A collection of budget responses

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* Senate President Don Harmon…

“I’m not accustomed to good news in a budget speech. This is a budget proposal unlike any I’ve seen in my time in the Senate. It speaks to the work we’ve done, together, to bring stability to our state finances. That stability allows us to invest back in our state and provide relief to those hit hardest by the pandemic and associated economic downturn. There’s a lot to like with this plan, and I look forward to working with the governor to produce a final product.”

* Speaker Chris Welch…

The governor’s budget address lays out a clear path to continue moving our state toward financial stability and surety while prioritizing hardworking Illinoisans. I could not be more proud of this state and the significant progress we’ve made in such a short amount of time.

It’s hard to imagine, but just a few years ago under the previous Republican administration we had a bill backlog of $17 billion, human service programs were decimated, our credit rating reached near junk status and Illinoisans were suffering because of it. It is thanks to hard work and responsible fiscal management that we are now in the position to discuss property tax relief, tax cuts for everyday necessities, millions in new spending for education, major investments in public safety and nearly eliminating our bill-payment backlog.

Our future is much brighter and our fiscal outlook is strong. This proposal by Governor Pritzker is an excellent starting point for our legislative budget negotiations. We cannot lose sight of the fact that we are still very much in the midst of an unprecedented pandemic and we must continue providing relief to people who are struggling. I have full confidence in Leader Greg Harris, his budget team, our appropriations committees and our Democratic Caucus to produce a final product that continues to build a better Illinois for all.

* Economic Security for Illinois…

In his State of the State budget address, Gov. Pritzker failed to include a popular proposal now up for debate in the General Assembly, which would provide 4.5 million low-income Illinoisans tax relief via an expansion to the Earned Income Credit. Shortly before the speech, the independent Center for Tax and Budget Accountability released a new report from finding the proposal would bring $1 billion in economic benefits to local economies, more than double the cost of the proposal and an overall net benefit of $600 million to the state.

“We are disappointed that the Governor’s ‘Family Relief Plan’ left low-income families behind. We are still in a pandemic, where families—particularly low-income families—continue to struggle. An expanded Earned Income Credit and new Child Tax Credit would directly benefit Illinoisans by putting cash in their hands and indirectly drive local economic investment for Illinois to build back better, ” said Harish I. Patel, Director of Economic Security for Illinois, a group which leads the Cost-of-Living Refund Coalition. “Our coalition will continue to fight alongside our partners in the General Assembly to provide permanent tax relief to Illinoisans who need it most.”

* A.J. Wilhelmi, President and CEO of the Illinois Health and Hospital Association…

“The Illinois Health and Hospital Association (IHA) echoes Gov. Pritzker’s heartfelt recognition of the extraordinary efforts undertaken by hospitals and healthcare workers around the state in the collective fight against COVID-19 over the last two years.

“The Governor’s budget proposal importantly allocates resources to begin addressing healthcare staffing shortages, which have been worsened by the pandemic. We support the Governor’s proposed funding for programs designed to help bring more workers into healthcare professions, and to help recruit and retain healthcare workers.

“Continuing to fully support our heroic, but fatigued, hospitals and healthcare workers will ensure that the Illinois hospital community remains viable and strong as they care for their patients in their time of need.

“IHA and the hospital community stand ready to work with the Governor and the General Assembly to enact a budget that ensures Illinois will emerge from this pandemic with its robust and innovative healthcare delivery system intact—and with hospitals having the necessary support to continue providing high-quality services to all Illinoisans.”

* Chicagoland Chamber…

“Between the commitment to further allocate funds to our state’s pensions, invest in workforce and economic development, increase funding for public safety, and pay down Illinois’ debt, we commend the Governor for the fiscal approach taken in this year’s proposed budget. Chicago’s business community has endured great hardship over the past several years, from an ongoing pandemic to rising property tax assessments and bills as well as violent crime that threatens every neighborhood throughout the city. The Chicagoland Chamber of Commerce stands ready to work with elected officials to ensure these proposed policies are enacted as well as to provide needed resources to our business community to both further economic growth and recovery and foster job creation and opportunity across Chicago and the state of Illinois,” said Jack Lavin, president & CEO, Chicagoland Chamber of Commerce.

* Illinois State Medical Society…

Illinois doctors are grateful that this budget commits to eliminating the reimbursement backlog for people covered under the state’s health plan. For many years medical practices serving state employees and retirees struggled as they waited months and months for reimbursement. The length of delayed reimbursement has improved in recent years and with this budget, if approved, should go away. This is good news.

In addition, ISMS appreciates the Governor’s acknowledgement of the Illinois medical community during this pandemic and his proposal to eliminate licensure fees for healthcare professionals. And we support funding the loan forgiveness programs that will help more doctors get into rural and underserved areas.

We also back the Governor’s ongoing efforts to continue to support the public health measures needed to mitigate COVID-19.

* IEC…

“The Illinois Environmental Council applauds Gov. JB Pritzker for proposing a state budget that prioritizes resources for combatting climate change, a first in Illinois history. Never before has an Illinois governor outlined such a strong budgetary commitment to climate solutions, including enactment of the Climate & Equitable Jobs Act, significant investments in electric vehicle infrastructure and support for clean energy and clean transportation manufacturing. Today’s proposal includes important first steps to rebuilding and adequately resourcing Illinois’ environmental and conservation state agencies, including increased staffing, something IEC has repeatedly called for. Finally, we are also thrilled to see the $113 million investment in replacing toxic lead service lines across the state.

“While more still needs to be done to safeguard our state’s natural resources the public health of all Illinoisans, these investments and those in the Climate & Equitable Jobs Act mark a turning point for our state, and we look forward to working with Gov. Prizkter and his administration to continue building Illinois’ nationally recognized climate leadership.”

* INA…

The Illinois Nurses Association supports Governor J.B. Pritzker’s plans to provide relief and financial support for important elements of the Illinois nursing work force. The Governor laid out his plans for Illinois in a combined State of the State and budget address today.

Nurses in Illinois have been serving patients in a pandemic that now enters its third year—nurses are stressed out, burned out, underpaid and underappreciated. We welcome the Governor’s support and are looking forward to working with him to help build the nursing workforce of the future.

INA officials also support the Governor’s efforts to ease the costs of obtaining a nursing license and his administration’s investment in nurses through the Advancement of the Healthcare Workforce Program and the Nursing Scholarship Education Program.

These programs can play an important role in recruiting new nurses to the health care workforce to help treat patients in the future.

* Illinois Hotel & Lodging Association…

“The hospitality and tourism industry, which has historically served as an anchor for Illinois’ economy, has been devastated by the pandemic – losing more than $111.8 billion in room revenue alone nationally. These losses have contributed to widespread layoffs, with many workers unable to return as recreational and business travel continues to be disrupted. Despite these struggles, Gov. J.B. Pritzker’s budget proposal neglected to offer any relief to the industry, which prior to the pandemic brought in $4 billion a year in state and local taxes and supported more than 290,000 jobs. As the governor looks for ways to support working families, we call on him to embrace our Hotel Jobs Recovery Plan, which would allocate $250 million in American Rescue Plan Act funds to hotels across the state. We urge the legislature and the Governor to support this initiative. This plan is an essential part of getting the industry, and our tourism and hospitality economy, back on stable footing and we look forward to working with the governor to make it a reality,” said Michael Jacobson, president & CEO, Illinois Hotel & Lodging Association.

* Illinois Federation of Teachers President Dan Montgomery…

“From the start of the pandemic, Governor Pritzker has steadfastly followed the science to protect our communities and move our state forward. We thank him for establishing mask and vaccine mandates that are helping keep our schools open and students and staff safe.

“The budget Governor Pritzker proposed today prioritizes the needs of students and educators and the delivery of public services to our most vulnerable Illinoisans. His proposed $350 million increase is a step toward adequately funding K-12 schools, especially in our neediest communities. But preK-12 funding is still billions of dollars short of the Evidence Based-Model funding target, which would provide the resources to educate every Illinois child well, no matter their zip code. We urge Governor Pritzker and the Illinois General Assembly to work toward fully funding the Evidence Based-Model.

“Critically, the state’s higher education system is suffering from decades of disinvestment. We are encouraged by the supplemental FY22 increase in funding for community colleges and universities that carries over to FY23. We urge the legislature to include this vital increase in higher education funding in the final budget.

“We also welcome the long-overdue recognition that the state must pay its bills – including the unfunded pension liability. The governor has proposed $500 million in pension funding over and above the required payment. This saves the state money in the long term and it’s the right thing to do.

