Question of the day

Tuesday, Jun 11, 2019 - Posted by Rich Miller

* I’ve tried watching Channel 20 news over the past few years and I could never make it through an entire broadcast. To me, it’s unwatchable. I didn’t even know who Joe Crain was until the recent uproar…

WICS-TV’s general manager said Monday the Springfield television station will change the phrase it uses to label early severe weather alerts.

Gone is “Code Red,” words that drew the ire of some viewers and prompted station meteorologist Joe Crain to use a morning on-air weather report last week to criticize the phrase, saying it is a “corporate initiative” that “doesn’t recognize that not all storms are equal.” Crain hasn’t been on the air since his comments, and his biography has been removed from the Channel 20 website.

In Code Red’s place now is the phrase “Weather Warn,” WICS general manager Rick Lipps said in a video posted to the station’s website.

“We firmly believe in the need to provide an early warning alert and will continue to provide this potentially lifesaving information, but we have come to understand that the words ‘Code Red’ may no longer be fitting,” Lipps said. “As such, we are changing the name of our early warning alert to ‘Weather Warn.’ In addition, we will continue to work to more precisely define the specific geographic areas of greatest concern.”

* The Question: Do you regularly watch local TV news? Take the poll and then explain your answer in comments, please.

panel management

110 Comments

|

* The Daily Line’s Hannah Meisel…

A new poll commissioned by Ideas Illinois, a dark money group formed to fight a ballot question that would change Illinois’ flat income tax to a graduated tax, shows support for the idea is slipping, especially in a key central Illinois media market. […]

Ideas Illinois’ new poll, conducted by We Ask America on May 29 and May 30, found that support for a graduated income tax has fallen to 51 percent among likely voters — 8 percent below the minimum 60 percent threshold of voters needed to approve the measure. A similar poll in February had found a higher level of support — 59 percent — prior to a blitz of television advertising from both sides this spring as Pritzker rolled out his specific proposals surrounding a graduated tax.

The poll also found that opposition to a constitutional change to a graduated tax has risen slightly in the same time period

As more voters have heard from both sides — which featured Pritzker in ads from both Ideas Illinois and the pro-graduated tax group set up by a former Pritzker campaign staffer — Republicans registered the biggest drop in support for the concept of a graduated income tax. While 32 percent of self-identified Republicans supported a graduated tax in February, 21 percent of Republicans support the idea now, according to the poll.

* Jim Dey…

The poll revealed support for the Pritzker tax plan has fallen “despite nearly $5 million in spending by (pro-amendment) Think Big Illinois.”

Why the decline in support?

We Ask America attributed the decline to Ideas Illinois’ attacks on what Pritzker calls a “fair tax.”

“Voters see right through it. While voters right now are seeing the Pritzker messaging, they also don’t like it,” the memo states.

Sampling from the Champaign/Springfield areas, where pro- and anti-tax television advertising has been heavy, found 46 percent “agreed that the constitutional amendment is ‘just a blank check for Springfield politicians to spend more and will hurt Illinois’ economy and force businesses to leave the state.’” The poll indicated 32 percent of respondents disagreed with that statement.

The harder the critics hit that idea, We Ask America concluded, the more opposition there will be to the proposed amendment.

* Daily Herald…

Illinois Gov. J.B. Pritzker said opponents of the proposed graduated income tax plan are intentionally misleading voters who will ultimately decide its fate in November 2020.

“I think opponents of the fair tax certainly are trying to muddy the waters trying to come up with words to make it seem like something it’s not,” Pritzker said Thursday morning in a meeting with the Daily Herald editorial board. “The most recent silliness was a ‘blank check jobs tax,’ which I’m not sure I understand. It really is a crazy notion that they’re putting forward and an untrue notion.”

That phrase was used by former Illinois Manufacturers’ Association President Greg Baise, whose Ideas Illinois opposes the graduated tax and says it will push jobs out of state.

* From the polling memo…

A near majority (46%) agree that the constitutional amendment is “just a blank check for Springfield politicians to spend more and will hurt Illinois’ economy and force businesses to leave the state,” with 32% disagreeing. While 74% of Republicans agree with that assertion, just 25% of Democrats do, but among Independents, 46% agree versus 33% who disagree.

