* Richard Irvin on Monday…

As mayor of Aurora, we eliminated wasteful spending. We balanced budgets every year and made government more efficient by doing more with less. We fought for property tax relief and worked hard to spark economic growth. He wants to raise your taxes, JB Pritzker, and he’s tried to enact the largest tax hike in our state’s history on every resident of Illinois. And he wants to continue to do it. If he’s elected, he will try again.

* The Pritzker campaign then sent me its file…

Aurora Taxes Under Richard Irvin’s Leadership

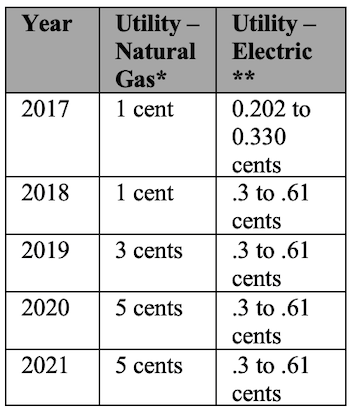

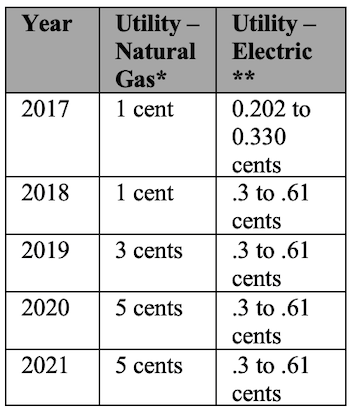

Aurora Utility Taxes

In Just 4 Years As Mayor, Richard Irvin Raised Aurora’s Utility Tax On Natural Gas By 400% And Raised Tax Rates On Electricity.

*Measured per therm

** Measured per kilowatt-hour

[City of Aurora, Budgets, 2017; 2018; 2019; 2020; 2021; proposed 2022]

Aurora Property Taxes

In Just 4 Years As Mayor, Richard Irvin Raised Aurora’s Property Tax Levy By $11,332,793 – 13.09% – From When He Took Office.

2017 Aurora Levy: $86,598,400 [Aurora 2018 Budget]

2018 Aurora Levy: $88,726,400 [Aurora 2019 Budget]

2019 Aurora Levy: $95,086,250 [Aurora 2020 Budget]

2020 Aurora Total Levy: $97,931,193

2020 Aurora Levy: $84,700,300 [Aurora 2021 Budget]

NOTE: The decrease “is caused by the removable of the Library Operating Fund from the city’s budget.” [Aurora 2021 Budget] 2020 Library Budget: $13,230,893 [Aurora Library 2020 Budget]

Original document with relevant links is here.

* In response, Eleni Demertzis at the Irvin campaign sent this along…

Richard Irvin’s record fighting to cut wasteful spending and deliver property tax relief is a stark contrast to a governor fighting for the largest tax hike in Illinois history while evading paying taxes of his own.

On background:

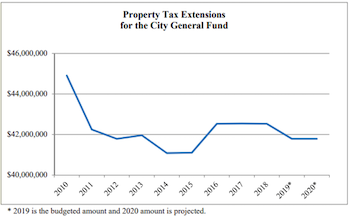

You’ll see that Aurora’s property tax extension for the general fund - which is the portion of the budget where the Mayor and city council have a high degree of control - has gone down under Irvin.

You’ll also see that Aurora’s property tax base has increased by 25%, and the taxes per $100 of EAV have gone down.

* The Irvin campaign’s property tax package…

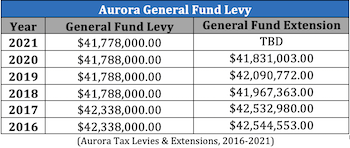

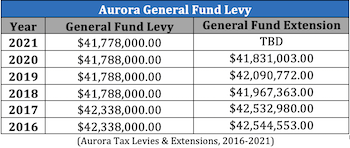

Irvin Has Reduced Aurora’s General Fund Property Tax Levy

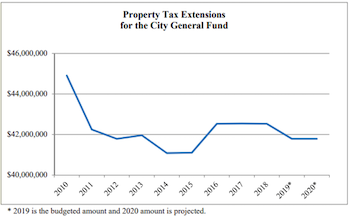

Since Irvin Became Mayor, Aurora’s Property Tax Extensions For The City General Fund Have Decreased. (Aurora 2021 Budget, Accessed 3/8/22)

The graph below presents the trend of the city’s property tax extensions for General Fund purposes since 2010 (2009 property tax levy).

