* WEEK TV…

The layoffs at Western Illinois University has captured the attention of Gov. J.B. Pritzker. […]

He’s well aware that WIU announced last week some 132 faculty and staff positions will be eliminated. Administrators cited reduced state funding and declining enrollment. School statistics show WIU lost more than 4,000 students over the past ten years.

“I proposed an increase in funding for our universities across the board in the state. And Western Illinois is just one of those universities that would get an increase under the budget that I put forward,” said Pritzker.

Um, WIU announced the layoffs well after the governor unveiled his budget plan. The money the governor wants to spend is obviously not enough to forestall those layoffs. The school saw what was coming and pulled the plug.

Later, Pritzker said the state needs a graduated income tax to restore the state’s universities to greatness “and even better.”

* Meanwhile…

[WIU] faculty members also have launched a petition to be delivered to Gov. J.B. Pritzker, urging him to appoint new board members and to provide emergency funding to help stave off the pending layoffs and program cuts.

Three of the seven governor-appointed seats on the board are vacant while the terms of three sitting members expired in January.

The MoveOn petition had more than 4,800 signatures as of Tuesday.

73 Comments

|

A worrisome job trend

Tuesday, Mar 5, 2019 - Posted by Rich Miller

* Hannah Meisel…

Illinois has lost the greatest number of jobs in some of the industries with the highest earnings over the last 10 years, while gaining jobs in the lowest-paying job sectors during the same period, according to the Commission on Government Forecasting and Accountability’s latest monthly report. While recent improvement in employment and wage growth in Illinois is “encouraging,” those long-term trends are “still concerning,” according to the report.

The industry with the highest weekly earnings — construction — is also the industry that lost the most jobs in Illinois during the last decade, according to the report. Workers in the construction industry earn an average of $1,424 per week, according to data from the federal Bureau of Labor Statistics, but jobs in the construction industry have decreased by 12.4 percent in Illinois since 2008. Similarly, jobs in the broad category of information, which earn an average of $1,335 per week, have decreased by 18.2 percent in Illinois since 2008.

During that same decade, industries like education and health services have been seen the biggest improvement in number of jobs — up 16.2 percent since 2008 — but that industry is among the lowest-paid in Illinois, earning an average of $814 per week. Jobs in the leisure and hospitality subsector have also seen a boom, but those are the lowest-paying jobs in Illinois, with an average weekly pay of $405, according to Bureau of Labor statistics. COGFA also points out that Illinois’ largest subsection, jobs classified as trade, transportation and utilities which employed over 1.2 million Illinoisans in 2018 and made up 20 percent of jobs in Illinois, “also has one of the lowest average weekly earnings totals in the state” — with average weekly earnings of $857.

However, recent trends are encouraging, like a 2.7 percent increase in construction — the state’s highest-paying industry, according to the report. Similarly, jobs under the umbrella of financial activities — another high-paying sector — increased by 2.1 percent during the last year after being essentially flat since 2008. “Time will tell if this recent growth in these higher paying jobs is the beginning of a long-term positive trend or just a temporary blip in an overall disappointing decade of employment activity in Illinois,” according to the report.

The full COGFA report is here.

27 Comments

|

Question of the day

Tuesday, Mar 5, 2019 - Posted by Rich Miller

* Finke…

More state income tax money and consolidation of downstate police and firefighter pensions top the agenda this year for the state’s mayors.

The Illinois Municipal League said Monday it also is making a priority approval of a capital plan that would provide more money for transportation, water, sewer and other improvements in cities. […]

The mayors also want the state to provide more state income tax money to cities and towns. Local governments were getting 10 percent of state income tax collections. However, local governments did not get a share of the income tax increase, meaning local governments now only receive about 5.75 percent of individual income tax collections and about 6.5 percent of corporate collections.

The IML said the General Assembly continues to impose mandates on local governments whose costs could be offset if the state returned to giving cities 10 percent of income tax collections. That, in turn, would take pressure off local property taxes to cover those costs.

* Illinois News Network…

Illinois currently sends just over 6 percent of personal and corporate income taxes to local municipalities, totaling around $1.3 billion in personal and corporate income tax annually.

