* Daily Herald…

The elected Crystal Lake city clerk, who has been charged with grooming and possessing images depicting child sexual abuse, made his initial court appearance Thursday, when a judge ordered he be released from county jail pretrial with conditions while awaiting trial.

The hearing also provided some of the first details of the allegations against Nicholas Kachiroubas, 45, who was arrested Tuesday after authorities from the McHenry County Sheriff’s Office Criminal Investigations Division served a search warrant, according to a news release.

Kachiroubas, who appeared in orange jail-issued clothing, is charged with possessing images of children being sexually abused, a Class 2 felony, and grooming, Judge Carl Metz said at the hearing. […]

Miller said Kachiroubas also possessed a nude photo of a child who was about 7 or 8 years old and that, when police asked Kachiroubas if he thought it was wrong for him to possess such a photo, he allegedly responded: “I guess I didn’t think I was doing anything (wrong).” […]

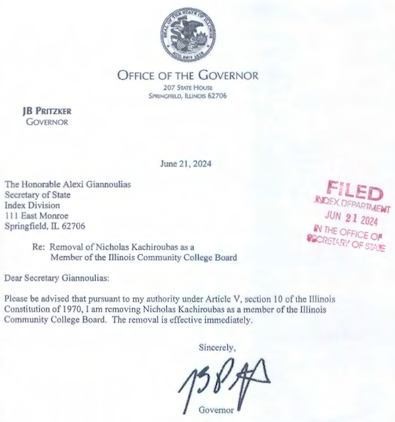

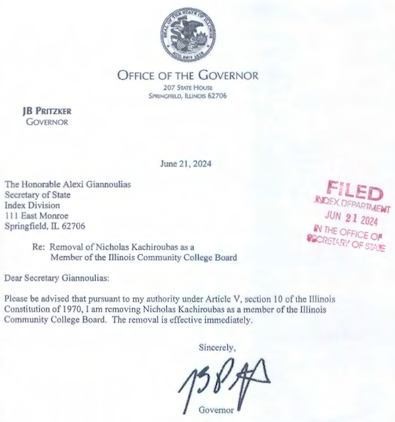

Kachiroubas is listed on DePaul’s website as an associate professor in the university’s School of Public Service. He also sits on the Illinois Community College Board, and has been the city clerk in Crystal Lake since 2009, having been elected in 2021 to his fourth term.

I’m told by the Illinois Community College Board and the governor’s office that the governor is removing Kachiroubas from the ICCB and we should see a formal announcement later today.

…Adding… And there it is…

5 Comments

|

Isabel’s afternoon roundup

Friday, Jun 21, 2024 - Posted by Isabel Miller

* WBEZ…

When it’s finally time to sentence the longest-serving Chicago City Council member in history for racketeering, bribery and attempted extortion, federal prosecutors want a judge to send “a simple, undiluted and unequivocal warning” to government officials across the state: […]

It’s been nearly a decade since an Illinois politician as significant as [ex-Ald Ed Burke] (14th) faced sentencing at the Dirksen Federal Courthouse. Plenty of lesser Chicago pols have been sent away, though, vexing judges inside the building. They’ve mulled the cost-benefit ratio for “rational” politicians who too often choose greed, graft and power over the public good.

Now, U.S. District Judge Virginia Kendall, one of the building’s most senior jurists, has a chance to send the loudest message since U.S. District Judge James Zagel gave 14 years to ex-Gov. Rod Blagojevich. Prosecutors want 10 years for Burke. Whatever Kendall does will add to a long-running courthouse debate about how to put a stop to corruption in Chicago — and whether that’s possible. […]

Burke’s sentencing hearing is set to begin at 10 a.m. Monday at the downtown courthouse. Hearings generally begin on time, so Burke must make his way by then to Kendall’s 25th-floor courtroom — which used to belong to Zagel.

* Sun-Times…

A federal judge sentenced former Illinois Sen. Annazette Collins to a year in prison Friday for cheating on her taxes in a case with ties to the same investigation that snared indicted former Illinois House Speaker Michael Madigan.

A jury in February convicted Collins of filing false individual tax returns for the years 2014 and 2015, failing to file one for the year 2016 and failing to file a corporate tax return for 2016.

“Her offenses were driven by greed,” U.S. District Judge Jorge Alonso said. “She doesn’t want to hear that, but it’s absolutely true.” […]

Meanwhile, the case brought by prosecutors revolved around her work with her lobbying firm, Kourtnie Nicole Corp., following her years in the legislature. That firm wound up collecting hefty sums from politically connected firms and utilities.

They included ComEd and AT&T Illinois, both of which were caught up in the Madigan investigation and faced criminal charges.

* Milwaukee Journal Sentinel…

A project aimed at keeping invasive carp out of the Great Lakes could be in jeopardy if Illinois doesn’t meet a fast-approaching deadline to release federal funds.

Illinois Gov. J.B. Pritzker has until the end of June to sign the agreement with the U.S. Army Corps of Engineers or the project will incur additional costs and continue to face delays.

The Brandon Road Interbasin Project is a state-of-the art barricade at an important pinch point at the Brandon Road Lock and Dam along the Des Plaines River in Joliet, Illinois. From there, invasive carp could make their way from the Mississippi River to Lake Michigan.

The project costs more than $1.1 billion, which many say is a small price to pay to keep the Great Lakes healthy and protect the multi-billion dollar fishing and recreation industries.

* Treasurer Micheal Frerichs…

The State Treasurer’s Office made a record $130.1 million in investment earnings from the state investment portfolio in May, Illinois Treasurer Michael Frerichs announced today.

Treasurer Frerichs is the state’s Chief Investment and Banking Officer. He is responsible for investing state revenue in the state investment portfolio. So far in Fiscal Year 2024, Frerichs’ Office has earned more than $1.3 billion for the state portfolio.

“Every dollar we earn in interest is a dollar that lawmakers don’t have to raise in taxes,” Frerichs said. “The State Treasurer’s Office cannot solve all of our problems, but we can be part of the solution.”

Also in May, nearly $90.9 million in gross investment earnings was earned for cities, villages, school districts, counties and other units of government thattake part in the highly rated Illinois Funds local government investment pool the State Treasurer’s Office operates. So far in Fiscal Year 2024, the Office has earned more than $973.6 million for the Illinois Funds, which has received the highest rating of AAA from Fitch, a national credit ratings agency.