“The pandemic will have lasting economic effects on students, educators, school staff, and communities of color. We applaud the governor for taking the necessary steps to assist in their recovery by providing some tax relief. The cuts to grocery and gas taxes and doubling the state property tax rebate will help provide the support that Illinois families need right now.

“The IFT looks forward to continuing to work with Governor Pritzker as he focuses on the state’s economic recovery from the pandemic.”

* SEIU Healthcare…

“As a union of the frontline home care, child care and healthcare workers who have experienced the direct impact of underfunded public services greatly exacerbated by a pandemic, we applaud the Governor’s continued commitment to responsible fiscal management.

“The Governor’s proposed budget is a step in the right direction, drawing upon the state’s strong economic performance and available Federal funding to pay for desperately needed rate increases for home care and child care workers as well as investment in schools, early childhood education, nursing home rate reform, mental health care, and the healthcare workforce in general.

“While the budget released today will provide crucial help to the workers and communities hardest hit by the pandemic, additional investment is still needed. We look forward to working with the Governor and the General Assembly to address the need for additional investment in crucial care services and infrastructure in communities across the state.

* Responsible Budget Coalition…

As a coalition of the state’s leading advocacy, human service, community and labor organizations, we judge any budget by these principles: It must contain adequate revenue, fairly raised, and it must avoid cuts to vital programs and services.

Sound fiscal management has put our state in a position to continue funding for many public services despite the COVID pandemic. With the state’s strong economic performance and important assistance from the federal government, we have more funds available to help all Illinoisans thrive, including those hardest hit by the ongoing pandemic.

The budget released today is a step in that direction. We are pleased with the funding increases for education as well as the focus on a number of other one time investments. However, Illinois must do more to focus on budget policies that would provide adequate revenue to support critical programs along with long-term tax relief to the lowest income people, by requiring the wealthy to pay their fair share.

We look forward to working with the Governor and the General Assembly to pass a budget that meets our moral obligation to fully fund education, health care, and human services. RBC will continue to further our mission to ensure that Illinois stays on sound financial footing as well as meeting the needs of its’ people. Working together, we can do both.

* Illinois Partners for Human Service…

Illinois Partners for Human Service, a coalition of more than 850 health and human service providers across the state of Illinois, is encouraged by Governor Pritzker’s FY23 budget proposal. We appreciate the priorities outlined in this budget for the health and human service sector and commend the significant investments proposed. Specifically, we are glad to see rate increases for many health and human services programs, including Behavioral Health, Developmental Disability Services, Childcare, the Community Care Program, and other key investments that will strengthen our sector and our communities.

Our health and human service coalition partners have been on the frontlines navigating this pandemic from the onset, and have tirelessly shouldered the burden of care for our communities. While state and federal relief dollars have been directed to our sector over the past two years, very little of this funding has addressed the systemic challenges facing the health and human services workforce. This budget is definitely a step in the right direction. At the same time, more work needs to be done to rectify the consequences of twenty years of disinvestment in the health and human service workforce in our state.

We look forward to working with the administration and our legislators to do everything possible to reduce administrative burden and ensure funding is directed to community providers. These organizations are trusted by those hardest hit by this pandemic, and their work is essential to the well-being of all Illinoisans.

* IMA…

“Facing record inflation, supply chain disruptions and workforce shortages, manufacturers across Illinois need support from policymakers to continue investing in our communities, growing our economy, and ensuring consumers receive the medicines, food and important goods they rely on. While we are encouraged by some of the priorities outlined by the Governor, including a significant investment in job training and workforce development programs, a focus on manufacturing careers, enhanced pension payment and the extension of the critical EDGE tax incentive, we must not lose sight of long-term challenges. These include policies that increase operating costs on employers and threaten job growth, such as $4.5 billion in debt plaguing the state’s Unemployment Insurance Trust Fund,” said Mark Denzler, president & CEO of the Illinois Manufacturers’ Association. “Manufacturers have time and again demonstrated our willingness to take on tough challenges and solve problems, and we remain prepared to work with the Governor and lawmakers to find solutions.”

…Adding… By Amdor’s request…

…Adding… Community colleges…

The Illinois Community College Trustees Association and the Illinois Council of Community College Presidents applaud Governor Pritzker and his administration for their planned investment in higher education through the FY 2023 budget, and support the proposed funding increases to operationalize strategies outlined in the collectively developed plan A Thriving Illinois: Higher Education Paths to Equity, Sustainability and Growth.

An unprecedented increase of $122 million in MAP funding will ensure more equitable access to higher education for all Illinois residents. This increase will also enable MAP grants to cover a greater portion of students’ tuition costs and expand funding eligibility to students pursuing short-term certificates or credentials in fields that meet essential workforce needs in our local communities, such as commercial driver’s license (CDL) and certified nursing assistant (CNA) credentials.

Illinois community colleges stand ready to partner with the Governor’s Office in the new and innovative Pipeline for the Advancement of the Healthcare (PATH) workforce program to support and expand opportunities for growing the nursing and healthcare worker pipeline. The $25 million in funding will assist community colleges with enhancing programming and wrap-around services to recruit future healthcare workers, remove barriers to entry into healthcare fields for low-income, first generation and minority students, and develop career advancement pathways for incumbent healthcare workers. These steps are essential to addressing unprecedented healthcare worker shortages and provide a ready supply of future workers.

The ongoing pandemic combined with years of near stagnant funding have strained higher education budgets, programming and services. A five percent increase to community college operational funding, and the addition of supplemental funding opportunities, will further strengthen our local institutions while easing the financial burden on local taxpayers and students.

Collectively, the proposed investments in higher education will assist the state in closing historic equity gaps and improve student outcomes for underrepresented students group, while retaining Illinois residents and creating pathways for development of a skilled workforce in key areas of the labor force to support the state’s business and industry.

Illinois community colleges are proud to work collaboratively with Governor Pritzker’s administration and our legislative leaders to maintain Illinois’ leadership as one of the most respected and progressive higher education systems in the nation, and we strongly support the proposed FY 2023 budget.

5 Comments

|

Republicans angry!

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* ILGOP…

There is an adage in politics that says the worse the internal poll numbers are, the more gimmicky a candidate’s campaign proposals become. For Governor JB Pritzker, 2022 is shaping up to be a bad year for his electoral hopes as crime, corruption, and high taxes continue running roughshod over Illinois families.

He needs a pick-me-up and this year’s joint budget and State of the State address is his latest attempt at distracting Illinoisans from his disastrous leadership and well documented record of asking us to pay more for a state government that doesn’t work.

Despite today’s election year gimmicks, Pritzker has a consistent record of supporting tax hikes. Sometimes he was successful in enacting them, and sometimes he was not. Let’s check the tape:

• Pritzker spent $58 million of his own money to try and convince Illinoisans to change the state constitution allowing for a massive income tax hike and the ability for Springfield lawmakers to increase middle class taxes whenever they want. Luckily, Illinois families said no to the largest tax hike in state history.

• Failing to pass the largest tax hike in Illinois history, Pritzker then turned to small businesses, increasing taxes by over $600 million on job creators across the state.

• When the federal bailout disappears and Pritzker’s out-of-control spending sends us even deeper into debt, Pritzker’s already telegraphed what he will do next: raise the income tax by 20%.

“Pritzker has never once pursued true property tax relief for Illinois families despite billions of dollars in federal bailout money flowing to our state, complete Democrat control at the capitol, and three years to get it done,” said ILGOP Chairman Don Tracy. “And now he has the audacity to trot out these campaign gimmicks that pale in comparison to the $5.2 billion in tax and fee hikes he has already imposed on us? Pritzker is a proven tax-hiker, and that’s why we need a Governor who will provide permanent property tax relief, spend within our means, and lower taxes.”

Most of those tax and fee hikes were approved in 2019 and included Republican votes. He didn’t impose anything.

…Adding… Gary Rabine sent out this press release 18 minutes before the governor was set to start speaking…

“Today we witnessed how out of touch our billionaire Governor, JB Pritzker, is with the people of Illinois. In his State of the State/Budget address, he described the State of Illinois in terms that only someone who spends his days in the cocoon of a North-side mansion or private jet could use.”

“JB Pritzker has not done one thing to improve the fundamental fiscal trajectory of the state. Biden paid off JB’s Illinois credit cards last year, but we are still in a fiscal death spiral. A one-time bailout from the federal government does not equate with sound fiscal management. Millions of dollars spent on TV and digital ads doesn’t turn fantasy into reality either.”

“The truth is that Illinois, outside of the Astor Street Mansion, is far different than what JB described. Chicago and its suburbs are the crime capitols of the country. Our unfunded public pension liability is at $130 billion – the worst in the nation. Our state has lost hundreds of thousands of jobs due to JB’s heavy handed, unilateral decision to shut down the state’s economy. We are the highest taxed state in the country and more people left Illinois in the last decade than any other state.”

