|

Fun with numbers

Tuesday, May 30, 2023 - Posted by Rich Miller * Crain’s…

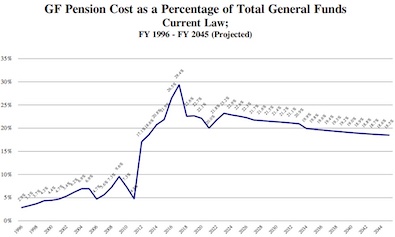

* From the legislature’s bipartisan Commission on Government Forecasting and Accountability’s projection of pension costs as a percentage of total General Funds…  If you look closely at the original chart (page 155), you’ll see that the state is currently a few percentage points below where it had been projected to be, avoiding that little spike. We’ve been at around 20 percent for a few years. Overall, high cost, but manageable, and, if projections stand, stable.

|

- Lucky Pierre - Tuesday, May 30, 23 @ 12:42 pm:

Despite contributing just under 11 billion last year, the unfunded liability grew 9.8 billion or 7.5%.

The funding ratio is only 44%. Assets are 109 billion liabilities 248.8 billion

https://www.wgem.com/2022/12/09/illinois-pension-debt-grows-1397-billion/?outputType=amp

- Larry Bowa Jr. - Tuesday, May 30, 23 @ 12:42 pm:

Yeah but it feels catastrophic to Crain’s that we don’t have a Daddy Republican executive making self serving mouth noises about addressing the debt while exacerbating it in reality. Things were way better back in 2017 when the fiscal grownups were in charge!

- Oswego Willy - Tuesday, May 30, 23 @ 12:43 pm:

=== Overall, high cost, but manageable, and, if projections stand, stable.===

Maybe another upgrade on the horizon?

- Grandson of Man - Tuesday, May 30, 23 @ 12:47 pm:

Maybe now the pension doomsaying can finally stop.

- Demoralized - Tuesday, May 30, 23 @ 12:58 pm:

Do you have a point @LP? Wait. I forget. You’re on the side of the pension stealers. You know. Changing people’s pensions and everything. I forgot that you are a Rauner Republican who isn’t interested in honoring contracts.

- Oswego Willy - Tuesday, May 30, 23 @ 1:03 pm:

=== Despite contributing just under 11 billion last year, the unfunded liability grew 9.8 billion or 7.5%.

The funding ratio is only 44%. Assets are 109 billion liabilities 248.8 billion===

“Therefore, any bailout of the Bears that in the long run will cause the state to take on either lost money or reimbursement of lost money to Arlington Heights should be scuttled, immediately”

Amirite?

- City Zen - Tuesday, May 30, 23 @ 1:17 pm:

==Maybe now the pension doomsaying can finally stop.==

Not unless Tier 2 benefits are locked in permanently. Because this projection assumes no enhancements to Tier 2.

- Demoralized - Tuesday, May 30, 23 @ 1:18 pm:

==Not unless Tier 2 benefits are locked in permanently. Because this projection assumes no enhancements to Tier 2==

You keep making this ridiculous argument. It’s the classic “yeah, but” argument. Anything can change at anytime. Nothing is ever set it stone. But to continually make this argument that we can’t make any pension assumptions “because” is just dumb.

- Oswego Willy - Tuesday, May 30, 23 @ 1:18 pm:

===Not unless===

Explain the Edgar Ramp and where payments will be and percentages going deeper in years.

- Frida's Boss - Tuesday, May 30, 23 @ 1:26 pm:

The Edgar Ramp was not good policy.

- Anonymous - Tuesday, May 30, 23 @ 1:26 pm:

When are projections ever correct?

- Bigtwich - Tuesday, May 30, 23 @ 1:29 pm:

“Explain the Edgar Ramp . . .”

I think it was designed by Evel Knievel.

- Oswego Willy - Tuesday, May 30, 23 @ 1:32 pm:

=== was not good policy===

That was not the question.

:)

- 47th Ward - Tuesday, May 30, 23 @ 1:34 pm:

===The Edgar Ramp was not good policy.===

Underfunding the pensions for decades was not good policy. Chemotherapy sucks, but it’s better than cancer. That’s the Edgar Ramp in a nutshell.

- Telly - Tuesday, May 30, 23 @ 1:45 pm:

== projection assumes no enhancements to Tier 2 ==

It also assumes no future Tier 2 penalty for violating federal Social Security safe harbor laws — something that is certainly not beyond the realm of possibility.

And yes, the Edgar Ramp ain’t great, but it’s been a better option than the only plausible alternative at the time — which was to do nothing.

- Pundent - Tuesday, May 30, 23 @ 1:52 pm:

=The Edgar Ramp was not good policy.=

It was the political reality of what was doable. Same as it ever was.

- City Zen - Tuesday, May 30, 23 @ 2:04 pm:

==You keep making this ridiculous argument.==

Based on ridiculous pension history.

Over the decades, numerous people looked at Tier 1 benefits and thought they were not good enough, even though they already exceeded current Tier 2.

Buy the projections if you want, but read the fine print.

- Oswego Willy - Tuesday, May 30, 23 @ 2:06 pm:

=== Buy the projections if you want, but read the fine print.===

You got winning lottery numbers too?

- Demoralized - Tuesday, May 30, 23 @ 2:12 pm:

@LP

Do you have a point? You frequently post links to things and offer nothing of substance along with those links. Try to make an argument rather than simply posting a link.

- Oswego Willy - Tuesday, May 30, 23 @ 2:14 pm:

===That’s the Edgar Ramp in a nutshell.===

It is, and why it’s not celebrated

- Jerry - Tuesday, May 30, 23 @ 2:19 pm:

“Therefore, any bailout of the Bears that in the long run will cause the state to take on either lost money or reimbursement of lost money to Arlington Heights should be scuttled, immediately”

Amirite?

Yes, you’re right OW.

- A - Tuesday, May 30, 23 @ 2:23 pm:

The “ridiculous pension history” alluded to above translates into using pension contributions by employees to fund all kinds of things other than pensions. Hence, the shortfall. Not a difficult concept for most to understand. In other words, ripping off public employees.

- Thomas Paine - Tuesday, May 30, 23 @ 2:35 pm:

Pretty much every financial advisor will tell you to set aside a minimum of 15% of your annual income to cover retirement costs.

We are upset at the state of Illinois for setting aside 20%?

It makes no sense.

- New Day - Tuesday, May 30, 23 @ 2:37 pm:

Contrary to LP, Wirepoints and their fellow travelers, we are on a slow but stead trajectory to get the pensions up to 90% funded, and in a sustainable way. Do I like spending 20% of the GRF for pensions? No. But it is manageable. I only wish this chart went to 2046 when pension costs will fall off the charts. I want to be THAT governor and GA when the windfall happens.

- RNUG - Tuesday, May 30, 23 @ 5:19 pm:

Rich, did my comment get trapped?

- Odysseus - Tuesday, May 30, 23 @ 7:48 pm:

“Pretty much every financial advisor will tell you to set aside a minimum of 15% of your annual income to cover retirement costs.”

It would be nice to be rich enough to do that. In my life I’ve managed that for about 4 years, 2001-2004.