A quick look at the budget

Tuesday, Jun 11, 2019 - Posted by Rich Miller

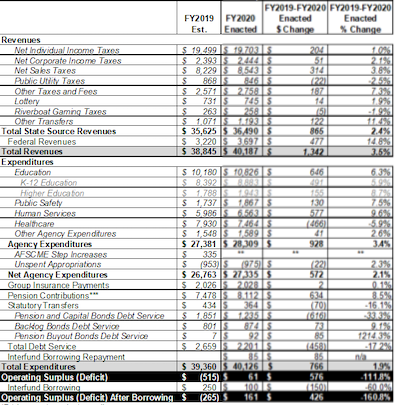

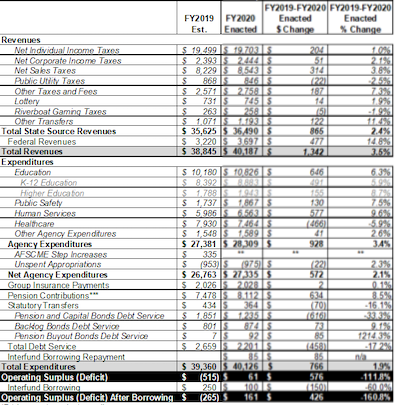

* Revenues are up, but net spending increases appear to be held to a minimum at first glance…

Healthcare expenditures appear to decrease because of the tax on managed care companies…

In the enacted budget, about $500 million of the total taxes paid by managed care organizations (MCOs) will be used in place of General Funds revenues

The state also paid off its Pat Quinn-era pension bond earlier this fiscal year, freeing up more than $600 million in base spending.

Those reductions allowed net General Funds expenditures to rise by just $766 million, or 1.9 percent, even though spending actually rose much higher than that.

* But is the budget really balanced? Wirepoints…

The state’s pension funding laws, set up nearly 25 years ago by the General Assembly and then-Gov. Jim Edgar, require the state to pay $9 billion* to Illinois’ five state-run pensions in 2020. “We are paying the full payment that is required under the ramp that was put in place in 1995, the statutory required payment,” Pritzker said when he signed the budget.

But what Pritzker ignores is the amount the state’s own actuaries say is required to properly fund Illinois’ pensions in 2020, an amount that exceeds $13 billion. That’s a total shortfall of $4 billion.

That’s true, but that’s the Edgar ramp. We’ll eventually get to the top. Until then, it won’t be pretty or cheap and folks will scream bloody murder.

* And what about the bill backlog?…

Despite these steps, [Comptroller Susana Mendoza] said it’s important to “remain grounded” and focused on paying down Illinois’ outsized bill backlog, which sits between $6 billion and $7 billion.

“We have $6.6 billion worth of bills that have not been paid yet, which means that we still owe that money; those are real liabilities that have been incurred,” she said. “But this is by far, by far, the closest thing that we’ve seen to a balanced budget in probably over a decade.”

That number sits at $6.4 billion today. The state gets to a 30-day payment cycle at somewhere around $3 billion. There’s $1.2 billion in bonding authorization in the budget to pay off some of that debt in order to reduce borrowing costs. Illinois didn’t get into this mess overnight and it won’t get out of it overnight either.

- Former State Worker - Tuesday, Jun 11, 19 @ 12:35 pm:

We aren’t going to get out of this mess overnight but I think people just want to see progress and a reasonable path to getting the pension funded.

There are some (many?) who have just given up and that we’ll never get out of this mess.

I, for once, do see progress. A lot of things have to go right for us and it’s going to be a rough path forward but I can at least see how we can get to the pensions being 90% funded.

- Donnie Elgin - Tuesday, Jun 11, 19 @ 12:41 pm:

“but that’s the Edgar ramp. We’ll eventually get to the top”

Yeah well 2044 is way off; and politicians of both parties think in election cycles.

- Michelle Flaherty - Tuesday, Jun 11, 19 @ 12:46 pm:

To give the Wirepoints crowd more attention than it deserves, if the state really did increase its payment to $13 billion, that crowd would scream bloody murder about the HUGE increase in state spending. You’ve seen that routinely over the years. Budget critics would blast the pension debt … and then blast the increased spending to pay the pension debt.

- lakeside - Tuesday, Jun 11, 19 @ 12:47 pm:

I’m excited as everything to just see one foot in front of the other.

Getting our vendors paid is literally an investment in our own workforce and industries. Asking companies to float the state makes it hard for them to thrive and grow.

- The Captain - Tuesday, Jun 11, 19 @ 12:50 pm:

I’m going off memory so I’m going to get some of the details wrong but I thought that during the impasse of the Rauner years there was some spending that took place but was never appropriated and the Rauner administration kept trying to get a supplemental passed after the fact to cover that spending but had no luck. I also thought that spending was included in part of the bill backlog but was there without the spending authority to pay it down, even if funds were there.

I assume some of what I wrote is factually inaccurate, I’m going off of a very faulty memory, but is this still an open issue?

- City Zen - Tuesday, Jun 11, 19 @ 12:53 pm:

“We have $6.6 billion worth of bills that have not been paid yet…”

Plus $6 billion from last year’s general obligation bond that went to the bill backlog. That doesn’t disappear because you re-brand it.

- RNUG - Tuesday, Jun 11, 19 @ 12:57 pm:

If the State can stay the course for the next 8 years, things will be better. Backlog should be all paid. We won’t be at the top of the Edgar ramp, but we should be making actuarial level payments by then and have the pension funding under control. Yes, there is still the balloon years at the end of the ramp, but they will then have the option of a new, level payment plan to refi those balloon payments. Not ideal, but very workable. Just need to keep new spending under control.

- Fax Machine - Tuesday, Jun 11, 19 @ 1:32 pm:

Ideas Illinois will probably point to the budget and say “See we don’t need to raise taxes on anyone”

- Rich Miller - Tuesday, Jun 11, 19 @ 1:36 pm:

===during the impasse of the Rauner years there was some spending that took place but was never appropriated===

Some? It was billions in court-ordered spending.

- Blue Dog Dem - Tuesday, Jun 11, 19 @ 1:50 pm:

RNUG. Your last sentence says it all. I am going out on a limb snd making a bold prediction. We wont control spending.

- Morty - Tuesday, Jun 11, 19 @ 1:52 pm:

Wirepoints and IPI will never be about a solution.

You can”t appease people who act in bad faith.

Their whole agenda is privatization at any cost.

- Morty’summer - Tuesday, Jun 11, 19 @ 1:55 pm:

We wont control spending-

It depends on your definition.

We won’t have austerity policies, and I believe that is a good thing

- Bruce - Tuesday, Jun 11, 19 @ 4:00 pm:

I surmise that AFSCME increase its the step item. I predict 0 % for contract year 1. If that is case it gets harder and harder to come to work for veteran employees who have not seen a COLA going on 4 years and then be asked to sit this one out. We will see tomorrow I am told.

- Chicagonk - Tuesday, Jun 11, 19 @ 4:22 pm:

Not sure if this is feasible (RNUG might need to correct me), but given the lockbox amendment, how is easy is it to split IDOT from the state employee pension fund and fund the IDOT pension benefits through transportation tax revenue?