“All might be well with the wine and cheese crowd but for the rest of us, it’s time for a new direction in Illinois.”

…Adding… Richard Irvin…

“It is no surprise that the Tax-Hiker-In-Chief is attempting to rewrite history today to mislead Illinois voters in an election year with gimmicks that rely on a disappearing federal bailout. This is the same governor who pushed for the largest tax hike in our state’s history on Illinois families and businesses, and we know he plans to raise billions more in taxes when the federal money runs out. The only way to stop Pritzker’s permanent tax hike campaign is at the ballot box in November.”

…Adding… House GOP Leader Durkin…

“The governor’s budget address is always a wish-list, and this year it’s clear that the governor wishes to be reelected. The budget laid out by Governor Pritzker today is packed with gimmicks and one-time tricks, but no structural reforms. The people of Illinois deserve a governor who will be honest and work to actually fix things like property taxes and out-of-control crime.”

* Politico…

House Speaker Emanuel “Chris” Welch will be listening for comments on Covid relief: “The surge we had in December and January reminds us that we’re still in the midst of a global pandemic and there’s more relief needed, and so I’m looking forward to hearing the governor’s ideas on that,” Welch said in an interview.

Senate President Don Harmon hopes to hear Pritzker “make a serious investment in public safety. in building up the ranks of our state police, and ensuring local governments have the resources to add and train local police officers and give them the equipment that they need.”

Republicans aren’t wowed by Pritzker’s plan for temporary tax cuts and property tax rebates, seeing it as an election-year gimmick.

State Rep. Blaine Wilhour, who represents part of southern Illinois, hopes the governor might defend what rights parents have to make decisions about their child’s health and having their kids vaccinated. “Parents need more rights and respect than what they get,” he told Playbook.

And in a statement, Senate Minority Leader Dan McConchie said instead of “short-term, one-time relief,” what Illinois families “really need are long-lasting solutions that make it affordable to live here.”

* Speaking of the budget…

Snow storm stiff arm: Pritzker to deliver State of State from Old State Capitol after House cancels session

[…] Pritzker’s closest aides scrambled to find a backup venue after a severe snow storm forecast forced the House and Senate to send their members home and cancel the week of scheduled legislative session. Without an invitation from the House, the governor had no grand stage to deliver his speech, and state law required him to deliver his budget address on the first Wednesday in February this year.

Um, no. Almost immediately after the decision to cancel session was made by the three Democratic leaders (including the governor) Monday evening, the governor’s people were telling me they wanted Pritzker to give his State of the State/budget address at the Old State Capitol. They only “scrambled” because they were unsure at first if the venue would be available. But the place was ideal for them because, unlike the House chamber, the Old State Capitol has a smallish chamber and they envisioned a smallish audience in attendance (including, as it now turns out, GOMB staffers who’ve never personally witnessed a budget address before, which is pretty cool). Also, state law only requires the governor to submit his budget plan to the General Assembly. He could’ve just sent them the text of his speech and his proposed legislation.

* But, just to be on the safe side, I reached out to House Speaker Chris Welch’s spokesperson Jaclyn Driscoll for comment…

We never disinvited the governor. And I am confident in saying we would have worked with him if he wanted to deliver the speech in the chamber. There were so many ideas discussed [Monday], but it came down to what the Governor wanted to do. The Speaker is fairly close with the Governor and he’s not trying to ’stiff arm’ him.

Driscoll added later that the House has no rules which would’ve prohibited the governor from using the House chamber for his address.

28 Comments

|

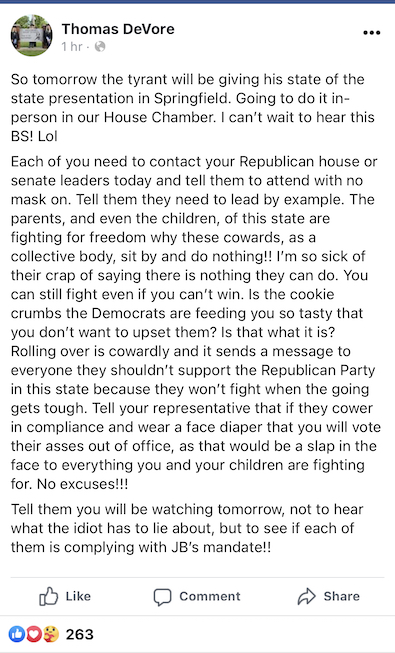

* Background is here and here if you need it. Darren Bailey talking on Facebook…

I’ve been blessed to be able to do these lives with you. I think I’ve been very consistent in my messaging and my purpose. Yesterday, fake liberal news somehow or another assumed that I was calling one of my opponents the devil. [laughs] Just go back and watch it and you make your own decision. I am honored and blessed that that fake liberal media is actually listening. Maybe some of this truth of God’s word will penetrate to their hearts and change change their lives and they’ll start reporting on truth. And wouldn’t that be awesome?

Lying is a sin.

* Speaking of which, before we get into the rest of his remarks, let’s do a bit of basic education…

What is a levy?

The amount of money a school district and/or local government (taxing districts) certifies to be raised from property tax.

* Back to Bailey…

I’m just going to share a little bit of this with you because there’s a lot of it. I ran for state Representative for the 2018 election, I ran against a tax hiker. And I was met with the full force and fury of my own people, my own party who wanted to keep me away because they wanted to keep a yes person. They wanted to keep people in that would raise taxes, would raise gas taxes. And we’ve got some of those people are running, actually, as in Lieutenant Governor positions, people who have raised your gas taxes by 20%. Do your education on these people.

But anyway, just a little bit of what’s going on. Many of your social media outlets were flooded yesterday with posts that Darren Bailey taxed elderly people out of their homes. And as a matter of fact, one of the most egregious fake news outlets and fake news reporters even came down and, and reported such a story. And I would appreciate if you just listen, if you see that story, just listen to it and dig deep into it and really listen to what you’re hearing, because what you’re hearing is not what this person is saying.

How many school board members do we have out there how many people who have served on an on a township board and and on a local community board and from time to time have have passed levies to keep your schools open, to keep certain particular interest open? You know that when you deal with a levy, that you’re not creating a burden, some tax that taxes people out of their homes ,that taxes the elderly, many of you know this and if you don’t go to your go to your county assessor and go and start talking about this, start getting yourself educated on how this works.

Many times the purpose of a levy is to fulfill what has not been promised temporarily and that’s what happened many times on the North Clay School Board. And and I was so honored and blessed by serving with the boards that I serve, we did an amazing job of communicating to the people and let giving them the option. And not just once, not trying to hide it, not trying to hide a tax increase or a levy to say that, you know, the next day people wake up and see this. Now we literally many times every time let people know how much exactly per household, you know, per 100 on your on your assessed value that this was going to cost during my term as they on those days. You can also look back and you will see the real reason why property taxes escalated all over the state. When I got on the North Clay School Board. We were one of the lowest taxed school districts in the state. When I got off, we were still well in the bottom third, but we were doing some amazing things that we were up to the 50% pay range on paying where we paid our teachers and what we were doing. We had an amazing school district but sadly enough, my state representative at the time and state government were failing to give the schools their money, you know, they have the education budgets and and many times at the end of the year, you realize that you didn’t get 200,000, 400,000 and on and there were delays. So the purpose of the levy is to fill that void.

So here’s what I went through, the 2018 election and here’s why, some of the same players are at play. And a little bit later I’m going to begin you know, letting you know who those are because they are players that are sitting in positions of power in the Illinois House of Representatives on the Republican side and they’re doing the exact same thing that they did five years ago and four years ago to try to keep me off.

Our mailboxes were full, I don’t even know which one to start with. [Holds up mailer.] ‘Darren Bailey taxed seniors out of their house 14 times when he was on the school board ,brought to you by the Illinois Republican Party.’ That’s where your money is going. [Holds up mailer.] Gosh, ‘Cash King farm subsidy Darrin Bailey, corporate welfare king.’ Think about these messages that we’ve just heard with the PPP money, with the the USDA assistance from for what you know for farms with and now that we’re taxing people. I mean, it’s endless. I got, here’s another one. Millions of dollars were spent on fliers when I was serving as, as running for this position [Holds up mailer] ‘Bought and paid for by Chicago.’ Gosh, friends, this is what we’re up against. And I asked you to get yourself educated, get yourself informed, please share these messages, push this out. This is how we’re going to do this to where, you know, until this is how we’re going to grow this movement.

Lots of words.

Please pardon all transcription errors.