The key here is to persuade Republicans that this is a Democratic trick and to pull away enough indies to deprive the governor of a win.

* However, a big Democratic turnout in a presidential year could allow the proponents to take advantage of this highlighted constitutional provision…

A proposed amendment shall become effective as the amendment provides if approved by either three-fifths of those voting on the question or a majority of those voting in the election.

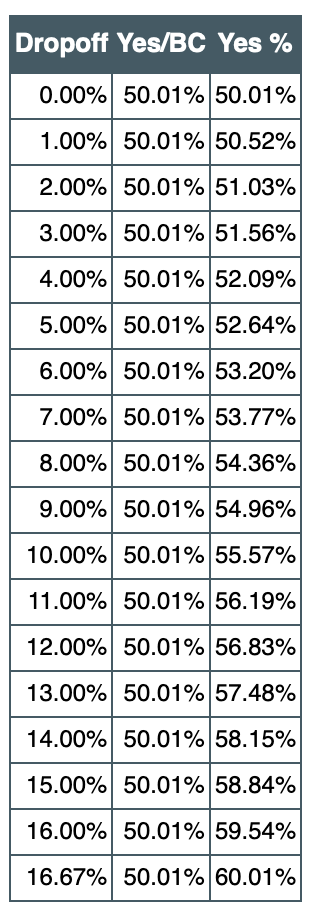

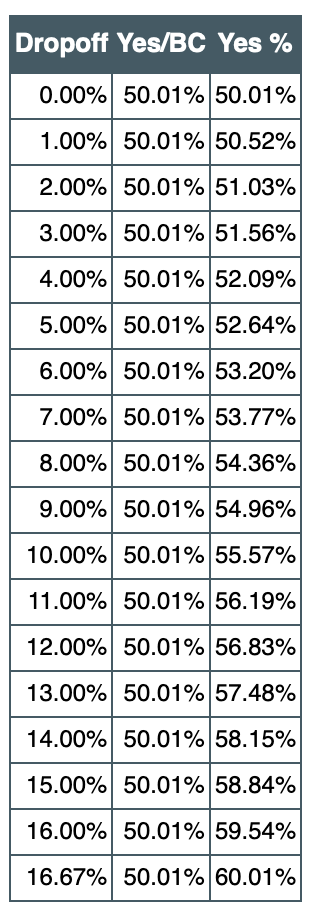

* Since 2010, the dropoff rate (those who took ballots compared to those who voted on the proposed constitutional amendment) has ranged from 8.1 to 17.15 percent. Here’s Scott Kennedy’s chart on the percentage needed to pass compared to the dropoff rate…

…Adding… Think Big Illinois Executive Director Quentin Fulks…

After trying and failing to prevent voters from having a say at the ballot box on the fair tax, opponents are now even more desperate to defend the current unfair tax system. This is nothing more than political posturing – Illinoisans want a tax system that works for everyone, not just the wealthy few. As voters continue to learn the truth about the fair tax, Think Big Illinois is confident they’ll vote for it next November.

Also, Idea Illinois’ memo about reaching 60 percent is here.

42 Comments

|

Because… Pickleball!

Tuesday, Jun 11, 2019 - Posted by Rich Miller

* Tribune…

Pickleball courts, dog parks and grants for an arts program led by House Speaker Michael Madigan’s wife are on a lengthy list of lawmakers’ pet projects paid for by a massive gambling expansion and tax hikes on smoking and parking.

The pork barrel bonanza comes courtesy of Democratic Gov. J.B. Pritzker’s $45 billion construction program that lawmakers approved as the spring legislative session spilled into overtime last weekend. It’s a signature away from becoming law. […]

Standing to benefit is pickleball, a fledgling sport that’s part tennis, part badminton and part pingpong. Democratic Sen. Terry Link of Vernon Hills tucked in $100,000 for the Buffalo Grove Park District for pickleball courts and other renovations.

