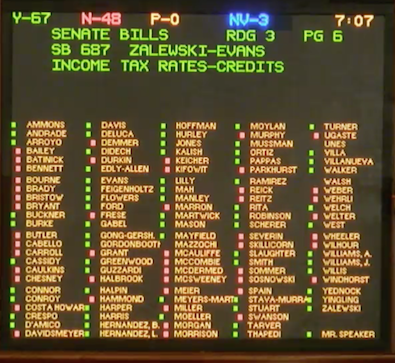

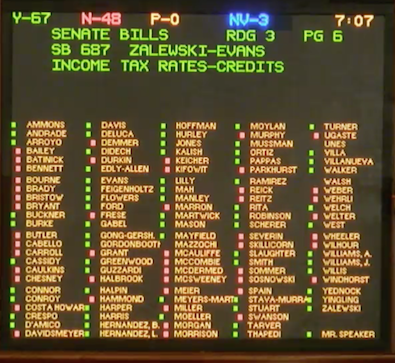

* The legislation now goes back to the Senate for concurrence…

Democrats voting “No” were Reps. Bristow, Carroll, Costa Howard, Kifowit, Morgan and Reitz. Rep. Walsh did not vote.

…Adding… The Senate Revenue Committee will take up the rates change bill tonight.

…Adding… Press release…

Speaker Michael J. Madigan released the following statement Thursday regarding House passage of a Fair Tax rate package that will provide relief for 97% of Illinois taxpayers:

“The completion of the Fair Tax package ensures the people of Illinois can evaluate the proposal on the basis of facts and hard numbers, not half truths and special interest spin. As we have advocated for several years, the rates passed today are a restatement of our commitment to middle-class families that they will receive a tax cut under this proposal. This vote is a critical step toward House Democrats’ pledge to balance the state budget while holding the line on middle-class taxes and stopping outrageous cuts to critical services like our schools, lifesaving breast cancer screenings, and Meals on Wheels for seniors. Critically, a Fair Tax allows us to accomplish this while also delivering relief for 97% of taxpayers statewide.

“There is more work to be done. While the Fair Tax takes steps to provide homeowners with property tax credits and expanded tax credits for families, House Democrats are going further by creating a Property Tax Relief Fund, because we recognize there is yet more we must do to ease the burden on middle-class families.

“House Democrats look forward to continuing our effort to build a stronger Illinois by building a stronger middle class. We will keep fighting to make taxes fairer for the middle class, strengthen our economy to make Illinois a center of high-wage job opportunities, and make health care more affordable.”

…Adding… Press release…

Governor JB Pritzker released the following statement after the House passed fair tax legislation making the wealthy pay their fair share while 97 percent of taxpayers pay the same or less.

“With tonight’s House vote, tax fairness has achieved an extraordinary milestone, and Illinois’ middle class and those striving to get there are poised to benefit. I’m especially grateful to Rep. Mike Zalewski for shepherding this measure through the House, as well as all of those who have worked hard for years to deliver on the promise of a fair income tax. A fair tax will bring monumental change to this state by protecting working families. 97 percent of taxpayers will pay the same or less, and we will stabilize Illinois’ finances. Opponents should be honest that they offer bad options – either cutting schools and public safety to the bone, or raising taxes on everyone by 20 percent. Instead, I stand firmly on the side of working families and fairness.”

* The House is now debating this bill…

Creates the Illinois Property Tax Relief Fund. Provides that moneys in the Illinois Property Tax Relief Fund shall be used to pay rebates to residential property taxpayers in the State. Provides that the Fund may accept moneys from any lawful source. Provides that the State Comptroller shall calculate a property tax rebate amount for the applicable property tax year by dividing the total amount appropriated from the Illinois Property Tax Relief Fund by the total number of homestead exemptions granted for homestead property in the State. Provides that the property tax bills of non-delinquent taxpayers who received a general homestead exemption under the Property Tax Code shall be reduced by the property tax rebate amount.

The bill will take effect immediately, but won’t start happening until 2021, presumably after the graduated income tax takes effect (depending on voter approval).

…Adding… The bill passed 96-18-1. The House is now debating this bill…

Creates the Property Tax Relief Task Force. Provides that the Task Force shall identify the causes of increasingly burdensome property taxes across Illinois, review best practices in public policy strategies that create short-term and long-term property tax relief for homeowners, and make recommendations to assist in the development of short-term and long-term administrative, electoral, and legislative changes needed to create short-term and long-term property tax relief for homeowners.

