Afternoon roundup

Monday, Feb 27, 2023 - Posted by Rich Miller

* Tribune…

When the whistle blows at the Belvidere Assembly Plant on Tuesday, it may signal the end of an era.

For nearly six decades, the massive auto plant has been the economic engine of the small river city near Rockford, churning out everything from the Plymouth Fury and the Chrysler New Yorker to the Dodge Dart.

But after several years of downsizing and dwindling demand for its current product, the Jeep Cherokee, Stellantis is idling the plant “indefinitely,” laying off the last 1,200 workers and perhaps closing it for good.

Statement from the Pritzker administration…

Illinois is focused on supporting workers impacted by the plant’s idling and has been on the ground providing workshops and support services to furloughed workers since receiving notification of the company’s plans in December 2022. In partnership with local leaders, community colleges and workforce partners, the State continues to work diligently to ensure impacted workers have the support they need. At the same time, Illinois continues to work closely with Stellantis as the company works to identify opportunities to repurpose the Belvidere facility to adapt to changes in the automotive market. REV Illinois and the closing fund, combined with our top-ranked infrastructure, abundant workforce and investments in statewide training, make Illinois a turn-key choice for any large company in the clean energy sector.

Not looking good.

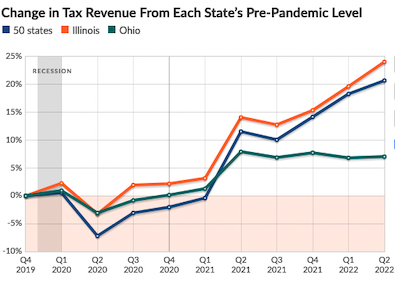

* Pew…

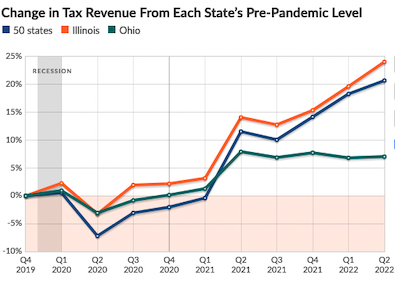

Nationwide and in 32 states as of the end of the second quarter of 2022, cumulative tax receipts since the pandemic’s start, adjusted for inflation, were even higher than they would have been if pre-COVID growth trends had continued—despite fallout from the pandemic and a two-month recession. According to Pew estimates, New Mexico led all states, with 17.1% more cumulative tax revenue than it would have collected under its pre-pandemic growth rate. Idaho was second at 16.7% above the trend. Nationally, combined tax revenue at the end of the second quarter of 2022 was 4% above estimates of what might have been collected had the pandemic not occurred.

However, estimates also show that cumulative tax revenue fell short of its pre-COVID growth trend in slightly more than a third of states since the pandemic’s onset. This suggests less extraordinary growth than the recent spate of budget surpluses and the scale and scope of enacted tax cuts might otherwise indicate.

Illinois in orange compared to all 50 states in blue and Ohio in green…

Click here to do your own comparisons.

* Tribune…

The Illinois Supreme Court should reject a “grab-bag of constitutional theories” put forward by prosecutors across the state who are challenging a measure that would eliminate cash bail, the attorney general’s office argued in a final appeal brief filed Monday. […]

The brief said the high court has “no persuasive reason” to side with the prosecutors, and argued that their position would “effectively bar the General Assembly from ever reforming pretrial procedures in the State.” […]

“The clause by its plain language guarantees rights only to crime victims; it cannot reasonably be read to require a system of monetary bail,” the brief said, “and it is easily squared with the pretrial release provisions, which at multiple stages require courts to consider crime victims in making release decisions.”

* Crain’s…

The practice of considering environmental, social and governance, or ESG, risk has gained mainstream traction over the past two decades — in some quarters, it’s almost routine. Is it wise to invest in an oil and gas producer if the market is shifting away from fossil fuels, or in a company that has a record of sexual harassment complaints?

Some Republican officials have decided, however, that they’ve had it with what they call “woke” investing. A dozen states have enacted bills or issued advisories restricting ESG investing for public pension funds and other public money. Other states are considering similar measures.

