* For decades, business and labor have sat down to negotiate how to solve any issues related to the state’s unemployment insurance program. The resulting compromises were then taken to the leadership in both parties and bills would be passed on a bipartisan basis because the leaders all give their word to stick to the deal. But negotiations apparently aren’t going well and a deadline is looming, so this letter from the House GOP Leader appears to break from the past in a major way…

Governor Pritzker,

Before the pandemic, our state’s unemployment insurance trust fund had a positive balance of more than $2.2 billion. The historic surge of unemployment benefit applications that began with the stay-at-home order quickly drained that balance and has now put the trust fund over $4.5 billion in debt—a debt that continues to grow as interest charges accrue daily. On top of the legitimate unemployment claims, Illinois also experienced a historic level of fraud—the total dollar amount of which your administration still refuses to estimate or release. These claims worsened the fund’s financial condition through no fault of employers or workers.

More than a year ago, my colleagues and I called attention to this debt and warned of the consequences of inaction, specifically that failing to pay off the debt would require a massive tax increase on businesses and a reduction in unemployment benefits for Illinois workers.

Unlike many of the other structural problems Illinois faces, this one-time COVID-related debt also came with a one-time COVID-related solution: Coronavirus Aid, Relief, and Economic Security Act (CARES) and American Recovery Plan Act (ARPA) funds. Many other states faced the same challenge we do, and they responsibly used these federal relief dollars to pay off their unemployment insurance debt and avoid tax increases or benefit reductions.

Unfortunately, the current fiscal year budget passed by Democrats in the House and Senate did not dedicate a single dime to paying off this pandemic-era debt. When the budget came to your desk, you used your amendatory veto authority to make changes to certain enactment dates in the poorly drafted and hastily enacted budget. You had an opportunity to address the unemployment insurance trust fund debt at this point in time, but you instead chose to ignore the problem, just like you ignored the roughly $1.5 billion in ARPA “pet project” spending that was added in by democrat legislators in the final hours of the spring legislative session.

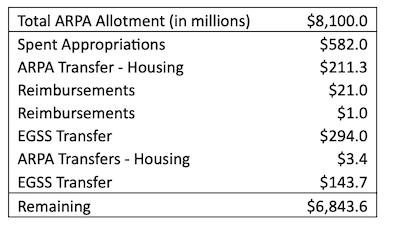

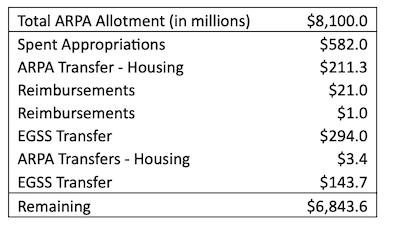

While Illinois cannot recover the $40 million paid in interest due to ignoring this problem so far, it’s not too late to stem the bleeding now. Of the more than $11.5 billion in CARES and ARPA funding the State of Illinois has received from the federal government, it appears that nearly $6.94 billion has not yet been spent. That means we still have sufficient funding to eliminate the unemployment insurance debt entirely and still have almost $2.5 billion remaining to pay for real COVID-related costs.

This problem could have been solved a year ago, and we could have avoided tens of millions of dollars in interest charges. But instead, Springfield is doing what it so often does: playing a game of brinkmanship with an April 1 federal deadline looming.

Let’s not raise taxes on Illinois businesses as they fight to emerge from the pandemic. Let’s not cut benefits for Illinois workers who may soon need the protection that unemployment insurance offers. Instead, let’s use the federal funds we have available to solve this problem once and for all.

Sincerely,

House Republican Leader Jim Durkin

Deputy Republican Leader Tom Demmer

I asked for their breakdown of available ARPA money…

Notice that the chart says “spent” appropriations. According to the governor’s office, another $3 billion or so has already been appropriated by the legislature and is awaiting approval from the US Treasury. This unspent money is mainly capital projects, but there are also several one-time items like violence prevention programs.

What’s actually left, the governor’s office says, is $3.5 billion.

Bottom line is the Republicans don’t want to vote for any election-year employer tax hikes at all even if unions agree to benefit cuts. The agreed bill process may be on its last legs.