The bill was taken out of the record after Republicans complained that the task force membership had no guarantee of bipartisanship.

47 Comments

|

* Press release…

The Cook County Assessor’s Office was informed by House leadership that SB 1379, the Data Modernization Bill, would not move out of the Rules Committee for a vote during the current legislative session.

In response, Assessor Fritz Kaegi released the following statement:

Days spent crafting a property tax reform bill: 272

“Yes” votes in the Senate: 36

Co-sponsors in the House: 39

Number of Cook County’s Southern Suburbs waiting for more accurate assessments: 80+

Number of jurisdictions in the U.S. with a similar method of data collection: 17

Business leaders, school districts, organized labor groups, community organizations and elected officials throughout Cook County and Illinois who publicly support the bill: 73

Hours of meetings with those who oppose the bill: Limitless

Reasons why Illinois and Cook County don’t deserve a fair, equitable and transparent assessment system: 0

SB 1379 remains the best first legislative step toward reform of the property tax system. We’ll be back next session to get it passed.

Fritz

*** UPDATE *** Press release…

The Chicagoland Chamber of Commerce, Illinois Retail Merchants Association and Illinois Manufacturers’ Association have issued this statement in response to the Assessor’s statement:

“We are disappointed by the Assessor’s statement and the disrespect it shows to the various stakeholders who engaged in meaningful discussion and the legislators who expressed their concerns with the unknown impacts. Approaching such a significant change to a $14.5 billion system should be done with thorough consideration. Haste makes waste and Cook County property owners, residential and commercial alike, have certainly experienced enough waste.”

26 Comments

|

* Sun-Times…

Ald. Edward M. Burke and his top political aide have been named as defendants in a pending federal bribery case involving a Lake Forest developer, court records show.

Burke and his aide, Peter J. Andrews, were named as new defendants in the federal bribery case against developer Charles Cui.

Cui is accused of allegedly using Burke’s law firm for property tax appeal work as Cui sought a sign permit that was critical to a redevelopment project on the Northwest Side. Burke was not originally charged in the case, which was brought earlier this year, but was implicated throughout the charges against Cui.

Details of the new charges against Burke and Andrews were not immediately available.

*** UPDATE 1 *** Tribune…

A 14-count indictment accused the alderman with half a century in office of corruption in connection with the redevelopment of the old main post office in downtown Chicago as well as two smaller projects in which prosecutors had previously alleged wrongdoing.

The charges also allege that Burke threatened to oppose an increase in the admission fee for a Chicago museum after the museum failed to respond to the alderman’s inquiry about an internship there for a child of a friend.

The indictment charges Burke with one count of racketeering, two counts of federal program bribery, two counts of attempted extortion, one count of conspiracy to commit extortion and eight counts of using interstate commerce to facilitate an unlawful activity.

Also charged for the first time was Peter J. Andrews, an employee in Burke’s 14th Ward office who is accused of assisting the alderman in attempting to shake down two businessmen seeking to renovate a Burger King restaurant in the ward.

*** UPDATE 2 *** Read the indictment by clicking here.

18 Comments

|

Illinois Credit Unions: Focused On The Members We Serve

Thursday, May 30, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Credit unions are a small segment of Illinois’ financial sector. By mid-year of 2018 credit unions controlled merely 7.6% of deposits. While credit unions are growing, other financial institutions dominate the market. Structure is the key difference between credit unions and our counterparts. Credit unions are member-owned, democratically governed, not-for-profit financial cooperatives. Our structure means there are no stockholders demanding market rate of return on their investments. Our earnings are passed along to member-owners rather than a small, wealthy group of investors. Because credit unions are not focused on making a profit for investors, they are able to provide lower rates on loans, high rates on savings, and community enrichment. Interested in learning more about the unique benefits of credit union membership? Visit YourMoneyFurther.com to learn more.

Comments Off

|

It’s just a bill

Thursday, May 30, 2019 - Posted by Rich Miller

* Big…

The Illinois House has unanimously passed a bipartisan reform package that aims to improve a number of health care programs in the state, including its often griped about Medicaid managed care program.

Under the program, the state pays private insurers a set amount per member per month rather than paying for each medical service provided. It aims to improve people’s health and control costs by ensuring all care is appropriate and high quality. But hospitals say it’s costing them money, as medical claims denied for administrative reasons cause significant reimbursement delays.

