* The legislation now goes back to the Senate for concurrence…

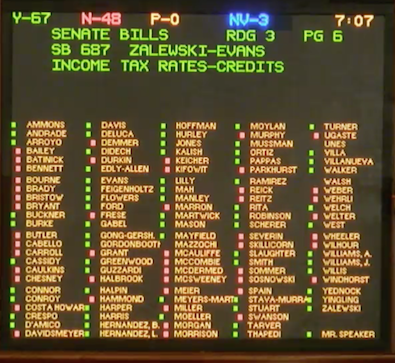

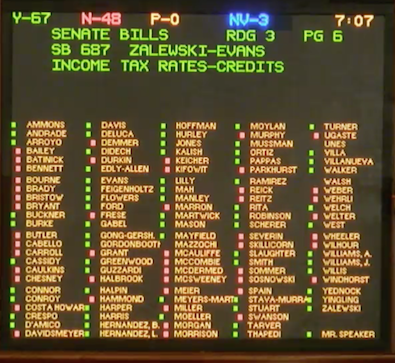

Democrats voting “No” were Reps. Bristow, Carroll, Costa Howard, Kifowit, Morgan and Reitz. Rep. Walsh did not vote.

…Adding… The Senate Revenue Committee will take up the rates change bill tonight.

…Adding… Press release…

Speaker Michael J. Madigan released the following statement Thursday regarding House passage of a Fair Tax rate package that will provide relief for 97% of Illinois taxpayers:

“The completion of the Fair Tax package ensures the people of Illinois can evaluate the proposal on the basis of facts and hard numbers, not half truths and special interest spin. As we have advocated for several years, the rates passed today are a restatement of our commitment to middle-class families that they will receive a tax cut under this proposal. This vote is a critical step toward House Democrats’ pledge to balance the state budget while holding the line on middle-class taxes and stopping outrageous cuts to critical services like our schools, lifesaving breast cancer screenings, and Meals on Wheels for seniors. Critically, a Fair Tax allows us to accomplish this while also delivering relief for 97% of taxpayers statewide.

“There is more work to be done. While the Fair Tax takes steps to provide homeowners with property tax credits and expanded tax credits for families, House Democrats are going further by creating a Property Tax Relief Fund, because we recognize there is yet more we must do to ease the burden on middle-class families.

“House Democrats look forward to continuing our effort to build a stronger Illinois by building a stronger middle class. We will keep fighting to make taxes fairer for the middle class, strengthen our economy to make Illinois a center of high-wage job opportunities, and make health care more affordable.”

…Adding… Press release…

Governor JB Pritzker released the following statement after the House passed fair tax legislation making the wealthy pay their fair share while 97 percent of taxpayers pay the same or less.

“With tonight’s House vote, tax fairness has achieved an extraordinary milestone, and Illinois’ middle class and those striving to get there are poised to benefit. I’m especially grateful to Rep. Mike Zalewski for shepherding this measure through the House, as well as all of those who have worked hard for years to deliver on the promise of a fair income tax. A fair tax will bring monumental change to this state by protecting working families. 97 percent of taxpayers will pay the same or less, and we will stabilize Illinois’ finances. Opponents should be honest that they offer bad options – either cutting schools and public safety to the bone, or raising taxes on everyone by 20 percent. Instead, I stand firmly on the side of working families and fairness.”

* The House is now debating this bill…

Creates the Illinois Property Tax Relief Fund. Provides that moneys in the Illinois Property Tax Relief Fund shall be used to pay rebates to residential property taxpayers in the State. Provides that the Fund may accept moneys from any lawful source. Provides that the State Comptroller shall calculate a property tax rebate amount for the applicable property tax year by dividing the total amount appropriated from the Illinois Property Tax Relief Fund by the total number of homestead exemptions granted for homestead property in the State. Provides that the property tax bills of non-delinquent taxpayers who received a general homestead exemption under the Property Tax Code shall be reduced by the property tax rebate amount.

The bill will take effect immediately, but won’t start happening until 2021, presumably after the graduated income tax takes effect (depending on voter approval).

…Adding… The bill passed 96-18-1. The House is now debating this bill…

Creates the Property Tax Relief Task Force. Provides that the Task Force shall identify the causes of increasingly burdensome property taxes across Illinois, review best practices in public policy strategies that create short-term and long-term property tax relief for homeowners, and make recommendations to assist in the development of short-term and long-term administrative, electoral, and legislative changes needed to create short-term and long-term property tax relief for homeowners.

The bill was taken out of the record after Republicans complained that the task force membership had no guarantee of bipartisanship.

- Grandson of Man - Thursday, May 30, 19 @ 7:18 pm:

Good deal. Very pleasantly surprised at the progress of the graduated income tax push. Sorry there are no moderate Republicans who don’t want big cuts or a flat tax hike.

- Perrid - Thursday, May 30, 19 @ 7:41 pm:

So they all voted for the CA, but 6 voted no one the rates. Any word on why? Carroll I know was making a fuss about more property tax relief, but I hadn’t heard about any others making waves.