IML-backed legislation would gradually increase that figure to 10 percent by 2023. […]

Increasing the amount of money directed to municipalities means less money for the state to spend. The state’s financial picture is bleak. Lawmakers face a $3.2 billion deficit in the next budget and more than $8 billion in backlogged bills. The state’s pension systems have more than $134 billion in unfunded liabilities. Pritzker’s proposed budget counts on revenue from recreational marijuana and sports gambling, among other taxes and fees, to plug the gap. Lawmakers have yet to legalize recreational marijuana or sports gambling.

* The Question: Should municipalities be returned to receiving 10 percent of all state income tax collections over four years? Take the poll and then explain your answer in comments, please…

surveys

32 Comments

|

Under the bus they go

Tuesday, Mar 5, 2019 - Posted by Rich Miller

* We talked about this cannabis legalization press release the other day…

“For generations, government policy of mass incarceration increased racial disparities by locking up thousands of individuals for marijuana use or possession,” said State Senator Toi Hutchinson (D-Chicago Heights), the legislation’s chief co-sponsor in the Senate. “Now, as we are discussing legalization, it is of the utmost importance that we learn from these mistakes and acknowledge the lingering effects these policies continue to have in neighborhoods across this state. No conversation about legalization can happen absent that conversation.” […]

“We’re not just trying to add diversity because it looks good. It’s not just diversity for diversity’s sake. It’s for equity’s sake; equity includes economics, it includes criminal justice,” said State Rep. Jehan Gordon-Booth, who is the chief co-sponsor of the legislation in the House. “We’re talking about specific communities that need to be made whole. When this is all normal and nice and people are making money, we will not have succeeded if black people and other people of color are shut out.” […]

“It is important that we work together to establish an adult use cannabis market that works for everyone,” said State Rep. Kelly Cassidy, the legislation’s House sponsor. “We’re contemplating additional license categories such as craft cultivation, transportation and processing to ensure that everyone is at the table. These will create space for more innovation and entrepreneurship in the industry, but more importantly, provide opportunity for more diversity in an industry with a pressing need for it.”

Again, those are the legislative architects of the legalization bill. And it’s abundantly clear from their comments here and elsewhere that diversity and addressing past wrongs is very high on their priority list and always has been.

* Gov. Pritzker was asked about the legislators’ efforts to date when he was at the Daily Herald editorial board…

They’ve done a pretty good job of putting at least the basics together for a bill.

There are pieces of it that I think need to be enhanced and we’re certainly talking to them about those pieces.

For example, I’m very focused on making sure that communities of color, which have been most burdened by the war on drugs, have the ability to get licenses.

The sponsors have asked the governor for a point person on this topic and didn’t get one. They asked for a briefing on Pritzker’s licensing fee plan and didn’t get one. But they did get called out publicly by the governor for not adequately addressing something they… were already diligently working on.

41 Comments

|

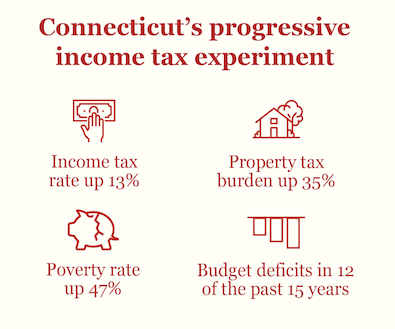

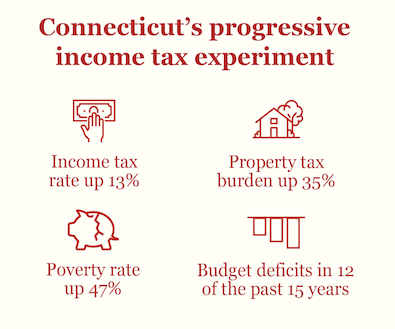

The last state to pass a progressive income tax

Tuesday, Mar 5, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Just one state in the past 30 years has adopted a progressive income tax: Connecticut. The result? Middle-class tax hikes, lost jobs and increased poverty – not to mention chronic outmigration and a financial situation just as dire as Illinois’.

There are harrowing similarities between the Connecticut experiment and Gov. J.B. Pritzker’s push for a progressive income tax in Illinois.

Connecticut lawmakers in the 1990s sold the progressive income tax as a way to provide middle-class tax relief and reduce property taxes. But neither occurred. Instead, the typical Connecticut household has seen its income tax rates increase more than 13 percent since 1999. At the same time, property tax burdens have risen by more than 35 percent.