S.B. 1321 aims to improve aspects of the program that seem to be causing hospitals the most grief, including requiring insurers to pay complete claims within 30 days or face a penalty. The bill now moves to the Senate.

It also requires the Department of Healthcare & Family Services, the agency that oversees Medicaid, to maintain a provider complaint portal, through which doctors can submit unresolved disputes with insurers. Hospitals have long requested more oversight from the agency.

* Press release…

The following can be attributed to Khadine Bennett, Advocacy and Intergovernmental Affairs Director of the American Civil Liberties Union of Illinois:

“The U.S. Supreme Court ruled last year that cell phone users have a reasonable expectation of privacy regarding their historical cell site location data. Thank you to the Illinois Senate for passing House Bill 2134, which reconciles the Illinois Freedom from Location Surveillance Act (FLSA) with this ruling by requiring law enforcement agencies in Illinois to obtain a court order or warrant before obtaining historical location information from a location device.

“We appreciate the leadership of sponsors Representative Ann Williams and Senator Don Harmon and we look forward to its signature into law by Governor Pritzker.”

* Bloomberg…

Illinois is poised to update its privacy law to require businesses to swiftly report larger data breaches to the state attorney general.

The [House] voted 79-32 to approve Senate Bill 1624 amending the Personal Information Protection Act. The Senate unanimously approved the bill in April, and Gov. J.B. Pritzker (D) is expected to sign it into law, according to the bill’s sponsor, Sen. Suzy Glowiak (D).

PIPA doesn’t currently require data collectors to make disclosures to law enforcement,

* Related…

* Tougher regulations on door-to-door energy sales pass Illinois House

* Illinois lawmakers OK bill to remove legal obstacles for those who provide clean needles to heroin users

* Bill headed to Pritzker defines consent for sex ed instruction in Illinois

2 Comments

|

* Mark Brown…

Voices were raised, tempers flared and accusations traded on the Illinois House floor Wednesday afternoon, nothing out of the ordinary in and of itself for this late stage of a legislative session.

“Welcome to the emotions of the last week in May,” said state Rep. Mark Batinick, R-Plainfield, directing his remark to new lawmakers who might be unfamiliar with how testy things can get in the waning days.

The immediate cause of the tensions was an obscure piece of legislation by Chicago standards — a fight over whether Champaign County should split away from five more rural counties with which it shares a judicial district.

But in that debate, fought strictly along partisan lines because the change would give Democrats a better shot at electing local judges, I thought we could see an emerging theme of this year’s legislative session.

That is, Democrats are completely back in charge in Springfield, and when push comes to shove, and at some point it always does, they’re going to do things their way. […]

One day after slamming through an expansive abortion rights bill over Republican opposition as a way to fight back against southern states moving in the opposite direction, House Democrats pushed another conservative hot button by voting to require fingerprinting of individuals seeking a Firearm Owners Identification Card.

In recent days, both chambers approved a constitutional amendment to switch Illinois to a graduated income tax, moving away from the flat rate tax that has been in effect nearly 50 years. And before that, they approved an increase in the minimum wage to $15 an hour.

* From Hollywood Center Squares, or whatever it’s called now…

Gov. J.B. Pritzker’s administration has introduced legislation crafted by the State Board of Elections that Republicans say would legitimize a third party to play spoiler to the GOP’s chances of regaining seats in the General Assembly.

The bill that passed in a House committee Thursday morning would allow for the Conservative Party to field candidates for state representative or state senator in any district where Sam McCann, the Conservative Party gubernatorial candidate supported by unions to siphon votes from former Gov. Bruce Rauner in 2018, got more than 5 percent of the vote.

State Rep. Tim Butler, R-Springfield, called the legislation a direct shot at the minority party.

“You come down with omnibus elections bills that screw the other party,” he told Majority Leader Greg Harris. “That’s what you’re doing.”

…Adding… From Matt Dietrich at the Illinois State Board of Elections…

I wanted to point out that the portion of the omnibus bill referenced in the story is not something we put in. Most of the bill comes from legislative changes we suggested but that part was not among them.

* The Question: Are the Democrats over-reaching this spring? Take the poll and then explain your answer in comments, please.

polls

*** UPDATE *** House Majority Leader Greg Harris has introduced an amendment to the omnibus elections bill to delete the language about establishing third parties. The language had infuriated House Republicans, who threatened to pull votes off all upcoming bipartisan bills unless it was stripped.