…Adding… Similar or coordinated message from the Richard Irvin campaign earlier today…

While JB Pritzker continues to push his election year gimmicks, his failure to lead will result in higher taxes and lower wages across Illinois as the gaping hole in the Unemployment Insurance (UI) Trust Fund continues to grow. Pritzker has thus far refused to use federal ARPA funds to replenish the shortfall and create a reserve balance in this crucial social safety net program. His lack of action results in $2 million in interest charges a week.

Instead of using the federal funds to fill this hole, Pritzker chose to pledge them towards one-time election year gimmicks of fake tax relief. If Pritzker continues to withhold the federal bailout funds, employers could see their unemployment taxes go up and employees could see their benefits cut.

The state’s Unemployment Insurance Trust Fund currently has a deficit of over $4 billion – plus interest. That number would just cover the deficit; much more will be needed to replenish the fund’s reserves. Even worse, a recent news investigation found the Department of Employment Security knowingly gave money to scammers and the Pritzker Administration refuses to disclose how much the Unemployment Insurance Trust Fund has lost due to fraud.

“JB Pritzker has never seen a tax increase he didn’t like, so it’s no surprise he’s angling to pull the wool over the eyes of Illinoisans once again,” said Irvin for Illinois spokesperson Eleni Demertzis. “This is his failure that taxpayers are now on the hook for, something that could have and should have been prevented.”

According to IRMA, state law has ‘speed bumps’ written into it that are expected to trigger $500 million in tax increases for employers and $500 million in benefit cuts for employees. Despite lawmakers pushing for Pritzker to use federal funds to replenish the debt, he has continued to stall as an April 1st federal deadline looms. Without action, higher taxes on employers and reduced benefits for workers are inevitable.

…Adding… Pritzker campaign…

At a time when working families across the state need assistance, we need to be honest about what Richard Irvin is objecting to in the governor’s budget proposal: tax relief for Illinoisans. Ken Griffin’s hold on Irvin remains so tight that even Bruce Rauner would blush at his rejection of policies that would help working families. Voters can see this candidacy and these embarrassing objections for exactly what they are and no amount of spin from Irvin’s team of Rauner rejects can change the truth.

…Adding… Jordan Abudayyeh…

Following the established agreed bill process, that for years has resulted in compromise, there have been 13 formal meetings and countless discussions since January 11th between business and labor along with lawmakers from both sides of the aisle. Earlier this year, Rep. Demmer asked the Governor’s Office what it means to have a seat at the grown-ups table. We would tell the Representative it means not abandoning a bipartisan and sincere effort to follow a decades long agreed bill process in favor of scoring cheap political points at a critical moment in the negotiations. The Pritzker administration will continue to convene all parties and negotiate in good faith for a compromise that is fair to both businesses and workers.

23 Comments

|

* Media advisory…

Illinois State Treasurer Michael Frerichs will stand with workers and employers who participate in Secure Choice, the innovative plan that created a mobile retirement savings account that travels with the worker.

Frerichs spearheaded the Secure Choice retirement savings program to combat the retirement savings crisis in Illinois and across the country. Illinois is a national leader in offering an auto‑enroll IRA program.

WHO: Illinois State Treasurer Michael Frerichs and Central Illinois workers and employers.

WHAT: Employees, employers and advocates will explain how Secure Choice works, how it combats the retirement savings crisis gripping the nation, and why it can save taxpayers money.

More than 100,000 workers and 6,400 employers participate in Secure Choice, with $82 million already saved.

WHEN: 10:30 a.m. on Monday, March 21, 2022.

WHERE: Capitol Blue Room in Springfield.

Chef Michael Higgins from Maldaner’s was one of the press conference participants and he talked about how he wishes he’d had something like this available when he was younger and about the benefits for his workers.

* About a half an hour before the press conference…

Republican State Representative Tom Demmer issued the following statement in advance of Treasurer Frerichs’ press conference on Illinois’ Secure Choice Retirement Program.

“Two years ago, Treasurer Frerichs joined with Governor Pritzker to support a radical tax increase plan on Illinois families. Frerichs even took the measure a step further by saying it could be ultimately used to tax retirement income—including pensions and 401ks—like Secure Choice. Thankfully voters rejected Frerichs’ call for taxing retirement income. However, with Frerichs continuously advocating for tax increases—even taxing retirement income—Illinois families and retirees have anything but secure choices for their hard-earned income and savings.”