Florida’s hard-line conservative Gov. Ron DeSantis led a resolution to bar state pension funds from considering ESG factors, and the state pulled about $2 billion in assets managed by investment giant BlackRock, an advocate of socially conscious investing. Texas blacklisted BlackRock and other financial firms it determined divested stocks of fossil fuel companies.

The backlash worries asset owners and managers in Illinois and other blue states. Why would anyone limit the considerations that go into selecting a sound investment strategy, they ask. That could potentially depress the returns of the pension funds or deprive the fund of a superior return because it’s unwilling to consider factors that impact long-term viability.

* Injustice Watch…

Illinois’ state child welfare agency for years has been illegally blocking undocumented survivors of child abuse from seeking a special visa for crime victims that would allow them to remain in the United States, an Injustice Watch investigation has found.

Since 2019, state law has required the Illinois Department of Children and Family Services and all law enforcement agencies to make a decision within 90 business days on whether undocumented immigrant applicants who have been victims of certain crimes and are applying for a type of permanent visa called a “U visa” are eligible.

That visa program was set up to help law enforcement gain the trust of undocumented immigrants who might otherwise be reluctant to come forward.

But records show that DCFS so far has taken more than four years to establish a process to review the applications, potentially denying hundreds of families a chance at legal immigration status and keeping others from even trying.

Full statement from DCFS…

The safety, health and welfare of our children are the primary concern of DCFS. The Department has received 7 requests for certification since January 1, 2019 and has signed one certification. The Department has designated a point of contact to review U Visa requests and established a specific email address for individuals to submit a certification form request. The Department is committed to further developing this process to assist individuals who may be eligible for a U Visa. The Department will also reevaluate those requests that were previously submitted to determine whether the requests for a certification can be granted.

* Ralph Martire on the proposed state budget…

However, many of the structural fiscal flaws that created years of deficits remain in place. Which means Illinois decision-makers have the rare opportunity to thoughtfully consider reforming the state’s fiscal system, with an eye toward building the capacity needed to sustain investments in core services over the long haul, rather than just dig out of the crisis du jour. Bottom line: the Pritzker administration should be commended for its responsible stewardship, but there’s still work to do.

