* Press release…

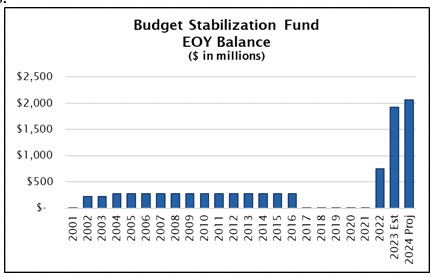

Tomorrow, as required by the Governor’s and General Assembly’s Fiscal Year 2023 budget, the final deposit for FY23 will be made into the Budget Stabilization Fund, and the State of Illinois’ Fiscal Year 2024 budget will deposit an additional $138 million, boosting the fund to over $2 billion, its highest balance in state history. The Budget Stabilization Fund held less than $60,000 when the Governor took office.

“Just six years ago our state had nearly nothing in our rainy-day fund, $17 billion in unpaid bills, and had suffered 8 credit downgrades,” said Governor JB Pritzker. “Today, we have no bill backlog, a $2 billion rainy-day fund, and eight credit upgrades. Illinois is finally finding its fiscal footing, and with an economy that has now reached over a $1 trillion in GDP, we are among the top states for workforce and business.”

Illinois created the Budget Stabilization Fund in 2001 with the intent to use it as a ‘rainy-day’ fund for future fiscal emergencies or economic downturns. Very little was deposited into the fund following its creation and its balance never exceeded $276 million – a small fraction of the state’s budget. It was used as a tool to assist with cash flow until it was nearly drained during the budget impasse in Fiscal Year 2017, when the $275 million balance was used to pay bills.

Strong revenue performance enabled the State to reduce unpaid bills, repay short-term borrowing, and set aside resources for future fiscal stability. During Fiscal Year 2022, the Governor worked with the General Assembly to deposit $746 million into the Budget Stabilization Fund, and the State will tomorrow finalize its deposits of another $1.18 billion in Fiscal Year 2023.

The balance in the Budget Stabilization Fund will grow an estimated $138 million in Fiscal Year 2024 under current law and is expected to have a $2.1 billion balance at the end of Fiscal Year 2024. Additionally, PA 102-1115 raised the targeted balance of the fund from 5 percent of general funds revenues to 7.5 percent of revenues, demonstrating Illinois’ commitment to responsible fiscal planning.

Ongoing dedicated revenues to the Budget Stabilization Fund and estimated FY2024 amounts include:

* 10% of state cannabis tax revenues ($25 million)

* Monthly transfers of $3.75 million from the General Revenue Fund ($45 million)

* Repayment over 10-years from the loan of $450 million to the State’s UI Trust Fund ($45 million)

* Interest earnings on the fund’s balance ($23 million)

* From the Comptroller’s office…

Comptroller Susana A. Mendoza announced Thursday that she is depositing $200 million into the state’s Rainy Day Fund (Budget Stabilization Fund), bringing the state’s reserve fund to a record of $1.94 billion.

The $200 million transferred to the Rainy Day Fund caps off an $850 million supplemental appropriation approved by the General Assembly and Governor in January, when revenue estimates came in higher than what was originally budgeted.

“One of the most important things state leaders did for this fiscal year was to resist spending this additional revenue on new programs, and instead decided to save and prepare the state for potential downturns in the future,” Comptroller Mendoza said.

The cash balance in the Rainy Day Fund now has reached an all-time high of nearly $2 billion, miles from the $48,000 balance in the fund in August 2018, which was barely enough to run state operations for 30 seconds.

- Anyone Remember - Thursday, Jun 29, 23 @ 11:21 am:

This is great news. But … again … how much of a bigger “bang for the buck” would we have gotten if these funds had been applied to pension debt?

- Captain Obvious - Thursday, Jun 29, 23 @ 11:22 am:

This is good news. It means there should be ample money available to cut deeply into the 30% lead inflation has on state salaries since 2015.

- Rich Miller - Thursday, Jun 29, 23 @ 11:24 am:

===there should be ample money available===

LOL

Nice try.

- Larry Bowa Jr. - Thursday, Jun 29, 23 @ 11:26 am:

I remember when the Republicans nominated a daddy figure who was going to get the state’s finances in order, and turned out to be completely vacuous and inept and uninterested in actually doing any of the actual work to achieve that goal.

Anyway, FIRE PRITZKER!!!

- Jibba - Thursday, Jun 29, 23 @ 11:47 am:

Maybe we can decide that 2B is enough and start to apply future funds to other needs, like pensions, schools, hiring, etc.?

- Levois - Thursday, Jun 29, 23 @ 11:48 am:

I may not agree with the Governor on everything but he has actually governing to that I give him credit. That aspect of the governorship has been neglected these last two decades.

- TheInvisibleMan - Thursday, Jun 29, 23 @ 12:27 pm:

The IL turnaround reminds me of the California turnaround in the 00s.

They went from issuing IOUs to pay bills, to having a massive surplus.

Or New York in the 70s.

JB deserves credit for his leadership. Mendoza deserves credit for her tenacity and the joy she seems to have for doing her job well.

Even the ILGOP deserves credit, for convincing their most… ‘fervent’ voters to leave the state completely.

- Go outisde - Thursday, Jun 29, 23 @ 1:35 pm:

Yeah, give Mendoza credit for moving the money that she was obligated to move. The credit here goes tot he Guv and the General Assembly. They could have spent that money and they didn’t.

- froganon - Thursday, Jun 29, 23 @ 1:58 pm:

Gov. Pritzker and the Dems in the GA have done an outstanding job of implementing sound, fiscal policy in Illinois. The work has begun but until the pensions are adequately funded, salaries are competitive and departments are staffed, our work isn’t done. No tax cuts until these things are accomplished. New and/or expanded programs need adequate revenue streams before being started.

- Do the right thang - Thursday, Jun 29, 23 @ 2:46 pm:

2 bill surplus = plenty of money for pension and workers.

- Demoralized - Thursday, Jun 29, 23 @ 3:24 pm:

Oh how quickly people want to raid the fund. I’m pretty sure salary increases don’t constitute the “emergency” that the fund is intended for.