* Tribune editorial…

The median U.S. pension fund lost 9.7% in the second quarter, according to the Pensions & Investments trade book, and the first quarter was weak as well. Though markets have staged a modest summer comeback, 2022 is shaping up as a reminder of the time bomb embedded in state finances.

The bottom line: Illinois’ major pension systems have nowhere near the money needed to pay promised benefits, despite booking a decade of positive investment results. […]

Governor, where is your grand plan to fix this slow-motion [pension] disaster? As of now, nowhere.

Frank Manzo III had a sound response to the editorial. Click here. And Crain’s has a piece up this week about how to improve the state’s investment returns. Click here.

* Since the editorial board relied on sources like woefully misinformed Florida resident Ken Griffin and didn’t bother asking the governor’s office, I let them go off. Here’s Jordan Abudayyeh…

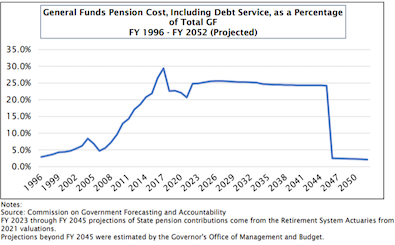

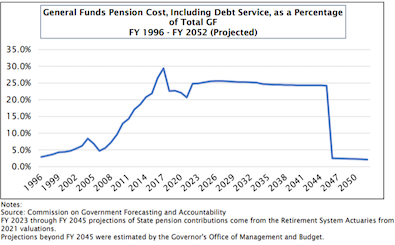

The State of Illinois HAS taken action to address the state’s pension funding challenges. In 1994, the State passed a 50 year funding plan to bring the systems to 90% funded by 2045, and it has stuck to this plan. There have been steadily increasing payments to the system as Illinois moved further into the plan, adjusting to market swings and actuarial assumption changes by the boards of the systems. Gov. Pritzker also worked with the General Assembly to ensure the state used part of the surplus to pay an additional $500 million into the pension system. Meanwhile, there have been essentially no increases in benefits affecting the liability of the five systems since fiscal year 2003, and payroll costs have fallen far below actuarial expectations. At this point in the funding plan, the state’s annual pension contribution to follow the 1994 plan is expected to remain flat as a percent of the State’s budget before falling off drastically in 2046. The pension payment, while it is a significant percent of the state’s budget, is not expected to grow faster than the rest of the budget. Below from last year’s budget book

* More…

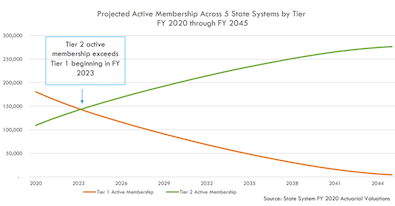

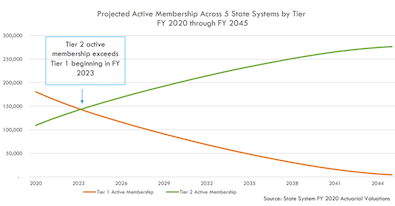

In 2010, the State reduced the pension package offered to new hires. The creation of Tier 2, modifying pension benefits for public employees hired January 1, 2011, and after, significantly lowered the baseline costs of the pensions offered to employees. As of today, nearly HALF of active state employees are Tier 2. Tier 2 also impacted other public sector employees in Illinois, bringing cost savings to local governments as well. Also of note — The ‘normal cost’ for Tier 2 is significantly lower than for Tier 1 employees and is lower than the cost the state would incur to move teachers and university staff into Social Security.

* More…

The Pritzker administration continues to take additional steps to address the State’s unfunded pension liabilities. The State budget committed an additional $300 million to the systems in fiscal year 2022 and another $200 million in fiscal year 2023 in addition to the systems’ certified amounts. This will be the first time since the 1994 funding plan was implemented that additional state revenues will be provided above the certified amounts. These contributions will help pay down the state’s pension debt more quickly and will save taxpayers an estimated $1.8 billion by fiscal year 2045.

In fiscal year 2018, the General Assembly authorized a then three-year plan to reduce the liabilities of the systems by allowing retiring members to sell a portion of the value of their post-retirement cost of living adjustments and allowing inactive employees to buy out of the systems. In 2019, the Governor and the General Assembly extended the sunset date of the program to fiscal year 2024 and extended it again to 2026 in this past spring session. Significant interest in the pilot program has already led to some liability reductions and reductions in needed annual contributions to the systems. The estimated value of the liability reductions for the retirement systems totals $1.4 billion already.