…Adding… Funny and accurate…

36 Comments

|

Budget briefing live coverage

Wednesday, Feb 2, 2022 - Posted by Rich Miller

…Adding… Very handy links…

* Full budget briefing [Fixed file]

* Operating budget proposal

* Capital budget proposal

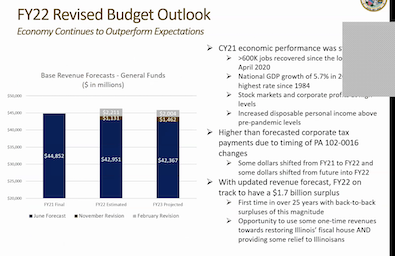

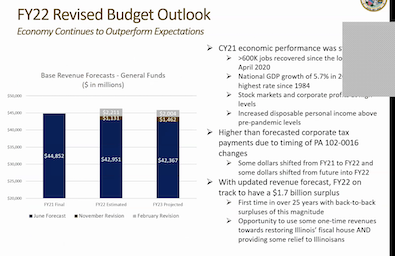

* The governor’s office has taken the embargo off of this morning’s budget briefing. They’ve revised the surplus upward for this fiscal year and next…

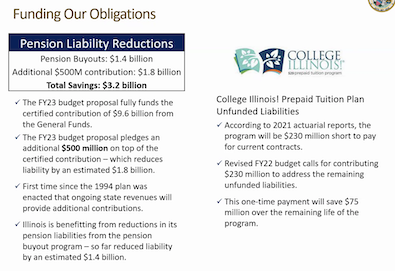

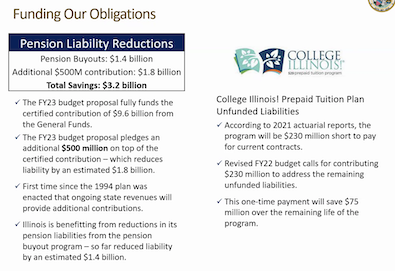

* As I told subscribers earlier, this is huge. An extra $500 million will be put into the pension systems…

* More…

* There was a problem with the screen earlier, so these are from yesterday’s briefing that I shared with subscribers…

* Revenues and spending…

* Education…

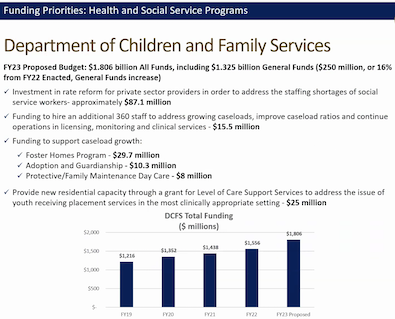

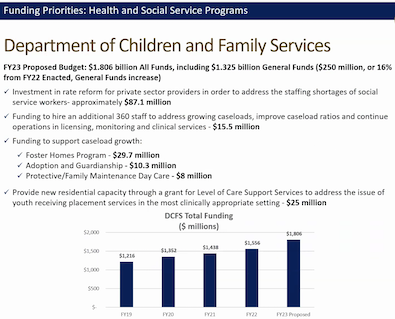

* DCFS…

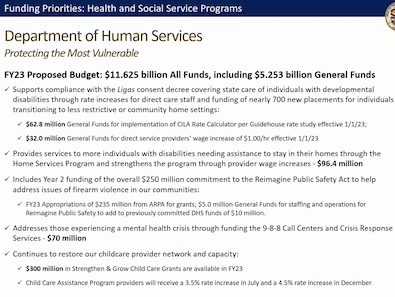

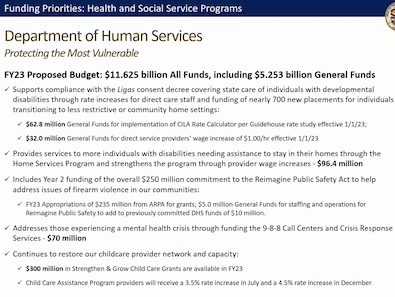

* DHS…

* Public safety and violence prevention…

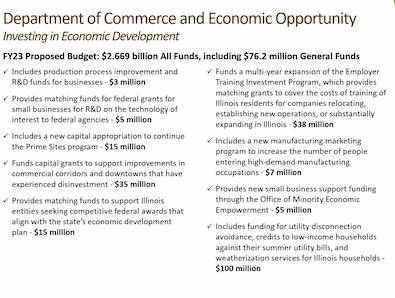

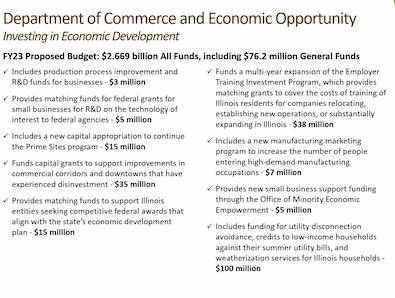

* DCEO…

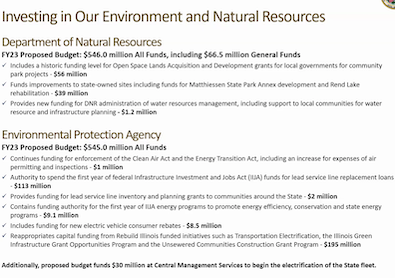

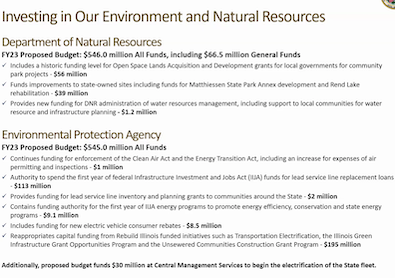

* IDNR and IEPA…

* Covid money…

* Capital…

I missed some stuff, but hopefully I’ll be able to link to a briefing book.

* Question about surpluses…

The surplus that we’re on track for in FY 22 is $1.7 billion, that is what is going to then be directed into some of our debt pay-down or Budget Stabilization Fund, and then a part of the tax relief proposal. The the surplus that’s left is the number that’s going into the accounts payable reduction.

* Any change in income tax revenue sharing with local governments? No.

* What about the unemployment insurance trust fund? Negotiations still ongoing through agreed bill process. Planning legislation by April adjournment.

* What percent of homeowners would see property tax relief? About 2 million people claim the income tax credit.

* Can you point to something that repairs a structural budget imbalance? Key part is aligning revenues with expenditures. The $500 million extra pension infusion will get the state funds to the “tread water” point, so that funding is actually paying down the debt. The massive state employee/retiree group health insurance backlog of nearly $900 million that has been around for years will be paid off if the budget is enacted.

* Do you have a Plan B for how to give drivers relief if Local 150 ends up killing your gas tax proposal? Long answer short: Not that I could discern.

31 Comments

|

* Some background is here if you need it. Mark Maxwell…

Maxwell: You can learn an awful lot about a politician combing through their voting record, especially when what they say on the campaign trail and what they do in office doesn’t quite add up.

Darren Bailey: I got ticked off at the tax increases that came in 2018.

Maxwell: Long before Darren Bailey arrived in Springfield in 2019, he was voting on issues that impacted his neighbor’s budgets,

Bailey: Serving on the school board.

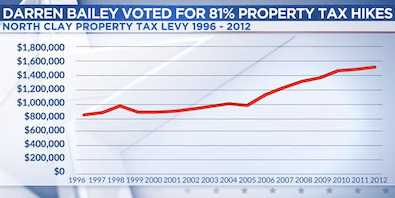

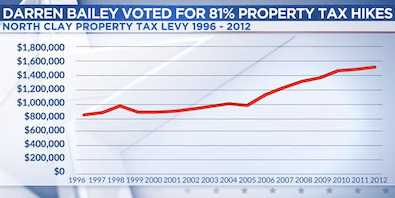

Maxwell: From 1996 to 2012, Clay County’s tax records show every time a property tax hike was on the table in the North Clay school district, Darren Bailey voted for it.

Bailey: I believe that’s a much different scenario. You know, taxing bodies have the ability to levy a certain amount.

Maxwell: When reporters pressed Bailey to explain his tax hikes, he downplayed the incremental cost increases.

Bailey: Many times it was $5 a household. I think the one time at the maximum was $19 a household.

Helen Joan-Cook: It could be a little better, especially for senior citizens.

Maxwell: 87-year-old Helen Joan-Cook lives in Bailey’s hometown on a fixed income.

Joan-Cook: Don’t go too far, when you make your house payment and everything else.

Maxwell: Over 17 years, Bailey voted to raise the property tax levy 13 times, adding up to an 81 percent increase, far higher than the rate of property tax growth in Chicago over that same span.

Joan-Cook: I just think that the taxes should be lowered, really.

Maxwell: What would it mean for you if you had a lower property tax bill?

