|

Pritzker’s preposterous pension proposal

Wednesday, Apr 17, 2019 - Posted by Rich Miller * Sun-Times…

I agree that some the criticism is coming from professional opposers who are making bank off doing and say anything they can to stop his tax proposal. But I don’t belong to that crowd. * The governor also talked yesterday about how he wants to transfer state assets to the pension system, something he’s never really fleshed out with specifics. And then he addressed the question about his plan to short the pension systems $1.1 billion a year over the next 7 years by lengthening the payment ramp…

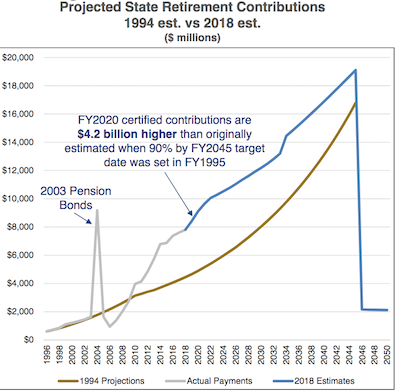

* From the governor’s budget walk-down…  1) That isn’t a “straight line” of projected state payments until 2045. 2) The real problem, as we’ve discussed before, is the ramp’s last ten years or so. Pritzker can’t “bend” that curve by lowering payments up front. That’s a preposterous thing to say. He’ll either make the curve worse or prolong the state’s fiscal agony or both. 3) If the governor truly wants to “bend the curve,” he’ll abandon this irresponsible idea and work on a solution for twenty years from now. Put more money in up front via bonding, asset transfers, whatever. But do not reduce payments by over $7 billion to spend elsewhere and then pat yourself on the back for fixing a problem that you’re only making worse.

|

- sewer thoughts - Wednesday, Apr 17, 19 @ 12:46 pm:

the window for new non-Blago POBs is closing as the spread narrows - it is as if the world is full of CFAs who forgot the time value of money

- Norseman - Wednesday, Apr 17, 19 @ 12:48 pm:

JB fumbled the ball on this one. Sadly, fumbling this ball has been a consistent characteristic of Illinois pols.

- wordslinger - Wednesday, Apr 17, 19 @ 12:50 pm:

–The governor also talked yesterday about how he wants to transfer state assets to the pension system, something he’s never really fleshed out with specifics. –

Still hasn’t based on the link.

- RNUG - Wednesday, Apr 17, 19 @ 12:54 pm:

Rich, very good summation.

Adding, what assets that are transferred to the pension funds need to be ones that generate positive earnings / cash flow, something on the order of 8% - 10% annually at minimum. Otherwise, all you have done is artificially made the funds temporarily look better on paper. For that reason alone, issuing bonds that are repaid with GRF, not pension fundings, are probably the best way to go.

Others can correct me, but I’m thinking the best was to do it would be a series of bond issuances over a year or two, in effect dollar cost averaging.

- Ole' Nelson - Wednesday, Apr 17, 19 @ 12:54 pm:

I hope he gets enough pressure on this to reconsider this ill-advised kicking of the (pension) can. More of the same ain’t what Illinois needs.

- RNUG - Wednesday, Apr 17, 19 @ 12:55 pm:

And, as others have noted, the best time to issue those bonds was 2 - 3 years ago.

- Perrid - Wednesday, Apr 17, 19 @ 12:59 pm:

Is his plan to short it for all 7 years? I thought it was an interim thing until/unless we went to a graduated income tax and the state had more money, which isn’t 7 years out. He campaigned on paying more upfront.

- A Jack - Wednesday, Apr 17, 19 @ 12:59 pm:

If there is s misunderstanding of what the Governor wants to do, then its up to the Governor to clear up that misunderstanding with a detailed plan, along with the rationale as to why extending the ramp would be desirable. Otherwise it appears that the Governor is just pushing off payments until after he has likely left office.

He did campaign in putting more money in upfront, but we haven’t heard anything about that lately. And I suspect the ratings agencies aren’t going to like extending that ramp based on a future constitutional amendment referendum.

- Donnie Elgin - Wednesday, Apr 17, 19 @ 1:00 pm:

By loudly linking these two ideas JB just gave “Fair Tax” opponents more ammunition. Better for him to divide the issues. His pension “fix” can be seen as making the fair Tax even more needed - to some - to others it seems like a manufactured problem meant to make the fair tax seem more necessary.