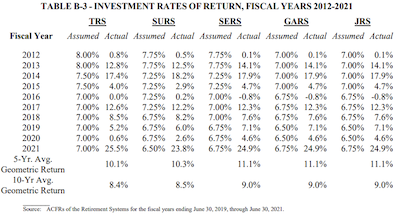

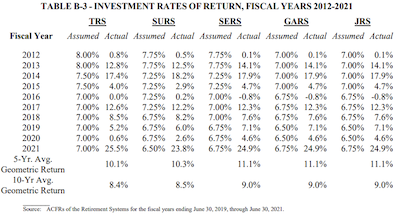

Looking at one quarter of investment returns and declaring ‘the good times are over’ doesn’t make sense. We know markets go up and go down and fluctuations are normal. We have adapted and made our payments. See below for year by year for 10 years of data. A one-quarter low return is hardly a ‘time bomb’

* More…

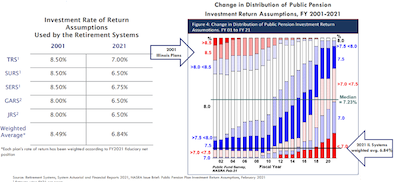

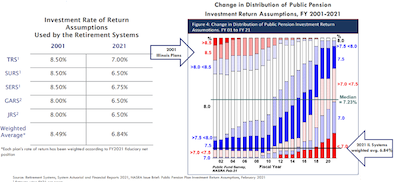

The State of Illinois retirement systems have more conservative rate of return assumptions than most public pension systems – with rates of return as of the end of FY21 assumed between 6.5%-7%. The systems have moved towards a more conservative portfolio as well to reduce the volatility in the systems’ rates of returns when the market underperforms. Again, one quarter of poor broad market performance is hardly a ‘time bomb’.

* More…

As for the already debunked point that public employees are not part of the Social Security system, for the three major state systems (SERS, SURS and TRS), most SERS employees DO participate in Social Security. However, teachers and university staff do not participate in Social Security. Which means that not only are these employees not paying the 6.2% from their paychecks into Social Security (and in fact, are paying a higher number directly to TRS or SURS), the state/employer is not making the employer contribution of 6.2% to Social Security either. The cost to the state/school districts/universities to have Tier 2 employees join Social Security would be a cost greater than the normal cost of a year of service for these employees (the marginal value of an extra year of service). Together employees and employers would have to contribute 12.4% of salary to Social Security, payments that are not being paid now.

Thoughts?

- Nick - Friday, Aug 26, 22 @ 1:17 pm:

It’s always fascinating to imagine what happens once we hit 2047 and theoretically there’s just… 20% of the entire budget is suddenly avaliable for other discretionary or mandatory areas.

- Rich Miller - Friday, Aug 26, 22 @ 1:20 pm:

===theoretically there’s just… 20% of the entire budget is suddenly avaliable ===

Hope I live to see it

- Big Dipper - Friday, Aug 26, 22 @ 1:22 pm:

Republicans will demand huge tax cuts then lol.

- Lance - Friday, Aug 26, 22 @ 1:26 pm:

All of that above translated means Pritzker hasn’t done anything to solve the pension crisis in illinois

- Correcting - Friday, Aug 26, 22 @ 1:27 pm:

Pensions are a ponzi scheme since they rely on constant population growth. I don’t care if the private sector does it but taxpayers shouldn’t be on the hook for a pyramid scheme like that.

- JS Mill - Friday, Aug 26, 22 @ 1:28 pm:

=20% of the entire budget is suddenly avaliable for other discretionary or mandatory areas.=

That is the plan, it isn’t “theory”. try and keep up.

- Pundent - Friday, Aug 26, 22 @ 1:32 pm:

=I don’t care if the private sector does it but taxpayers shouldn’t be on the hook for a pyramid scheme like that.=

So you’re all for abolishing social security?

- Chicagonk - Friday, Aug 26, 22 @ 1:42 pm:

@Nick - Or it could be returned to the taxpayers. Illinois needs to work on making it more financially attractive to live here.

- Correcting - Friday, Aug 26, 22 @ 1:44 pm:

If it’s not a sustainable system, then it should be abolished, yes.

If you can fund it by making reforms such as removing the regressive payroll cap, then maybe we can keep it.

But there is one difference between social security and pensions. Social security has its own payroll tax. Another difference is Social Security is theoretically for everybody and paid for by everybody while pensions are for everybody paying for a small group of people.

Maybe pensioners should be on social security.

- A - Friday, Aug 26, 22 @ 1:44 pm:

I’ve been waiting for all this to bubble up again–the pension bashing. I also wonder why, in these inflationary times, where SS just got a 6% increase to benefits, why people have stopped whining about those outrageous, extravagant, luxurious 3% increases pensioners get. I thought the 3%-ers were bankrupting the state.

- Oswego Willy - Friday, Aug 26, 22 @ 1:52 pm:

- Correcting -

Explain the Edgar Ramp… and then how it applies to your thoughts.

Thanks.

- JS Mill - Friday, Aug 26, 22 @ 1:53 pm:

=Pensions are a ponzi scheme since they rely on constant population growth. I don’t care if the private sector does it but taxpayers shouldn’t be on the hook for a pyramid scheme like that.=

and then…

=But there is one difference between social security and pensions. Social security has its own payroll tax. Another difference is Social Security is theoretically for everybody and paid for by everybody while pensions are for everybody paying for a small group of people.=

You neither understand how Illinois public pensions work nor do you understand social security.