* Illinois Department of Employment Security…

The Illinois Department of Employment Security (IDES) announced today that the unemployment rate increased +0.1 percentage point to 4.9 percent, while nonfarm payrolls increased +12,700 in May, based on preliminary data provided by the U.S. Bureau of Labor Statistics (BLS), and released by IDES. The April revised unemployment rate was 4.8 percent, unchanged from the preliminary April unemployment rate. The April monthly change in payrolls was revised from the preliminary report, from +7,300 to +1,900 jobs. The May unemployment rate and payroll jobs estimate reflect activity for the week including the 12th.

In May, the industry sectors with the largest over-the-month job gains included: Professional and Business Services (+7,100), Government (+3,300), and Financial Activities (+2,400). The industry sectors with monthly payroll job declines included Manufacturing (-2,300), Leisure and Hospitality (-1,200), Construction (-100) and Mining (-100). […]

The state’s unemployment rate was +0.9 percentage point higher than the national unemployment rate reported for May. The national unemployment rate was 4.0 percent in May, up +0.1 percentage point from the previous month. The Illinois unemployment rate was up +0.7 percentage point from a year ago when it was 4.2 percent.

Compared to a year ago, total nonfarm payroll jobs increased by +43,900 jobs. The industry groups with the largest jobs increases included: Private Education and Health Services (+29,200), Government (+28,600), and Leisure and Hospitality (+13,900). The industry groups with the largest jobs decreases included: Professional and Business Services (-24,800), Trade, Transportation, and Utilities (-6,600), and Financial Activities (-4,500). In May, total nonfarm payrolls were up +0.7 percent over-the-year in Illinois and up +1.8 percent in the nation.

The number of unemployed workers was 317,400, up +1.3 percent from the prior month, and up +17.8 percent over the same month one year ago. The labor force was up +0.2 percent over-the-month and up +1.4 percent over-the-year. The unemployment rate identifies those individuals who are out of work and seeking employment. An individual who exhausts or is ineligible for benefits is still reflected in the unemployment rate if they actively seek work.

*** Statewide ***

* ABA Journal | 19 state AGs fire back after others demand ABA diversity standards change: Illinois Attorney General Kwame Raoul sent the letter to “reaffirm our commitment to ensuring that diversity, equity, and inclusion programs continue to effectively address discrimination throughout the private and philanthropic sector.” […] “We also write to respond to coordinated attempts to contort the law and invalidate programs aimed at eliminating and preventing racial inequities,” the June 20 letter states.

* Sun-Times | The heat inside your car can turn deadly in minutes this summer: A Sun-Times test this month — before the recent heat wave hit — found the inside temperature of a parked car in a sunny spot rocketed to dangerous levels in minutes. […] The black 2015 Toyota Corolla we tested June 13 on a residential street in Irving Park reached 103.1 degrees in 15 minutes and 114.1 degrees in 45 minutes, according to a sensor placed inside the car out of direct sunlight.

* Press Release | IDNR and Department of Ag to offer free camping at select state parks during 2024 Illinois State Fair: The Illinois Department of Natural Resources (IDNR) and the Illinois Department of Agriculture (IDOA) are teaming up to offer two nights of free camping at select state parks for anyone who purchases a 2024 Illinois State Fair admission book online between June 26 and July 3.

* Center Square | A book about bucket list items to see and do in Illinois: “100 Things to Do in Illinois Before You Die” is published by Reedy Press. Author Melanie Holmes said she wasn’t planning to write a guide book but became aware of Reedy Press’s series and decided there needed to be a book about her home state. […] Holmes said one of her favorite things to do is to visit the zoological park in Hanna City.

*** Chicago ***

* Crain’s | A year on, Chicago is still grappling with the void Jim Crown’s death created: Crown died in a racetrack accident on June 25, 2023, in Colorado on his 70th birthday, just weeks after the Civic Committee of the Commercial Club of Chicago unveiled a violence-reduction program he championed, one that fell outside the group’s comfort-zone focus on transportation, education and state finance. His death cast a pall over Chicago’s civic community and renewed scrutiny of the city’s boardroom commitment to philanthropic causes against the backdrop of a corporate headquarters drain blamed in part on the city’s bleak homicide record.

* Sun-Times | In bid for young voters, Democrats offer social media influencers press access to August convention: It’s part of a critical voter outreach plan that’s been in place since President Joe Biden’s 2020 campaign and has extended into the halls of the White House — as Biden combats former president Donald Trump and his army of social media influencers. An estimated 32% of people between 18 and 29 got their news from TikTok last year, according to a Pew Research Center poll. And a poll conducted by the University of Chicago’s GenForward late last month found Biden has lost support from young Black and Latino voters compared to 2020.

* ABC Chicago | Indiana Fever vs. Chicago Sky rematch tickets poised to be most expensive in WNBA history: Ticket prices for Clark’s Indiana Fever and Reese’s Chicago Sky are the most expensive for a WNBA game ever, according to TickPick, with the average hovering at around $253 - 187% higher than the Sky’s average purchase price of $88. Currently, the cheapest seat just to see the game is around $250 with the most expensive ticket on sale going for more than $9,000.

* Block Club | 15 Things To Do In Chicago This Weekend: Pride Fest, Vegandale And A Bronzeville Bazaar: This weekend is packed with Chicago street and food festivals, including Pride Fest, Vegandale, Motoblot and the Magnificent Mile Art Festival. There’s also the Andersonville Vintage Market, a Lakeview native plant sale, the Bernard Street Yard Sale in Logan Square, a 5K along the 312 RiverRun trail and the return of the Bronzeville Vendor Fair and Wildflower Music Festival.

*** Cook County and Suburbs ***

* WBBM | Embattled Dolton mayor at center of chaotic Thornton Township board meeting: People complained about Henyard’s leadership, about a canceled previous meeting and the amount of time they’re allowed to speak. Those in attendance also argued with one another. They even argued with a man who stood at the podium and suggested they act like adults.

* Tribune | One migrant worker’s effort to claim workers’ comp, a right all workers have despite immigration status: Jose Antuna fell through a drain at a west suburban car wash where he worked and tore his meniscus in mid-November. […] In Illinois, it is illegal under the Immigration Reform and Control Act of 1986 to knowingly hire workers who are in the country without legal permission. However, these workers are as entitled to workers’ compensation benefits when injured on the job as people who are citizens.