- lakeside - Wednesday, Apr 17, 19 @ 1:05 pm:

Pay. The. Pensions.

Do not make guesses - as others did disastrously before - about the state’s magical and infinite ability to pay 20 years from now. It’s tough now, I know, but we have no way of knowing when the next Great Recession is coming. Pay what we owe.

(Also good point, Donnie.)

- Just A Dude - Wednesday, Apr 17, 19 @ 1:06 pm:

I was pretty much thinking what Perrid stated. Kind of hoping this evolves into less of a shorting proposal into something more positive. GA could tweak what is currently prposed, correct?

- Three Dimensional Checkers - Wednesday, Apr 17, 19 @ 1:06 pm:

Why not change the ramp? That seems like the only way to bend the curve at the end besides putting more cash in the systems.

- lake county democrat - Wednesday, Apr 17, 19 @ 1:07 pm:

A good faith way to address a massive budget deficit problem is to combine tax hikes and spending cuts. Since JB won’t do the latter, he should have bumped up his progressive tax rates. Are there any assets the state can sell instead of bonds? Or would that publicize the nature of the crisis too much?

- Ole' Nelson - Wednesday, Apr 17, 19 @ 1:11 pm:

I voted for JB, so definitely not an opponent. I’m all for giving the Governor a chance, but his pension plan just seems like a really bad idea any way you look at it.

We needed him to take office and make the hard decisions necessary to right the ship, and I am convinced this isn’t it.

- Life Long R - Wednesday, Apr 17, 19 @ 1:12 pm:

Governor Hynes , oops deputy Governor Hynes needs to go back and think of something better for the long term needs of our state and its pension problem.

- cdog - Wednesday, Apr 17, 19 @ 1:15 pm:

Good job keeping it real, and don’t forget those other big numbers– $8.5b in payables currently, no relief for FY20, or FY21 (at least first 6 mos)

It’s an amazing conversation to watch, especially when the math-deniers keep spinning to justify more irresponsible spending.

- Sue - Wednesday, Apr 17, 19 @ 1:17 pm:

Assuming 2 terms- his proposal is consistent with Governors pre Edgar- spend on BS without paying for it and borrowing the funds from the pensions. JB is deplorable to do this while attempting to say we need to fix our fiscal mess by raising taxes on the 3 percent. Every dollar of new revenue needs to go to pensions- we don’t need more wasteful spending

- JS Mill - Wednesday, Apr 17, 19 @ 1:17 pm:

=spending cuts.=

We have billions in current debt due to the back log of bills. Most of the spending is pension debt and medicade. There is very little else.

So, let the cutters offer some real cuts and see if they can get approval.

This is a debt and revenue issue.

- Fav human - Wednesday, Apr 17, 19 @ 1:20 pm:

Channelling his inner Edgar. Didn’t the state try a fix with back loaded payments before?

- Lucky Pierre - Wednesday, Apr 17, 19 @ 1:23 pm:

JB’s plan to fix the unsustainable pension crisis is to pretend it doesn’t exist

- Anonymous - Wednesday, Apr 17, 19 @ 1:23 pm:

Every $0.01 of new tax revenue should be going to pensions. Pritzker is terrible.

- lake county democrat - Wednesday, Apr 17, 19 @ 1:25 pm:

JS - They said similar things before the fed sequestration. The agencies know where cuts can be made surgically better than anyone else. That said, the GOP should be making some proposals.

- Centennial - Wednesday, Apr 17, 19 @ 1:28 pm:

Preach, Rich. I can only add that JB ran on “pensions are a promise.” If you truly believe that man, act like it and fund them.

- Rich Miller - Wednesday, Apr 17, 19 @ 1:29 pm:

===Otherwise, all you have done is artificially made the funds temporarily look better on paper===

Meh. If they have actual resale value I’d be fine with it.

- Anon - Wednesday, Apr 17, 19 @ 1:29 pm:

There should have been not one new dollar spent in this state until we made the pension payment.

The progressive tax numbers show that this increase doesn’t even show what the rates will have to be for the state to start making the necessary pension payments.

They will be back asking for more money in short order, and this time it won’t be only those over 250k footing the bill.

JB is going to sink the whole party if this is his governing plan.

People are already starting to see through him.