Since 2016, Aurora’s General Fund Levy Has Fallen From $42,338,000 To $41,778,000. (Aurora Tax Levies & Extensions, 2016-2021)

Since 2016, Aurora General Fund Extension Has Fallen From $42,544,553 To $41,831,003. (Aurora Tax Levies & Extensions, 2016-2021)

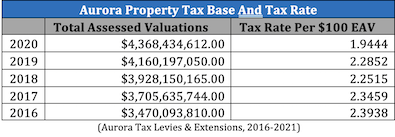

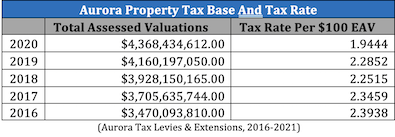

Aurora’s Property Tax Base Has Grown 25 Percent Under Irvin

Since 2016, Aurora’s Property Tax Base Has Grown From $3,470,093,810 To $4,368,434,612, An Increase Of More Than 25 Percent. (Aurora Tax Levies & Extensions, 2016-2021)

Since 2016, Aurora’s Tax Rate Per $100 Of EAV Has Fallen From 2.3938 To 1.9444. (Aurora Tax Levies & Extensions, 2016-2021)

Irvin Supported Eliminating The Aurora Election Commission And Using The Savings To Reduce Property Taxes

The rest of the document is here if you’re interested in the Aurora Election Commission.

* I was awash in information and needed some help. So, I turned to a good friend who is an up and coming property tax lawyer and asked him to sort it out for me. Here you go…

Both the Irvin and Pritzker camps are talking past one another. There are various factors at play, the levy (both general revenue and the overall levy), the total assessed value of Aurora’s tax base, and all of the individual tax rates of the various taxing bodies. All of these contribute to a taxpayer’s overall property tax liability. The fact sheets that were sent to you highlight the strengths of each side and downplay the weaknesses (unsurprisingly). The end result is that you are left to compare apples to oranges. I will try to streamline these below:

Levy

The levy is incredibly important because it’s probably the one instrument that the administration can control the most. It’s the overall number of dollars that they are requesting from their taxpayers on an annual basis. Irvin’s people highlight that the general fund levy and the general extension decreased from 2017-2018. This is technically true but it leaves out the other funds that the city controls. Pritzker’s numbers are more reliable in that it takes into account the overall levy of each budgetary line item under the purview of the administration/ city council. As they correctly note, the overall levy increased every year other than from 2019 to 2020. (As Pritzker’s people correctly note, in 2020 the Aurora Library became its own taxing district and was separated from the general operating fund (see p. 61 of the Aurora budget document)). If you count the funds allocated towards the library the overall levy actually increased every year from 2017-2020.

Tax base

The tax base plays an important part because if you grow your tax base it lessens the individual burden for each taxpayer. Irvin’s document correctly points out that the total assessed values for his tax base grew from 2016 through 2020. Whether that is from new businesses locating to Aurora, an increase in property values, an increase in assessments, or all three I do not know.

Individual taxing districts

Attached are tax bills from an average Aurora home for tax years 2016-2020. They have been redacted to maintain this homeowner’s privacy. I’ve also compiled a spreadsheet that accounts for the various Aurora taxing district rates for these pertinent years. Despite Pritzker’s point about the library, they have actually had an individual line item for their tax rate since before Irvin became Mayor, so parsing that out isn’t very difficult.

As you can see from the attached spreadsheet, the Aurora City tax rate and the overall tax rate ( which accounts for Aurora, Aurora’s pensions, and the library) all decreased from 2016 to 2017 and then again from 2019 to 2020. As noted above, this is not due to a decrease in the overall levy but rather from additional assessed values greater spreading out the tax burden. Regardless, Irvin can correctly point to a decrease in these actual tax rates and the subsequent decreased tax dollars for individual taxpayers. However, the City did not request less in total taxes for these particular years.

