* First we were told the governor’s budget would short the pension funds by “about $800 million a year” for seven years. Then we found out it was closer to $900 million. But Amanda Kass has crunched the numbers and determined that next fiscal year’s shorting alone will be $1.1 billion…

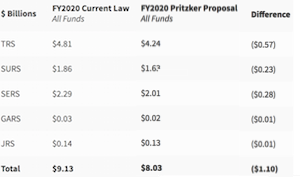

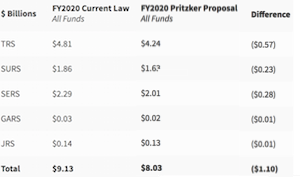

The State of Illinois’ pension contributions would be about $1.1 billion less in state fiscal year 2020 than required under current law, according to my analysis of Governor J.B. Pritzker’s introduced budget, as shown in the chart below.

The table above compares what Illinois is required to pay to each of the five pension systems in FY2020 under current law versus the contributions that are in Governor Pritzker’s budget proposal for FY2020. To be extra clear, I’m not comparing the actuarial recommended contributions with current law (actuarial recommendation is based on 100% target in 20-30 years; Illinois law is 90% target by 2045); for a comparison like that see Figure 3 in this report).

How is that $1.1 billion decrease accomplished? The details in the budget proposal are a bit thin (see pages 35-36 of the budget proposal), but they involve a number of pension related changes. The two main items are extending the repayment timeline past 2045 to 2052, and making an already existing pension acceleration program permanent. (The acceleration program is for Tier-1 members, and is currently temporary. You can read details of the program here.)

And, remember, he wants to do this every year for seven years.

Go read the rest.

- Not a Billionaire - Thursday, Apr 11, 19 @ 11:41 am:

I would give him a break until the graduated tax passes so fy 20 and 21 then need to get back on the ramp.

- I Miss Bentohs - Thursday, Apr 11, 19 @ 11:42 am:

Edgar Jr

- Angry Republican - Thursday, Apr 11, 19 @ 11:43 am:

== Edgar Jr ==

I think you mean Blago Jr

- Wow - Thursday, Apr 11, 19 @ 11:44 am:

Shorting the pension system?? Mmmmm is this a new concept??

- PublicServant - Thursday, Apr 11, 19 @ 11:47 am:

What happened to asset sales, 2 billion in bonds, consolidation? The whole extending the term thing was so he could take billions off the state’s payments for the next 7 years? JB, you’re flirting with junk bond status, funds that can’t by state bonds and much higher interest rates on all state borrowing. How is that fiscally prudent?

If you need money, make your case to the votors, and raise taxes.

The pensions are not a piggybank.

- Nonbeleiver - Thursday, Apr 11, 19 @ 11:50 am:

“The pensions are not a piggybank.”

YES they are! Even back in 1970 which was thereason for the language in the 1970 Constitution so that those in the system would not get stiffed. (And the GA still tried to stiff it.)

- Old Illini - Thursday, Apr 11, 19 @ 11:52 am:

Income tax amendment to the Constitution? Check.

Progressive state income tax? Check.

Short the pension system for 7 years? Does Moody’s have a Zzzzzz bond rating?

- Anon - Thursday, Apr 11, 19 @ 11:54 am:

Illinois has some choices:

Raise individual income tax rates to 6.5% or 7% right now for everybody and jack up the corporate tax rates for all business to close the structural gap between revenues and spending

-OR-

Change the constitution to allow a graduated income tax rate and raise taxes on the households (and maybe businesses) that can most afford to pay, and implement that tax in the very near future to close the structural gap between spending and revenues.

Anyone that’s pretending like there is a third option is a fraud, liar, or cheat and should be run out of town on a rail.

It’s time that everyone in the legislature starts adulting, and stop pretending like all their owes can be solved by secession.

- Honeybear - Thursday, Apr 11, 19 @ 11:55 am:

I smell perfidy.

That’s why he’s got to go to the trades for

Labor praise it seems.

It’s the anti labor move

Rauner should have done if he was smart

Favor the trades

Perfidy to the public unions.

I’m not seeing many other explanations

- Perrid - Thursday, Apr 11, 19 @ 11:56 am:

It’s a little judgmental to call moving the goal back 7 years “shorting” pensions, Rich. It’s a decrease, but shorting implies less than is owed, which is subjective at best.

I don’t like it either, I’d love for the entire debt to be paid as soon as possible, but I don’t see where the money comes from.

- Rich Miller - Thursday, Apr 11, 19 @ 11:58 am:

===shorting implies less than is owed===

Well, then that’s accurate because it’s less than current statute requires.