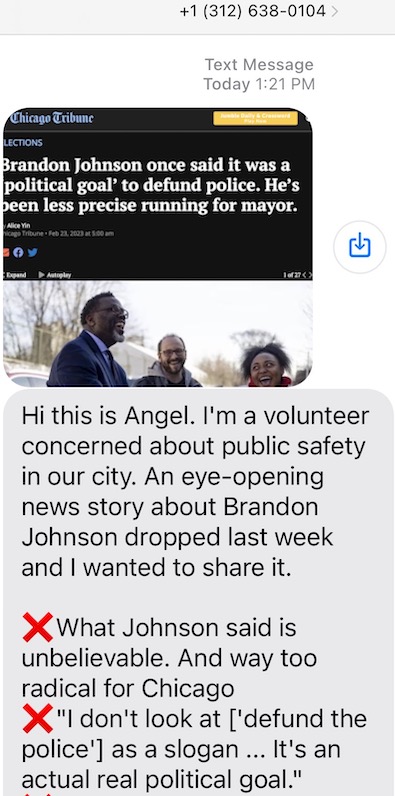

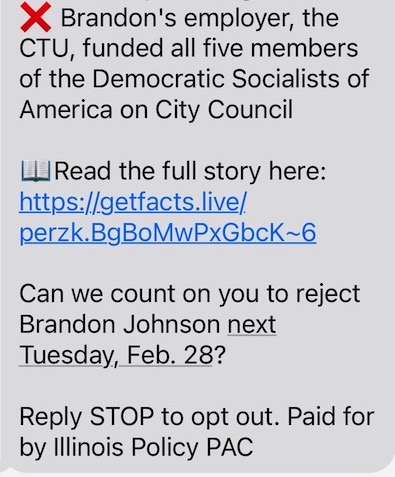

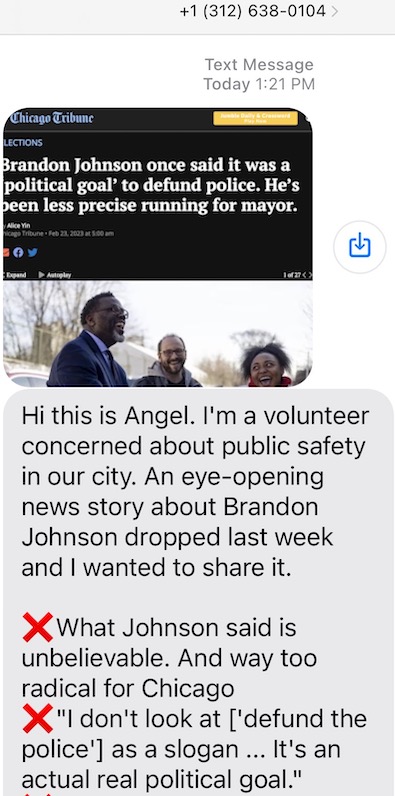

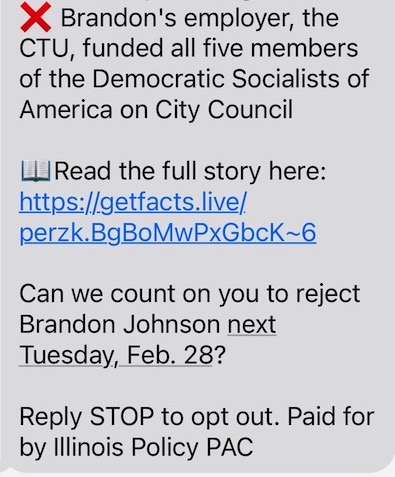

…Adding… Illinois Policy Institute sending text messages attacking Brandon Johnson and CTU…

* Isabel’s roundup…

* Inside Climate | Illinois Put a Stop to Local Governments’ Ability to Kill Solar and Wind Projects. Will Other Midwestern States Follow?: Now, officials from places that had restricted development of renewables projects—like Ford County, located in the rural area between Chicago and Champaign-Urbana—are livid about what they view as a power grab by majority Democrats.

* The Grio | White House to meet with historic five Black speakers of state legislatures: Julie Chavez Rodriguez, director of the White House Office of Intergovernmental Affairs, and Domestic Policy Advisor Susan Rice will welcome Speaker Chris Welch of Illinois, Speaker Rachel Talbot Ross of Maine, Speaker Adrienne Jones of Maryland, Speaker Joe Tate of Michigan and Speaker Carl Heastie of New York.

* NYT | Indian Americans Rapidly Climbing Political Ranks: In retrospect, the watershed appears to have been 2016, just after then-Gov. Bobby Jindal of Louisiana became the first Indian American to run for president. That was also the year Representatives Pramila Jayapal of Washington, Ro Khanna of California and Raja Krishnamoorthi of Illinois were elected, bringing the number of Indian Americans in the House from one — Representative Ami Bera of California, elected in 2012 — to four. It was also the year Kamala Harris became the first Indian American elected to the Senate.

* CNN | 12 blue states sue FDA, saying it’s too strict in limiting abortion drugs as legal battle over mifepristone heats up: The suit is a possible hedge by states waiting to see how a federal judge in Texas rules in a lawsuit brought by anti-abortion groups seeking to block the FDA’s approval of mifepristone altogether. Conflicting rulings could mean the Supreme Court is asked to sort out the issue.

* Reuters | Dow said it was recycling our shoes. We found them at an Indonesian flea market: U.S. petrochemicals giant Dow Inc and the Singapore government said they were transforming old sneakers into playgrounds and running tracks. Reuters put that promise to the test by planting hidden trackers inside 11 pairs of donated shoes. Most got exported instead.

* Chicago stuff from Isabel…

* Block Club | South Siders Organizing To Help New Migrant Neighbors At School-Turned-Shelter: ‘Woodlawn Is A Welcoming Community’: The short-notice rollout of the Wadsworth School shelter was met with fierce backlash. But neighbors organizing to help the migrants said “it doesn’t have to be an ‘us versus them.’”