The pension rules are the rules and were written 100 years ago and then a new system was developed 12 years ago.

For TRS, schools pay 11.3901% and the state matches at roughly 9%.

Social security has long been underfunded and supplemented by ta dollars (mine included) and many people receive benefits that never paid a dime into the system. Talk about schemes.

But you are a troll and now you have been fed.

- NickNombre - Friday, Aug 26, 22 @ 2:00 pm:

It amazes me that people who have no idea how pensions work think they have the solutions to the moderate pension funding challenges. It’s like a person whose car won’t start thinking the solution is to change the tires.

- StateEmployeeThatIsNotInAFSCME - Friday, Aug 26, 22 @ 2:06 pm:

==As of today, nearly HALF of active state employees are Tier 2.==

Thank you Pat Quinn. s/

- Oswego Willy - Friday, Aug 26, 22 @ 2:17 pm:

- Correcting -

So… you can’t explain the Edgar Ramp?

- Oswego Willy - Friday, Aug 26, 22 @ 2:19 pm:

=== people on this blog are state workers?===

We’re ALL guests here.

Does it bother you state workers might be commenting here?

Wait, first, the Edgar Ramp… can you explain that in your takes?

- Rich Miller - Friday, Aug 26, 22 @ 2:26 pm:

===Does it bother you state workers might be commenting here?===

lol

While using a uis.edu email address.

- Oswego Willy - Friday, Aug 26, 22 @ 2:34 pm:

=== While using a uis.edu email address.===

I’ll be “correcting” my questioning accordingly

To the post,

I appreciate the administration’s response.

===… and didn’t bother asking the governor’s office===

The Governor’s office did not have the opinion that mattered or the facts that helped. So that was that?

- rnug - Friday, Aug 26, 22 @ 2:47 pm:

Pension bashing …

Round #28 since the Edgar Ramp

Round #12 since Tier 2 reform

- RNUG - Friday, Aug 26, 22 @ 2:55 pm:

3% AAI …

Not looking so sweet now that inflation is running north of 6%. We’ve come to the end of 0% to 2% inflation, at least for the next decade IMO. State retirees, who saw their purchasing power increase the past decade, will see their buying power decrease over the next decade.

Maybe now is the time the retirees should be lobbying for a COLA based variable AAI?

Seriously, that would lead to vastly varying, and higher, pension payments every year because the State would have to forecast much higher annual increases. You think the pension payments are high now? The payments would be much higher (and less predictable) under a COLA based annual increase. That’s just math.

- Huh? - Friday, Aug 26, 22 @ 3:02 pm:

The tribune employees got screwed out of their pensions by Sam Zell. So they want to drag everyone else down.

- Gracchus - Friday, Aug 26, 22 @ 3:26 pm:

By 2027, Tier 2 pensions will have to be sweetened, or they’ll be in violation of Federal law for not meeting the Social Security benchmark.That should provide for some interesting legislation.

- Just A Dude - Friday, Aug 26, 22 @ 3:28 pm:

Maybe now is the time the retirees should be lobbying for a COLA based variable AAI?

However, I’m afraid any change to the current AAI terms would entail a possible change away from the increase being compounded. If that is the case I’ll keep the current 3% compounded.

- Skeptic - Friday, Aug 26, 22 @ 3:30 pm:

Amazing how the word “Pension” brings out the no-nothing trolls, isn’t it?

- What's the point? - Friday, Aug 26, 22 @ 3:36 pm:

Know-nothing?

- Pundent - Friday, Aug 26, 22 @ 3:41 pm:

-Correcting-

A simple “I have no idea how pensions work” comment would have sufficed.

- JS Mill - Friday, Aug 26, 22 @ 3:48 pm:

=Seriously, that would lead to vastly varying, and higher, pension payments every year because the =

Eric Madair was Cullerton’s chief legal counsel and he did the most exhaustive research on the sources of pension debt. At the time he did his research, the AAI, he claimed, was the main driver of new pension debt but only a small amount 6% iirc) of the overall debt.

I say this in support of RNUG’s post, although he needs no support as he understands this issue better than anyone.

I would take an AAI that was tied directly to CPI like social security is. SSI recipients are getting a nice increase this year while TRS pensioners get 3%.

So unfair (to steal a whine from trump and bailey).

- Sue - Friday, Aug 26, 22 @ 3:48 pm:

As someone who does know how pensions work- the sole good news of late is our annual adjustment is limited to 3 percent. Granted for the past 20 plus years as inflation was lower then the annual adjustment recipients benefited. Now we can catch up as inflation is really around 9 percent but the annual adjustments are far lower. Hopefully there won’t be any legislative move to raise the annual adjustments