- Rich Miller - Thursday, Apr 11, 19 @ 12:00 pm:

===but I don’t see where the money comes from. ===

Rod? Is that you?

- JS Mill - Thursday, Apr 11, 19 @ 12:02 pm:

=t’s a decrease, but shorting implies less than is owed, which is subjective at best.+

With respect..it is shorting the pension payment.

- Anonymous - Thursday, Apr 11, 19 @ 12:03 pm:

It’s funny how some of the same people who don’t want taxes raised also don’t want to short the pension payments. A cynic might suggest that they want the Governor to fail for political reasons.

- wordslinger - Thursday, Apr 11, 19 @ 12:04 pm:

I wonder if there’s a pension shift in the cards next session. Some of those suburban school districts are carrying awfully big balances.

- RNUG - Thursday, Apr 11, 19 @ 12:07 pm:

== And, remember, he wants to do this every year for seven years. ==

GOP wanted cuts; there are cuts … not wise cuts, but cuts.

I was going to open this comment with a crack about it taking a lot of money for the new spending JB wants. But what this really shows us is how inadequate the current revenue versus spending match is, highlighting the need for more revenue.

Unfortunately, JB’s graduated income tax effort is tied into this. In order to keep the new tax structure from costing more for 97% of the payers (as proposed), he has to keep the rates low. That doesn’t generate quite enough revenue to pay for everything. Wonder what the top rate would need to be to generate another $1B-$2B?

Maybe they need to rethink the proposed tax structure, cutting the proposed rates, and then adding a surcharge just for the oensions.

- Lucky Pierre - Thursday, Apr 11, 19 @ 12:09 pm:

JB must be hiding in the bathroom when his budget director stops in to see him

JB is the one with no plan to fix Illinois, he is just following the 12 year playbook where Democrats had total control of Springfield to the letter.

There is more to governing than just continuing to make empty promises you can’t pay for to Democratic special interest groups and planning to raise taxes on the “millionaires and billionaires” to pay for everything when you know the math doesn’t add up

- Three Dimensional Checkers - Thursday, Apr 11, 19 @ 12:11 pm:

== I wonder if there’s a pension shift in the cards next session. ==

Ha, the House may not be able to pass the things Democrats want, like the the progressive income tax or legalized pot.

Timing my friend, timing.

- Daniel Kay Hertz - Thursday, Apr 11, 19 @ 12:11 pm:

“First we were told the governor’s budget would short the pension funds by “about $800 million a year” for seven years.”

That wasn’t my understanding–what I think is happening is that the target year for reaching a 90% funded ratio has been pushed back by seven years to 2052. That means that actually we should see a proportional decline in contributions every year through 2045, and then in 2046-2052, instead of having drastically lower contributions as we’d have under current law, the contributions will continue growing. So we exchange lower contributions from 2020-2045 for much, much higher contributions from 2046-2052.

Although notably *part* of that will be offset by the promise to contribute part of the revenue ($200 million) from the Fair Tax to pensions “over and above” the certified contribution amounts.

- Norseman - Thursday, Apr 11, 19 @ 12:21 pm:

This is bad policy. JB gets a fail on this one. Hynes does too. IL must pay what’s required until a vetted plan that experts believe will get us out of the hole is enacted.

- OneMan - Thursday, Apr 11, 19 @ 12:24 pm:

There was a rule for the writers who worked on Seinfeld.

“No hugging and no learning”

It seems the no learning part is going to apply to state budgeting.

If you are going to raise my taxes, fine, not thrilled about it, but it is what it is.

Please for the love of all can we burn the Blago budget process once and for all.

The ramp sucks, but the longer we stretch the ramp the longer it is going to be until we reach the end.

- Back to the Future - Thursday, Apr 11, 19 @ 12:30 pm:

Disappointed, but not surprised. I suspect the biggest problem any tax change will have is trust in anything that comes out is Springfield.

- Rich Miller - Thursday, Apr 11, 19 @ 12:37 pm:

===I suspect the biggest problem any tax change will have is trust in anything that comes out is Springfield===

lolol

If that’s what they should worry about then they can all rest easy.

- Just saying - Thursday, Apr 11, 19 @ 12:37 pm:

The pensions are quite sustainable if they would only pay it.

Like a mortgage, buying a house is sustainable if you make the required payments. I made my payments for 30 years.

Paid in full.

- Blue Dog Dem - Thursday, Apr 11, 19 @ 12:47 pm:

The good news.? At least Gov Kick the Can didn’t campaign on being a fiscal conservative.