Joan-Cook: It would mean I’d have a few dollars left over for food when I have to really cut corners.

Maxwell: Bailey blamed his votes on the state’s record low levels of state education funding.

Bailey: Many times in a small school district, state government would short school districts ,they still do it today. Sometimes we got the money a year, two years later, sometimes we didn’t.

Maxwell: On that point, Bailey is right. Illinois spent so little money on education for so long, local school districts often had to make up the difference with property tax increases. But here’s the key, when Bailey finally arrived in Springfield and had the power to do something about it, the House and Senate voted to increase state education funding three times. And three times, Bailey voted against it.

I mean… Ouch.

* Included graph…

* Ms. Joan-Cook…

Right out of central casting.

* From the Internet version…

When Grain Systems, Inc. (GSI) closed its Flora manufacturing site in Bailey’s district in 2019, the newly inaugurated state representative blamed the job losses on “tax hikers” who “keep raising taxes and increasing fees on families and businesses.”

However, long before he was taking votes in the General Assembly, Bailey was voting to extend and raise property tax levies at the North Clay School District.

Tax records at the Clay County Treasurer’s office and the Illinois Department of Revenue show that from 1996 to 2012, Bailey voted to raise the property tax levy by a combined 81%. Chicago Public Schools showed more fiscal restraint, raising its property tax levy by 57.1% over the same period.

That would be almost double the rate of inflation for the time period.

* Meanwhile, Bailey was on WGN Radio’s Lisa Dent show today. Here he is talking about Richard Irvin…

This situation with Irvin is an absolute farce and I think it’s going to fall flat on its face. Irvin is a Democrat in disguise. I think the Republicans across Illinois have already figured that out. And I think he’s probably spent what he’s got.

* On Ken Griffin backing Irvin…

We have absolutely no facts or proof that Ken Griffin is backing this. This is rumor. I’ll believe it when I see it. And and I will wait, I’ll wait expectantly for his call when he realizes that the candidates, I’m the candidate who will get Illinois back on track.

That’s the second time Bailey has made a pitch for Grif money. But just a few weeks ago, he was calling Irvin and the rest of the slate “bought and paid for candidates.” I dunno, maybe pick a lane?

* On the governor’s proposed one-year elimination of the grocery tax and freezing the Motor Fuel Tax for a year…

Well, again, I’ll believe it when I see it. It doesn’t surprise me. We’ve received over $21 billion of COVID relief that the governor has taken and unfortunately refused to get the state fiscally sound again. And yeah, I expect him to toss money to the four winds to people, and I expect him to hope that they forget the devastation and the destruction that Illinois has gone through in the last two years.

Please pardon any transcription errors.

*** UPDATE 1 *** The Irvin/Bourne campaign is pushing this video made by Darren Bailey on February 17, 2021…

* Transcript…

I think many people have become disgusted with politics. I was that way 10 years ago, I checked out. Friends we can’t check out right now because we’ve got to get ourselves educated, we’ve got to get ourselves informed. And then we’ve got to get to work and do something about it.

Get involved locally, the decisions that are made locally, they affect the property taxes that are affecting us so adversely.

As usual with Bailey, when somebody else does it - COVID loans, tax hikes, etc. - it’s bad. When he does it, well, friends, it’s good.

*** UPDATE 2 *** Irvin campaign email…

Friend,

“Over 17 years Bailey voted to raise the property tax levy 13 times, adding up to an 81 percent increase, far higher than the rate of property tax growth in Chicago”

We wanted to make sure you got to see this local news report about Darren Bailey. He may say he’s against tax increases, but as a member of his local school board he voted to increase taxes THIRTEEN TIMES by more than EIGHTY PERCENT!!

Darren Bailey Voted for 81% Property Tax Hikes

But that shouldn’t surprise you about a career politician who’s been in office for 20 years, and now running for his 4th different elected office.

87 year-old Helen Joan Cook, who lives in Bailey’s hometown, says property tax hikes like Bailey’s make it hard to afford food and thinks they should be lowered. If you agree with Helen that property taxes should be lowered, SHARE THIS VIDEO AND HOLD CAREER POLITICIANS ACCOUNTABLE.

43 Comments

|

* Press release…

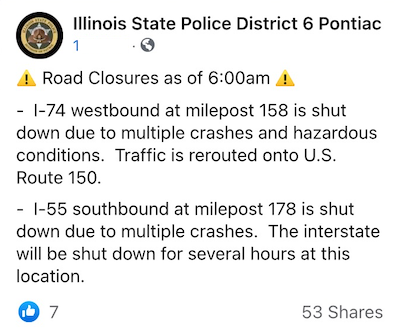

The Illinois Department of Transportation is warning the public that a major winter storm is expected to create treacherous conditions starting tonight and lasting for several days, with the potential for extremely dangerous and, at times, life-threatening travel across much of the state. Throughout Illinois, periods of heavy snow, rain, ice, high winds and bitter cold should be anticipated, leading to a likelihood of whiteout conditions and roads that will be impassable in the hardest-hit regions.

“The Illinois Department of Transportation spends the entire year preparing for snow-and-ice season and is ready to respond around the clock to this significant weather event, but clearly the public needs to be prepared for the worst-case scenario and postpone all unnecessary travel,” said Illinois Transportation Secretary Omer Osman. “Always remember, during extreme weather, the safest option is to stay home. If you must be on the roads, please be prepared for the real possibility of becoming stranded if you are unable to make it to your destination. Your cooperation and patience will be essential to keeping everyone safe the next several days.”

The National Weather Service is forecasting a winter storm warning starting later today, with mixed precipitation shifting to snow this afternoon and evening, extending into the overnight hours.

In central Illinois, along the Interstate 55, 57, 70 and 72 corridors, snow totals are expected to range between 6 and 20 inches, with the highest amounts in the Springfield, Bloomington, Champaign areas and as far north as Kankakee. Because of the intensity and amounts of snow, travel is expected to be dangerous and strongly discouraged.

Across the Chicago area, trace accumulations to more than a foot of snow are predicted. Significant ice and sleet accumulations are possible in much of southern Illinois, creating extremely slippery surfaces and slick conditions. The far northwest region of the state, Rockford and the Quad Cities, are expected to miss much of the storm.

Blowing and drifting snow will create hazardous conditions Wednesday night and Thursday, with winds gusting to 30 mph. Colder air will bring subzero temperatures by Friday morning.

Due to the long duration of the storm, sustained high winds, severe cold reducing the effectiveness of materials to treat the roads, as well as the challenges of staffing a prolonged winter weather event, IDOT is advising the public to remain patient and prepare for longer travel times to persist, with snow-and-ice response and cleanup efforts potentially lasting several days.

Statewide, IDOT has available more than 1,800 trucks and equipment to plow, treat roads and respond to weather emergencies. If you encounter a plow or any maintenance vehicle during your travels, please slow down, increase your driving distance and remain patient. Do not attempt to pass – conditions in front of the plow will be worse than behind it.

“The Illinois State Police, along with our state and local partners, are tracking this storm and stand constantly ready to meet the challenges presented by these types of weather events,” said ISP Director Brendan F. Kelly. “While we are helping motorists out of ditches and handling crashes related to this snow-and-ice storm, we want to remind the public of the Move Over Law. By slowing down and moving over, drivers are helping all first responders and stranded motorists get back home to their families safely.”

If travel is absolutely necessary:

• Drastically reduce speeds and take it slow, especially when approaching intersections, ramps, bridges and shaded areas that are prone to icing.

• Make sure your gas tank is full.

• Keep a cell phone, warm clothes, blankets, food, water, a first-aid kit, washer fluid and an ice scraper in your vehicle. Dial *999 in the Chicago area for assistance in case of emergency.

• Check the forecast and make sure someone is aware of your route and schedule.

• Reminder: Using handheld phones while driving is illegal in Illinois, unless it is an emergency.

• If you are involved in a crash or break down, remain inside your vehicle, which is your safest form of shelter. Exiting your vehicle into live traffic can have fatal consequences.

• Always wear a seat belt, whether you’re sitting in the front seat or back seat. It’s the law. Never get behind the wheel impaired.

For regular updates on statewide road conditions, visit www.gettingaroundillinois.com. You also can follow IDOT on Facebook and Twitter.

That reminds me that my truck is almost on empty. I think I’ll be taking a pause to go fill it up after I put up another post. Stay safe out there.

*** UPDATE *** Press release…

In advance of the anticipated severe winter storm expected to hit the entire state, Governor JB Pritzker today issued a disaster declaration and activated approximately 130 members of the Illinois National Guard to ensure all state resources are available to deal with the heavy snow, ice, and blizzard conditions expected over the coming days. The Governor is directing IEMA to coordinate a robust, statewide response which will include more than 1,800 IDOT trucks and equipment, ISP patrols to help stranded motorists, and approximately 130 members of the Illinois National Guard.