85 Comments

|

Rate the new anti parking tax radio ad

Thursday, May 30, 2019 - Posted by Rich Miller

* Spot…

* Script…

Do you drive to work in Chicago or anywhere else in Cook County? Do you pay to park your car? Watch out for a nasty surprise.

Do you drive to shop, dine out or see a play? Do you drive to the airport? Watch out for a nasty surprise.

The new administration has proposed the first and only state parking tax in America. If this is voted into law, you will pay up to 40% in taxes just to park in Chicago and suburban Cook County.

Up to 40%!

Chicago parking taxes are already higher than New York, Washington and LA. Three times higher than Dallas or Houston.

Do you want to pay more than ever to work or shop, go out to dinner, see a show or visit a museum?

Every parking lot, garage and even airport parking will cost more!

Business owners? Your employees and your customers will suffer. That means your business will suffer.

Call your state representative and state senator. Tell them to vote no.

They’re ready to vote. So call them now. Or visit noparkingtaxhike.com for more information.

That’s noparkingtaxhike.com.

Paid for by Teamsters Local 727 and the Parking Industry Labor Management Committee.

The proposed state tax is actually 6 percent for daily and hourly parking and 9 percent for monthly. They’re adding in local taxes to the mix. Also notice that they don’t mention Pritzker’s name. It’s just “the new administration.”

10 Comments

|

Give up the funk!

Thursday, May 30, 2019 - Posted by Rich Miller

* From that Center Square thingy…

Gov. J.B. Pritzker threw an early birthday party for Secretary of State Jesse White, but the Chicago billionaire declined to comment about the cost of the celebration.

Amid stormy weather in the Springfield-area, the Wednesday night party took place under a massive tent with a raised platform on the lawn of the Governor’s Mansion. The temporary structure took a week to construct.

Asked Thursday how much the party cost, the governor, who has an estimated net worth of more than $3 billion, wouldn’t say.

“[First Lady] M.K. [Pritzker] and I were thrilled to have a birthday party for Secretary of State Jesse White,” Pritzker said. “He’s one of the great public servants in the history of the state of Illinois. He’s revered, he’s a friend, he somebody I’ve known for 35 years.”

Funk superstar George Clinton performed at the birthday celebration.

“We obviously were interested in making sure we had entertainment that was appropriate to the evening and so we were glad to be able to get George Clinton to perform,” Pritzker said.

He noted that a number of Illinois distillers and craft brewers provided drinks for the evening.

“Everybody enjoyed themselves,” Pritzker said.

Everybody did, indeed, enjoy themselves. It was quite the bash, and it was privately funded, so I don’t really care about the cost. From the Danenberger Family Vineyards Facebook page, here’s an early pic of the inside of the tent…

* Sponsors…

* The band…

* The man himself…

Say whatever you want about the governor, but our state’s First Lady knocks it out of the park whenever she throws a party. She may very well be the best ever.

16 Comments

|

[The following is a paid advertisement.]

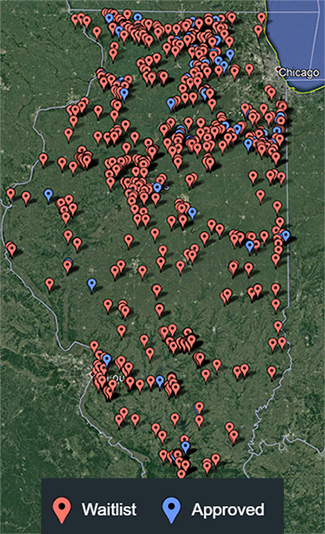

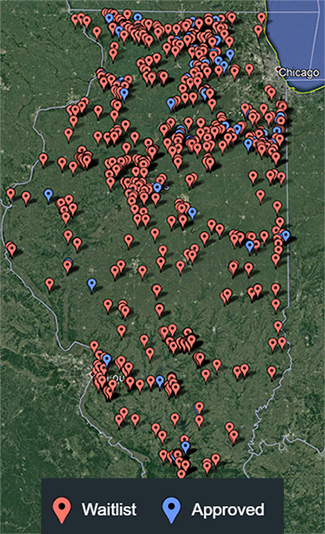

More than 800 solar energy projects are on hold because Illinois’ renewable energy program isn’t adequately funded to meet either current demand or the statutory renewable portfolio standard requirement of 25% by 2025.