- Honeybear - Thursday, Apr 11, 19 @ 12:58 pm:

And here I was so hopeful when Martire was appointed to the transition team.

Public Sector Labor’s not doing well with JB

Strike

1) No backpay for illegally withheld contractually owed backwages.

2) Shorting Public Servant pensions

3) ?

(I have a theory but I wonder what you all think)

- Perrid - Thursday, Apr 11, 19 @ 12:59 pm:

“Well, then that’s accurate because it’s less than current statute requires”

To me that’s like saying you are shorting the bank if you take out a 30 year mortgage instead of a 15 year mortgage. It changes the structure and the timing of the payments, not the total debt. Blago kept the same schedule - 90% by 2045- and just didn’t make the payments. That’s shorting it.

- Long Time R - Thursday, Apr 11, 19 @ 12:59 pm:

This is all on Hynes plain and simple. JB has nothing to do with any of these plans or ideas. The guy who wanted to be governor but couldn’t get elected is now running the show behind the scenes.

- Back to the Future - Thursday, Apr 11, 19 @ 1:01 pm:

I am not in the sate pension system, but I have a lot of friends that are and it is very frustrating to see the pension system shorted again.

I really think it is absolutely the wrong thing to do, but it is what it is.

I also think the administration should check their math before opening their mouths, it is very frustrating to try to keep up with all the projections.

- wordslinger - Thursday, Apr 11, 19 @ 1:09 pm:

–This is all on Hynes plain and simple. JB has nothing to do with any of these plans or ideas.–

Not in charge?

Silly, weird and untrue, all at the same time. The buck stops at the governor.

- Anonymous - Thursday, Apr 11, 19 @ 1:16 pm:

Take the flat tax to 7, fund the pensions and get it over with. Pension shorting is not cost savings, its just deferring expenses and adding interest.

- Keyrock - Thursday, Apr 11, 19 @ 1:16 pm:

How many times are we doomed to replay this same game?

I really hate to say this, but I miss Pat Quinn.

- Blue Dog Dem - Thursday, Apr 11, 19 @ 1:19 pm:

Reallocate LGDF to make the pension payments. There. Fixed it and spread the pain statewide.

- RNUG - Thursday, Apr 11, 19 @ 1:20 pm:

== I wonder if there’s a pension shift in the cards next session. ==

I can see that as the next move if the graduated income tax fails … and maybe even if it succeeds. My guess is they would phase a shift in starting with only those earning over $100K or $150k and then gradually lower the number.

- Jibba - Thursday, Apr 11, 19 @ 1:20 pm:

No one thinks shorting the pensions again is a good idea, but we ran out of good ideas in 2014 when the tax increase expired and the Rauner plan took over.

JB needs to rein in the structural deficit in the next couple of years by remaining on an austerity budget or raising taxes now. That deficit cannot reappear after the progressive tax is passed, so spending can increase but will have to remain restrained. Additional financial trickery is likely to backfire with the ratings agencies and will further erode public trust in government.

- Generic Drone - Thursday, Apr 11, 19 @ 1:32 pm:

Another sacrifice forced on employees. Guess JB can join forces with Quinn, Madigan, Rayner, Cullerton. They all use employees like tools

- Anon - Thursday, Apr 11, 19 @ 1:34 pm:

There will be a reckoning at some point.

We have been told we need a progressive tax to make ends meet, and yet the proposed rates only barely balance a budget that requires kicking the can on funding pensions for 7 years to make the numbers work.

I would love to be there for the look on voters faces when it becomes apparent down the line that all of these tax increases were merely to facilitate a budget that makes the pension situation that much worse down the line with added costs and increased interest payments.

When that bill comes due the same politicians will be back to explain how the millionaire tax wasn’t enough, so they need more revenue because kicking the can on the pensions is no longer possible.

Suddenly the professional (100-250K) folks will be square in the line of fire, and the progressive tax those who thought were safe passed in a few years will find they unknowingly signed their own death warrant.

Not one new dollar should have been spent until we were able to balance a budget that met the required pension funding levels without kicking the can on them.

If I were a Republican I would be blasting far and wide that this tax increase not only doesn’t solve the budget problem, but makes it that much worse by deferring billions in pension payments.

If folks clearly understood that this tax increase was merely the first in a long line they might think twice about making it easier for Springfield to keep raising taxes on those with incomes above 100K.

They could only make the numbers work without paying for pensions. Once they can’t do that anymore they will be back for more revenue, and if the over 250k club truly were cable of carrying the burden alone they would have those rates published now and a budget reflecting pension payments.