*** Downstate ***

* SJ-R | ‘Icon of Springfield’: New plaque recognizes Horseshoe sandwich: Visit Springfield, a tourism division of the Springfield Convention & Visitors Bureau, unveiled a plaque to commemorate the birth of the Horseshoe sandwich at the historic Leland Building at the corner of Sixth Street and Capitol Avenue in Springfield. The location is where the original Springfield Horseshoe Sandwich was created.

* Intelligencer | Steven Cook pleads guilty to falsifying bank records: The president of a southern Illinois bank admitted to a scheme to falsify bank records to facilitate real estate loans. Steven Cook pleaded guilty in U.S. District Court in Benton, Illinois to three felony counts of aiding and abetting the making of a false bank entry. Cook was the president of SouthernTrust Bank at the time. The bank has branches in Marion, Vienna and Goreville, Illinois. Cook was also a member of the bank’s board and a member of its loan committee.

* WCIA | Illinois Raptor Center in urgent need of donations: The Illinois Raptor Center specializes in aiding all kinds of birds. They said they are currently “floor-to-ceiling” in baby raptors, and are struggling to keep them fed and medicated. The organization also said their air conditioning isn’t working at their office and education center. The break-down puts pressure on their need for funding — however, money for food and meds must be prioritized over repairs, they said.

*** National ***

* AP | Car dealerships are being disrupted by a multi-day outage after cyberattacks on software supplier: For prospective car buyers, that may mean delays at dealerships or vehicle orders written up by hand, with no immediate end in sight. Here’s what you need to know. CDK Global is a major player in the auto sales industry. The company, based just outside of Chicago in Hoffman Estates, Illinois, provides software technology to dealers that helps with day-today operations — like facilitating vehicle sales, financing, insurance and repairs. CDK serves more than 15,000 retail locations across North America, according to the company. Whether all of these locations were impacted by this week’s cyberattacks was not immediately clear.

1 Comment

|

You reap what you sow

Friday, Jun 21, 2024 - Posted by Rich Miller

* Apparently, now Jeanne Ives isn’t pure enough for some folks. Illinois Review…

Ever since news broke that embattled Illinois Republican Party Chairman Don Tracy was resigning effective July 19th, Illinois GOP state central committee member Jeanne Ives has been working the phones trying to gauge support as she considers a potential run for the party’s top spot – despite spending the last two years angering the very base that made her, and was instrumental in Tracy’s decision to resign.

In December of 2022, Ives stunned a room full of over 200 grassroots activists during a SSC meeting when she defended then IL GOP Finance Chairman Vince Kolber, who had just insulted the grassroots for not donating money to the state party – yelling – in an almost out of body experience that, “Vince is not your problem! This man gave me $750,000 when I ran against Gov. Bruce Rauner!”

Just months before challenging Gov. Rauner in the GOP primary, Ives was seen smiling for a photo with her soon-to-be Republican political opponent. Rauner – bruised and damaged during a vicious primary against Ives, would lose his re-election to political newcomer JB Pritzker by 16 points – just two years before the pandemic and Gov. Pritzker’s shutdown orders and mask mandates.

Last September, Ives endorsed Florida Gov. Ron DeSantis for president during the 2024 presidential primary, despite the wildly popular former president Donald Trump leading in the polls among Republicans over his political opponents, including DeSantis by over 30 points. And when Ives learned that the president’s son – Donald Trump Jr. was coming to Illinois to promote Letters to Trump last October, her team made requests to interview Trump Jr. on her radio show, and to speak on stage during the event. When the requests were turned down, and this publication accurately reported about it, she became angry – and went on Facebook attacking the event featuring Trump Jr. and falsely alleged that the hosts couldn’t sell tickets.

Hilarious.

19 Comments

|

* AP…

The Supreme Court on Friday upheld a federal gun control law that is intended to protect victims of domestic violence.

In their first Second Amendment case since they expanded gun rights in 2022, the justices ruled 8-1 in favor of a 1994 ban on firearms for people under restraining orders to stay away from their spouses or partners. The justices reversed a ruling from the federal appeals court in New Orleans that had struck down the law.

Chief Justice John Roberts, writing for the court, said the law uses “common sense” and applies only “after a judge determines that an individual poses a credible threat” of physical violence.

Justice Clarence Thomas, the author of the major 2022 Bruen ruling in a New York case, dissented.

* The Washington Post…

The challenge to the law was brought by Zackey Rahimi, a drug dealer who was placed under a restraining order after a 2019 argument with his girlfriend. He argued that the government had violated his Second Amendment rights by blocking him from possessing guns.

Rahimi knocked the woman to the ground in a parking lot, dragged her back to his car and fired a shot at a bystander, according to court records. The girlfriend escaped, but Rahimi later called her and threatened to shoot her if she told anyone about the assault. The pair have a child together.

A Texas court found that Rahimi had “committed family violence” and that such violence was “likely to occur again in the future.” It issued a protective order that suspended Rahimi’s gun license, prohibited him from having guns and warned him that possessing a firearm while the order remained in effect might be a federal felony.

Rahimi later violated the protective order and was involved in five shootings between December 2020 and January 2021, according to a government brief. […]

Rahimi argued in federal court that he had the right to possess guns, but a judge ruled against him on that issue. Afterward, he pleaded guilty to the federal charge and received a sentence of six years in prison. He continued to challenge the law, and the U.S. Court of Appeals for the 5th Circuit reheard his case after the Supreme Court’s Bruen ruling.

* WAND…

Writing for the majority, Chief Justice John Roberts wrote that since the United States was founded “our nation’s firearm laws have included provisions preventing individuals who threaten physical harm to others from misusing firearms.”

The provision at issue in the case “fits comfortably within this tradition,” he added. […]

In his dissent, Thomas stuck to his view that the history of similar laws at the time of the nation’s founding is determinative. Other justices are more willing to consider laws that are not exactly the same but have a similar effect.

“Not a single historical regulation justifies the statute at issue,” Thomas wrote.

* G-PAC…

The Gun Violence Prevention PAC (G-PAC) of Illinois today applauded the U.S. Supreme Court decision to uphold federal law that bars domestic violence abusers from having guns when they have an order of protection entered against them.

John Schmidt, G-PAC Executive Board Member and former U.S. Associate Attorney General, issued the following statement in response to today’s decision in U.S. v Rahimi:

“The Court’s decision upholds the basic principle that we can deny guns to dangerous people. It rejects the false idea that common sense limits on gun ownership are inconsistent with the Second Amendment right to bear arms for self-defense. The fact that the decision was written by Chief Justice John Roberts with the support of all but one of the other Justices sends a positive sign the Court will continue to uphold sensible laws that protect us against gun violence.”