Overall Conclusion

You asked me to answer whether or not Irvin lowered property taxes. As you can see from above, this isn’t an easy question to answer. However, if I was PolitiFact and I was asked to rate the statement “Richard Irvin lowered property taxes” for accuracy, I would rate the statement as “somewhat true.” He did not “cut” property taxes by decreasing the overall Aurora levy but he did decrease individual property tax liability for Aurora taxpayers by increasing the assessed value of his tax base.

Emphasis added.

The sample tax bill is here. Make sure you’re looking at the city’s share, highlighted in yellow on the left. The spreadsheet is here.

* However, there’s still that bit about raising taxes on natural gas and electricity. I have a feeling that we will likely see that pop up again.

- OneMan - Wednesday, Mar 9, 22 @ 12:32 pm:

Pulling my tax bills for the last few years (what is available on-line from Kane County) the “Tax Rate” for the city of Aurora has gone down from 1.97 (2018) to 1.906 (2020), it’s still high compared to other cities.

But when it comes down to it over the past few years I have been paying a progressively lower rate to the city.

When it comes to the library, I think we are a district now.

https://www.chicagotribune.com/suburbs/aurora-beacon-news/ct-abn-aurora-library-st-1117-20191115-525kz23erjhf3i53y7kw664n4i-story.html

And I seem to recall board members showing up on a ballot.

Also, we built a huge (and nice) library a few years ago on the old location of the Beacon-News so I am not surprised to see that rate had gone up.

- One hand //ing - Wednesday, Mar 9, 22 @ 12:38 pm:

“I called in the national guard — kinda, sorta, not really.”

“I’ve always been tough on crime — if you ignore my criminal defense practice.”

“I’m a combat veteran — technically.”

“I cut property taxes — if you squint really hard.”

We’re watching a campaign build a candidate as opposed to a candidate building a campaign.

- TheInvisibleMan - Wednesday, Mar 9, 22 @ 12:40 pm:

== I have a feeling that we will likely see that pop up again. ==

I think there are going to be many things like this.

Home rule is a knife that will cut both ways.

We also haven’t even arrived at the revolving door of leadership at the Aurora police department yet.

- NonAFSCMEStateEmployeeFromChatham - Wednesday, Mar 9, 22 @ 12:41 pm:

==doing more with less==

Shades of Blagojevich in that quote as that was one of his favorite sayings. Making most other agencies and constitutionals do more with less while he Did More with More and More and More.

- Oswego Willy - Wednesday, Mar 9, 22 @ 12:42 pm:

===there’s still that bit about raising taxes on natural gas and electricity. I have a feeling that we will likely see that pop up again.===

More than fair game.

As all utilities, gas for our vehicles, as all things “rise” in these economic times, utilities and raising the costs to them hurts everyone… owners, renters, businesses… in that lil snapshot, yeah, we are likely to see that “raised taxes” as the look-see at Irvin and taxes.

Sure, it’s not like Bailey and his countless tax increases he put on locals in the past, but in a :30 or :45 second ad, its “mostly true”, maybe.

- OutOfState - Wednesday, Mar 9, 22 @ 12:50 pm:

As a property tax professional, I’m skeptical of calling an increase in tax base “decreasing individual property tax liability” unless you can point to what we call in the business “net new construction,” which is the increase in a property tax base due to actual improvements to real estate (new buildings or remodels of existing buildings). Otherwise, it’s just acknowledging your house would sell for more while taxing you the same.

To be able to use the increased tax base to justify saying taxes were lowered, Irvin should to point to development in Aurora (e.g. new commercial space opening, residential or apartment developments, etc.)

- NIU Grad - Wednesday, Mar 9, 22 @ 12:51 pm:

It’s going to be a long, long year.

- JS Mill - Wednesday, Mar 9, 22 @ 12:55 pm:

Speaking as someone who sets the school district levy I can tell you that the “tax rate” issue is a smoke screen. People are always confused because they focus on the rate when it is the overall Levy they should be focused on.

Our tax rate has gone down every year since I have been in my position and our levy (the taxes people actually pay) has gone up.

The rate reflects property values and how much you will pay per every $10k of assessed valuation. The higher the value the lower the rate. And some people are happy when the rate goes down not understanding their taxes maty still rise.

Also, Aurora is under PTELL so they will take their automatic increase and not lower the levy because it it is sos difficult to get those funds back when you need them.