The Park District plans to seal coat eight new courts at Mike Rylko Community Park because the paddle sport has “really taken off,” said Ryan Risinger, the district’s executive director. The new courts would replace rarely used sand volleyball courts, he said.

There’s also $20,000 for pickleball courts at Gwendolyn Brooks Park in Chicago’s North Kenwood neighborhood. Freshman Democratic Sen. Robert Peters said the court provides “first touches” for people in his district, saying he made choices based on local experts and community leaders who saw the need to upgrade broken and rusted equipment.

“I hope people understand why kids feel like they can’t even be in their own neighborhoods right now — if the park isn’t even safe in its structure,” Peters said. “Growing up on the South Side, the park was where I would go when I couldn’t go home. It’s its own shelter in a time of need.”

The $120,000 total listed above is 0.00027% (two-point-seven ten-thousandths of one percent) of the new infrastructure bill. And even that microcosmic percentage is way too high because the Buffalo Grove Park District appropriation isn’t solely for pickleball…

The sum of $100,000, or so much thereof as may be necessary, is appropriated from the Build Illinois Bond Fund to the Buffalo Grove Park District for costs associated with the arts center renovations, pool repairs, ADA compliant ball field construction, playground renovation, and a pickleball court.

Build Illinois is from the George Ryan Jim Thompson era, by the way.

* State capital bills routinely help fund local park projects. But, hey, cherry-picking an odd-sounding newish “sport” can be a useful tool to persuade the masses that the rest of their tax dollars are being misspent. Hey, they could very well be right, but a little context might be in order. Here’s the Tribune editorial board to close…

Illinois taxpayers deserve more accountability from their elected leaders. This bill should have been downsized significantly. It wasn’t.

Anyone for pickleball?

41 Comments

|

A quick look at the budget

Tuesday, Jun 11, 2019 - Posted by Rich Miller

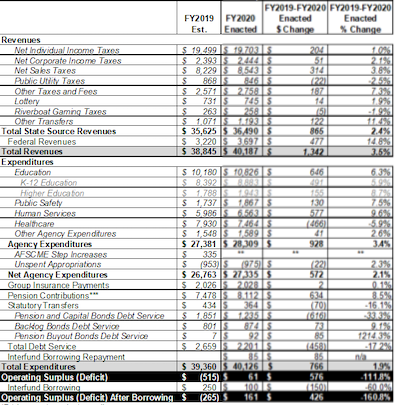

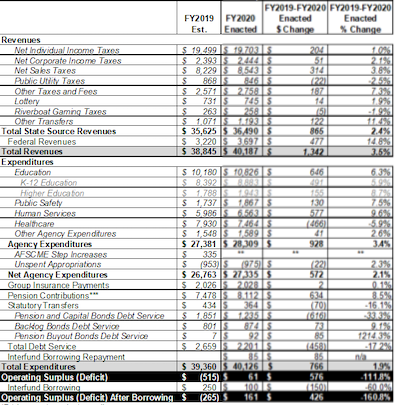

* Revenues are up, but net spending increases appear to be held to a minimum at first glance…

Healthcare expenditures appear to decrease because of the tax on managed care companies…

In the enacted budget, about $500 million of the total taxes paid by managed care organizations (MCOs) will be used in place of General Funds revenues

The state also paid off its Pat Quinn-era pension bond earlier this fiscal year, freeing up more than $600 million in base spending.

Those reductions allowed net General Funds expenditures to rise by just $766 million, or 1.9 percent, even though spending actually rose much higher than that.

* But is the budget really balanced? Wirepoints…

The state’s pension funding laws, set up nearly 25 years ago by the General Assembly and then-Gov. Jim Edgar, require the state to pay $9 billion* to Illinois’ five state-run pensions in 2020. “We are paying the full payment that is required under the ramp that was put in place in 1995, the statutory required payment,” Pritzker said when he signed the budget.

But what Pritzker ignores is the amount the state’s own actuaries say is required to properly fund Illinois’ pensions in 2020, an amount that exceeds $13 billion. That’s a total shortfall of $4 billion.

That’s true, but that’s the Edgar ramp. We’ll eventually get to the top. Until then, it won’t be pretty or cheap and folks will scream bloody murder.