* Sun-Times | At final rally, Mayor Lori Lightfoot revs up crucial backers: Black women: Lori Lightfoot ran a longshot race in 2019. This time round, the stakes are higher, and her support from Black women is crucial for her re-election to a second term.

* Tribune | Chicago mayor candidates in final push for every last vote: ‘Don’t stand on the sidelines’: Early voting turnouts suggest interest in the race is relatively high, exceeding both the 2019 and 2015 races. Early vote turnout is the highest in wards known for dense populations of city workers: the 19th Ward on the far South Side, the 41st and 38th on the far Northwest, the 13th on the Southwest Side, and the 11th, centered around Bridgeport and Chinatown.

* Politico | The 9-person stage drama in Chicago that won’t end on Election Day: “It’s possible that somebody gets into the runoff again with less than 20 percent of the vote,” Mixon, the Urban Studies Program director at the school, said. “It’s not the best way to elect people. The whole idea was to get machine politics out of elections but going to ranked-choice voting would be a better idea. We’d save a ton of money and avoid a runoff.”

* Block Club | Older Voters Are Leading The Way In Early Voting For Tuesday’s Election: And so far, it’s older voters who are rushing to the ballot box. Among various age groups, voters 65-74 years old have had the highest turnout, making up 23.42 percent of voters so far, according to an elections board news release. Chicagoans 55-64 are next, making up 18.94 percent of voters.

* Tribune | Ald. Jeanette Taylor aims to fend off rivals to her 20th Ward seat: Four years ago, community activists Jeanette Taylor, Jennifer Maddox and Andre Smith were among a crowded field of candidates vying for the 20th Ward City Council seat, which was vacant following a string of corruption scandals. Now the three are in a rematch for the position. Only this time, Taylor — who easily topped the first-round vote in 2019 and went on to win the seat — brings the benefits of incumbency but also a record to defend.

* CBS Chicago | Candidates for 1st Ward alderperson talk crime, affordability, transparency: Incumbent Daniel La Spata, Attorney Sam Royko and Community Activist Stephen “Andy” Schneider sat down with CBS2 to discuss their positions on issues such as crime and gentrification. Twice, we had an interview set up with former alderperson Proco “Joe” Moreno but ultimately, he answered our questions via email.

* Block Club | O’Hare Travelers Won’t Be Able To Get An Uber Or Lyft From Terminal 5 Starting Monday: Taxi and black car pick-ups will still be available at all terminals, the city said. Lyft riders taking Lux Black and Lux Black XL cars also can still use Terminal 5, Lyft spokesperson Katie Kim said.

* Tribune | Candidates for 19th Ward on the Southwest Side stake out positions on the left, right and the middle: On the right in the 19th Ward race, Fraternal Order of Police-backed former Chicago police Sgt. Mike Cummings is hammering O’Shea, saying he has failed to support cops and take the steps necessary to make area residents and business owners feel safe. And on the left, computer consultant Tim Noonan argues the ward is far more racially, economically and politically diverse than O’Shea and other Southwest Side Democratic machine politicians in charge over the decades have accepted.

* WGN | From Bessie Coleman to the Tuskegee Airmen, African-American aviation history took off in Chicago: A century ago, Americans were fascinated by the new spirit of aviation. And nowhere was this more the case than among the Black community in Chicago. From newspaper reports to aviation schools, many African-Americans saw potential in the freedom of the skies. Unfortunately, the segregation of the times would limit opportunity until WWII created a new chance for Black aviators to prove themselves.

25 Comments

|

That toddlin’ town roundup

Friday, Feb 24, 2023 - Posted by Rich Miller

…Adding… The dark money PAC New Leadership for Chicago has reported spending $135,500 on direct mail for Chuy Garcia. That means the group has spent almost all the $400K it has reported raising. It’s just one of several IE committees that are spending in the mayor’s race.

* Nice timing. Press release…

JOINT STATEMENT FROM MAYOR LORI E. LIGHTFOOT AND AFSCME COUNCIL 31 EXECUTIVE DIRECTOR ROBERTA LYNCH

“Today, we are pleased to announce that negotiators for the City and the union have reached a tentative agreement that will improve the economic security and working lives of thousands of Chicago’s dedicated frontline employees. These workers are critically important to our city and impact every major department of City government. We have all worked together diligently to ensure that their efforts to help keep our city moving forward are recognized and valued. Terms of the agreement will be released after union members have the opportunity to review and vote on its ratification.”