In addition, over the last 8 years Frerichs has accepted over $275,000 from former indicted Speaker Michael Madigan’s run political action committees. To date, Frerichs has not returned any of these questionable contributions.

My first thought was that Demmer wants Frerichs to help pay Madigan’s legal expenses by refunding contributions.

* Frerichs was asked about both topics in his press conference. First up, taxing retirement income…

Q: Right around the time I sat down in this chair, I got an email from your opponent’s campaign saying ‘Retirement savings? Well, retirement income is just what Treasurer Frerichs wants to tax.’ What is it you want to do? And how are you going to drive away from this, I don’t know if you want to call it an albatross or some other sort of winged or assorted animal, is this going to continue?

A: This is only gonna continue because my opponent continues to talk about something that’s not an issue. I have stated clearly, time and time again in front of the media that I don’t support a retirement tax, I’ve proposed no retirement tax, I’m not going to propose any sort of retirement tax. My opponent keeps talking about this because he doesn’t want to talk about the real issues of retirement. His numerous votes to reduce retirement benefits. His vote against creation of Illinois Secure Choice, something that’s going to give people a better retirement.

* Madigan…

Q: Your opponent also in the email he sent out before your news conference talked about 275,000 you got from Madigan-linked political campaign funds. Do you just plan on giving that back somehow? What’s your reaction to this?

A: My opponent’s not reached out, I’ve not seen this. I don’t know what he’s referring to or how many [crosstalk, restating the question]

A: I think the justice system is working right now. Indictments have been filed. There’ll be a trial. And I think that we need to do, especially root out corruption in the state of Illinois. We need to have greater transparency and greater ethics to make sure that we don’t have corruption in our state.

Q: What about the campaign funds that you may have gotten from DPI under Madigan’s control? What should happen with those dollars?

A: I’m not aware of the funds he’s talking about.

* ILGOP press release after the press conference…

Illinois Treasurer Mike Frerichs was a deer in headlights today when asked if he would return over $275,000 in tainted campaign contributions from the former Madigan-run Democratic Party of Illinois over his tenure, claiming he now doesn’t recall one of his largest campaign donors.

Frerichs said he was unclear what the sources of campaign cash were, so let’s look at the most recent Madigan contributions to Frerichs’ campaigns for Treasurer:

• On October 17, 2014 Frerichs reported $38,712.96 from Madigan’s DPI Committee.

• On October 24, 2014 Frerichs reported $37,363.40 from Madigan’s DPI Committee.

• On October 27, 2014 Frerichs reported $73,632.24 from Madigan’s DPI Committee

• On November 24, 2014 Frerichs reported $40,000 from Madigan’s DPI Committee

• On October 31, 2018 Frerichs reported $55,400 from Madigan’s DPI Committee

• On November 15, 2018 Frerichs reported $30,000 from Madigan’s DPI Committee.

During his 15 years in Springfield, Frerichs has accepted over $275,000 in contributions from former indicted Speaker Michael Madigan’s run political action committees. To date, Frerichs has not returned any of these questionable contributions.

“It’s incredibly clear that Mike Frerichs has a Mike Madigan problem. Madigan was one of Frerichs’ largest donors in his campaigns for Treasurer, but now Frerichs says he doesn’t remember those contributions. Unbelievable, but true,” said Shaun McCabe, Executive Director of the ILGOP. “Frerichs needs to own up to his past support for and from Madigan and tell taxpayers what he intends to do with the over quarter of a million dollars in tainted contributions.”

DPI contributions are often pass-throughs from other sources so the candidates can obtain postage discounts. More than half of the above-mentioned DPI contributions were in-kinds for mailers.

…Adding… From Rep. Stephanie Kifowit (D-Oswego)…

My son who is in the Navy currently participates in an auto enroll type IRA. He has quite the nest egg already at 20 years old. I wish the military would have had that when I was in.

…Adding… Frerichs press release…

The innovative plan to create a mobile retirement savings account that travels with the worker topped the 100,000 enrollment milestone, Illinois State Treasurer Michael Frerichs said today.