* The Network…

The Network: Advocating Against Domestic Violence has released a statement about the U.S. Supreme Court’s 8-1 decision in United States v. Rahimi which upholds a federal law that prohibits people subject to domestic violence orders of protection from possessing firearms. The Court reversed the U.S. Court of Appeals for the Fifth Circuit decision that individuals subject to domestic violence protective orders have a constitutional right to possess firearms.

“The Supreme Court has asserted that an individual found by a court to pose a credible threat to the physical safety of another may be temporarily disarmed consistent with the Second Amendment. Survivors of domestic violence deserve to be protected from harm and this decision reinforces the obligation of governments to safeguard survivors. The Illinois General Assembly must reaffirm this right to safety from gun violence and pass Karina’s Bill this fall,” said Amanda Pyron, Executive Director of The Network: Advocating Against Domestic Violence.

The court held that when an individual has been found by a court to pose a credible threat to the physical safety of another, that individual may be temporarily disarmed consistent with the Second Amendment. Thousands of survivors seek orders of protection each year as an element of safety while they break free from domestic violence situations.

The importance of prohibiting firearms in domestic violence situations cannot be overstated.

- Risk of intimate partner homicide increases 500% when abusers have access to a gun.

- Leaving a domestic violence relationship is a period of high lethality risk, including when filing for an order of protection.

- In domestic violence homicides where the victim had an order of protection, 1 out of 5 victims were killed within two days of the order being issued.

By validating the federal law prohibiting abusers with orders of protection against them from gun possession, the Supreme Court has shown its agreement that the safety of survivors – particularly women – is critical. The Network is grateful to the Supreme Court for its action to protect victims of domestic violence in the U.S.

* Ben Szalinski…

More on Karina’s Bill here and here.

* Attorney General Kwame Raoul…

Attorney General Kwame Raoul today issued the following statement in response to the U.S. Supreme Court’s decision in U.S. v. Rahimi, which will preserve federal law that prohibits individuals under domestic violence restraining orders from possessing firearms.

“For decades, federal law has barred individuals who are subject to domestic violence restraining orders from possessing firearms, and I am very pleased to see the U.S. Supreme Court uphold these longstanding, commonsense tools that protect victims of domestic violence and prevent gun violence.

“As we highlighted in the brief we led in this case – which was joined by 25 attorneys general across the country – intimate partner violence and gun violence are closely connected. Firearms are the leading cause of intimate partner homicides – more so than all other weapons combined. Studies have shown that an abuser is five times more likely to murder an intimate partner if a firearm is in the home. Laws like the federal law upheld today and similar protections in Illinois that bar abusers from accessing firearms have successfully reduced intimate partner homicide.

“The harms of domestic violence reach beyond intimate partners and family members. Perpetrators of domestic violence are also a threat to public safety. From 2014 to 2019, 60% of mass shootings in the United States either involved domestic violence attacks or the perpetrators had a history of domestic violence.

“Domestic abusers are dangerous and should not have access to firearms. Full stop. Today’s decision is a commonsense win for public safety and gun violence prevention.”

* Senator Dick Durbin…

“Today, the Court reaffirmed that the Second Amendment is not limitless and rejected a meritless challenge to an essential gun safety law. In doing so, they are protecting the lives of women and families across the nation. Unfortunately, Justice Thomas, the lone dissenter in the case, continues to isolate himself from a commonsense view of the limits of the Second Amendment.

“But let’s be clear: the only reason this case was before the Court is that two years ago a conservative supermajority of judicial activists established a radical new standard that makes it much easier for the gun lobby to challenge longstanding gun safety laws. The Court should overturn its misguided Bruen decision as soon as possible.”

In March 2023, Durbin chaired a Senate Judiciary Committee hearing entitled “Protecting Public Safety After New York State Rifle & Pistol Association v. Bruen.” The hearing focused on the impact of the radical new standard for the constitutionality of modern-day gun safety laws set by the Supreme Court’s decision in New York State Rifle & Pistol Association v. Bruen in 2022. With that decision, the Supreme Court ruled that the constitutionality of modern-day gun safety laws depends on whether the government can demonstrate that there were sufficiently similar historical gun laws in place at the time of the adoption of the Second Amendment in 1791 or the Fourteenth Amendment in 1868. This 2022 ruling opened the door to the Fifth Circuit’s overturning of its original ruling in United States v. Rahimi, thus allowing those with domestic violence protective orders to still possess firearms.

In August 2023, Durbin joined nearly 170 members of Congress in filing an amicus brief in opposition to the constitutional challenge. In the bicameral brief, Durbin and the members called on the Supreme Court to set a clear standard allowing Congress to pass laws that keep the American people safe.

*** Adding *** Rep. Maura Hirschauer…

State Rep. Maura Hirschauer, D-Batavia, issued the following statement Friday after the Supreme Court sided overwhelmingly with gun safety advocates and survivors of domestic violence by upholding federal protections preventing abusers from possessing firearms:

“The United States Supreme Court spoke clearly and forcefully in favor commonsense gun safety, with justices from every end of the ideological spectrum upholding efforts to get guns out of the hands of domestic abusers.

“While this ruling is a great relief for survivors of gender-based violence, the federal protections affirmed today merely preserve the status quo—and for tens of thousands of women and families, it is clear that this is not enough. We now know without question that we can do more, and we must. Here in Illinois, we should move forward by enacting Karina’s Bill, which will provide clear guidance for getting guns out of the hands of abusers, and ensure those weapons are removed sooner—all within a framework that justices have now overwhelmingly endorsed.

“The Supreme Court has shown us that we can enact Karina’s Bill with confidence, knowing that the gun lobby’s bad faith claims have been rejected by the nation’s highest court. I look forward to working with my colleagues to get this important legislation into law as soon as possible.”

*** Adding *** Illinois State Rifle Association…

US Supreme Court Upholds Importance of Due Process in US v. Rahimi

Today, the US Supreme Court held in US v Rahimi that the temporary restriction of a dangerous individual’s ability to possess a firearm is consistent with the history of the 2nd Amendment.

While there are those in Illinois who would seek to remove firearms and deny rights to individuals without the benefit of due process, The Illinois State Rifle Association points out that today’s opinion makes clear that proper due process is an important part of the process where 2nd Amendment rights are concerned.