* And what about the bill backlog?…

Despite these steps, [Comptroller Susana Mendoza] said it’s important to “remain grounded” and focused on paying down Illinois’ outsized bill backlog, which sits between $6 billion and $7 billion.

“We have $6.6 billion worth of bills that have not been paid yet, which means that we still owe that money; those are real liabilities that have been incurred,” she said. “But this is by far, by far, the closest thing that we’ve seen to a balanced budget in probably over a decade.”

That number sits at $6.4 billion today. The state gets to a 30-day payment cycle at somewhere around $3 billion. There’s $1.2 billion in bonding authorization in the budget to pay off some of that debt in order to reduce borrowing costs. Illinois didn’t get into this mess overnight and it won’t get out of it overnight either.

14 Comments

|

The very definition of “polarized”

Tuesday, Jun 11, 2019 - Posted by Rich Miller

* New York Times…

When J.B. Pritzker took over as the governor of Illinois this year, Democratic lawmakers, who had spent four years at an impasse with his Republican predecessor, vowed that their party’s new grip on the State Capitol would bring immediate change.

The pace has been startling. In recent months, Illinois legislators have moved sharply to the left, deeming abortion a fundamental right for women no matter what the Supreme Court might decide, raising the minimum wage, taking steps to legalize recreational marijuana and introducing a graduated income tax.

Some 700 miles to the south, the Alabama State Capitol, dominated by Republicans, has raced in the opposite direction.

Alabama lawmakers voted during this term to ban most abortions. They eliminated marriage licenses, so that probate judges opposed to same-sex marriage would not have to sign marriage certificates. And they approved requiring sex offenders who commit crimes involving children to undergo chemical castration at their own expense.

* There was one bit of agreement, however…

This year’s [Alabama] legislative session started with the gasoline tax for roads clearly established as the top priority for leaders in the Republican-controlled Legislature and Gov. Kay Ivey. The legislation quickly passed with bipartisan support during a special session Ivey called to focus on the issue.

The tax on gasoline and diesel will increase by 6 cents a gallon after Aug. 31 and by 2 cents each of the next two years. The 10-cent increase is projected to raise more than $300 million a year for roads. The state gas tax was last raised in 1992. Advocates for the increase said the state could not build and maintain a road system to handle traffic volume and economic demands without more revenue.

Leaders from both parties joined the governor for a ceremony to sign the bill that Ivey called historic.

13 Comments

|

Let’s be careful out there

Tuesday, Jun 11, 2019 - Posted by Rich Miller

* Sun-Times…

There are more questions than answers when it comes to where a Chicago casino will land — and a revamped Illinois Gaming Board will be wading into uncharted territory in taking up the biggest gambling expansion the state has ever seen.

Although the measure passed by the Illinois General Assembly hasn’t yet been signed by Gov. J.B. Pritzker, there are plans to make changes to the Illinois Gaming Board to make the board more “pro-gaming,” according to state Sen. Terry Link, D-Vernon Hills, who sponsored the gambling legislation and has worked to expand gaming in the state for years.

“You’re going to see changes rapidly,” Link said of the board tasked with regulating six new casinos, including a privately owned one in Chicago.

With one vacancy, the Gaming Board is likely to grow to five members. And Pritzker is expected to name a new [chairman] next month to replace Don Tracy, an appointee of former Republican Gov. Bruce Rauner.

You don’t want an “anti-gaming” Gaming Board, which was partly why video gaming legalization took so long to implement. But a “pro-gaming” Gaming Board could open a different can of worms.

11 Comments

|

* Mr. Kass somehow managed to pack more sputtering vitriol than usual into this one. One notable example…

All that spending comes with no structural reforms whatsoever in return. But that hasn’t stopped Gov. Big Boy and Boss Madigan and even a few quisling Republicans are bragging about the historic nature of their deal.

He goes on to identify those quislings as the Republican legislative leaders.

* Merriam-Webster…

Vidkun Quisling was a Norwegian army officer who in 1933 founded Norway’s fascist party. In December 1939, he met with Adolf Hitler and urged him to occupy Norway. Following the German invasion of April 1940, Quisling served as a figurehead in the puppet government set up by the German occupation forces, and his linguistic fate was sealed.