Frerichs set up the Secure Choice retirement savings program to combat the retirement savings crisis in Illinois and across the country. Illinois is a national leader in offering an auto enroll IRA program. Workers in Illinois began saving in July, 2018.

“A retirement savings tool that can travel from job-to-job with the worker makes it easier to save, allows a worker to retire with dignity, and saves taxpayer money by reducing the need for publicly funded safety net programs,” Frerichs said.

Today, more than 100,000 workers and 6,400 employers participate in Secure Choice, with $82 million already saved. None of this was possible without Secure Choice. The 100,000 milestone was surpassed in the first quarter of this year.

“I chose to enroll in Illinois Secure Choice to increase my retirement options,” said Sam Hall, a father of three children who works as the program director for DREAAM in Champaign, the Rantoul Division, a social services organization helping boys and young men between the ages of 5 and 24. “The enrollment process was easy, and I feel more secure knowing I have a plan for retirement.”

DREAAM stands for Driven to Reach Excellence and Academic Achievement for Males. Tracy D. Dace is the Founder. “As a CEO, I was impressed with the ongoing support from the Illinois Secure Choice team to establish an account, enroll employees, and manage the administration of the deductions,” Dace said. “The built-in support indicated a commitment to excellent customer service and overall program quality.”

The General Assembly required employers to either offer a retirement savings plan or participate in Secure Choice, which is overseen by a seven-person board chaired by Frerichs. Secure Choice investments are managed by a private-sector financial services firm and kept in a trust outside of state government and its finances.

Key to passing legislation that created Secure Choice was the assurance that employers would not be financially liable for plan administration and would not be legally liable for investment changes. Employees can opt-out of the program at any time.

“I supported the expansion of Secure Choice as a state legislators because we need to be able to do more for our workers and small businesses,” said Mike Murphy, a former Republican lawmaker from Springfield and current President and CEO of the Greater Springfield Chamber of Commerce.

Enrollment began in 2018 with companies at least two years old and with 500 or more employees. Smaller companies enrolled in phases thereafter to ensure a smooth transition. The success was so strong that most business groups initially neutral or opposed to Secure Choice did not oppose the legislation passed by the General Assembly in 2021 to expand the program. That legislation requires employers with at least five employees to provide a retirement vehicle, or access to Secure Choice, by November, 2023.

The access is critical:

• Nearly half of all working-age families have nothing saved for retirement.

• Although Social Security is not intended to be the sole source of retirement income, 23 percent of Illinois retirees rely on Social Security for at least 90 percent of their retirement income.

• Workers are 15 times more likely to save for retirement if they can do so at work.

• However, 40 percent of Illinois private-sector employees work for a business that does not offer a retirement savings plan.

About Illinois Secure Choice

Illinois Secure Choice is managed by Ascensus, a private-sector financial services firm responsible for all recordkeeping and day-to-day aspects. Fund options include BlackRock, Charles Schwab, and State Street Global Advisors. Participants are enrolled in a default target-date Roth IRA with a five percent contribution rate. Participants can choose to change their contribution level or fund option at any time. More information can be found at www.ilsecurechoice.com.

32 Comments

|

* Press release…

For the first time ever, the Illinois Department of Insurance (IDOI) announced today fines totaling $339,000 for Health Care Service Corporation (HCSC), the parent company of Blue Cross Blue Shield of Illinois, for violating the material change notice requirement in the state’s Network Adequacy and Transparency Act.

Network adequacy filings are an important tool to help ensure that consumers have access to a network of providers that meets proper time and distance standards. This is critical to ensuring that patients have access to care that they need.

The Department found that the company did not properly file updated network adequacy filings following the termination of its contract with Springfield Clinic which serves approximately 100,000 consumers in Central Illinois. After months of delay, the Department finally received BCBS’s final filing for its network adequacy review on Thursday. The Department determined that the filings were 244 days late and 95 days late, accumulating a total fine of $339,000. Late fees are $1,000 per day.

“Insurance companies must be able to show that they have adequate provider networks, so that Illinois consumers have access to the medical care and providers that they pay for,” said Governor JB Pritzker. “This fine should serve as notice that we will require insurers to maintain adequate provider networks and uphold all consumer protections under the law.”