I really wish people would look behind the curtain as they aren’t even being coy in what their intentions are.

- SAP - Thursday, Apr 11, 19 @ 2:06 pm:

Shorting the pensions by a cool $7 Billion over 7 years plays right into the hands of the IPI and all those other goofs who want the state to declare bankruptcy so the state can avoid its pension payment obligations (but not any other financial obligations).

- SSL - Thursday, Apr 11, 19 @ 2:08 pm:

That’s some weak sauce there JB.

Here’s a couple of ideas for you to fix this. First, you have to tax retirement income. Provide an exemption, tax the rest at 3% and move on. Second, raise the income tax on income over $1MM to 9%. That would make your friends and family angry, but it would add credibility to your so called progressive tax. Third, give every state agency a 2% expense bogey that they have to find, or the top person goes. They’ll find it. Get rid of the least effective person in the shop, or do it any other legal way you have to.

You can do it.

- Dirty Red - Thursday, Apr 11, 19 @ 2:28 pm:

“Third, let’s listen to experts and exercise good financial management. We can lower the cost of our pension debt and inject cash immediately into the system by issuing a small-scale pension bond of about $2 billion. The bond proceeds would be used for no purpose other than to be deposited directly into the funds — and would be used only for paying down our more expensive pension liabilities. No skimming off the top to pay this year’s pension payment. No using bond proceeds to pay for operating costs.”

- Dan Hynes, Feb. 14, 2019 at the City Club of Chicago

https://capitolfax.com/2019/02/14/hynes-talks-about-state-budget-pensions/

- Nick - Thursday, Apr 11, 19 @ 2:41 pm:

What’s your theory. Honey bear

- Anonymous - Thursday, Apr 11, 19 @ 3:07 pm:

And when the stock market tanks next year as the US moves into a recession, Illinois will owe more money for pensions.

- Nieva - Thursday, Apr 11, 19 @ 3:09 pm:

Save a billion then blow a billion somewhere else. This solves nothing.

- wordslinger - Thursday, Apr 11, 19 @ 3:13 pm:

–And when the stock market tanks next year as the US moves into a recession, Illinois will owe more money for pensions.–

Do you realize you’re making an argument for shorting pension contributions now?

Why would you kick into the funds if you believe the contribution will be wiped out by investment losses?

- State of DenIL - Thursday, Apr 11, 19 @ 3:55 pm:

Word, if the buck stops with JB, I guess he is okay with Robert Steered as General Counsel over at GOMB. Google Robert Steere Illinois Policy.

- Just saying - Thursday, Apr 11, 19 @ 5:09 pm:

Perrid - “To me that’s like saying you are shorting the bank if you take out a 30 year mortgage instead of a 15 year mortgage. It changes the structure and the timing of the payments, not the total debt.”

That is an incorrect statement because it also changed the total payout over the long run by not paying so much compounded interest; and that is much of the same problem with not paying the pensions on time.

- Tequila Mockingbird - Thursday, Apr 11, 19 @ 5:23 pm:

If a school district or a municipality were running this scheme, the state would step in and seize control. Who steps in when the state pulls this crap?

- Just Me 2 - Thursday, Apr 11, 19 @ 5:54 pm:

The State has been mismanaging the pension system for 30 years. Why change it now? It is just money that future generations will have to pay.

- RNUG - Thursday, Apr 11, 19 @ 6:47 pm:

== The State has been mismanaging the pension system for 30 years. ==

More like 110 years when the State first messed up pension funding.

- Anonymous - Thursday, Apr 11, 19 @ 7:03 pm:

States can’t declare bankruptcy.

- RNUG - Thursday, Apr 11, 19 @ 7:19 pm:

== Who steps in when the state pulls this crap? ==

Unless the citizens vote in a new set of legislators, nobody.

- Southwest Sider - Thursday, Apr 11, 19 @ 7:57 pm:

JB was rather silent about his solutions to our financial problems during the elections. Expectations were not high, but at least was hoping that the pension deficit would not grow. We have to do better than this.

- Stuntman Bob's Brother - Thursday, Apr 11, 19 @ 8:00 pm:

==Take the flat tax to 7, fund the pensions and get it over with. Pension shorting is not cost savings, its just deferring expenses and adding interest==

This. Not only is it fiscally responsible to do so, it will guarantee support to JB’s progressive 2020 plan, and will have the added benefit of injecting intellectual honesty to the claim that “97% of taxpayers will see a cut”.