|

Not easy to find details about new revenues in FY26 state budget (Updated)

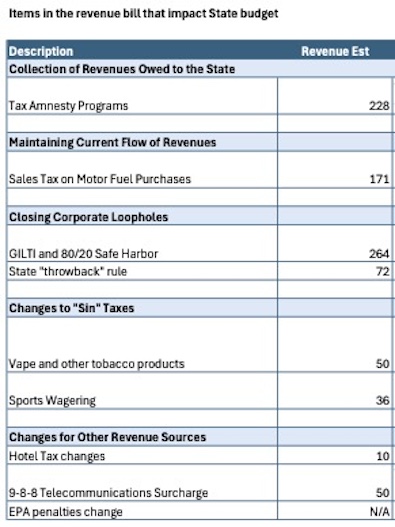

Monday, Jun 2, 2025 - Posted by Rich Miller *** UPDATE *** This partial document is from the Governor’s Office of Management and Budget. Click the image for the full document, which includes notes on each revenue item…  * Roundup of somewhat conflicting news reports about new state revenues…

Tribune: estimated $800 million plus in tax increases WGLT: $1 billion in new taxes on nicotine products, sports betting, and businesses. Sun-Times: “You know how it’s a bad budget? When it starts out with at least $1 billion in taxes,” said Senate Minority Leader John Curran, R-Downers Grove. Capitol News Illinois: just over $1 billion in new taxes and revenue changes. * The Illinois Policy Institute claims the revenue bill includes $394 million in tax hikes, $237 million in fund sweeps and $216 million from “delaying promised funding.” * There is no complete list that I’m aware of to explain how much all these changes are expected to bring in. We told you about some of the estimates on Saturday. So, I’ve taken those and grafted it onto the only comprehensive revenue list I’ve seen so far, which is from Government Solutions Group…

I wouldn’t call a tax amnesty program a tax hike. And the delayed sales tax payment to the Road Fund is a one-time budgetary gimmick. Those two alone total $399 million. The fund sweeps are not included in that list. They add up to about $100 million for the coming fiscal year, and more for this fiscal year. Also, click here for an analysis which shows the total amount raised from the sports wagering tax will be about $160 million. I’ll let you know if I find a reliable list of projected revenues.

|

- Bigtwich - Monday, Jun 2, 25 @ 2:40 pm:

= A sports wagering tax of $0.25 per wager for the first $20 million wagers and $0.50 for each wager in excess of $20 million.=

It took me a few minutes but shouldn’t the second and forth $ be omitted.

- Paul Powell - Monday, Jun 2, 25 @ 3:05 pm:

Tax and spend Democrats really hit nail on the bullseye with this turkey.

What is the rationale for a $7,000 raise for legislators for a state in the middle of fiscal crisis?

- TheInvisibleMan - Monday, Jun 2, 25 @ 3:08 pm:

“Increase in the tobacco and vape tax to 44 cents to help fund the Medicaid program.”

I think this being listed in ‘cents’ may be incorrect. That would be a massive tax decrease on tobacco to change the tax to be 44 cents. Unless this is a different tax specifically for medicaid, other than the standard tobacco excise tax.

“149 mills per cigarette or $2.98 per package of 20 cigarettes.”

https://tax.illinois.gov/research/taxrates/excise.html

I believe the current tax is 36% of the price, and the new budget will be raising that to 45%.

Also, from WTTW:

Consumers will also see new taxes on tobacco products. The tax rate will rise to 45% from 36%

https://news.wttw.com/2025/06/01/illinois-democrats-pass-555b-state-budget-new-taxes-sports-betting-nicotine-products

- Rich Miller - Monday, Jun 2, 25 @ 3:17 pm:

===What is the rationale===

Raises are tied to cost of living. Constitution says you can’t lower a legislator’s pay during their term in office. Canceling the raise would therefore be unconstitutional.