Although the Department reviews every plan’s network for adequacy when the plan is filed, the law recognizes that a plan’s network may change mid-plan year. In anticipation of these potential changes, there is a provision that if there is a “material change” in the network, the company must submit updated network adequacy filings to demonstrate that the change has not rendered the network inadequate. Under state law, insurers are required to report to the Director any material change to an approved network plan within 15 days after the change occurs.

“This is the first time the Department has issued a fine for the material change filing requirement in the Network Adequacy Transparency Act,” said IDOI Director Dana Popish Severinghaus. “We’re disappointed that the company continues to evade acknowledging this material change. Under Illinois law, the removal of a major health system, like Springfield Clinic, is a material change that could render a network, or parts of a network, inadequate. We are committed to exercising the Department’s full authority to protect consumers from being harmed in a corporate contract dispute.”

Blue Cross Blue Shield must pay the fine immediately, and the company has 10 days to contest the fine. The Department will continue its review of the network adequacy filing for compliance with applicable state and federal laws.

The Notice of Apparent Liability for late filing of Network Adequacy can be found here.

* Last week, Richard Irvin’s campaign suggested imposing those daily fines, among other things…

• Swiftly investigate Blue Cross Blue Shield’s compliance with the state’s network adequacy requirements, and impose fines for every day it is in violation.

• Order Blue Cross Blue Shield to provide true continuity of care coverage as required by state law and re-adjudicate previous claims that should have been considered in-network.

• Consider capping Blue Cross Blue Shield’s enrollment if the company does not swiftly come into compliance with provider network adequacy requirements.

Now that the government has network adequacy requirement data, it can take a look at what’s actually going on. But the Department of Insurance dropped the ball here. No way should it have allowed BCBSI to not file those reports for so long, particularly since this impacts a hundred thousand people in central Illinois.

And though I doubt BCBSI would even notice a grand a day, the company is taking increasing Statehouse heat, including a recent call to strip its state tax-exempt status. Big Blue has stayed relatively mum so far, but they’re now starting to engage.

…Adding… A top official in the Pritzker administration says BCBSI is not a not for profit corporation, despite reporting to the contrary. “There is no tax exemption for BCBS in IL,” the official texted.

* From Harmony Harrington, Vice President, Government, Communications and Community Engagement at Blue Cross and Blue Shield of Illinois…

“Blue Cross and Blue Shield of Illinois has been working closely with the Illinois Department of Insurance since contract negotiations first began with Springfield Clinic last May. Though we had a reasonable and well-informed opinion that Springfield Clinic’s decision to leave our network did not trigger any network change filing, when the Department requested one within the past few weeks, we promptly complied. As we evaluate the Department’s decision, we will continue to work collaboratively and in compliance with applicable laws and regulations while ensuring access, affordability and quality in health care for the more than 8 million Illinoisans we cover.”

The insurance company has claimed that Springfield Clinic is demanding a 75 percent increase in what they claim is an already high reimbursement rate. As a Blue Cross policyholder and a Springfield Clinic patient, I want this to end now. I don’t know what the state can do if the clinic is indeed making outrageous demands, but if BCBSI is to be believed, they’re not totally at fault here and Springfield Clinic needs to get to the table with reasonable expectations. /rant

33 Comments

|

* A Republican operative joked last week that they should probably be required to report Foxx as an in-kind contribution. From the Richard Irvin campaign…

In yet another example of his pro-criminal, anti- police positioning, J.B. Pritzker last year signed a law allowing far-left State’s Attorney Kim Foxx to petition for sentence reductions for violent criminals. Naturally, despite skyrocketing crime in Chicago and Cook County, Foxx announced that this week she will begin petitioning the courts to release violent criminals from prison early.

Thanks to Pritzker’s enabling, Foxx’s resentencing initiative will potentially grant early release to criminals serving long sentences for violent crimes. Foxx will present three resentencing motions as early as this week with more planned for later this month. In total, Foxx’s office anticipates the early release of as many as 25 people by the end of the year. This is the latest affront to crime victims, in addition to her support for ending cash bail and her call to allow Jussie Smollet to escape paying for his crimes.

“Whether via pardon or commutation, signing his anti-police crime bill or enabling Kim Foxx to push for lighter sentencing for criminals, J.B. Pritzker always sides with criminals over police and community safety,” said Irvin for Illinois Spokesperson Eleni Demertzis.