“I’m authorizing a disaster proclamation for Winter Storm Landon, effective immediately, to support local government disaster response and recovery operations wherever necessary. I want to assure county and local officials and everyone in the path of the storm that my administration will provide resources every step of the way,” said Governor JB Pritzker. “On the ground, all state assets stand ready to assist. I encourage everyone to do what you can to stay safe: listen to local authorities to stay up to date with the latest conditions in your community and make sure your household has essentials.”

IEMA’s State Emergency Operations Center in Springfield will be activated to coordinate the state’s response to the storm. Representatives from relevant state agencies will staff the SEOC 24 hours a day throughout the storm and quickly deploy resources to impacted communities.

“We’re working closely with local emergency management officials throughout the state to monitor conditions and be ready to provide assistance they may need,” said Scott Swinford, Deputy Director of the Illinois Emergency Management Agency (IEMA). “But it’s also important that people prepare themselves for this storm with food, water, working flashlights, weather radios, and other necessities.”

In response to the storm, the Governor is activating approximately 130 members of the Illinois National Guard to support winter weather operations in central Illinois. The soldiers and airmen will be assigned as winter weather platoons with each platoon consisting of approximately 18 soldiers equipped with six High Mobility Multipurpose Wheeled Vehicles (HMMWV) and one Heavy Expanded Mobility Tactical Truck Wrecker. The Airmen, from the 182nd Airlift Wing, based in Peoria, will also be equipped with six HMMWVs.

“While most people will be watching this week’s weather event unfold from the comfort of their home, the Illinois National Guard will be braving the cold weather and snow alongside local and state first responders as they assist to protect life and property, and alleviate suffering in the communities where they will be assigned,” said Maj. Gen. Rich Neely, the Adjutant General of Illinois and Commander of the Illinois National Guard.

The Illinois National Guard will serve as a critical force multiplier for the ISP, who will be deploying teams of troopers to assist stranded motorists across the state. Guard units will initially be deployed to ISP Districts 9 - Springfield, 10 - Pesotum, 18 - Litchfield, 20 - Pittsfield and 21 – Ashkum, helping reduce response times and capacity to reach motorists. From the SEOC, ISP will be monitoring conditions on the ground and shifting personnel based on the trajectory of the storm.

“The men and women of the ISP stand ready to face the challenges mother nature has in store and, like we always do, will rise to the occasion,” stated Illinois State Police Director Brendan F. Kelly. “The Illinois National Guard will also be standing with us as a force multiplier. With their assistance, service to the public will be greatly augmented, reducing first responder response times to stranded motorists.”

Statewide, IDOT will deploy more than 1,800 trucks and equipment to plow, treat roads and respond to weather emergencies. If you encounter a plow or any maintenance vehicle during your travels, please slow down, increase your driving distance and remain patient. Do not attempt to pass – conditions in front of the plow will be worse than behind it. Because of the storm’s potential, non-essential travel is strongly discouraged.

32 Comments

|

*** UPDATED x1 *** Campaign notebook

Tuesday, Feb 1, 2022 - Posted by Rich Miller

*** UPDATE *** I forgot to post this, so I’m putting it at the top…

Today, the REALTORS® Political Action Committee (RPAC) expressed their support for State Representative Sam Yingling’s bid for State Senate.

“Sam’s legislative career has focused on property tax relief, reform, and promoting affordability and access to housing for all Illinoisans. His work on local government consolidation and homeowner rights, combined with his leadership on reducing the property tax burden on property owners, make him worthy of our support,” said Michael Oldenettel of Jacksonville, Chair of the REALTORS® Political Action Committee Board.

“That is why the REALTORS® Political Action Committee (RPAC) is ‘all-in’ for Sam’s Senate bid and recently increased its financial support of his campaign so that he can continue to champion policies that enable all Illinoisians the opportunity to achieve the American Dream of homeownership,” continued Oldenettel.

State Rep and candidate for Illinois State Senate, Sam Yingling, said, “I am very proud to have the support of the REALTORS® Political Action Committee (RPAC) in my race for State Senate. REALTORS® are one of the backbones of small business in our communities. As a REALTOR®, I have seen their commitment to helping people pursue their dream of homeownership. This has inspired my career of public service, which I will carry to the Illinois State Senate.”

* Politico…

Republican Rep. Rodney Davis and Democratic Rep. Sean Casten are outpacing their intra-party opponents in fundraising, though no one can keep up with Rep. Raja Krishnamoorthi.

The 8th Congressional District Democrat has banked $11 million — double what House Speaker Nancy Pelosi has on hand at $5.4 million — after raking in $1.1M in the fourth quarter of 2021.

In the race to represent the newly shaped 15th District, Davis raised $420,699 in the fourth quarter, according to FEC reports, and has $1 million on hand. His GOP opponent, Rep. Mary Miller, raised $164,262 in the same period and has $414,795 in the bank.

In the 6th Congressional District, Casten raised $699,384 and has nearly $1.6 million on hand. His Democratic opponent, Rep. Marie Newman, raised $337,876 and has $573,120 cash on hand.

And in the newly created 3rd Congressional District, Democrat Gilbert Villegas, a Chicago alderman, raised $386,473 and has $377,055 in the bank in his race to best Democratic state Rep. Delia Ramirez, who raised $113,2018 and has $110,443 cash on hand.

In other races: Rep. Lauren Underwood in the 14th District said she raised $752,011 during the fourth quarterly FEC filing period and reported nearly $2.1 million cash on hand. And in the 17th District’s open seat, Republican Esther Joy King raised $639,970 and has $655,957 in the bank.

* Coming a bit late to this…

* Apparently, this clownish appellate court candidate didn’t get the word that session is canceled…

* From a Richard Irvin campaign fundraising email authored by Jeffrey R. Brincat, who was forced to resign from the Illinois Racing Board by Gov. Pritzker after allegedly making an illegal campaign contribution…

Corruption here is simply the norm and places a tax on the head of all Illinoisans. Let’s make this the “old” Illinois.

* Some guy named Chase Thrasher is running for governor…

My name is Chase Thrasher. I’m from Olney, a little town in southern Illinois. I am 34 years old and a single father to an amazing 4-year-old son. I have been a Correctional Officer for the last 7-and-a-half years and have lived in Illinois for the past 25 years.

I am running for Illinois Governor in 2022 as I have long been dedicated to serving Illinois and want to make this state a great place to live, for you, for myself, and for generations to come.

And, yes, that’s his real name. There are four people named Thrasher on the state payroll.

I gather that he is a Republican, but that word appears nowhere on his website. Then again, Richard Irvin’s first campaign ad didn’t use the word, either.

* Speaking of Richard Irvin, the Bears hired head coach Matt Eberflus last Thursday. Yesterday, just four days later, Eberflus and new general manager Ryan Poles held a free-wheeling, 90-minute press conference. It’s now been more than two weeks since Irvin formally kicked off his campaign and he has yet to grant a single interview that I’m aware of.

…Adding… From a member of Rep. Bob Rita’s (D-Blue Island) political organization…

News From the Actual Front: Rita’s organization started circulating last week. 6 days they got 1000 signatures door to door. No cocktail parties. No social media meetups. Just good old fashioned field work. Didn’t get one complaint about people not answering doors for covid or any other reason.

42 Comments

|

* Last year, Sen. Elgie Sims (D-Chicago) predicted to me that the state budget he and others were crafting was going to lead to the first credit upgrade for Illinois in more than two decades. He was right. So, when I asked the Senate Appropriations Committee Chair this morning about the governor’s proposed budget, he reminded me of his prediction and made another prediction…

You and I talked last year before we passed the 2022 budget, and I was sure, I was very confident that it was going to lead to a credit rating upgrade. I think this budget will do the same. This is going to show taxpayers that we are good fiscal stewards, that we’re taking care of their money they entrust us with. And it’s going to show the rating agencies that Illinois knows how to govern.

Discuss.

…Adding… A comment below made me think that I probably should’ve put this here. Greg Hinz …

The Pritzker administration is promising to inject “substantial” amounts of federal COVID relief cash into the state’s cash-short unemployment insurance program, an action that will reduce and perhaps virtually eliminate the need for sharp tax hikes on employers and/or benefit cuts for workers.

In the first public comments after weeks of behind-the-scenes negotiations, Deputy Gov. Andy Manar said “very productive” talks have advanced enough that Gov. J.B. Pritzker will dangle a big carrot during his speech tomorrow on what will be in his proposed fiscal 2023 budget.