Notably, Chief Justice Roberts finds that a temporary restriction under 922(g)(8) is proper because in part:

“A prosecution under Section 922(g)(8) may proceed only if three criteria are met. First, the defendant must have received actual notice and an opportunity to be heard before the order was entered.”

The Illinois State Rifle Association has opposed recent attempts by activists to pass laws which restrict 2nd Amendment Rights without due process, and we strongly encourage those groups to heed the words written in the majority opinion today which also contains the following passages:

“we note that Section 922(g)(8) applies only once a court has found that the defendant “represents a credible threat to the physical safety” of another.”

“the Second Amendment right may only be burdened once a defendant has been found to pose a credible threat to the physical safety of others.”

Again, today’s decision makes clear that a court must make a finding before restricting 2nd amendment rights. These rights cannot be curtailed on the basis of an unverified allegation, and the ISRA will continue to fight against attempts to remove firearm owner’s rights to due process in the Illinois legislature.

“Today’s opinion applies solely to those who have been shown to be a credible threat to others through due process in the legal system. The ISRA continues to fight for the rights of peaceful citizens to protect themselves through firearm ownership and exercise of their 2nd amendment rights” - Richard Pearson, Executive Director, Illinois State Rifle Association.

* Related…

* NPR | In today’s gun rights cases, historians are in hot demand. Here’s why: Bruen has also created sudden, intense interest in research from people such as Brennan Gardner Rivas, an independent scholar who wrote her dissertation on the history of gun regulation in Texas. “The states and attorneys general who are trying to defend their gun laws from challenges now have to seek out historians to identify analogous historical laws,” Rivas says. “They’ve all found me on their own through Googling me and looking up my publications and things like that.”

24 Comments

|

* November of 2021…

The Itasca Village Board turned down a proposed drug rehab center after two years of debate among residents.

The Haymarket Center wanted to turn a former Holiday Inn, located at 860 West Irving Park Road, into a 240-bed drug treatment center.

Since 2019, there has been opposition by some Itasca residents since the proposal, who argue the village is too small for the facility. They have voiced concerns related to zoning changes, tax revenues and whether emergency services would be able to handle possible increased demand. […]

While the proposed facility cleared zoning and planning, the village’s board had the final say with a 6-0 vote Tuesday night not to go ahead with construction.

* December of 2021…

The Haymarket drug treatment center’s more-than-two-year attempt to open a rehab in Itasca took another turn Thursday when officials said U.S. Attorney John Lausch has launched an investigation into whether the village’s rejection of the center was in keeping with the Americans with Disabilities Act.

Mayor Jeff Pruyn released a letter Lausch sent last week, in which he announced the probe and noted that the ADA protects people with disabilities — including substance use disorder — from discrimination.

The Lausch letter is here.

* January of 2022…

The Haymarket drug treatment center filed a federal lawsuit Tuesday against the village of Itasca, claiming its rejection of a rehab facility proposed for a former hotel amounted to discrimination against people with substance-use disorder. […]

“The intentional and orchestrated discriminatory conduct across Itasca’s key governmental entities is designed to interfere with the rights of Haymarket Center, the people with disabilities it serves, and their families,” attorney Mary Rosenberg of Access Living, an advocacy center for the disabled that is representing Haymarket in the lawsuit, said in a statement announcing the lawsuit.

* Today…

The U.S. Attorney’s Office in Chicago has sought to file a complaint in intervention in a pending lawsuit against Itasca, Ill., alleging the village engaged in unlawful disability discrimination in reviewing and ultimately denying a zoning request filed by a non-profit health care provider to use its property as a treatment center for people with substance-use disorders.

* From the complaint in intervention…

The Department of Justice has since completed an extensive investigation and substantiated Haymarket’s claim that the Village violated Title II of 2 the ADA in reviewing and denying its zoning request. […]

The Village engaged in disparate treatment by employing a host of unprecedented and highly anomalous tactics to frustrate Haymarket’s treatment center proposal. As one primary tactic, Village officials—especially Mayor Jeffrey Pruyn—legitimized, endorsed, and fanned the flames of residents’ fears by issuing scores of public statements disparaging Haymarket and its supporters while urging residents to voice their fears and concerns at zoning hearings. Just as the officials intended, the discriminatory opposition movement swelled, seeped into the hearings, and persisted until it ultimately tainted the decision-making process.

Village officials also concocted a pretextual narrative that the treatment center would impose severe economic harms on the region and its taxing bodies. To accomplish this, before the zoning hearings began, the Village: (1) misclassified the treatment center as a planned development instead of a “health center” special use; (2) waged a public campaign against Haymarket that focused the public discourse on its pretextual economic concerns while amplifying 3 residents’ fears; and (3) drew the Itasca Fire Protection District (“Fire District”) and Itasca School District 10 (“School District”) into the zoning process as “interested parties” to oppose Haymarket.

The misclassification imposed onerous zoning requirements on Haymarket, most notably by requiring it to prove, with assistance from experts and attorneys, that the center would impose no economic harms on the region. The public campaign disseminated pretextual economic talking points to Haymarket’s opponents and further fomented opposition. And the “interested party” designations allowed the Fire and School Districts to leverage nearly trial-like due process rights to help the Village bury Haymarket’s proposal under baseless economic concerns. […]

The tactics prejudiced Haymarket by galvanizing the discriminatory opposition movement around made-up economic impact claims and converting what should have been a routine special-use zoning proceeding into an unprecedented and openly hostile zoning process involving 35 hearings lasting over two years, with heavy participation from attorneys and experts, and imposing staggering costs for Haymarket.

After the hearings concluded, the Village denied zoning approval based on pretextual economic impact concerns that (1) the Village would lose desperately needed tax revenue if a nonprofit rather than a hotel operated at the site; (2) Haymarket’s patients would require costly emergency medical services from the Fire District; and (3) Haymarket patients or their children would overwhelm the local K-8 School District. During the hearings, Haymarket had offered overwhelming proof that these purported concerns were unlawfully considered and baseless, and it made extraordinary concessions to resolve them anyway. But these efforts fell on deaf ears because they spoke only to concerns that were pretext for discrimination.

Lastly, the Village failed to fulfill its accommodation obligations under the ADA prior to denying Haymarket’s zoning request. First, the Village failed to accommodate Haymarket’s reasonable request to use its special-use process. And second, the Village conducted a fake accommodations analysis after deliberately breaking down and failing to conduct any meaningful interactive process that might have revealed solutions to its purported concerns.