- Rich Miller - Thursday, May 30, 19 @ 7:50 pm:

===Any word on why?===

Same thing happened in the Senate.

- Simple Math - Thursday, May 30, 19 @ 7:54 pm:

Everyone who voted no voted against a tax cut.

- Oswego Willy - Thursday, May 30, 19 @ 8:03 pm:

===Everyone who voted no voted against a tax cut.===

This is a misleadingly inaccurate sentence, but correct for many.

For 97%, the rates are lower.

For 3%, it will lead to a graduated rate increase.

- Matt - Thursday, May 30, 19 @ 8:06 pm:

The marriage penalty is still included in this bill. We shouldn’t tax married couples more than two single people.

- Oswego Willy - Thursday, May 30, 19 @ 8:07 pm:

===The marriage penalty is still included in this bill.===

For 97% of the folks, married or not, they are getting a measure of relief.

Why you insist on forgetting that…

lol

- Matt - Thursday, May 30, 19 @ 8:14 pm:

Name one reason that two married teachers each making $75k should pay more than two single people making them same amount.

- Paul S. - Thursday, May 30, 19 @ 8:14 pm:

97% are the same or slightly less - not 97% get a cut. Big difference

- Oswego Willy - Thursday, May 30, 19 @ 8:15 pm:

===Name one reason that two married teachers each making $75k should pay more than two single people making them same amount.===

All four will receive a relief.

Correct?

- Oswego Willy - Thursday, May 30, 19 @ 8:17 pm:

===97% are the same or slightly less - not 97% get a cut. Big difference===

… then those over $250K… the 3%

So… your point?

- Matt - Thursday, May 30, 19 @ 8:19 pm:

Two will pay less and two will pay more.

Again, name one reason the married couple should pay more than the coliving couple.

- Oswego Willy - Thursday, May 30, 19 @ 8:21 pm:

===Two will pay less and two will pay more.===

All four are better off than the current rate.

Correct?

- Grandson of Man - Thursday, May 30, 19 @ 8:24 pm:

“Two will pay less and two will pay more.”

Two married people making $75k each would get a small tax cut, so they won’t be paying more than they are now.

- Matt - Thursday, May 30, 19 @ 8:25 pm:

All will not pay the same taxes. The married couple will pay more.

- Oswego Willy - Thursday, May 30, 19 @ 8:27 pm:

===All will not pay the same taxes. The married couple will pay more.===

Answer the question please…

===All four are better off than the current rate.===

Yes or no?

Only 3% will be paying a “higher tax” then currently instituted

- Oswego Willy - Thursday, May 30, 19 @ 8:29 pm:

All four are not seeing any increase - Matt -

That’s the answer.

- Particular Nuisance - Thursday, May 30, 19 @ 8:29 pm:

No one will be better off as Illinois continues it’s slow economic decline and population loss.

- Present - Thursday, May 30, 19 @ 8:29 pm:

Colors are being shown. Duly noted.

- Oswego Willy - Thursday, May 30, 19 @ 8:34 pm:

===Colors are being shown. Duly noted.===

The losing argument is ignoring the overall effect as Pritzker will spend millions on beating back nay sayers, pointing to the 3%

That’s the argument that needs the rebuttal.

Arguing the marriage “penalty” that arguably will effect the married 3% over $250K will be arguing you are supporting the millionaires.

Yep. A losing argument.

- Oswego Willy - Thursday, May 30, 19 @ 8:37 pm:

“It’s odd you won’t recognize the married couple and the single two are not seeing an increase in their taxes. I suspect it’s because you realize your reasons are bereft of that logical fact.”

LOL

- Present - Thursday, May 30, 19 @ 8:37 pm:

Willy, agreed just observing. But like many other bills. Pass what you can.

- Demoralized - Thursday, May 30, 19 @ 8:38 pm:

Matt

In your example none of them pay more. Married or not

- park - Thursday, May 30, 19 @ 8:44 pm:

Taxes, taxes, taxes. We voted for this. Live with it.

- Oswego Willy - Thursday, May 30, 19 @ 8:45 pm:

===Taxes, taxes, taxes. We voted for this. Live with it.===

97% will see no change or a cut.

“Those pesky millionaires… they are getting soaked”

:)

- wordslinger - Thursday, May 30, 19 @ 8:45 pm:

Rolling like Sherman through Georgia now.

- Matt - Thursday, May 30, 19 @ 8:51 pm:

The married couple will pay more compared to the coliving couple.

This is a fact. Now please name one reason why it’s fair.

- Oswego Willy - Thursday, May 30, 19 @ 8:52 pm:

===The married couple will pay more compared to the coliving couple.===

All four will not see an increase in their income tax rate.

Again.

You know that, correct?

- Demoralized - Thursday, May 30, 19 @ 8:53 pm:

Matt

In your example neither will pay more. Use another example.

Stop making yourself look silly.

- lakeside - Thursday, May 30, 19 @ 9:18 pm:

I wonder if we needed Rauner to open the GA’s eyes to all the [stuff] they really needed to get done - and that *can* be done.