Pritzker’s argument for the progressive income tax relies on the same myths – that it will allow for middle-class tax relief and lower property taxes, and shore up the state’s finances.

But if Illinois ditches its constitutionally protected flat income tax, Illinoisans will face the same fate as Connecticut – higher taxes for everyone, fewer jobs and an even more sluggish economy.

Comments Off

|

Long wish lists, but few funding ideas

Tuesday, Mar 5, 2019 - Posted by Rich Miller

* BND…

The metro-east’s and southern Illinois’ wish lists for a capital bill include road improvements and building construction, but a way to pay for the projects remains elusive.

Members of the state Senate Subcommittee on Capital met Monday at Southern Illinois University-Edwardsville for the first of five regional hearings on local construction needs around the state. The remaining four hearings are scheduled around the state this spring. […]

When state Sen. Martin Sandoval D-Chicago, asked representatives from Southern Illinois University if they would be willing to pay a higher gas tax, or tax on candy or license plate renewals, taxing freight or pollution, few, if any people raised their hands.

Senators said they would need to have support from people asking for funding on ways to help pay for the construction projects.

“We’re going to have to make the case for revenue to 12 million taxpayers in the state of Illinois, and it would be helpful if we had organizations making requests for capital, also publicly support the revenue needs in order to make that happen,” said state Sen. Ram Villivalam, D-Chicago.

* Southern Illinoisan…

Officials from the Southern Illinois University system presented a long list of projects, starting with an $83 million plan to refurbish the aging mass communications and media arts building and a $98 million science building on the Carbondale campus. The university is also hoping for a new education building for its medical school campus in Springfield.

In addition to those projects, however, John Dunn, interim chancellor of the SIU Carbondale campus said the school has a backlog of about $700 million worth of “deferred maintenance” projects.

“Visually, we need cranes on our campus,” he said. “Cranes on the campus send a powerful message to the public at-large that we’re alive and well, we’re working forward and we’re creating jobs.”

* Edwardsville Intelligencer…

Sandoval occasionally had a number of sharp questions for those testifying, ranging from how they would guarantee inclusion of women, minorities and veterans in various infrastructure projects, to pointed questions about how it should be paid for.

He repeatedly asked those testifying that question, often asking specifically if they would support a gas tax, mileage tax or other tax increases.

Responses ranged from some saying that it was the legislator’s job to figure that out, to a few others who said they would support some specific measures. They often couched those answers by saying elected officials would have to do a better job of explaining exactly how the money would be spent.

33 Comments

|

The Credit Union Difference

Tuesday, Mar 5, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Comments Off

|

* Gov. Pritzker sat down with the Daily Herald editorial board yesterday. I’m still going through the whole thing, but he said this when asked why people were moving out of state…

I think there are several reasons. One is that we have been significantly underfunding education in the state and one of the reasons that business and jobs get created in the state is because it has great talent and it invests in that talent. That’s certainly why people come here on a day like this when it’s below zero. Why would a business choose Illinois? It’s because we’ve got great people, we have terrific talent. And it’s because we have great universities, and because we are producing great talent that we can work in those businesses.

But not if you don’t invest in it. So, we lose people in part because we aren’t continuing to invest in the talent that we need. We lose people because we have a property tax system that overburdens people. And we lose people because when you don’t fund universities, and when you threaten not to fund MAP grants, tens of thousands, it turns out it’s more than 72 thousand, young people choose not to go to school in Illinois and when they leave about 70 percent of them don’t come back. So those are all things that contribute to why people leave.

He was kind of all over the place there, but your thoughts on what he said?

…Adding… Related…

* Wooing Illinois to Indiana? It’s not just businesses doing it - A Chicago real estate agent is sprinkling Illinois suburbs with postcards pitching affluent homeowners on the property tax benefits of jumping the border. The only hitch: She hasn’t found any takers yet: In the three weeks since sending the first postcard, Pender said, she hasn’t received any calls from Cook County residents asking to look at her Indiana listings.