* Heckuva job, Chicago /s…

About one-third of the city’s election day polling places are fully compliant with the Americans with Disabilities Act standards, according to new data.

A WBEZ analysis of new polling place accessibility ratings from the Chicago Board of Election Commissioners shows wide geographic disparities in access to ADA-compliant polling places.

In some wards, more than half of polling places fully meet ADA standards. In other wards, fewer than 20% of polling places are fully compliant. Voters in the 33rd Ward on the Northwest Side have just one fully accessible polling place. […]

In the 37th Ward, which covers parts of Austin and Humboldt Park, just 8% of polling places are fully compliant. Roughly two-thirds of its polling places in that ward are rated “low or no” for accessibility.

By my count, out of 380 precincts rated “low or no” accessibility, 141, or 37 percent, are in Black-majority wards. Black people make up 29 percent of the city’s population.

* Politico…

Mayoral candidate Paul Vallas is taking hits from all sides ahead of Tuesday’s municipal election. He has front-runner status, so it comes with the territory. Vallas is being criticized for his remarks on critical race theory, his social media actions and his latest TV ad.

About CRT: State Sen. Ram Villivalam called Vallas’ comments “the same racist talking points echoed by right-wing demagogues.” And state Rep. Theresa Mah says Vallas is “unfit” to be mayor and owes Chicagoans an apology.

What he said: In 2021, Vallas said, “For white parents, I mean, how are you going to discipline your child when your child comes home and your child has basically been told, you know, that their generation, their race, their parents, their grandparents they have discriminated against others and they have somehow victimized another person’s race.” via Wirepoints. […]

About his new ad: It touts Vallas’ support for the LGBTQ community. But Equality Illinois, LGBTQ Victory Fund and LPAC called the ad offensive, saying it is “a desperate attempt to cover up his anti-equality track record.” They want the ad taken down. Here’s the ad.

* WTTW…

The union representing Chicago Police Department officers paid to send a flyer to voters showcasing that Jessica “Jessie” Fuentes, who is running to represent the 26th Ward on the Chicago City Council, was arrested for battery in September 2008 as a 17-year-old.

The Fraternal Order of Police Lodge No. 7’s political action committee made an in-kind contribution of approximately $10,000 to the campaign of Julian “Jumpin’” Perez, who used those funds to pay for the flyers, said Officer Michael Cosentino, field representative and political director for the union. […]

U.S. Rep. Delia Ramirez, state Sen. Cristina Pacione-Zayas and state Rep. Lilian Jimenez, whose districts include the 26th Ward, accused Perez of “using tired Chicago-machine tactics of intimidation and threats.” […]

Perez is one of 26 City Council candidates endorsed by the police union as part of a push to defend its supporters on the City Council from challengers supported by progressive groups and to defeat their opponents.

Five candidates — Ald. Anthony Beale (9th Ward); Ald. Raymond Lopez (15th Ward); Ald. Samantha Nugent (39th Ward); Ald. Jim Gardiner (45th Ward) and 19th Ward candidate Michael Cummings, a police officer, jointly reported approximately $42,000 in contributions from the police union’s political action committee, according to records filed with the Illinois State Board of Elections.

* South Side Weekly…

Over the past few weeks, journalists affiliated with the Chicago Reader and The TRiiBE have been the targets of harassment campaigns on social media for their coverage of a Police District Council candidate and the shooting of a Black man by Paul Vallas’s son. In January, Jim Daley, a former Weekly editor and then-news editor at the Chicago Reader, published a story detailing racist, sexist, and homophobic comments made online and in group chats by Pericles “Perry” Abbasi, an election attorney for the Fraternal Order of Police (FOP) and FOP-endorsed candidate for the 25th Police District Council. After the article’s publication, dozens of Abbasi’s supporters began harassing Daley on Twitter, with Abbasi retweeting the harassment.