I mean, that’s what I’m telling myself to forget about the Good Friday massacre, the years without a budget, all the closed providers.

Guys, this session is a banger. Most exciting one I’ve seen. I wish we hadn’t had to go through the last four years, but there are a lot of very good things happening that seemed impossible months and even days ago.

- Matt - Thursday, May 30, 19 @ 9:23 pm:

Excuse me but one couple with pay more. Married couples will pay more than coliving couples making the same amount under these tax brackets.

The brackets need to double for married filing jointly otherwise we unfairly penalize married couples compared to coliving couples.

It’s not fair.

- Oswego Willy - Thursday, May 30, 19 @ 9:26 pm:

===Excuse me but one couple with pay more.===

- Matt -

Neither will pay higher than the current rate.

You ignore this. Why?

- Matt - Thursday, May 30, 19 @ 9:46 pm:

Oswego,

You fail to recognize that the new rates penalize married couples by making them pay more in comparison to singles.

Why is that?

- Not a Superstar - Thursday, May 30, 19 @ 10:08 pm:

Matt, do you ever use the Internet? The Wikipedia entry on “Marriage Penalty” says: “It can be shown that it is mathematically impossible for a tax system to have all of (a) marginal tax rates that increase with income, (b) joint filing with income splitting for married couples, and (c) combined tax bills that are unaffected by two people’s marital status.”

So you’re just using lots of words to say you don’t like a progressive income tax.

- Demoralized - Thursday, May 30, 19 @ 10:20 pm:

Matt

You fail to realize that in the specific example you used they do not pay any more. Again, find another example because the incomes you listed do not result in any of them paying any more. Period.

And stop whining.

- Lester Holt’s Mustache - Thursday, May 30, 19 @ 10:21 pm:

==It’s not fair.==

It sounds like you’re arguing that the GA should not pass this bill giving Illinoisans the chance to vote on whether or not they approve of almost everyone getting a tax cut, on the grounds that married people’s tax cuts will be a little bit smaller than single people’s tax cuts. This a bad and wrong take. The GA should instead pass this bill, allowing Illinoisans the chance to vote on whether or not to take the good now and work towards the perfect in the future.

- TheInvisibleMan - Thursday, May 30, 19 @ 11:24 pm:

I think someone needs to literally spell this out for Matt;

75+75=150

- njt - Thursday, May 30, 19 @ 11:25 pm:

Pretty sure you are still able to file separate tax returns if you are married so the point, as has been stated by Rich and OW ad naseum, is invalid

- cover - Thursday, May 30, 19 @ 11:32 pm:

$75K apiece for a married couple = $150K, which is less than the $250K threshold for higher tax rates. Matt, are you too dense to understand your own example?

- Pick a Name - Friday, May 31, 19 @ 7:22 am:

A sleight of hand, the fuel tax increase alone will more than offset any decrease in the state income tax for most.

- Pundent - Friday, May 31, 19 @ 7:51 am:

The noise around the “marriage penalty” is trolling obfuscation. It’s designed to distract from acknowledging that the group most impacted by this change is high income earners. It also serves to create the weak straw man argument that his is somehow an attack on marriage, or probably more to the point “traditional” marriage. It’s about as transparent as calling this a “jobs tax”.

- Nicky - Friday, May 31, 19 @ 8:52 am:

What is there that would prevent a bait and switch after the fact

Sure the rates dont look bad now for 97%

But where is the guarantee that once a graduated tax is in the constitution. The varying rates won’t get increased

- Pundent - Friday, May 31, 19 @ 8:56 am:

=What is there that would prevent a bait and switch after the fact=

The same thing that has prevented flat tax rates from changing - elections.

- Perrid - Friday, May 31, 19 @ 8:57 am:

Nicky, there is no guarantee. There has NEVER been a guarantee. The GA could, today, right now, pass a bill making the income tax rate 10% flat. That would never pass, but they have that power. You are hand wringing about giving the GA a power they already have.

- Oswego Willy - Friday, May 31, 19 @ 9:10 am:

===What is there that would prevent a bait and switch after the fact

Sure the rates dont look bad now for 97%

But where is the guarantee that once a graduated tax is in the constitution. The varying rates won’t get increased===

(Sigh)

The last vote on income tax… was to let a higher rate sunset.

How many times had the income tax rate been raised?

Rich Miller here did a whole thing on it.

GA Members, both parties, don’t like to raise taxes, they avoid it every chance they get.

You are unrealistic to human nature and political realities.

- Cubs in '16 - Friday, May 31, 19 @ 9:10 am:

Matt

Allow me. How is it fair that a married couple will receive less of a break than two individuals? But you also fail to mention a married couple can file individually.

- Pick a Name - Friday, May 31, 19 @ 9:15 am:

Willy, to say the dems don’t like to raise taxes is just not accurate. They love to raise taxes, history shows that, because they love big government and, erroneously, they feel money in the hands of the government is far better than $ in the hands of the public.