* From the linked story…

Three men are slated for possible resentencing next week, the first to potentially benefit from a new state law allowing prosecutors to petition for shorter sentences ”if the original sentence no longer advances the interests of justice.” […]

The office is first reviewing cases of people who have served at least 10 years for a drug, theft, robbery or burglary conviction; people 65 or older who have served at least 20 years for a case not related to a sex crime or homicide; and people who have served at least 15 years for a case other than a sex crime or homicide and who were younger than 21 when they committed the offense. […]

Victims in each case will be notified “at different steps of the resentencing process,” and will have a chance to submit statements to the judge to consider at sentencing, the office stated.

Foxx did not offer an estimate of how many cases may be eligible for resentencing under those criteria. But prosecutors are scheduled to present their first three resentencing requests in court [this] week, according to Foxx’s office.

* Sun-Times…

Larry Frazier, 63, is one of the men hoping to shave significant time off his sentence when his case goes back before a judge Wednesday.

Frazier was 40 when he was given 60 years in prison for a home invasion that took place in Calumet Park when he was 36, according to court records.

At the time he was sentenced in 1999, Frazier was given an extended sentence because the victim was 62 — only a year younger than Frazier is now, documents show. Details of the case were not immediately available, but other charges Frazier faced included weapons offenses and unlawful restraint.

By that time, Frazier had already amassed a significant criminal record of charges, including theft and armed robbery, going back to the early 1980s, state records show.

In their motion, prosecutors noted the victim wasn’t hurt physically in the home invasion and argued that since being locked up, Frazier “has taken substantial steps toward rehabilitation,” though no details were provided. […]

Ed Wojcicki, executive director of the Illinois Chiefs of Police Association, said he finds the idea of resentencing inmates for the crimes they were convicted of fundamentally unfair.

“The rules are what they were when they were sentenced,” he said when reached by phone Friday. Wojcicki said he worries about the impact the resentencing hearings will have on crime victims.

* WBEZ…

The small number of cases means the initial impact could be small, but the effort carries significant political risks for Foxx because it turns the conventional understanding of America’s adversarial court system on its head, putting prosecutors and defense attorneys on the same side, pushing for leniency and forgiveness.

Foxx said they are embarking with caution, seeking to prove to the people of Cook County that the early releases will not endanger public safety before expanding the effort. Ultimately, it will be up to judges whether they will grant the motions and what kinds of sentences will be handed out.

Still, the county’s controversial top prosecutor is taking up the initiative at a time when her office is already under fire because of a perception that Foxx is going easy on criminals during a surge in violence.

“I think we have to show people that it works … There are segments of our population who believe, ‘you’ve done the crime you do the time, even if you wouldn’t get that same time today,’ ” Foxx said. “So I think the initial foray into this is to show people what it looks like, to de-stigmatize what the process looks like, to demonstrate that this is actually good public policy and it’s actually good for us as a community.” […]

“I’m always expecting backlash because it’s different than what we’ve normally done,” Foxx said. “Here in Cook County, we have been very much entrenched in a culture with our justice system that had been very punitive, that … the way to fight crime was to just lock everybody up.”

Thoughts?

*** UPDATE *** Greg Hinz followed up…

Foxx is firing back: “As a former and longtime defense attorney, Mayor Irvin knows all too well, of the evolution in sentencing laws, which he has used to advocate for the criminal defendants whom he represented,” her office said in a statement. “The resentencing initiative recognizes that the sentences previously imposed would be less if imposed today. The purpose of the law is to address that discrepancy.”

The Pritzker folks took aim at both Foxx and Irvin.

“The governor had hoped prosecutors would’ve first prioritized those who committed non-violent offenses,” they said in a statement. “This decision sends the wrong message at this moment in time.”

Still, they added, “As we continue to put forth good-faith solutions to both reduce crime and reform our criminal justice system, we will not be lectured by Republicans who see crime as yet another issue to exploit for cheap political shots. Richard Irvin can’t seem to decide what side of his mouth he wants to talk out of today and while he continues to ignore his long career profiting off of keeping violent criminals out of jail and free from accountability.”

53 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|