There is no nuance needed, Irvin raises everyone’s taxes. Pointing to one fund is playing word games.

More dishonesty for Irvin.

Given his backer, taxes will be a big issue and he is very vulnerable here.

- jimbo - Wednesday, Mar 9, 22 @ 1:05 pm:

==unless you can point to … “net new construction,” which is the increase in a property tax base due to actual improvements to real estate==

Even that comes with caveats. With the downfall of retail, Aurora has rezoned (and continues to) rezone retail to residential. Townhomes and condos are appearing up and down Rt 59- including demolishing part of the mall to build apartments. This is good for the city of Aurora but bad for the school district that will at some point end up raising taxes to handle the influx of kids.

So while you get a decrease on the city, it’ll be more than offset by the school.

- Donnie Elgin - Wednesday, Mar 9, 22 @ 1:05 pm:

Aurora is a home rule community, and thus not subject to PTELL, however, it is often a good comparison tool. The max levy increase allowed under PTELL for the recent tax years is:

2018-19 2.3%

2019-20 1.4 %

Aurora’s general levy for those years increases by 0 %.

- frustrated GOP - Wednesday, Mar 9, 22 @ 1:07 pm:

Let’s remember for the city the property taxes are a small part of the revenue. The previous admin limited increases and had a deficit and hidden budget issues for anyone coming in. And yes, they played games with the library. To say you dropped taxes because you moved the library off the books doesn’t really count, but at the same time, there was/is some issues with the city budget that goes back a long time with the prior mayor. There are some other legitimate issues Irvin needs to answer, some of the no bid construction work, and how much went to campaign contributors construction firms.

- Correcting - Wednesday, Mar 9, 22 @ 1:16 pm:

This is good info. Thank you. I’ve wondered about Irvin’s record as mayor. I’d suggest looking at crime rates and businesses lost/gained for other metrics. Not many bloggers and journalists are researching and reporting stuff like this.

- Grandson of Man - Wednesday, Mar 9, 22 @ 1:18 pm:

Aurora isn’t Illinois. Let’s see the Griffin-Irvin plan of cutting state taxes and budget management? What are they going to cut? Surely the people who stand up to “criminal thugs” are not afraid of putting out a plan?

If we want to look at financial benefit to Aurora, that’s millions of dollars thanks to Rebuild Illinois. If we look at that plus last year’s Biden stimulus and federal infrastructure law, that’s a lot of money. Irvin should say whether he voted for Pritzker or Biden.

- ANNON'IN - Wednesday, Mar 9, 22 @ 1:24 pm:

Too many words. Did RichieRich get it wrong(as usual) or what

- OneMan - Wednesday, Mar 9, 22 @ 1:29 pm:

Gonna say from my perspective the only number I care about is the amount of cash money I pay in taxes and that amount for the city and that amount has gone down, can say that about some tax entities and I can about others.

EAV and all that other stuff is nice, but it what I pay is what I care about tbh

- Donnie Elgin - Wednesday, Mar 9, 22 @ 1:30 pm:

=Also, Aurora is under PTELL=

Aurora is a home rule community - and thus not subject to PTELL…

https://www.iml.org/homerule-municipalities

- Siriously - Wednesday, Mar 9, 22 @ 1:46 pm:

I think it is interesting and somewhat misleading for Irvin’s spokesperson to claim he doesn’t have control over the general levy as Mayor.

The Mayor and council can lower the levy if they choose, they vote on it. They set the budget policies.

- Boone's is Back - Wednesday, Mar 9, 22 @ 1:47 pm:

Irvin’s argument would be a lot stronger if he could point to specific budget items that he either reduced or eliminated. Instead his campaign is touting an article from 2017 quoting him being in favor of eliminating the election commission. Did that even ever happen? The consistent increase in the levy is the more telling thing to me.

- Rich Miller - Wednesday, Mar 9, 22 @ 1:49 pm:

===the only number I care about is the amount of cash money I pay in taxes and that amount for the city and that amount has gone down===

Yep.

- Lakefront - Wednesday, Mar 9, 22 @ 1:49 pm:

Yes, as many commenters noted, tax levy is what matters for the operation of the city and how many resources a local government is consuming. However, to the average voter, what matters? Tax rate. It’s what plays with voters. Unless assessments were out of control - residents should’ve seen some relief or at least mitigation.