107 Comments

|

Fact-checking the fact-checkers

Tuesday, Mar 5, 2019 - Posted by Rich Miller

* Click here for background if you need it. From Julie Sampson at Citizen Action Illinois…

Illinois needs to replace its current income-tax system, which has long allowed rich people and big corporations to get away with not paying their share. We should amend the constitution to permit a fair tax that requires wealthy people with higher incomes to pay more, while allowing working people with lower incomes to pay less.

A recent “fact check” by the Better Government Association overly complicates Gov. JB Pritzker’s position on this important issue. The governor is taking the lead to pass a fair tax because he understands that for our state to thrive, we need to fund our schools and universities, rebuild our infrastructure and pay our bills—and that wealthy people like himself can and should pay a little more to make that possible.

The BGA suggests there are alternatives to a fair tax amendment that would also raise needed revenue while cutting taxes for low- and middle-income taxpayers. That in itself is only half true: The devil is in the details.

One BGA alternative is expanding the state sales tax to services. Yes, a tax on brokers, lawyers and chartered jets would fall mostly on the rich, but applying sales tax to haircuts and dry-cleaning, not so much. Plus this approach wouldn’t raise significant revenue if, as the BGA suggests, the rate was lowered at the same time.

The BGA also looks at taxing retirement income, something the governor opposes. If such a proposal were limited only to rich retirees, it would likely run afoul of the very constitutional provision the fair tax seeks to amend.

Finally, the BGA raises the prospect of a significant rate increase in the current flat tax, accompanied by increased exemptions and credits to reduce the impact on lower-income taxpayers. That’s just a complicated, backdoor way to achieve the basic goals of adequate revenue, fairly raised. Better to pursue those goals in the most clear and straightforward way possible: By asking voters to change the constitution and permit a fair tax.

That’s not only the best public policy, but good, transparent government, too: It allows voters to democratically decide for themselves whether the state will move to a fair tax system. That may be why more than 7 of 10 Illinoisans backed the fair tax amendment in a Paul Simon Institute poll last year.

* On the other end of the spectrum, here’s Kristen McQueary in the Tribune…

It was the Stamp Act of 1765 that seeded the colonists’ revolution against British government overreach when taxation transitioned from a tool to regulate commerce into a mechanism to raise revenue. Attitudes toward taxation are distinct in the U.S. and particularly in the Midwest. Taxpayers deserve respect.

Conservatives accept and participate in taxation. We understand that taxes are fundamental to paying for education, public safety, infrastructure and services for the most vulnerable.

What we rebel against is the inefficient expenditure of the bounty, the refusal to enforce spending discipline, the corruption woven throughout state and local government that feeds the beast.

There’s no way to argue with a straight face that the Illinois politicians in power now have thoughtfully approached the sacred nature of taxation. Instead, they’ll impose a graduated tax rate without allowing commensurate relief on the constitution’s pension clause. And they’ll present their graduated tax rate schedule as proof of their moral compass.

But the question is: Where was that moral compass all along?

58 Comments

|

C’mon, Greg

Tuesday, Mar 5, 2019 - Posted by Rich Miller

* Illinois News Network…

As Gov. J.B. Pritzker prepares for talks with legislative leaders about possible tax rates and income levels for a progressive income tax in Illinois, a pro-business group is calling for those discussions to be done in public. […]

Greg Baise, the leader of Ideas Illinois, a group formed to oppose a graduated income tax system in the state, said any such negotiations should be done in the open, especially around tax time.

“As they prepare for April 15 this year, people are sort of paying attention to [income taxes] right now,” Baise said. “So we’re suggesting let’s have openness and transparency. Politicians love to talk about that until they want to start talking about your money.” […]

A spokesman for House Speaker Michael Madigan, D-Chicago, said he’s “not aware of any plans” for a leaders’ meeting to discuss the rates of a progressive tax.

“The Senate President looks forward to a comprehensive, bipartisan discussion this session. For years people have been saying Illinois should be more like our neighboring states that have more modern and fairer tax systems,” Senate President John Cullerton’s spokesman John Patterson said in an email.

Baise ably ran the Illinois Manufacturers Association for over a quarter of a century. He started life as a political golden boy who became Gov. Jim Thompson’s patronage chief and transportation secretary. That Greg Baise would’ve laughed off any suggestion that leaders meetings be held in public.

Also, as he well knows, if you’re completely opposed to a proposal from the get-go, you don’t get an invite to the table. Why negotiate with a solid “No”?

56 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|