The waitlisted, shovel-ready projects could create thousands of jobs, lower consumer electric bills and generate $220 million in property tax revenue for local governments. Funding for new commercial and community solar projects and wind farms will be depleted after 2019.

To see projects on the waitlist in your community – visit www.pathto100.net/waitlist

Without a fix to the state’s renewable energy program, waitlisted projects may not be built.

Vote YES on HB 2966/SB 1781 to fix Illinois’ clean energy cliff and let shovel-ready projects move forward.

For more information, please visit pathto100.net

Comments Off

|

* Good question, but not quite a complete answer…

Total McCormick Place attendance in 2017 was 2.5 million, compared with over 3 million in 2001. Use of the convention center as measured by square footage dropped by half.

So why does the center keep getting more money, and racking up new debt?

Part of the reason is that it’s in a highly competitive industry where other cities are making ill-considered investments in centers of their own. There’s a futile arms race at play.

The bigger reasons for expansion are political. Organized labor and private businesses collaborate to push expansion plans year after year. When they succeed, the mayor of Chicago and other officials then get to stand at ribbon-cuttings and take credit for tourism numbers.

Um, name me another place that brings in 2.5 million people mostly from out of state to Illinois every year for extended periods of time. That’s why those “private businesses,” which are actually hotels, restaurants, etc. aren’t totally opposed to new taxation. The restaurant association, I’m told, is so far neutral on this bill…

Dining out in certain parts of Chicago would get a little more costly under a measure approved Wednesday in the Illinois Senate to help pay for a construction project at McCormick Place.

By a 44-6 vote, the Senate passed a bill to expand the boundaries of the area in which the Metropolitan Pier and Exposition Authority, the agency that oversees McCormick Place and Navy Pier, levies a 1% restaurant tax. The measure now moves to the House.

The tax currently is collected downtown, but the expanded area, which would include parts of the North, Northwest and South sides, was designed to bring in more money from trendy restaurants in areas such as Wrigleyville, Logan Square and Hyde Park, McPier CEO Lori Healey said during a committee hearing Wednesday. The agency expects to bring in an additional $10 million in annual revenue from the expanded boundaries, she said. […]

Chicago Mayor Lori Lightfoot said Wednesday that she doesn’t know enough about McPier’s proposal to have a position.

No group filed a witness slip in opposition yesterday.

* But the proposed boundaries of what would be a much larger taxing district have some locals up in arms…

Ald. Tom Tunney (44th), owner of Ann Sather restaurants, said he adamantly opposes the dramatic expansion of a restaurant tax that was supposed to be temporary.

“This tax was supposed to go away — not expand,” said Tunney, the new chairman of the City Council’s Zoning Committee.

“I’m not supportive of it. We already have the highest sales tax in the country, and we’re expanding it? I just feel that the cost of dining out is very expensive. It’s close to 12 percent. Consumers notice. I also think it hurts us on the competitiveness of the convention and tourism business.” […]

Ald. Brian Hopkins (2nd) joined Tunney in opposing the expansion.

“The whole purpose of the original tax on restaurants for McCormick Place was to capture tourism dollars. We know they’re concentrated in the downtown area,” Hopkins said.

“The further you push that away [from downtown], the more you’re putting that burden on local residents who are going to their neighborhood restaurant. That’s not fair, and I don’t support it.”

That bill flew out of the Senate before any opposition could coalesce. There may not be enough time to stop it in the House. We’ll see. It’s been assigned to the House Executive Committee, where it should blow right through to the floor.

*** UPDATE 1 *** Greg Hinz…

Mayor Lori Lightfoot has come out against a legislative plan to expand McCormick Place by hitting areas as much as 10 miles away from the convention center with a 1 percent tax on restaurants, bars, and take-out food items.

The move may well stall action on the proposal, at least for now, as lawmakers in Springfield race toward a scheduled adjournment of their spring session at midnight tomorrow.

In a statement, the mayor, who insisted at a press conference yesterday that she was just learning details of the plan, based her opposition in part on the fact that the proposed bill has a carve-out for sports stadiums with a capacity of at least 20,000 people—including Wrigley Field, Guaranteed Rate Field and the United Center.