- Captain Obvious - Wednesday, Apr 17, 19 @ 1:37 pm:

This obfuscation and dishonesty is why J Bob is already a failed governor. He lacks the will to do what must be done to fix Illinois’ many problems. Not giving him a mulligan here. The plans he has put forward are woefully inadequate.

- wordslinger - Wednesday, Apr 17, 19 @ 1:44 pm:

–This obfuscation and dishonesty is why J Bob is already a failed governor.–

Wow, that was quick.

The DC Republicans doubling the annual deficit in a growth economy must really get to you.

- NeverPoliticallyCorrect - Wednesday, Apr 17, 19 @ 1:45 pm:

Boy, the people who have been in charge over the last few decades have really messed things up for everyone. JB is in a tough spot, but he wanted it so make the hard decision and move on. However I don’t see the the current primary co-conspirators, Madigan and Cullerton, being willing to unravel the sweetheart pension deals that are killing this state. So good luck to all of us, we’ll need it.

- Sue - Wednesday, Apr 17, 19 @ 1:45 pm:

Rich- transferring non- revenue generating assets into the pension plans is a totally dumb idea unless they have the right to sell them. The plans need to generate investment income or they are forced to sell other assets to pay beneficiaries. It’s like a farmer selling his seed instead of planting it

- Rich Miller - Wednesday, Apr 17, 19 @ 1:47 pm:

===totally dumb idea unless they have the right to sell them===

Which is precisely what I said.

- Honeybear - Wednesday, Apr 17, 19 @ 1:48 pm:

-He campaigned on paying more upfront.-

Yep, what the hell was Martire on the transition team for if not that? It seems like Martire was just a perfidy token.

It’s offensive really because in my opinion Ralph’s idea was correct.

- Anonymous - Wednesday, Apr 17, 19 @ 1:52 pm:

What would happen if the state supply defaulted when there isn’t enough money?

- Smalls - Wednesday, Apr 17, 19 @ 1:59 pm:

= ===totally dumb idea unless they have the right to sell them===

Which is precisely what I said. =

Rich, actually you didn’t. There is a difference between having resale value, which is what you said, and actually having the right to sell the asset. The state could put the tollway into the pension funds, which would have a large value. But if the pension funds don’t have a right to turn around and resell the tollway to a third party, then it really has limited value.

- Rich Miller - Wednesday, Apr 17, 19 @ 2:06 pm:

===and actually having the right to sell the asset===

If you don’t have the right to sell it then it doesn’t have any resale value.

For crying out loud, this ain’t Twitter, either. Don’t be that “actually” dude.

- lincoln's beard - Wednesday, Apr 17, 19 @ 2:08 pm:

=== The state could put the tollway into the pension funds, which would have a large value. But if the pension funds don’t have a right to turn around and resell the tollway to a third party, then it really has limited value.===

If the pension funds have the ability to set the tolls at whatever they need to make payments, perhaps problem solved?

- Hal - Wednesday, Apr 17, 19 @ 2:12 pm:

So they are saying they are going to solve the problem of having never paid enough money into the pensions, by paying less into the pensions?

That makes sense in some world I guess.

- Skeptic - Wednesday, Apr 17, 19 @ 2:13 pm:

“There should have been not one new dollar spent in this state until we made the pension payment.” Tell that to the people drive over crumbling roads and bridges (or take a delayed train because of crumbling signals) to work in a crumbling building.

- Sue - Wednesday, Apr 17, 19 @ 2:40 pm:

Skeptic- we need to assume you cannot trust the political leadership on anything. On infrastructure- we need to increase the gas tax provided the funds go only to infrastructure- JB is like the rest of our pols- you need to force how new revenue is used otherwise- it’s going to be wasted on social programs

- From optimist to pessimist - Wednesday, Apr 17, 19 @ 2:46 pm:

Lots of comments on why this is a bad idea and the need to actually fix the pensions. Problem is the votes are there to do exactly what has been proposed, regardless of the long term impact. Short term re-election trumps fixing a long term problem. If ever there was a time to fix things is when there is control of all state offices and legislature.

- SAP - Wednesday, Apr 17, 19 @ 3:05 pm:

I keep looking at that 2003 pension bond payment spike followed by a couple years of underfunding and think about how much better off if that magic pension bond money hadn’t been grabbed for day-to-day operations.

