? And you are OK with that and with redefining when a crisis hits on that front? According to these professors, it is only a crisis when checks start bouncing to pensioners.

Can you imagine the political uproar if Rauner pushed for reramping the ramp and calling for a $800 million per year pension holiday for the next 7 years? And today we find out it’s not $800 million a year, but $870 million?

I strongly disagree with the professors here on their redefinition of “crisis” as it pertains to our state pension funds.

- Sue - Thursday, Feb 21, 19 @ 5:24 pm:

Anonymous- the average property owner gets a breakout as to the dollar figure they pay for the school district cost of pension costs. As for the State contribution we all learn what the annual contribution is and adept of Rev advises what percentage of all revenues come from the personal income tax- do the math

- JS Mill - Thursday, Feb 21, 19 @ 5:26 pm:

=Would have to know the active/retired ratio of pension participants, what % of the budget pension payments consumed, and pension benefit levels in 1970 to make a relevant comparison.=

40% of obligations in 1970 and 40% of obligations in 2019 is THE relevant comparison. Those obligations are current dollar current obligations.

- wondering - Thursday, Feb 21, 19 @ 5:31 pm:

City Zen, is your statement germane? If so, how so?

- Liandro - Thursday, Feb 21, 19 @ 5:31 pm:

So it’s only a crisis when retirees get affected? All the other damage isn’t a crisis as long as a check can still be cut, post budget carnage, to retirees?

Louis is right–that’s a heartless (and nonsensical) position to take.

I agree with their point that legislators have to stop trying to pay LESS into the pensions annually when they clearly need to pay MORE. Short of allowing bankruptcy, that’s also nonsensical.

- JS Mill - Thursday, Feb 21, 19 @ 5:36 pm:

===Taxpayers that don’t receive pension benefits far outnumber those that do. We should have much more say.==

What brilliance. What about SSI? You think that you are self funding the Social Security endowment? You are not. I will not get it and every dollar I put in will go to supplement yours. So I guess by your logic I should have more say over SSI.

- Been There - Thursday, Feb 21, 19 @ 5:43 pm:

I have always said it’s not really a crisis, at least not yet, Using the same arguments for those that propose they wish the state could file bankruptcy. Just as the bankruptcy judge would ask “Are there any other available revenue sources?” “Well there is this thing called an income tax that can be raised. But we don’t like to do that because it’s not good politically.”

So in other words I don’t think it’s a “crisis” because we have options. Maybe not good for political careers but for those that want to do the right thing the option is always there.

- Anonymous - Thursday, Feb 21, 19 @ 6:00 pm:

- no proactive measures to stabilize our state pension systems in Illinois. None whatsoever. -

I can think of $125k per year over the last 4 I would have liked to see redirected to the pensions.

- Anonymous - Thursday, Feb 21, 19 @ 6:06 pm:

Sue

What is your contribution

You must have done your math since you complain so much about pensions

I bet you havent

- RNUG - Thursday, Feb 21, 19 @ 6:24 pm:

== We should have much more say. ==

If you truly believe that, then work to get a majority in the House and Senate, pass a Constitutional Amendment to be placed on the ballot, and then round up the voters to enact it.

The public voted against a Constitutional Convention the last time they had a chance.

- RNUG - Thursday, Feb 21, 19 @ 6:28 pm:

== Below 50% funding ratio is often considered the point of no return ==

Historical fact: Illinois has been underfunding pensions for 100+ years. Pensioners somehow got paid all those years.

- RNUG - Thursday, Feb 21, 19 @ 6:31 pm:

== Rev advises what percentage of all revenues come from the personal income tax ==

I gave the 2016 income tax statistics yesterday plus a link to the supporting documentation.

Seek and you shall find.

- Anonymous - Thursday, Feb 21, 19 @ 6:44 pm:

The key to this is all is reducing other state spending enough so the state can meet the pension obligation.

- Shemp - Thursday, Feb 21, 19 @ 7:00 pm:

It’s not saving the State, it’s deferring and passing the cost on to younger people. There is no saving in re-amortizing, only prolonging and loss of compounding interest.

- Anonymous - Thursday, Feb 21, 19 @ 7:00 pm:

Well, we can all thank Governor Edgar for the current mess, if you prefer not calling it a crisis.

- Stuntman Bob's Brother - Thursday, Feb 21, 19 @ 7:07 pm:

Semantics. It appears the question of whether decades of unfunded promises to state workers should be called an “addressable problem” or a “crisis” depends on whether or not the burden of fixing it impacts your own finances.

As a “middle class” taxpayer through my entire working life, I feel like I paid “my fair share” - even if my income taxes were artificially low, my artificially high real estate and sales taxes more than made up for it. So, now it’s time for the people who did the best under the system to divvy up to fix it. And that includes high-income retirees. The idea of kicking 870 million cans down the road each year (for another ten years) is ridiculous. JB needs to raise the flat income tax rate until he can get the progressive tax in - and if he wants to minimize its effect on the Little Guy, the personal exemption can be raised accordingly. And, maybe we should stop making promises we are not willing to fund in real time. Or, did we elect the wrong Governor again?