“The mayor is committed to ensuring that Chicago’s convention industry remains vibrant, and supports making investments that will enhance McCormick Place and drive new economic growth for the city of Chicago,” the statement said. “However we are concerned about this proposal in its current form, specifically the exemption favoring large venue owners, whose customer base includes visitors and conventioneers, and the potential unintended consequences for small businesses in Chicago.

*** UPDATE 2 *** A source on the House Executive Committee says the plan is to strip the tax hike from the bill. The General Assembly will punt to the fall veto session.

*** UPDATE 3 *** Same source updates with info that the bill will not be called during tonight’s hearing.

40 Comments

|

* WBEZ…

When he’s in Chicago, Michael Zalewski is a lawyer at the downtown offices of Taft Stettinius & Hollister LLP.

At the same time, in Springfield, the Democratic state representative from Chicago’s Southwest Side has taken the lead role in the effort to legalize betting on sports in Illinois.

And it’s in Springfield where the Taft law firm has dozens of lobbying clients with interests in gambling, including sports betting. […]

“In the last week there’s been a concentrated effort by certain stakeholders to accuse me of being the problem when it comes to passing the sports-betting law,” Zalewski told WBEZ on Wednesday. […]

Springfield sources say the complaints about Zalewski’s side job at Taft came from executives of the company that owns Rivers Casino in Des Plaines. A spokeswoman for Rivers Casino declined to comment. […]

According to his bio on Taft’s website, Zalewski also is “of counsel” to the firm. That means he is employed by the firm but is not a partner with an equity stake in the firm. He said he does not work for any of the firm’s many clients who have interests in Springfield. […]

After the U.S. Supreme Court cleared the way for sports betting, Zaleswki said he made sure that there were no legal or ethical hurdles to his acting as the chairman at hearings on crafting a sports-gambling law for Illinois.

“I asked and received an ethical opinion from my chief ethics officer,” Zalewski said. “I’ve complied with all ethical and legal guidelines regarding this topic, and I’ve acted with integrity and honor.”

The Rivers people have, indeed, been trying to get Zalewski out of the picture with this story for several days. Rivers has been trying to box out the sports betting companies and temporarily blowing up the process would be a positive for the casino.

Zalewski showed me an opinion from the House Democrats’ ethics officer which had no objection to his law firm work, but outlined everything he needed to do to avoid a problem. He is beloved under the dome, but going to that law firm - even as an “of counsel” - was probably not the best decision he’s ever made.

* Meanwhile, here’s Hannah Meisel…

After weeks of fighting between billionaire Rivers Casino owner Neil Bluhm and the CEOs of the fantasy sports and sports betting tech companies FanDuel and DraftKings that threatened one of Gov. JB Pritzker’s top priorities, negotiators say an omnibus gaming bill will be heard in committee Thursday morning — a bill that includes a deal favorable for Bluhm.

State Sen. Terry Link (D-Vernon Hills) told The Daily Line that while the specifics of the brick-and-mortar casino part of the bill have been solid for a week, deals with the video gaming industry and on sports betting were the last pieces of the puzzle. Deals on both on video gaming and sports betting have crystalized in the last few days, and Link said Wednesday that Bluhm will “be on board supporting this bill.” […]

State Rep. Mike Zalewski (D-Riverside), who had been helping to lead those negotiations, announced Wednesday that he would no longer participate in the talks amid criticism that his law firm represents clients with a stake in the bill, as first reported by WBEZ Wednesday afternoon.

In a series of tweets after the story published, Zalewski said he had never “worked on an issue as hard as I worked on sports betting.”

“In the last week, it became clear some thought I was the problem in the room, so I stepped back and let our gaming negotiator try to land the plane,” Zalewski wrote. “At no time did I put my thumb on the scale for anyone. You only have your integrity, the respect of your colleagues, and your word down here to get you by. I hold my head high that on sports betting, and any other issue I work on, I treat everyone with respect. I hope we get sports betting done. And I think we will. And I’ll have been a part of it. And that will be a cool thing.”

23 Comments

|

|

Comments Off

|

Cannabis roundup

Thursday, May 30, 2019 - Posted by Rich Miller

* Jaclyn Driscoll…

Illinois state Senators approved a proposal on Wednesday to legalize recreational marijuana for adults 21 years and older beginning on January 1, 2020.

With a roll call of 38-17, the measure received support from three of the Republicans in the chamber while two Democrats decided to vote “no.”

Rock Island state Sen. Neil Anderson is one of two Republican co-sponsors of the proposal. He said even though he was voting in favor, he personally is still against cannabis use.