…Adding… Haymarket Center President & CEO Dr. Dan Lustig…

We are heartened by the Department of Justice’s finding that Haymarket Center faced a ‘discriminatory’ and ‘onerous’ zoning application process in our effort to open a comprehensive substance use disorder treatment center in the Village of Itasca. By filing to intervene in this case, the DOJ joins Haymarket Center in our efforts to reinforce equality and fairness in healthcare, address discrimination and inequities against those with substance abuse disorder and protect vulnerable populations by ensuring access to life-saving treatment. As always, we welcome the opportunity to find a resolution with Itasca leaders and hope the DOJ filing moves us closer to opening Haymarket DuPage.

9 Comments

|

Uber Partners With Cities To Expand Urban Transportation

Friday, Jun 21, 2024 - Posted by Advertising Department

[The following is a paid advertisement.]

Uber is leading the charge to close critical transportation gaps, ensuring reliable access to its services in places that need it most, such as underserved areas like Englewood. This is a part of Uber’s broader commitment to augment and expand the reach of Chicago’s transportation ecosystem, focusing on overcoming the first-mile/ last-mile hurdles that have long plagued residents in farther afield neighborhoods. Uber aims to extend the public transit network’s reach, making urban transportation more accessible and efficient for everyone. Discover the full story on how Uber is transforming city transportation for the better.

Comments Off

|

It’s just a bill

Friday, Jun 21, 2024 - Posted by Isabel Miller

* WBEZ…

An effort is also underway to waive or minimize filing fees for transgender people as they request a legal name change — and allow the petitioner to request that a court seal the name change if public disclosure may harm their health or safety. The bill is aimed at protecting other vulnerable populations, including survivors of violence and refugees. Legislation stalled in the Illinois Senate this spring.

“Obviously, we have to think about the whole state. And here in Chicago, you can live relatively anonymously. But, you’re living in a small town and you have to publish in your local newspaper that you’re transitioning, that’s going to put you at significant risk,” said the bill’s sponsor, State Rep. Kelly Cassidy, D-Chicago. “So, similarly, we provide the safety waivers for folks who have other risks, whether it’s somebody fleeing a domestic violence situation, somebody coming out of a trafficking situation, things like that. We’ve created these bypasses for folks, and this would have added to it.”

Cassidy is also pushing for a measure that would give a $500 tax credit to people and health care providers who are fleeing states that limit access to abortion or gender affirming care.

Equality Illinois is leading a push for the state to require sex education in public schools. The state provides districts with a “medically accurate, evidence-informed, response and trauma-informed guide” for sex education — but it is optional for districts to provide. Parents can also opt their students out of it.

* Purple Circle LLC CEO Amber Lengacher…

With the legislative session over for spring in Illinois, cannabis/hemp industry stakeholders across the state are regrouping and making plans for a veto session in the fall. Hemp advocates and supporters in Illinois must unite over the summer to ensure that their industry is protected, and their business models can continue to flourish. […]

I recently chatted with Rep. Ford about this spring session and his plan for 2024’s veto session.

Here’s what he had to tell me:

Today, after much work and consideration, hemp products are still unregulated in Illinois. Last year, I introduced Illinois House Bill 4161, which would create a regulatory framework for hemp products and establish important requirements like licensing, testing, and labeling. I also introduced HB4193 that would create age minimums for hemp product purchases, limited to adults who are 21 years of age or older. This year, I introduced HB5306, the Industrial Hemp Act, designed to accomplish those same goals.

I agree with Gov. JB Pritzker that a hemp regulatory proposal must be top priority during veto session this fall. I joined him in his disappointment that we couldn’t get a bill through in spring. Going into veto session, I hope to work with all stakeholders to educate lawmakers on solutions to our communities’ issues while still leaving opportunities for this growing industry to flourish in Illinois. We will then finalize a bill that will accomplish all stakeholder goals. Anything else could put hundreds – if not thousands – of Illinois companies out of business and Illinoisans out of work, while starting a new war on drugs in Illinois. Our communities have been targeted and destroyed by this failed war, and it is past time to repair the harm, not create prohibition 2.0.

* Tribune…

A crying 6-year-old was brought to an emergency department after being found sluggish and cold to the touch. The parents had been at work when the babysitter gave several cookies from the kitchen to the child as a snack. Each cookie contained several adult doses of THC, the part of marijuana that gets people high. The child was admitted to the hospital overnight and recovered.

This was just one of 244 cases of cannabis edible exposures among children 5 and younger reported in 2023 to the Illinois Poison Center. […]

Illinois lawmakers couldn’t decide between regulating or banning the products this spring, so they did nothing. Unlike licensed cannabis, which must undergo testing and labeling and is only available to those 21 and over, hemp products remain unregulated, without even a legal age restriction, though some companies impose their own age limits and testing.

Nevertheless, exposures appear to occur with both licensed and unlicensed products, said Dr. Michael Wahl, medical director of the poison center.

* Capitol News Illinois…

Among the bills that did not pass is a piece of legislation that sought to restore protections for wetlands stripped last year in a United States Supreme Court decision. In May 2023, federal protections for wetlands were gutted, weakening Clean Water Act protections for millions of acres of wetlands across the U.S.

An Illinois bill, SB 771, or the Wetlands Protection Act, that would have reinstated those protections in the state passed in committee, but failed to make it to the chamber floors of the General Assembly. The bill will be considered again during the veto session this fall. […]

Sponsors of the bill said a law is needed for Illinois to fill the gap left by the Supreme Court decision. The reinstatement of regulations would ultimately help reduce flooding in vulnerable communities and improve water quality, proponents said.

One major opponent of the legislation was the Illinois Farm Bureau, which also signed onto the federal lawsuit that eventually reversed wetland protections. Chris Davis, the farm bureau’s director of state legislation, said its opposition stemmed from not enough protections for landowners. […]

Sen. Laura Ellman (D-Naperville), sponsor of the senate Wetlands Protection Bill, said that she’s still committed to working with the farm bureau this summer.

* Fox2 Now…

Illinois State Rep. Harry Benton (D-Plainfield) formally introduced HB 5860 on June 11.

The bill would amend Illinois’ Flag Display Act and prohibit officials from knowingly displaying or causing to display “the United States national flag with the union down on government property.” […]

A separate, but closely related bill (HB 5861) would amend Illinois’ Flag Display Act to fine government officials up to $25,000 for flying an American flag upside down on public property. The current penalty for a violation is anywhere from $1-15.

