Oppo dump! Another homestead exemption issue

Wednesday, Jan 15, 2020 - Posted by Rich Miller

* From a GOP oppo dump…

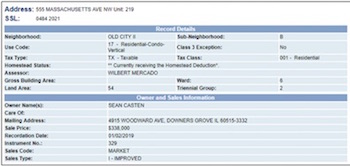

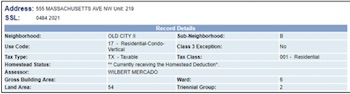

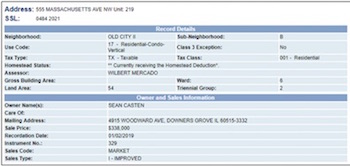

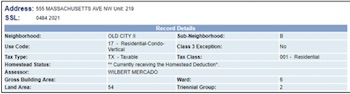

[US Rep. Sean Casten] claims his condo on Massachusetts Ave as his primary residence while running for Congress in Illinois.

Sean Casten currently takes a homestead deduction on his Condo in Washington, DC. In order to take a homestead deduction in Washington, DC, a property must be the owners ‘primary residence’:

On January 2, 2019, Sean Casten purchased a Condo at 555 Massachusetts Ave NW in Washington DC.

(DC Office of Tax and Revenue, “Property Search – 555 Massachusetts Ave NW United 219,” Accessed 3/19/19)

Casten claimed the homestead deduction on his Washington, DC condo – claiming it as his primary residence.

(DC Office of Tax and Revenue, “Property Search – xxx Massachusetts Ave NW United 219,” Accessed 3/19/19)

According to the Office of Tax and Revenue for the government of Washington, DC, in order to take homestead exemption the property must be the primary residence of its owner. “The property must be the principal residence (domicile) of the owner/applicant.” (DC Office of Tax and Revenue, “Homestead/Senior Citizen Deduction”, Accessed 3/20/19)

The homestead deduction reduced Casten’s taxes by $636.23. (DC Office of Tax and Revenue, “Property Search – xxx Massachusetts Ave NW United 219,” Accessed 3/19/19)

Yep. Checks out.

Oops.

* I reached out to Casten’s campaign yesterday. Spokesperson Chloe Hunt’s initial response today…

As soon as Sean became aware of the error he immediately took action to remove the exemption, rectify the situation, and pay back the difference.

Casten’s letter to the DC tax office…

Office of Tax and Revenue, Real Property Administration

PO BOX 176

Washington, DC 20044

To the DC Office of Tax and Revenue,

I recently learned that through a clerical error, I have been receiving the Homestead deduction on a property I purchased in 2019. To address this error, I have filled out the FP-105 Cancellation of Homestead Deduction - Senior Citizen/Disabled Tax Relief form through your website, a copy of which is attached to this letter. I also submitted a payment through the online portal with the amount of property tax that was mistakenly deducted from my tax bill.

Thank you,

Sean Casten

They also sent along screen shots of the cancellation.

* But, I wondered, how was this a “clerical error”? The reply…

The exemption was applied to the property in 2016 at the request of a previous owner.

Following Rep. Casten’s purchase in 2019, he’s taken steps to remove the exemption and paid the full amount of the taxes without the exemption.

Stand by for a response which I am sure is coming.

- NIU Grad - Wednesday, Jan 15, 20 @ 12:18 pm:

I’m sure the response will be tempered and well-reasoned, as is befitting the GOP House campaign organization.

- Donnie Elgin - Wednesday, Jan 15, 20 @ 12:22 pm:

Perhaps he wanted to run against Eleanor Norton

- Perrid - Wednesday, Jan 15, 20 @ 12:25 pm:

It’s not good, but someone thinks $600 a year is significant enough to dump? You’d have to be certifiable to have a secure job and risk it for $600 dollars a year. Mistakes happen

- Precinct Captain - Wednesday, Jan 15, 20 @ 12:28 pm:

A congressman lives in Washington! The horror! The horror!

- Blue Dog Dem - Wednesday, Jan 15, 20 @ 12:28 pm:

Kinda like that pesky toilet bowl caper.

- BigLou - Wednesday, Jan 15, 20 @ 12:31 pm:

Is it a bit presumptuous for a first term congressman from a highly contested district to buy a condo in DC? Unless there is an investment play here of course.

- RNUG - Wednesday, Jan 15, 20 @ 12:36 pm:

I don’t get that upset about these issues. It may truly be a clerical error … or maybe not.

For a number of years I got a homestead exemption on 2 homes. I notified the county that I had moved and to change my voter registration; didn’t explicitly say cancel the homestead exemption but thought the county should have known that since I identifed the one address as my primary residence. And it’s not like it was in different cities or states; it was literally the same ward, just a different precinct.

They finally realized their mistake when I applied for the Senior Citizen exemption, but never made any attempt to collect back taxes.

So I guess I better never run for office … my opposition could claim I was a property tax cheat at one time. I don’t really feel guilty about it; if we had wanted to deliberately play games I could have claimed one house as primary and my wife could have claimed to live in the other house as primary … that’s a fairly common ploy.

- 47th Ward - Wednesday, Jan 15, 20 @ 12:44 pm:

Talk about first world problems. Someday I hope to own enough homes that I have to worry about this sort of thing.

- Billy Sunday - Wednesday, Jan 15, 20 @ 1:12 pm:

This tends to be quite common with individuals who live in more than one home. Your deduction is always noted on your tax bill so I’m not sure how this ‘discount’ is overseen. Plus as a federal legislator, your DC condo/apt/home not your primary residence…

- Lord of the Fries - Wednesday, Jan 15, 20 @ 1:15 pm:

The timing of this is interesting. As the citations suggest the GOP has been sitting on this for ten months. Why now? So early in the election year it gives him a ton of time to correct the mistake and explain that it was just that, a mistake.

Should’ve sat on it a little longer and hit him for 1 claiming to be a DC resident ie not an Illinoisan and 2 being a tax cheat. Strategy failure on this hit.

- A Guy - Wednesday, Jan 15, 20 @ 1:45 pm:

The better line to go after here has nothing to do with the nominal tax issue. It’s more like:

Sean Casten believes his “Primary Residence” is in DC.

We can confirm that.

- Three Dimensional Checkers - Wednesday, Jan 15, 20 @ 3:10 pm:

Not the end of the world, but you’d think people would double check this given how many times this has been an issue for politicians and public figures.

- 17% Solution - Thursday, Jan 16, 20 @ 6:55 am:

Not enough information. In Washington DC, if you passively are registered as a resident and have to take action to unregister, then I would presume it to be true that it was an oversight.

$600 is chump change compared to the sums of money spent in reelection, so it’s hard to see how this helps Casten’s bottom line.