“I will continue to tell my kids that they should not smoke tobacco, they should not smoke cannabis and that is my job as a responsible parent,” said Anderson. “But to those adults out there that want to use cannabis, as I’ve said before, freedom is freedom.”

* Tina Sfondeles…

During the Senate debate, state Sen. Dale Righter argued legalization will increase use and has led to more organized crime prosecutions in Colorado.

“More people are going to use and this is going to cause more hazards for the public, not less,” Righter, R-Mattoon, said. But his Republican colleague, state Sen. Jason Barickman, said he now supports the measure, in part because of additions protecting employers. He said it also gives people “more freedom of their choices.”

And bill sponsor state Sen. Heather Steans, D-Chicago, said just one state that has legalized marijuana has seen an increase in teen use.

“It’s not something of course that we want teens to do … and the notion that you can prevent teens from doing this by simply ignoring that they currently are is what got us into this place,” Steans said. “This is where we are right now.”

“We can’t pretend that we don’t actually have cannabis smoking going on. We know we do. In Illinois, we estimate that about 800,000 people are using. Burying our heads in the sand about that does not improve the situation or the outcomes on this,” Steans said. “A different approach is going to have a much better outcome.”

The biggest reason arrests have risen in Colorado is the cannabis law gave the police more money than they ever had before to go after the bad guys. Part of the legalization process has to be eventually knocking out the criminal networks. First you weaken them with competition, then you take them out.

* Rick Pearson, Dan Petrella and Jamie Munks…

Steans said legalizing marijuana is expected to generate $57 million in general revenue in the coming budget year and $30 million for a cannabis business development fund. That’s far less than the $170 million Pritzker projected in his spending plan, but Steans said budget negotiators aren’t counting on any of that revenue.

After paying for regulatory expenses and costs related to the expungement process, marijuana revenue would be divided among a number of areas. The largest share, 35%, would go into the state’s general fund; 25% would go to community grants; 20% to mental health and substance abuse programs; 10% to pay down the state’s backlog of unpaid bills; 8% to support law enforcement; and 2% for public education.

Opponents to legalization are now gearing up for a fight in the House.

State Rep. Marty Moylan, a Democrat from Des Plaines who sponsored the resolution to slow the legalization process, said it should be delayed until the summer to allow lawmakers time to understand what’s in the bill.

“They’re trying to ram it down our throats at the last minute,” he said. “They’re presenting it real late so we have a hard time finding out what’s in it.”

All the opponents who claimed this was “really” about some desperate need to collect massive state revenues were wrong from the beginning.

And, Marty, people have been working on this bill for two years. The recent changes were in response to some of your own demands.

* And these folks will never be happy…

“The concern there still remains in terms of home grow. We don’t have access. We won’t be able to tell who’s doing what. The penalties associated with home grow, anything less than five plants is a civil citation, from $100 to a max of $200. That is a concern for us. We want to make sure that it is a strong deterrent for home grow,” said Jim Kaitschuk on behalf of the Illinois Sheriff’s Association.

“We won’t be able to tell who’s doing what.” *Sigh* Kaitschuk, I love you, but try easing up on the Orwell.

* Wut?…

It also gives preference in license applications to people who live in or have connections to neighborhoods characterized by high arrest rates for marijuana and other drug-related offenses.

Some opponents of the measure, however, said that provision was one of the reasons why they voted against the bill.

“There is a limited number of licenses and we’re going to give preference to vendors who are going to be in the poorest zip codes in Illinois,” said Sen. Chapin Rose, R-Mahomet. “We’re going to give preference to keeping poor people stoned.”

So, you’d rather grant official state preference to vendors in… wealthy areas?

* Tara Molina…

The bill would allow adults 21 and older to legally buy and possess marijuana — 30 grams of cannabis flower or five grams of cannabis concentrate.

According to the bill, cannabis products may not be transported over state lines, and tax revenue will cover needs and costs related to expungement or the clearing of marijuana related records before it’s broken out. Additionally, local towns can decide individually how cannabis-related businesses may fit into their communities and employers may still maintain zero tolerance workplaces. Landlords and business owners can have zero tolerance policies as well.

Even with the changes, some are still against the proposal.

“More people are going to use, and that’s going to create more hazards for the public, not less,” said Dale Righter (R-Matoon). “Our kids are watching this. Maybe this is OK for us for now, and for a couple years we’ll get tax revenue. But its meaning 10 or 15 years down the road? And that’s my concern, and that’s why I oppose the bill.”