Daley was hired by The TRiiBE in early February and reported a story on mayoral candidate Paul Vallas’s son being one of three cops who shot and killed a fleeing Black man in Texas last year. When the story was published, The TRiiBE was targeted for racist harassment on social media.

These harassment campaigns, which include threats of violence, make clear the importance of the work these journalists are doing as well as the imperative for fellow journalists to show support and solidarity. Reporting on the powerful always comes with risks, but that doesn’t mean we should accept them as inevitable or do nothing. To show your support, head over to The TRiiBE’s website, subscribe and donate.

* Some apparent landlord-tenant tension…

* Disqualifying?…

* Isabel’s roundup…

* Block Club | Mayor’s Race Could Be Too Close To Call On Election Night, With Mail-In Votes The Deciding Factor: An explosion in people voting by mail and a crowded field in the mayor’s race could leave races too close to call the night of, said Max Bever, spokesperson for the city’s election board.

* NBC Chicago | It’s Not Just the Mayoral Race on Chicago Ballots This Election Day. What Else to Expect: According to the Chicago Board of Elections, advisory referendums, such as the ones that will appear on select ballots on Feb. 28, are designed not to create or approve of laws, but rather “to solicit the opinion of voters on a question of public policy.”

* Sun-Times | Here’s how the 4 mayoral front-runners plan to make the runoff: If the vote total is close to the 556,758 mayoral ballots cast in 2019, the two hopefuls making the runoff are likely to get 20% each. But the four top-polling contenders each have a different formula to reach that benchmark.

* Paul Vallas | Paul’s Plan for Accountable and Transparent Government: Chicago’s chronic challenges – violent crime, burdensome taxes, structural deficits, crushing debt, underfunded pensions, inequitable development practices, empty community engagement and participation mechanisms, lack of transparency, lack of accountability, poor policy decision-making and poor public administration in the implementation of policy – are connected to its system of government.

* Triibe | How has Chicago’s Aldermanic Black Caucus been representing the community?: The CABC is on the brink of a major shakeup this election season, with six of its members either stepping down, retiring or challenging Mayor Lori Lightfoot for her seat. The TRiiBE produced an accountability dashboard that takes a look at the voting records of each Black alder, dating back to former Mayor Rahm Emanuel’s tenure. The dashboard is the first of its kind in Chicago.

* CBS Chicago | Mayoral candidates take lighter questions at forum at The Hideout: The candidates largely had serious answers as Kaufmann asked them what they were thinking in running for such a misery-inducing job as mayor. But a different side of the candidates came out when it came to “lightning rounds” about Chicago bands and iconic sports teams, among other subjects.

* Crain’s | Money and mud flow into the race for the 25th Ward: In recent days, the Get Stuff Done PAC, a business-backed group that says the city needs consensus-minded aldermen, has dropped just under $160,000 into ads and mailed flyers either bashing incumbent Byron Sigcho-Lopez and/or promoting his rival, public school principal Aida Flores.

* WBEZ | Does Chicago need a Black consensus candidate?: Black folk have never been a monolith, despite them being lumped as one community. In this mayoral race, ideas are varied. Candidates are different. Black voters have stark choices when they go to the polls on Feb. 28. The commonality is that they all paint themselves as different from incumbent Lori Lightfoot. The gospel of businessman Willie Wilson contrasts from young activist Ja’Mal Green. The politically active Chicago Teachers Union backs Brandon Johnson. State Rep. Kam Buckner centers the CTA in his platform. Sophia King and Roderick Sawyer — son of Eugene Sawyer — are giving up their city council seats to run for mayor.

* Block Club | Norfolk Southern Derailment Sent Toxic Fumes Into Ohio’s Air. Now, Chicago’s Englewood Neighbors Are Fighting To Keep Their Community Safe: The company has spent years expanding on the South Side, gearing up to run more freight traffic through a dense residential area shouldering decades of environmental burden.

* Sun-Times | Higher education can do more to help our city’s immigrants: It is hard to know whether we will see comprehensive immigration reform in our lifetimes, but there are steps that higher-ed can take, right here and now, to partner with the organizations that serve immigrant communities.