Work cooperatively for the betterment of the state, get called a Hitler lover by an editorial board member at the state’s largest newspaper.

Keep that in mind the next time the paper complains about candidates refusing editorial board interviews.

…Adding… Here’s some of what those horrible traitors did this spring…

* In response to #MeToo, state lawmakers approved sweeping legislation to fight sexual harassment in Illinois: “Hopefully, it will change not only the behavior in Springfield, but across the state in the workplace,” said Rezin, a Morris Republican. “If I heard of someone being harassed, I would bring it to the attention of superiors. The complaint seemed to go no further. Now, at least, the individual can file a complaint in a confidential manner and an independent inspector general will investigate their claim. That’s so important.”

* Editorial: Speaking as one is how you get stuff done: Rockford’s wins went beyond the big four — casino, video gaming fees, airport and rail. There were other “really amazing things,” McNamara said. There was more money for Rockford University, Rock Valley College, RAMP and the Boys & Girls Clubs. Rockford Mass Transit District did well and there was $250,000 for the Rockford Art Museum. Not Rockford specific, but sure to help the city, there were increases in funding to fight sexual assault, fight domestic violence and improve early childhood education to name just three.

* SIUC Chancellor Dunn: State budget brings good news for SIU: The budget for the 2020 fiscal year includes a 5 percent increase in general operating funding for each institution plus increases in funding for MAP grants, the Illinois AIM High program and more. When added together, the increases total 8.2 percent, reflecting the largest percentage increase for higher education since 1990. The budget also includes increases for capital projects.

* Pritzker’s Nearly $45B Capital Plan Is Way Better for Transportation Than Expected: The bill also includes longterm, sustainable funding for public transportation, with transit receiving $4.7 billion over the first six years and $281 million for each year afterwards. That represents 23 percent of the total transportation spending, or about twice as much as was indicated in the initial proposal.

* From road repairs to transit expansions, $33 billion in capital bill will have ‘monumental’ impact: One big difference in the funding bill passed last weekend compared with previous capital bills is that it not only provides a one-time infusion of funding through bond sales but also sustainable funding for projects, repairs and new equipment over time. Transportation funding is being mostly paid for through a doubling of the state’s 19-cent-per gallon motor fuel tax, starting July 1. The gas tax, last raised in 1990, will be indexed to future inflation increases. One of the most significant road projects funded in the bill is the I-80 expansion, which will get $1 billion. According to Illinois Department of Transportation spokesman Guy Tridgell, the project will include replacing two of the state’s most dilapidated bridges, which cross the Des Plaines River in Joliet.

* Illinois doubles fuel tax rates, nixes despised truck fee: One more provision in the bill will end collection of the commercial distribution fee. The Illinois Trucking Association, Midwest Truckers Association, and the Owner-Operator Independent Drivers Association have long pushed to get the fee eliminated.

* Pritzker after Legislature adjourns: ‘Illinois is back’: Advocates for the nursing home industry say the added funding will help stem a tide of 20-plus skilled- and intermediate-care facility closures that occurred over the past five years due to crippling budget cuts and decades-old Medicaid reimbursement rates. “This money means survival,” said Pat Comstock, executive director of the nursing home advocacy group Health Care Council of Illinois. “Our members are thrilled, but they’re also relieved because these dollars are going to provide some much needed relief from the struggles to survive that members are experiencing.”

* Tom Kacich: Capital program full of benefits for area: The capital bill the Legislature approved means $100 million for construction of a math, statistics and data science center at the University of Illinois-Urbana; $195 million for other unspecified improvements at the UI; $118 million for a new science building at Eastern Illinois University; $2.2 million for renovation of a clock tower center and ornamental horticulture facility at Danville Area Community College; and $100 million for unspecified passenger rail improvements on the Chicago to Carbondale Amtrak route.

Shocking.