I don’t even know what to say to that. I kinda doubt he even knows how to translate that word salad.

56 Comments

|

* This flooding is getting real…

With urgent flooding situations along the Illinois and Mississippi rivers, Governor JB Pritzker has activated approximately 200 Illinois National Guard soldiers for State Active Duty to assist with the state’s flood fight operations and urged all residents in affected communities to listen to the directions of first responders.

“As we face historic weather in this state, the safety of our communities will always be my top priority, and every relevant state agency is working in concert to protect communities,” said Governor JB Pritzker. “This morning, I activated the two hundred members of the Illinois National Guard to regions along the Illinois and Mississippi Rivers to assist in sandbagging operations and levee monitoring and reinforcement, with another 200 on standby. We have deployed more than two million sandbags, hosted multi-agency resources centers in impacted communities, and I issued a disaster declaration impacting 34 counties. My administration will continue using every tool at our disposal to protect impacted Illinoisans.”

Soldiers of 2nd Battalion, 123 Field Artillery Regiment were notified of the activation last night (Wednesday) and began reporting to their units in Milan, Galesburg and Springfield today (Thursday). The soldiers will help strengthen levees and construct protective barriers in flooded areas. The soldiers will be ready to deploy to affected areas by tomorrow (Friday). In addition, Governor Pritzker is activating a small team of Illinois National Guard planners to augment the Illinois Emergency Management Agency staff.

“The Illinois National Guard is a community-based organization, and when our communities need help we answer the call. As they do to answer they do when they deploy to fight their nations wars, they are leaving families and jobs behind to help their fellow citizens,” said Brig. Gen. Richard Neely, The Adjutant General of the Illinois National Guard. “These guardsmen will assist the residents of impacted areas and help protect the communities from further damage.”

Alicia Tate-Nadeau, acting director of the Illinois Emergency Management Agency, said she has been in contact with National Guard leaders throughout the state’s flood response. “The National Guard is an important part of the overall state emergency response team. As a retired National Guard general, I’m well aware of the great capability that the Guard brings to the fight. They are professionals in both their state and federal military missions.”

“The Illinois Department of Transportation takes great pride is assisting communities during natural disasters,” said Acting Illinois Transportation Secretary Omer Osman. “By mobilizing the National Guard, the governor is helping to ensure residents get the relief they need during this critical time, and IDOT is ready to ensure that critical infrastructure is protected and safe for travel.”

* More…

IEMA has also told residents in several counties to prepare for potential evacuation.

*** UPDATE *** Whoa…

A Chicago alderman is calling on the governor to provide cash to save the city’s shoreline as Lake Michigan’s water levels rise to record highs.

Ald. Brian Hopkins, 2nd, acknowledged the severity of the problem. He’s calling on Gov. JB Pritzker for the money needed to save Chicago’s shoreline.

“Right now we are in crisis mode,” he said.

Rogers park resident Tom Heineman is watching this shoreline dissolve more every day. The water level this year is the highest he’s seen since the 80s.

“There used to be a beach that went out a good 20 yards,” Heineman said. “The lake is so high that with the northeasterly storms this is what it did.”

28 Comments

|

Yep, it’s false

Thursday, May 30, 2019 - Posted by Rich Miller

* We’ve already discussed this topic, so I was pleased to see PolitiFact take it on today…

Citing remarks made in February by the governor of New York, [Rep. Mike Murphy, R-Springfield] claimed that when that state “implemented a program” to tax the wealthy at higher rates it saw a revenue shortfall “because of the outward migration of their top earners.”

Cuomo did raise the specter of out-migration among the state’s better-off taxpayers when personal income tax revenues came in below projections early this year. But he blamed the drop on fallout from the Republican federal tax overhaul of 2017 and other factors, not graduated income tax rates in New York which haven’t been raised in a decade.

What’s more, IRS data show the number of people filing with income greater than $200,000 in New York has increased every year since 2009 when New York raised rates on top earnings to levels similar to those currently under consideration in Illinois.

We rate Murphy’s claim False.

The piece also mentions that New York’s April personal income tax collections spiked 57 percent over last year.

* Related…

* Analysis Raises Doubts Higher Income People Will Leave If Illinois Adopts A Graduated Income Tax

21 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|