* ABC Chicago | Chicago pays $40 million annually to private firms, same as entire Law Department budget: Through a public records request, the I-Team found that over the past five years Chicago forked over about $40 million a year to private firms instead of hiring more in-house attorneys who would make significantly less money as public employees. We calculated that the entire Law Department budget is about the same as the total amount the city spends annually on outside law firms.

* Sun-Times | Loop sees its population continue to grow during the pandemic, report finds: The area outpaces other areas of downtown in attracting new residents, but affordable housing is in short supply, and there’s a need for open space and outdoor dining.

13 Comments

|

The perennial fight over LGDF continues

Friday, Feb 24, 2023 - Posted by Rich Miller

* A quick history of the Local Government Distributive Fund…

[From 1969] Until January 2011, counties and municipalities received 10% of total state income tax revenues through LGDF. Following a temporary increase in state income tax rates in 2011, the percentage of tax revenue allocated to LGDF for distribution to local counties and municipalities declined to 6%.

In January 2015, the local share of the state income tax increased to 8% when the higher income tax rates declined according to a predetermined schedule established by law.

The state income tax was permanently increased in 2017 and the local government share was reduced to 5.45% for individual income tax collections and 6.16% for corporate income tax collections for State Fiscal Year (SFY) 2018.

The LGDF share was slightly increased within the SFY 2021 state budget and is presently 6.06% for individual income tax collections and 6.845% for corporate income tax collections. This is significantly below the 10% share received by counties and municipalities prior to January 2011.

Yes, but there’s another way of looking at it. The actual dollars local governments currently receive via the 6 percent LGDF share of the state’s approximately 6 percent personal income tax rate is 45 percent higher than the 10 percent of the state income tax’s 2.5 percent rate which locals received in 1969, when the deal was made. Simply put, six percent of a six percent tax results in lots more cash than 10 percent of a 2.5 percent tax. Of course, 10 percent of 6 percent is even more, and that’s what the fight is all about.

* Press release…

As a former mayor, State Senator Don DeWitte (R-St. Charles) is keenly aware of the importance of the Local Government Distributive Fund (LGDF), money that is raised locally through income taxes, sent to the state, with 10% returned to the community of origin. As a Senator, he has now made it a priority to ensure local communities receive the full share of LGDF money they were originally promised.

“Municipalities rely on these funds to help balance their budgets,” said DeWitte. “Several years back an agreement was made that local governments would have 10% of the collected LGDF money returned to them, but in recent years the State of Illinois has been shortchanging communities and sending them lesser amounts. When the Governor sweeps those funds, he places an additional financial strain on local communities, and the ultimate burden falls on property taxpayers.”

Through DeWitte’s Senate Bill 2206, the Illinois Income Tax Act would be amended to ensure that an amount equal to 10% of the net revenue realized from the State income tax each month would be transferred from the State General Fund to the Local Government Distributive Fund. With money transferred monthly, DeWitte feels communities will be better protected from fund sweeps.

“The people I represent in Kane, McHenry, and DuPage Counties already pay some of the highest property taxes in the nation,” added DeWitte. “We need to protect them by enshrining the 10% LGDF promise in our statutes once and for all. By doing so, budgeteers in every Illinois community can have confidence and reliable revenue figures when they work through their local budget processes.”

SB 2206 currently sits in the Senate Assignments Committee.

The legislation would take effect immediately.

* I asked Sen. DeWitte what budget items he would cut to pay for it…

I think the better question may be what state budget issue can be so short funded that it requires the on-going sweep of locally marketed, promoted, and generated sales and income tax revenues being paid by residents of Illinois municipalities and communities into GRF?

The Administration hangs their collective hats on the various new revenues that local governments purportedly now enjoy based on new revenue sources the administration claims to have generated (cannabis, MFT, etc.) but conveniently ignores the fact that the recipient of the highest percentage of those “new” revenue streams is actually the State of Illinois.

These LGDF revenues are one of the few tools that allow local governments to minimize, and potentially reduce, the local property tax burdens that continue to weigh on our residents and businesses. They belong to the local governments that generate them.

The Governor has proposed adding nearly $3 billion in new spending in his 2024 budget proposal. Why doesn’t he fund current obligations before adding new programs?