39 Comments

|

Today’s quotable

Tuesday, Jun 11, 2019 - Posted by Rich Miller

* Former Attorney General Lisa Madigan in Chicago Magazine…

I was a government major at Georgetown, and I don’t think I learned one thing in class that helped me at all in the last 20 years. What I’ve said to so many students is, “If you really think this is what you want to do, you’ve got to work on a campaign, you need to work for an elected official. Because you’re not going to learn it in a classroom.”

55 Comments

|

* My weekly syndicated newspaper column…

If you talk to the Statehouse old-timers, they’ll tell you they haven’t seen such a productive spring legislative session since Gov. Jim Thompson’s days.

I think it’s probably safe to say that Gov. J.B. Pritzker cleared even that high historical bar this year, mainly because he had friendly Democratic super-majorities in both chambers. The Republican Thompson had to deal with a Democratic-controlled Legislature for almost all of his tenure.

Thompson, a master schmoozer and cajoler, didn’t try tackling nearly as many huge, generational changes all at once like Pritzker did in his first session. And even with Pritzker’s supermajorities, passing bills like almost doubling the minimum wage, changing the state Constitution to allow for a progressive income tax, rewriting almost all of the state’s abortion laws and legalizing recreational cannabis were seriously heavy-duty lifts.

On the afternoon of Friday, May 31, the last scheduled day of session, House Speaker Michael Madigan announced that the House could not possibly adjourn by the end of the day and would be in overtime session at least throughout the weekend. That meant all the tax and fee hikes and the gaming expansion to fund the massive $45 billion infrastructure bill would need three-fifths majorities, and everybody knew there was no way Madigan would take the political risk of putting 71 of his 74 members on those bills. Republicans, therefore, would be needed.

The rookie governor claims he didn’t panic, saying he “knew there was a path to dealing with all of it.”

”Going from a 60-vote requirement to a 71-vote requirement, having just gone through the ‘Fair Tax’ amendment, felt like a high bar, but I also knew that there was a path,” Pritzker said during a phone interview.

”Yeah, the odds have gone down of getting everything done, but there’s a path,” Pritzker said he felt at the time.

Asked at what moment he felt like everything would be OK, Pritzker pointed to House Republican Leader Jim Durkin’s demands later that Friday for pro-business legislation in exchange for his caucus’ support. Pritzker said he felt that “several” of Durkin’s proposals, which were developed by business groups “were relatively easy for us to come to an understanding about” because, the governor said, he agreed with them.

Pritzker inherited much of his money, but he has been involved in business most of his life. When Durkin broached the subject of repealing the state’s franchise tax, Pritzker said he quickly agreed. The franchise tax, which is essentially a tax levied for the privilege of doing business in Illinois, has been a bane to business groups forever. And Pritzker said he looked at it and decided “it didn’t need to be there, for small business especially.”

Gov. Thompson was endorsed by both the Illinois Chamber of Commerce and the Illinois AFL-CIO when he sought his fourth and final term. Pritzker’s steep minimum wage hike, the graduated income tax and the dozens of pro-labor bills he’ll be signing in the coming weeks makes a repeat of that feat impossible. But there is no doubt that business lobbyists were pleasantly surprised by the session’s final days.

Pritzker also revealed to me that he began studying “Big Jim” Thompson’s tenure before taking office.

”It was important to me after I won the election to figure out what are the models out there for governing that have been effective and fit with who I am,” Pritzker said.

”Certainly, lots of people pointed to Jim Thompson,” Pritzker said, unprompted, of the former Republican governor. “Thompson was somebody who could talk to anybody (and) they would talk to him. He would go to the floor and speak with legislators. He had people go to the mansion to negotiate, to discuss and sometimes have a drink with. There was just a lot of bipartisan, across the aisle dialogue. That kind of leadership fits with who I am and my own background and people that I’ve worked with over the years.”

Thompson was, indeed, a talented governor who got a lot done. Sometimes, though, the things he got done came back to bite his state in its collective rear. Thompson’s annual three percent compounded pension payment increase for public retirees has forced the state to spend tens of billions of dollars, while exempting retirement income from state taxation dried up untold billions more from an important and growing revenue source.

So, just a cautionary note to our new governor that just because you can pass a bill doesn’t always mean that you should.

12 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|