The carrot: allotting a chunk and maybe most of the $3.5 billion the state still has left over from the American Rescue Plan Act of 2021 to begin paying off the roughly $4.5 billion in loans from the U.S. Treasury that kept the unemployment insurance system operational. […]

But Manar did give a tantalizing hint, saying states like Illinois that borrowed from the U.S. Treasury at the height of the pandemic have typically used one quarter to one third of their ARPA funds for such a purpose.

…Adding… Might as well put this here, too…

U of I Flash Index up again in January

URBANA — The resurgence of the University of Illinois Flash Index continued in January, rising to 105.9 from its 105.7 level last month. This reading approaches the post-recession high of 106 from June and September of 2021.

Illinois’ unemployment rate fell to 5.3% from its 5.7% level the previous month and 8% a year ago. Fourth-quarter national gross domestic product rose by 6.9% in real terms. Similarly, the components of the Flash Index (individual income tax, sales tax, and corporate tax receipts) were all up in real terms compared with the same month last year, with especially large percentage increases in corporate and individual income tax collections.

“These strong indicators of economic performance pose a perplexing picture since the emergence of the omicron COVID-19 variant, supply chain disruptions, weakness in financial markets, and the emergence of serious inflation paint a darker image,” said University of Illinois economist J. Fred Giertz, who compiles the monthly index for the Institute of Government and Public Affairs. “There are unanswered questions about whether the relationship of Illinois tax revenues and state economic performance have become untethered; only time will tell.”

Most observers do expect a cooling of the national economy in 2022, in part, because of a paring of expansionary fiscal and monetary policy.

“The strong performance of Illinois revenues has apparently not escaped the notice of Gov. J.B. Pritzker. The governor reportedly plans to call for a one-year, one-billion-dollar tax cut, only 15 months after the failure of a constitutional amendment that would have allowed the state to bring in more revenue through a graduated income tax structure,” Giertz said.

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through January 31, 2022. Nearing two years since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates.

…Adding… Press release…

Governor JB Pritzker today announced the State of Illinois has acquired nearly 10 acres of land in the Dirksen Business Park located at 2900 Dotmar for a purchase price of $1.55 million, to construct a new Central Computing Facility (CCF) for the Illinois Department of Innovation & Technology.

“As governor, I’ve sought to bring efficiency and modernization to state government, and this new data center is a key asset in that endeavor,” said Governor JB Pritzker. “Through this new facility, we’re enhancing the State of Illinois’ digital infrastructure and doing so while bringing hundreds of new jobs to the east side of Springfield. I want to recognize Senator Doris Turner for her leadership in bringing this development to the region.”

DoIT’s current central computing facility in Springfield is inefficient and dated. DoIT is working with the Illinois Capital Development Board and the Illinois Department of Central Management Services to build the new CCF in the Springfield area.

“With the evolution of technology and DoIT’s continuing modernization of digital assets, the current data center has grown less suitable for our needs,” said Jennifer Ricker, Acting Secretary for DoIT. “A modern, efficient, and secure data center will allow Illinois to continue to be a leader in technology and innovation.”

Governor Pritzker’s bipartisan Rebuild Illinois capital plan, the first in nearly a decade, appropriated nearly $80.5 million to CDB, who will oversee the project’s design and construction with Exp U.S. Services, serving as the architect of record. The new facility will be programmed to achieve, at a minimum, LEED Silver Certification for data centers.

CMS, who will serve as the owner and property manager of the facility, researched property in the area and subsequently issued a Request for Information (RFI) on June 9, 2021 for the purchase of vacant land within the City of Springfield to construct a CCF. The selected 9.4 acre site is located within an Enterprise Zone and offers access to a fiber network, synergies to nearby State offices, and close proximity to transportation options.

“This investment is further evidence the State of Illinois is striving to deliver the best, most cutting-edge infrastructure to support our operations,” said Janel L. Forde, Director for the Department of Central Management Services. “The new state-of-the-art facility will be built with the most advanced infrastructure technology, and designed with the highest standards of redundancy, resiliency, and reliability.”

“The relocation of the Central Computing Facility is a game changer for the East Side of Springfield – an area I was proud to represent on the Springfield City Council,” said State Senator Doris Turner (D-Springfield). “The new data center will spur additional economic development to the area and expand our technological opportunities. I am proud and thankful that Governor Pritzker is prioritizing Springfield in the ambitious Rebuild Illinois Project.”

The relocation of the CCF to the East Side of the City will also bring hundreds of State jobs to the area, spur economic development, and ensure the State’s technology infrastructure keeps pace as technologies advance.

The historic Rebuild Illinois capital plan passed with bipartisan super-majorities will invest $45 billion in roads, bridges, railways, universities, early childhood centers, and state facilities that will create and support an estimated 540,000 jobs over the life of the six-year plan and revitalize local economies across the State.

11 Comments

|

* Senate President Don Harmon just told his caucus members to stay put in their districts if they aren’t down in Springfield right now. The National Weather Service in Lincoln is predicting snow “in excess of 12 inches with locally higher amounts possible” for the Springfield area Tuesday night through Thursday. I’ve seen one model that predicted 27 inches. But, who really knows? Snow is difficult to predict.

Anyway, Harmon said he may have to send members back home tomorrow morning so nobody is forced to drive home in the storm.

Harmon told his members that he, Speaker Welch and Gov. Pritzker are connecting on a final plan about what to do with the budget address and the State of the State address scheduled for Wednesday. The budget address date is in state law (click here), so it’s not clear what will happen.

Because of COVID, the Senate wasn’t even invited to the House chambers to watch the address, so no big deal if they don’t show. But the House Speaker’s office hasn’t yet responded to questions about whether they expect to have a quorum in town, although several folks are already here.

This post will likely be updated.

*** UPDATE 1 *** From the House Democrats’ chief of staff…

URGENT update on scheduling

Members:

Please be advised that due to the winter storm heading toward Central Illinois, we will be canceling session this week (all three days). Staff will be following up with you shortly to ensure that everyone is notified as soon as possible.

Additional information on scheduling will be forthcoming, but virtual committees will continue as planned this week.

Stay safe, and I’ll be in touch,

Tiffany

*** UPDATE 2 *** Jordan Abudayyeh…

The governor plans to deliver a State of the State and budget address on Wednesday. Details will be forthcoming.

*** UPDATE 3 *** A tippity-top Senate Dem says the chamber will be sending members home in the morning, but will not be changing its deadline schedule. So, February 10 will remain as the Senate’s deadline for substantive bills out of committee.

*** UPDATE 4 *** Formal news media announcement…

“Difficult if not impossible” travel conditions force session cancelation

SPRINGFIELD – With the National Weather Service warning motorists that travel across the central portion of Illinois this week could be “difficult if not impossible,” the leaders of the Illinois General Assembly have canceled the House and Senate sessions scheduled this week.

The forecast calls for several inches of snow combined with icy conditions and 30 mph wind gusts in Central Illinois. Similarly treacherous conditions are expected elsewhere in the state. Weather and safety officials urge drivers not to travel, and legislative leaders opted to cancel session to keep safe the staff, lawmakers and hundreds of others who travel to the Capitol for session days.

“With the National Weather Service forecasting a winter storm for Central Illinois that could produce up to two feet of snow, it is in our best interest to cancel session for this week,” said House Speaker Emanuel “Chris” Welch. “The winter storm warning says travel will be dangerous and we do not want to put people’s lives at risk while they’re on the road to and from Springfield.”

Senate President Harmon said the Senate would be in session at noon on Tuesday but the rest of the week is canceled.

“Across the state people are being told to avoid unnecessary travel and to not put themselves at risk. We will turn to our remote committee process to get the work of the people done and look forward to a break in the weather and a safe return to the Capitol hopefully next week,” Harmon said.

The House and Senate will continue remote committee work for the remainder of the week.

*** UPDATE 5 *** I’m told that House Republican Leader Jim Durkin plans to stay in town for the governor’s live address. Should be fun.

20 Comments

|

It’s just a bill

Monday, Jan 31, 2022 - Posted by Rich Miller

* Press release…

With heating bills skyrocketing across Illinois, a coalition of consumer advocates joined with key legislators on Monday to urge the Illinois General Assembly to eliminate a natural gas surcharge that has helped major utilities rapidly increase bills, plunging many families into crisis this winter.

At a news conference, AARP Illinois, the Citizens Utility Board (CUB), Community Organizing and Family Issues (COFI), the Environmental Law & Policy Center (ELPC), Illinois PIRG and the Natural Resources Defense Council (NRDC) called on the General Assembly to pass the Heating Affordability & Utility Accountability Act (House Bill 3941/Senate Bill 570). Sponsored by state Rep. Joyce Mason and state Sen. Cristina Castro, the bill would end the “Qualifying Infrastructure Plant” (QIP) surcharge on Peoples Gas, Nicor Gas and Ameren Illinois bills in 2022.