- Lucky Pierre - Wednesday, Apr 17, 19 @ 3:19 pm:

The ramp looks like Half Dome

We have to short the 9 billion payment now by 1 billlion but JB is selling the 20 billion payment is no sweat

- RNUG - Wednesday, Apr 17, 19 @ 3:38 pm:

== Why not change the ramp? ==

Because there isn’t much gain to extending the ramp. We are already near to the point of zero gain for the future expense. Go run some spreadsheet numbers. Create some of the most optimistic projections you can. Those will say, maybe, you could stretch the ramp out 7 years before you reach the point of diminishing returns.

Extending the ramp only makes sense if you are going to make, at minimum, full actuarially required payment or, at best, flat payments like a mortgage. Both those scenarios require equal or larger annual pension payments, not smaller ones.

Edgar mortgaged our kids. Blago mortgaged our grandkids. JB is talking about mortgaging our great-grandkids.

- RNUG - Wednesday, Apr 17, 19 @ 3:43 pm:

Adding … everyone should understand that issuing pension bonds is converting owed but more or less unsecured debt into secured debt that must be paid regardless.

In personal terms, think of it as paying off your credit card debt using a home equity line of credit / 2nd mortgage.

- GA Watcher - Wednesday, Apr 17, 19 @ 3:49 pm:

The Governor’s folks should take a look at Ralph Martire’s proposal: https://www.ctbaonline.org/reports/addressing-illinois’-pension-debt-crisis-reamortization

- Rich Miller - Wednesday, Apr 17, 19 @ 3:50 pm:

===The Governor’s folks should take a look at Ralph Martire’s proposal===

Ralph was on the transition committee. Pritzker talked often about Ralph’s plan during the campaign. They’re not proposing this out of ignorance of Ralph’s ideas.

- OneMan - Wednesday, Apr 17, 19 @ 3:58 pm:

JB didn’t spend a huge amount (at least to most people) of his own money to get elected to be stuck being the guy who couldn’t do anything. They don’t build statues to the guy who fixed the pension problem.

This allows him to do what he wants to do, social programs and the rest.

It shouldn’t really suprise anyone.

- RNUG - Wednesday, Apr 17, 19 @ 3:58 pm:

== They’re not proposing this out of ignorance of Ralph’s ideas ==

I would guess they are proposing this for the same reason previous administrations limited pension funding … to keep financial flexibility to short the pension systems in a future (or current) fiscal crisis.

- City Zen - Wednesday, Apr 17, 19 @ 4:19 pm:

==he Governor’s folks should take a look at Ralph Martire’s proposal==

You mean the one that lowers the target funding percentage to 70%? No thanks.

- Three Dimensional Checkers - Wednesday, Apr 17, 19 @ 4:20 pm:

== Because there isn’t much gain to extending the ramp. We are already near to the point of zero gain for the future expense. Go run some spreadsheet numbers. Create some of the most optimistic projections you can. Those will say, maybe, you could stretch the ramp out 7 years before you reach the point of diminishing returns.

Extending the ramp only makes sense if you are going to make, at minimum, full actuarially required payment or, at best, flat payments like a mortgage. Both those scenarios require equal or larger annual pension payments, not smaller ones.

Edgar mortgaged our kids. Blago mortgaged our grandkids. JB is talking about mortgaging our great-grandkids. ==

I’ll take your word for it. After all, you are the resident pension guru.

The chart is pretty ridiculous if true. Paying $2 billion a year for pensions in 2045 dollars is laughably small compared to the current payments. Changing the ramp would also smooth out future payments and make future budget more predictable, which is a good idea for the state. It looks like it won’t happen though if Pritzker has already reject Martire’s proposal.

- Stuntman Bob's Brother - Wednesday, Apr 17, 19 @ 4:27 pm:

Bump the flat income tax rate to 7% today and pay our bills. And when the progressive tax comes up for a vote, its passage will be virtually guaranteed, and the subsequent rate decrease back to 4.95% for 97% of taxpayers will make JB look like a hero. What’s the downside to this?

- Rich Miller - Wednesday, Apr 17, 19 @ 4:28 pm:

=== What’s the downside to this? ===

Nobody ever believes taxes will go down.