- Medvale School for the Gifted - Thursday, Feb 21, 19 @ 7:21 pm:

But…

https://www.illinoisreview.com/illinoisreview/2006/01/is_the_a_chicke.html

- Ebenezer - Thursday, Feb 21, 19 @ 7:26 pm:

Y’all should read the report. They are saying thinking of it as a crisis makes the problem worse. They are not saying its fine. The problem is the legislature has not, is not and will not appropriate the money.

Unfunded liabilities from the report:

1994 17 Billion

2003 40 Billion

2019 130 Billion

In that period state GDP grew by ~ 2X, while unfunded liabilites grew by 8X.

It may not be a crisis, but its not getting better.

GDP from Fred.stlouisfed.org

- RNUG - Thursday, Feb 21, 19 @ 7:42 pm:

== Well, we can all thank Governor Edgar for the current mess, if you prefer not calling it a crisis. ==

Between the pension bonds where part of the revenue was diverted to yearly operations, saddling the pension funds with indirectly repaying the bonds, and resting the the ramp, it was made worse significantly worse by Blago.

And if you really want to go to the toot cause, you can blame the 1971-1975 GA’s for spending all the new excess income tax revenue and Walker for shorting the proposed FY75 pension contributions and the subsequent lawsuit that resulted in the 1975 IL SC decision IFT v Lindberg that let the State short the pension funds

- Da Big Bad Wolf - Thursday, Feb 21, 19 @ 7:44 pm:

==Increasing ACA rags returns by a percent or two would pay for repairing a lot of roads and bridges==

It would be nice to get more bang for the buck. What percentage return do we get now? Maybe invest in Illinois bonds?

- Anonymous - Thursday, Feb 21, 19 @ 7:48 pm:

The problem with this article is that we have more than one negative narrative. The population loss narrative is another. Add them together and that explains why many (including Dems) have a poor business sentiment for our State.

- Anonymous - Thursday, Feb 21, 19 @ 8:30 pm:

We can also blame the state constitution for math defying pension provisions.

- Blue Dog Dem - Thursday, Feb 21, 19 @ 9:00 pm:

I wonder. If the analytics end up in projecting the upcoming progressive tax as say,$50k/yr at a 6% rate and upwards from there. If a 2020 amendment doesn’t pass , what will really happen to gov Kick the Cans budget.

- wordslinger - Thursday, Feb 21, 19 @ 10:05 pm:

–@wordslinger, OK then, you wish no proactive measures to stabilize our state pension systems in Illinois. None whatsoever.–

You’ll have to point out where I said that, Strawman Maker.

And strangely, you keep forgetting to point out at what percentage of funded ratio that it became a “crisis,” and at what percentage it no longer will be.

You’re also, somehow, missing the entire point of the report you claimed to have read:

–Bruno, Kass and Merriman suggest that referring to the issue as a “crisis” leads to focusing only on short-term metrics and solutions. They urge state lawmakers to abandon the crisis rhetoric and to also abandon the practice of reducing that state’s pension contributions in order to balance the state budget.–

- walker - Thursday, Feb 21, 19 @ 10:20 pm:

It is often worthwhile to refocus on Rich’s headlines when drifting off course in comments.

- Question More - Friday, Feb 22, 19 @ 4:21 am:

Camelot: British Co. “Managing” IL Lottery sending profits to the Ontario Teachers Pension Fund in Canada. Makes sense. We love the “middle man” No Qualified Executives in IL to “Manage” the Lottery.

- Anon - Friday, Feb 22, 19 @ 6:46 am:

When the Funds need to sell assets to pay benefits, will it then be okay to call it a “pension crisis?” Or perhaps it is only when beneficiaries’ checks bounce that a “pension crisis” truly exists. Look, the Funds are under 50% funded and are declining, if advocates like the authors want to call the situation something else, fine. Actuaries, which the three advocate-authors are not, know better. But by all means, listen to those with little to no math skills- because it probably feels better.

- City Zen - Friday, Feb 22, 19 @ 8:27 am:

==Or perhaps it is only when beneficiaries’ checks bounce==

I don’t think pension checks can technically bounce. The pension checks will just come out of the general fund, much to the chagrin of the vendors and everyone on payroll.

- Anon - Friday, Feb 22, 19 @ 9:06 am:

You are absolutely wrong, City Zen.

- common_sense - Friday, Feb 22, 19 @ 9:06 am:

Call the pension situation whatever you like but listen to the following advice “to also abandon the practice of reducing that state’s pension contributions in order to balance the state budget.–”

- Frank - Friday, Feb 22, 19 @ 9:09 am:

Question More- thank Grima Wormtongue aka Hans Zigmund for that. He was on the committee that set up that deal. Funny I don’t think his emails were ever investigated by Hinshaw and Culbertson even though he was a state employee.