“The legislation passed in 2013 was intended to address safety issues for consumers, not to serve as a blank check for utility companies,” Rep. Mason said. “For too long, gas companies have been allowed to indiscriminately raise their prices with little to no oversight from state regulators. We need to hold these companies accountable for their actions and put an end to out-of-control heating costs.”

“The passing of the landmark Climate and Equitable Jobs Act was an important step in holding natural gas companies accountable. Now, this legislation will go even further to end unnecessary surcharges on our residents’ utility bills,” state Sen. Castro said. “We’re doubling down on our state’s commitment to protecting ratepayers and demanding transparency from natural gas companies.”

Illinois’ major utilities have launched expensive and aggressive infrastructure projects, which they fund through delivery charges on gas bills. In 2013, the General Assembly allowed them to add the QIP charge to bills. This regulatory shortcut allows utilities to recover certain costs more quickly and with less oversight from the Illinois Commerce Commission (ICC).

The utilities claim the surcharge is a necessity to pay for pipe-replacement and other work. While everyone agrees old pipes should be replaced, consumer advocates argue the utilities should do it in a responsible way that doesn’t cause hardship for their customers. Utilities are already legally obligated to replace pipes, and they did it for decades without hitting customers with a special surcharge.

On Monday, consumer advocates showed how the utilities have abused the QIP charge, using it to rake in revenue more quickly and increase bills in the most expensive winter since 2008-09.

Peoples Gas: Supporters of the 2013 legislation claimed the QIP would only cost Peoples Gas customers about $13 a year, but they are now paying more than $13 a month, on track to pay $150 a year. Projected costs for the gas utility’s aggressive capital program have skyrocketed from about $2 billion to $11 billion, and an analysis by the Illinois Attorney General’s office estimated that gas bills could double over the next 20 years. The program has already begun to take its toll on customers: In December, 17 percent of Peoples Gas customers were behind on their bills, by a total of $77 million.

Nicor Gas: Even though the state’s biggest gas utility has already replaced its old cast iron pipes, it continues to spend at a breakneck pace, spending over a billion dollars since it replaced its last cast iron pipe in 2018. Nicor has raised delivery rates by more than $500 million, or 77 percent, since 2018. That includes this past November, when it won a $240 million increase—the largest gas hike in Illinois history.

Ameren Illinois: Even though Ameren has finished replacing cast iron pipes, the utility last year won a $76 million increase.

“We cannot afford these charges,” said Donna Carpenter, of Englewood, a parent leader with COFI/POWER-PAC IL. “Greedy gas companies have passed these ridiculous charges onto customers time and time again, harming low-income Black and Brown communities who either have to be cold or can’t afford to cook meals for their families because of sky-high gas prices. We need the Illinois Legislature to take action now!”

* From a publication called Politico Morning Tech…

The Senate Judiciary Committee is set to mark up the Open App Markets Act, S. 2710 (117), next week, spurring a new burst of lobbying by the bill’s supporters. But the real action on app store bills is still in the states, where several legislatures are poised to move bills aimed at paring back Apple and Google’s holds over their respective app ecosystems this year.

Here are the states to watch, according to lobbyists and advocates:

— Illinois: Democratic Illinois state legislators in both chambers earlier this month introduced the Freedom to Subscribe Directly Act, legislation that would give app developers the legal right to do business directly with their customers rather than having to work through Apple and Google’s payment systems. State Sen. Sara Feigenholtz, a Democrat who represents Chicago, told MT she believes the legislation could help build out Illinois’ tech sector.

Illinois is an important state for app store regulation — it’s both the home state of Basecamp co-founder David Heinemeier-Hansson, one of the strongest advocates for state and federal legislation, and Senate Judiciary Chair Dick Durbin, who is a co-sponsor of the federal app store bill. Feigenholtz told MT she is in communication with Durbin and his staff, and has a meeting set up to discuss the issue next week. “My sense would be that he would love to see Illinois move forward on this and possibly be the first state to have it,” Feigenholtz said. Durbin’s office did not respond to a request for comment.

* Press release…

In an effort to support single working parents, State Senator Mike Simmons (D-Chicago) initiated a measure that will allow them to claim unpaid time off from work to support their child’s needs.

“Single parents deserve the same rights and protections as parents who have partners,” said Simmons. “When I had the opportunity to meet with a group of these parents, many of them talked about the need for time off from work to meet with their children’s teachers or tend to other well-being needs of their kids.”

Senate Bill 4040 would allow employees who are single parents to take either five days or up to 40 hours of unpaid time off to care for a child’s needs- provided that the employees give their employers a sufficient period of notice. Needs include education, child care, or any duty a single parent may reasonably be responsible for.

Additionally, the measure would prevent an employer from discriminating in any way against an employee because they happen to be a single parent.

“One out of three households in my district are headed by single parents,” said Simmons. “I feel it is critical that my legislative work this spring should address their concerns about how to balance parental responsibilities with their work.”

The measure originated from a people’s legislative council that Simmons held with a group of single parents in 2021. The measure awaits a committee hearing.

…Adding… Press release…

Rep. Will Guzzardi (D-39), introduced House Bill 5300 the Insulin for All Act, on Friday, January 28th. The legislation aims to make insulin more affordable and accessible for all Illinoisans.

The Act creates an Urgent Need Program, which would allow diabetics to access an emergency 30-day supply of insulin at a minimal cost from their local pharmacy. It also requires manufacturers to create patient assistance programs that offer low-cost insulin to eligible patients. The Act will leverage the state’s bargaining power to offer a negotiated price on insulin for any person with diabetes who can’t get it cheaper elsewhere. Lastly, it lowers the insulin copay cap to $35 a month.

In 2019, Rep. Guzzardi passed a law capping copays for insulin at $100 a month. As state laws can only cover certain types of insurance, the cap only affected around 15% of Illinoisans, and $100 a month remains unaffordable for many families and individuals who need insulin on a daily basis. There is a great need to lower that copay and provide alternatives for the 85% of people who aren’t covered by the current $100 a month cap, which this bill strives to accomplish.

“The past two years have been a vivid reminder that pharmaceutical research can produce incredible results. But no matter how great they are, drugs don’t work if people can’t afford them,” said Rep. Will Guzzardi (D-39).

5 Comments

|

Inept oppo dump

Monday, Jan 31, 2022 - Posted by Rich Miller

* From the end of a press conference last week…

Amy Jacobson: Governor, I wanted to ask you about Jennifer Thornley. Did you or did someone else direct CMS to put her, she’s your former campaign aide, on state disability payroll after she was fired for theft?

Gov. Pritzker: No.

State disability payroll? What the heck is that? I asked the governor’s office what that was about and they had no idea.

* It became slightly more clear when ILGOP Chair Don Tracy had an op-ed published in Real Clear Politics…

The more we learn about the Jenny Thornley affair, the more it appears that senior members of the Pritzker administration, including potentially the governor and his wife, may have facilitated a fraud on the state by a now-indicted former campaign aide to enrich her and then obstructed efforts to bring her to justice.

This is a tangled web, so stay with me as I set forth a timeline of events and characters, according to the Chicago Tribune.

Tangled is a word.

* I’m not gonna go through the whole Thornley thing again today. But here’s the heart of the Tracy story…

However, after Thornley was fired, someone with clout in the Pritzker administration somehow granted her disability payments reserved for people that are actually state employees. These payments (amounting to some $71,000) went on for more than a year, ending days before she was indicted for theft and fraud. These extensive payments were for “injuries'’ sustained from an “assault” that Egan determined had not occurred.

I asked a GOP spokesperson over the weekend what the heck disability payments they were talking about. Workers’ compensation was the reply.

So, the Republicans are saying she apparently got workers’ comp for an alleged injury she sustained on a job she no longer had and it turned out she apparently wasn’t even injured. But look at how they phrased it: “Someone with clout in the Pritzker administration somehow granted her disability payments.”

Huh?

* Back to Tracy’s op-ed…

Who effectuated Thornley’s enrollment in the disability program over the objections of the merit board — and on whose orders did that person or persons act?

Don Tracy has been a business owner in Illinois for a very long time. He surely knows what workers’ comp is and how workers - even former workers - can receive compensation over the objections of their employer. He also certainly knows that some workers have committed fraud in order to obtain WC benefits.

Now, if there were attempts by the administration to sway the Workers Compensation Commission or the appeals process or whatever, then it’s a story. But what they are peddling here so far is a bunch of inept, dressed-up oppo.

…Adding… From comments…