- Earnest - Wednesday, Apr 17, 19 @ 4:32 pm:

I don’t know. For me, I’m happy to see the major things being done to increase revenue and the spending being done as an investment in Illinois basic governmental functions, delayed vendor payments, education and human services. If it were going to pinstripe patronage or corporate handouts I’d be frustrated.

Quinn, for all his faults, was financially responsible with payments, cuts, signing Tier II and increasing revenue. I don’t think voters rewarded him for it. Pritzker seems to be trying to buy a chance to do good things for the state rather than sacrifice that opportunity in order to implement austerity.

Then I think back to the million times I’ve typed “a stable, balanced budget is the best thing Illinois could to to improve its business climate.” I acknowledge my hypocrisy.

- City Zen - Wednesday, Apr 17, 19 @ 4:48 pm:

==Quinn, for all his faults, was financially responsible with payments, cuts, signing Tier II and increasing revenue.==

*Temporarily* increasing revenue.

- Tbone - Wednesday, Apr 17, 19 @ 5:41 pm:

The long-term liability should improve when Tier II members start to retire since the pension benefits in Tier II are so much less. In essence, This is a problem that eventually could take care of itself. The system just needs to stay solvent until this Tier II members start to retire.

- Anonanonsir - Wednesday, Apr 17, 19 @ 5:50 pm:

If the graph is accurate, the state’s contributions since 1996 have exceeded the 1994 projections. Despite that, the future contributions needed are still far higher than the 1994 projections. That’s the sort of result that fuels the pension skeptics.

Pritzker’s desire for a more even ramp rather than a steep climb and sharp fall seems reasonable to me.

Raising money via bonds has pluses and minuses, particularly after a 10-year bull market in stocks. The success of such a move would depend on market returns. And some think that the pensions’ projected returns are still too high.

- wordslinger - Wednesday, Apr 17, 19 @ 5:59 pm:

–You mean the one that lowers the target funding percentage to 70%? No thanks.–

What’s wrong with 70%? In good investment years, you’re making good bank.

In bad investment years, you’re not losing principal on the other 30%.

- Pelonski - Wednesday, Apr 17, 19 @ 6:10 pm:

“The long-term liability should improve when Tier II members start to retire since the pension benefits in Tier II are so much less. In essence, This is a problem that eventually could take care of itself. The system just needs to stay solvent until this Tier II members start to retire.”

I think it would be more accurate to say when the Tier I people die off. It is the cost of the Tier I pensions that is the main problem. As the Tier I people leave the system, things get more manageable. We haven’t hit the peak of Tier I retirees, though, so we have a long way to go before things get better.

- Pelonski - Wednesday, Apr 17, 19 @ 6:24 pm:

I’m typically willing to give new office holders the benefit of the doubt, but JB has not impressed me so far. He may have said “pensions are a promise”, but he is leaving it up to future politicians to fulfill that promise. We’ve had enough of that type of “leadership” from both parties. Until we have someone in the office who realizes that we need both spending constraint and new revenue, I don’t see how Illinois ever gets out of this mess.

- Generic Drone - Wednesday, Apr 17, 19 @ 6:32 pm:

Sue. So spending on social programs is a waste? I suppose it is to folks who have it good like you, huh.

- Captain Obvious - Wednesday, Apr 17, 19 @ 7:06 pm:

Not sure what DC Republicans have to do with this topic or my comment. I guess if you can’t refute the message you try to impugn the messenger. I expect better from the person with the commenter award named for them.

- Anonymous - Wednesday, Apr 17, 19 @ 9:10 pm:

Pensions are a promise. Social services aren’t.

- theCardinal - Wednesday, Apr 17, 19 @ 11:07 pm:

Bond rating BINGO anyone ? Whats the Over and Under on the BBB- designation drop date ? Moody’s can you hear me.

- Anon - Thursday, Apr 18, 19 @ 12:56 am:

I presume everyone here is on board with immediately increasing the income tax in order to continue making pension payments at the required rate under the ramp.

- City Zen - Thursday, Apr 18, 19 @ 8:54 am:

==As the Tier I people leave the system, things get more manageable.==

Until Tier 2 gets enhanced. Plenty of time left on that clock.

- No way - Thursday, Apr 18, 19 @ 10:47 am:

Stop saying tier 2 will get enhanced. IL can’t even pay what it owes now; there is no realistic way tier 2 can be enhanced. The whole thing is going to collapse during the next recession. Get ready.