- OneMan - Wednesday, Mar 9, 22 @ 2:21 pm:

== Irvin’s argument would be a lot stronger if he could point to specific budget items that he either reduced or eliminated. Instead, his campaign is touting an article from 2017 quoting him being in favor of eliminating the election commission. Did that even ever happen? ==

You could have spent 30 seconds on google to find out, but I understand it is easier just to raise suspicion.

Aurora election commission eliminated

https://patch.com/illinois/aurora/aurora-election-commission-could-be-dissolved-after-primaries

It had been around since 1934

Yes, the election commission was eliminated. I was actually at the commission the night of the election that voted it out of existence.

In my time in town (25+ years) there had been three attempts to eliminate it.

The first one failed to be approved at the ballot box.

The second attempt under the previous mayor wasn’t filed correctly (there is a process that wasn’t followed) and was tossed off the ballot.

The third attempt passed, there was a group that sent out mailings about it.

For what it is worth I was not in favor of it and voted against it, but the mayor and others worked to get the elimination passed and it did. One of the funny things about it was the number of government entities who were going to claim savings out of it. For what it is worth at least in Kane County the Clerk managed the elimination well and does a great job with early voting in town and other election stuff.

- Anchors Away - Wednesday, Mar 9, 22 @ 2:33 pm:

I’m old enough to remember how during the 2000 presidential election the Bush campaign was able to use a series of innocent sounding white lies or exaggerations that Al Gore would tell to cast him as a serial liar. Each taken on its own, what Gore was saying was not anything too dramatic but taken together they seemed to paint a picture of a candidate who could not be trusted. Someone wrote an interesting article about this strategy post-election that dubbed it Al Gore’s “Pinocchio Problem.”

I bring it up because as another commenter above noted, Irvin seems to be heading down this path. Some stuff he says are outright lies (see the conversation about phone calls with the governor regarding Covid mitigations) but other issues are like the example here - exaggerations that fly in the face of what people actually feel. At the very least, as a campaign I’d be hesitant to make this claim bc I bet if you polled Aurora residents about their property taxes they’d tell you they were too high, regardless of any steps the Mayor has taken.

Anyway, Irvin should be careful. He’s developed a Pinnochio problem that his weirdly scripted answers do nothing to deflect from and frankly contrast badly with JB who has a tell it like it is demeanor that was honed during those pandemic briefings.

- The Velvet Frog - Wednesday, Mar 9, 22 @ 3:05 pm:

==he’s tried to enact the largest tax hike in our state’s history on every resident of Illinois==

I’m trying to figure out what that is, could someone explain?

- Arsenal - Wednesday, Mar 9, 22 @ 3:50 pm:

==unless you can point to … “net new construction,” which is the increase in a property tax base due to actual improvements to real estate==

I get that, but I think as a voting issue it all comes down to- did a large number of voters pay less in taxes? It looks like the answer is “yes”?

Of course, if the cut to their property taxes was offset by increases to their energy taxes, they’re probably still pretty salty. Voters don’t do nuance.

- JS Mill - Wednesday, Mar 9, 22 @ 4:04 pm:

=Aurora’s general levy for those years increases by 0 %.=

Anyone can dissect the Levy into the various funds and find an area where the levy went up or down. In the end it is the FULL levy that counts.

=Aurora is a home rule community - and thus not subject to PTELL…=

You are correct. My bad.

- Leslie K - Wednesday, Mar 9, 22 @ 4:23 pm:

Thanks for that analysis from your friend, Rich. And thanks to the commenters here for an educational discussion. The property tax stuff makes my head spin sometimes; I think I have a better handle on it now.

- duck duck goose - Wednesday, Mar 9, 22 @ 5:41 pm:

Reducing the general-fund levy may or may not be a valid argument that one lowered taxes–it all depends on the other funds in the basket. Depending on

Levies for the pension funds (police, fire, and imrf) will, far and away, make up the biggest chunk of the overall levy. The city generally has little control over those levy amounts; the levies are what the actuaries say they are. These pension costs rarely go down. Therefore, it’s possible that the general-fund levy will decrease, but the property taxes will increase because of the pension (or other) levies.