- Paul Powell - Monday, Jun 2, 25 @ 3:35 pm:

Legislator pay is now up from 72K to 93K in the past few years for a part time job

Fourth highest pay in America

They certainly take excellent care of themselves during a “very tough budget year”

- Jack in Chatham - Monday, Jun 2, 25 @ 3:36 pm:

Interesting how in recent year we had high inflation and the General Assembly cancelled the increase in the standard deduction for personal income tax.

Small beans, but the Tobacco Retailer’s Sales license fee was increased from $75 to $150 which will raise about $2 million. Given how long this fee was stuck at $75 this will not be enough to impact compliance rates and decrease black market tobacco sales to an acceptable level but it is a step in the right direction.

- cla skinner - Monday, Jun 2, 25 @ 3:42 pm:

Mary Kay O’Brien claimed credit for the inflationary increase legislation while lobbying for a judicial pay raise.

Wish I could remember the year she spoke from the podium.

- Flyin' Elvis'-Utah Chapter - Monday, Jun 2, 25 @ 4:05 pm:

“Tax and spend Democrats really hit nail on the bullseye with this turkey.”

You must be absolutely beside yourself with the amount of debt the proposed federal budget bill adds to the national debt.

- Jeb - Monday, Jun 2, 25 @ 4:06 pm:

The first one on Government Solutions is wrong. Vape tax is not 44 cents. It’s 45%, and some of it went from weight-based to percentage of wholesale price.

- Joseph M - Monday, Jun 2, 25 @ 4:52 pm:

“What is the rationale for a $7,000 raise for legislators for a state in the middle of fiscal crisis?”

In addition to the points raised above, I see a few tangible benefits to higher wages for lawmakers:

1. Less likely to accept bribes

2. Better chance of attracting top talent to run for office (or remain in office) instead of choosing a more lucrative career path

3. More freedom for policymakers to focus on their job instead of under-the-table side hustles and family businesses

As a taxpayer, I’m okay with this.

- Proud Papa Bear - Monday, Jun 2, 25 @ 5:20 pm:

“ for a part time job”

I’m going to give you the benefit of the doubt and assume you don’t work with legislators. Every one I’ve met, regardless of affiliation, is extremely hard working, putting in more than full-time hours, away from their families for weeks at a time.

- Hank Sauer - Monday, Jun 2, 25 @ 5:28 pm:

Always interesting to see how much they say they can bring in from tax amnesty. Why not collect it in the first place . No accounting will ever be done on this

- The Farm Grad - Monday, Jun 2, 25 @ 5:47 pm:

Re the Telecom Tax.

From 7.00% to 8.65%

24% Tax Hike

- snowman61 - Monday, Jun 2, 25 @ 5:54 pm:

I believe there are close to 900 dedicated funds that can be swept. So when are we going to know which funds will be swept or are we going go thru the year waiting until it happens.

If the fund is no longer being used but monies are being deposited, why and then make adjustments accordingly. The Funds were set up to serve a purpose but if the purpose is gone, why keep the fund?

- Sue - Monday, Jun 2, 25 @ 6:52 pm:

Is there any evidence the State can collect anything approaching the plug number for past due taxes- what happened the last time they did this?

- Candy Dogood - Monday, Jun 2, 25 @ 7:08 pm:

===- Paul Powell - Monday, Jun 2, 25 @ 3:35 pm:===

Hope you didn’t intentionally choose your nickname to be that of a white supremacist.

===Fourth highest pay in America===

Get a load of what those legislators with garbage pay are doing in neighboring states like Indiana, Missouri, Kentucky, and Iowa.

I’d rather pay a bit more to make sure that we’re not stuck with people who are dependent on outside income to be a legislator and think gimmicks like picking which Illinois counties will join their state are good law making.

- Rich Miller - Monday, Jun 2, 25 @ 7:15 pm:

===So when are we going to know which funds will be swept===

I had that on the blog over the weekend.