I don’t think LGDF is a “current obligation” because the 10 percent share negotiated in 1969 is not currently in state statute.

* I pointed out to Sen. DeWitte that 6 percent of a 6 percent rate results in far more money than 10 percent of a 2.5 percent rate. His reply…

The tax rate has increased nearly 60% during that same period, yet the state has continually received the largest piece of that expanding revenue stream, while taking more of the LGDF fund from locals. And don’t forget, the state charges locals an additional 1.5% service fee for the privilege of having their share of sales taxes collected and redistributed back to them.

It’s disingenuous for the Gov to pat himself on the back for “financial stability” while continuing these fundamentally unfair practices of sweeping these funds from local governments.

Cut hell…let the Gov use his “sound financial foundation” to find another rev source to give the locals their own generated revenues. And to repeat, honor existing obligations before spending an available $3 billion on new programs.

Again, it’s not an existing obligation if it’s not in the books. In a perfect world, local municipal governments would receive a full 10 percent cut. But the biggest driver of local property taxes isn’t city and county governments, it’s schools. And schools don’t get a cut of that dough. Also, “another rev source” for local governments? What might that be?

Also too, the decision was made to cut the locals’ share when the tax rates were raised 2 points in 2011 partly because so many mayors (including Daley) publicly slammed the proposal. It was a bit of a snit, for sure. But when you fight hard against raising more revenues during a period of extreme state fiscal peril, it’s kinda hypocritical to then demand your full share of that significantly bigger pie.

…Adding… From the governor’s office…

A critical part of the state financial infrastructure is the operations of local governments. When possible, the State has provided additional funding mechanisms to help local governments, including one-time and permanent revenue supports to minimize the need for local property tax increases. Examples of on-going support, totaling over $1.15 billion annually, enacted since Governor Pritzker took office include:

• An additional $200 million a year in sales taxes from the passage of internet sales tax language following the Wayfair decision, including the Leveling the Playing Field for Illinois Retail Act, to help ensure compliance with state tax laws on internet sales.

• Over $600 million annually in additional motor fuel taxes directed to local governments and transit districts to support needed transportation projects through the passage of Rebuild Illinois.

• Granting $1.5 billion in state transportation bond funds directly to local governments for road and highway project expenditures, saving local governments $110 million annually in debt service costs from not issuing local bonds.

• Authorization of adult-use cannabis, generating an estimated $100 million in additional revenues for local governments.

• Increased allocations through the Local Government Distributive Fund process totaling $46 million annually from business loophole closures included in PA 102-0016.

• Increased tax rates and positions for video gaming operations is expected to generate an additional $77 million a year for local governments.

• Anticipated additional local revenues from the opening of new casinos authorized under the Rebuild Illinois plan.

• Provided $400 million to support local governments during the 12-month suspension of the grocery tax authorized under the Illinois Family Relief Plan.

• Increased the percentage of individual income taxes that state government shares with municipalities and counties from 6.06 to 6.16 percent of total individual income tax collections. This 0.1 percent increase is worth $27 million annually.

Illinois distributed to smaller local governments $250 million from its Coronavirus Relief Fund allocation and established the infrastructure necessary to distribute the $740 million Local Fiscal Recovery Fund payment received pursuant to ARPA. These key sources of funding helped small local governments maintain services during uncertain fiscal times.

As noted above, PA 101-0610 consolidated the assets of local police and fire pension funds into two statewide funds to increase investment returns and lower management costs. Helping lower the pressure on local property taxes, the consolidation is projected to produce additional returns worth billions of dollars over the next 20 years. The higher investment returns from consolidation is expected to translate into fiscal relief for local taxpayers supporting these pension costs.

Finally, in the last few years, local governments have seen an increase in the percentage of income and sales taxes that state government shares with towns, counties and transit districts due to removal of the distribution proration that was put into place during the budget impasse. In fiscal year 2018, these allocations totaled $1.7 billion, but are expected to total $2.7 billion in the fiscal year 2024 budget proposal – a $1 billion, or 59 percent, increase – in annual state support in the last six years.

22 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|