Neither bill addresses whether a government official or someone else could display an American flag upside down on private property.

* Ben Szalinski…

3 Comments

|

Stop Illinois From Making Credit Cards Hard To Use

Friday, Jun 21, 2024 - Posted by Advertising Department

[The following is a paid advertisement.]

Lawmakers in Springfield recently negotiated a back-room deal that could radically change the way small businesses and consumers use their credit and debit cards to give corporate megastores a multi-million dollar giveaway.

This new law could:

- Force separate cash payments on sales tax and tips

- Reduce consumer privacy by exposing more information on your purchases

- Create costly operational nightmares and paperwork burdens for small businesses

This first-of-its-kind, untested mandate would create chaos, removing credit and debit cards as the safe, secure and hassle-free way to pay in Illinois — all so giant, out-of-state corporations can look a little better to their shareholders.

Prevent credit card chaos. Learn more at guardyourcard.com/illinois.

Comments Off

|

Question of the day

Friday, Jun 21, 2024 - Posted by Rich Miller

* OK, right up front I need to disclose that I was given the option of receiving a free cicada bobblehead as part of the marketing for this post, which I accepted. But I really would’ve posted it anyway because it’s a pretty cool thing and I’ve purchased other products from this company in the past…

This morning, the National Bobblehead Hall of Fame and Museum unveiled the first Cicada Bobblehead. Due to an unusual overlap of the lifecycles of two types (or broods) of cicadas, trillions of the insects are expected to emerge in the United States by the end of June, especially in the Midwest. The 13- and 17-year cicadas only emerge in the midwestern and eastern U.S. in the same year every 221 years, with 2024 being the first such year since 1803. The first-ever Cicada Bobblehead is being produced by the National Bobblehead Hall of Fame and Museum.

Positioned on a base bearing its name across the front with a grass-like texture on top, the cicada bobblehead features its prominent red eyes set wide apart, short antennae, and membranous wings. The bobbleheads, which will be individually numbered, are only available through the National Bobblehead Hall of Fame and Museum’s Online Store. Expected to ship in November, the bobbleheads cost $30 each, plus a flat-rate shipping charge of $8 per order. […]

“We’re excited to create this bobblehead celebrating the triumphant return of the cicada,” National Bobblehead Hall of Fame and Museum co-founder and CEO Phil Sklar said. “The sounds of summer have taken on a new meaning in 2024 with the arrival of the popular insects. This bobblehead is a must-have for cicada lovers everywhere!”

Click here if you want to buy one…

Other than the free sample, I won’t make anything else off of this. But maybe we can convince the “Hall of Fame and Museum” to produce an Illinois politics bobblehead line.

* Meanwhile, from the Sun-Times…

The periodical cicadas, which emerge from underground in the spring every 17 years, are expected to die off by the end of June, according to Morton Arboretum scientists. When they die off, millions of the dead insects will cover the ground in suburban Chicago and much of northern Illinois.

* The Question: What has the cicada situation been like by you?

47 Comments

|

Open thread

Friday, Jun 21, 2024 - Posted by Isabel Miller

* What’s going on in your part of Illinois?…

2 Comments

|

Isabel’s morning briefing

Friday, Jun 21, 2024 - Posted by Isabel Miller

* ICYMI: Businesses closed into next week after fire on East Adams Street in Springfield. SJ-R…

- The 400 block of East Adams will remain closed indefinitely until remains of the building are demolished, final demo is set for Tuesday.

- The cause of the fire is still undetermined.

- All businesses – save for Buzz Bomb Brewing Co which has a separate side entrance – will be closed for the following week at least for the building’s demolition.

* Related stories…

The fire also left an IMA employee without a home or belongings. Click here for her GoFundMe.

* Jake Lewis…

*** Isabel’s Top Picks ***

* Sun-Times | Illinois a blue haven for gender affirming care, but LGBTQ+ advocates say housing, safety still a concern: An effort is also underway to waive or minimize filing fees for transgender people as they request a legal name change — and allow the petitioner to request that a court seal the name change if public disclosure may harm their health or safety. The bill is aimed at protecting other vulnerable populations, including survivors of violence and refugees. Legislation stalled in the Illinois Senate this spring. “Obviously, we have to think about the whole state. And here in Chicago, you can live relatively anonymously. But, you’re living in a small town and you have to publish in your local newspaper that you’re transitioning, that’s going to put you at significant risk,” said the bill’s sponsor, State Rep. Kelly Cassidy, D-Chicago.

* The Atlantic | The Truth About America’s Most Common Surgery: Despite the C-section being the country’s most common surgery, many expectant parents are not encouraged to seek out information about the specifics. This leaves mothers poorly equipped for the procedure’s aftermath, especially when the surgery is unplanned. At the beginning of the book, Somerstein recounts her own emergency C-section, during which the anesthesia failed and the obstetric staff disregarded her anguish. “I felt it all: the separation of my rectus muscles; the scissors used to move my bladder; the scalpel, with which he ‘incised’ my uterus,” she writes. “Yet the operation continued. I was expected to bear the pain.” Invisible Labor follows her search for context about this traumatic experience, and her desire to understand why women’s pain is so often treated as psychological rather than physiological.

* WaPo | Reggie Jackson shares searing stories of racism at Negro Leagues tribute: As a young member of the Athletics’ organization in 1967, just before the major league club moved from Kansas City to Oakland, Jackson played for Birmingham at Rickwood Field and other ballparks in the South. On Thursday, he said returning to Birmingham was “not easy.” “The racism, when I played here, the difficulty of going through different places where we traveled — fortunately, I had a manager and I had players on the team who helped me get through it,” he said.

*** Statewide ***

* Daily Herald | State Republican Party chair quits, Del Mar hopes to fill void: Palatine Republican and former lieutenant governor candidate Aaron Del Mar announced Thursday he will seek the chairman’s job. “Moving forward, if my peers believe in me and give me the opportunity to lead this party, the Democrats better be ready. I’m no milquetoast,” said Del Mar, a State Central Committee member.

* WGEM | SkillsUSA Illinois leader excited about funding increase for career and technical education: Career and Technical Education (CTE) programs in Illinois are getting a boost new state budget. The fiscal year 2025 budget will invest $58 million in CTE programs, a $10.3 million increase. […] SkillsUSA Illinois Executive Director Eric Hill said the money will allow it to expand in underserved rural areas and connect more students with real-world learning experiences.

* AGRINEWS | Illinois Soybean Association celebrating 60 seasons of success: The Illinois Soybean Association will observe its 60th anniversary with special events and commemorations throughout the year. Over those six decades, ISA has worked, in tandem with farmers and industry, to help Illinois’ soybean farmers grow better soybeans and find new markets for their products.

*** Chicago ***

* ABC Chicago | Democratic National Convention officials tour LGBTQ+ businesses ahead of Chicago DNC: “Part of our job as a hosting is to make sure that that is equitably distributed, especially to growing businesses,” DNC Senior Director of Community and Civic Engagement Mo Green said. Side Track, a bar that has been welcoming the LGBTQ+ community for over four decade, is ready.

* Sun-Times | Pilsen ‘serial polluter’ Sims Metal should not get city permit, groups say: Ahead of a community meeting Friday night, multiple organizations are warning Chicago’s public health department that Sims Metal Management should not receive a new permit because it hasn’t yet built and tested pollution controls required after a state lawsuit. In addition to the pollution controls, some community members are asking for a health impact study that would take into account other sources in the area that contribute to poor air quality.

* Sun-Times | White Sox lose for 15th time after leading in seventh inning:

“We let one get away from us,” manager Pedro Grifol said. So it goes for the Sox, who fell to a major-league-worst 20-56 despite six innings of one-run ball from Flexen and RBI from Luis Robert Jr. (double), Andrew Vaughn (single) and Andrew Benintendi (sacrifice fly) against Spencer Arrighetti in the fifth inning.

* Sun-Times | Angel Reese makes WNBA history as first rookie with seven consecutive double doubles: On Thursday, as the Sky (5-9) snapped their four-game losing streak with an 83-72 victory over the Wings, Reese made history with her seventh consecutive double-double. It’s the longest double-double streak by a rookie in WNBA history and the third-longest streak by any player. With it comes a message: Not only is Reese’s game translating just fine, but she’s proving to be the biggest steal of the draft, with a very strong case for Rookie of the Year developing.

*** Cook County and Suburbs ***

* Daily Herald | ‘This is not a moment of pride for anybody’: McHenry County Board scales back Pride Month resolution: The scaled-back version includes language such as “Pride Month offers a unique and significant opportunity to affirm and uphold the rights of all to freedom of choice in sexual orientation” and “Pride Month further upholds the ideal that LGBTQ+ residents of McHenry County, as all residents, have the right to live their lives with freedom from fear of harassment; exclusion; educational, housing or employment bias.” The original proclamation included language referencing LGBTQ people serving in government and the military, as well as those who are “forced to hide their identities and live in secrecy and fear due to the criminalization of their relationships,” among other things.

* Daily Southtown | Will County Board members question vote on Pride month resolution: The Will County Board voted Thursday to approve a proclamation recognizing June as LGBTQIA+ Pride Month, but not before some board members questioned why the proclamation was on the agenda. “I would like to know where’s the representation for the traditional family,” said Julie Berkowicz, a Republican from Naperville, who was one of two Republicans questioning why the board was voting on the Pride proclamation.

* Lake County News-Sun | Robert Crimo III expected to change not guilty plea in Highland Park July 4th mass shooting: Lake County State’s Attorney Eric Rinehart confirmed Thursday night that Crimo, who had pleaded not guilty to 117 felony counts, is expected to change his plea at a Wednesday hearing before Judge Victoria Rossetti. Rinehart declined to discuss specifics of the plea change, other than making a brief statement. “We have been continuing to work with victims and survivors as the situation develops,” he said.

* ABC Chicago | Rescheduled Thornton Township meeting devolves into chaos as residents complain to Tiffany Henyard: As public comment began, people were upset initially over the amount of time allotted for public comment. “This has got to stop,” a resident said. “Stop shutting down the voice of the people, and you won’t have a problem, because we are going to speak whether you want us to speak or not.”

* The Root | All The Alleged Schemes, Scandals and Shenanigans That Keep This Chicago-Area ‘Super Mayor’ In The News: On top of a recent lawsuit from a previous employee claiming wrongful termination for refusing to aid in her alleged “political schemes,” Henyard’s reputation has been smacked left and right by claims of corruption. She’s denied most if not all of the claims stacked against her, claiming she’s got receipts to prove “fact over fiction.” If you want to keep track of the legal battle, here’s 15 allegations Henyard is going up against.

* Sun-Times | Michelle Mbekeani leaving Cook County state’s attorney’s office 6 months after taking new role: The website, Periodsentence.com, also drew the ire of a judge at the courthouse, who believed her involvement with the organization conflicted with her role in the prosecutor’s office. Judge Michael McHale ordered Mbekeani banned from his courtroom in January after holding a conflicts hearing in the case of Dante Brown, who is fighting to overturn his double murder conviction. She told the judge the website was a “class project” and “not a real business,” according to the judge’s order. When McHale learned that Mbekeani had registered the business with the Illinois secretary of state and asked her to explain, he said he found her answers “duplicitous, incomplete, evasive and untruthful.”

*** Downstate ***

* Door County Pulse | Craig Blietz Painting Hangs in the Illinois Governor’s Mansion: A call from an architect friend in Chicago made Door County artist Craig Blietz aware that a painting of his was featured on the opening page of a book by M.K. Pritzker, wife of Illinois governor J.B. Pritzker. “My friend received the book as a present from his wife and had no idea anything of mine was in there,” Blietz said.

*** National ***

* ProPublica | How a Network of Nonprofits Enriches Fundraisers While Spending Almost Nothing on Its Stated Causes: ProPublica identified a group of connected political nonprofits — with names like American Breast Cancer Coalition and National Coalition for Disabled Veterans — that appear to be funneling more than 90% of donations to fundraisers.

* ABC Chicago | Why millions of student loan borrowers will have lower payments starting in July: For most borrowers, the SAVE plan requires a lower monthly payment than other federal student loan repayment plans, and it cancels student debt for some borrowers after they make as few as 10 years of payments. More than 8 million people have enrolled in the SAVE plan to date.

4 Comments

|

|

Comments Off

|

Live coverage

Friday, Jun 21, 2024 - Posted by Isabel Miller

* You can click here or here to follow breaking news. It’s the best we can do unless or until Twitter gets its act together.

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|